albert Chan

Introduction

What’s the Story?

Multiple and intermittent waves of disruption have impacted the consumer economy. After two years of pandemic-induced upheaval, shoppers and retailers are now grappling with decades-high inflation while consumers are continuing their return to more normal living. Consumer preferences and spending patterns changed due to mandatory and periodic lockdowns, travel restrictions and hybrid working models, among other reasons, which led to higher consumer savings.

In addition, the US government offered stimulus relief to put more money in the hands of American consumers, which amounted to $1.66 trillion in total direct payments over 2020 and 2021. This translated to most households having increased liquidity, with a strong retail rebound as a result. However, even with the worst of the Covid-19 pandemic likely behind us, macroeconomic volatility remains concerning, due to the rising prices of consumer goods and the Russia-Ukraine war.

In this report, we analyze the findings of a March 2022 Coresight Research survey of consumers across the US and Canada; respondents were from across generations, including Gen Z (aged 18–25), millennials (26–45), Gen X (46–57) and baby boomers and silents (58 and above). We explore whether respondents have taken any measures to deal with rising inflation and their expectations around an increase in consumer prices in 2022, spending and BNPL adoption.

This report is sponsored by BNPL provider Afterpay.

Why It Matters

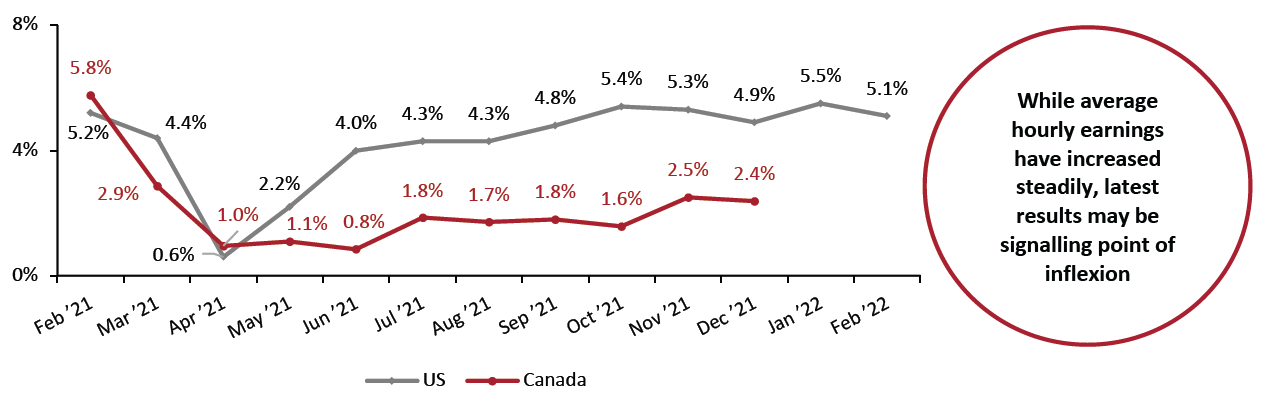

Increased availability of money in the form of stimulus and increasing hourly wages—which were up 5.1% year over year in February 2022 in the US, according to US Department of Labor—are some of the reasons contributing to the demand-pull inflation.

However, demand is not the sole cause of rising inflation. Recent supply chain bottlenecks—leading to product out-of-stocks—and increasing raw material prices continue to contribute to cost-push inflation. For example, logistics providers have increased prices for moving goods: Overall domestic shipping rates for moving goods by road and rail were up about 23% year over year in the US in 2021, according to freight audit and payment company Cass Information Systems. Global shipping charges are also on the rise—for example, the spot price to ship a 40-foot container from Shanghai to Los Angeles in December 2021 was around 75% higher than the price in December 2020, according to Xeneta, a Norway-based transportation data company. In addition, Russia’s invasion of Ukraine sent the price of Brent crude oil to over $100 per barrel on February 24, 2022, the highest level since July 2014.

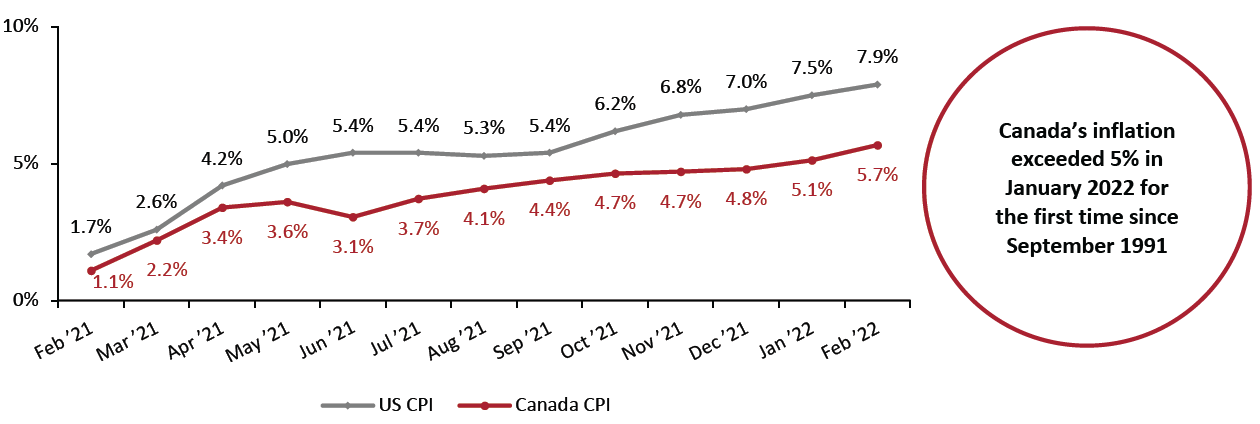

The rate of inflation has skyrocketed since early 2021, reaching a four-decade high in the US in February 2022—increasing by 7.9% year over year that month versus 1.7% growth during February 2021. Canada witnessed a similar increase in inflation during the same period, with 5.7% year-over-year growth in February 2022 versus a 1.1% increase in February 2021 (see Figure 1). Canada’s inflation exceeded 5% in January 2022 for the first time since September 1991.

