DIpil Das

What’s the Story?

India has a thriving startup ecosystem, with the country ranking 20th among the top 100 countries in the Global Startup Ecosystem Index 2021 by StartupBlink, a global startup ecosystem map and research center—up from 23rd position in 2020. In this report, we examine the factors driving the growth of India’s startup ecosystem and discuss notable startups and unicorns (privately held startups valued at over $1 billion) in retail and related sectors. We also explore the government initiatives and schemes that are supporting the country’s startup ecosystem, as well as the incubators and accelerators that are creating development opportunities for startups in India.Why It Matters

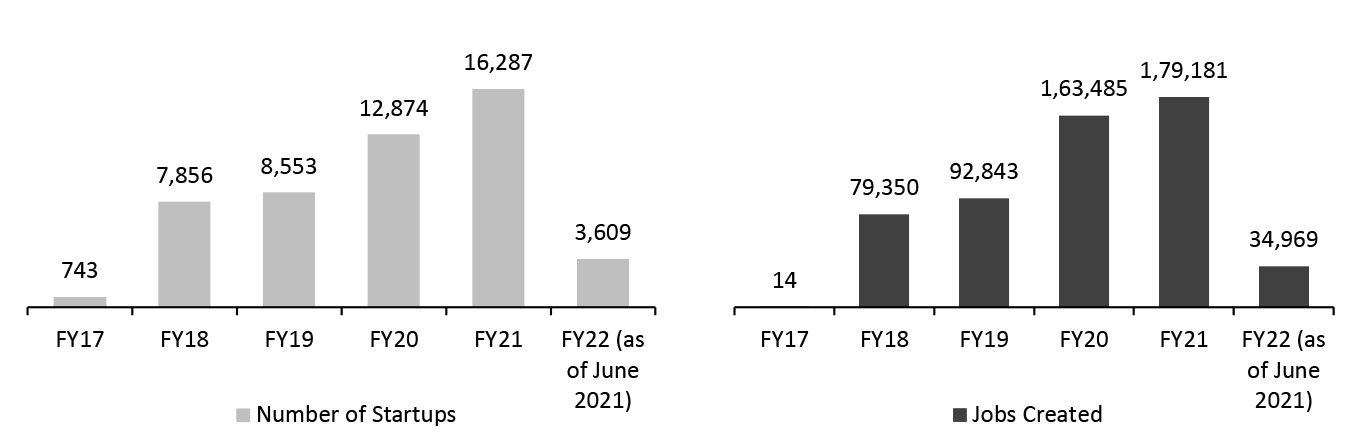

India’s startup ecosystem has seen huge growth over the past few years. The total number of startups recognized by the Department for Promotion of Industry and Internal Trade (DPIIT)—which acts as the nodal department for the Indian government’s Startup India initiative (discussed later in this report)—since January 2016 reached 50,000 on June 3, 2021. In the same time frame, 549,842 jobs had been created by 48,093 startups, according to the DPIIT. We break these numbers down by fiscal year (which runs April 1–March 31 in India) in Figure 1.Figure 1. Indian Startups Recognized by DPIIT (Left) and Jobs Created by Startups (Right), FY17–22* [caption id="attachment_137727" align="aligncenter" width="701"]

*Fiscal year runs from April 1 to March 31; FY22 YTD as of June 3, 2021

*Fiscal year runs from April 1 to March 31; FY22 YTD as of June 3, 2021 Source: Startup India [/caption]

