Introduction

Technology is clearly disrupting the consumer-facing element of the apparel and fashion industry. With the rapid growth of e-commerce, mobile shopping and the integration of online and offline shopping is changing the way consumers shop.

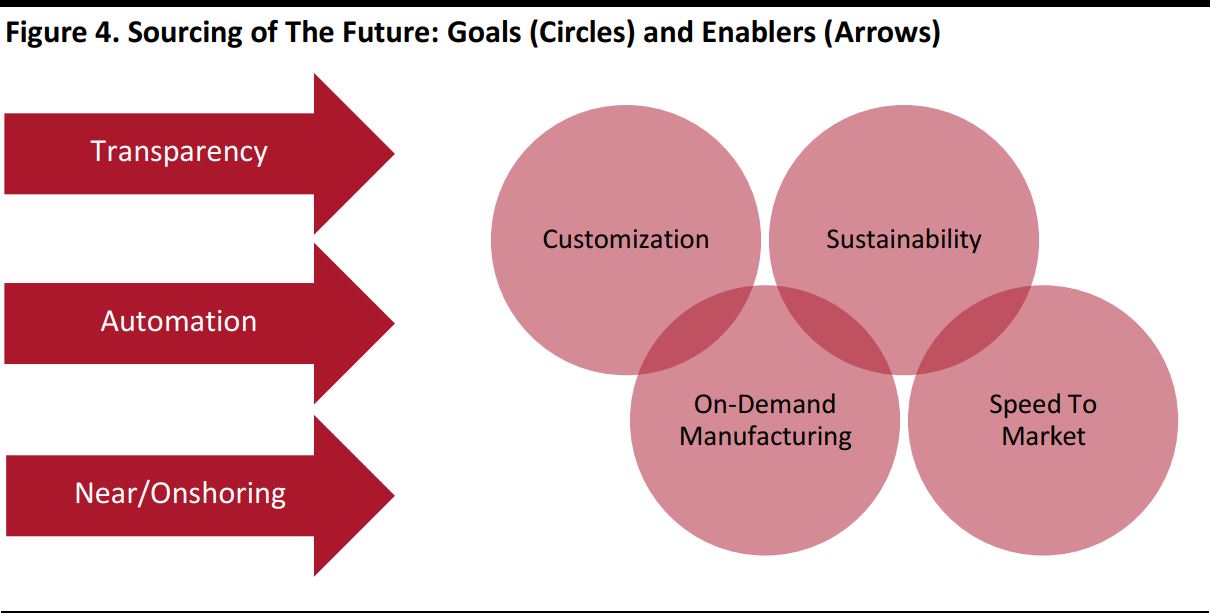

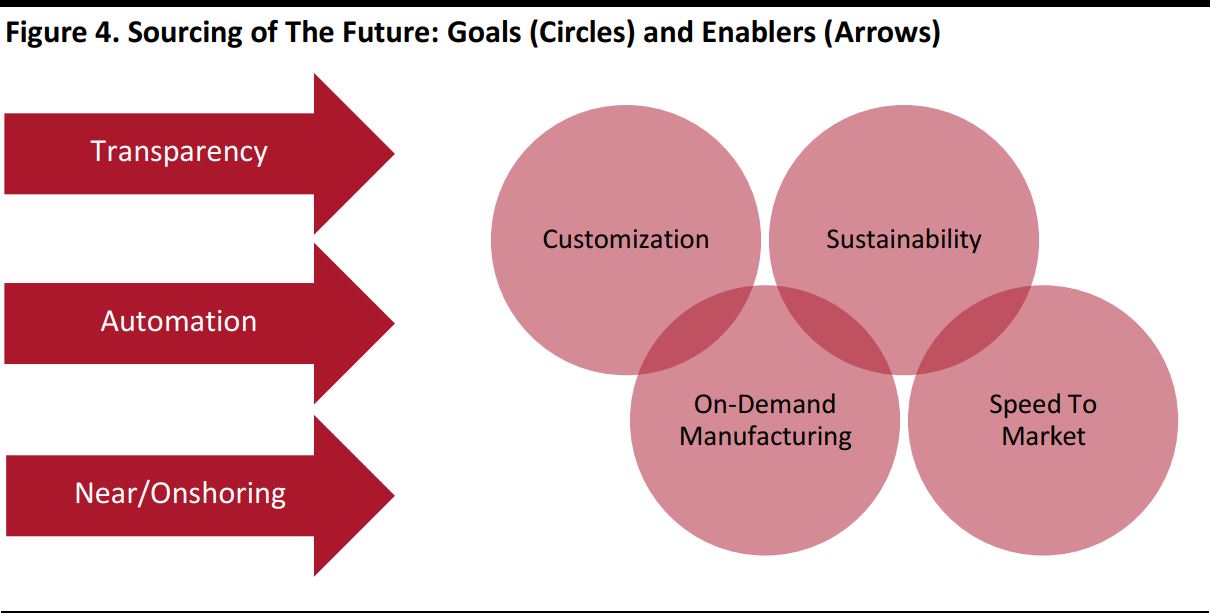

The disruption that technology is bringing to apparel sourcing and supply chain is not as apparent but just as significant, with automation enabling faster speed to market, greater customization, more transparency and sustainability throughout the product cycle, reduced costs and the shift of manufacturing closer to the end market.