Figure 1. US and Canada: Consumer Price Index (CPI) (YoY % Change) [caption id="attachment_146081" align="aligncenter" width="700"]

Source: US Bureau of Labor Statistics/Statistics Canada[/caption]

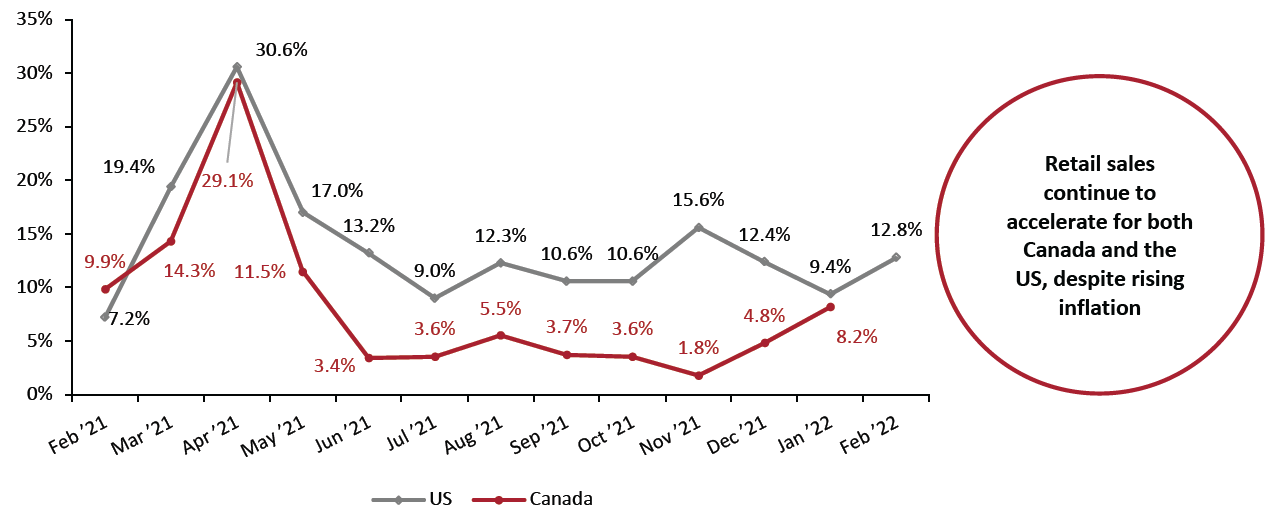

Supported by rising prices, retail sales continue to grow robustly over strong 2021 comparatives. US retail sales accelerated into double-digit growth, of 12.8%, in February 2022 (ahead of retail inflation and so reflecting real-terms increases), while Canada retail sales grew 8.2% year over year in January 2022.

Source: US Bureau of Labor Statistics/Statistics Canada[/caption]

Supported by rising prices, retail sales continue to grow robustly over strong 2021 comparatives. US retail sales accelerated into double-digit growth, of 12.8%, in February 2022 (ahead of retail inflation and so reflecting real-terms increases), while Canada retail sales grew 8.2% year over year in January 2022.

Figure 2. US and Canada: Total Retail Sales ex. Gasoline and Automobiles (YoY % Change)

[caption id="attachment_146082" align="aligncenter" width="700"] Note: US retail sales data are not seasonally adjusted; Canada retail sales data are seasonally adjusted

Note: US retail sales data are not seasonally adjusted; Canada retail sales data are seasonally adjustedSource: Statistics Canada/US Census Bureau/Coresight Research[/caption]

Finally, the average hourly earnings increase shows signs of deceleration in 2022 in the US, which may have an impact on shopper spending habits (see Figure 3).

Figure 3. US and Canada: Average Hourly Earnings, Seasonally Adjusted (YoY % Change)

[caption id="attachment_146083" align="aligncenter" width="700"] Note: US retail sales data are not seasonally adjusted; Canada retail sales data are seasonally adjusted

Note: US retail sales data are not seasonally adjusted; Canada retail sales data are seasonally adjustedSource: US Census Bureau/Statistics Canada/Coresight Research[/caption]

Due to myriad factors contributing to rising inflation, we do not expect inflation to fall drastically in the near term, so consumers will continue to grapple with inflation in 2022. However, the response thus far has been upbeat—robust retail sales are representative of growing consumer spending despite the inflationary pressure. It will be interesting to track how retail sales hold up against rising consumer prices over the coming months and how consumer attitudes toward inflation, spending and retail destinations change in 2022.