The Indian Startup Ecosystem: Coresight Research Analysis

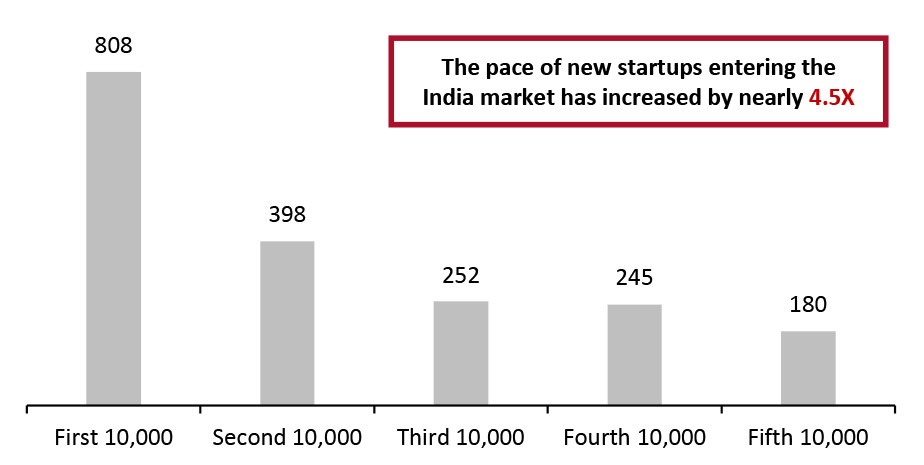

Key Growth Drivers The Indian startup ecosystem is growing at an ever-faster rate, with the latest 10,000 startups being recognized by the DPIIT in a record 180-day period, according to Startup India figures reported in June 2021. We show the increasing growth rate in Figure 2 and explore four key drivers behind this trend below.Figure 2. Number of Days Taken for the Addition of Every 10,000 Startups* [caption id="attachment_137728" align="aligncenter" width="699"]

