Nitheesh NH

Introduction: Defying the Discretionary Downturn

Over the past few months, the coronavirus pandemic has delivered a significant blow to most discretionary retail categories in the US and globally. However, the domestic appliances market is one that has found a lot of favor among consumers. In this report, we explore the small domestic appliances market in the US, with a focus on discussing key players and the impact of the Covid-19 pandemic, as well as recent trends. We define small domestic appliances as a category that comprises devices such as irons, electric fans, heaters and small kitchen appliances—including microwaves, blenders, coffeemakers, food processors, kettles and toasters. For our coverage, we focus on small kitchen appliances.The US Small Domestic Appliances Market: An Overview

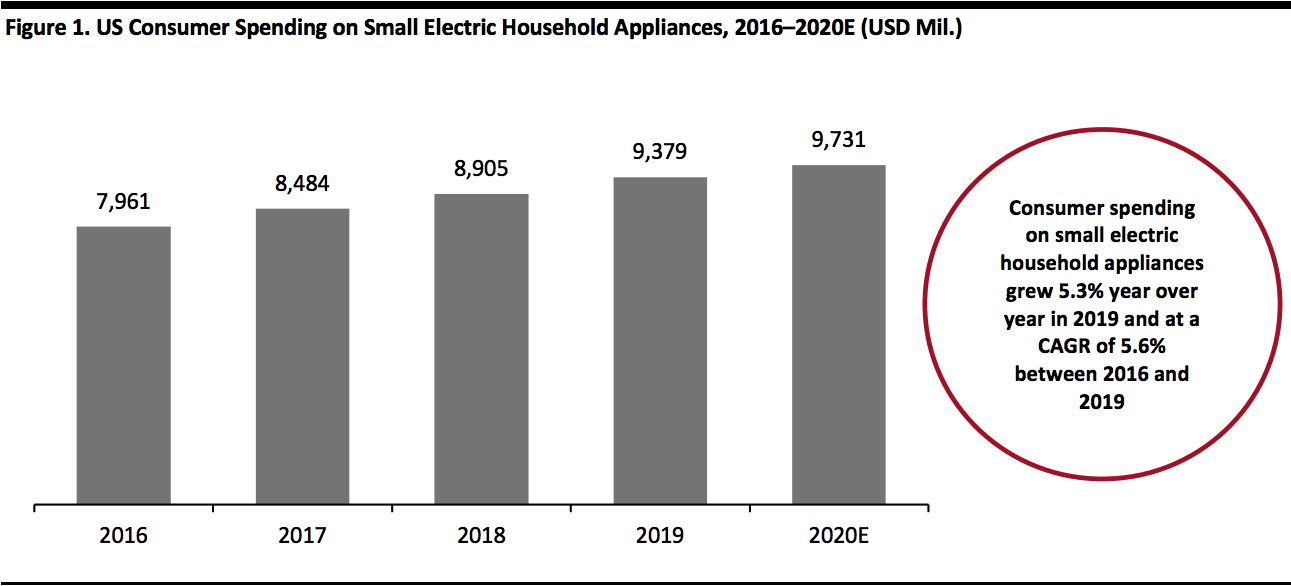

In recent years, the small kitchen appliances market has been experiencing significant growth in the US, owing to increasing consumer preferences for healthy eating and healthy lifestyles, the popularity of baking as a pastime and the evolution of food science and technology. Market Size US consumers spent $9.4 billion on small electric household appliances in 2019, representing a 5.3% increase over 2018, according to data from the Bureau of Economic Analysis. Spending grew at a CAGR of 5.6% between 2016 and 2019. We saw consumer spending grow steadily in the category in the first quarter of 2020, but April saw a 1% dip amid the lockdown. However, this was followed by strong 9.9% growth in May, with stores having started reopening from this month onwards. We expect growth to moderate in the second half of 2020—but we expect annual growth to remain positive, despite the economic headwinds. We estimate that total consumer spending in the segment will rise by 3.5–4.0% this year. We discuss the tailwinds to this growth later in this report. [caption id="attachment_112794" align="aligncenter" width="700"] Source: Bureau of Economic Analysis/Coresight Research[/caption]

