albert Chan

What’s the Story?

MFCs are automated fulfillment centers with footprints typically ranging from 5,000 to 20,000 square feet. They can be co-housed inside an existing store or located in a smaller warehouse space in an urban location. MFCs have a very high storage density and rely on artificial intelligence (AI) and robotics to pick items, put them into the right bins and send them to the packer.

In this report, we discuss MFC technology and cover key drivers, trends and challenges within the US grocery industry.

Why It Matters

There are three key reasons why MFCs are currently one of the most pressing topics in grocery retail:

The pandemic has accelerated online grocery adoption: The health crisis was a significant catalyst in accelerating online grocery adoption and transformation in 2020. Coresight Research estimates that online sales of food and beverages in the US will grow by a substantial 112.3% in 2021 on a two-year basis. Our US online grocery survey conducted in April 2021 suggests that the pandemic has reinforced online buying behaviors among many online shoppers. Over one-third of online grocery shoppers do not expect to change their online grocery shopping habits once the crisis eases or ends. Additionally, over one-quarter of shoppers said that they plan to buy groceries online after the crisis subsides more frequently than they did during the pandemic.

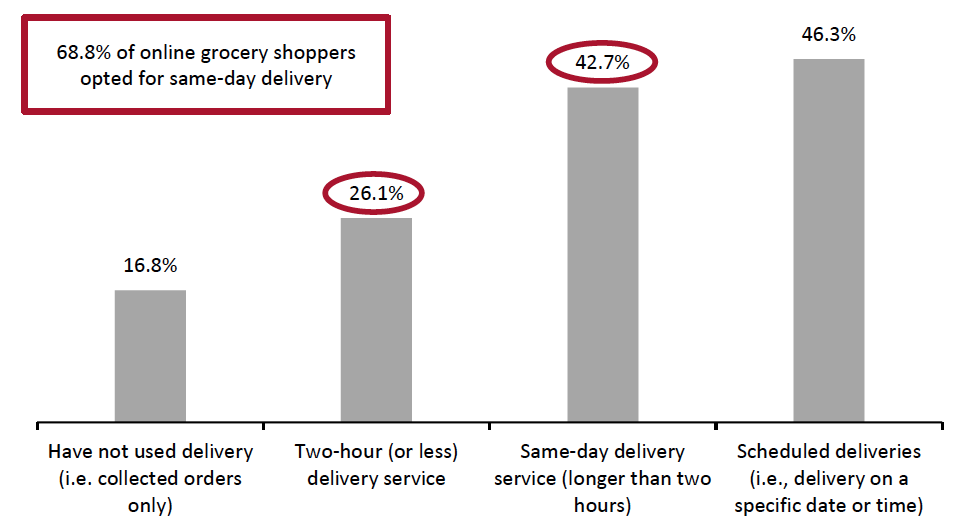

Customers prefer rapid delivery: Delivery time is critical for online grocery shopping experiences. Our abovementioned survey found that 42.7% of online grocery shoppers had used same-day shipping services, while more than one-quarter had used rapid two-hour delivery services in the prior 12 months. This is dictating need for fulfillment strategies that move inventory closer to consumers.

Figure 1. Online Grocery Shoppers: Delivery Service They Used in the Past 12 Months (% of Respondents [caption id="attachment_136813" align="aligncenter" width="550"]

Base: US respondents aged 18+, who had purchased groceries online in the 12 months prior to April 2021

Base: US respondents aged 18+, who had purchased groceries online in the 12 months prior to April 2021Source: Coresight Research[/caption]

The need for a profitable online strategy: At present, the online grocery channel is significantly margin dilutive, with picking and delivery costs dragging down profitability. Coresight Research estimates that the operating margin of the manual, in-house store pick and delivery model drops to (0.3)%–(0.5)% when a customer retrieves the order through a free in-store/curbside pickup service. This decreases even further to an estimated (5)%–(6)% with home delivery, even when the retailer charges $7 for the service.