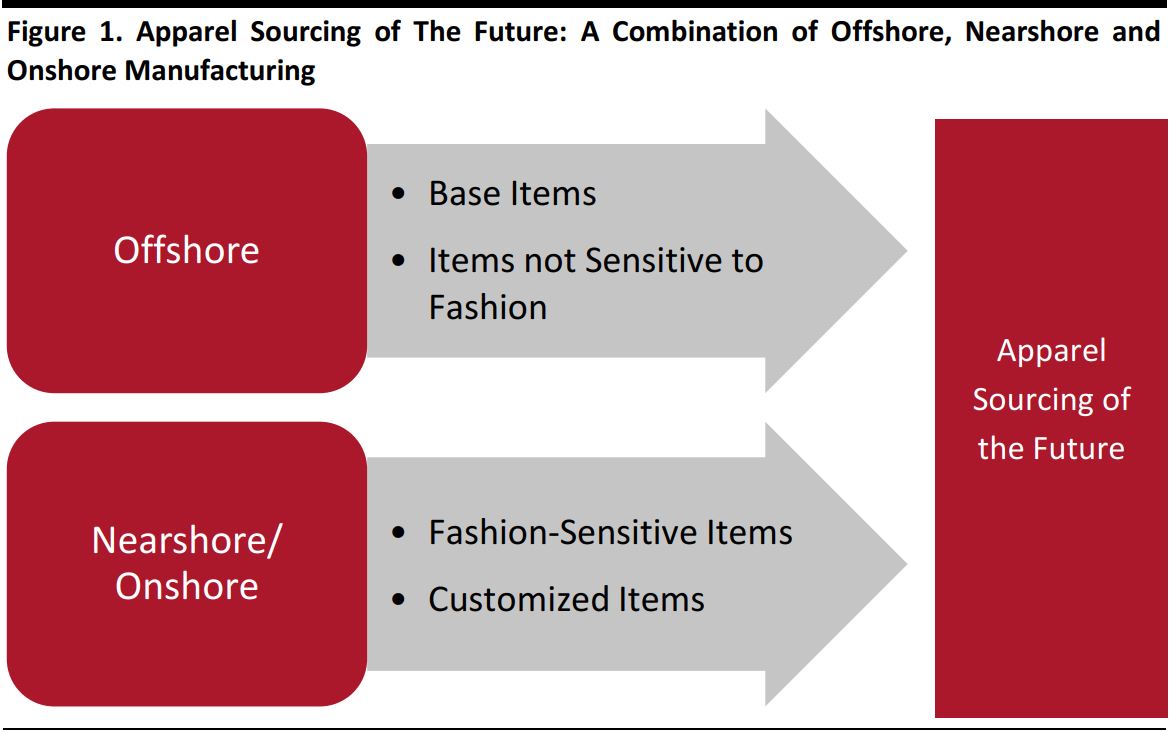

This report shows how technology is changing apparel sourcing and how sourcing of the future will be able to combine more efficient and transparent offshore manufacturing, with agile and local production facilities to enhance speed to market, deliver greater customization and better respond to rapid changes in consumer demand.

Technology to Play a Key Role in the Future of Apparel Sourcing

Apparel has been slower to adopt automation compared to other industries such as, for example, automotive. This is because apparel could more easily move production to countries in which labor costs are low, making investment in expensive new technology uneconomical.

However, the cost of labor in key traditional sourcing countries has increased significantly in the last decade. For example, the monthly minimum wage in Shanghai, China increased 188% in the last 10 years to RMB2,420 (USD348) in 2018,according to The Ministry of Human Resources and Social Security of the People’s Republic of China.At the same time, technology has made manufacturing automation less expensive.

As a result, more companies have started to assess the possibility of rebalancing the sourcing mix by adopting onshoring and nearshoring production, using automation to reduce the need for human labor while also retaining the traditional, more labor-intensive offshore channels.

End markets such as the US have also been becoming more cost competitive in recent years as the gap in labor costs narrows, with wages rising steadily in China but remaining relatively flat in the US.Using automated production lines, which require a smaller workforce to operate, makes production in higher-wage markets competitive again.

Companies are increasingly exploring opportunities to use technology in sourcing to:

- Increase transparency, efficiency and agility of operations.

- Reduce operational costs, improve speed to market, traceability and sustainability.

- Hedge against rising labor costs in core offshore markets.

- Better respond to changes in consumer demand and deliver more product customization.

Technology is helping brands and retailers become more competitive by enabling them to redesign the apparel value chain to make it more transparent, agile and demand driven.