According to Statista, the US small kitchen appliances market (a subset of small electric household appliances) will be worth around $7.4 billion in 2020. Statista’s definition of small kitchen appliances includes blenders, food processors, mixers, electric juicers, electric deep fryers, egg cookers and waffle irons, and excludes accessories and parts for small kitchen appliances, toasters and commercial appliances. Statista estimates that during the period 2020–2025, the small kitchen appliances market will grow at a CAGR of 2.5%.

Startups such as SmartyPans and June Oven have led growth in the small kitchen appliances market. Furthermore, the low barrier to entry that Amazon offers to startups entering this space has enabled it to become a key sales and marketing platform for them—leading to the e-commerce giant becoming a major player in the market.

Source: Bureau of Economic Analysis/Coresight Research[/caption]

According to Statista, the US small kitchen appliances market (a subset of small electric household appliances) will be worth around $7.4 billion in 2020. Statista’s definition of small kitchen appliances includes blenders, food processors, mixers, electric juicers, electric deep fryers, egg cookers and waffle irons, and excludes accessories and parts for small kitchen appliances, toasters and commercial appliances. Statista estimates that during the period 2020–2025, the small kitchen appliances market will grow at a CAGR of 2.5%.

Startups such as SmartyPans and June Oven have led growth in the small kitchen appliances market. Furthermore, the low barrier to entry that Amazon offers to startups entering this space has enabled it to become a key sales and marketing platform for them—leading to the e-commerce giant becoming a major player in the market.

Impact of Covid-19: Consumer Focus on At-Home Cooking and Healthy Living

During the initial period after the outbreak of the coronavirus in the US, consumers were focused on stocking up on nondurable household essentials, such as toilet paper, frozen foods and cleaning supplies. Coronavirus-led lockdowns also prompted consumers to shift their attention to at-home cooking and beverage preparation, as they were prevented from visiting coffee shops, restaurants and other food-service locations. Consumers therefore invested more time in their kitchens, driving up demand for small kitchen appliances. The pandemic also focused many consumers’ attention on health, sanitation and wellness, and consequently on devices that can support these. In dollar terms, sales of small appliances rose by almost 8% year over year during the week ended March 14, 2020 (when stores began closing in the US), according to market research firm The NPD Group. Water-filtration devices, air purifiers, handheld cleaning devices and countertop kitchen appliances experienced strong demand. Products such as bread makers, citrus juicers, electric pasta makers, rice cookers and sandwich makers also proved popular.- Some consumers began paying more attention to maintaining a clean living environment, which led to significant demand for handheld specialty cleaning appliances and air purifiers.

- Others, finding that they had more spare time due to the lockdowns, turned to home baking—accelerating an existing trend fueled in part by popular content such as The Great British Bake Off—which drove sales of bread makers.

- Food preservation assumed more importance among consumers at the start of lockdowns, with products such as vacuum sealers proving instrumental to the overall growth in small kitchen electrics, according to data from the NPD Group.

Key Players

The small kitchen appliances market is fragmented, with several players vying for market share but none having real dominance. It is also a sector in which startups and inventor-led firms often have an edge over major appliance brands in terms of defining new trends and developing new innovative products. Below, we profile some of the key players operating in the small kitchen appliances segment in the US. Hamilton Beach Brands Holding Company Founded in 1904 and headquartered in Virginia, Hamilton Beach Brands Company, along with its subsidiaries, engages in designing, marketing and distributing small electric household and specialty houseware appliances—including air fryers, blenders, coffee makers, food processors, juicers, mixers and toasters. The company sells products through brands such as CHI and Wolf Gourmet through various mass merchandisers, department stores, distributors, e-commerce retailers, variety- and drug-store chains, specialty home retailers and other retail outlets. In its first quarter of 2020, Hamilton Beach Brands reported that consumer demand for many small kitchen appliance categories was strong. The company added that various newly introduced products—such as air fryers, breakfast appliances, coffee makers and a premium cocktail machine—were quite popular in the marketplace. [caption id="attachment_112795" align="aligncenter" width="700"] A select range of small kitchen appliances offered by Hamilton Beach Brands