MFCs can deliver on profit-enhancing efficiencies by automating the tedious and time-consuming picking and packing process. For instance, MFC solution provider Takeoff Technologies claims to assemble an average online order in fewer than 15 minutes, which is 10 times faster than manual picking in store.

The Growth of Micro-Fulfillment Technology in US Grocery: Coresight Research Analysis

Against the backdrop of pandemic-induced upward e-commerce trends, retailers are prioritizing competitive online experiences that deliver orders faster and at lower costs. MFC solutions enable shorter order to delivery cycles, decreases transportation costs and the potential to offer hyper-localized product offering while reducing labor costs and enhancing customer satisfaction and loyalty.

By 2026, the MFC opportunity is set to reach $10 billion globally across all retail sectors, according to supply chain and logistics firm Logistics IQ. Grocery will be the key driver, with one MFC for every 10 grocery stores.

MFC technology can be executed in the following three ways:

- Back of a store: The MFC is installed in the back of an existing store or in an adjacent space.

- Dark stores: Dark stores are small fulfillment centers that are specifically geared for fulfilling online grocery orders and do not serve walk-in customers. These dark stores can be combined with MFC automation to enhance manual picking efficiency.

- As a service: A micro-fulfillment company builds out a stand-alone MFC and rents out space to different retailers. The micro-fulfillment company would run the center instead of the retailer.

Technology supporting micro-fulfillment solutions can vary substantially. However, each of the different solutions essentially solve the same problem—the efficient retrieval of merchandise from a shelf to a human picker using material handling equipment, enabling an online order to be fulfilled quickly.

The MFC automation used for online grocery fulfillment can be categorized into three main systems.

Shuttle System

This system combines robotic shuttles and lifts, enabling products to be stored horizontally or vertically in bins, cartons or trays. Each row is served by one or more shuttles that can travel down aisles to access products within each row. The lift then lowers the selected bins or cartons to conveyors that feed order assemblers.

This system is proven, reliable and currently the most widely used. However, it is susceptible to varying single points of failure as one malfunctioning shuttle can block the entire aisle. A single point of failure is a part of the system that, if dysfunctional, would cause the entire system to fail.

[caption id="attachment_136814" align="aligncenter" width="550"] MFC solution provider Honeywell Intelligrated’s shuttle technology

MFC solution provider Honeywell Intelligrated’s shuttle technologySource: Honeywell Integrated[/caption]

Hive System

This cube-based system facilitates a very compact storage solution. It has four main components: a 3D storage grid; storage bins containing product inventory; robotic systems that retrieve bins; and pick stations that serve as an interface between operator and system. In this system, robots at the top of the hive retrieve bins and bring them through the picking station along the outer perimeter of the unit.

The cube-based profile enables the system to scale vertically in relation to a facility’s physical footprint and a company’s high-density storage demands.

It has a less complex mechanic structure than in a shuttle system, with a flexible footprint and does not have a specific single point of failure. Hive systems are in the beginning stages of being rolled out in the grocery market.

[caption id="attachment_136815" align="aligncenter" width="550"] MFC solution provider Alert Innovation’s mobile robotics technology

MFC solution provider Alert Innovation’s mobile robotics technologySource: Alert Innovation[/caption]

Mobile Robotics

This system consists of scalable racks in between which robots climb up and down. The robots are autonomous and pick up totes from shelves and bring them to picking stations. This solution has no single point of failure but requires a high initial investment.

This is the newest micro-fulfillment technology and is offered by young, early-stage companies. This solution remains in the “proof of concept” phase.

