albert Chan

What is the Greater Bay Area?

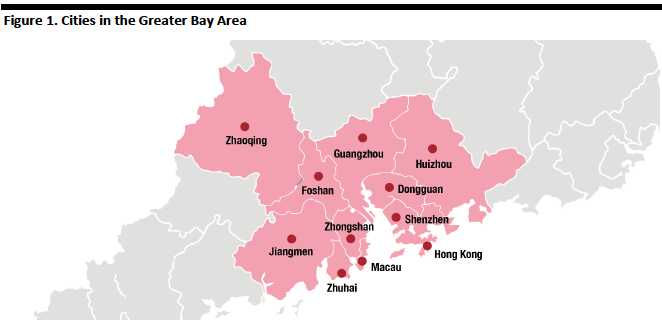

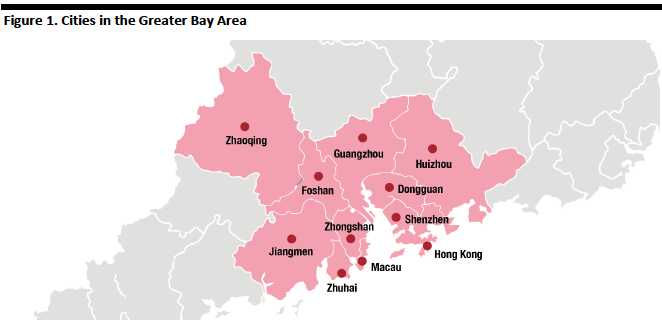

The Chinese government refers to nine cities in the Pearl River Delta area plus Hong Kong and Macau as the Greater Bay Area. The nine cities are Guangzhou, Shenzhen, Zhuhai, Dongguan, Huizhou, Zhongshan, Foshan, Zhaoqing and Jiangmen.

[caption id="attachment_81229" align="aligncenter" width="662"] Source: Coresight Research[/caption]