A select range of small kitchen appliances offered by Hamilton Beach BrandsSource: Company website[/caption] Newell Brands Founded in 1903 and headquartered in Atlanta, Georgia, Newell Brands sources, designs, manufactures and distributes consumer and commercial products globally. Appliances and cookware comprise one of the company’s four key business segments. Under the appliance and cookware category, which includes small kitchen appliances, the company has three major brands—Calphalon, Crock-Pot and Oster. In its first-quarter earnings call on May 1, 2020, Newell Brands reported that it registered six consecutive weeks of sequential improvement in its appliance and cookware business, including growth in Mr. Coffee bread makers, air purifiers and heating pads. The company added that even in previous economic downturns, it saw growth in its small kitchen appliances category, which augurs well for the category for the rest of this year. [caption id="attachment_112796" align="aligncenter" width="400"]

A blender from Newell Brands’ appliance and cookware brand Oster

A blender from Newell Brands’ appliance and cookware brand OsterSource: Company website[/caption] Spectrum Brands Holdings, Inc. Known as HRG Group Inc until its name change in July 2018, Spectrum Brands Holdings, Inc. is headquartered in Middleton, Wisconsin. The company’s offerings include home appliances under the Black & Decker, Breadman, Farberware, George Foreman, Juiceman, Russell Hobbs and Toastmaster brands. In March 2020, the company expanded its lineup of appliances under its Black & Decker brand, with a heightened focus on the coffee category, and also augmented its portfolio of toaster ovens and slow cookers. The brand is also expanding in its air fryer and air fryer/toaster-combination units. The company stated in its second-quarter earnings call on April 30, 2020 that its net sales were driven by growth in both small appliances and personal care. With China being a major source for its appliance business, there were supply-chain disruptions initially in the quarter due to the global coronavirus pandemic. However, the company reported that this situation has since stabilized, and China continues to be a reliable supplier for Spectrum Brands. [caption id="attachment_112797" align="aligncenter" width="400"]

A coffeemaker from Spectrum Brands’ Black & Decker brand.

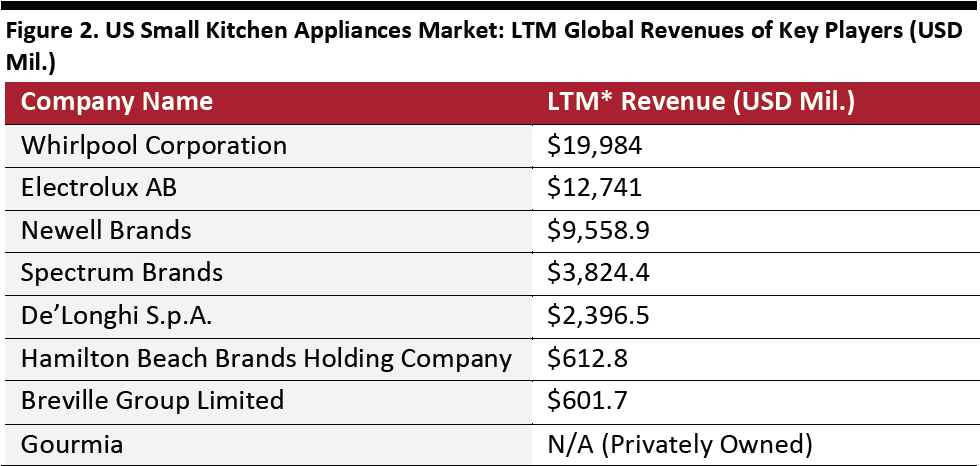

A coffeemaker from Spectrum Brands’ Black & Decker brand.Source: Company website[/caption] Company Revenues Apart from the companies profiled above, other key players include Breville Group Limited, Gourmia, Electrolux and Whirlpool Corporation, but there are many others. In Figure 2, we present the key players’ LTM (last 12 months) revenues. [caption id="attachment_112809" align="aligncenter" width="550"]

