Web Developers

Growth and productivity were the key themes running through Home Depot’s Investor and Analyst Conference on December 8, 2015.

As he kicked off the conference, Chairman, CEO and President Craig Menear noted that Home Depot has recently been focusing on:

Later in the conference, Bill Lennie, Executive Vice President of Outside Sales and Service, returned to the subject of targeting professional customers. In the past, Home Depot “acted like a 7-Eleven for bigger pros,” Lennie said. The company wants to move on from that positioning, and become a true one-stop shop for even bigger professional customers. The acquisition of Interline, a seller of products to professional customers, is intended to bolster Home Depot’s penetration of this segment. Lennie also noted that delivery, credit, sales reps for professional customers and the Pro Xtra loyalty program are key areas of focus that will attract professional customers.

Later in the conference, Bill Lennie, Executive Vice President of Outside Sales and Service, returned to the subject of targeting professional customers. In the past, Home Depot “acted like a 7-Eleven for bigger pros,” Lennie said. The company wants to move on from that positioning, and become a true one-stop shop for even bigger professional customers. The acquisition of Interline, a seller of products to professional customers, is intended to bolster Home Depot’s penetration of this segment. Lennie also noted that delivery, credit, sales reps for professional customers and the Pro Xtra loyalty program are key areas of focus that will attract professional customers.

Professionals are not the company’s only focus. Alongside pros, baby boomers and millennials make up the identified core customer segments for Home Depot, said Powers. The needs of these groups are different: affluent-but-unenergetic boomers are keen to pay for “do-it-for-me” services, while first-time-buyer millennials want an experience with a company that cares about its impact on communities and its associates.

Their needs are different, but for all these groups, services such as buy online, pick up in-store (BOPIS) and buy online, deliver from store are simply new iterations of existing shopping habits, Powers said. Shoppers across segments are looking for “old things done a new way.”

Professionals are not the company’s only focus. Alongside pros, baby boomers and millennials make up the identified core customer segments for Home Depot, said Powers. The needs of these groups are different: affluent-but-unenergetic boomers are keen to pay for “do-it-for-me” services, while first-time-buyer millennials want an experience with a company that cares about its impact on communities and its associates.

Their needs are different, but for all these groups, services such as buy online, pick up in-store (BOPIS) and buy online, deliver from store are simply new iterations of existing shopping habits, Powers said. Shoppers across segments are looking for “old things done a new way.”

