DIpil Das

Introduction

The world’s payment landscape has seen drastic changes in recent years – and is likely to continue evolving along a similar trajectory for the foreseeable future. Online and in-store merchants are evolving to increase customer convenience and satisfaction by allowing consumers to pay using mobile phones, digital wallets and even cryptocurrencies. In combination with new technology in artificial intelligence and machine learning (AI/ML) as well as other biometric systems, marketplaces are working to streamline the checkout process to make it as seamless as possible.

This report covers two main aspects of digital banking: Digital wallets and cryptocurrencies.

Digital wallets offer a way to send money and make purchases online, via laptop, desktop or mobile device.

Digital banking is a fast-growing industry and one likely to lead the way in the future of payments. There are currently over 1.5 billion active digital wallets around the world, according to a Merchant Machine report, which also predicts this number will double in just three years.

In the US, over 100 million adults said they have tried digital banking at least once to make a payment, according to finder.com. An Experian report noted that millenials in the US use mobile banking apps much more often than their older counterparts. As the millennial generation increases buying power and Gen Zers come of banking age, we expect to see digital banking grow even more rapidly.

China has led the way in mobile banking: Its two most popular payment apps, WeChat Pay and Alipay, have more than one billion active accounts, combined.

The use of mobile payments has been growing in countries such as Norway and the UK as well, but they do have competition: Contactless cards, which are very popular. According to a Mastercard Report, half of all transactions in 15 European countries are processed using contactless cards. In early 2019, Sweden announced ambitions to become the first cashless society by 2023.

Cryptocurrencies are also likely to play a role in the future of payments, despite the slow inroads in daily use now: Companies such as Microsoft, Overstock and Newegg now accept Bitcoin.

In June 2019, Facebook, the world’s largest social media network, announced plans to release Calibra, a mobile banking platform that will use the Libra, a cryptocurrency backed by a reserve of low risk assets.

In this report, we look at various mobile payment platforms, their functionality and usage, in the US and China. We also look at some of the most valuable cryptocurrencies, their current uses and potential future applications.

Digital Wallets Digital wallets are online or app-based platforms that provide banking and financial services. Essentially, the digital wallet contains information on the user’s credit cards, bank account or other payment information: When the user pays for something using the digital wallet, the system takes the money from whatever payment method is linked to the digital wallet. Digital wallets offer services such peer-to-peer payment systems, in-store purchasing, escrow payments, investment strategy, portfolio management and even services such as insurance. With many apps, people can send money anywhere in the world at much lower rates than traditional banks. Leading the way are companies such as Alibaba, Tencent, Apple, Google, PayPal, which, according to company reports, collectively process trillions of dollars per year and have billions of customers.Payments in the US

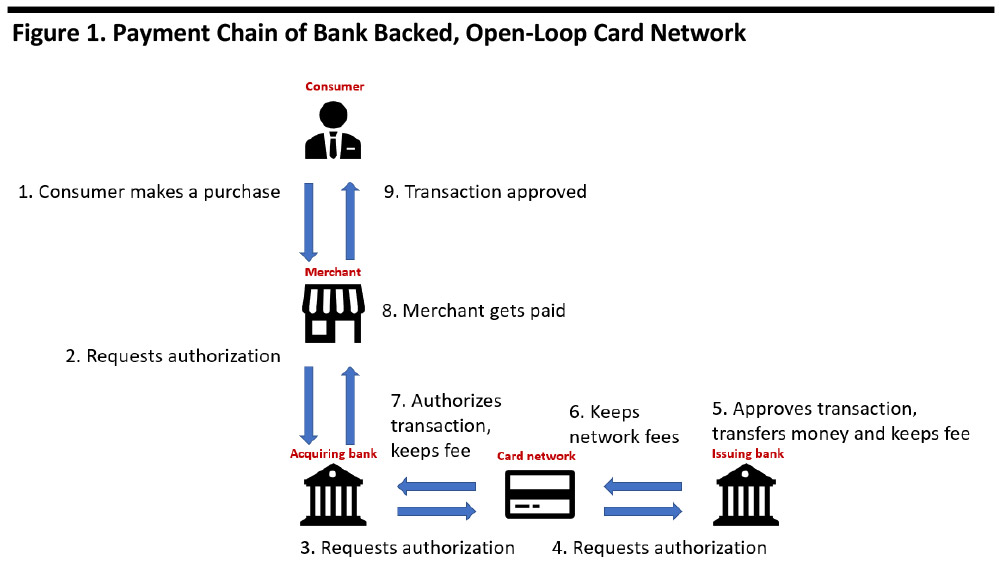

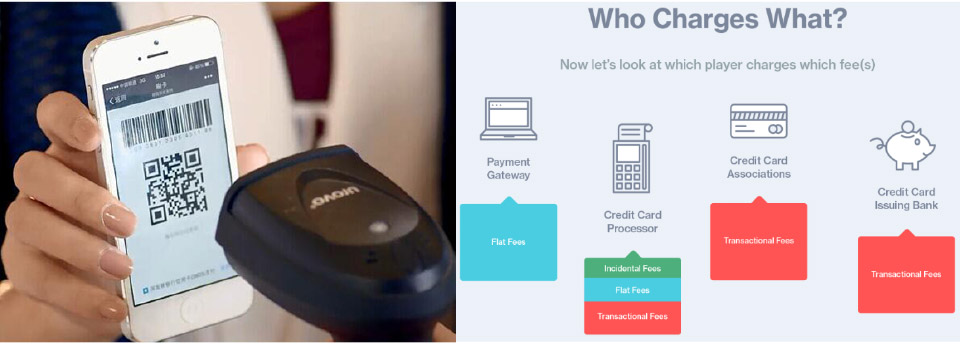

The US uses an open loop system, which requires the use of a credit or debit card. When a consumer uses a credit card, the transfer goes through a complicated circuit. As shown in the diagram below, the pathway starts at the point of sale terminal, which sends the information across the credit card payment processing network to the merchant’s bank, which then connects with the bank that issued the card to authorize the payment, then back. The flow of money follows the opposite path back to the merchant. Each step of the way, intermediaries take a small percentage as a fee: In the end, merchants may lose 3-4% of every sale in fees. This industry collects $90 billion per year from these fees.

[caption id="attachment_94937" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Mobile payment apps such as PayPal, Venmo and the Cash App do not require this complex chain. Within those platforms the amount of money is simply added and subtracted from user accounts. Merchants lose far less in fees; however, consumers use these payment systems for many reasons, chief among them being it is what they know.

According to a Bloomberg report, Americans also say convenience, security and rewards are enough to keep them from making the transition to fully digital.

Currently, the transition to digital banking in the US is in its infancy. According to an eMarketer report, only 25% of smartphone users in the US use their phones to make an in-store purchase and these mobile purchases account for only a little over 1% of all dollars spent in store.

Financial services companies have begun pairing online platforms with consumer wants such as rewards programs or real customer service representatives to try to create a more seamless banking experience – which could be the catalyst for the digital banking revolution in the US, led by younger people raised on technology. A Bank of America report said 60% of millenials use digital banking apps to make peer-to-peer payments on a regular basis.

In this section, we look at some of the digital wallets leading US digital payments.

Apple Pay

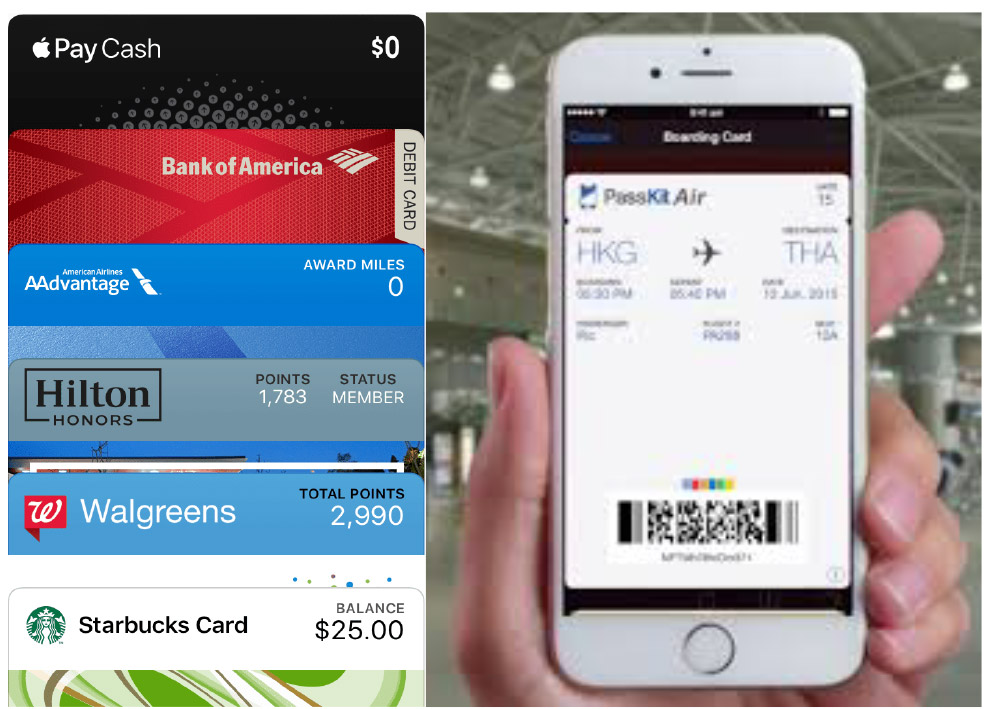

In 2014, Apple announced Apple Pay, a multi-faceted mobile wallet, integrated into and available only via Apple’s iOS platform. Users of more recent Apple iPhone models and the Apple Watch can use their digital wallets to store credit cards, debit cards, online passes, coupons and Apple Cash. Cards in the wallet can be used to make purchases at any store that accepts Apply Pay, which uses a contactless payment terminal.