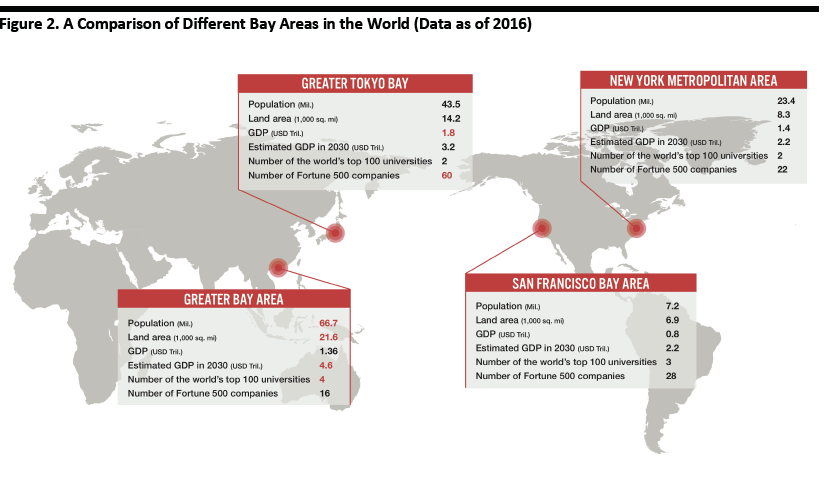

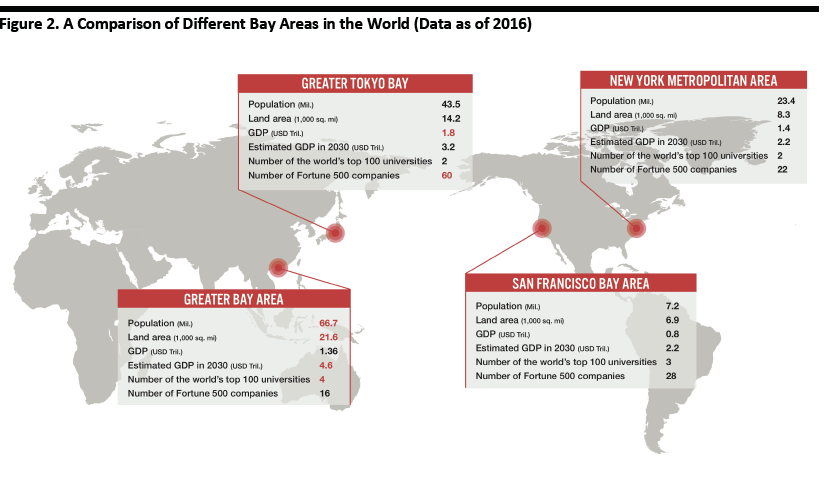

The GBA is designed to mirror other successful bay areas in the US and Japan (San Francisco, New York and Tokyo); see Figure 2 for a comparison. Of them, the GBA has the largest population and land area, with 70 million people and 56,000 square kilometres (21,621 square miles). The region had a combined GDP of $1.5 trillion in 2016. The GBA is estimated to have the largest GDP among all bay areas in 2030, reaching $4.6 trillion, according to the China Center for International Economic Exchanges, a think tank based in Beijing.

[caption id="attachment_83502" align="aligncenter" width="824"]

Source: Coresight Research[/caption]

The GBA is designed to mirror other successful bay areas in the US and Japan (San Francisco, New York and Tokyo); see Figure 2 for a comparison. Of them, the GBA has the largest population and land area, with 70 million people and 56,000 square kilometres (21,621 square miles). The region had a combined GDP of $1.5 trillion in 2016. The GBA is estimated to have the largest GDP among all bay areas in 2030, reaching $4.6 trillion, according to the China Center for International Economic Exchanges, a think tank based in Beijing.

[caption id="attachment_83502" align="aligncenter" width="824"] Source: HSBC/China Center for International Economic Exchanges/Coresight Research[/caption]

What are the Roles of Cities in the GBA?

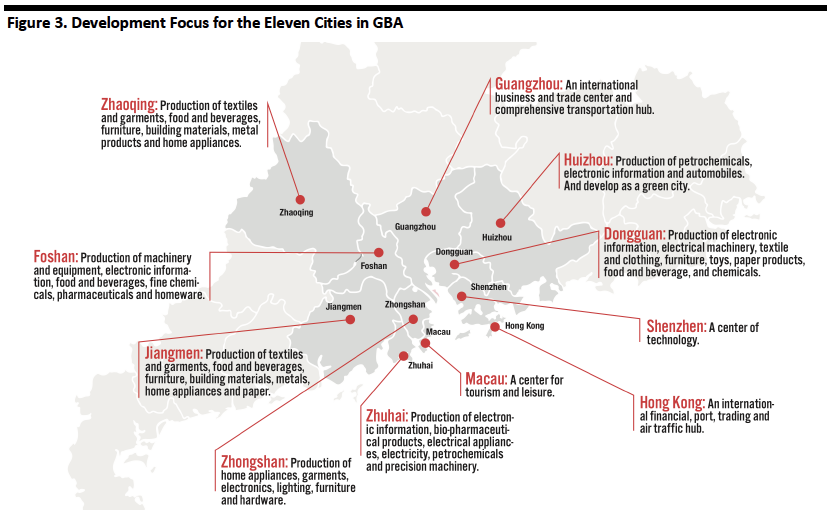

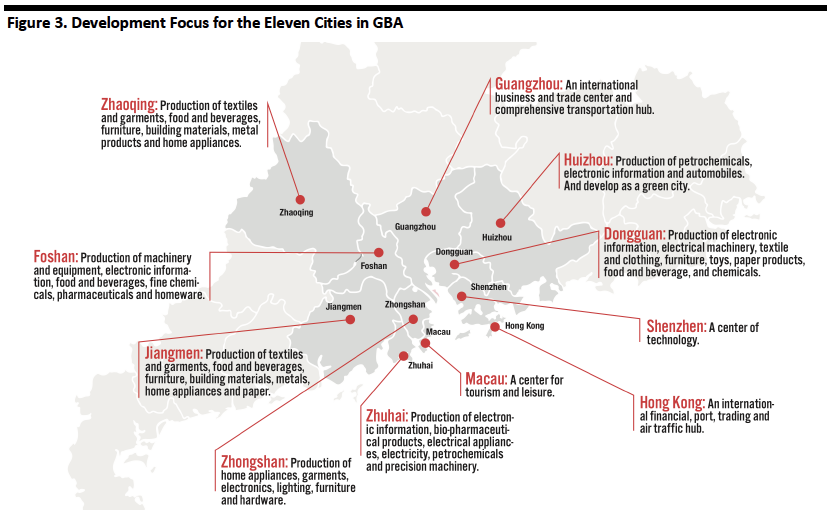

Under the Chinese government plan, each of the cities will play a specific role. Of the 11 cities in the GBA, the plan sees Hong Kong, Macau, Shenzhen and Guangzhou as likely to remain the core engines of growth in the region. Further, the plan calls for:

Source: HSBC/China Center for International Economic Exchanges/Coresight Research[/caption]

What are the Roles of Cities in the GBA?

Under the Chinese government plan, each of the cities will play a specific role. Of the 11 cities in the GBA, the plan sees Hong Kong, Macau, Shenzhen and Guangzhou as likely to remain the core engines of growth in the region. Further, the plan calls for:

Source: Government documents/Coresight Research[/caption]

What is the Vision for the GBA?

The GBA plan is a blueprint for development that hopes to turn the region into a hub of information technology, biotech, 3D printing, artificial intelligence and DNA testing. The plan exhorts others to support the plans objectives by calling for:

Source: Government documents/Coresight Research[/caption]

What is the Vision for the GBA?

The GBA plan is a blueprint for development that hopes to turn the region into a hub of information technology, biotech, 3D printing, artificial intelligence and DNA testing. The plan exhorts others to support the plans objectives by calling for:

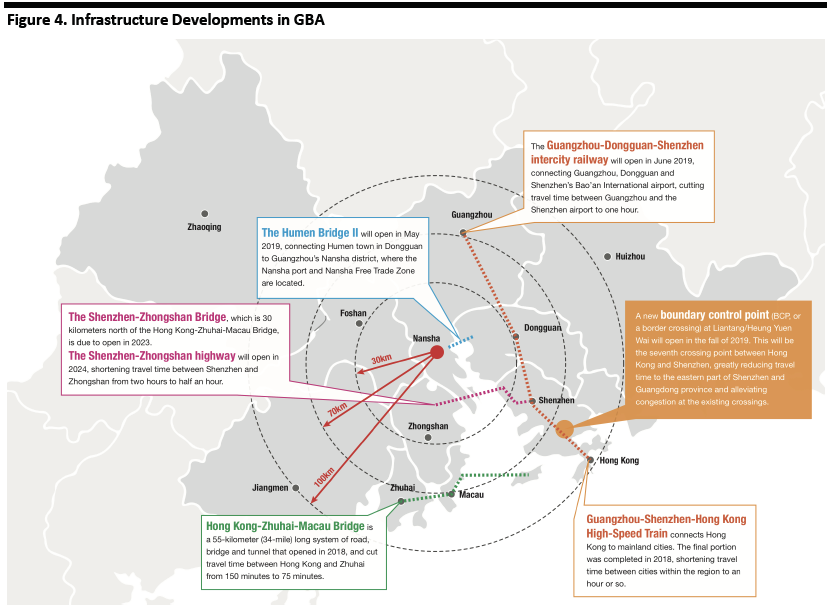

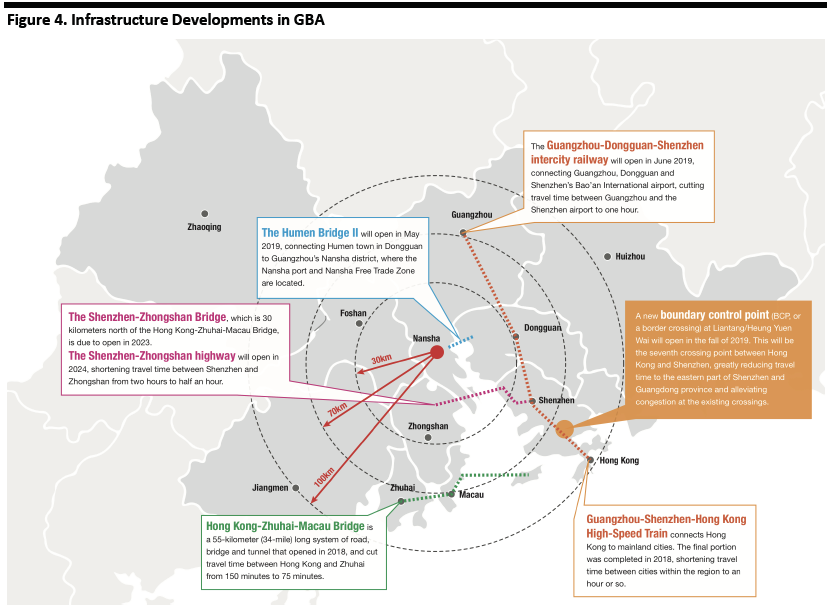

Dongguan is around 30 kilometers away from Nansha, Macau is around 70 kilometers away from Nansha, and Huizhou is around 100 kilometers away from Nansha.

Dongguan is around 30 kilometers away from Nansha, Macau is around 70 kilometers away from Nansha, and Huizhou is around 100 kilometers away from Nansha.