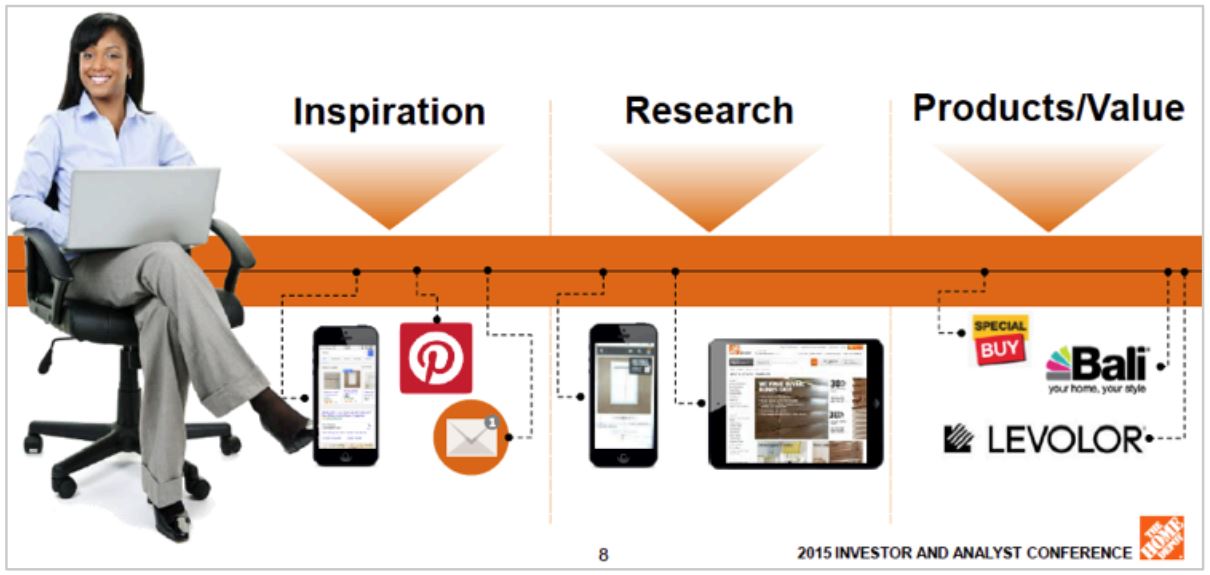

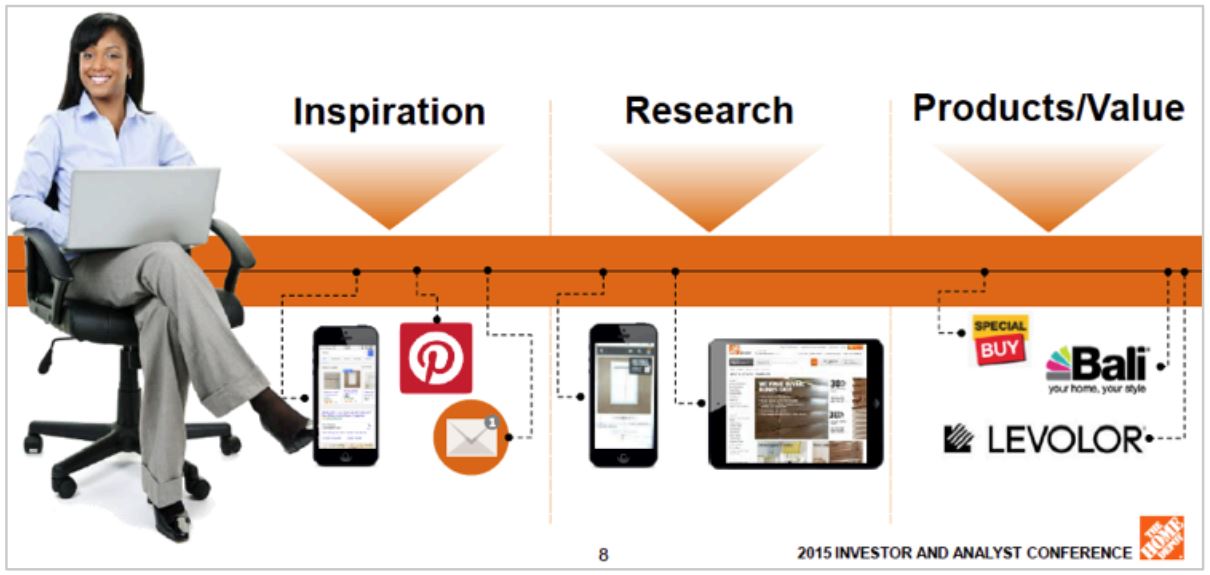

Home Depot is anticipating significant growth in the online channel and Kevin Hoffman, President of Online Home Depot, discussed the company’s approach to digital retail.

Home Depot is anticipating significant growth in the online channel and Kevin Hoffman, President of Online Home Depot, discussed the company’s approach to digital retail.

Meanwhile, inventory turnover is expected to grow from 4.8 times estimated for the current fiscal year to 5.7 times in fiscal year 2018. Also looking ahead, Tomé said that by 2018, the cost of goods should fall, as the company will have made continued efforts to drive out costs. But gross margins will be broadly flat as it reinvests the costs savings into lower-margin categories. Moreover, expenses are expected to grow at around 50% of sales growth as “people costs” rise.

Tomé returned to a theme mentioned by several speakers across the day: productivity. For Home Depot, she said, productivity is a “virtuous cycle,” whereby savings can be reinvested in the proposition, such as in staff and in “interconnected retail,” which should deliver further top-line growth.

Meanwhile, inventory turnover is expected to grow from 4.8 times estimated for the current fiscal year to 5.7 times in fiscal year 2018. Also looking ahead, Tomé said that by 2018, the cost of goods should fall, as the company will have made continued efforts to drive out costs. But gross margins will be broadly flat as it reinvests the costs savings into lower-margin categories. Moreover, expenses are expected to grow at around 50% of sales growth as “people costs” rise.

Tomé returned to a theme mentioned by several speakers across the day: productivity. For Home Depot, she said, productivity is a “virtuous cycle,” whereby savings can be reinvested in the proposition, such as in staff and in “interconnected retail,” which should deliver further top-line growth.

- Identifying potential disruptors to its industry.

- Generating ideas to expand sales across the next three to eight years.

- Coming up with new productivity ideas.

