Nitheesh NH

What’s the Story?

Shopping holidays have become a worldwide phenomenon, creating a sense of urgency and a fear of missing out among shoppers, who rush to score the best deals. In the second half of 2020, shopping holidays hold heightened relevance for many retailers, brands and sellers as they look to jump-start their sales recoveries and clear inventory following coronavirus-led lockdowns. Furthermore, consumers may need encouragement to spend, particularly on hard-hit discretionary categories. This year, Coresight Research is launching the 10.10 Shopping Festival in collaboration with shopping rewards app Shopkick and online fashion marketplace Fashwire. We believe that there is a significant opportunity for a new shopping festival in the US to engage consumers, drive brand awareness and revitalize retail. The three-day event will be held on October 9–12, 2020, before the traditional start to holiday shopping and to take advantage of existing Columbus Day (October 12) buying behavior. We present timeline of selected China- and US-based shopping festivals in Figure 1. [caption id="attachment_116523" align="aligncenter" width="700"] Source: Coresight Research[/caption]

In this report, we detail the 10.10 Shopping Festival and the global landscape of shopping festivals, key benefits of shopping holidays to retailers and brands, and what sellers can do to leverage these festivals.

Source: Coresight Research[/caption]

In this report, we detail the 10.10 Shopping Festival and the global landscape of shopping festivals, key benefits of shopping holidays to retailers and brands, and what sellers can do to leverage these festivals.

The 10.10 Shopping Festival in Detail

The 10.10 Shopping Festival—which Shopkick sees as an opportunity to expand on the success of its annual “Shopper Appreciation Weekend”—enables consumers to earn rewards while shopping. During October 9–12, participating retailers will offer deals and rewards to consumers for both online and offline shopping activities via the Shopkick mobile app, in the form of “kicks” (the app’s internal currency). Retailers participating in 10.10 include major names in footwear, apparel, electronics, home goods and baby products. The 10.10 Shopping Festival can help capture shoppers’ attention in three ways:- Focus on e-commerce—As it includes broad participation from leading omnichannel and direct-to-consumer retailers, 10.10 will enable consumers to shop safely.

- Provide strong value to the consumer—10.10 recommends that retailers provide consumers with discounts of 25% or more on popular products, incentivizing them to shop early. Shoppers can also redeem “kicks” for gift cards at retailers such as Amazon, Target and Walmart, to realize further savings in time for the holidays.

- Prominent charitable emphasis—In the spirit of giving, shoppers will have the opportunity to redeem their rewards in the form of a charitable donation and Shopkick will donate 5% of the monetary value of all “kicks” earned throughout the weekend to St. Jude’s Children’s Research Hospital.

- The shopping festival could create sales momentum and buzz well beyond what any one merchant could achieve, as well as prepare brands to contend with Amazon Prime Day, which is expected to take place in October this year.

- Some 22.7% of respondents in a recent Coresight Research survey of US consumers who expect to spend on the holiday season said that they are planning to start holiday shopping earlier than usual this year. 10.10 is strategically positioned to capture early shoppers’ dollars.

- By pulling forward holiday shopping, 10.10 is also intended to help alleviate supply chain bottlenecks that many retailers could experience as a result of soaring online demand this year.

- The festival could provide retailers an early read of consumer sentiment to help them better manage, or if necessary, amend their plans for the rest of the holiday season.