*Between January 1, 2016, and June 3, 2021

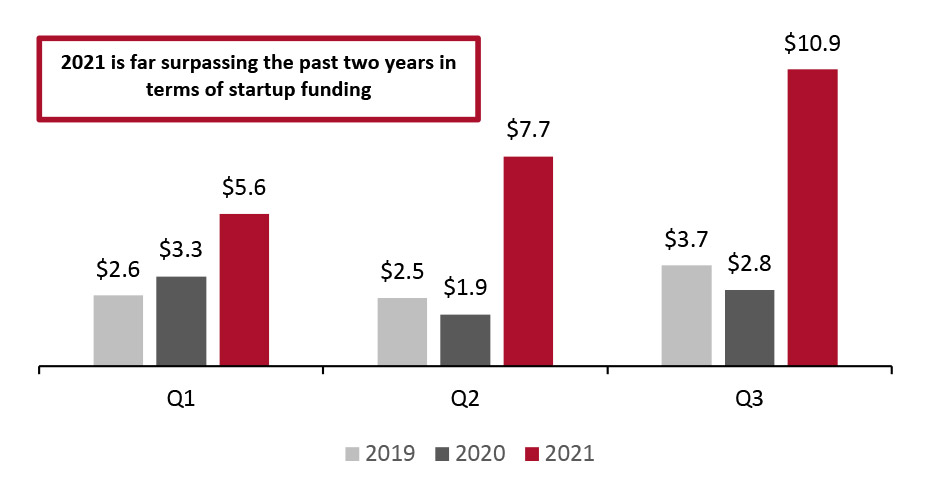

*Between January 1, 2016, and June 3, 2021 Source: Startup India [/caption] 1. Young Workforce India has the second-highest population in the world, at nearly 1.4 billion people as of December 2021, with an average age of 28.4 years, according to Worldometer (based on United Nations data). Furthermore, 67.4% of the total population are aged 15–64 years old (working age group), according to the United Nations Population Fund’s (UNFPA’s) 2021 data. The country’s young population drives a culture of innovation, entrepreneurship and diversity, positioning India as a key investment hub. It also contributes to shifts in social dynamics, leading to growth in India’s economic potential. 2. Urbanization India is undergoing urbanization: The urban population grew from 33.6% of India’s total population in 2017 to 34.9% in 2020, according to World Bank data. This trend is causing various societal shifts, including in the occupation types of urban residents, and the number of women in the workforce and women entrepreneurs—45% of startups in India have a women entrepreneur in their leadership team, the DPIIT reported in June 2021. Urban consumers have more disposable income than rural consumers, so the urbanization trend has also resulted in a rising per capita income—which increased by 65% from $4,190 in 2010 to $6,920 in 2019, according to World Bank data. This provides opportunities for startups to create products and services at higher price points to target these consumers. 3. Increasing Internet Penetration and Smartphone Adoption A rise in smartphone adoption and increased Internet access through affordable broadband solutions and mobile data have led to higher levels of online content consumption among Indian consumers. The number of broadband Internet subscribers in India has continued to increase through 2021, standing at 813.5 million as of August 2021 (latest data available)—up from 782.9 million in April 2021—according to the Telecom Regulatory Authority of India (TRAI), a statutory authority under the Department of Telecommunications, Ministry of Communications. Furthermore, India’s smartphone base is set to reach 829 million, accounting for 60% of the population, by 2022, according to a report by the Indian Cellular and Electronics Association and KPMG. The digital switch will create a network of digital consumers, providing opportunities for startups embracing technologies and those operating in sectors including fintech, health technology, educational technology, etc. 4. Growing Investor Interest India’s startup ecosystem is seeing much interest from investors, driven by technology innovations and new business models amid consumers’ increased digital adoption. Startups raised total funding of $24.2 billion during the first three quarters of calendar 2021, according to PwC and Venture Intelligence. For the first time, privately held Indian startups recently raised more than $10 billion in a given quarter—totaling $10.9 billion in the July–September 2021 quarter, across 347 venture capital/private equity deals. As shown in Figure 3, these numbers represent an increase in funding in terms of value compared to 2020, demonstrating growing investor interest among various Indian and international VC investors. Fintech, educational technology, SaaS (software-as-a-service) and B2B (business-to-business) e-commerce were the top four sectors, attracting the highest funding in the first three quarters of 2021, according to PwC.

Figure 3. Privately Held Startup Funding in India in the First Three Quarters (Jan–Sep), 2019–2021 (USD Bil.) [caption id="attachment_137730" align="aligncenter" width="699"]

Data are for calendar years

Data are for calendar years Source: PwC/Venture Intelligence [/caption] Notable Startups In Figure 4, we present selected startups across the retail, retail technology, logistics, fintech and consumer services sectors in India.

Figure 4. Notable Retail-Related Startups in India [wpdatatable id=1526 table_view=regular]