Home Depot’s Core Strategy

Source: Home Depot

Growth and Productivity

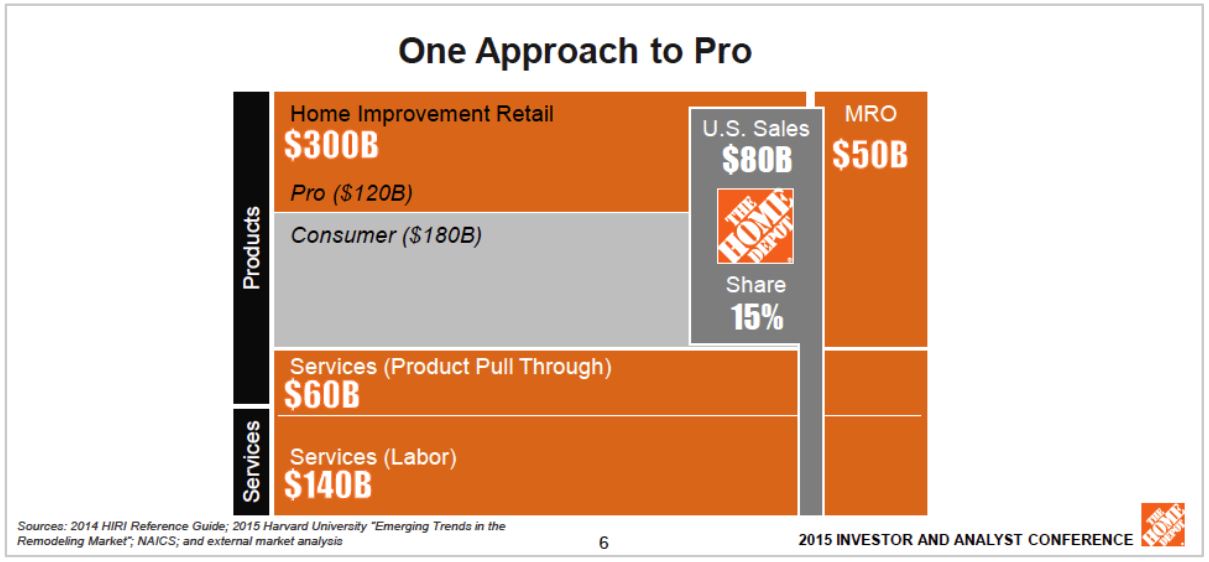

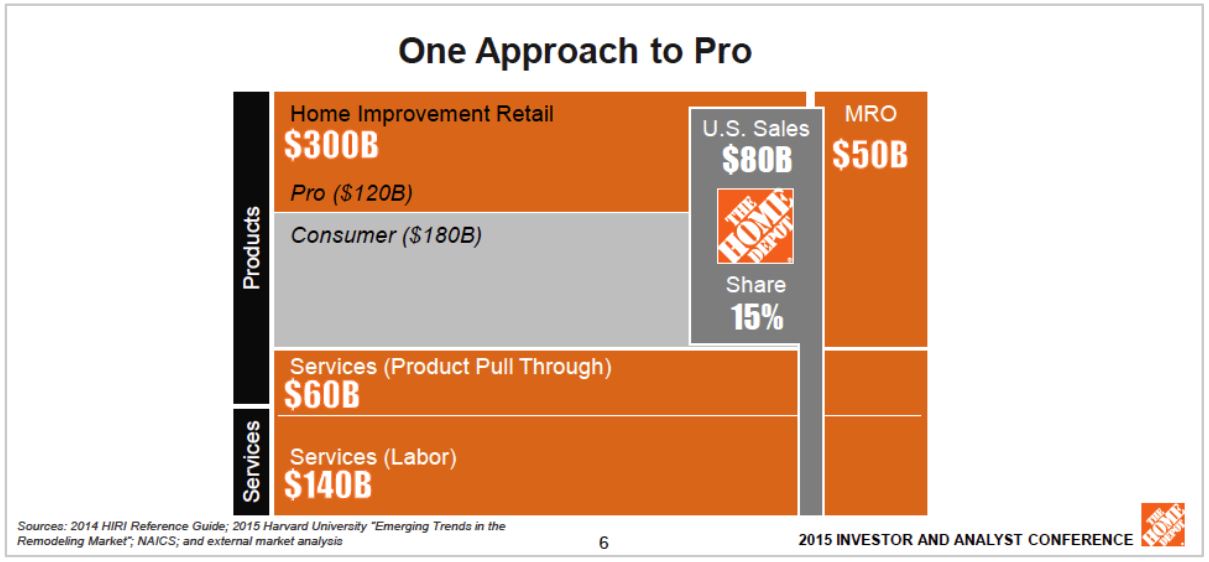

The US still holds substantial growth potential for Home Depot, according to Menear, and the company aims to grow to $101 billion in sales by 2018, up from $83 billion in the year ending February 2015. The company’s share of the total addressable market in the US is still only around 15%, he told analysts. Adding spending on consumer home improvement to spending on professional maintenance, repair and operations (MRO) and “do-it-for-me” services creates a total potential US market of $550 billion. So, there looks to be much opportunity still for $80-billion Home Depot to pursue. However, there are a number of choices that are currently off limits for Home Depot, Menear said. These include small-store formats: Home Depot has “gone down that road before” and did not succeed in that space, the CEO told analysts. The company will also not expand into new international markets nor make acquisitions in order to buy sales—although it will make strategic acquisitions to add capability, such as it did with its purchase of Blinds.com. Menear noted two particular areas of opportunity:- Professional customers, i.e., tradespeople. Home Depot has been leaning into this segment, Menear said, because the aging population (which has a “do-it-for-me” bent) and growth in the number of multifamily households (which require MRO) have made it a growth segment. The company has reorganized in order to have one group dedicated to professional customers’ needs.

- Interconnected retail, i.e., multi-channel retail. Home Depot’s digital business will grow by nearly $1 billion in sales in 2015, we were told. And some 10% of digital orders are being placed by a device in use within an actual Home Depot store—confirming the extent to which shoppers are browsing and buying across channels. The company is deepening its curated online and in-store assortments by leveraging data to tailor assortments at the local level.

