albert Chan

What’s the Story?

Amid the resurgence of in-store shopping with physical stores reopening, retailers are facing the perfect storm: labor shortages, intense hiring competition and heavier employee workloads. At the same time, physical stores are taking on new roles such as online fulfillment and additional takeout/delivery options, impacting merchandising, promotions and more. In this environment, retailers should evaluate the new digital tools available to support frontline employees and enhance the customer experience by optimizing store performance.

In this report, we analyze key findings from a September 2021 Coresight Research survey of 165 retail and restaurant industry decision-makers in the US, the UK and Canada from six retail verticals to uncover current pain points and assess the level of adoption and benefits of digital workplace technology. We also asked respondents about their organizations’ use of digital applications that arm deskless, frontline employees with the tools they need to meet the evolving challenges of in-store execution. To clarify what we’ll be discussing, we define the key terms as follows:

- Deskless, frontline employees—On-site workers whose responsibilities require being outside of an office/not sitting at a desk; often responsible for customer experience and shopper/diner interaction

- Digital workplace applications—Software applications for frontline and service workers to manage tasks, communicate with each other and go through training, development and other e-learning tasks

- Store execution—Activities carried out at the store/restaurant level by frontline employees. Successful store execution is the correct and consistent implementation of brand guidelines, promotions and customer interactions across store networks

Our research indicates that now more than ever, retailers need to seek out digital workplace technology solutions that help frontline employees cope with increased demands; companies that have are already reaping the benefits.

This report is sponsored by YOOBIC, a leading digital workplace platform provider.

Why It Matters

Frontline employees are the face of the company and play a vital role in the customer experience and shopper engagement with the brand. Multiple trends heightened by the pandemic have made their jobs more demanding than ever (which we discuss later in this report).

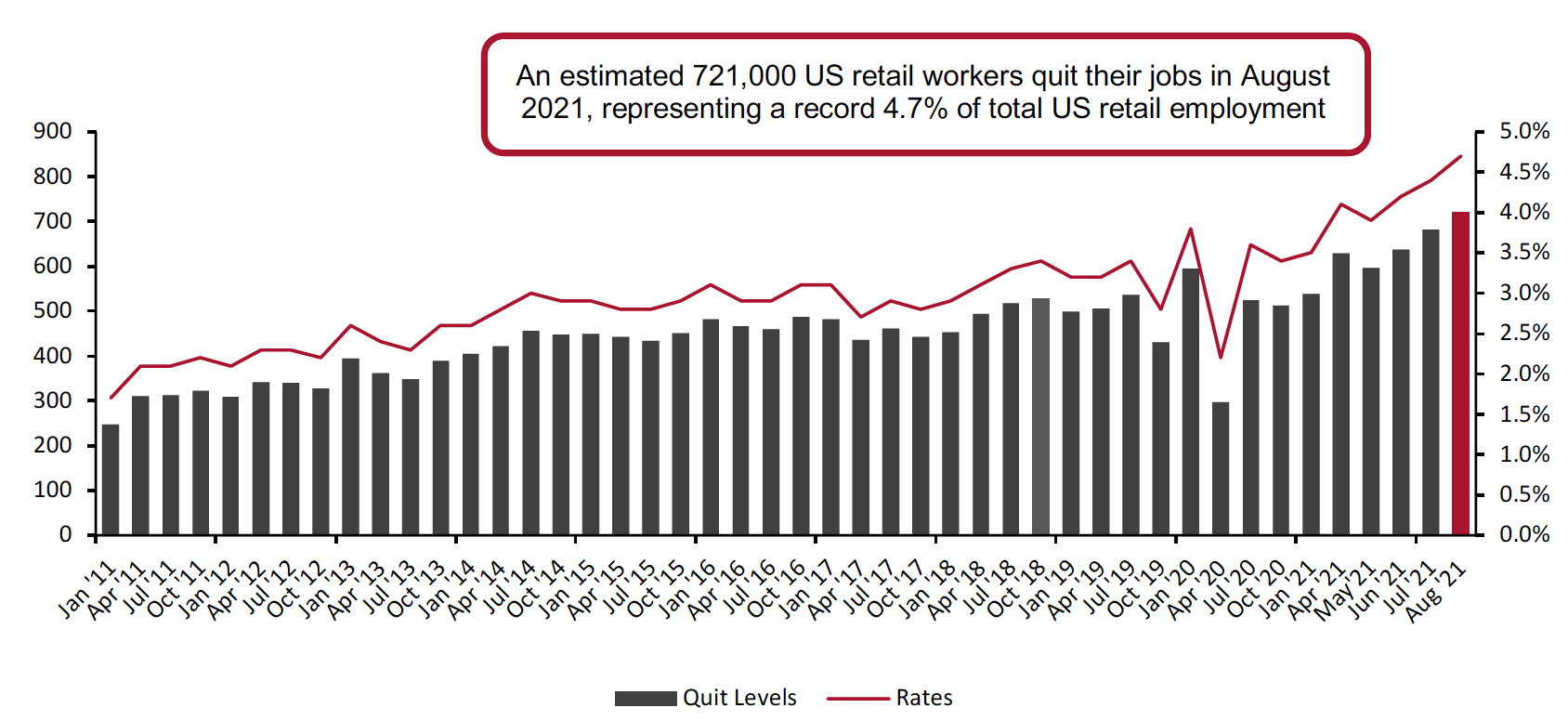

Additionally, reports of labor shortages across industries are impacting small businesses and large corporations alike. The latest data show record numbers of people leaving the retail workforce: As shown in Figure 1, an estimated 721,000 US retail workers quit their jobs in August 2021, according to the US Bureau of Labor Statistics. There are numerous factors contributing to this trend across industries, particularly with the pandemic serving as a catalyst for workers to re-evaluate their career priorities amid changing life circumstances. Within the retail sector, reasons for leaving jobs may include burnout and lack of career growth, as well as loss of reliable childcare.

Retailers are finding themselves shorthanded during a period of significant change as they adapt to changing consumer preferences, transition to digital business processes and reinvent their physical spaces to respond to pandemic-impacted landscape. Our survey found that some 70% of respondents said that high turnover and staff shortages are “moderately” or “very” challenging to their business—making them the two most common current pain points.