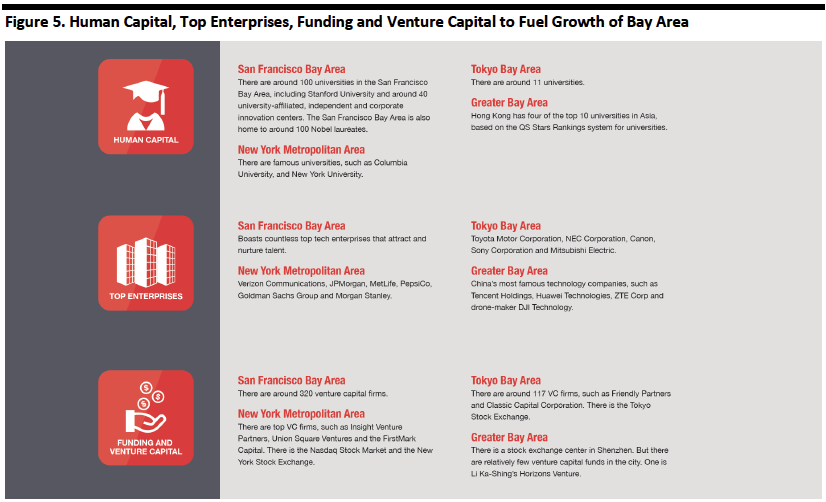

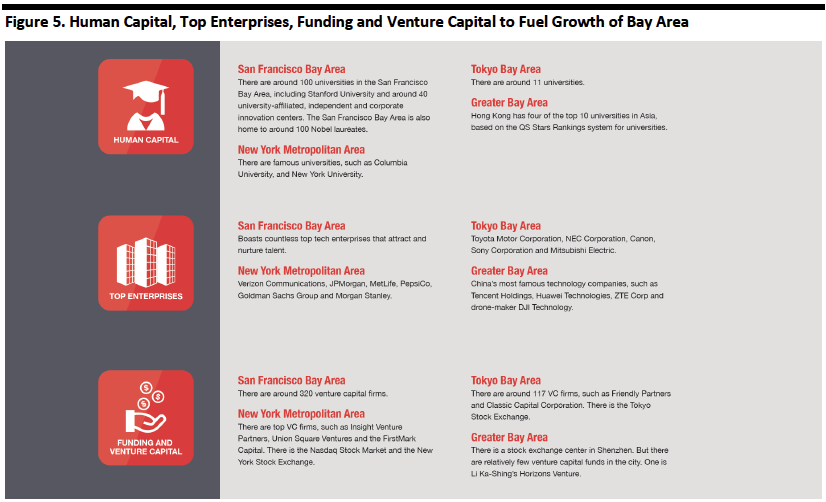

Source: Government documents/Coresight Research[/caption] What are the Challenges? Hong Kong, Macau and the nine Pearl River Delta cities have different social and economic systems, legal systems, culture, currencies and customs policies. These fundamental issues will create barriers to the seamless cooperation envisioned in the official plan. For example, Hong Kong, Macau and the nine Pearl River Delta cities have different tax codes. In Hong Kong, only Hong Kong-sourced profits are taxable. There is no tax for capital gains, no value added tax (VAT) or other indirect tax on goods and services. In mainland China, there are higher corporate and individual tax rates as well as a value added tax on goods and services. Hong Kong uses the Hong Kong dollar, which is feely convertible; Macau uses the Macanese pataca (which is also convertible) while the other nine cities use the not-so-easily-convertible renminbi. Hong Kong is also a free port: Almost everything is allowed in duty free with a few exceptions such as alcohol, tobacco and fuel. The cities in mainland China would be subject to import tariffs, in addition to a VAT system that applies a standard rate to most taxable activities, including importing goods and supplying services involving labor provision. Will it Succeed? The central government has laid out some ambitious goals in its GBA plan. Will it succeed? The government in Beijing definitely has a proven track record of setting ambitious long-term development goals – and then delivering them. So, despite the challenges of separate legal systems, currencies and customs zones, we believe the GBA will over time become even more integrated. At the very least, the region will likely develop into a mega-city with several centers: The region is home to 70 million people – less than 6% of the country’s population – yet it produces 37% of the country's exports and 12% of its gross domestic product. Let us look at human capital, the presence of top global enterprises, funding and government support. Human capital is one of the key elements for success in the nine-county San Francisco Bay Area (SFBA), which includes Silicon Valley. Education and research institutions provide a highly-educated workforce for high-tech businesses. There are around 100 universities in the SFBA, including Stanford University and around 40 university-affiliated, independent, and corporate innovation centers. And the SFBA is also home to around 100 Nobel laureates. In New York Metropolitan Area, there are famous universities, such as Columbia University, and New York University. In the Tokyo Bay Area, there are around 11 universities. By comparison, Hong Kong has four of the top 10 universities in Asia, based on the QS Stars Rankings system for universities. Top enterprises, which house and nurture the human capital within the area, are also important to the success of the GBA. Coresight Research[/caption]