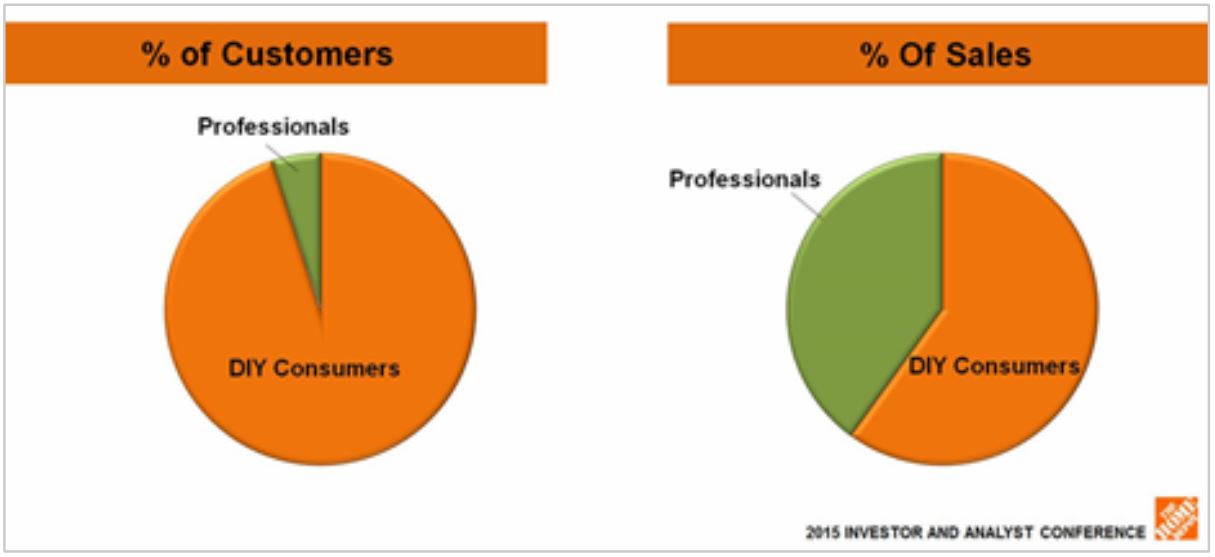

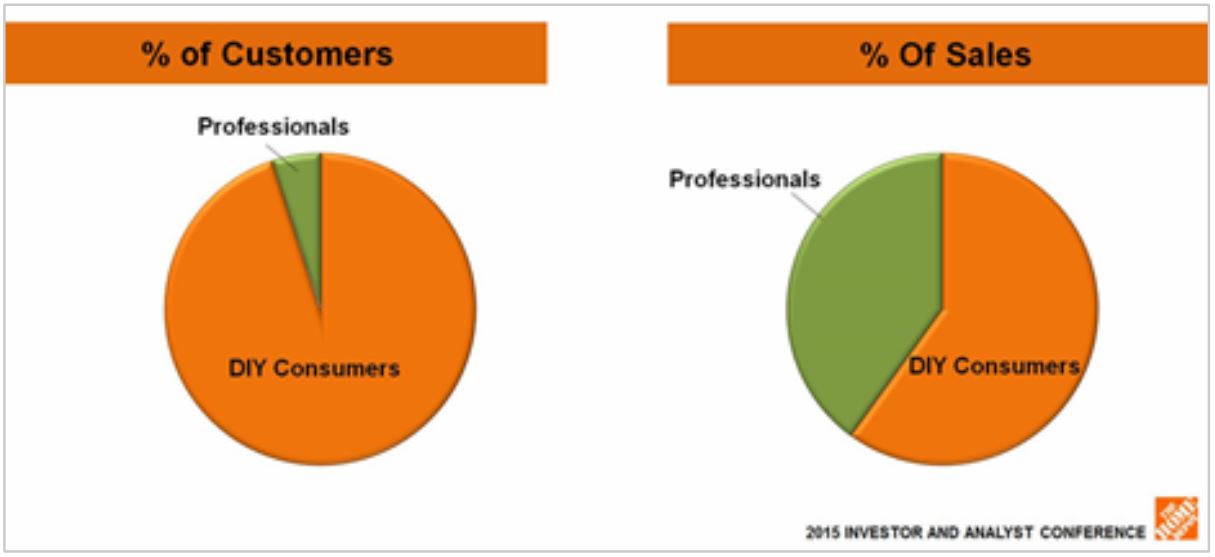

Stores to Serve More Pro Customers

Professionals make up just 3% of Home Depot shoppers, Powers said, but contribute fully 40% of sales. The average annual spend by a consumer at Home Depot is $330; for a professional, it is $6,500. Later in the conference, Bill Lennie, Executive Vice President of Outside Sales and Service, returned to the subject of targeting professional customers. In the past, Home Depot “acted like a 7-Eleven for bigger pros,” Lennie said. The company wants to move on from that positioning, and become a true one-stop shop for even bigger professional customers. The acquisition of Interline, a seller of products to professional customers, is intended to bolster Home Depot’s penetration of this segment. Lennie also noted that delivery, credit, sales reps for professional customers and the Pro Xtra loyalty program are key areas of focus that will attract professional customers.