Figure 1. US Retail Trade: Quit Levels (Thousands; Left Axis) and Quit Rates (% of Total Employment; Right Axis)

[caption id="attachment_134734" align="aligncenter" width="700"] Source: US Bureau of Labor Statistics[/caption]

Source: US Bureau of Labor Statistics[/caption]

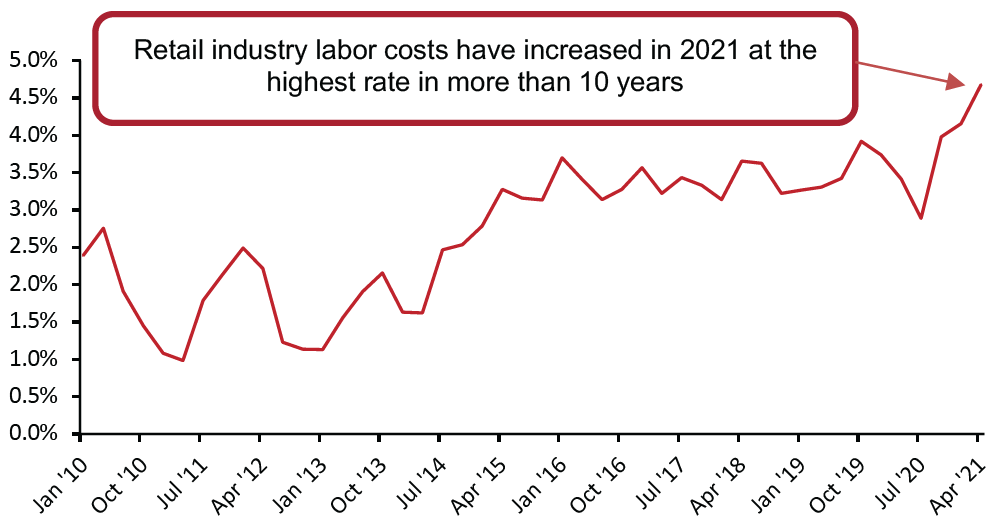

The price of labor is also adding to this perfect storm. For the US retail sector overall, wages and salaries have risen at the highest rate in 2021 in more than 10 years (see Figure 2), as retailers and restaurants are having to compete hard to attract and retain talent given the shortage in labor.

Figure 2. US Employment Cost Index: Wages and Salaries for Private Industry Workers in Retail (YoY % Change)

[caption id="attachment_134719" align="aligncenter" width="550"] Source: US Bureau of Labor Statistics[/caption]

Source: US Bureau of Labor Statistics[/caption]

In this challenging environment, retailers are being forced to do more with less and evaluate new ways of doing business—chief among them is adopting new technology to boost employee productivity, job satisfaction and engagement, in order to cope with the changing workforce dynamics.

The Digital Workplace in 2021: Retail Survey Findings

We dive deeper into retailer pain points, the current state of digital workplace technology and look at what decision-makers are saying about their organizations’ current use of digital platforms and strategies for empowering frontline workers.

Heightened by the Pandemic, Retail Organizations Currently Face a Perfect Storm of Challenges

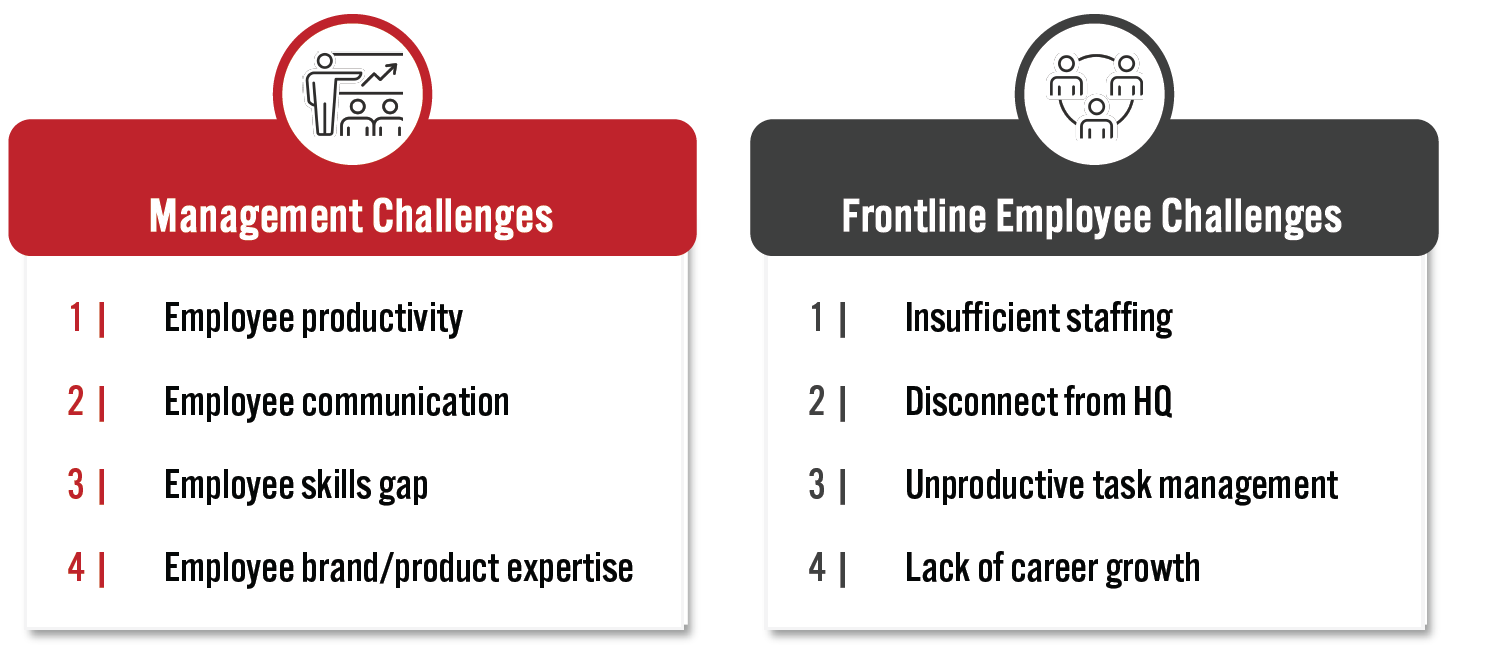

We summarize the key challenges that retailers face in managing frontline employees, and the challenges that employees face in performing their best on the job, in Figure 3. We explore these challenges in detail below.

Figure 3. Summary of Key Challenges for Retail Management and Frontline Employees (% of Respondents)

[caption id="attachment_134720" align="aligncenter" width="700"] Rankings based on proportions of respondents that ranked each challenge as one of the top three most important

Rankings based on proportions of respondents that ranked each challenge as one of the top three most importantBase: 165 retail industry decision-makers, surveyed in September 2021

Source: Coresight Research[/caption]

From transforming store layouts to overhauling restaurant menus and scrambling to add new service options, retailers are having to do it all in with overburdened staff, including new hires coming in with limited experience.