Technology Improves Efficiency, Transparency and Sustainability of the Supply Chain

Technology will improve significantly offshore apparel sourcing, making it more efficient, cost effective, transparent and sustainable.

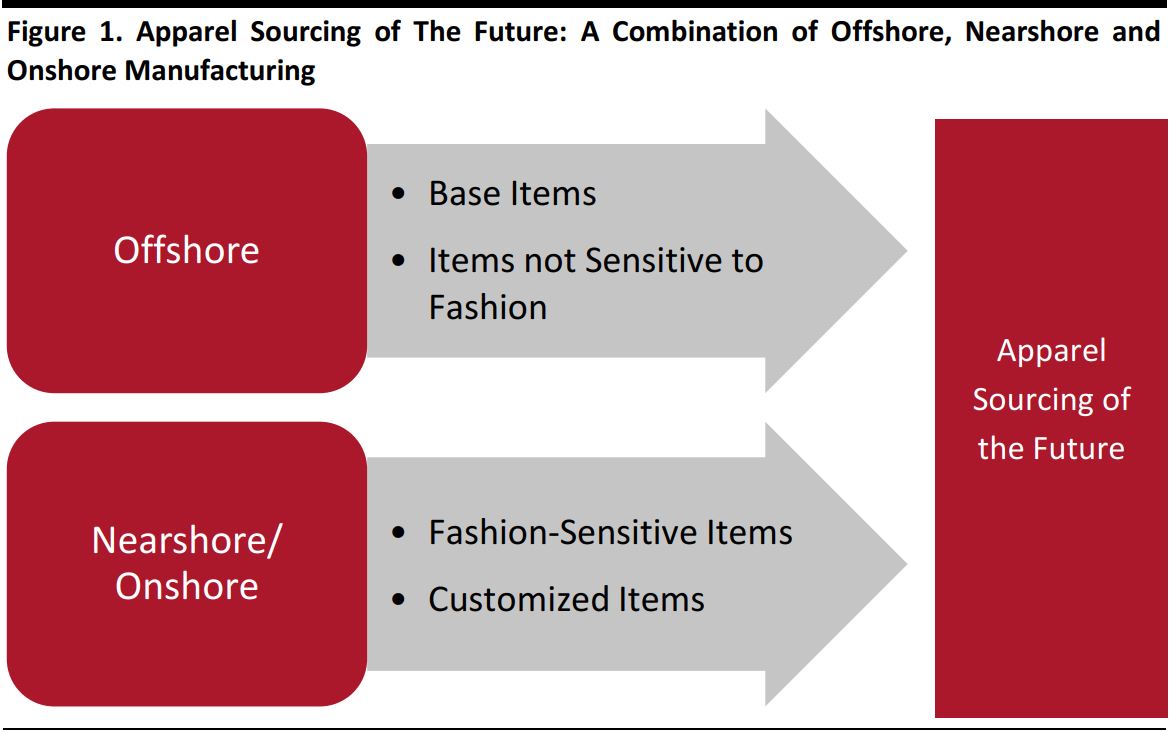

We believe offshore manufacturing will remain a key element in the future of apparel sourcing and will be complemented by onshore automated production facilities that will be used for finishing and customization, or to produce limited batches of fashion-sensitive garments.

Offshore facilities will continue to be used to produce basic items, collections that are not fashion sensitive and for base items that are shipped to onshore production facilities for finishing.