Apple Pay also offers a peer-to-peer payment service, Apple Cash. Apple Cash lets users send money through the iPhone imessage texting platform with no fee as long as the wallet is connected to a debit card or bank account (but not a credit card).

Apple Pay can also be used for a variety of platforms within the iOS system. For example, many mobile apps including Airbnb, HotelTonight, Seamless and Target allow users to pay for in-app purchases using Apple Pay. Apple Pay transactions are secured using a PIN, TouchID or FaceID biometric systems.

[caption id="attachment_94938" align="aligncenter" width="700"] Source: Apple/Passkit[/caption]

Source: Apple/Passkit[/caption]

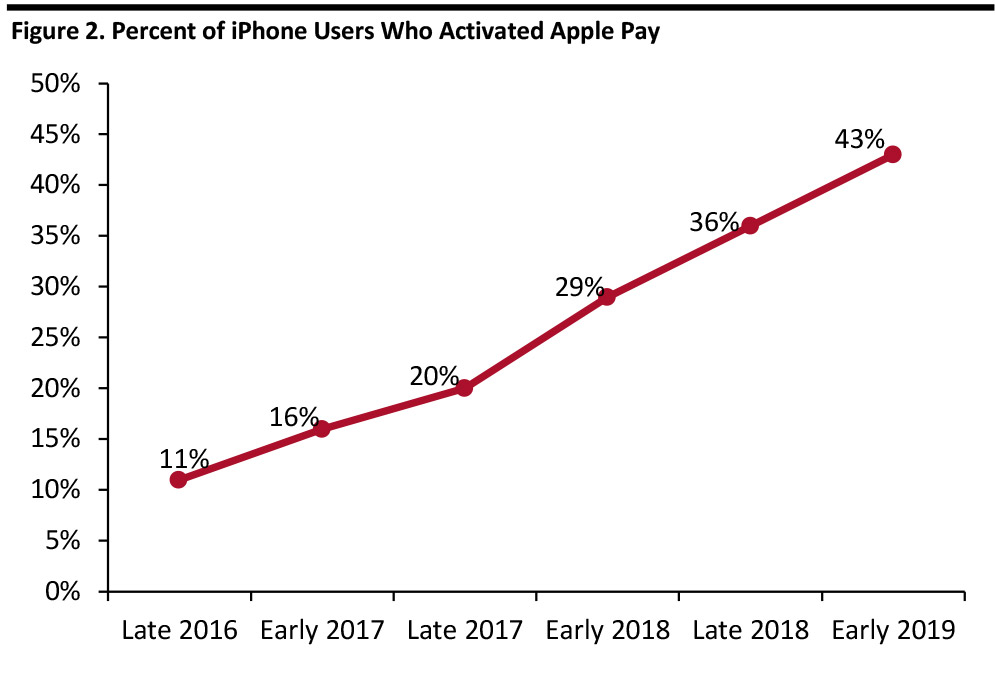

According to a February 2019 Loup Ventures report, 43% of iPhone users around the world have activated Apple Pay on their devices. This is up significantly from the previous September, when only 36% of users reported they had activated Apple Pay. This jump is likely tied to Apple’s January launch of Apple Cash.

And, Apple users are becoming more comfortable using its mobile payment platform: There are now approximately 380 million global Apple Pay users, and these users conducted over 10 billion transactions during the last fiscal year.

[caption id="attachment_94939" align="aligncenter" width="700"] Source: Loup Ventures/Apple[/caption]

Source: Loup Ventures/Apple[/caption]

Apple Pay is offered in over 50 countries, and according to the same report, 88% of registered users are outside the US. According to Loup Ventures, 47% of international iPhone users activate their wallets, compared to just 24% of US users.

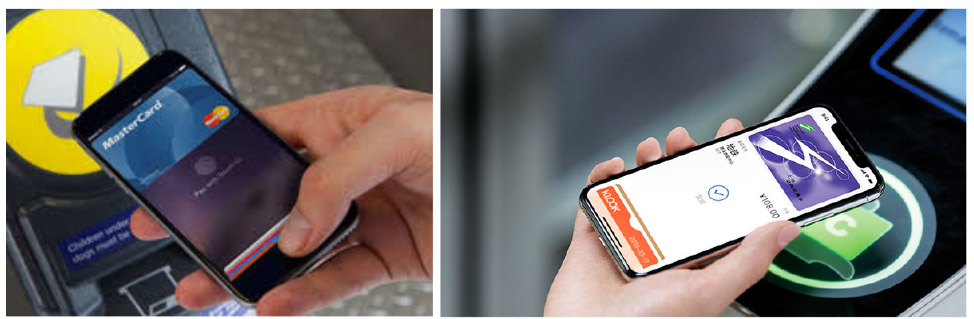

There are many factors that lead to Apple Pay’s quicker adoption in other countries, but one important factor is being able to use Apple Pay for public transport. Countries such as China, Japan, Russia and the UK have all created the infrastructure to let passengers pay using a mobile device.

[caption id="attachment_94940" align="aligncenter" width="700"] Source: Executive Traveler/Apple Insider[/caption]

Source: Executive Traveler/Apple Insider[/caption]

Despite Apple Pay’s slow progress in the US, we see potential for further growth: After reaching agreement with several majors incuding Target and Taco Bell, Apple Pay is now acepted at around 65% of retailers in the US, including 74 of the top 100 retailers.

Additionally, in March 2019, the Chicago Transit Authority began allowing users to add money to their Ventra electronic fare collection cards with a digital wallet or contactles card, including Apple Pay. In late may, the New York Metropolitan Transit Authority (MTA) began a pilot of OMNY, based on the same platform and lets riders on select subway lines and bus routes pay using digital wallets or contactless pay. Apple hopes the widespread use of these contactless pay terminals will lead to a greater reliance on its digital wallet.

Google Pay

Google Pay is the Android counterpart to Apple Pay. Google Pay is split into two methods of payment: The Google Pay app (previously known as Android Pay and Pay with Google) and Google Pay Send.

With the Google Pay app, users link a credit card or debit card and use the app to pay in store, in app on Android phones and online at different marketplaces.

[caption id="attachment_94941" align="aligncenter" width="700"] Source: Android Police [/caption]

Source: Android Police [/caption]

Google Pay Send (previously known as Google Wallet) lets users link a debit card or bank account to send money peer-to-peer at no cost for either person.

PayPal

With nearly 300 million active accounts, Paypal is the most popular digital wallet app in the US. PayPal, similar to many other digital wallets, is two pronged: It’s an online payment system that allows people to send and receive money to other individuals – as well as to pay for online or other purchases.

PayPal’s peer-to-peer payment system is probably the most disruptive: Users simply connect a bank account or debit card and can send money within the US with no fees – dramatically easier than any other method. PayPal does charge a fee for sending money internationally, although it is lower than the cost of a standard money order. According to company reports, PayPal’s peer-to-peer services are offered in over 200 markets and 25 currencies.

PayPal’s other offering serves as an electronic alternative to checks, money orders or direct use of a credit card to pay for things online and in store. PayPal users connnect their credit card, bank account details or other payment information and process purchases through the PayPal network, adding convenience as it avoids typing in credit card details and other information for each purchase. Paypal is free for consumer transfers, but merchants pay a fee for commercial transactions.

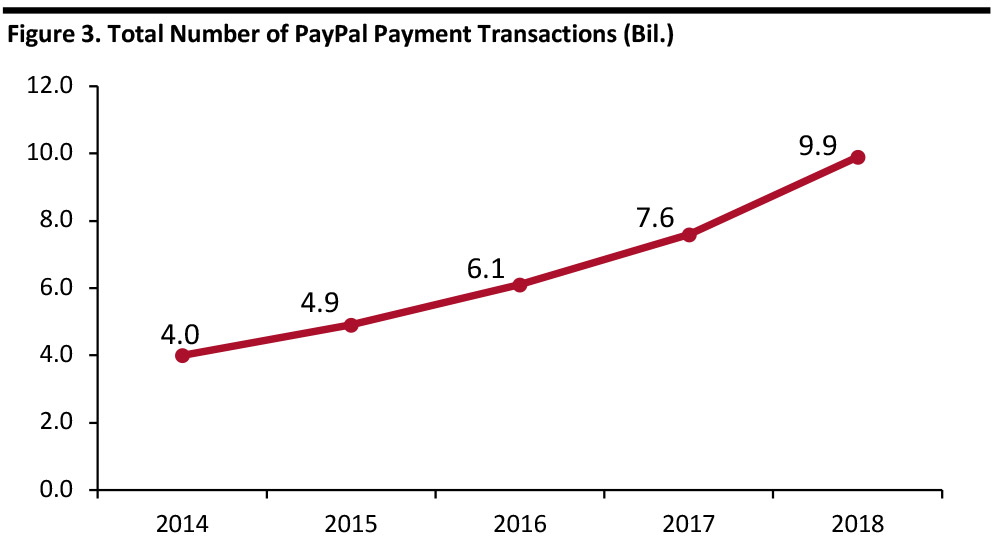

Most PayPal payments occur outside the traditional card processing infrastructure. According to company reports, over 22 million merchants accepted PayPal as of April 2019. As shown below, the number of PayPal transactions has consistently increased over the years. We expect that number to continue growing.

[caption id="attachment_94973" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]

Venmo

Venmo is a mobile payment service that was acquired by PayPal. It was created as a peer-to-peer payment service but is also accepted at millions of online marketplaces. When using a debit card or bank account, users can send and receive money at no charge as well as transfer money to their own bank accounts. Credit cards can also be linked to a Venmo account, but those incur a small fee taken from every transaction.