[caption id="attachment_136816" align="aligncenter" width="550"] MFC solution provider Alert Innovation’s mobile robotics technology

MFC solution provider Alert Innovation’s mobile robotics technologySource: Alert Innovation[/caption]

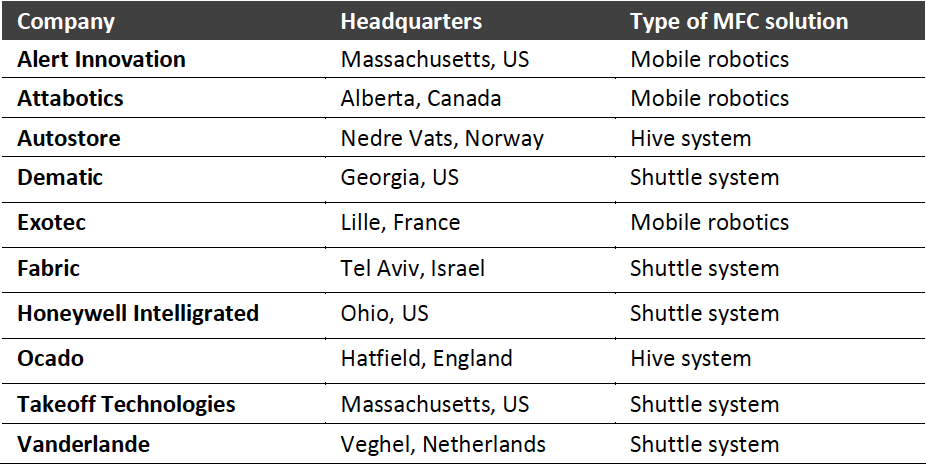

Figure 2. MFC Companies: Solutions Types [caption id="attachment_136817" align="aligncenter" width="550"]

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

The software that runs the system is as important as the hardware. Many hardware companies are partnering with systems integrators to be able to offer a complete end-to-end package. As testing of automated solutions becomes more widespread in the near future, we expect to see further partnerships and consolidation.

2. Key Drivers of Micro-FulfillmentThe Amazon Effect

Amazon has made two-day shipping a standard across the retail industry since its launch of a two-day delivery service in 2005. Amazon went on to launch Prime Now in 2014, offering two-hour delivery of groceries and other items. In early 2019, Amazon started rolling out one-day shipping for a range of goods in the US.

Amazon has set an extremely high bar for delivery speed and quality by making significant investments in logistics expansion focused on last-mile fulfillment. In its earnings call for the first quarter ended March 31, 2021, Amazon said that it boosted its fulfillment capacity—the network of warehouses, delivery stations and drivers it uses to get packages to customers—by 50% in 2020. According to supply chain consultancy MWPVL, Amazon’s delivery stations (the facilities closest to consumers) are growing the most as the e-tailer builds out its logistics footprint. The emphasis on delivery stations suggests that Amazon is seeking to get its inventory dramatically closer to the consumer to enhance its last-mile delivery speed and efficiency.

By reducing delivery time, Amazon has inflated consumer expectations. Increasingly, all online sellers are judged against the exacting standard set by Amazon. The grocery industry is looking to adopt new and cutting-edge technology to rise to the challenge and has come up with micro-fulfillment as a solution.