What are the Opportunities for Businesses in the GBA? How Can Companies Benefit from This Plan?

Infrastructure/Property: Apart from transportation, infrastructure in areas such as finance and telecommunications will also need to be upgraded to ensure connectivity, including mobile payments, cross-border financial products and shared communication networks.

Service businesses focusing on quality living: The plan envisions the GBA to be a quality living circle that improves people’s livelihoods, which would encourage service focused businesses to grow in the region, such as Health Care, Communication, Culture, Leisure, Personal Care, Transportation, Housekeeping and Hotel Lodging.

Technology related businesses: One of the key objectives of the GBA plan is to support technology innovation. If this happens as planned, there could be opportunities for technology companies to develop and test ideas in the GBA.

What are the Implications for the Retail Industry?

If the plan succeeds in delivering growth to the area, we should see stronger demand for high-end products in cities such as Shenzhen, Guangzhou and Hong Kong.

There will also be new retail opportunities near new residential communities in Zhuhai, Foshan, Zhongshan and Dongguan, as these cities grow and become more populated. Grocery and consumer staples sectors should see ample business opportunity.

[caption id="attachment_83507" align="aligncenter" width="572"]

Coresight Research[/caption]

What are the Opportunities for Businesses in the GBA? How Can Companies Benefit from This Plan?

Infrastructure/Property: Apart from transportation, infrastructure in areas such as finance and telecommunications will also need to be upgraded to ensure connectivity, including mobile payments, cross-border financial products and shared communication networks.

Service businesses focusing on quality living: The plan envisions the GBA to be a quality living circle that improves people’s livelihoods, which would encourage service focused businesses to grow in the region, such as Health Care, Communication, Culture, Leisure, Personal Care, Transportation, Housekeeping and Hotel Lodging.

Technology related businesses: One of the key objectives of the GBA plan is to support technology innovation. If this happens as planned, there could be opportunities for technology companies to develop and test ideas in the GBA.

What are the Implications for the Retail Industry?

If the plan succeeds in delivering growth to the area, we should see stronger demand for high-end products in cities such as Shenzhen, Guangzhou and Hong Kong.

There will also be new retail opportunities near new residential communities in Zhuhai, Foshan, Zhongshan and Dongguan, as these cities grow and become more populated. Grocery and consumer staples sectors should see ample business opportunity.