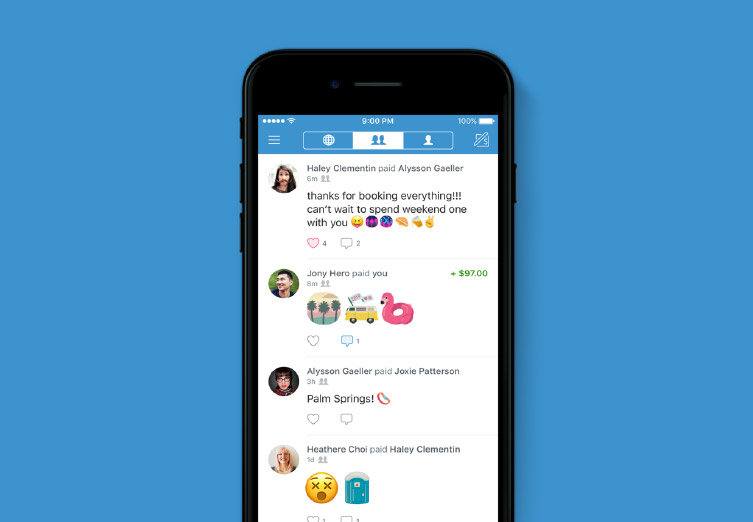

Venmo’s biggest differentiator is its social media aspect. With every transaction, users are asked to create a caption, highlighting their purchase. Users can choose to pin these captions on a public forum, for friends only or within a private page. Users can type, use emojis or even Bitmojis, a personalized emoji app, to write their captions. According to Venmo CEO Dan Schulman, allowing users to show their transaction captions publicly creates a social experience. This is why younger generations who have grown up on social media are the majority of Venmo users. In a crowded field, this feature helped diferentiate Venmo, which now has around 40 million active users and processed $19 billion in transactions during the first quarter of 2019.

[caption id="attachment_94943" align="aligncenter" width="700"] Source: Inverse.com[/caption]

Starbucks

[caption id="attachment_94944" align="aligncenter" width="700"]

Source: Inverse.com[/caption]

Starbucks

[caption id="attachment_94944" align="aligncenter" width="700"] Starbucks mobile platform

Starbucks mobile platform Source: imore.com [/caption]

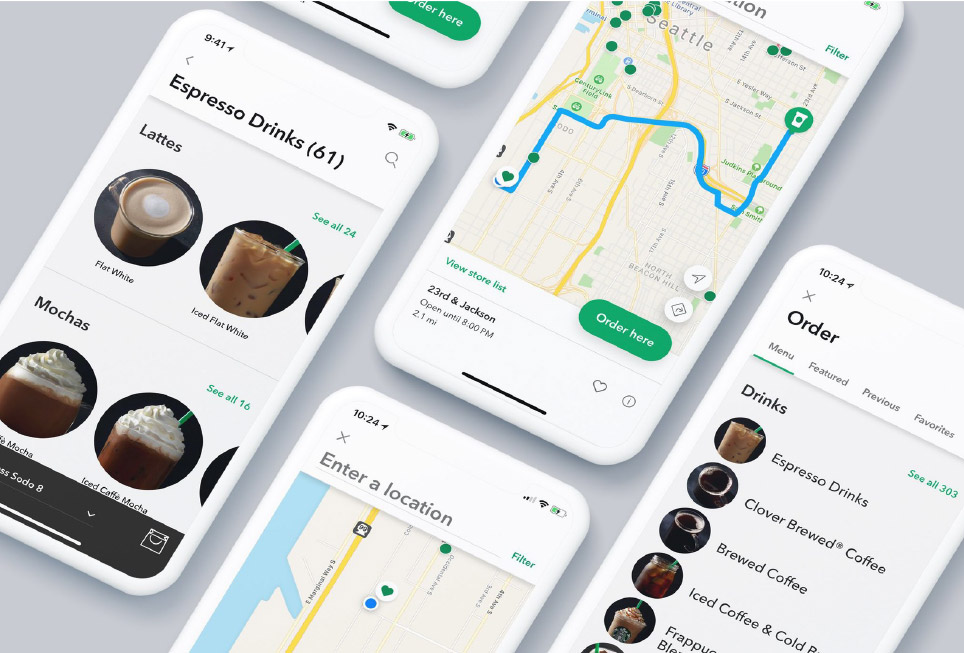

One of the most popular digital wallets is surprisingly not a banking or financial one: It’s the Starbucks app. Similar to other digital payment systems, users connect a credit card, debit card or other digital wallet to the app, then use the app to order online for pickup or just use the app to pay in store. The only difference is that the Starbucks app loads cash first, then adds more money once the amount saved in the app’s digital wallet is used. The app also connects to the company’s loyalty program.

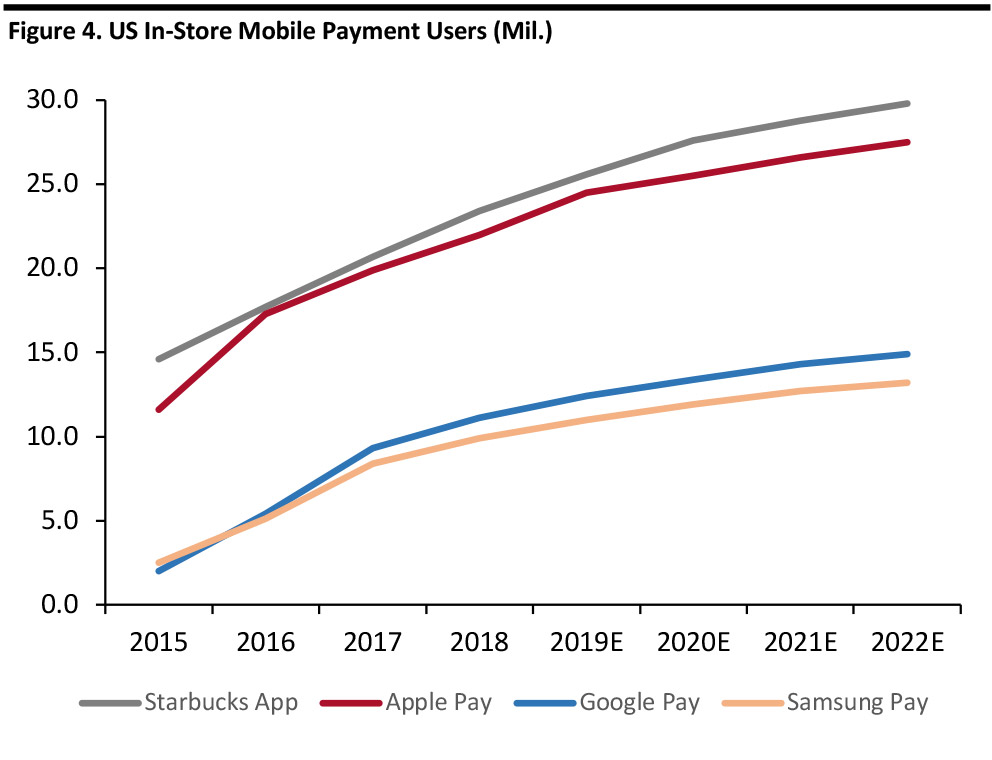

The Starbucks app is so popular that according to eMarketer, of the 55 million people in the US who made an in-store mobile payment, 40% used the Starbucks app. This makes it more popular than Apple Pay, Google Pay and Samsung Pay in the US. As shown in the figure below, according to eMarketer estimates, Starbucks will remain the most used in-store mobile payment platform in the coming years.

[caption id="attachment_94975" align="aligncenter" width="700"] Source: eMarketer[/caption]

Source: eMarketer[/caption]

Amazon Pay

Amazon Pay is a financial web-service that businesses can use to simplify the checkout experience using Amazon. Amazon Pay lets customers make purchases using voice commands, online via desktop, with a mobile device, in store or even through social shopping.

When customers log in to their Amazon accounts, payment information and addresses are pre-loaded, creating greater simplicity around the checkout process to cut abandonment rates caused by complicated checkout experiences. Amazon Pay offers benefits to merchants such as featured listing during events such as Prime Day. According to builtwith.com, as of 2019, Amazon Pay is listed on around 75,000 websites, accounting for over 10% of web retailers in the world.

Walmart Pay

Walmart Pay is the company’s own payment system. It also connects to a credit card, debit card or gift card. Rather than using a contactless NFC chip, which Apple Pay, Google Pay and other contactless platforms use, Walmart Pay app users scan a QR code to verify payment. Walmart pay is the only form of mobile payment accepted at Walmart and the company has said it has no plans to explore other mobile payment options and will continue to invest in Walmart Pay.

[caption id="attachment_94946" align="aligncenter" width="700"] Walmart Pay’s QR codes shown at checkout

Walmart Pay’s QR codes shown at checkout Source: Walmart [/caption]

Others

Additional mobile payment methods in the US include:

- Square Cash is a mobile app similar to Venmo. It offers peer-to-peer payments free of charge when sending money using a bank account or debit card, but with the social media features. Square Cash offers a debit card for in-store use, allowing you to spend directly connected to your preloaded balance.

- Zelle is a digital payment network tied directly to bank accounts. It has partnered with over 90 banks including Bank of America, Chase, Capital One, Wells Fargo and TD Bank.

- Facebook Messenger lets users make peer-to-peer payments using a debit card to Facebook contacts via the messenger service. The payment system currently operates in 20 countries and does not charge a fee.

Installment Paying

Installment paying is a buy now, pay later concept. This modern version of the layaway payment program gives the customer the product right away with regular installment payments, as opposed to waiting until it is paid off under the layaway system. Installment payments are popular among millenial buyers, some of whom have ditched credit cards in favor of digital banking.