The Inflation Pressure Cooker: Coresight Research x Afterpay Analysis

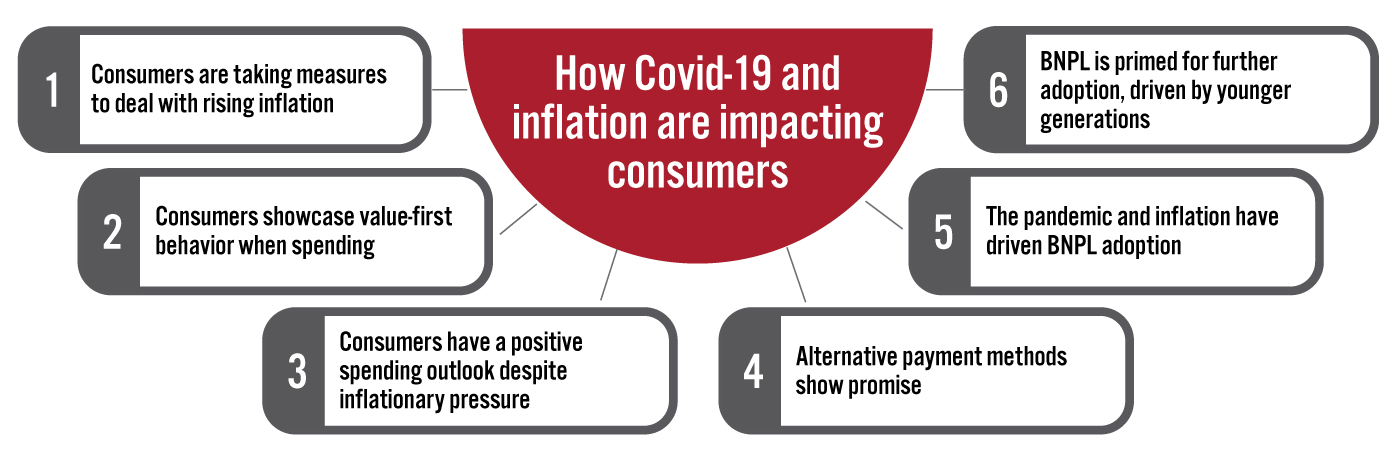

Based on the analysis of our survey findings, we have identified six key trends in consumer spending and behavior in the US and Canada. We summarize our insights in Figure 4 and explore each in detail below.

Figure 4. Disruption in Consumer Habits: Summary of Key Survey Findings

[caption id="attachment_146084" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

1. Consumers Are Taking Measures To Deal with Rising Inflation

Inflationary pressure has a substantial impact on the household budgets, which do not increase in the same proportion as inflation. It then becomes difficult for households to continue to buy the same basket of products they would purchase otherwise.

Inflation was among the key talking points during the holiday quarter in 2021, and there was skepticism around spending as the University of Michigan consumer confidence index fell to 67.4 in November—the lowest level in a decade. In addition, 67.5% of US consumers were either slightly or very concerned about a winter wave of Covid-19 infections, according to Coresight Research’s US Consumer Tracker.

However, despite the inflationary pressure and the spread of Omicron, retail sales for the US holiday season (three months ended December 2021) totaled $1.25 trillion—up 12.9% year over year—according to our analysis of US Census Bureau data. On a two-year basis, holiday-quarter retail sales were up 23.3% in 2021.

Most retailers are doing their best to absorb most of the price rises, but it is inevitable that they will need to pass a higher proportion of increased costs to consumers at some point. This means that many consumers need to take measures to deal with rising prices—particularly among lower-income households.

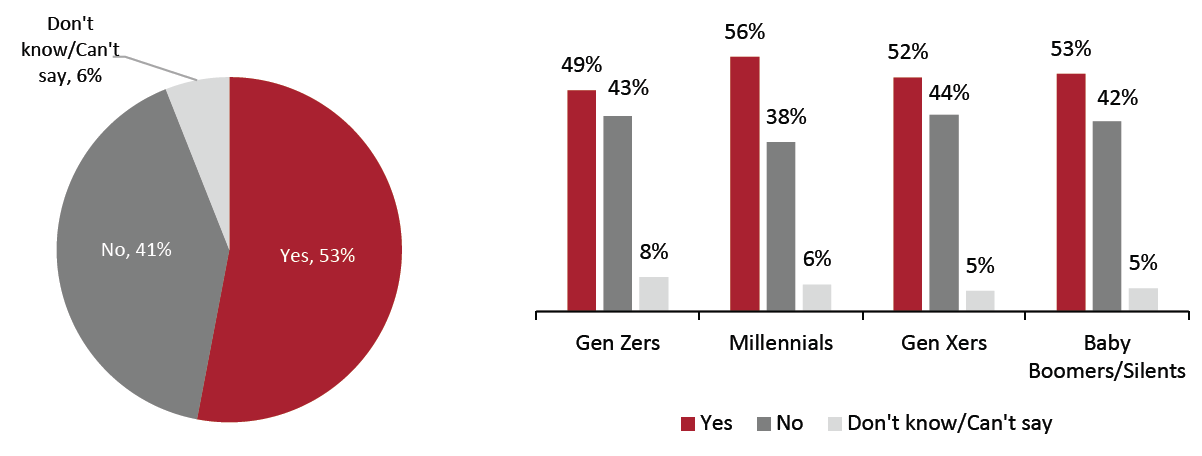

We asked our survey respondents whether they have taken any measures to deal with rising inflation and found that:

- Over half (53%) of all consumers have taken measures to deal with rising inflation.

- Millennials emerged as the most cautious generation—some 56% of this age group reported that they have already taken measures to deal with rising inflation.

Figure 5. Whether Consumers Have Taken Measures To Deal with Rising Inflation (% of Respondents) [caption id="attachment_146085" align="aligncenter" width="700"]

Base: 500 consumers across the US and Canada, surveyed in March 2022

Base: 500 consumers across the US and Canada, surveyed in March 2022Source: Coresight Research[/caption]

2. Consumers Showcase Value-First Behavior When Spending

Strong sales in the holiday quarter and into 2022 (as discussed earlier) show that consumers are willing to spend as they return to more normal ways of living. However, with many reporting that they have taken measures to deal with rising inflation, brands and retailers must continue to adapt to continued shifts in consumer spending.