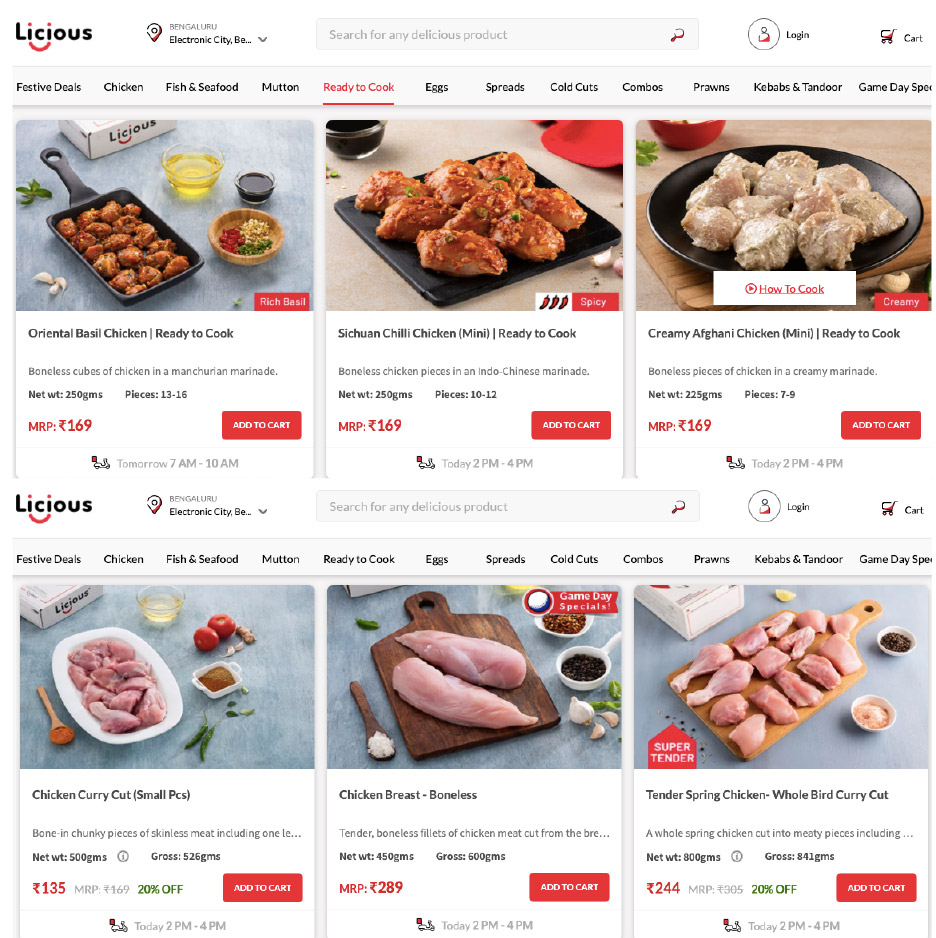

Source: Company reports/Coresight Research Notable Unicorns By the end of 2020, the Indian startup ecosystem had 38 unicorns; it then saw 28 unicorns emerge in the first nine months of calendar 2021, according to estimates from the National Association of Software and Service Companies (NASSCOM), an Indian non-governmental trade association and advocacy group focused on India’s tech industry. NASSCOM reported in September 2021 that these 66 unicorns have raised cumulative funding of over $51 billion, with 18% of them raising $1 billion each; 60% of the companies are from e-commerce, fintech and SaaS verticals; and about 90% of the startups turned unicorns in less than 10 years, with 70% of those reaching unicorn status in less than five years. Below, we examine some of the companies that reached the unicorn status recently. CRED CRED, a fintech firm founded in 2018 and headquartered in Bangalore, offers reward-based credit card payments. CRED is a membership-based credit card bill-payment platform offering exclusive rewards and experiences from premium brands to its members for clearing their bills on time. Members earn a “CRED Coin” for every rupee cleared on their credit card bill, which can be later redeemed to claim brand rewards and experiences, such as access to events, gift cards and upgrades from brands including Cure.Fit, Diesel, Myntra and Olive Bar & Kitchen, among others. Furthermore, to make the CRED experience rewarding, CRED has its own marketplace that features a wide range of products from 500+ brands across personal care, grooming, electronics, food and beverage, and other categories. CRED entered the unicorn club in April 2021 with a $215 million funding round led by new investor Falcon Edge Capital and existing investor Coatue Management LLP, giving it a valuation of $2.2 billion. In total, the company has raised a total of $722.2 million in funding over eight rounds. Licious Licious is a DTC online fresh-meat brand founded in 2015 in Bangalore. The company claims to address the consumer problem of finding “safe, delectable and trustworthy” fresh meat in the country. It operates a farm-to-fork model, owning the entire back-end supply chain and cold chain. The company’s product range includes poultry, fish and seafood, and mutton. Licious also offers a wide range of convenience and packaged food such as ready-to-cook meat dishes, spreads and cold cuts. The company has a presence in 14 Indian cities, and it has two experience centers in Delhi and Bangalore. Licious operates under the banner Delightful Gourmet Private Limited. In October 2021, Licious raised $52 million in a Series G funding round led by IIFL Asset Management’s late-stage tech fund and Avendus; it entered the unicorn club at a valuation of $1.05 billion. The company claims that it was the first DTC unicorn in the country. Licious plans to use the funding to enhance its product lines in the ready-to-eat and ready-to-cook categories and further its omnichannel presence by entering smaller cities. Licious has raised a total of $338.5 million in funding over eight rounds. As of October 2021, the company claims to have served more than 2 million customers, and it serves about 1 million orders every month with 90% repeat orders across markets. [caption id="attachment_137732" align="aligncenter" width="700"]