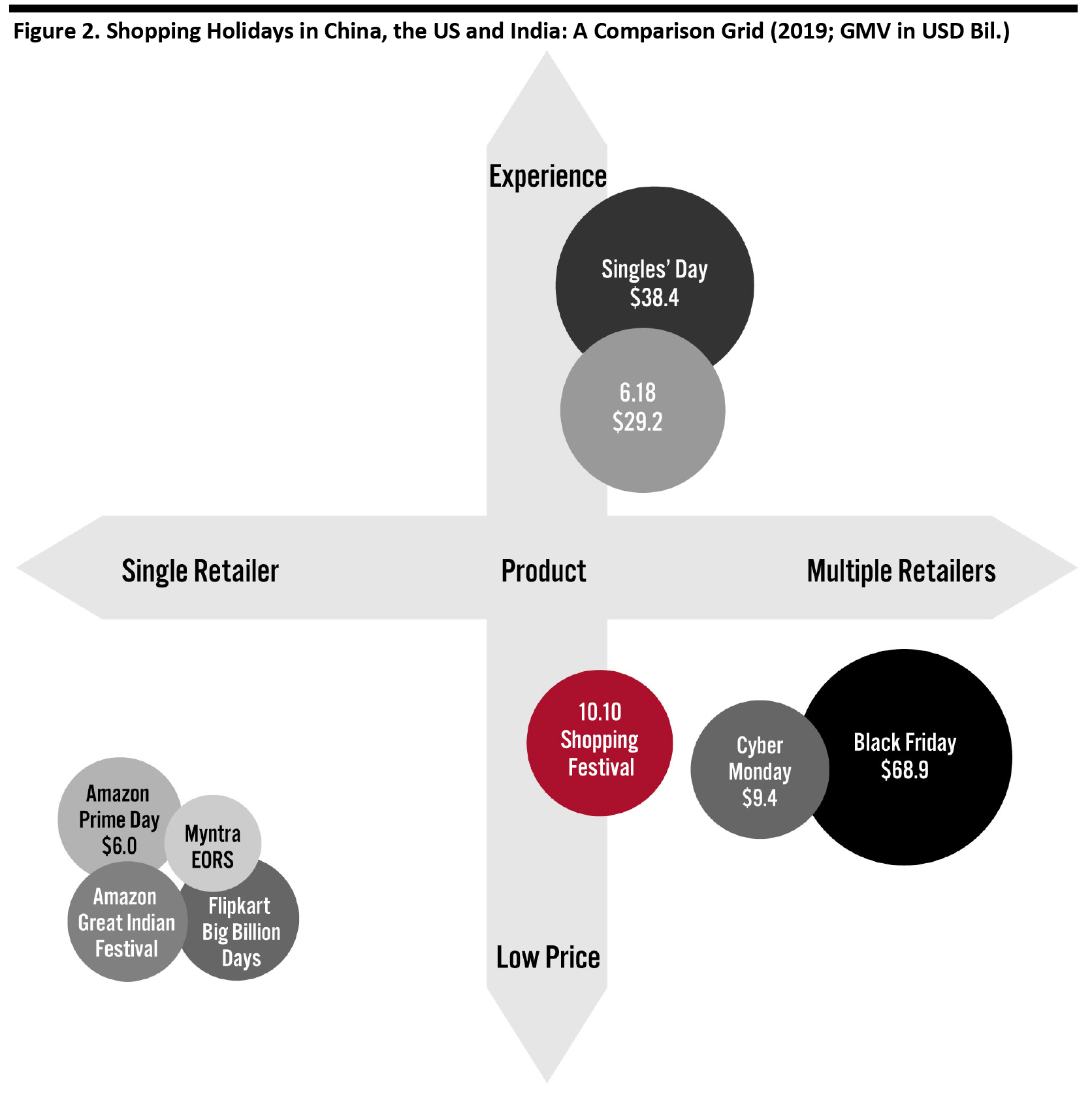

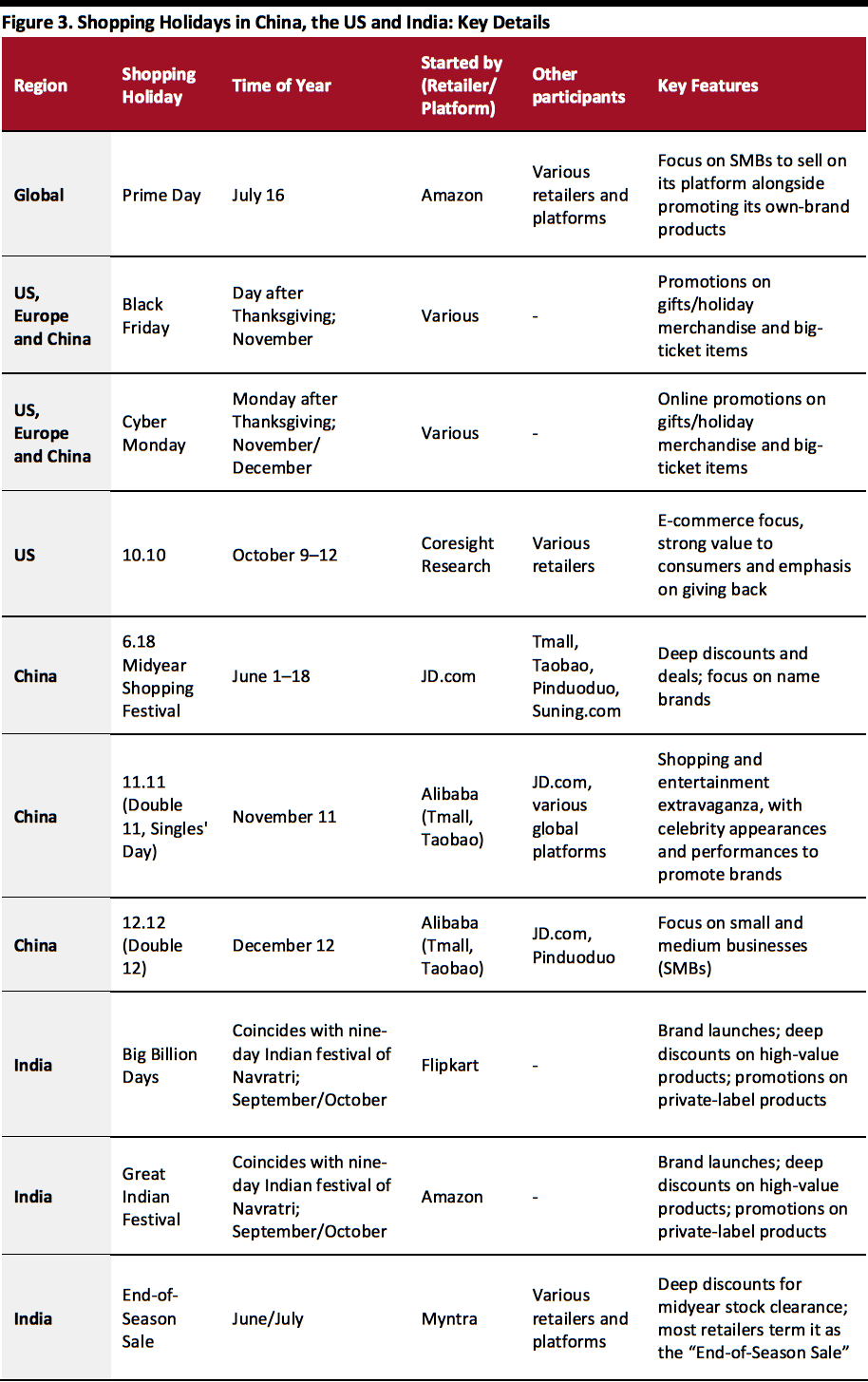

Not to scale. 6.18 GMV is for JD.com only; Singles’ Day GMV is for Alibaba platforms only; Prime Day GMV is for global markets; Black Friday GMV is for US only, for four days (Thursday to Sunday); Cyber Monday GMV is US and online only; Flipkart, Myntra and Amazon India do not disclose GMV.

Not to scale. 6.18 GMV is for JD.com only; Singles’ Day GMV is for Alibaba platforms only; Prime Day GMV is for global markets; Black Friday GMV is for US only, for four days (Thursday to Sunday); Cyber Monday GMV is US and online only; Flipkart, Myntra and Amazon India do not disclose GMV. Source: Company reports/Salesforce/Adobe/Consumer Growth Partners/Coresight Research [/caption]

The Benefits of Major Global Shopping Festivals

Shopping festivals present immense opportunities for retailers and brands to not just grow their sales but also increase their brand visibility in existing markets, as well as to enter new markets. In the second half of this year, they are also a means to help retailers recover lost sales from the Covid-19 crisis. [caption id="attachment_117397" align="aligncenter" width="700"] Source: Company reports/Adobe/Consumer Growth Partners/Salesforce/Coresight Research[/caption]

Below, we present five key benefits of shopping holidays to brands and retailers.

1) Shopping holidays’ limited-time offers create a sense of urgency for shoppers

Shopping holidays provide consumers with access a wide range of products through attractive deals and with heavy discounts. As these events last for a limited time, they drive sales by creating a sense of urgency for shoppers, who may feel that they will miss out if they do not make impulse purchases.

2) Shopping festivals provide a means to clear inventory

Shopping festivals in India rake in sizeable GMV, although retailers generally do not publish these numbers. Instead, they tout the number of high-value items sold, such as the following:

Source: Company reports/Adobe/Consumer Growth Partners/Salesforce/Coresight Research[/caption]

Below, we present five key benefits of shopping holidays to brands and retailers.