AfterPay, an Australia-based company, has been at the frontier of these installment payments. AfterPay bills customers every two weeks, timed to coincide with paycheck cycles. AfterPay does not charge interest or fees for on-time payments. According to similartech, AfterPay is the most used buy now, pay later model in the world, used on over 15,000 websites around the world.

Another major installment company is Sezzle, which uses a similar model: four payments over a six week period. According to similartech, Sezzle is the most used buy now, pay later software in Bahrain, Georgia, Malta and Qatar.

Payments in China

In China, most consumers use a closed-loop system, which cuts out intermediaries and sends money directly to the merchant or peer. Rather than operating through a card network, mobile apps have built their own digital platforms to process payments, so users can transfer money from one person’s wallet to another using the other person’s user name. Mechants get paid almost instantly and will be charged a fee, but lower than one percent.

In the world of mobile payments, China leads the way, moving from a heavily cash-based society to digital and largely skipping over the credit card phase. Unlike the US, China did not have an entire generation that grew up using credit cards, so the transition to leapfrog directly to mobile was much easier. In China, the average person holds 0.3 credit cards. The average American holds 2.5.

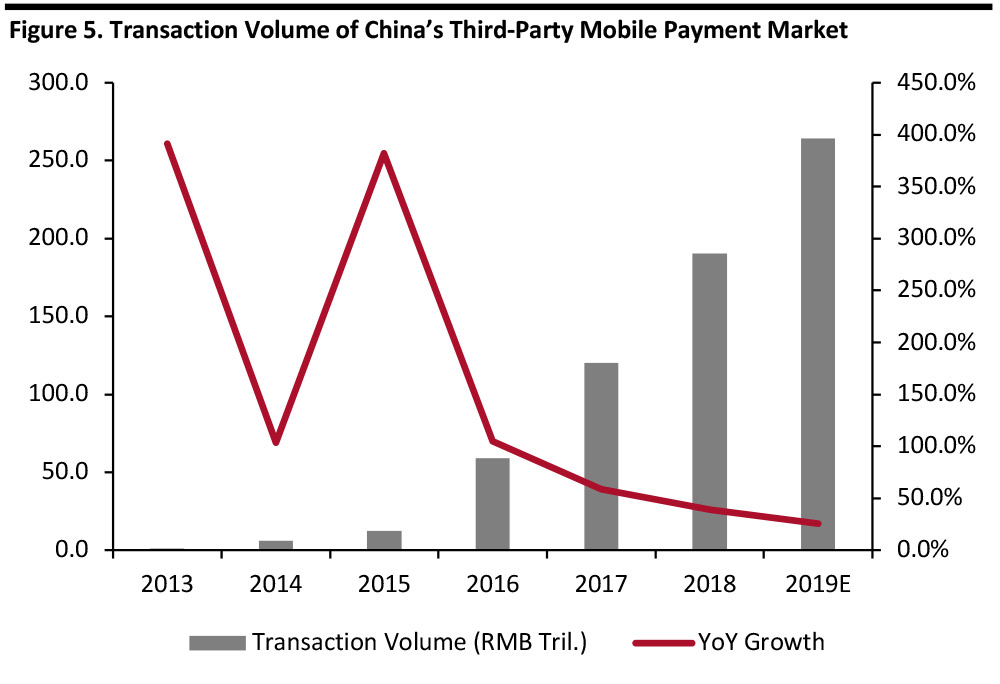

Over ¥190 trillion (over $27 trillion) was sent over various digital banking apps in China in 2018, according to company reports.

[caption id="attachment_94947" align="aligncenter" width="700"] Source: iResearch[/caption]

Source: iResearch[/caption]

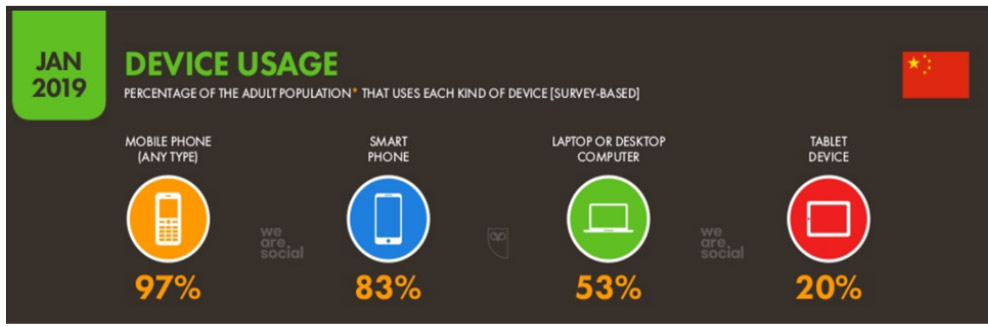

Smart phone penetration only added to the rapid rise: As of January 2019, the number of mobile phone subscriptions in China was greater than the country’s population, with 97% owning a mobile phone and 83% owning a smartphone, according to Statista.

[caption id="attachment_94948" align="aligncenter" width="700"] Electronics usage by device type

Electronics usage by device type Source: Hootsuite/We Are Social [/caption]

These apps were designed for ease of use and affordability: When linked to a bank account, paying friends within the app is free and instant. Paying merchants is similar, although merchants do incur fees – but far less than for credit cards, hitting a ceiling of 1.5% versus the 3% US credit cards typically charge.

[caption id="attachment_94949" align="aligncenter" width="700"] Source: Open Jaw Technologies/Bloomberg[/caption]

Source: Open Jaw Technologies/Bloomberg[/caption]

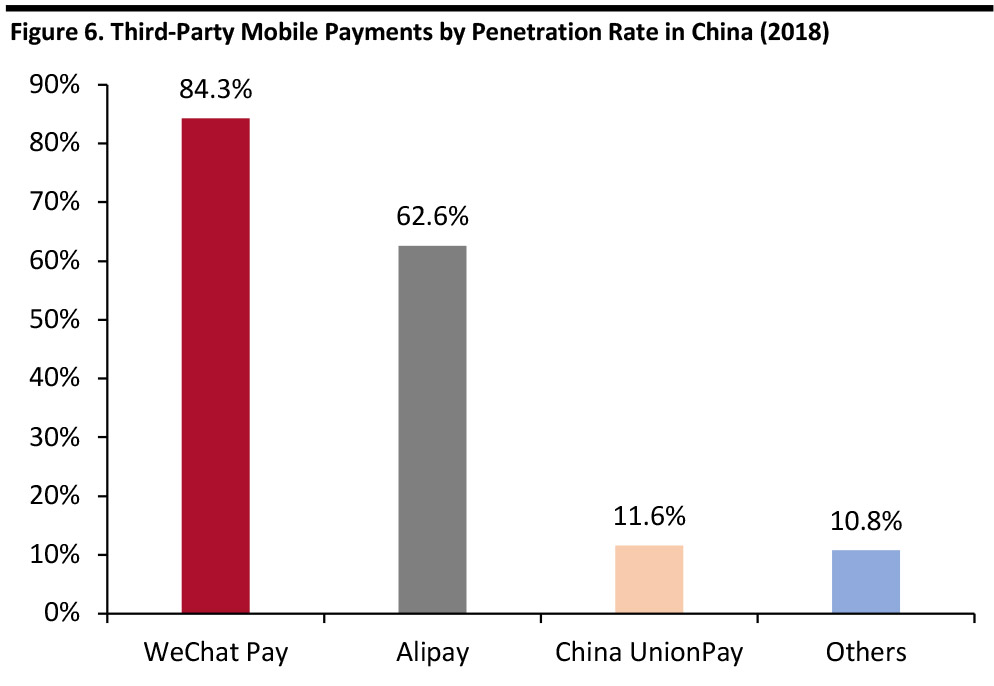

Companies such as Tencent and Alibaba, which offer the payment services WeChat Pay and Alipay, have revolutionized the way people in China pay for everyday purchases. These two are industry leaders, processing the majority of China’s mobile payments.

[caption id="attachment_94950" align="aligncenter" width="700"] Source: eMarketer[/caption]

Source: eMarketer[/caption]