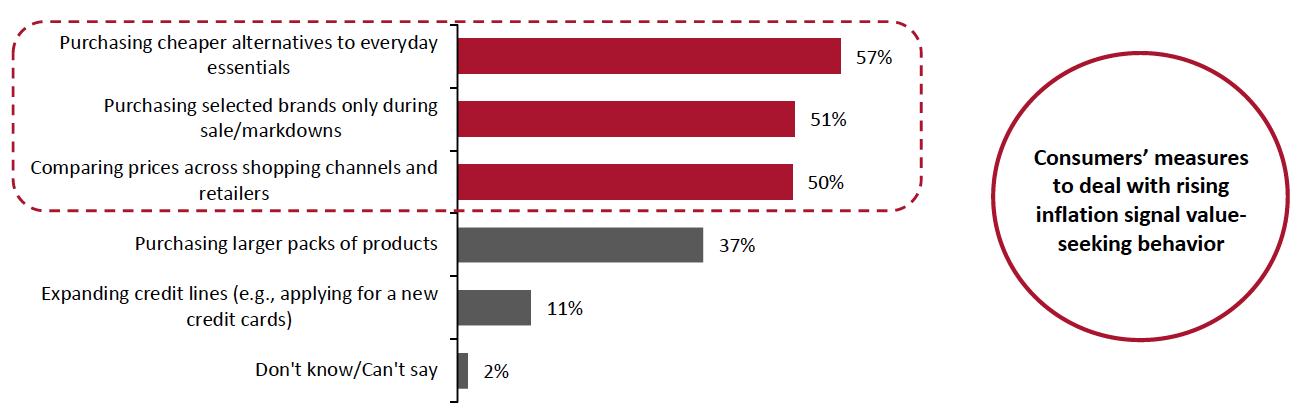

We asked consumers who have taken measures to deal with rising inflation about the measures they have taken, and the top responses represent that while consumers are willing to spend, they are cost-conscious and want to maximize the value they receive in return for any expenditure.

- As part of this value-seeking behavior, consumers are looking to purchase cheaper alternatives to non-discretionary goods, buy selected brands only during promotions and compare prices across channels and retailers before making a purchase—all three of which were options chosen by at least half of the respondents that have taken measures to deal with rising inflation.

Figure 6. Selected Measures That Consumers Are Taking To Deal with Rising Inflation (% of Respondents) [caption id="attachment_146086" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple optionsBase: 263 consumers across the US and Canada who have taken measures to deal with rising inflation, surveyed in March 2022

Source: Coresight Research[/caption]

3. Consumers Have a Positive Spending Outlook Despite Inflationary Pressure

Indicators such as total retail sales and a strong holiday quarter imply that consumer spending has recovered and continues to rise. As consumers look to overcome the day-to-day disruptions caused by Covid-19, newer avenues to spend emerge.

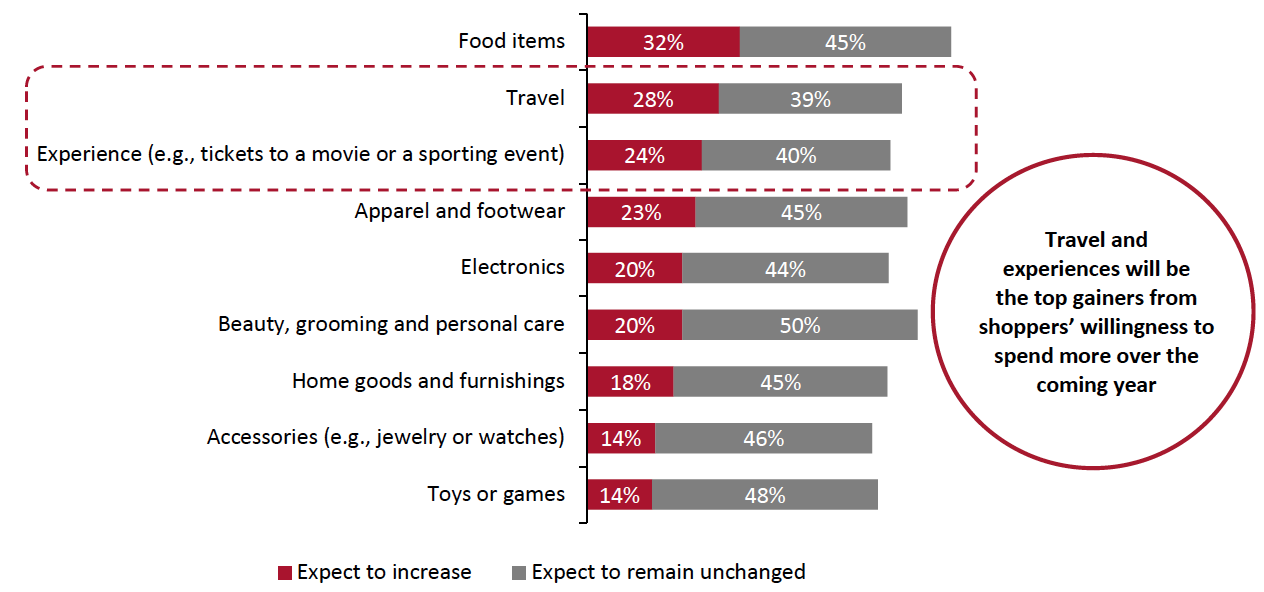

We asked our survey respondents their expectations around spending in the coming 12 months and found that most respondents expect to keep their spending unchanged across all product categories, despite their expectations of a persistent inflationary environment.

Unsurprisingly, among non-discretionary categories, travel and experiences are set to gain the most from increased consumer spending: 28% of consumers expect to spend more on travel over the coming 12 months, and 24% expect to spend more on experiences (see Figure 7).