Source: Coresight Research

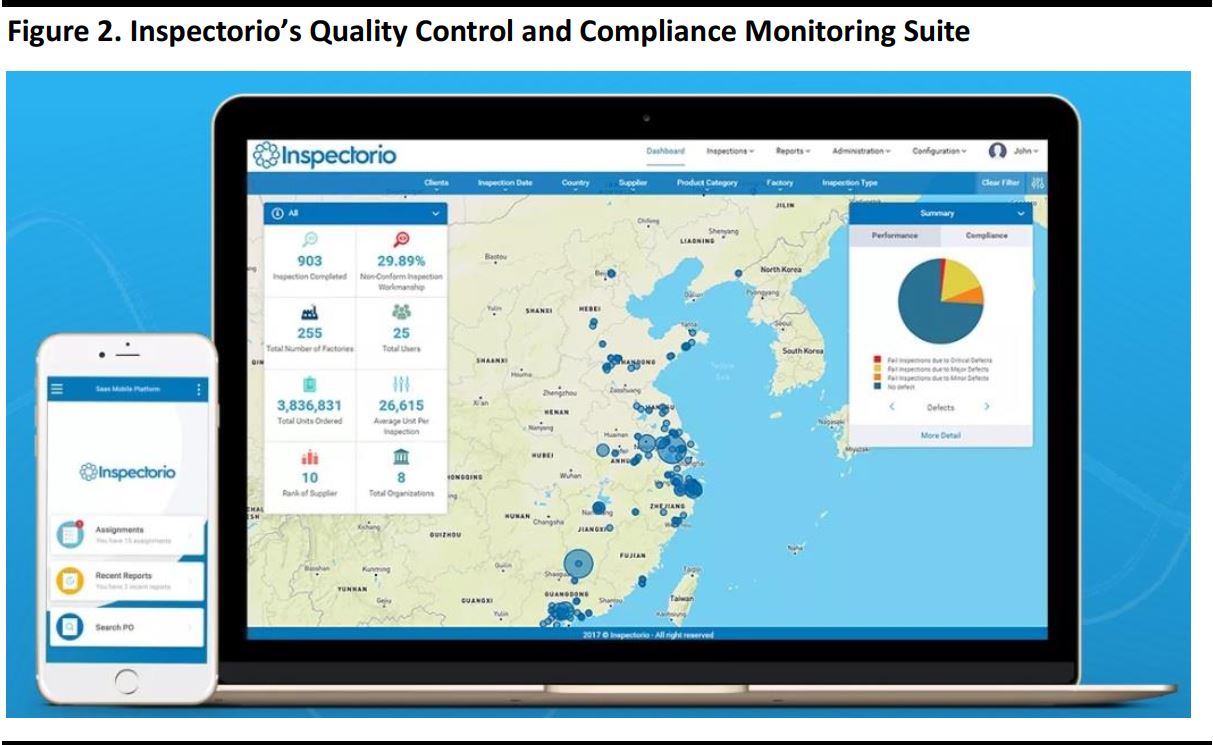

The apparent supply chain is fragmented:manufacturers, suppliers and retailers are often located in distant parts of the world, work in silos with little coordination, and brands and retailers use a large number of suppliers to ensure orders are met.Using technology such as AI and the IoT could resolve many of the issues fragmentation causes.

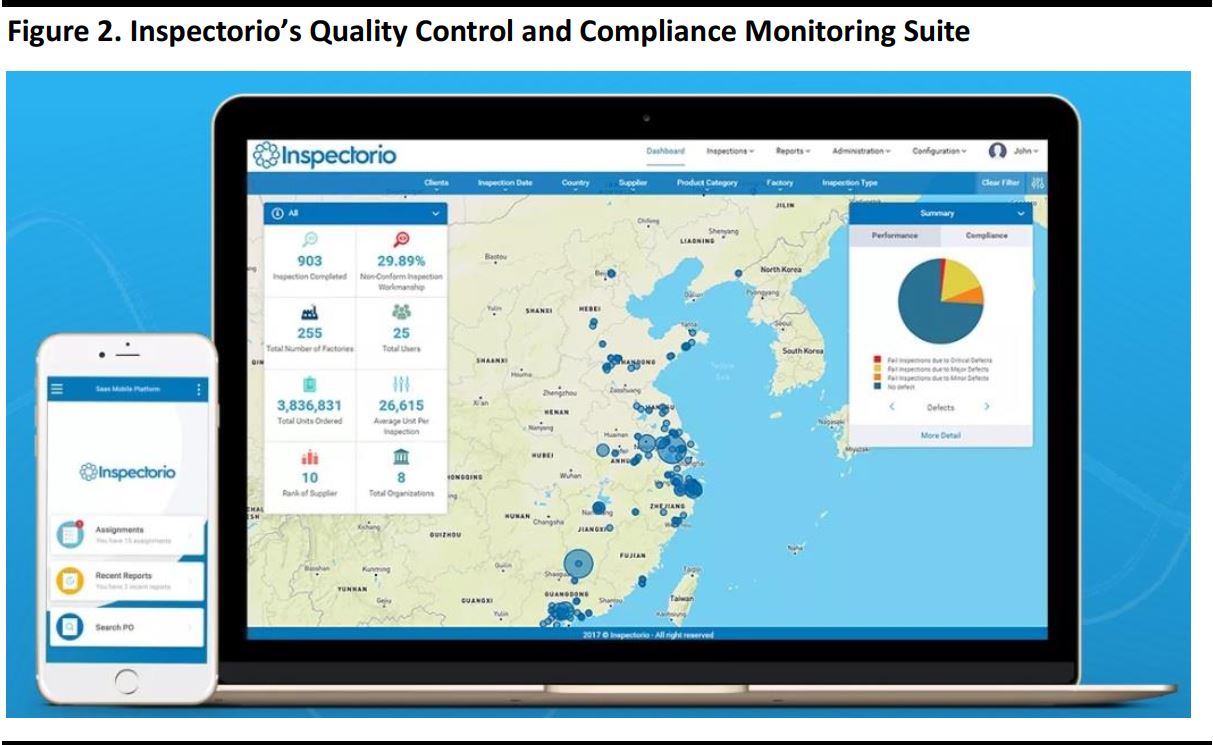

Technology firm Inspectorio is one example of how technology will redefine the future of apparel sourcing. The company provides software for the apparel sourcing industry, and has developed a platform that allows retailers, brands, vendors and factories to digitalize key tasks in supply chain management—such as quality control and compliance monitoring processes. This digitalization is enabled by a system that uses technology such as AI and machine learning, and helps improve supply-chain efficiency, visibility and productivity.

