Source: Company reports

2Q 2016 RESULTS

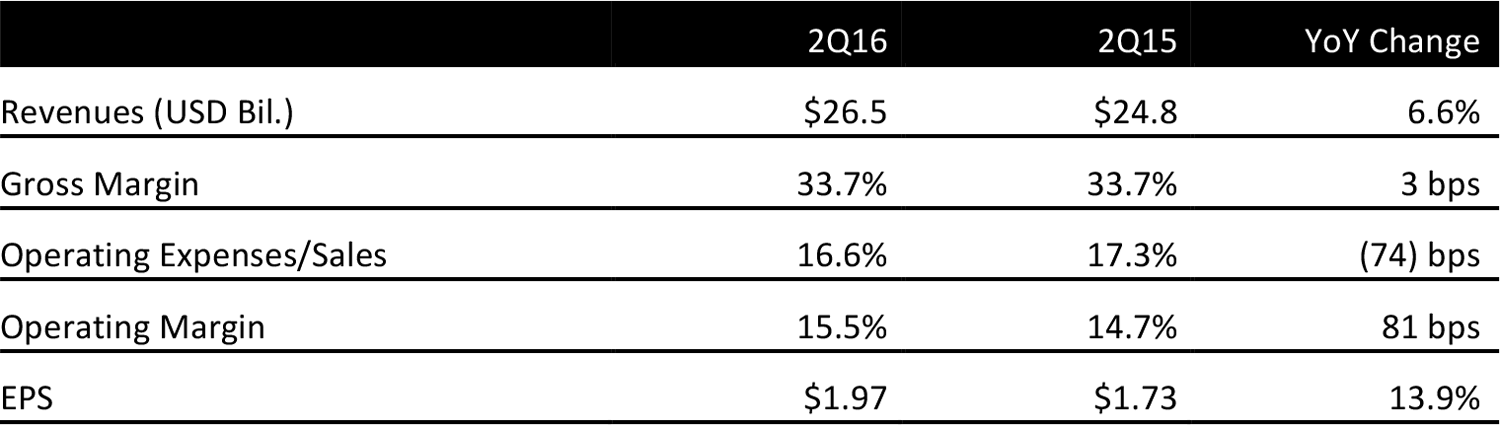

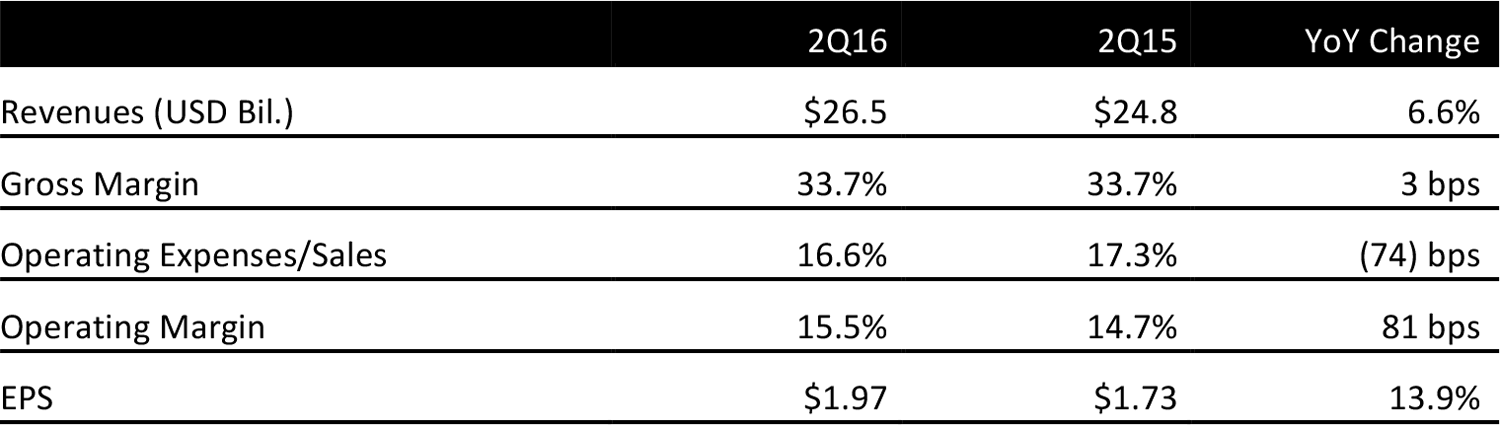

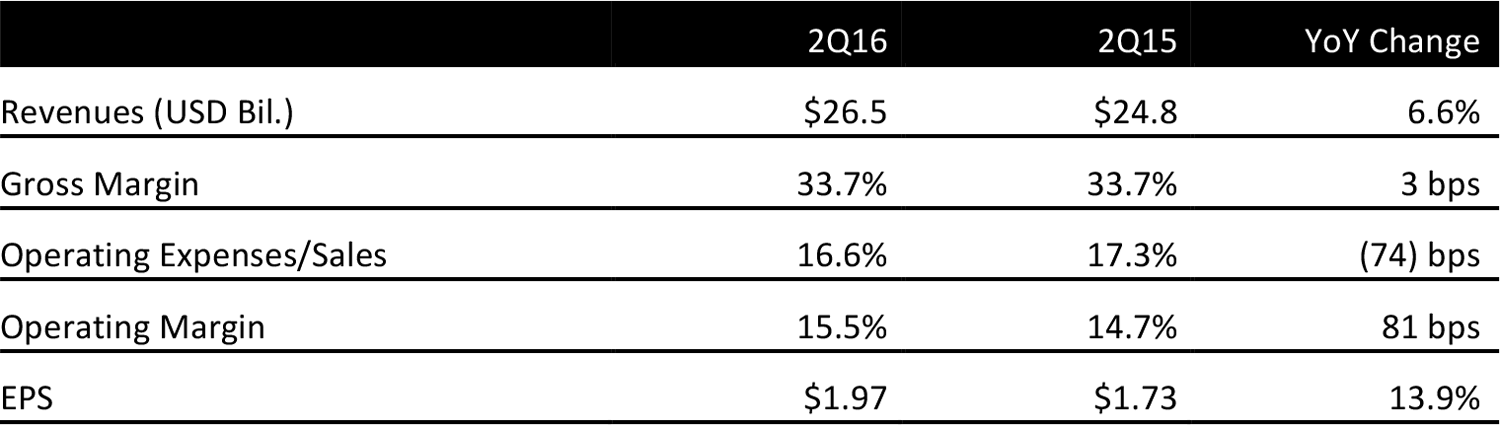

Home Depot reported 2Q 2016 revenues of $26.5 billion, up 6.6% year over year and in line with the consensus estimate. Management characterized the results as solid, with record revenues and net earnings, a benefit of a tailwind from housing. The stronger US dollar hurt sales by $181 million, or 69 basis points.

Growth was balanced in the quarter, with total comp transactions up 2.2%. The average ticket increased 2.5%, from a higher number of items per basket and 18 basis points of inflation in the price of building materials, including lumber. Big-ticket sales (i.e., over $900) represented 20% of US sales and increased 8.1% year over year, driven by strength in high-voltage air conditioning ( HVAC), appliances and roofing.

The gross margin was 33.7% in 2Q 2016, up 3 basis points from a year ago due to the combination of 13 basis points of expansion from improvements in the supply chain and 12 basis points of expansion from higher co-op and rebate tiers, offset by 22 basis points of contraction because of the Interline acquisition.

Management was pleased with expense control during the quarter, and SG&A expense decreased by 74 bps as a percentage of sales. Expenses are now expected to grow at just 32% of the rate of corporate revenue growth in 2016.

EPS was $1.97, compared to $1.73 in the year-ago quarter, up 13.9% and in line with consensus. Net earnings in the year-ago quarter benefited from the combination of a $92 million pretax expense related to the data breach, more than offset by a $144 million pretax gain on the sale of stock, for a net benefit of $0.02.

Inventory was $12.3 billion at the end of 2Q 2016, up $464 million or 3.9% year over year, due to the acquisition of Interline. Inventory turned 5.2 times in the quarter, at roughly the same rate it did in the year-ago quarter.

BUSINESS UPDATE

Comps were 4.7%, slightly below the 4.8% consensus estimate, and 5.4% for US stores due to the tailwind from housing. All three US divisions posted positive comps, led by the Western division. Moreover, all 19 US regions and top-40 markets recorded double-digit comps.

Monthly comps were positive; 2.3% in May, 7.5% in June and 4.5% in July, and were affected by the timing of the Memorial Day holiday. Adjusted for the timing of the holiday, comps would have been 4.3% in May, 7% in June and 5% in July.