Tencent and WeChat Pay

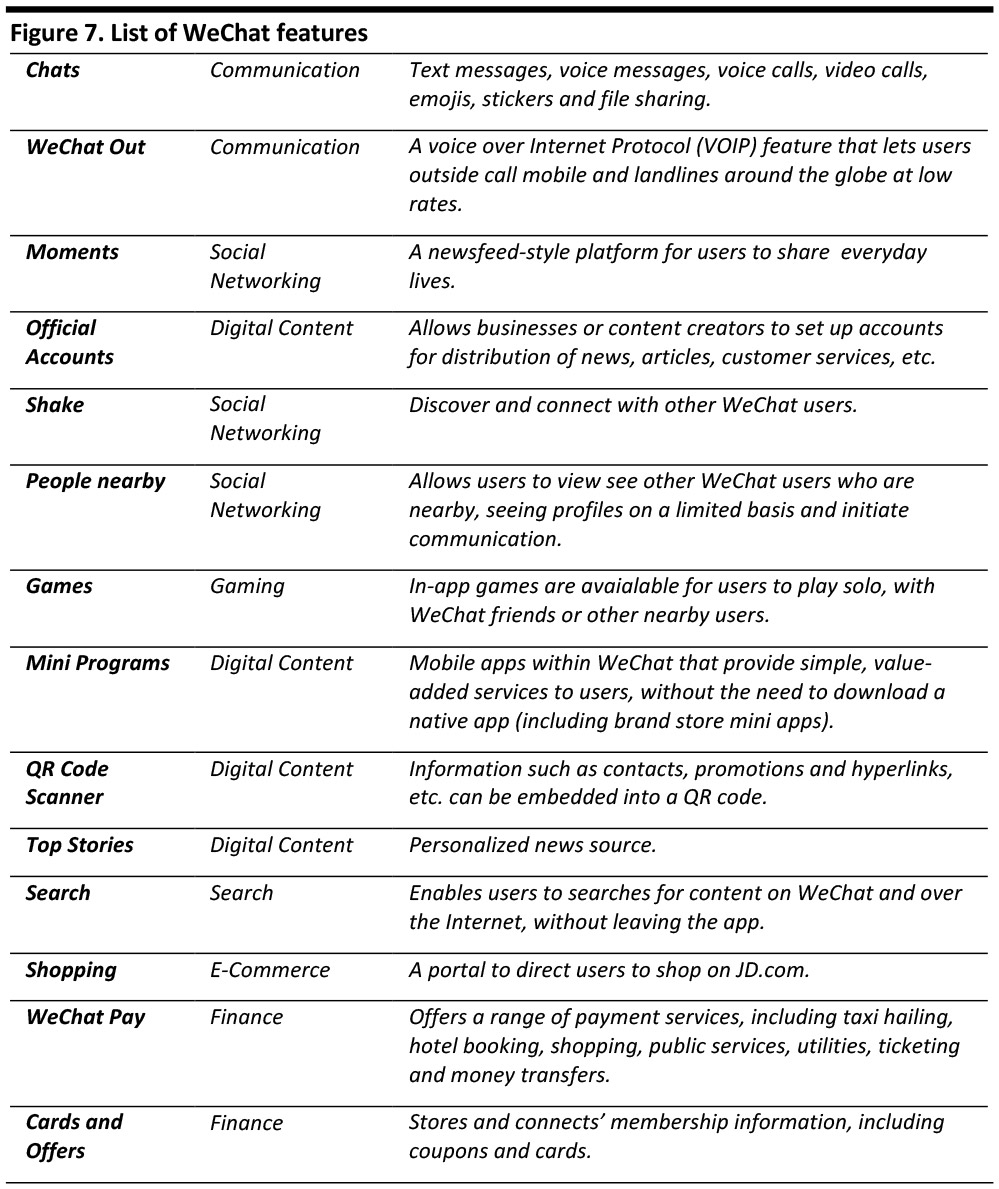

According to the CAICT WeChat Economic and Social Impact Report 2017, WeChat, developed by parent company Tencent, is the most popular app in China. Released in 2011, it is a fully equipped “Swiss army knife” of mobile apps. As shown in the figure below, not only does the mobile app offer payment and banking services, but also communications, social media, gaming and other options.

[caption id="attachment_94976" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

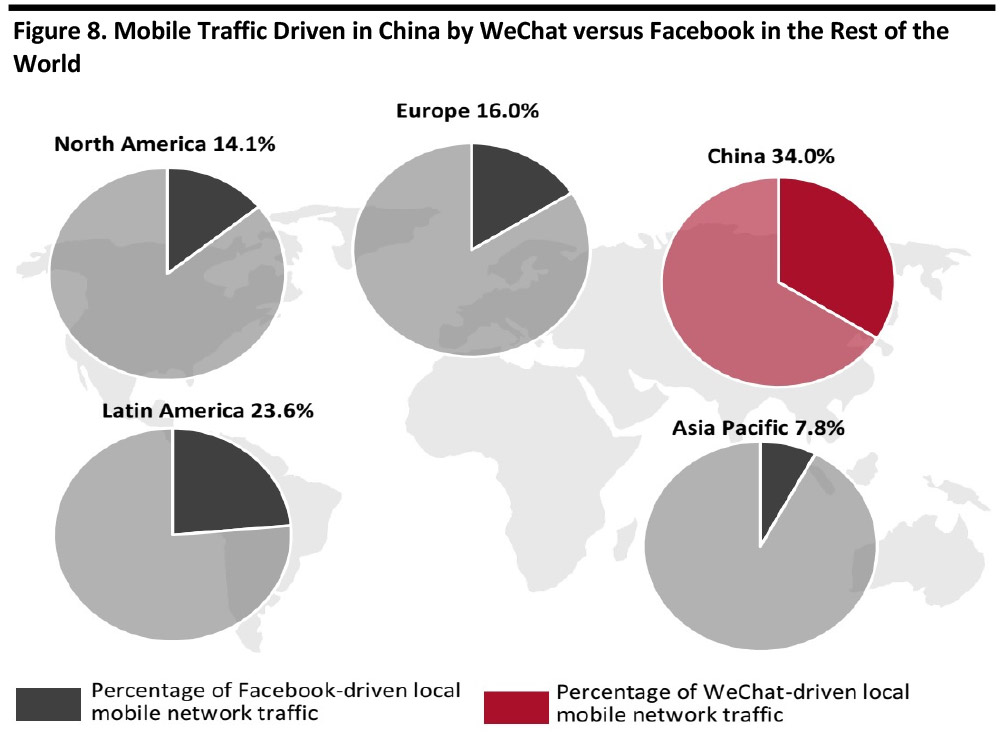

This variety of options made it one of the most popular apps in China and created a more engaged average user. With over one billion monthly active users and over 900 million daily active users, WeChat accounts for 34% of all mobile traffic in China. In comparison, Facebook in North America accounts for about 14%.

[caption id="attachment_94977" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

This variety of options made it one of the most popular apps in China and created a more engaged average user. With over one billion monthly active users and over 900 million daily active users, WeChat accounts for 34% of all mobile traffic in China. In comparison, Facebook in North America accounts for about 14%.

[caption id="attachment_94977" align="aligncenter" width="700"] Source: CAICT WeChat Economic and Social Impact Report 2017/WalktheChat[/caption]

Source: CAICT WeChat Economic and Social Impact Report 2017/WalktheChat[/caption]

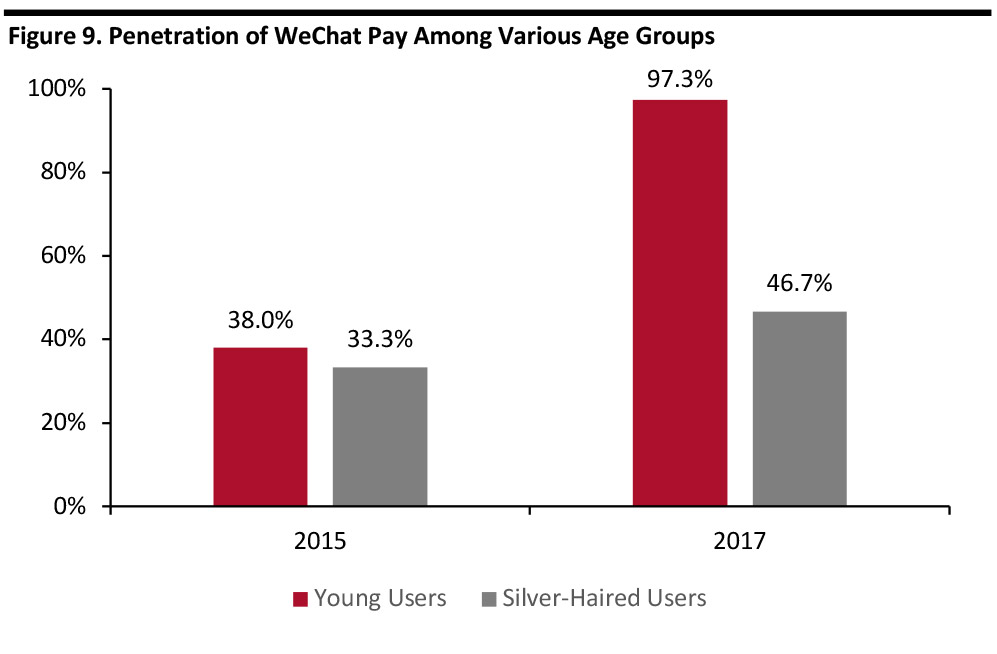

WeChat Pay has a similar design to Facebook’s Messenger app. While both are designed similarly, WeChat Pay is used in many more ways. According to Tencent company reports, WeChat Pay is commonly used in convenience stores, supermarkets, department stores and with many online retailers. Over 97% of users under the age of 18 use WeChat Pay, while 50% of users over the age of 60 do.

[caption id="attachment_94953" align="aligncenter" width="700"] Source: CAICT WeChat Economic and Social Impact Report 2017/WalktheChat[/caption]