*LTM revenues for Hamilton Beach Brands and Breville Group are as of December 31, 2020; Spectrum Brands’ LTM revenue is as of March 29, 2020; LTM revenues for all other companies in the list are as of March 31, 2020

*LTM revenues for Hamilton Beach Brands and Breville Group are as of December 31, 2020; Spectrum Brands’ LTM revenue is as of March 29, 2020; LTM revenues for all other companies in the list are as of March 31, 2020Source: Company reports/S&P Capital IQ/Coresight Research[/caption]

Key Trends

Millennials Driving Demand for Small Kitchen Appliances One of the key driving forces behind the growth of the small appliances market is demand among millennials. At their oldest, this age group turns 40 this year, meaning that its consumers are generally becoming more settled in their careers, family lives and households. Excluding the current crisis, this demographic will, on average, be seeing their incomes grow and will be having children and establishing households. From meal preparation to baking, millennials are increasingly choosing to cook at home over dining out, not least because it is considered a healthier option, enables consumers to save money and gives them better control over their diet. Cooking is also widely considered to be an enjoyable pastime, with a sizeable base of millennials see it as a social activity. Consequently, small appliances are seen as facilitative to a healthy and active lifestyle. Multifunctional Small Appliances Are in Demand Generally speaking, millennials tend to value eco-friendliness, energy efficiency and a minimalistic aspect to the products that they use, so modern, multifunctional appliances with small form factors are likely to find favor among this age cohort. Furthermore, across all consumers, there is a growing trend toward living a low-cost, simpler life in smaller spaces, with decluttering being a key driver. This trend towards minimalism augurs well for multifunctional, small kitchen appliances. Growth Prospects Are Spurred by Advancements in Technology Rising consumer interest in food science has led to considerable investments in the area, resulting in the creation of many innovative appliances—such as masticating juicers, air fryers and sous vide cookers. Technological advancements have resulted in firms launching artificial intelligence-enabled small kitchen appliances. For example, GE offers a smart countertop microwave oven that connects to Amazon Alexa, which then enables users to operate it through voice commands. Similarly, the AmazonBasics microwave—when paired with the EchoDot smart speaker—allows users to control the appliance through voice commands. [caption id="attachment_112799" align="aligncenter" width="500"] AmazonBasics Microwave bundle with Echo Dot

AmazonBasics Microwave bundle with Echo DotSource: Company website[/caption] SmartyPans is an example of a startup that designs smart kitchen appliances that leverage artificial intelligence. The technology can track the nutritional composition of food cooked in real time and integrates that data with fitness apps and devices. The company’s smart cooling pans also detect and understand voice commands. Another startup, June Oven, offers the June Intelligent Oven, which uses sensors and artificial intelligence to take the guesswork out of cooking, by recognizing, monitoring and cooking food to the user’s liking. The product was first launched in 2016, and a new model was then introduced in 2018 that enables voice commands through the Amazon Alexa app. [caption id="attachment_112800" align="aligncenter" width="500"]

The June Intelligent Oven

The June Intelligent OvenSource: Company website[/caption] Aside from voice control and artificial intelligence, there is also a growing preference among consumers toward environmentally friendly and sustainable products, which has led to more innovation to cater to this demand. The new generation of small appliances will be designed to be more energy efficient, intelligent and integrated with better safety. Increasing Popularity of High-End Products Although a sizeable base of beverage drinking households in the US already own an appliance for making beverages such as coffee and tea, the market will continue to benefit from the growing popularity of smarter and more premium appliances that enable consumers to have greater control over their brewing experience. Increased working at home and likely sustained avoidance of public places in the medium term—due to concern and uncertainty in the wake of the Covid-19 crisis—are likely to fuel premiumization on coffee machines as consumers seek to go beyond traditional drip machines and replicate the coffee-shop experience.