Source: Inspectorio

Source: Inspectorio

Inspectorio is expanding platform capabilities by integrating IoT technology to facilitate production tracking, responsible sourcing verification and the verification of manufacturing locations. The technology enables real-time monitoring of performance, quality standards, sustainability criteria and so on – so companies can identify problems immediately and intervene promptly, making the operations overall more efficient and cost effective.

For further analysis on how Inspectorio’s technology is transforming the management of the apparel value chain, please see our

Innovator Intelligence report

Inspectorio—Building a Digital Ecosystem Through AI to Improve Quality Control and Compliance Monitoring.

Technology Delivers Speed to Market and Customization

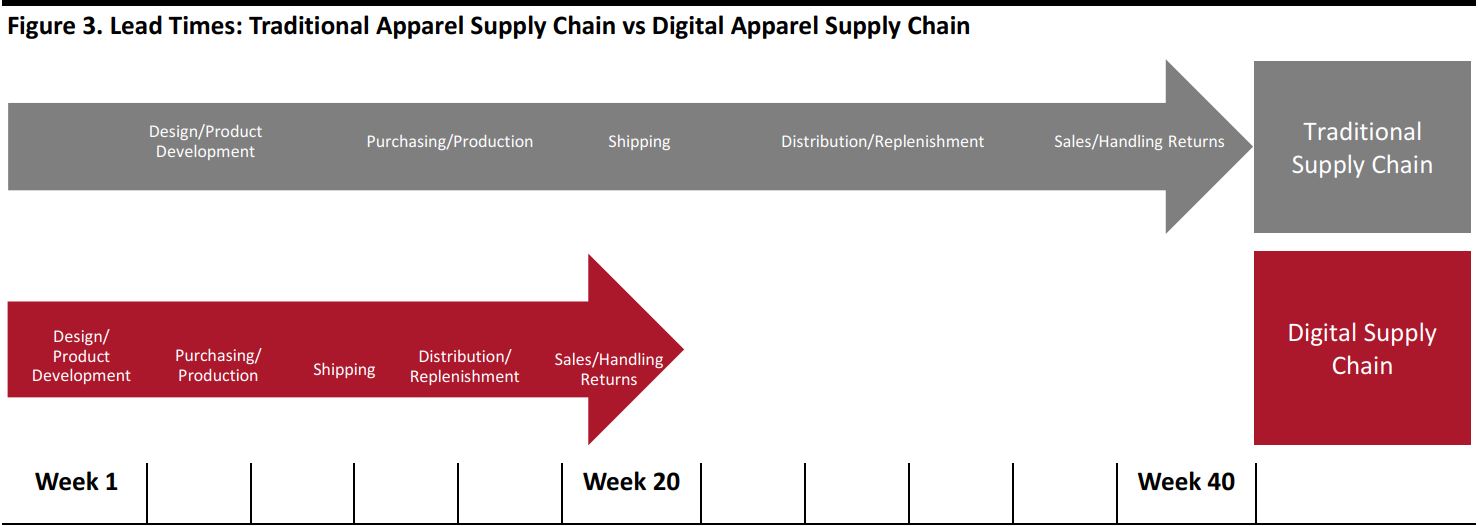

Technology will play a key role in the future of apparel sourcing as it will help brands and retailers achieve crucial competitive advantages such as speed to market.