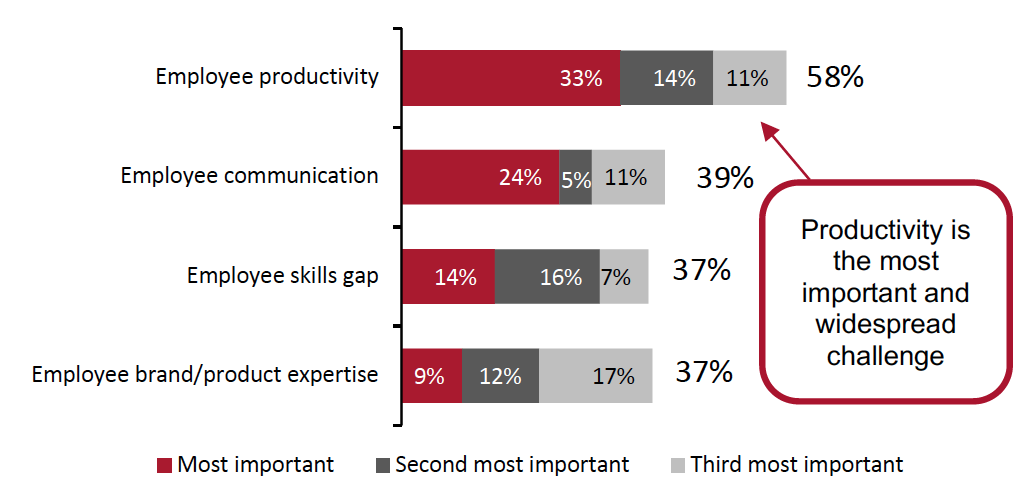

We asked respondents about the top challenges their organizations face in managing frontline employees. The top three challenges, cited by the most respondents, are as follows:

- Employee productivity was the most cited challenge, by a wide margin. Given insufficient staffing and high turnover, managers are struggling to find ways to improve employee productivity and overcome staffing constraints.

- Employee communication ranked the second biggest challenge to retailers in terms of importance. This has emerged as a critical theme throughout our survey. Getting everyone on the same page in terms of store execution, merchandising and brand guidelines is currently a common problem among retailers with a large number of physical locations.

- An employee skills gap has emerged, with the labor crunch leading many retailers to hire candidates who may not possess the desired skills or experience.

Figure 4. Retailers’ Top Challenges in Managing Frontline Employees (% of Respondents)

[caption id="attachment_134721" align="aligncenter" width="550"] Respondents were asked to select and rank the top three challenges

Respondents were asked to select and rank the top three challengesBase: 165 retail industry decision-makers, surveyed in September 2021

Source: Coresight Research[/caption]

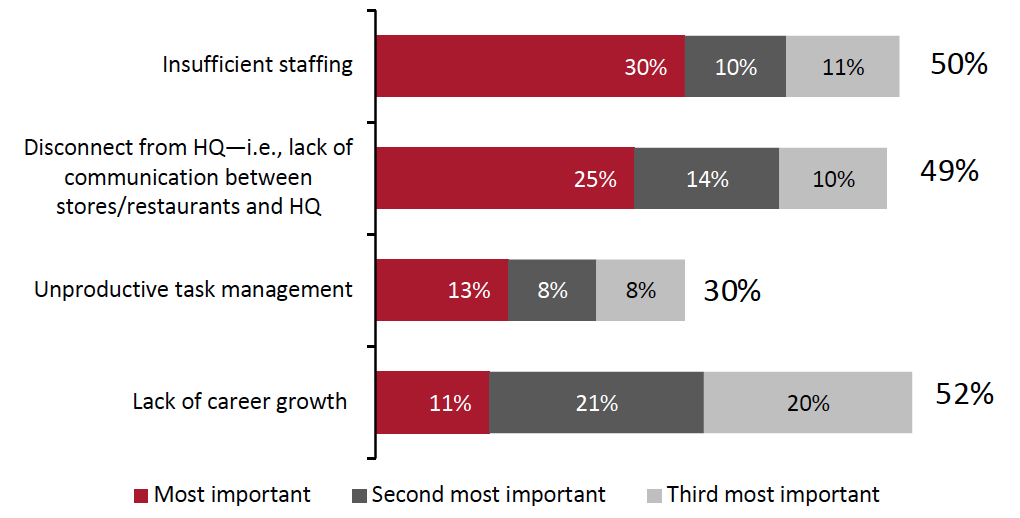

We also asked respondents to think about the situation from their employees’ perspectives, to identify what challenges are preventing frontline staff from performing their best on the job. The top three challenges, cited by the most respondents, are as follows:

- Insufficient staffing was reported as challenging by 50% of respondents, who indicated it is the most important issue preventing employees from performing their best. Employees are being asked to take on additional responsibilities and shoulder responsibilities that would otherwise be handled by other colleagues as stores/restaurants look to add services to meet customer needs.

- A disconnect from headquarters (HQ) involves a lack of a communication and feedback loop between stores/restaurants and HQ. This was cited by 49% of respondents as hampering employee performance. This result mirrors the finding that employee communication is a top issue for management. For retailers with many physical locations, keeping everyone on the same page is an ongoing challenge.

- Unproductive task management links directly to the management issue of employee productivity due to staffing shortages and suboptimal communications and training tools.

Figure 5. Top Challenges That Prevent Frontline Employees Performing Their Best on the Job (% of Respondents)

[caption id="attachment_134722" align="aligncenter" width="550"] Respondents were asked to select and rank the top three challenges, with Rank 1 being the most important

Respondents were asked to select and rank the top three challenges, with Rank 1 being the most importantBase: 165 retail industry decision-makers, surveyed in September 2021

Source: Coresight Research[/caption]