Later in the conference, Bill Lennie, Executive Vice President of Outside Sales and Service, returned to the subject of targeting professional customers. In the past, Home Depot “acted like a 7-Eleven for bigger pros,” Lennie said. The company wants to move on from that positioning, and become a true one-stop shop for even bigger professional customers. The acquisition of Interline, a seller of products to professional customers, is intended to bolster Home Depot’s penetration of this segment. Lennie also noted that delivery, credit, sales reps for professional customers and the Pro Xtra loyalty program are key areas of focus that will attract professional customers.

Professionals are not the company’s only focus. Alongside pros, baby boomers and millennials make up the identified core customer segments for Home Depot, said Powers. The needs of these groups are different: affluent-but-unenergetic boomers are keen to pay for “do-it-for-me” services, while first-time-buyer millennials want an experience with a company that cares about its impact on communities and its associates.

Their needs are different, but for all these groups, services such as buy online, pick up in-store (BOPIS) and buy online, deliver from store are simply new iterations of existing shopping habits, Powers said. Shoppers across segments are looking for “old things done a new way.”

Professionals are not the company’s only focus. Alongside pros, baby boomers and millennials make up the identified core customer segments for Home Depot, said Powers. The needs of these groups are different: affluent-but-unenergetic boomers are keen to pay for “do-it-for-me” services, while first-time-buyer millennials want an experience with a company that cares about its impact on communities and its associates.

Their needs are different, but for all these groups, services such as buy online, pick up in-store (BOPIS) and buy online, deliver from store are simply new iterations of existing shopping habits, Powers said. Shoppers across segments are looking for “old things done a new way.”

Home Depot is anticipating significant growth in the online channel and Kevin Hoffman, President of Online Home Depot, discussed the company’s approach to digital retail.

Home Depot is anticipating significant growth in the online channel and Kevin Hoffman, President of Online Home Depot, discussed the company’s approach to digital retail.