Figure 7. Consumer Expectations To Maintain or Increase Spending Levels Over the Next 12 Months, by Selected Product Categories (% of Respondents Expecting to Increase or Retain Current Spending Levels) [caption id="attachment_146087" align="aligncenter" width="700"]

Base: 500 consumers across the US and Canada, surveyed in March 2022

Base: 500 consumers across the US and Canada, surveyed in March 2022Source: Coresight Research[/caption]

On the other hand, in the US, inflationary pressure continues to maintain a strong foothold. Federal Reserve policymakers have signaled the possibility of a half-percentage-point interest-rate hike at the next policy meeting in May—representative of an aggressive stance to fight inflation.

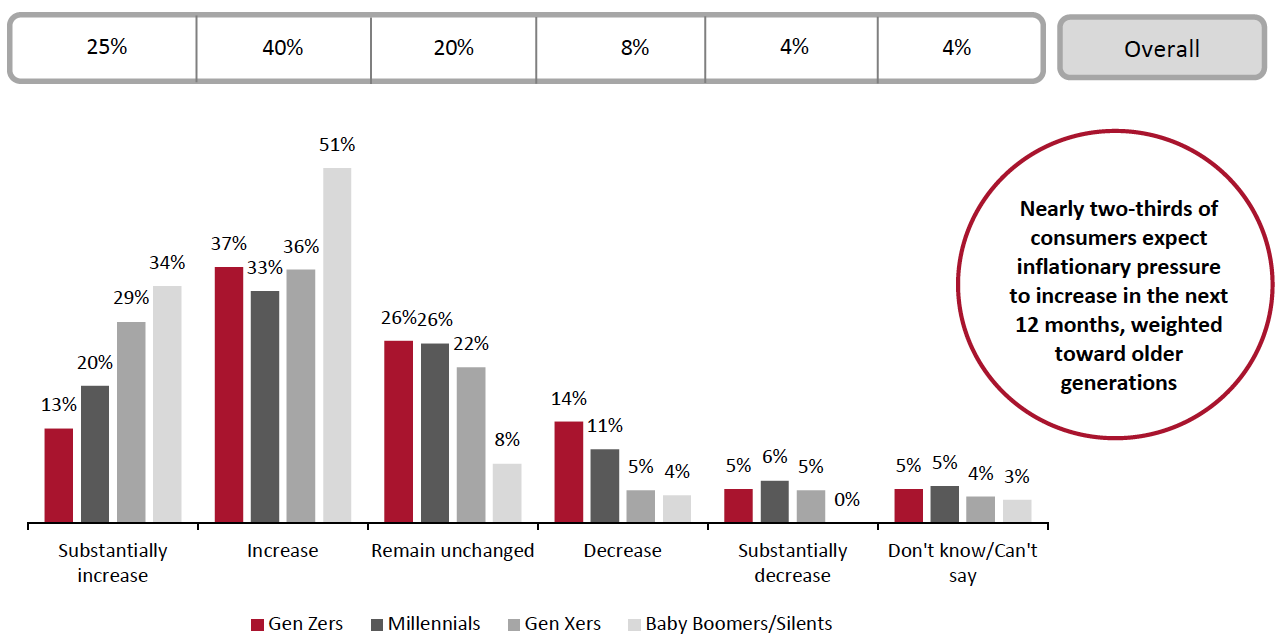

To understand the expectations around inflation, we asked our survey respondents whether they expect inflation to increase or decrease in the next 12 months.

- Overall, our survey findings indicate that consumers are expecting a surge in inflation in the coming year. Due to multiple factors including strained supply chains, increased wages and rising oil prices, we expect the short-term inflationary pressure to persist.

- Nearly two-thirds of respondents expect inflation to increase.

- Younger generations—Gen Zers and millennials, are slightly more optimistic toward inflation versus older generations. Only 13% and 20% of Gen Z and millennial respondents, respectively, expect inflation to “substantially increase” in the coming 12 months—compared to over one-third of baby boomers/silents.

Figure 8. Consumer Expectations for a Change in Inflationary Pressure in the Next 12 Months, Overall and by Generation (% of Respondents) [caption id="attachment_146088" align="aligncenter" width="700"]

Base: 500 consumers across the US and Canada, surveyed in March 2022

Base: 500 consumers across the US and Canada, surveyed in March 2022Source: Coresight Research[/caption]

Despite expectations for rising inflation, the majority of consumers expect to either increase their spending or keep spending levels unchanged across product categories. This may be an indication that consumers are now ready for a more “normal” lifestyle, which was upended by the pandemic.

4. Alternative Payment Methods Show Promise

Amid consumer willingness to spend but with a heightened focus on value, alternative payment methods such as BNPL can help brands and retailers attract newer and retain existing customers by providing flexibility and convenience in the purchase process. Alternative payment methods also provide consumers with cashback initiatives and offers.

We asked our survey respondents about the payment methods they have used in the past year to make purchases and found that the most-used payment method was credit/debit cards (65% of respondents), closely followed by cash (64%). However, alternative payment methods such as gift cards, prepaid cards and BNPL are also used by consumers.

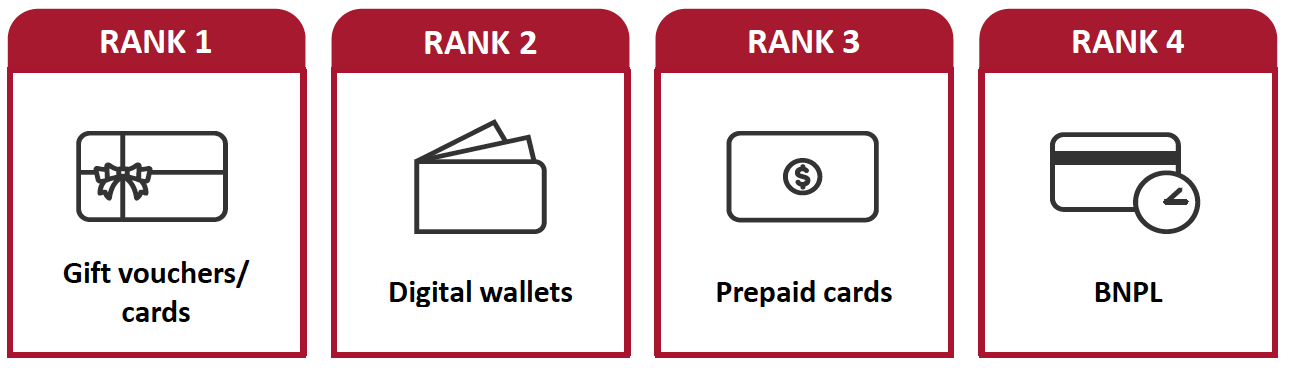

In Figure 9, we rank the top four alternative payment methods as cited by respondents based on their usage in the past 12 months.