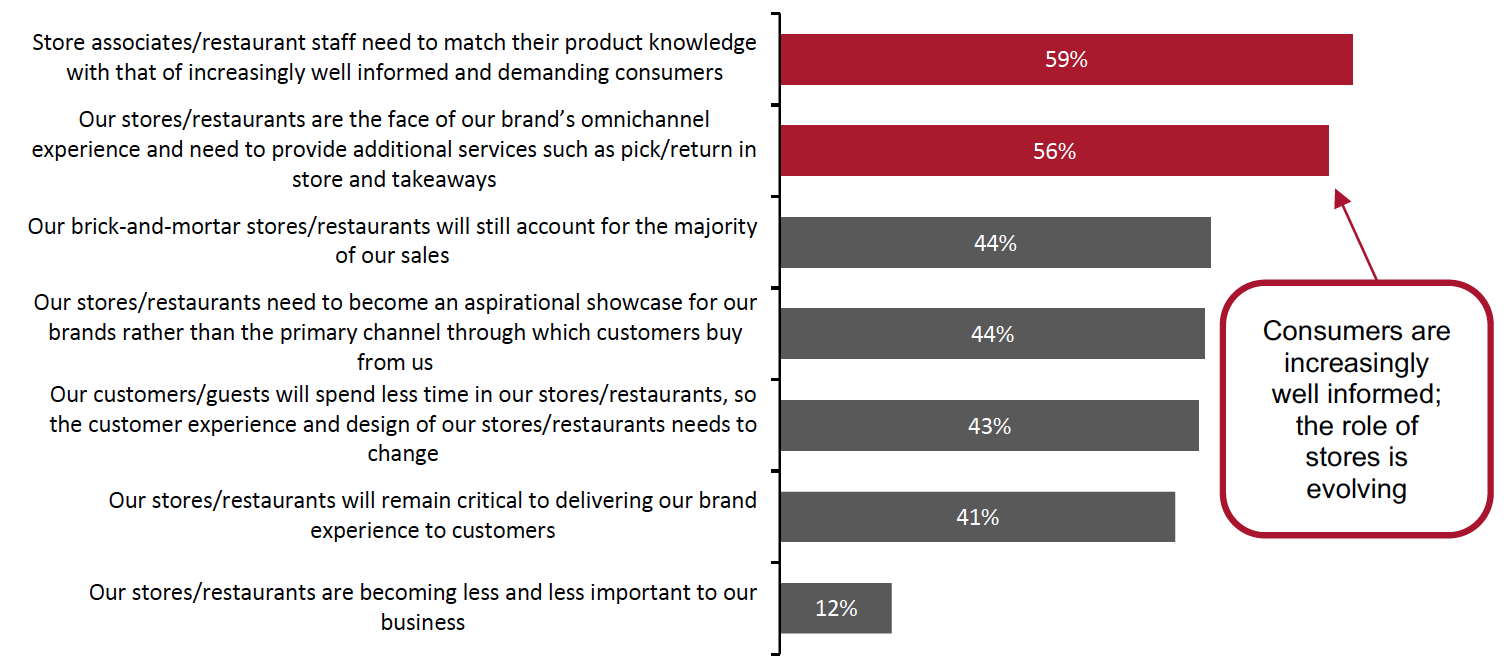

Retailers are facing these challenges while having to adapt their stores and restaurants to meet changing consumer needs. We asked respondents how they view the role of their physical locations over the next few years. Our research affirms that brick-and-mortar stores/restaurants remain critical to retailers’ sales and represent the face of brands’ omnichannel experiences.

- Frontline employees need help dealing with increasingly well-informed and demanding consumers. Respondents also say that their store associates/restaurant staff need to match their knowledge with that of savvy customers. With product/restaurant reviews, menus, competitor offerings and pricing data all within a moment’s reach at any time, today’s consumer is often well researched. Frontline employees need to be armed with better tools to keep up with these digitally savvy customers.

- Stores/restaurants are the face of the brand’s omnichannel experience. The in-store experience remains critical, but retailers increasingly need to offer additional services such as pickup/return in store and food ordering/delivery options linking to online channels.

- Physical locations remain critical. Our survey found that 44% of survey respondents reported that their stores/restaurants will continue to account for the majority of sales over the next few years.

Figure 6. How Retailers See the Role of Their Stores/Restaurants Over the Next Few Years (% of Respondents)

[caption id="attachment_134723" align="aligncenter" width="700"] Respondents were asked to select and rank their top three statements

Respondents were asked to select and rank their top three statementsBase: 165 retail industry decision-makers, surveyed in September 2021

Source: Coresight Research[/caption]

As the role of their physical locations evolves and faced with employee productivity challenges due to staff shortages, high turnover, and suboptimal communications across large store/restaurant networks, retailers increasingly need to look for new solutions to adapt their operations to overcome challenges.

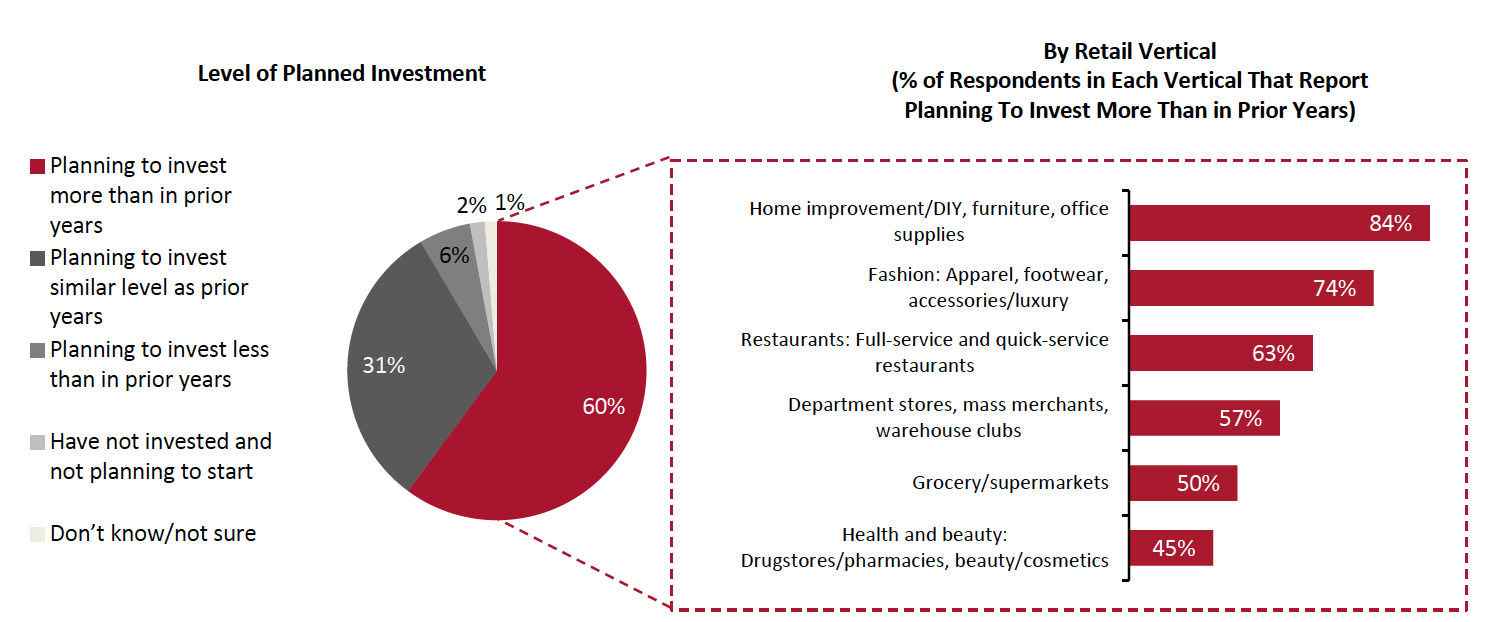

Retailers Recognize the Importance of Investing in Digital Workplace Technology

Retailers need to meet consumer demand while managing headcount constraints, which means finding new ways to boost employee productivity and improve store execution. Our research indicates that most retailers recognize the importance of investing in digital workplace technology to address this.

- Over 60% of respondents plan to invest more in digital workplace technology over the next 12–18 months than in prior years.

- By country, 66% of UK respondents say they plan to invest more versus 60% of US respondents and 52% of respondents in Canada.

- Home improvement, fashion and restaurants lead the way, with these retail verticals seeing the highest proportions of respondents report a planned increase in investment in digital workplace applications. We believe this could be due, in part, to increased home-improvement customer traffic as DIY projects surged amid pandemic-induced stay-at-home measures, as well as pent-up demand for new apparel and eating out following office and restaurant reopenings as consumers headed into the summer months with optimism.

- Only 6% of respondents are planning to spend less on digital workplace technology than in prior years, and our survey found that current system sufficiency and other initiatives taking precedence are the top reasons for decreasing investment among these respondents. In other words, the vast majority of retailers (91%) surveyed plan to continue investing in digital workplace technology at the same or increased levels as previously over the next 12–18 months.