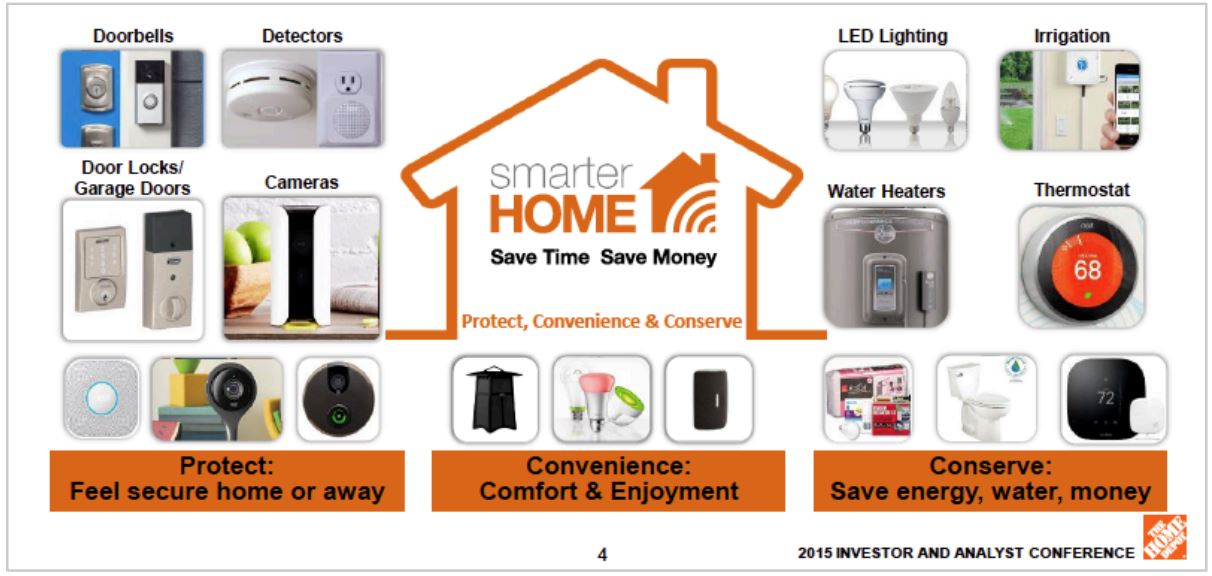

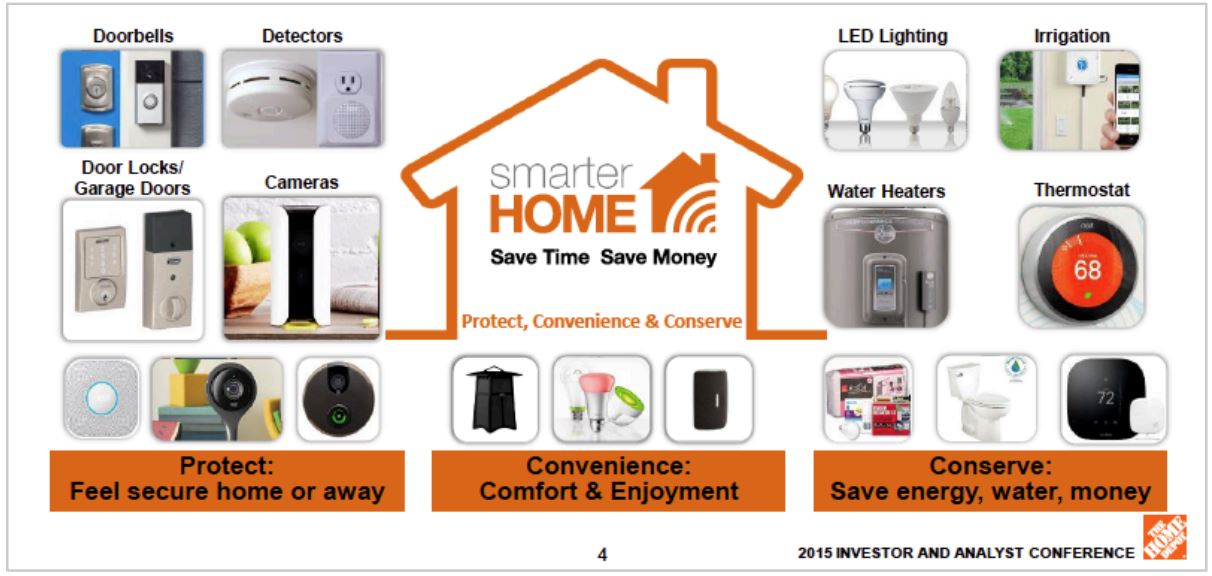

“Protect, Convenience, and Conserve” Are Three Pillars for a Smarter Home

Home Depot is seeing great demand for smart home products. Decker estimates that a typical smart household will have about 500 smart products by 2020. To accelerate adoption rate, Home Depot provides open platform products so customers do not have to be locked in to specific systems at early stage. Decker also shared three principles for Home Depot’s smart home categories.- Protect: customers increasingly need to feel safe at home and away from home. Smart home security products such as smart smoke detectors, smart doorbells/locks, and smart cameras are popular selling items.

- Convenience: with the popularity of telecommute, people will spend more time at home and will invest in making their homes more comfortable and enjoyable.

- Conserve: smart water heaters, thermostat, LED lighting can help consumers save on their energy bills in the long run. Purchases of energy conserving smart home products have a clear return on investment.

“Orange Aprons in the Digital Aisle”

“Old things done a new way” was a theme reiterated by Kevin Hofmann, President of Online at Home Depot. The company will deliver convenience, product authority and an end-to-end customer experience in its digital and store channels, Hofmann said. Home Depot’s digital efforts include:- Expanding assortments and reach into underpenetrated categories.

- Rolling out a new BOPIS system in 2016.

- Using data to leverage the customer journey.

- Offering online content, curation, ratings, reviews and room scenes.

- Undertaking 40–50 digital category resets each year.

Huge Professional Customer Opportunity

Of the total $550 billion addressable US market for Home Depot, $370 billion is with professional customers, including $120 billion in home improvement retail, $200 billion in services (product pull through and labor), and $50 billion in MRO (maintenance, repair and operations). Home Depot’s recent acquisition of Interline Brands, a national direct marketer and distributor of MRO products, will help the company to better service pro customers through added core competency in b2b purchases, expanded assortment, and enhanced last-mile distribution capability. Interline has 100,000 skus of products and owns significant number of delivery trucks.