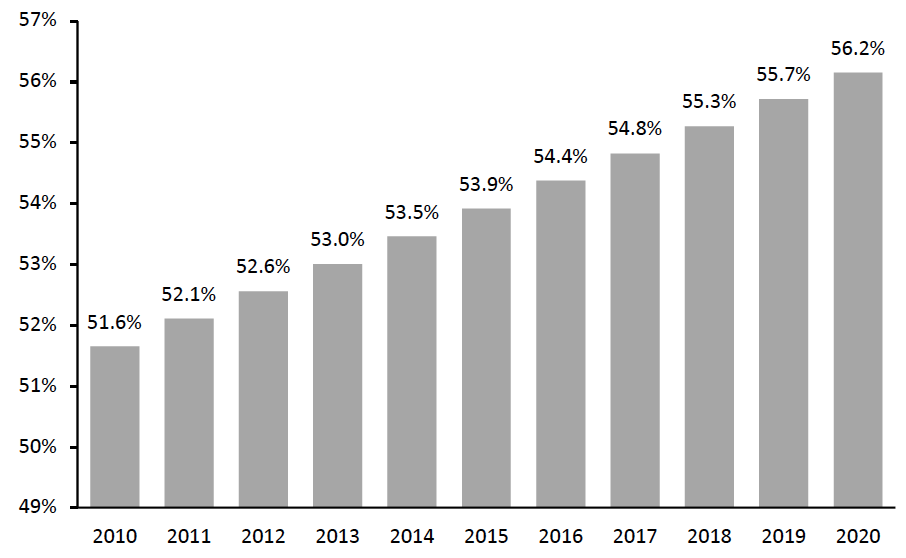

Urbanization

According to the latest world urbanization prospects report from the United Nations in July 2018, 68% of the world’s population, or an additional 2.5 billion people, will live in urban areas by 2050, up from 55%. Urban areas are especially attractive for the buildout of MFCs. With regional distribution centers challenged by fulfilling rapid deliveries, establishing smaller facilities in high-density areas or leveraging existing urban store networks can significantly improve last-mile delivery.

In addition, densely populated metropolitan areas are typically characterized by high concentrations of millennials and dual-income families, most of whom are regular e-commerce shoppers. Being able to serve consumers in these areas with same-day or two-hour service provides significant revenue opportunity and lead to a sustainable, profitable logistics model.

Figure 3 presents the global urban population as a percentage of the total population.

Figure 3. Global Urban Population (% of Total Population)

[caption id="attachment_136818" align="aligncenter" width="550"] Source: Worldbank.org[/caption]

Source: Worldbank.org[/caption]

In-Store Fulfillment Challenges

An overabundance of click-and-collect and delivery order pickers in stores can negatively impact browsing experiences for regular store clientele. The added fulfillment burden can also put pressure on replenishment processes, often leading to stocking issues, such as out-of-stock items, inability to fulfill online orders and frustrated shoppers. Using traditional in-store inventory for online order fulfillment is not a sustainable long-term strategy.