Figure 7. Level of Planned investment in Digital Workplace Applications for Frontline Employees Over the Next 12–18 Months (% of Respondents)

[caption id="attachment_134724" align="aligncenter" width="700"] Totals may not sum to 100 due to rounding

Totals may not sum to 100 due to roundingBase: 165 retail industry decision-makers, surveyed in September 2021

Source: Coresight Research[/caption]

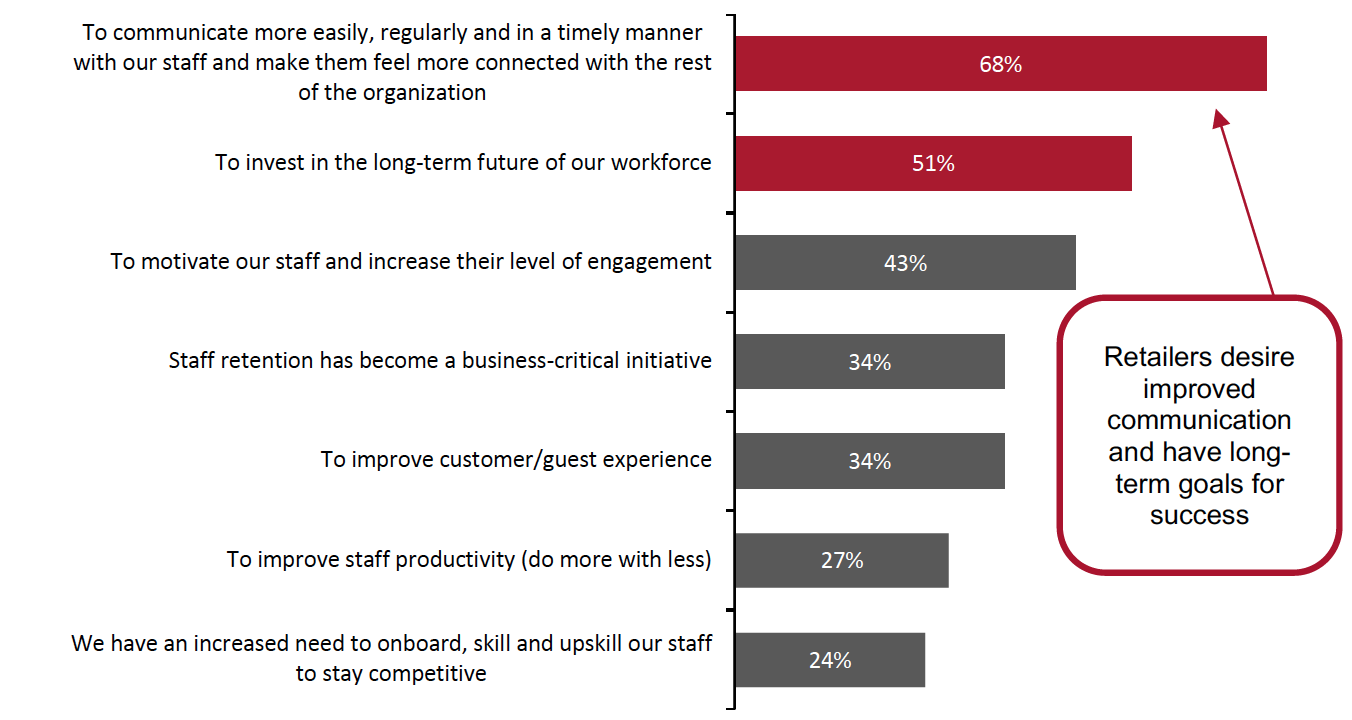

We asked respondents the reasons behind their plans to increase investment into digital workplace applications and found that many are likely driven by the issues that retailers are facing around insufficient staffing and turnover.

- To improve communications emerged as the top reason—covering ease, regularity and timeliness of communication with staff, to make them feel more connected with the rest of the organization. This finding ties into the disconnect from HQ that respondents reported as a top challenge keeping employees from performing their best on the job.

- Investing in the long-term future of the workforce is among the top drivers of increased investment in the digital workplace—cited as one of the top three most important reasons by more than 50% of respondents. Facing labor shortages and high turnover, retailers are realizing that they need to do more to invest in the long-term future of their workforce so that they can provide a more satisfying employee experience, enabling employees to see improved growth opportunities and a clearer career path.

- To increase staff engagement was cited as one of the top three important reasons to increase investment into digital workplace applications by 43% of respondents that plan to spend more. More motivated and engaged staff are often more productive, and an enhanced employee experience boosts retention.

Figure 8. Reasons Driving Increased Investment in Digital Workplace Applications (% of Respondents)

[caption id="attachment_134725" align="aligncenter" width="700"] Respondents were asked to select and rank the top three reasons

Respondents were asked to select and rank the top three reasonsBase: 99 retail industry decision-makers who plan to invest more in digital workplace technology over next 12–18 months, surveyed in September 2021

Source: Coresight Research[/caption]

Companies That Have Adopted Digital Workplace Applications Are Seeing Significant Benefits

Investing in tools and technologies that boost employee engagement and productivity leads to increased sales, greater profitability and better customer experiences, in addition to improved job satisfaction and employee wellness.