Figure 9. Top Four Alternative Payment Methods Used by Consumers Over the Past 12 Months [caption id="attachment_146089" align="aligncenter" width="700"]

Base: 500 consumers across the US and Canada, surveyed in March 2022

Base: 500 consumers across the US and Canada, surveyed in March 2022Source: Coresight Research[/caption]

As value remains top of mind for consumers every time they spend, it is essential for retailers to ensure they reflect this in their pricing and checkout experience—the point where consumers part with their money. There has been a strong uptake in digital payments by retailers, and attractive discounts, cashback initiatives and the ability to pay back in interest-free installments can strengthen retailers’ positioning in capturing a higher share of revenues from increasing consumer spending.

Among alternative payment methods, BNPL meets the value-seeking nature of consumers through interest-free payments. Retailers understand this opportunity and continue to expand their BNPL payment. For example, the likes of Amazon, Target and Walmart announced BNPL partnerships ahead of the holiday-season quarter last year. Looking beyond general-merchandise retailers, DICK’S Sporting Goods partnered with BNPL provider Afterpay in December 2021 to offer flexible payments for both online and offline transactions.

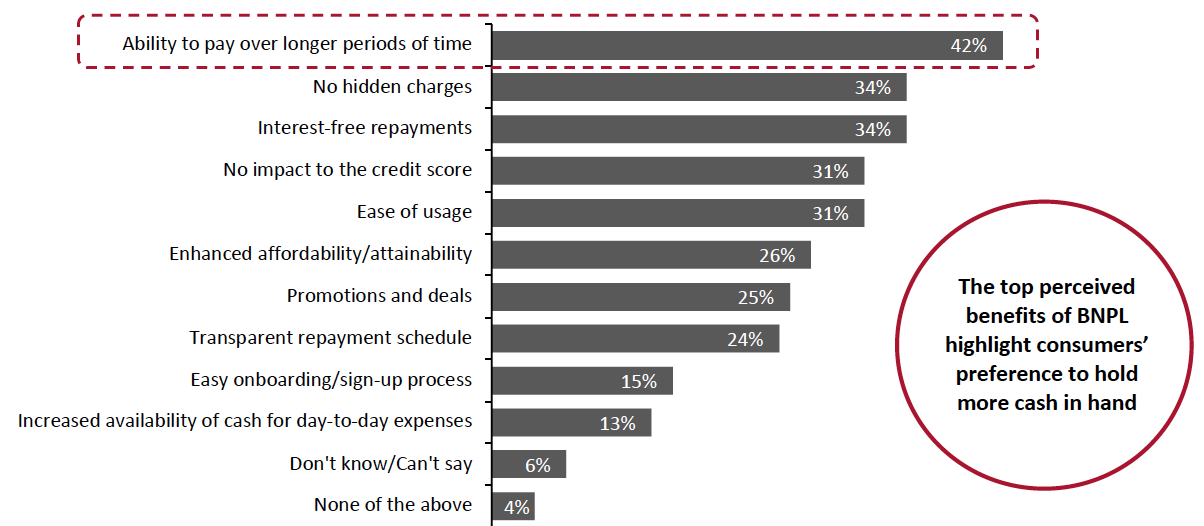

We asked respondents interested in using BNPL about the key perceived benefits of the alternative payment method and found that the top four perceived benefits highlight a consumer preference to hold more cash in hand—which is essential in today’s macroeconomic environment and aligns with cost-conscious value-seeking behavior (which we discuss further in the next section).

Figure 10. Consumers Interested in Using BNPL: Key Perceived Benefits of Using BNPL as a Payment Method (% of Respondents)

[caption id="attachment_146090" align="aligncenter" width="700"] Base: 114 consumers across the US and Canada who are interested in using BNPL, surveyed in March 2022

Base: 114 consumers across the US and Canada who are interested in using BNPL, surveyed in March 2022Source: Coresight Research[/caption]