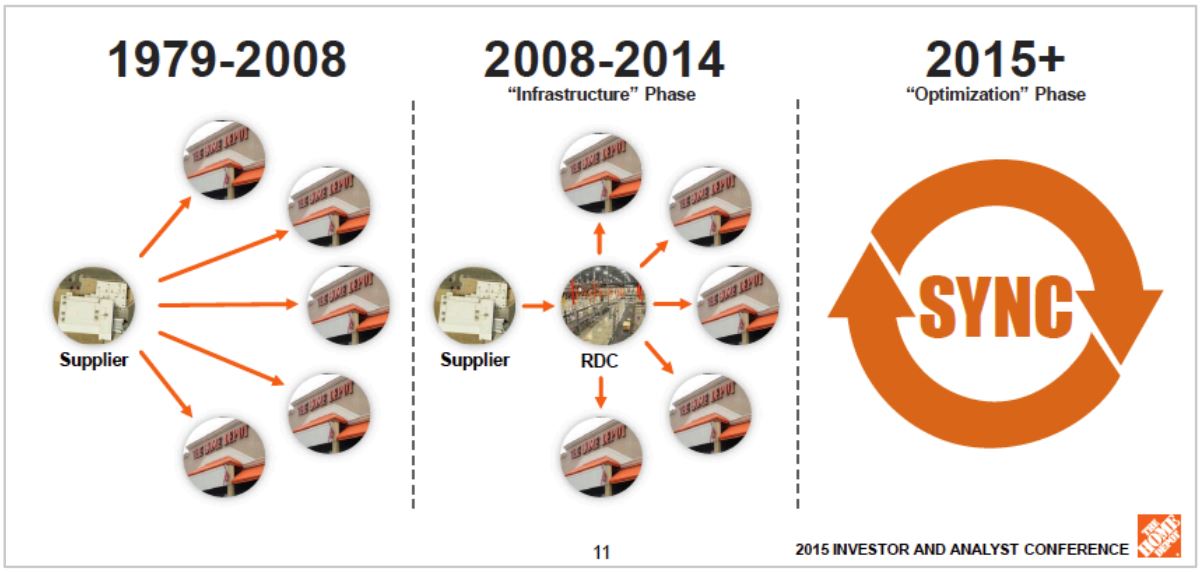

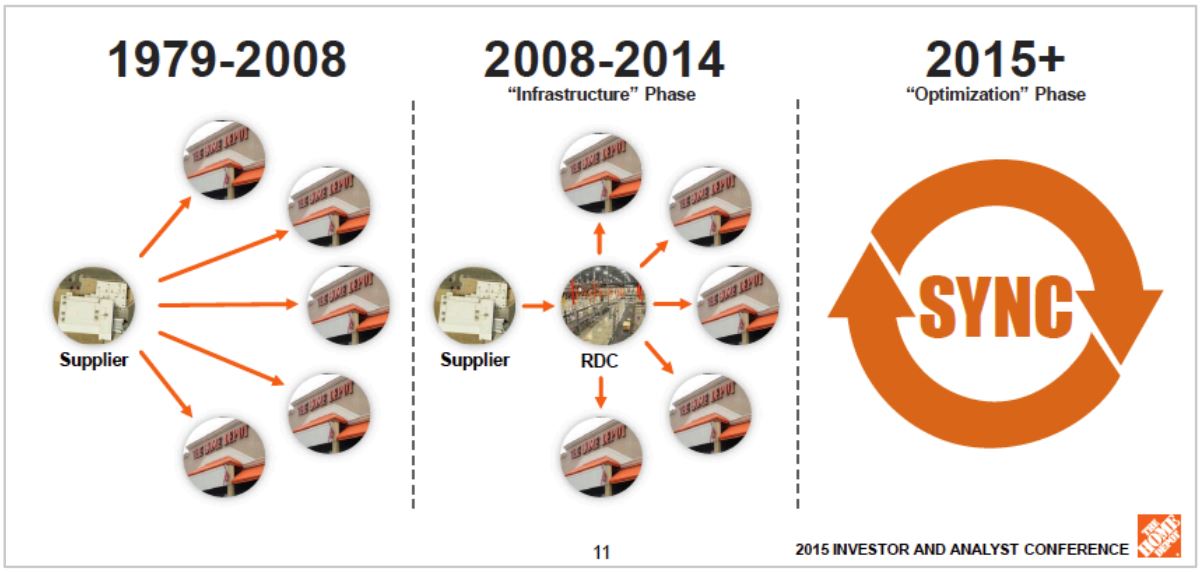

Improving Logistics

Home Depot’s logistics initiatives include:- Developing a global view of where inventory is, from fulfilment centers to stores.

- New capabilities for buy online, ship to store, where customer orders for in-store collection are shipped via a rapid distribution center and dispatched to the store along with a core store shipment instead of being shipped directly to the store separately, resulting in reduced shipping costs.

- Ability to offer buy online, deliver from store—which can narrow delivery windows and prove particularly useful to professional customers.

- Three new direct fulfilment centers, which enable delivery to 90% of Home Depot’s US business customers within two days, and which can hold up to 100,000 SKUs each.

- Project Sync, which optimizes distribution from supplier to store, cutting the total shipping time from around 11 days to as few as five, and resulting in a more predictable, steady flow of freight for stores to handle.

