Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

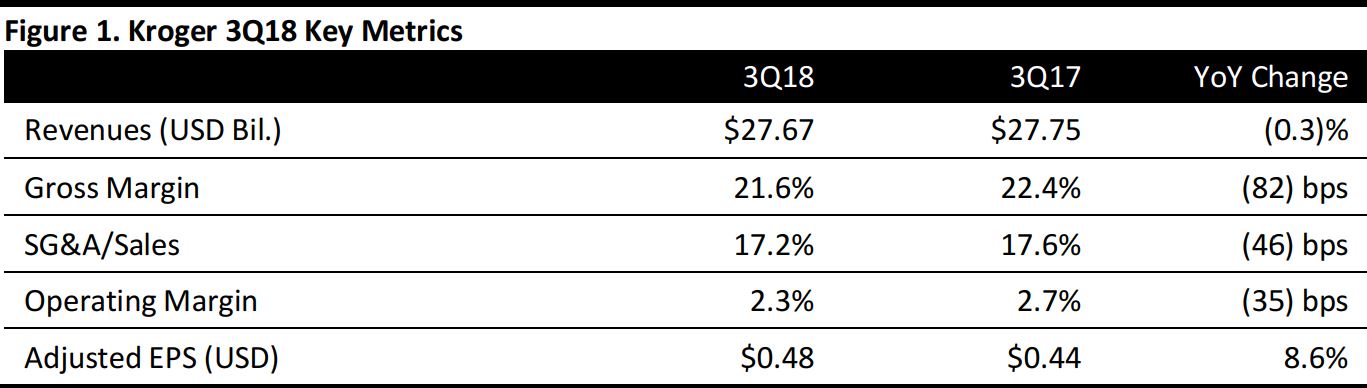

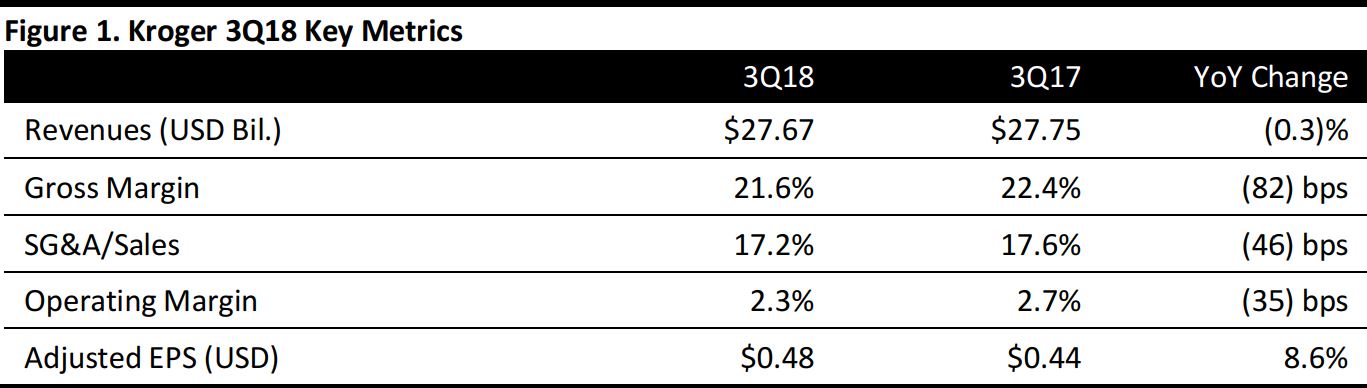

3Q18 Results

Kroger reported 3Q18 revenues of $27.67 billion, slightly ahead of the $27.65 billion consensus estimate and down 0.3% year over year.

Digital sales grew 60% in the quarter, and Kroger Ship was expanded to all divisions.

Adjusted EPS was $0.48, beating the $0.43 consensus estimate and up 8.6% year over year. GAAP EPS was $0.39, compared to $0.44 in the year-ago quarter. The GAAP earnings reflect a $100 million, or $0.09 per share, charge related to the value of the company’s investment in Ocado.

Details from the Quarter

Management commented that Kroger is moving from a traditional grocer to a growth company with both a strong customer ecosystem that offers anything, anytime, anywhere, and asset-light, high-margin alternative partnerships and services. The company’s Restock Kroger program is the blueprint for this transformation, with financial targets for 2020.

Restock Kroger highlights in the quarter include the following:

- The number of digital households grew in the double digits.

- Kroger‘s Our Brands achieved record unit and sales growth.

- The company introduced its Dip private-label brand in 300 stores nationwide.

- Kroger announced an exploratory partnership with Walgreens.

- The company introduced Geoffrey’s Toy Box in 600 stores and plans to hire 10,000 employees this holiday season.

Other points:

- At its recent investor conference, Kroger highlighted Kroger Personal Finance, as well as several businesses under the 84.51° portfolio, including the Kroger Precision Marketing media offering. Kroger Personal Finance delivered record year-to-date profit and is on track for its most profitable year ever. The media business has high-margins, is strong and is growing. Revenue for Kroger Precision Marketing is up more than 150% year-to-date.

- In its service line, the products and search business enables advertisers to influence how their products show up on Kroger’s websites and created more than 700 million product impressions in the quarter, personalized to Kroger shoppers, with click to conversion rates that are two to three times the industry standard.

- Management sees tremendous potential in asset-light, margin-rich businesses built from a robust grocery supermarket experience. Kroger’s coverage area now reaches more than 90% of Kroger households, which also includes Kroger Pickup and Delivery.

- Kroger Ship is now available in all supermarket divisions, in which customers can shop from a curated selection informed by 84.51° data and insights of more than 50,000 grocery and household essentials, plus there are 4,500 unique Our Brand products available.

- As mentioned during the Investor Day, Kroger expects to be able to cover not only 100% of its customers but also the entire US population.

- Kroger’s Our Brands continue to perform exceptionally well with customers and are one of the most profitable parts of the supermarket business. Our Brands made up 28.7% of unit sales and 26.6% of sales dollars, both of which represent records in the third quarter.

- The Private Selection and Simple Truth brands saw strong sales, units and gross margin gains in the quarter. Simple Truth and Simple Truth Organic are Kroger’s fastest growing brands, with sales up double digits in the quarter. Our Brands account for four of the top five items sold through Kroger Pickup, and 41 of the top 50 items sold on Kroger Ship.

Outlook

Kroger updated 2018 guidance as follows:

- Adjusted EPS: maintained at $2.00–$2.15.

- GAAP EPS: updated to $3.80–$3.95 from $3.88–$4.03.

- Second-half sales ex fuel: similar to the 1.7% figure in the first half.

- Capex: $3.0 billion.

- Tax rate: 23% for GAAP EPS, 21% for adjusted EPS.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research