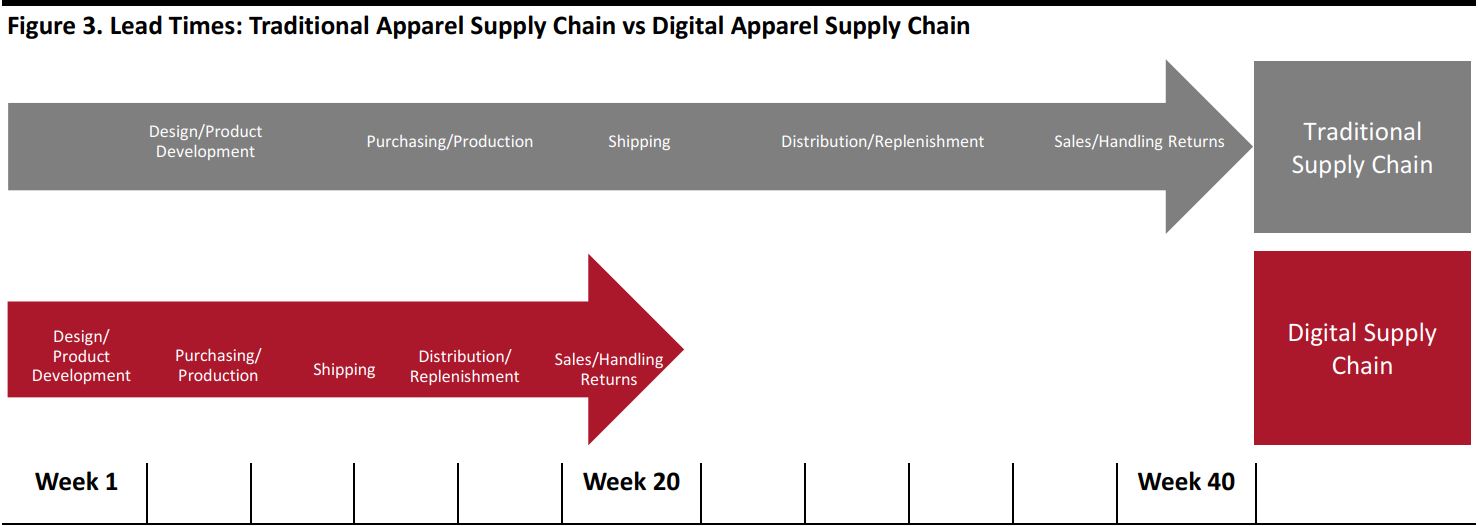

Industry experts from leading sourcing firm Li & Fung we interviewed for a previous report on

digitalizing the supply chain confirmed that digitalization of the supply chain can cut lead times from design to sales from 40 weeks to 19 weeks. This may include automating production and using digital technology to manage different stages of the apparel value chain.

The figure refers to a non-fast-fashion apparel supply chain with production in China and an end market in the US or Europe. Stages tend to overlap. The duration of the stages can vary substantially in different companies.

Source: Coresight Research

The figure refers to a non-fast-fashion apparel supply chain with production in China and an end market in the US or Europe. Stages tend to overlap. The duration of the stages can vary substantially in different companies.

Source: Coresight Research

In addition to making offshore sourcing faster and more efficient, technology is also enabling onshoring and offshoring strategies using robotics. Automated production lines require smaller workforces to operate, and so reduce the need to source from low-cost countries.

Onshore and nearshore sourcing enables brands and retailers to benefit from a more agile supply chain that can increase competitiveness by delivering greater customization, on-demand manufacturing, greater speed to market and sustainability.