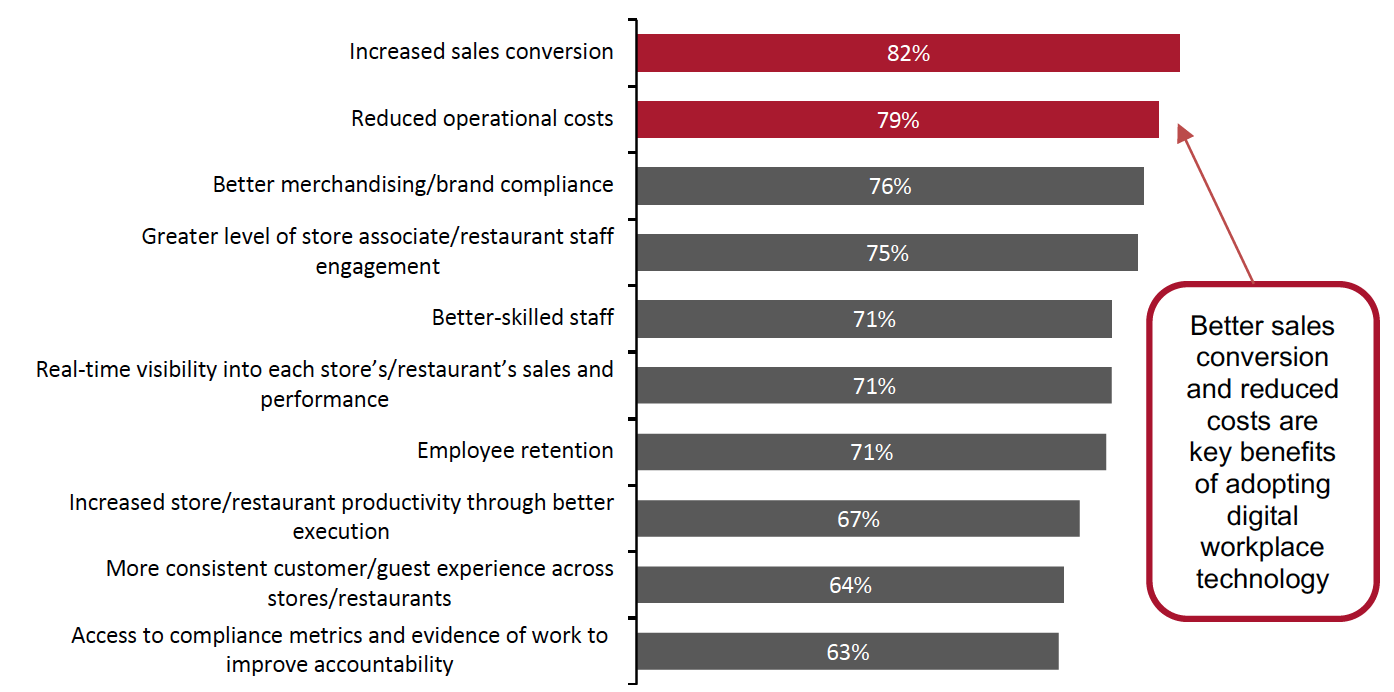

Our survey identified the following business outcomes as the most improved since the introduction of digital workplace applications to manage frontline employees—cited as “improved” or “substantially improved” by the highest proportions of respondents whose organizations have adopted digital workplace applications (see Figure 9):

- Increased sales conversion—82% of respondents whose organizations have adopted digital workplace applications indicated improvement in sales conversion since the introduction of the new technology, likely as a result of better communications, task management and store execution.

- Reduced operational costs—79% of respondents whose organizations have adopted digital workplace applications say they have reduced operational costs as digital workplace technology can eliminate the need for costly store visits and audits by management.

- Better merchandising/brand compliance across stores/restaurants—Consistency in what customers experience each time they step into a store/restaurant or visit another location is important across retail. Just one suboptimal experience that doesn’t live up to brand guidelines can degrade customer loyalty, return rate and ultimately, sales. Digital checklists and brand guideline instructions delivered via mobile apps help add clarity for staff.

- Greater level of store associate/staff engagement—75% of respondents whose organizations have adopted this technology reported that their companies have seen improvement in the level of store associate/restaurant staff engagement since introducing digital workplace applications, which is helping drive all of these improved business outcomes.

Figure 9. Most Improved Business Outcomes Since the Introduction of Digital Workplace Applications To Manage Frontline Employees (% of Respondents)

[caption id="attachment_134726" align="aligncenter" width="700"] Proportions of respondents that reported “improvement” or “substantial improvement” in each area

Proportions of respondents that reported “improvement” or “substantial improvement” in each areaBase: 126 retail industry decision-makers whose organizations have adopted digital workplace technology, surveyed in September 2021

Source: Coresight Research[/caption]

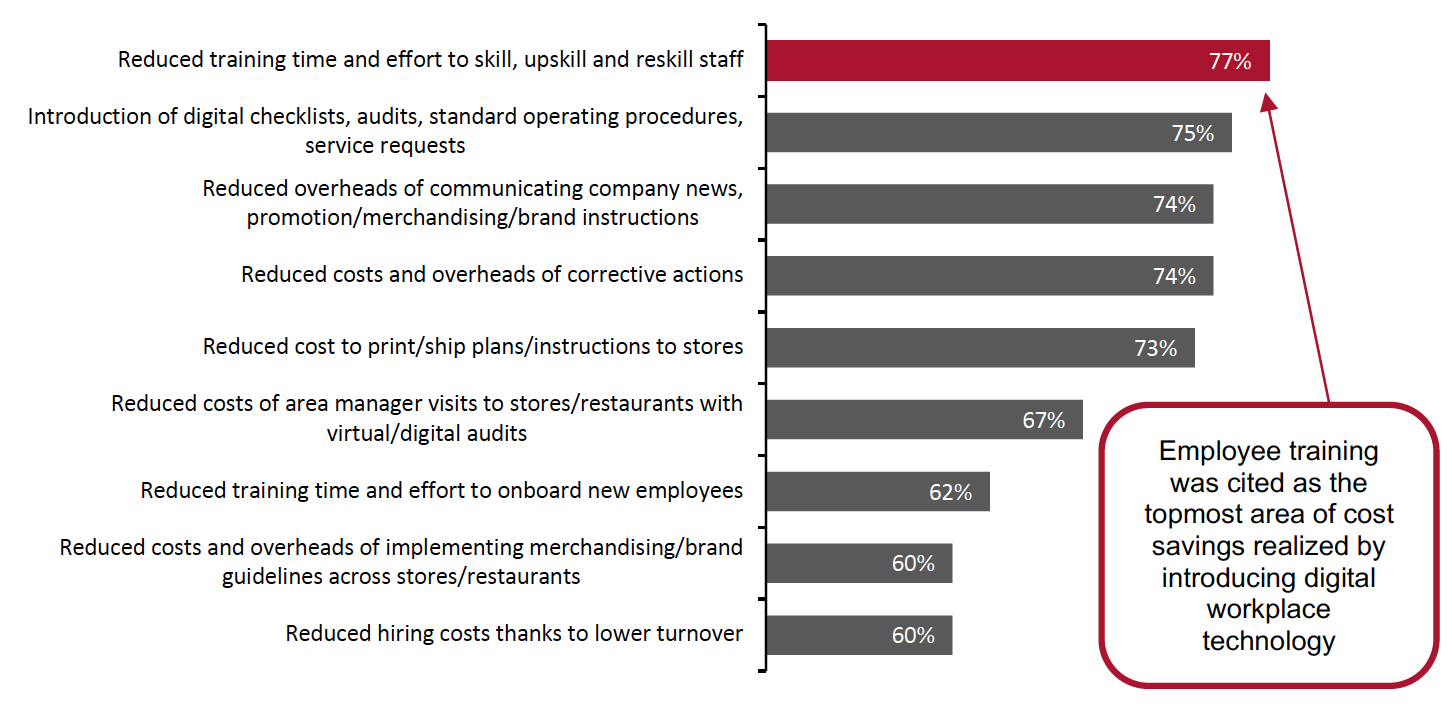

Respondents whose organizations have adopted digital workplace technology also indicated that substantial cost savings have been achieved across key operational areas since the introduction of digital workplace applications:

- Training— 77% of this subset of respondents reported that their organizations have reduced training time and effort to skill, upskill and reskill staff thanks to mobile learning tools provided by digital workplace applications.

- Task management—The introduction of digital tools such as digital checklists, audits, standard operating procedures and service requests has helped 75% of such technology adopters achieve significant cost savings in task management.

- Communications—74% of respondents whose companies have implemented digital workplace technology indicated that the ability to push out instructions and company news through a mobile app has provided moderate or substantial cost savings, reducing overheads of communicating company news and promotion/merchandising/brand instructions.