[caption id="attachment_83507" align="aligncenter" width="572"] Source: Colliers International/Coresight Research[/caption]

Key Insights

The GBA plan aims to group nine cities in Guangdong with Hong Kong and Macau into a unique zone which the government will seek to develop into an advanced economic and business hub. The central government hopes to position the GBA as an innovation and technology center. Infrastructure projects are already completed or underway that will improve transportation connectivity, helping to better integrate the area. We expect more projects and initiatives in transportation, technology, education and businesses in the coming years.

Source: Colliers International/Coresight Research[/caption]

Key Insights

The GBA plan aims to group nine cities in Guangdong with Hong Kong and Macau into a unique zone which the government will seek to develop into an advanced economic and business hub. The central government hopes to position the GBA as an innovation and technology center. Infrastructure projects are already completed or underway that will improve transportation connectivity, helping to better integrate the area. We expect more projects and initiatives in transportation, technology, education and businesses in the coming years.

Source: Coresight Research[/caption]

The GBA is designed to mirror other successful bay areas in the US and Japan (San Francisco, New York and Tokyo); see Figure 2 for a comparison. Of them, the GBA has the largest population and land area, with 70 million people and 56,000 square kilometres (21,621 square miles). The region had a combined GDP of $1.5 trillion in 2016. The GBA is estimated to have the largest GDP among all bay areas in 2030, reaching $4.6 trillion, according to the China Center for International Economic Exchanges, a think tank based in Beijing.

[caption id="attachment_83502" align="aligncenter" width="824"]

Source: Coresight Research[/caption]

The GBA is designed to mirror other successful bay areas in the US and Japan (San Francisco, New York and Tokyo); see Figure 2 for a comparison. Of them, the GBA has the largest population and land area, with 70 million people and 56,000 square kilometres (21,621 square miles). The region had a combined GDP of $1.5 trillion in 2016. The GBA is estimated to have the largest GDP among all bay areas in 2030, reaching $4.6 trillion, according to the China Center for International Economic Exchanges, a think tank based in Beijing.

[caption id="attachment_83502" align="aligncenter" width="824"] Source: HSBC/China Center for International Economic Exchanges/Coresight Research[/caption]

What are the Roles of Cities in the GBA?

Under the Chinese government plan, each of the cities will play a specific role. Of the 11 cities in the GBA, the plan sees Hong Kong, Macau, Shenzhen and Guangzhou as likely to remain the core engines of growth in the region. Further, the plan calls for:

Source: HSBC/China Center for International Economic Exchanges/Coresight Research[/caption]

What are the Roles of Cities in the GBA?

Under the Chinese government plan, each of the cities will play a specific role. Of the 11 cities in the GBA, the plan sees Hong Kong, Macau, Shenzhen and Guangzhou as likely to remain the core engines of growth in the region. Further, the plan calls for:

- Hong Kong to continue to leverage its status as an international financial, port, trading and air traffic hub. In finance, the plan sees Hong Kong supporting offshore yuan trading, international asset management and risk management. Hong Kong will also invest in and develop innovation and technology, such as launching a joint Innovation and Technology Park between Hong Kong and Shenzhen.

- Macau to develop into a center for tourism and leisure.

- Shenzhen to remain a center of technology, being home to several of China’s most famous technology companies, such as Tencent Holdings, Huawei Technologies, ZTE Corp and drone-maker DJI Technology.

- Guangzhou to focus on developing into an international business and trade center and comprehensive transportation hub. The city will also invest to upgrade its science and technology education and cultural services, according to the plan.

Source: Government documents/Coresight Research[/caption]

What is the Vision for the GBA?

The GBA plan is a blueprint for development that hopes to turn the region into a hub of information technology, biotech, 3D printing, artificial intelligence and DNA testing. The plan exhorts others to support the plans objectives by calling for:

Source: Government documents/Coresight Research[/caption]

What is the Vision for the GBA?

The GBA plan is a blueprint for development that hopes to turn the region into a hub of information technology, biotech, 3D printing, artificial intelligence and DNA testing. The plan exhorts others to support the plans objectives by calling for:

- Collaboration in technology research between universities, institutions and enterprises in the region.

- Building R&D centers focused on five major areas: logistics, textiles, communication technology, automotive components and nano-materials.