Source: Company website[/caption]

Meesho

Meesho is a social commerce platform that enables small retailers to connect and sell their products through resellers using social media. It was founded in 2015 and is headquartered in Bangalore.

Meesho creates an environment for homemakers, aspiring entrepreneurs and students to start their businesses without any investment. The platform takes on retail distribution for sellers. It features a variety of products in 200 categories, including clothing, cosmetics, jewelry, accessories and household items.

In April 2021, Meesho raised $300 million in a funding round led by Japan’s SoftBank Group Corp. With a valuation of $2.1 billion through this funding, Meesho entered the unicorn club. The company plans to use the investment for team building, strengthening its senior leadership, creating awareness about its business in smaller towns and funding its new grocery vertical, Farmiso. The company has raised a total of $1.1 billion in funding over 11 rounds, according to business intelligence platform Crunchbase.

On October 6–9, 2021, Meesho hosted a festive sale called “Maha Indian Shopping League,” during which the company recorded 750% growth in its user base compared to last year. It had also launched an industry-first 0% commission model for its sellers in July 2021 and claims that sellers saved over ₹136 million ($1.83 million) during the festive sale event alone.

Source: Company website[/caption]

Meesho

Meesho is a social commerce platform that enables small retailers to connect and sell their products through resellers using social media. It was founded in 2015 and is headquartered in Bangalore.

Meesho creates an environment for homemakers, aspiring entrepreneurs and students to start their businesses without any investment. The platform takes on retail distribution for sellers. It features a variety of products in 200 categories, including clothing, cosmetics, jewelry, accessories and household items.

In April 2021, Meesho raised $300 million in a funding round led by Japan’s SoftBank Group Corp. With a valuation of $2.1 billion through this funding, Meesho entered the unicorn club. The company plans to use the investment for team building, strengthening its senior leadership, creating awareness about its business in smaller towns and funding its new grocery vertical, Farmiso. The company has raised a total of $1.1 billion in funding over 11 rounds, according to business intelligence platform Crunchbase.

On October 6–9, 2021, Meesho hosted a festive sale called “Maha Indian Shopping League,” during which the company recorded 750% growth in its user base compared to last year. It had also launched an industry-first 0% commission model for its sellers in July 2021 and claims that sellers saved over ₹136 million ($1.83 million) during the festive sale event alone.

- We discuss Meesho in more detail our separate Retail Innovators: India E-Commerce report.

Figure 5. Various Government Schemes, Policies, and Initiatives to Promote Startup Ecosystem in India–2015–2021 [wpdatatable id=1527 table_view=regular]

Source: Government of India/Startup India Startup Accelerators and Incubators Startup incubators and accelerators play an important part in the startup ecosystem by helping entrepreneurs succeed and grow their businesses. Startup incubators can be either for-profit or non-profit organizations run by both public and private entities. Below, we examine the types of accelerators and incubators, with key examples in India’s startup ecosystem. Corporate Accelerators Corporate accelerators are seed accelerators sponsored by an established for-profit organization. They support startup companies with mentorship, capital and office space. TLabs, NASSCOM Initiative, and Venture Nursery are some of the corporate accelerators in India.

- Founded in 2011, Gurgaon-based TLabs, backed by Indian Internet technology company Times Internet, is a startup accelerator and an early-stage seed fund for mobile and technology startups in India. It also offers a mentorship program in the technology space.