All merchandising departments posted positive comps, and the Pro and DIY categories maintained a healthy balance. Comps were led by appliances, which had double-digit comps. Tools, lumber, plumbing, decor, indoor garden, building materials and lighting reported above-average comps, while hardware, outdoor garden, kitchen and bath, millwork, electrical, paint and flooring achieved positive comps but below the company average.

Pro sales grew faster than the corporate average, led by the higher spending of Pro customers. Commercial and industrial lighting, fencing, power tools, power tool accessories, wiring devices and interior doors had above-average comps.

In the international markets, the performance of the Mexican and Canadian businesses was characterized as solid. Mexico posted the 51st consecutive quarter of positive comps, which were in the double digits in the quarter.

The Canadian business posted its 19th consecutive quarter of positive comps; comps were positive in local currency in the quarter. Both ticket size and the number of transactions increased. Canadian Pro sales outpaced DIY sales in the US in the quarter.

Management said the integration of Interline is progressing and they are working on offering Interline’s catalog products to the Pro section of the company’s stores.

Online sales grew 19% year over year and represented 5.6% of total sales, or $1.5 billion, a benefit of double-digit growth in site traffic and higher conversion rates. Mobile and tablets represented more than 50% of traffic. The company is enhancing the functionality of its mobile app with features such as larger and clearer product images, live mobile chat and a simplified checkout experience. Approximately 42% of online orders now use the store footprint for fulfillment and nearly 90% of online product returns are processed through the company’s physical stores.

OUTLOOK

Looking at the macro environment, management said they continue to see positive signs in the housing market, which is creating a tailwind for the company’s business.

The company maintained 2016 guidance of revenues up 6.3% and comps up 4.9%. This figure implies comps of 4.3% in the second half of the year, which management stressed is a year-over-year figure and does not imply a sequential slowdown. On a two-year stock basis, comps in the second half are expected to be the same as in the first half.

Management raised EPS guidance to $6.31, up 15.6%, from $6.27 previously, due to improved expense control and operating leverage throughout the year.

The company plans to introduce a new DEWALT power system and a new RYOBI connected garage-door opener, as well as a variety of seasonal products in Q3 2016.