A Look Ahead to 2018

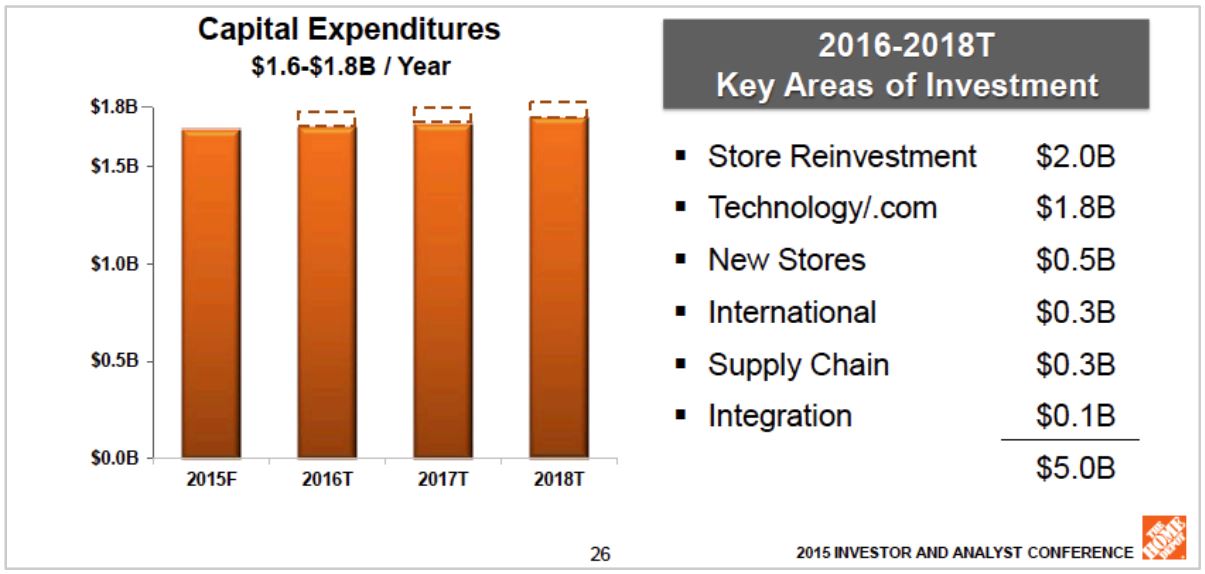

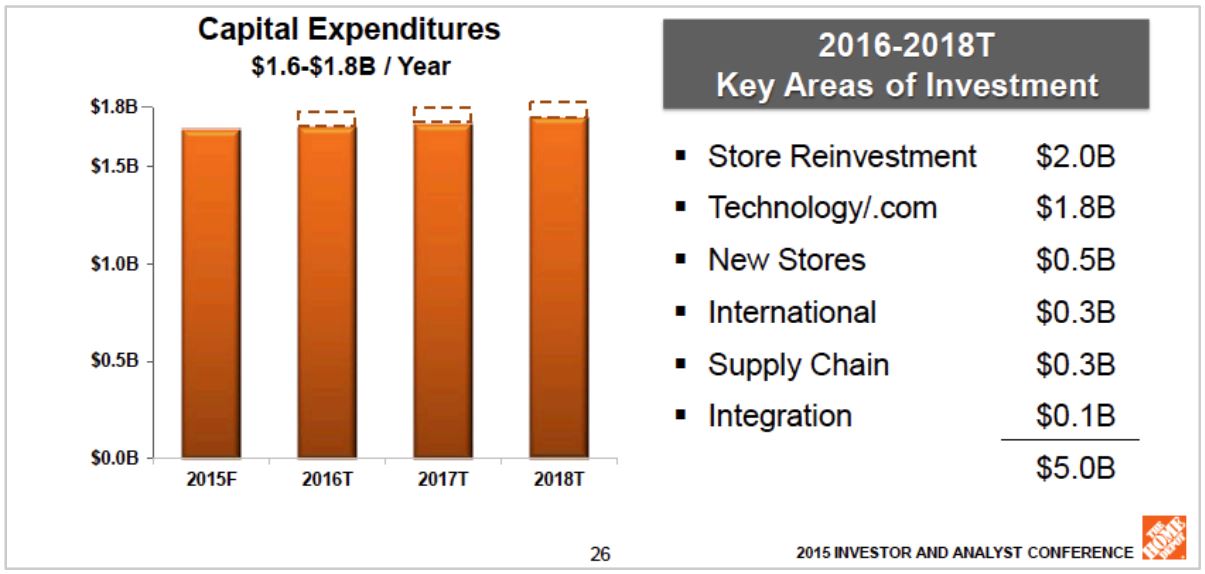

Tomé reiterated the company’s guidance for the current fiscal year: 4.9% comparable sales growth, 5.7% total sales growth (to $88 billion), an operating margin of 13.2% and diluted EPS of $5.36, up by around 14% year over year. The strength of the dollar will hit total sales growth by around $1.4 billion in 2015, Tomé noted. Looking ahead, Tomé said that three positive underlying forces bode well for the company: a modest economic recovery, housing metrics trending in the right direction and changing demographics. Underlying shifts include more renter households and more multifamily households, and Home Depot’s attempt to strengthen its sales to professionals is a response to these trends. Between 2015 and 2018, Home Depot expects:- To grow sales by $13 billion in total, taking sales to $101 billion; this is the same sales growth, in absolute terms, that was seen between 2012 and 2015.

- Comp growth to average around 4%.

- Total sales to increase at a compound annual growth rate of around 4.7%, helped by the Interline acquisition and modest new store growth.

Meanwhile, inventory turnover is expected to grow from 4.8 times estimated for the current fiscal year to 5.7 times in fiscal year 2018. Also looking ahead, Tomé said that by 2018, the cost of goods should fall, as the company will have made continued efforts to drive out costs. But gross margins will be broadly flat as it reinvests the costs savings into lower-margin categories. Moreover, expenses are expected to grow at around 50% of sales growth as “people costs” rise.

Tomé returned to a theme mentioned by several speakers across the day: productivity. For Home Depot, she said, productivity is a “virtuous cycle,” whereby savings can be reinvested in the proposition, such as in staff and in “interconnected retail,” which should deliver further top-line growth.

Meanwhile, inventory turnover is expected to grow from 4.8 times estimated for the current fiscal year to 5.7 times in fiscal year 2018. Also looking ahead, Tomé said that by 2018, the cost of goods should fall, as the company will have made continued efforts to drive out costs. But gross margins will be broadly flat as it reinvests the costs savings into lower-margin categories. Moreover, expenses are expected to grow at around 50% of sales growth as “people costs” rise.

Tomé returned to a theme mentioned by several speakers across the day: productivity. For Home Depot, she said, productivity is a “virtuous cycle,” whereby savings can be reinvested in the proposition, such as in staff and in “interconnected retail,” which should deliver further top-line growth.