5. The Pandemic and Inflation Have Increased BNPL Adoption

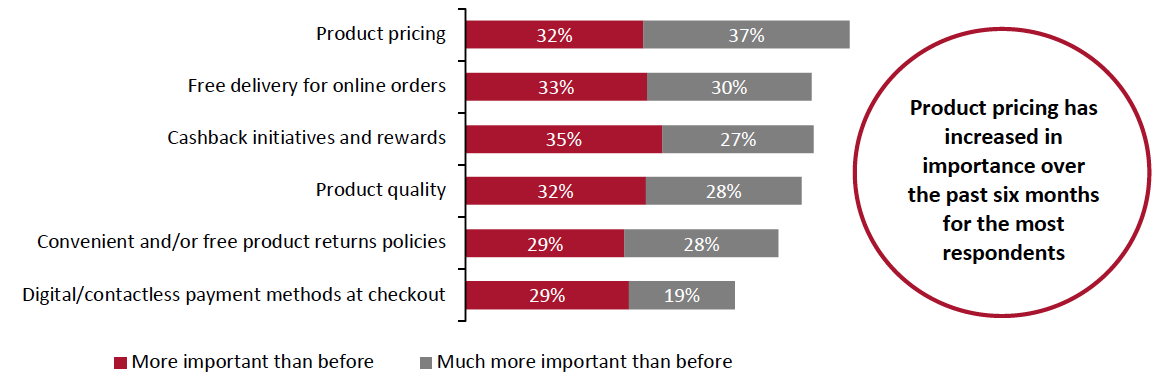

Access to tools such as BNPL can act as a powerful budgeting tool for consumers. Our survey highlights that brands and retailers can gain a competitive advantage from offering alternative payment methods amid economic uncertainty: When choosing a retailer to shop from, almost seven in 10 (69%) respondents cited pricing as “more” or “much more” important now than it was six months ago, and 63% of respondents reported the same for cashbacks and rewards.

These findings indicate that value-first nature of consumers has only strengthened over the past six months, reinforced by the fact that 60% of consumers cited product quality to be either more or much more important now. Consumers want to buy for less or at an attractive price, but they also want to buy better products.

Figure 11. Top Six Criteria Impacting Consumers’ Choice of Retailer To Shop from: Increase in Importance Over the Past Six Months (% of Respondents) [caption id="attachment_146091" align="aligncenter" width="700"]

Base: 500 consumers across the US and Canada, surveyed in March 2022

Base: 500 consumers across the US and Canada, surveyed in March 2022Source: Coresight Research[/caption]

We expect the value seeking nature of consumers to strengthen further. For example, John Swygert, CEO at discount retailer Ollie’s, said in the company’s fourth-quarter earnings call in March: “The value we provide is more critical than ever as we recognize that our customer has been impacted by the rapid rise in inflation; this type of environment plays into our strengths.”

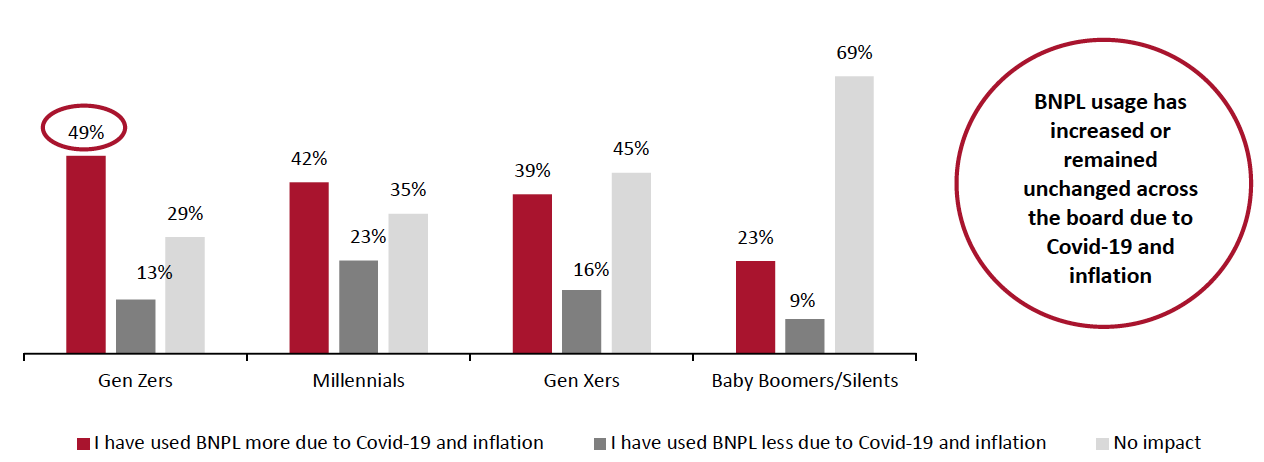

Consumers who are already using BNPL see it as a solution to continue spending in the volatile environment, with 39% of respondents increasing their usage of BNPL and 42% citing the same amount of usage as before Covid-19 and inflationary pressure. In addition, as pricing becomes more important for consumers (as shown earlier in Figure 11), we expect BNPL to increase in usage.

Gen Z consumers have contributed the most to the increased usage of BNPL, with nearly half (49%) of this age group reporting that they have used the alternative payment method more due to Covid-19 and inflation (see Figure 12).

Figure 12. Change in Consumers’ BNPL Usage Due to Covid-19 and Inflation, by Generation (% of Respondents) [caption id="attachment_146092" align="aligncenter" width="700"]

Base: 170 consumers across the US and Canada who are regular or occasional BNPL users, surveyed in March 2022

Base: 170 consumers across the US and Canada who are regular or occasional BNPL users, surveyed in March 2022Source: Coresight Research[/caption]

6. BNPL Is Primed for Further Adoption, Driven by Younger Generations

BNPL helps consumers make purchases without the need to fully pay for the products up front. It can be an effective and convenient mode of payment for those looking for payment flexibility.