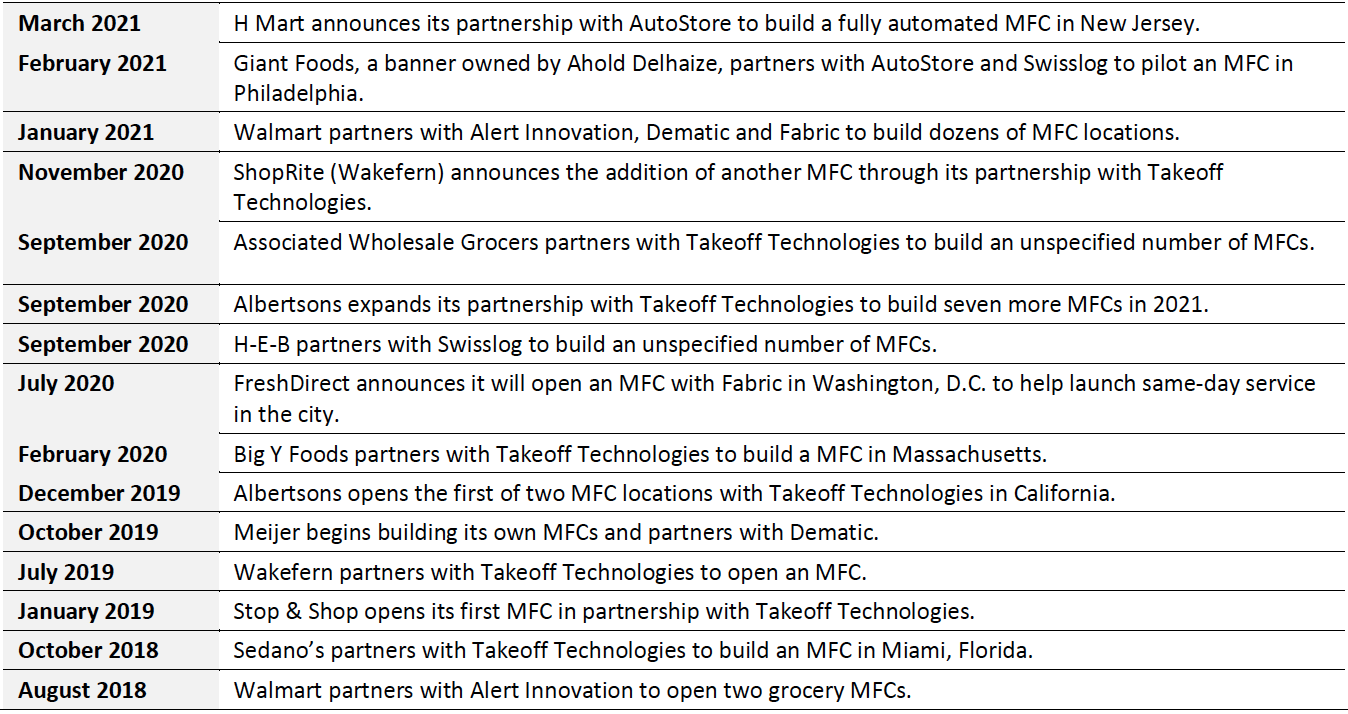

3. Key Trends in Micro-FulfillmentMFCs Dominate New Automation Projects in US Grocery

MFCs took center stage in 2019 in US grocery delivery and have since emerged as a strong alternative to manual in-store fulfillment and CFCs. As previously discussed, manual picking becomes inefficient with increased customer demand and fails to accommodate shrinking delivery windows. Additionally, many retailers see MFC as a preferential strategy to centralized fulfillment due to its faster implementation potential, smaller footprint, lower initial investment and increased proximity to consumers.

Companies including Ahold Delhaize, Albertsons and Walmart have moved into the MFC space and launched pilots before Covid-19. The pandemic has induced these players to accelerate the implementation.

Figure 4. US Grocery Retailers: Timeline of MFC Deployment Announcements

[caption id="attachment_136819" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

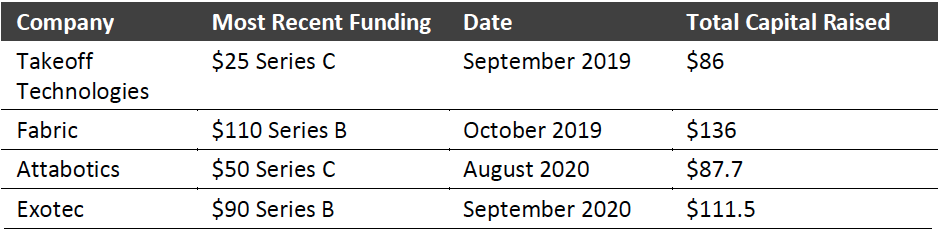

Deluge of Funding from Investors

There has been a significant amount of investment capital flowing into the MFC grocery space. Venture capital made huge investments in startups and we have also seen notable merger and acquisition activity.

Figure 5. Recent Capital Raised by MFC Vendors (USD Mil.) [caption id="attachment_136820" align="aligncenter" width="550"]

Source: Company reports/Coresight Research[/caption]