1) Shopping holidays’ limited-time offers create a sense of urgency for shoppers

Shopping holidays provide consumers with access a wide range of products through attractive deals and with heavy discounts. As these events last for a limited time, they drive sales by creating a sense of urgency for shoppers, who may feel that they will miss out if they do not make impulse purchases.

2) Shopping festivals provide a means to clear inventory

Shopping festivals in India rake in sizeable GMV, although retailers generally do not publish these numbers. Instead, they tout the number of high-value items sold, such as the following:

- Walmart-owned Flipkart claimed to have sold one in two television sets, one in three washing machines, one in five refrigerators and one in five air conditioners that were sold overall in India during its Big Billion Days shopping festival in October 2019.

- Amazon reported that sales of smartphones on its e-commerce platform grew by 15x, large appliances by 8x and Echo devices by 70x during its Prime Day 2019 in India, which ran in parallel with Flipkart’s festival.

- Samsung Galaxy M31s smartphone, priced at ₹19,999 ($267) for the 6+128GB model

- Haircare electronics from Philips

- Water purifiers from Eureka Forbes Aquaguard

- A new apparel and footwear collection from fashion brand Max

- Refrigerators from Whirlpool

- 240 products were themed specifically around Singles’ Day.

- Cosmetics brand MAC sold 60,000 units of its Double 11-exclusive lipstick in the first five minutes of pre-sales.

Issues That Retailers May Face Around Shopping Holidays

Retailers need to prepare for challenges that could hamper sales during the shopping holidays.- Supply chain and last-mile delivery challenges: Factories, warehouses and transport hubs that were shut or running on reduced capacity for some part of this year due to the pandemic will limit the inventory that retailers can access, or cause disruptions to timely deliveries. During Prime Day in India in August, many shoppers reported long wait times for deliveries of orders and others noticed stock-outs on a few products. Although retailers may be well-stocked to cater to high demand during shopping holidays, they could experience challenges during last-mile delivery due to inadequate delivery capacity.

- Website glitches due to high shopper traffic: As large numbers of shoppers tend to shop at the same time during shopping festivals, websites can experience slowdowns or even crash—Amazon has faced this challenge nearly every year during its Prime Day shopping event.

What We Think

As consumers are likely to become more frugal with their spending against the backdrop of the coronavirus crisis, brands and retailers should look for alternative ways to counterbalance lost revenue. They could leverage shopping holidays to improve sales, clear inventory, launch products, reach new markets and take advantage of consumer preference for e-commerce over physical retail formats. Implications for Brands and Retailers- Brands and retailers should use online shopping events to deepen engagement with their customers to maintain visibility in a time when opportunities to do so are few as shoppers continue to avoid public spaces, including shopping centers and stores.

- As consumer spending increasingly shifts online, brands and retailers that do not yet have a strong online presence could use shopping holidays to pivot to e-commerce quickly.

- Retailers should also look to enhance the back-end technology that powers their digital stores in anticipation of higher traffic during shopping holidays. One new addition that retailers could consider is on-hand customer assistance—video consultations or product demos via video chat, which can help with conversion.

- In anticipation of an increased shift to online, retailers could look to increase their fulfillment and last-mile delivery capacity by locating warehouses or “dark stores” closer to regions with high demand. They could also invest in additional delivery capacity and last-mile routing technology that will help them identify the most efficient routes and times for deliveries.

- Retailers and brands in the US can look to China’s shopping festivals for inspiration on turning events into extended shopping extravaganzas.

- Online shopping events tend to see heavy customer traffic that can slow down platform pages or crash websites altogether. Technology vendors should look at ways to mitigate these instances, particularly because more shoppers will be shopping online this year than ever before due to the Covid-19 crisis.

- Brands and retailers that are not yet online or do not yet have a strong online presence will likely seek out plug-and-play applications that are easy to deploy and create an online storefront. Vendors should look to assist them with setting up an online store or boosting their online presence with efficient, cost-effective programs that cause minimal disruption to existing technological architecture.

- Technology providers for digital payments, supply chain management and last-mile delivery should look at ways to enhance retailers’ existing systems and help them deploy specific features quickly with minimal investment.