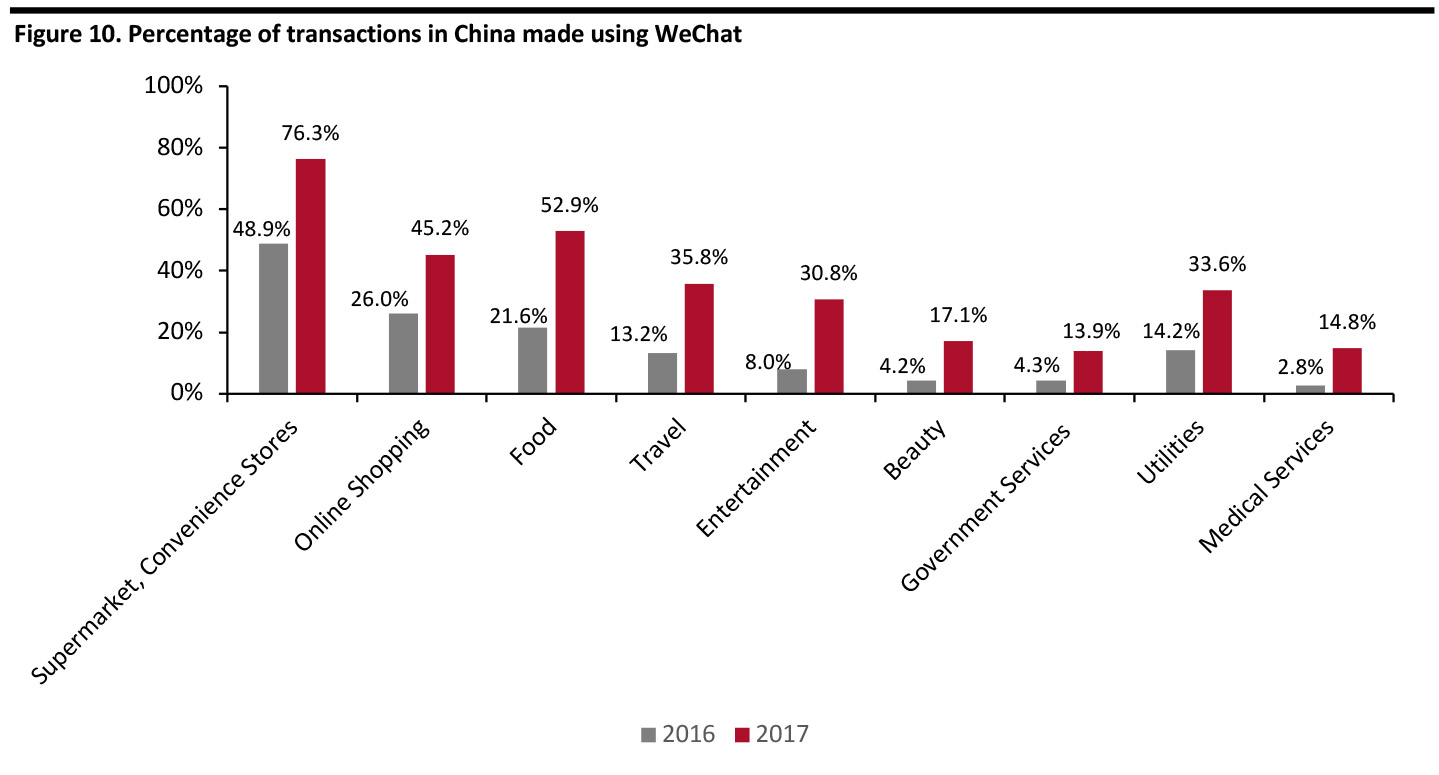

According to a CAICT report, 76% of convenience and grocery store purchases are made using WeChat Pay.

[caption id="attachment_94954" align="aligncenter" width="700"]

Source: CAICT WeChat Economic and Social Impact Report 2017/WalktheChat[/caption]

According to a CAICT report, 76% of convenience and grocery store purchases are made using WeChat Pay.

[caption id="attachment_94954" align="aligncenter" width="700"] Source: CAICT/WalktheChat[/caption]

Source: CAICT/WalktheChat[/caption]

Alipay

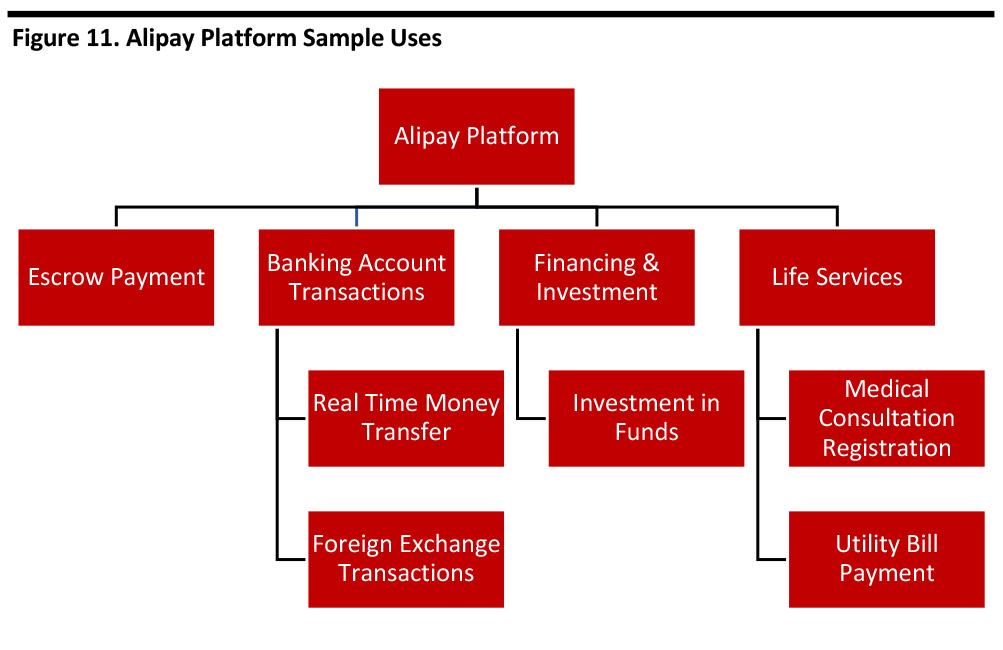

Alipay is a mobile and online payment platform developed by parent company Ant Financial. As shown in the figure below, Alipay provides payment, escrow and financial services for over 600 million active users. Alipay is not only used on Alibaba platforms but has expanded to be used in store, at online marketplaces and to pay utility bills – in addition to Alipay insurance, investment funds, personal loans and other financial services. These services are so popular that over 100 million Alipay users engage in all five of its main platforms: payments, insurance, personal loans, checking credit scores and investing.

[caption id="attachment_94955" align="aligncenter" width="700"] Source: Alipay[/caption]

Source: Alipay[/caption]

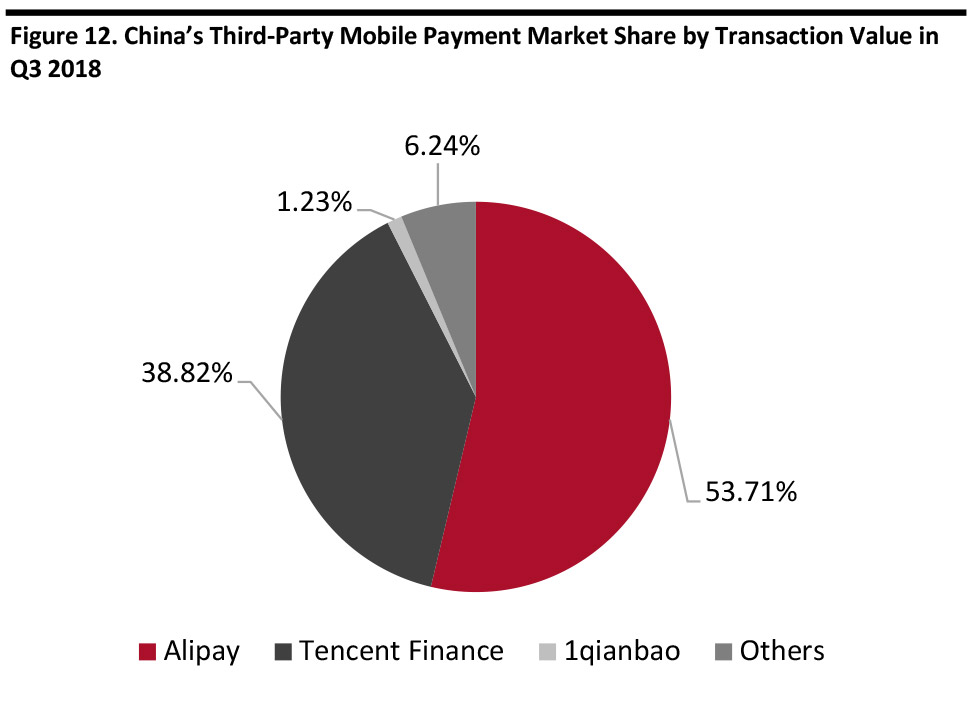

Alipay dominates the third-party mobile payment field: Over 50% of all money sent through mobile payment apps in China went through Alipay. Alipay is so popular it has helped make Ant Financial one of the largest financial institutions in the world, with a valuation over around $150 billion.

[caption id="attachment_94956" align="aligncenter" width="700"] Source: Analysys[/caption]

Source: Analysys[/caption]

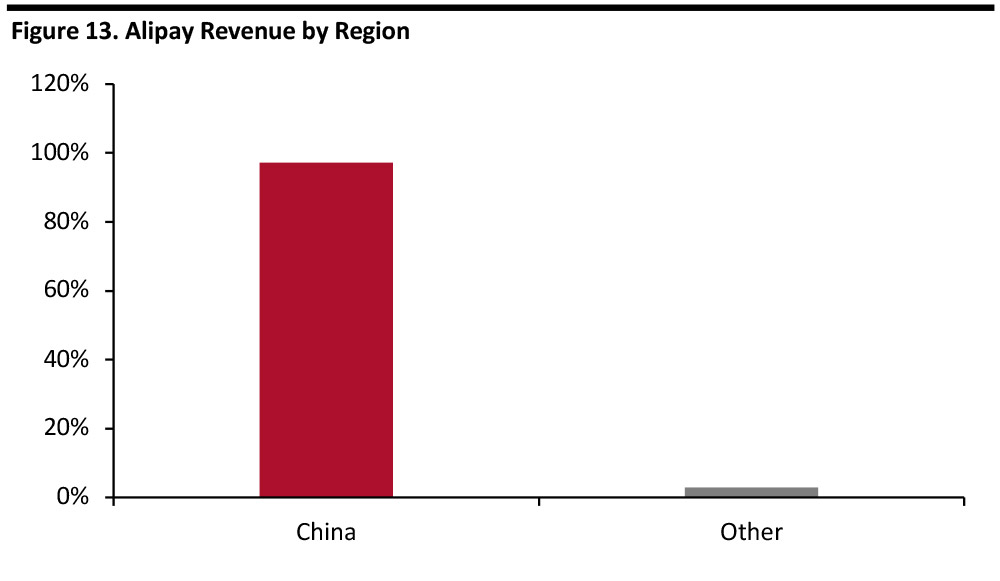

Alipay has three primary sources of revenue: Interest, commission and advertising. Alipay doesn’t pay interest, meaning it can invest user money without giving users returns. Alipay also makes money from fees: 0.1% on credit card payments greater than ¥2,000 ($300) and a 0.1% fee for withdrawals over ¥20,000 ($3,000). Finally, like many social media apps, Alipay hosts advertisements.