Figure 10. Areas of Moderate or Substantial Cost Savings Since the Introduction of Digital Workplace Applications (% of Respondents)

[caption id="attachment_134727" align="aligncenter" width="700"] Proportions of respondents that reported “substantial” or “moderate” cost savings in each area

Proportions of respondents that reported “substantial” or “moderate” cost savings in each areaBase: 126 retail industry decision-makers whose organizations have adopted digital workplace technology, surveyed in September 2021

Source: Coresight Research[/caption]

Case Study: Lancôme

International cosmetics retailer Lancôme is an example of an international brand that is realizing significant benefits since implementing digital workplace applications into its business processes. Lancôme uses digital workplace platform provider YOOBIC to deliver consistently high-quality in-store customer experiences by providing direct, efficient communication with field teams and real-time visibility into store execution.

With thousands of points of sale, Lancôme manages a lot of complexity across different retailers at different times. YOOBIC enables teams in the field to manage this in a simplified way. Before YOOBIC, it would sometimes take Lancôme months to recognize a problem, but with YOOBIC, problems are exposed and addressed very quickly. According to YOOBIC, the solution is seeing Lancôme save 80 hours per week on store monitoring activities while also eliminating 500+ time-consuming emails per week between field and HQ teams.

The image below shows an example of YOOBIC’s digital workplace app.

[caption id="attachment_134728" align="aligncenter" width="250"] YOOBIC digital workplace app

YOOBIC digital workplace appSource: YOOBIC[/caption]

The Path Forward: Best Practices for Improving Employee Productivity and Engagement

To investigate why digital workplace software is so impactful in helping retail organizations overcome current challenges, our survey asked respondents about the specific tools and best practices that are most effective in boosting employee engagement, job satisfaction and efficiency of task execution. Our research shows that the top areas of focus for retailers/restaurants are in the areas of employee communication, task management and training, all of which are key features of digital workplace applications.

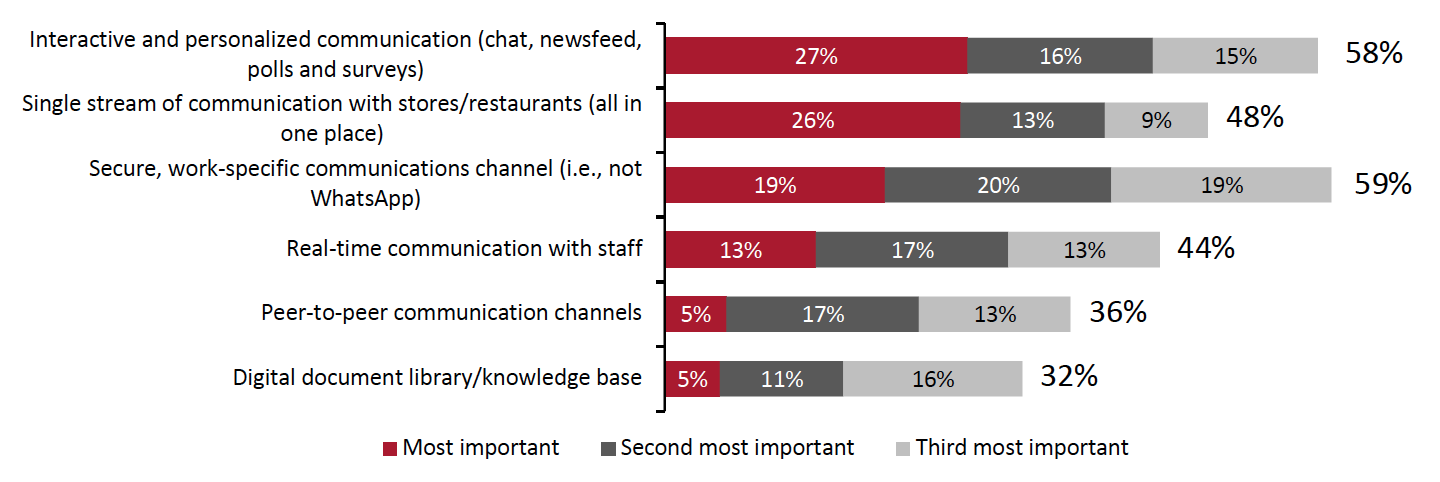

Regarding communication, respondents cited the following practices as key to increasing employee engagement, job satisfaction and efficient task execution:

- Interactive and personalized communication (chat, news feeds, polls, surveys)—Delivering information that is directly relevant to a given employee’s job in an engaging way was reported as the most important best practice by the most respondents (27%). With overburdened resources juggling multiple responsibilities, the ability to tailor information to each employee’s needs and help them focus on what they need to know in an interactive platform is critical.

- Single stream of communication—Respondents cited the need for all communications to take place in a single channel among the most important communication-related best practices. Working in a fast-paced, quickly changing environment, frontline employees benefit from a single stream of communication to stay connected and coordinate tasks across the organization.

- Secure, work-specific communications channel—Unlike office-based teams which have multiple choices for communications platforms (e.g., Slack, Microsoft Teams), frontline employees who need the ability to chat in real time with their teams have historically needed to resort to personal chat apps such WhatsApp. Our survey respondents called out having a secure, work-specific channel as a top best practice overall, which is a key feature of digital workplace technology.

Figure 11. Selected Employee Communication Best Practices for Retailers or Restaurants To Ensure Increased Employee Engagement, Job Satisfaction and Efficiency of Task Execution (% of Respondents)

[caption id="attachment_134729" align="aligncenter" width="700"] Respondents were asked to select and rank the top three challenges

Respondents were asked to select and rank the top three challenges Base: 165 retail industry decision-makers, surveyed in September 2021

Source: Coresight Research[/caption]

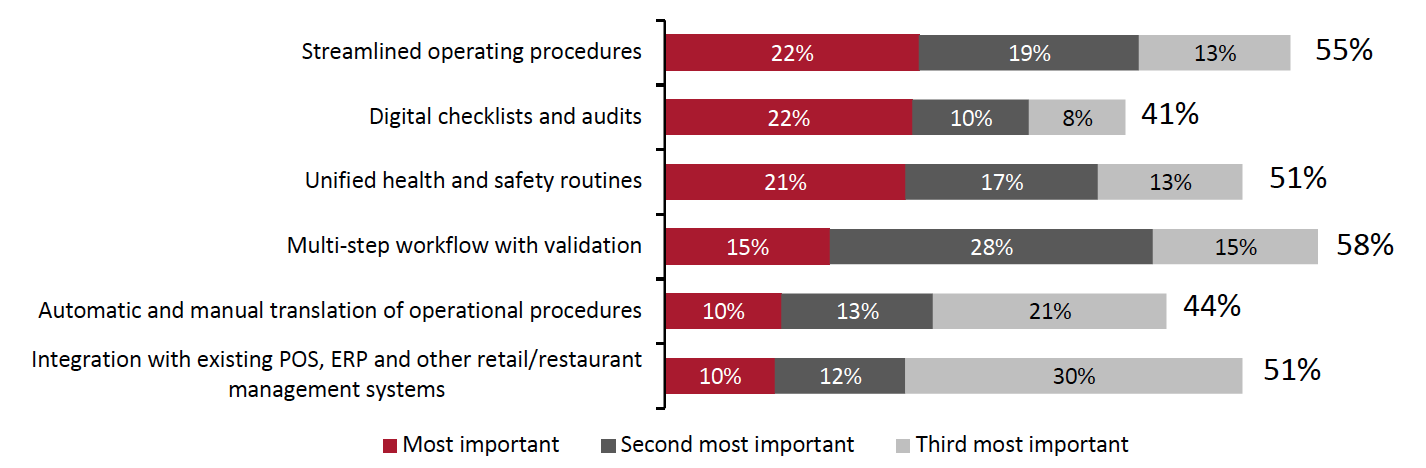

When it comes to task management, keeping things simple and arming frontline employees with the tools to track tasks and implement safety routines are among the top best practices to improve execution, according to respondents. We summarize task management best practices in Figure 12, of which the top three are as follows:

- Streamlined operating procedures—Cited as the number-one best practice by retailers, the ability to streamline operating procedures is one of the key features of digital workplace technology.