- Establishing technology incubators in the nine Pear River Delta cities to support tech companies.

- Focusing on intellectual property (IP) protection, such as establishing a mechanism for dealing with cross-border IP cases.

- Developing an innovative, integrated application of information technology, such as the Internet of Things, cloud computing and big data, in the field of transport.

- Facilitating the mutual recognition of digital signatures in areas such as public services, finance, trade and commerce.

- Further integrating the region financially with cross-border payment systems across Hong Kong, Macau and the cities in China.

- Reducing roaming charges for mobile phones within the region.

- Hong Kong-Zhuhai-Macau Bridge is a 55-kilometer (34-mile) long system of road, bridge and tunnel that opened in 2018, and cut travel time between Hong Kong and Zhuhai from 150 minutes to 75 minutes.

- Guangzhou-Shenzhen-Hong Kong High Speed Train connects Hong Kong to mainland cities. The final portion was completed in 2018, shortening travel time between cities within the region to an hour or so.

- The Humen Bridge II will open in May 2019, connecting Humen town in Dongguan to Guangzhou’s Nansha district, where the Nansha port and Nansha Free Trade Zone are located.

- The Guangzhou-Dongguan-Shenzhen intercity railway will open in June 2019, connecting Guangzhou, Dongguan and Shenzhen’s Bao’an International airport, cutting travel time between Guangzhou and the Shenzhen airport to one hour.

- A new boundary control point (BCP, or a border crossing) at Liantang/Heung Yuen Wai will open in the fall of 2019. This will be the seventh crossing point between Hong Kong and Shenzhen, greatly reducing travel time to the eastern part of Shenzhen and Guangdong province and alleviating congestion at the existing crossings.

- The Shenzhen-Zhongshan Bridge, which is 30 kilometers north of the Hong Kong-Zhuhai-Macau Bridge, is due to open in 2023.

- The Shenzhen-Zhongshan highway will start to operate in 2024, shortening travel time between Shenzhen and Zhongshan from two hours to half an hour.

Dongguan is around 30 kilometers away from Nansha, Macau is around 70 kilometers away from Nansha, and Huizhou is around 100 kilometers away from Nansha.

Dongguan is around 30 kilometers away from Nansha, Macau is around 70 kilometers away from Nansha, and Huizhou is around 100 kilometers away from Nansha.Source: Government documents/Coresight Research[/caption] What are the Challenges? Hong Kong, Macau and the nine Pearl River Delta cities have different social and economic systems, legal systems, culture, currencies and customs policies. These fundamental issues will create barriers to the seamless cooperation envisioned in the official plan. For example, Hong Kong, Macau and the nine Pearl River Delta cities have different tax codes. In Hong Kong, only Hong Kong-sourced profits are taxable. There is no tax for capital gains, no value added tax (VAT) or other indirect tax on goods and services. In mainland China, there are higher corporate and individual tax rates as well as a value added tax on goods and services. Hong Kong uses the Hong Kong dollar, which is feely convertible; Macau uses the Macanese pataca (which is also convertible) while the other nine cities use the not-so-easily-convertible renminbi. Hong Kong is also a free port: Almost everything is allowed in duty free with a few exceptions such as alcohol, tobacco and fuel. The cities in mainland China would be subject to import tariffs, in addition to a VAT system that applies a standard rate to most taxable activities, including importing goods and supplying services involving labor provision. Will it Succeed? The central government has laid out some ambitious goals in its GBA plan. Will it succeed? The government in Beijing definitely has a proven track record of setting ambitious long-term development goals – and then delivering them. So, despite the challenges of separate legal systems, currencies and customs zones, we believe the GBA will over time become even more integrated. At the very least, the region will likely develop into a mega-city with several centers: The region is home to 70 million people – less than 6% of the country’s population – yet it produces 37% of the country's exports and 12% of its gross domestic product. Let us look at human capital, the presence of top global enterprises, funding and government support. Human capital is one of the key elements for success in the nine-county San Francisco Bay Area (SFBA), which includes Silicon Valley. Education and research institutions provide a highly-educated workforce for high-tech businesses. There are around 100 universities in the SFBA, including Stanford University and around 40 university-affiliated, independent, and corporate innovation centers. And the SFBA is also home to around 100 Nobel laureates. In New York Metropolitan Area, there are famous universities, such as Columbia University, and New York University. In the Tokyo Bay Area, there are around 11 universities. By comparison, Hong Kong has four of the top 10 universities in Asia, based on the QS Stars Rankings system for universities. Top enterprises, which house and nurture the human capital within the area, are also important to the success of the GBA.