Alipay has users in over 110 countries. However, Alipay operates as a mode of payment in only 10 countries outside China, which account for just 2.9% of annual revenue.

[caption id="attachment_94957" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Outlook

WeChat pay and Alipay are likely to continue to dominate mobile payments in China for years to come. Since both companies have engaged a majority of the population, growth will have to come from abroad, so we believe both platforms will seek to expand acceptance to merchants outside China. A top priority will be finding ways to let Chinese tourists to use WeChat Pay and Alipay abroad. Both companies have partnered with some overseas department and luxury stores, but real expansion will likely come through partnerships and acquisitions.

The biggest challenge for both companies could be satisfying financial and legal regulations in other countries, which could slow international expansion.

Cryptocurrencies and Digital Assets

Cryptocurrencies are digital moneys not issued by any government agency and generally not backed by any supporting assets (nor the guarantee of a sovereign state). They were created to replace government currency, making them free of centralized banking, monetary policy etc. Instead, they use a network of computers, and blockchain software to execute and record transactions – and keep track of who owns what. There are currently more than 2,200 publicly traded cryptocurrencies, and they have a collective market cap of around $250 billion – with Bitcoin accounting for over half of that.

While cryptocurrencies have increased significantly in value over the last decade, their influence in the payments sector has been minimal. Many online marketplaces such as Overstock, Microsoft and Newegg accept cryptocurrency payments, but widespread adoption is far in the future.

Bitcoin

Bitcoin was the first and currently is the most common and valuable form of cryptocurrency in use. Created in 2009 by an unknown entity using the code name “Satoshi Nakamoto,” the currency was invented to create an electronic payment system free of centralized banking institutions.

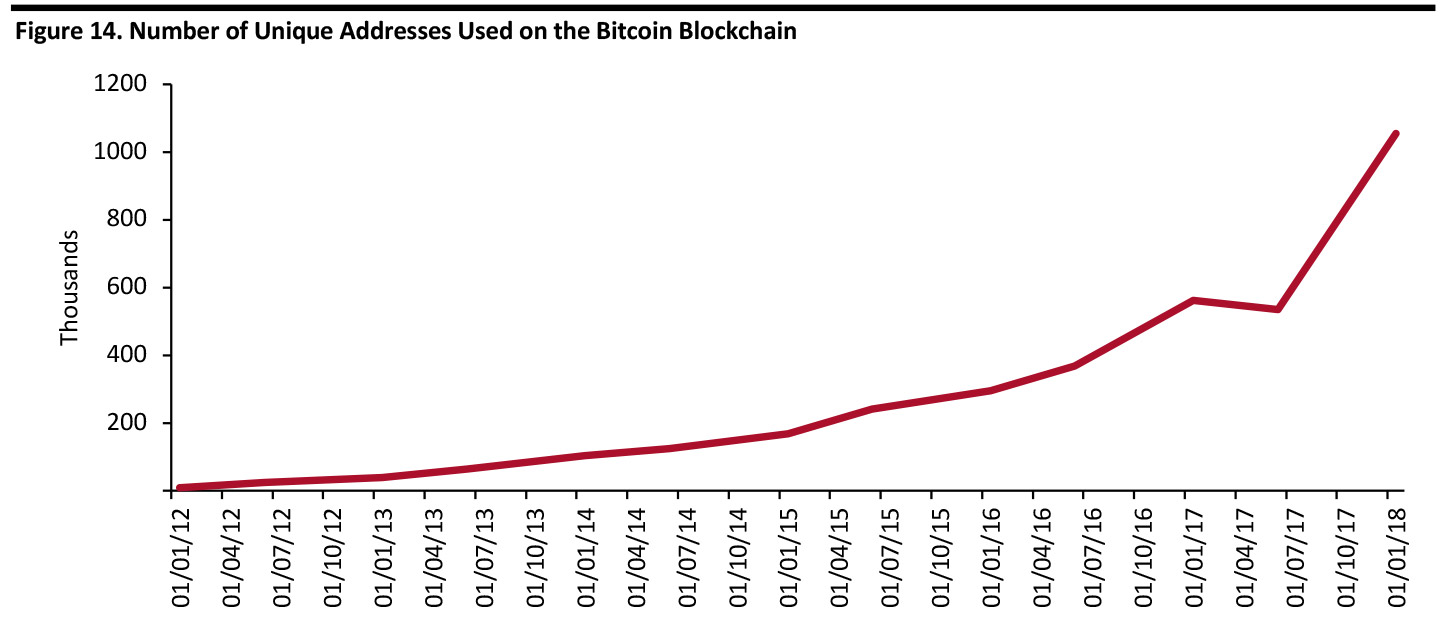

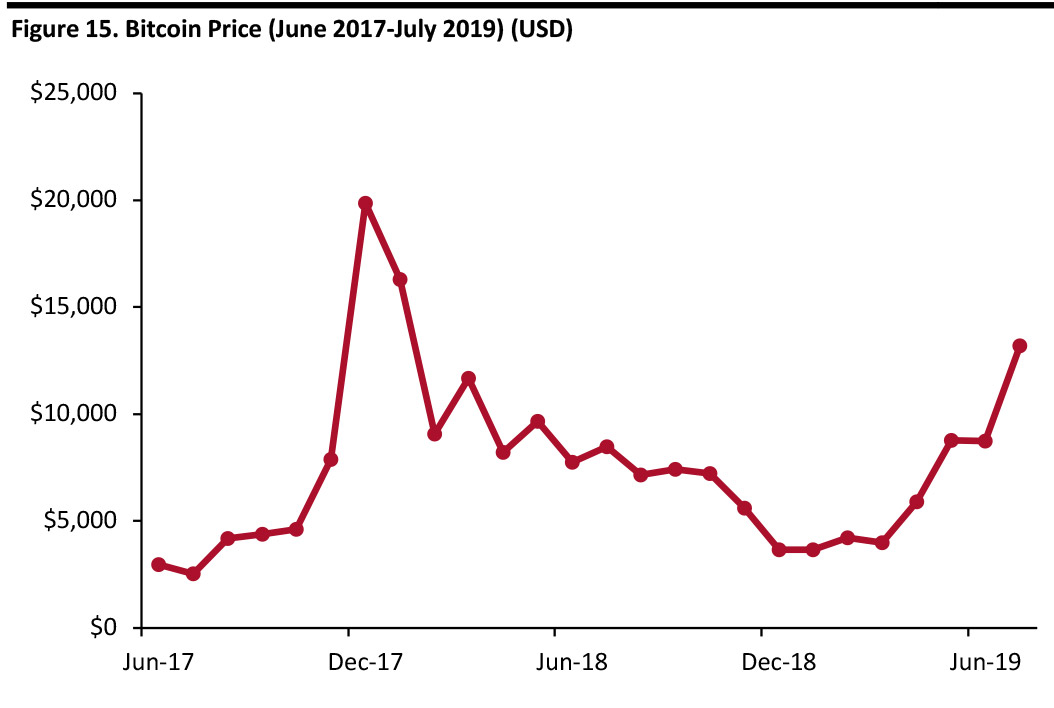

As shown in the chart below, the number of Bitcoin accounts created has increased significantly over the last few years.

[caption id="attachment_94958" align="aligncenter" width="700"] Source: blockchain.com[/caption]

Source: blockchain.com[/caption]

Bitcoin pairs users with encryption keys rather than social security numbers or tax IDs. This allows each transaction to be recorded publicly on a ledger across thousands of computing and server databases.

While boasting security, transparency and anonymity, Bitcoin has yet to prove its viability for widespread use. With exchange rates hitting $20,000 and then plummeting to $3,000 within one year, many remain cautious about using the new currency. Additionally, some US government officials have questioned Bitcoin for its anonymity and lack of accountability, suggesting that there is too much scope for it to be used for illegal activities.

[caption id="attachment_94959" align="aligncenter" width="700"] Source: Yahoo Finance[/caption]

Source: Yahoo Finance[/caption]

Facebook’s Calibra and Libra Currency

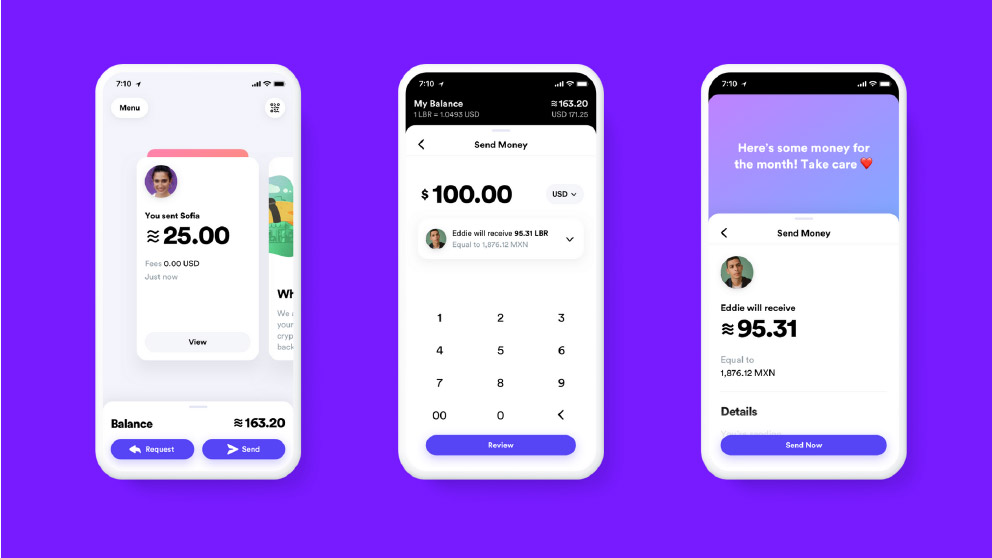

On June 18, 2019, Facebook announced plans for Calibra, a subsidiary that will provide financial services, allowing people to access the Libra network, a new digital wallet and a new virtual currency called the Libra that will rely on blockchain. Facebook’s goal with Libra is to create a stable, low inflation, globally accepted currency that can be changed into local currency with ease.