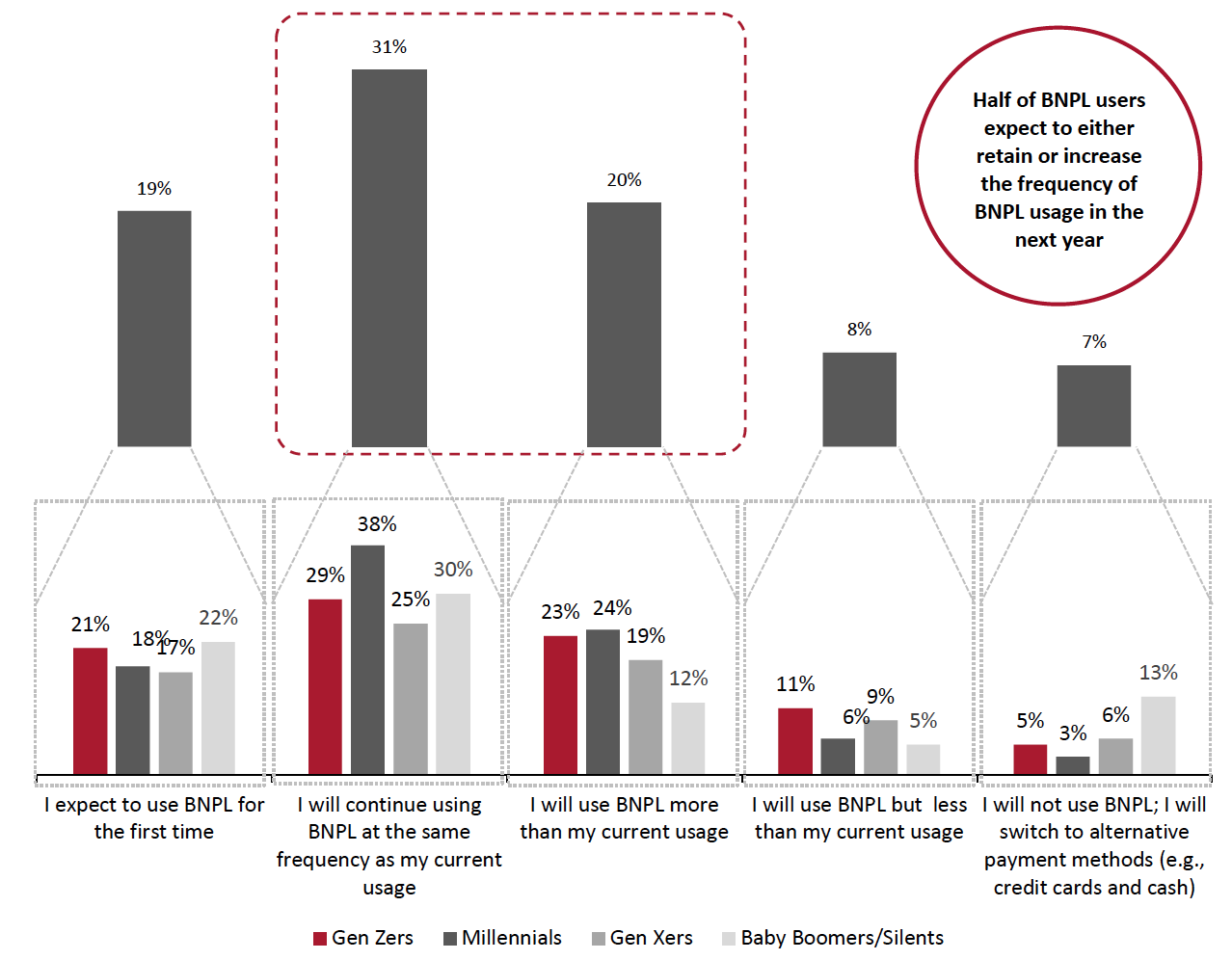

With the cost of both discretionary and non-discretionary purchases increasing due to rising inflation, our survey data reveals that BNPL will be an important mode of payment in the coming 12 months. We asked consumers that use (either occasionally or regularly) or are interested in trying BNPL about their planned use of the payment method over the next year:

- Just over half (51%) of respondents expect to either retain or increase the frequency of BNPL usage over the next 12 months.

- Only 7% of respondents expect to move away from BNPL to alternative payment methods—indicating that BNPL has thus far been an effective tool for consumers to deal with rising inflationary pressure and the pandemic.

Figure 13. Consumers That Use, or Are Interested in Trying, BNPL: Planned Usage of BNPL as a Payment Method Over the Next 12 Months, Overall (Top) and by Generation (Bottom) (% of Respondents) [caption id="attachment_146093" align="aligncenter" width="700"]

Totals do not sum to 100% because “Don’t know/Can’t say” responses are not included

Totals do not sum to 100% because “Don’t know/Can’t say” responses are not includedBase: 284 consumers across the US and Canada who are either interested in using BNPL or are regular/occasional users, surveyed in March 2022

Source: Coresight Research[/caption]

What We Think

Our survey findings inform three key recommendations for brands and retailers to capitalize on changing consumer preferences while partially offsetting negative impacts due to rising inflationary pressure.

- Factory reset any prior understanding of the consumer: The past two years have considerably changed shopping habits. Adding to it, inflationary pressure is set to alter the already reshaped habits. However, the general theme that we observe in our analysis of the survey results is that of value seeking—buying better products at attractive prices. Retailers must rethink their strategies based on demographics such as age groups as well as improve their personalization efforts by identifying how different consumers spend money and their interactions across channels. Adapting to rapidly evolving consumer habits) can help retailers position themselves strongly and attract value-minded consumers.

- Revisit promotional strategies: As prices spike, consumers expect to shop the best deal available by searching multiple channels before making a purchase. Deep discounting may attract one-time customers, but this strategy may prove costly over the longer run. Brands and retailers must focus on small-duration promotions. Short-lived deals and promotions may lead consumers to believe that the deals may not return in future, while focusing on the quality of their products—this may help in building long-term loyalty.

- Focus on payment methods and rewarding shoppers: It is imperative for brands and retailers to offer multiple payment methods when serving the mobile-first digital-era consumers. Offering digital wallets, co-branded credit cards and partnering with BNPL providers can help retailers attract value-seeking shoppers. Running promotions with payment partners and integrating third-party rewards can provide retailers with a competitive edge.

Methodology

This study is based on the analysis of data from an online survey of 500 consumers (aged 18+) in the US and Canada surveyed in March 2022.