Source: Coresight Research

Source: Coresight Research

Advances in Production Line Automation

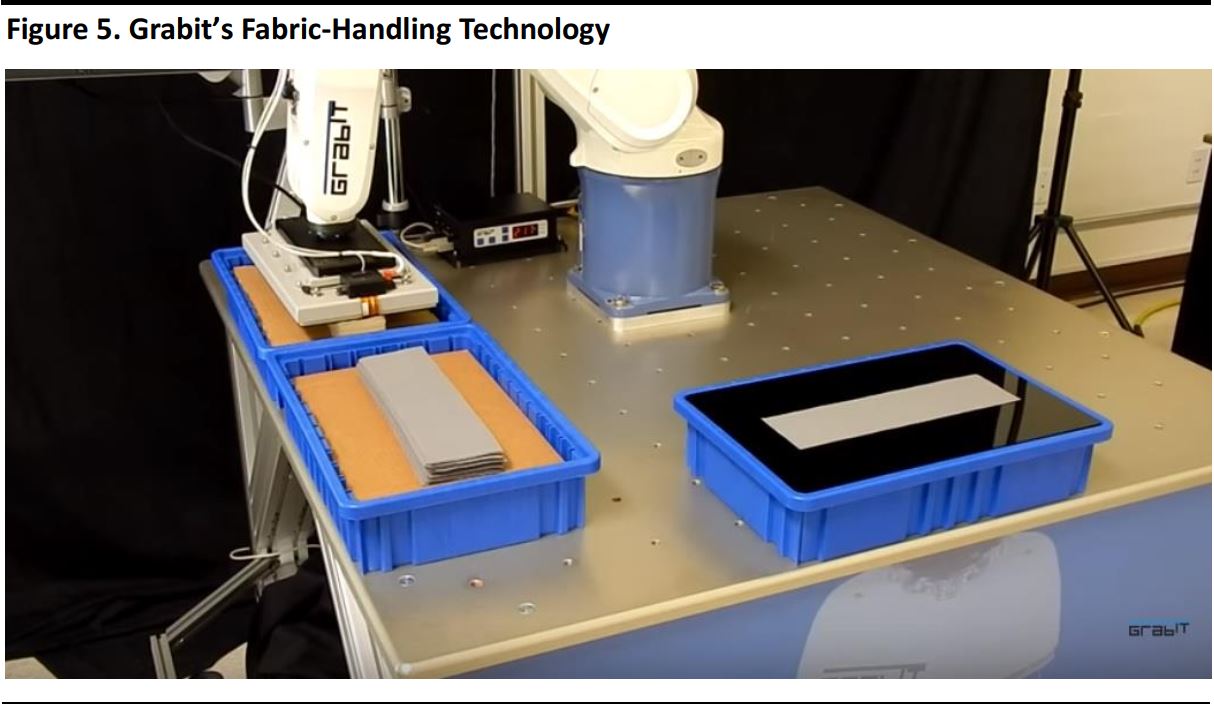

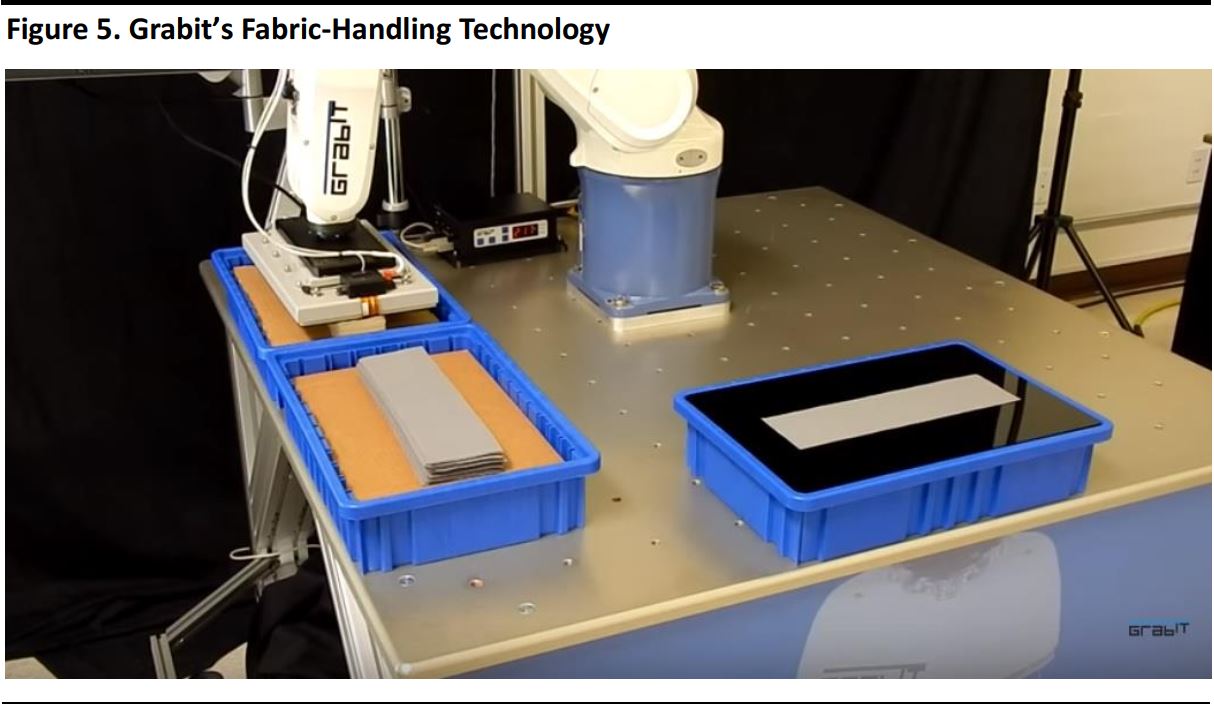

Apparel and footwear manufacturers are working with tech companies to develop the technology that enables production line automation.Historically, the apparel industry has relied heavily on human labor, not only because it was easier (and cheaper) to find low-cost labor than to to invest in advanced machinery, but also because handling of soft goods such as textile was been difficult to automate. But now, tech companies such as Grabit and Softwear Automation have been developing innovative ways to automate fabric handling.

Grabit: Bay Area startup Grabit is developing a technology that uses electroadhesion to handle fabrics.Using technology that channels static cling to act as a magnet to enable automatic handling, the company built an auto-layering robot capable of handling textile, automating and speeding garment production. According to the company, Grabit’s technology increases manufacturers’ productivity twenty fold.

Source: Grabit

Source: Grabit

Sportswear giant Nike acquired a minority stake in Grab it in 2013 and started to install the company’s technology in factories in China and Mexico,Bloomberg reported in August 2017.

Hong Kong textile giant Esquel Group also invested in Grabit, the South China MorningPost reported in September 2018. The partnership with Grabit is part of Esquel’s strategic approach to production cycle automation. Esquel opened a new factory in Jiumeiqiao, China, which uses automation to reduce the cost of making clothing and shirts, the South China Morning Post reported in December 2016.