- The San Francisco Bay Area boasts countless top tech enterprises that attract and nurture top talent.

- Japan’s capital is also home to many of the country’s top companies, with global players such as Toyota Motor Corporation, NEC Corporation, Canon, Sony Corporation and Mitsubishi Electric based in the Tokyo Bay Area.

- The New York Metropolitan Area is similarly home to numerous major US multinational companies, such as Verizon Communications, JPMorgan, MetLife, PepsiCo, Goldman Sachs Group and Morgan Stanley, to name a few.

Coresight Research[/caption]

What are the Opportunities for Businesses in the GBA? How Can Companies Benefit from This Plan?

Infrastructure/Property: Apart from transportation, infrastructure in areas such as finance and telecommunications will also need to be upgraded to ensure connectivity, including mobile payments, cross-border financial products and shared communication networks.

Service businesses focusing on quality living: The plan envisions the GBA to be a quality living circle that improves people’s livelihoods, which would encourage service focused businesses to grow in the region, such as Health Care, Communication, Culture, Leisure, Personal Care, Transportation, Housekeeping and Hotel Lodging.

Technology related businesses: One of the key objectives of the GBA plan is to support technology innovation. If this happens as planned, there could be opportunities for technology companies to develop and test ideas in the GBA.

What are the Implications for the Retail Industry?

If the plan succeeds in delivering growth to the area, we should see stronger demand for high-end products in cities such as Shenzhen, Guangzhou and Hong Kong.

There will also be new retail opportunities near new residential communities in Zhuhai, Foshan, Zhongshan and Dongguan, as these cities grow and become more populated. Grocery and consumer staples sectors should see ample business opportunity.

[caption id="attachment_83507" align="aligncenter" width="572"]

Coresight Research[/caption]

What are the Opportunities for Businesses in the GBA? How Can Companies Benefit from This Plan?

Infrastructure/Property: Apart from transportation, infrastructure in areas such as finance and telecommunications will also need to be upgraded to ensure connectivity, including mobile payments, cross-border financial products and shared communication networks.

Service businesses focusing on quality living: The plan envisions the GBA to be a quality living circle that improves people’s livelihoods, which would encourage service focused businesses to grow in the region, such as Health Care, Communication, Culture, Leisure, Personal Care, Transportation, Housekeeping and Hotel Lodging.

Technology related businesses: One of the key objectives of the GBA plan is to support technology innovation. If this happens as planned, there could be opportunities for technology companies to develop and test ideas in the GBA.

What are the Implications for the Retail Industry?

If the plan succeeds in delivering growth to the area, we should see stronger demand for high-end products in cities such as Shenzhen, Guangzhou and Hong Kong.

There will also be new retail opportunities near new residential communities in Zhuhai, Foshan, Zhongshan and Dongguan, as these cities grow and become more populated. Grocery and consumer staples sectors should see ample business opportunity.

[caption id="attachment_83507" align="aligncenter" width="572"] Source: Colliers International/Coresight Research[/caption]

Key Insights

The GBA plan aims to group nine cities in Guangdong with Hong Kong and Macau into a unique zone which the government will seek to develop into an advanced economic and business hub. The central government hopes to position the GBA as an innovation and technology center. Infrastructure projects are already completed or underway that will improve transportation connectivity, helping to better integrate the area. We expect more projects and initiatives in transportation, technology, education and businesses in the coming years.

Source: Colliers International/Coresight Research[/caption]

Key Insights

The GBA plan aims to group nine cities in Guangdong with Hong Kong and Macau into a unique zone which the government will seek to develop into an advanced economic and business hub. The central government hopes to position the GBA as an innovation and technology center. Infrastructure projects are already completed or underway that will improve transportation connectivity, helping to better integrate the area. We expect more projects and initiatives in transportation, technology, education and businesses in the coming years.