- Founded in 2006 and based out of Bangalore, Kalaari Capital invests in companies within the e-commerce, clean technology, information technology, mobile, healthcare, software products and services sectors. It led the $2.6 million Series A funding round of DTC sports brand Elevar in August 2021.

- Founded in 2014, Axilor Ventures is an early-stage seed fund and startup accelerator that supports entrepreneurs. In March 2021, it led a pre-Series A funding round of $1.5 million for Hyderabad-based healthtech startup Cancer Clinics.

- Started in April 2006, Indian Angel Network (IAN) is a network of angel investors that includes leaders in the entrepreneurial ecosystem and individuals with strong operational experience as CEOs or creating new and successful ventures. The IAN Incubator invests in early-stage businesses and offers mentoring. The IAN Incubator typically invests in startups with scalable businesses and differentiated value propositions across the agriculture, retail, e-commerce, gaming, healthcare, Internet and lifestyle sectors, among others.

- KSUM was founded in 2006. It is the nodal agency of the Government of Kerala and promotes technology-based entrepreneurship activities, creating the infrastructure and ecosystem needed to support technology startups. KSUM has more than 1 million square feet of incubation space, over 40 incubators and 300+ innovation centers, according to the agency. KSUM data show that it has raised over 3,100 startups and disbursed grants worth ₹196 million ($2.6 million) and funds worth ₹7.5 billion ($101 million), as of December 2021.

- Established in 2007, the Center for Innovation Incubation & Entrepreneurship (CIIE) is a not-for-profit company that is governed by a board comprising government, industries and Indian Institute of Management Ahmedabad representatives. CIIE closely works with the government to offer grants for idea-stage startups and entrepreneurs building product-based solutions in areas such as biotech. It also helps with seed-stage funding ranging from ₹2 million ($20,000) to ₹10 million ($130,000) and seed-to-growth-stage funding of between ₹30 million ($400,000) to ₹150 million ($2 million) in the areas of deep tech, innovation and inclusion.

- The Society for Innovation and Entrepreneurship (SINE) was set up in 2004 as an umbrella organization at IIT Bombay that promotes entrepreneurship and supports technology startups. SINE provides “start to scale” support for tech-based entrepreneurship and helps for the conversion of research to entrepreneurial ventures, according to the organization. SINE also provides prototyping grants and runs accelerator programs in partnership with corporate entities. Sectors that SINE invests in include fintech, medtech and information technology.

What We Think

Technology adoption among brands and retailers is already prominent in India. Currently, after the pandemic-led digital switch among consumers, brands and retailers are looking at integrating immersive technologies to offer a seamless shopping experience. We believe that this will lead to a growth in tech startups and opportunities to offer new-age technologies, attracting investor interest. We anticipate the emergence and growth of startups in sectors that impact retail, such as fintech (digital payments), SaaS (solutions and platforms) and supply chain and logistics (back-end operations). We believe that India will soon witness a rise in the number of “decacorns”—startups with a valuation of over $10 billion—as the ecosystem matures. Startups currently have the best market conditions to flourish, with digital products and services adoption at an all-time high, leading to the creation of more jobs and adding to India’s economic growth. Implications for Brands/Retailers- Brands and retailers should look at partnerships with new-age tech startups that augment their current technology offerings to achieve scale and continued fast-paced growth.

- Brands and retailers should focus on bringing in innovation that disrupt their operational sectors, which will also attract domestic and foreign investment.

- The growing startup ecosystem presents opportunities for real estate firms to launch and develop technology parks with state-of-the-art offices and co-working spaces.

- Accelerators and incubators that nurture tech startups provide opportunities for real estate firms to develop technology spaces such as tech labs for research and development.

- India’s young and tech-savvy working population presents opportunities for technology vendors to develop platforms that disrupt the traditional and informal retail systems currently in place in the country.

- Technology startups that offer software solutions can help small and medium-sized offline businesses achieve a digital switch and fast growth.