Nearly half of all adults in the world have no active bank account, with numbers in developing countries and among women even higher. Additionally, 70% of small businesses do not have access to a line of credit. Migrant workers hand over some $25 billion each year in remittance fees to send money home.

Facebook hopes to use its user base of over two billion monthly active users to bring financial services to the masses – and encourage more widespread merchant adoption. Not only will Calibra use Libra currency, it will also accept third party payments from other digital wallets.

Calibra is set to be released in 2020.

[caption id="attachment_94960" align="aligncenter" width="700"] Source: Facebook[/caption]

Source: Facebook[/caption]

And, to head off the problem of exchange rate volatility, Facebook will back the Libra with the Libra Reserve: real assets that include bank deposits and short-term government securities from several stable central banks, giving the cryptocurrency tangible assets to back it.

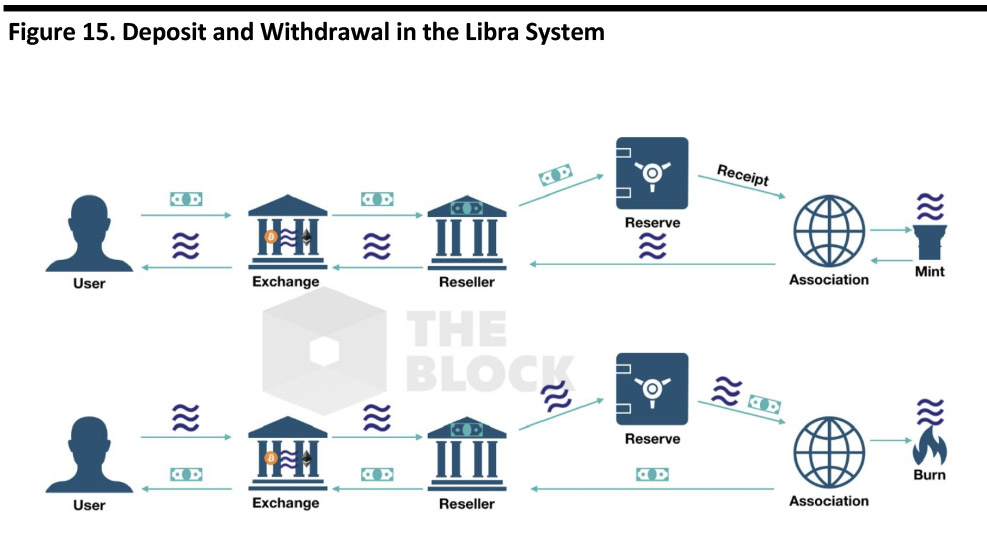

The chart below shows two possible paths for a Libra transaction. In the first, the user deposits into a Libra account, allowing Libra to place funds into its reserve. The second illustrates a user retrieving cash from a Libra account.

[caption id="attachment_94961" align="aligncenter" width="700"] Source: Medium[/caption]

Source: Medium[/caption]

For the Libra to succeed, Facebook needs to overcome trust issues. Facebook has faced multiple scandals regarding collection, sharing and use of personal and private data. On July 12, 2019, Facebooks was fined $5 billion by the Federal Trade Commission (FTC) to settle various privacy violations.

On July 16, 2019, Calibra head David Marcus testified before a US Senate hearing about Calibra and its reach into users’ private data, assuring members of the senate panel that Calibra and Facebook would not share information and that they currently had no intention of asking users for that ability. Marcus added that Calibra would await regulatory approval before releasing Libra to the public in the US.

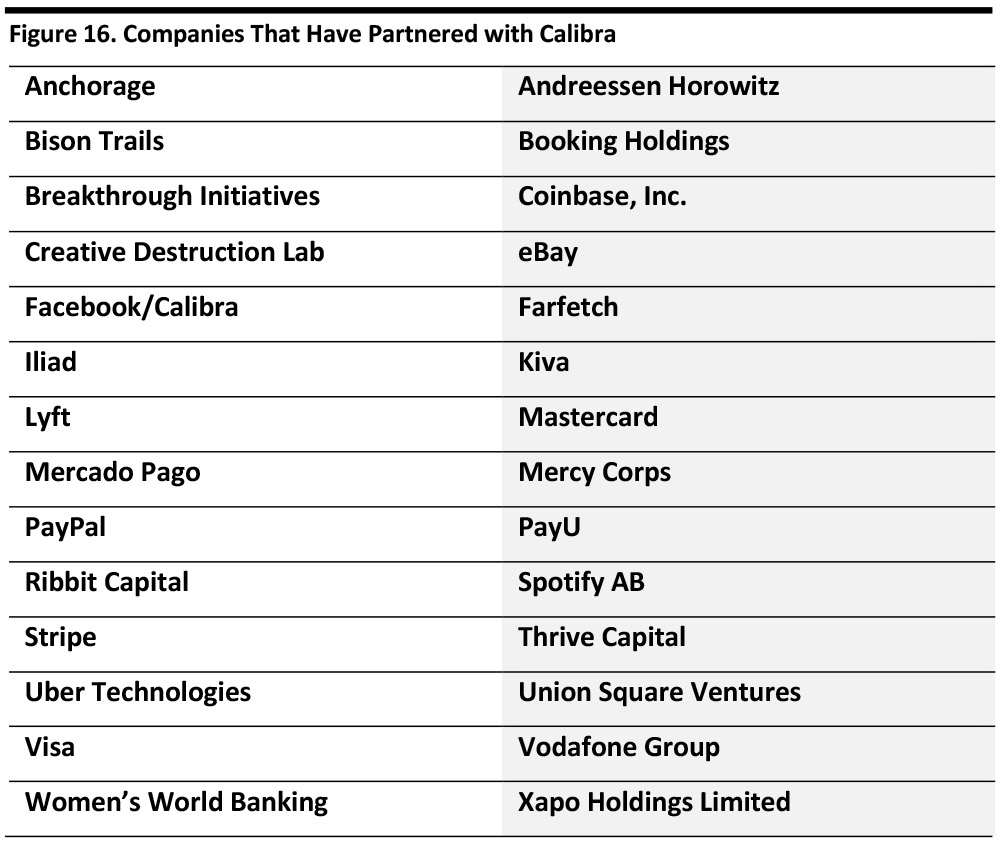

Some believe the data and privacy issues that have plagued Facebook are in the past: Over two dozen companies (listed below) have pledged support for the Libra, saying they will help ensure payments are processed with the speed, efficiency and safety – most interestingly, supporting companies include MasterCard and Visa.

[caption id="attachment_94962" align="aligncenter" width="700"] Source: Facebook[/caption]

Source: Facebook[/caption]

Others

Litecoin (Abbrev: LTC)

Litecoin is a cryptocurrency similar to Bitcoin that also operates on an open-source global network and uses script algorithms to verify proof of work. The big difference between Bitcoin and Litecoin is its faster block generation time, which allows quicker transaction verification.

[caption id="attachment_94963" align="aligncenter" width="693"] Source: Forbes[/caption]

Source: Forbes[/caption]

Ethereum (Abbrev: ETH)

Ethereum is a decentralized software platform that uses blockchain to enable smart contracts, and distributed applications to run freely without downtime, interference or fraud, according to the company. According to Ethereum, the currency and platform can “codify, decentralize, secure and trade just about anything.”

[caption id="attachment_94964" align="aligncenter" width="480"] Source: Yahoo Finance[/caption]

Source: Yahoo Finance[/caption]

Ripple (Abbrev: XRP)

Ripple is a global settlement network that processes international transactions. The model Ripple employs enables banks to make payments across borders with a high level of speed, certainty and efficiency, while maintaining low fees. Ripple, unlike many other cryptocurrencies, holds a ledger that does not require mining. Instead, it is a consensus ledger that publicly records transactions. This enables Ripple to cut the power needed in the network and reduce latency.

[caption id="attachment_94965" align="aligncenter" width="480"] Source: thecollegeinvestor.com[/caption]

Source: thecollegeinvestor.com[/caption]

Key Insights

While credit and debit cards still rule the payment landscape in the US, their future is unclear. Mobile payments such as Apple Pay and PayPal are now accepted by nearly two-thirds of retailers in the US.

China offers a glimpse of what the future may look like in the US: Mobile payments are the norm, and users can use their mobile devices to pay for almost any good or service, including rent and utilities.

Cryptocurrencies have grabbed headlines but have yet to make a big impact on consumer spending. Despite having a combined market cap of over $250 billion, only a handful of retail stores accept cryptocurrencies – largely due to high volatility.

Facebook plans to release its own cryptocurrency in 2020, backed by real-world assets to better manage volatility.

We expect the mobile payment landscape to include more mobile payment options in the coming years. Based on what we’ve seen in countries such as China, a mobile payment revolution could be coming to the US.