- Digital checklists and audits—Digital workplace applications provide the ability to deploy quick and convenient digital checklists and audits to make executing tasks and monitoring compliance much more efficient. Respondents cited this practice among the most important to implement.

- Unified health and safety routines—Staying on top of rapidly evolving Covid-19 health and safety protocols and localized regulations has proven to be a massive challenge, especially for the retail industry. Respondents reported that implementing unified health and safety routines is among the top three best practices retailers can implement to help frontline employees. Digital workplace technology makes unifying, managing and updating these routines much easier.

Figure 12. Top Task Management Practices Retailers or Restaurants Should Put in Place to Ensure Increased Employee Engagement, Job Satisfaction and Efficient Task Execution (% of Respondents)

[caption id="attachment_134730" align="aligncenter" width="700"] Respondents were asked to select and rank the top three challenges

Respondents were asked to select and rank the top three challengesBase: 165 retail industry decision-makers, surveyed in September 2021

Source: Coresight Research[/caption]

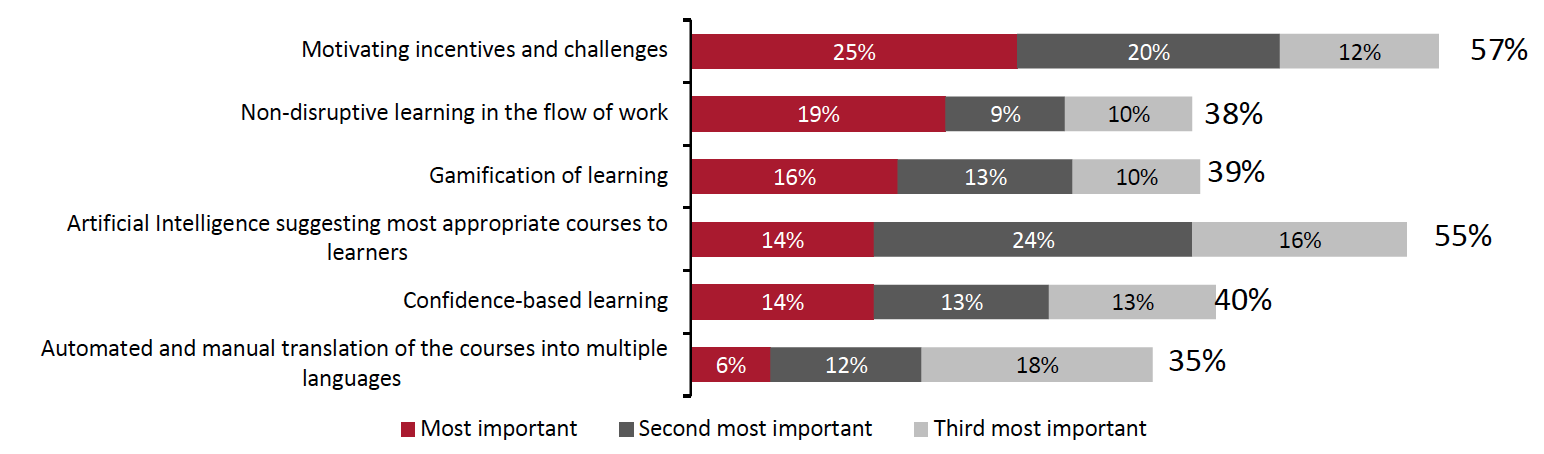

Regarding training, we asked about mobile-learning best practices enabled by workplace technology. Retailers highlighted the importance of incentives in spurring employee engagement, as well as integrating training into the everyday flow of work and making it fun/interesting through gamification:

- Motivating incentives and challenges—The most important best practice identified by our survey respondents is putting in place motivating incentives and challenges. Mobile learning features in digital workplace applications.

- Non-disruptive learning in the flow of work—Retailers recognize that mobile learning needs to be integrated into the flow of work, with non-disruptive learning in the flow of work emerging as the second most important best practice.

- Gamification of learning—Making training exercises into video content or game-like experiences enables retailers to increase trainee engagement, especially among digitally savvy younger millennial and Gen Z employees.

As an example, through its Me@Walmart app, Walmart provides mobile learning and task management capabilities to field associates. The app brings together personal and work needs and simplifies daily tasks, enabling associates to manage work schedules, swap shifts, take Covid-19 health assessments, and more.

Figure 13. Selected Mobile-Learning Best Practices for Retailers or Restaurants To Ensure Increased Employee Engagement, Job Satisfaction and Efficiency of Task Execution (% of Respondents)

[caption id="attachment_134731" align="aligncenter" width="700"] Respondents were asked to select and rank the top three challenges

Respondents were asked to select and rank the top three challengesBase: 165 retail industry decision-makers, surveyed in June 2021

Source: Coresight Research[/caption]

What We Think

Propelled by the Covid-19 pandemic, the acceleration of several industry trends at once has forced retailers to adapt quickly, especially those that rely on physical store/restaurant locations for their business. With increasingly digitally savvy and demanding consumers who expect seamless omnichannel shopping experiences, retailers need to arm frontline employees with the modern tools needed to meet consumers where they are. Faced with insufficient staffing and fierce competition for labor, retailers must look for ways to increase employee productivity, engagement and job satisfaction.

All of these challenges that retailers are facing make investing in digital workplace applications that enable organizations to do more with less increasingly relevant. As we have discussed in this report, improving communication is a major pain point across the industry and motivator for retail organizations to invest in digital workplace applications. Companies that adopt digital workplace technology can realize significant financial benefits through better connecting frontline employees with staff across the organization, including the following:

- Increased sales conversion

- Reduced operational costs

- Better merchandising/brand compliance

By increasing the level of employee engagement, digital workplace applications can help deliver enhanced customer experiences and store execution, which rely on great frontline employee experiences, making digital workplace technology table stakes in the current retail environment.

Methodology

This study is based on the analysis of data from an online survey of 165 retail industry decision-makers in the US, the UK and Canada. Respondents in the survey satisfied the following criteria:

- 100+ stores/restaurants in operation

- Company annual revenues of $100 million and above

- Senior management roles including C-suite, heads of internal communications, retail/restaurant operations, learning and development