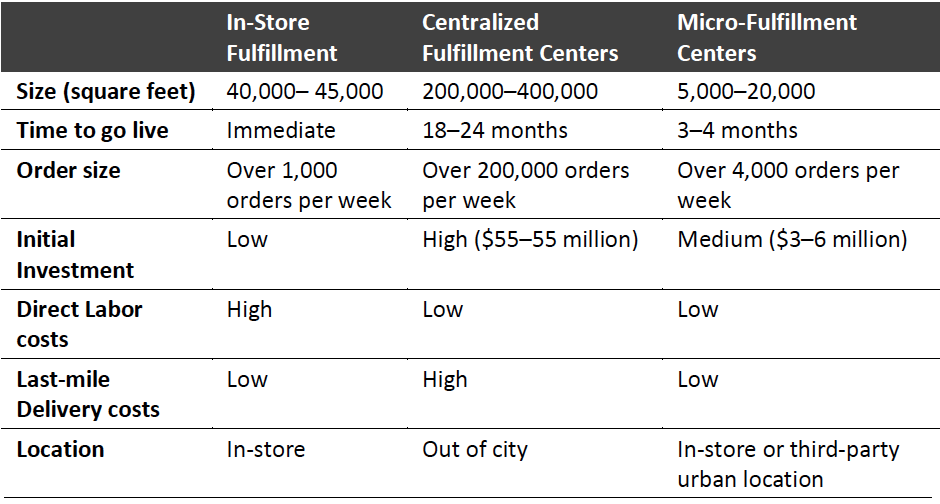

4. Comparison of Online Grocery Fulfillment Solutions

Source: Company reports/Coresight Research[/caption]

4. Comparison of Online Grocery Fulfillment Solutions

There are no one-size-fits-all solutions to online grocery fulfillment but volume and delivery time are key considerations for a retailer’s decision on automation. Both CFCs and MFCs suit high population density areas. However, in less densely populated areas, the lower volume of sales may not justify the operating costs of a large fulfillment center and MFCs are thus a more suitable option. In even more sparsely populated areas, manual picking through stores will still play a prominent role.

Figure 6. In-Store Fulfillment, Centralized Fulfillment and Micro-Fulfillment Centers: A Comparison [caption id="attachment_136821" align="aligncenter" width="550"]

Source: Coresight Research[/caption]

5. Key Challenges in Micro-Fulfillment

Source: Coresight Research[/caption]

5. Key Challenges in Micro-Fulfillment

Even though MFCs have many benefits, we do not believe they are the right solutions for every grocer. We discuss our reasoning below.

Cost Impact for Small to Mid-Sized Grocers

Several million dollars in upfront MFC costs are a significant investment for small grocers. These automated systems require a higher volume of incoming orders to justify their hefty price tags. Even though we expect the demand for online grocery to continue to grow, there is a risk that the extremely heightened consumer interest in online grocery driven by the pandemic may wane in the near term. In the case of insufficient online sales volumes, grocers that have invested in MFCs will find them more expensive and less efficient than expected.

MFC Technology Incompatibility with Certain Grocery Items

While the picking equipment used in MFCs works well with ambient items, it is not designed to handle fresh, frozen, refrigerated and bulky items (such as cases of bottled water, toilet paper and pet food). However, these items form a significant proportion of an average online order. As a result, manual picking is still required in an MFC setting, requiring retailers to operate sizable separate picking operations inside a store, which adds time and labor costs.

However, MFC vendors are working to fill this gap by partnering with companies that provide technology that works alongside their automation systems. For example, in March 2021, Takeoff Technologies partnered with refrigeration firm Hussmann to give an MFC provider direct access to food refrigeration systems to maintain the required temperature while it is handled.

Space Requirements

Many large food retailers, such as Walmart, have excess store space that they can repurpose to deploy a MFC system. However, this is often not the case for mid-sized or small food retailers.

What We Think

MFC is filling an immediate long-term need among retailers and we think it is here to stay—especially given the advancement in robotics and the large amount of capital moving into the industry. Although MFC technology is still in its relative infancy, it is being tested by more and more retailers. As the market matures, we expect to see further consolidation among MFC providers or between retailers and MFC vendors.

Implications for Retailers

- Retailers should take a holistic view of their total supply chain strategy to see how a MFC solution fits in before evaluating it based on software and robot design.

- Retailers should analyze online order volumes for each urban store and aggregated to each urban area. This will help to provide insights as to whether MFCs can provide enough collective capacity or whether fewer and large facilities such as dark stores are more appropriate.

- Retailers should assess the capacity limit of their stores that carry out online order fulfillment against future order volume forecasts to determine when and where capacity constraints may be experienced. This will provide a view as to the relative urgency in the need for a MFC solution to increase capacity capabilities.

Implications for Technology Vendors

- Technology vendors should build out MFC infrastructure that does not hamper normal store activity. They should provide MFC solutions that are flexible enough to fit in different retail locations and have the capacity to add more storage space and robots as order volumes grow.