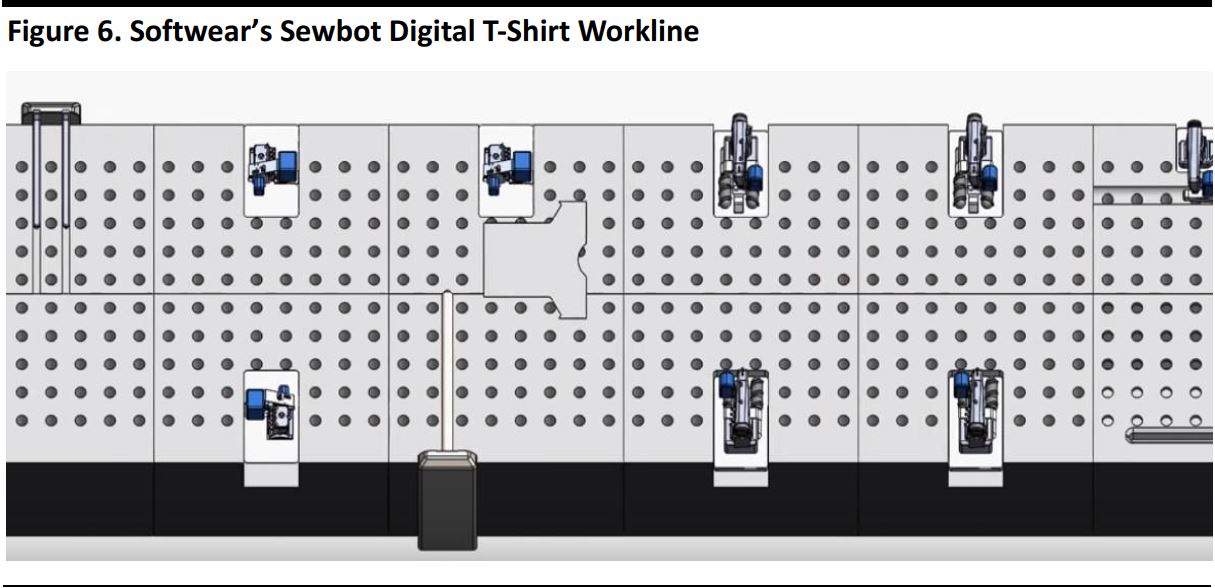

Softwear Automation: US tech firm Softwear developed Sewbot, a fully autonomous workline that can complete a t-shirt in half the time required by manual sewing – cuttin workforce requirements 90%, according to the company’s website.

Source: Softwear Automation

Source: Softwear Automation

Li & Fung is collaborating with Softwear to develop a fully digitized apparel and textile supply chain, the sourcing firm announced in May 2018.The partnership between Li & Fung and Softwear Automation will initially focus on t-shirt production, but expand to other categories in the future.

Automation will enable manufacturers to deliver better productivity and efficiency, according to Li & Fung. The partnership with Softwear Automation is part of the soucing firm’s strategy to deliver the apparel supply chain of the future, which in the company’s vision will be characterized by speed, innovation and digitalization.

Companies Adding Onshoring to Their Sourcing Mix

Automation is enabling companies to set up onshore or nearshore production facilities to better respond to fast changing consumer trends, personalization needs and to enhance speed to market. Below, we report three notable examples of apparel manufacturers and brands that have been setting up onshore manufacturing facilities.

Tianyun Garments: Chinese apparel manufacturer Tianyun Garments, a company that supplies sportswear giant Adidas, set up an automated t-shirt factory in Little Rock, Arkansas, that uses Softwear Automation’s technology, Bloomberg reported in August 2017. The facility, which will produce t-shirts for Adidas, has a production capacity of 800,000 t-shirts per day. According to the company, the labor cost per item would be about $0.33, making the production facility cost competitive even with the cheapest sourcing markets. The factory began production in January 2018, Arkansas-based media company

Talk Business & Politics reported in June 2018.

Adidas SpeedFactory: Adidas is piloting automating its product sourcing cycle with SpeedFactory facilities to make tailored, limited edition, high-end sneakers. SpeedFactory is a completely automated production facility whose flexible model challenges traditional centralized production to make products close to where the consumer is, the company announced in July 2016.

At the time of writing, two SpeedFactory facilities were operational, one in Bavaria, Germany, near the Adidas headquarters, and the second in Atlanta, Georgia. The Atlanta facility produces AM4NYC (Adidas Made for New York City) sneakers, a product specifically designed for New York City consumers,

Business Insider reported in April 2018. SpeedFactory facilities are likely to complement traditional offshore production facilities, to help the company with flexible and faster production and supply cycles for custom items or swift replenishment of fast-selling items.

Levi Strauss: Through automation, denim manufacturer Levi Strauss is reshoring part of the jeans manufacturing process to the US. This is designed to cut lead times and allow the firm to better respond to shoppers’ demands. In partnership with technology firm Jeanologica, the company is testing a laser technology that automates the finishing phase that gives the “worn-in” look to jeans, the company announced in February 2018. This program, labeled by the company as Project F.L.X. (future-led execution), will significantly reduce lead times as it enables faster finishing, enabling Levi Strauss to deliver faster speed to market and flexibility to quickly respond to changing consumer demand. The company built a large finishing facility at its Sky Harbor distribution center near Las Vegas to get ready for full-scale adoption of the technology in 2020. The laser finishing is not only faster, but also more environmentally friendly as it dramatically cuts the use of chemicals in the traditional denim finishing process.

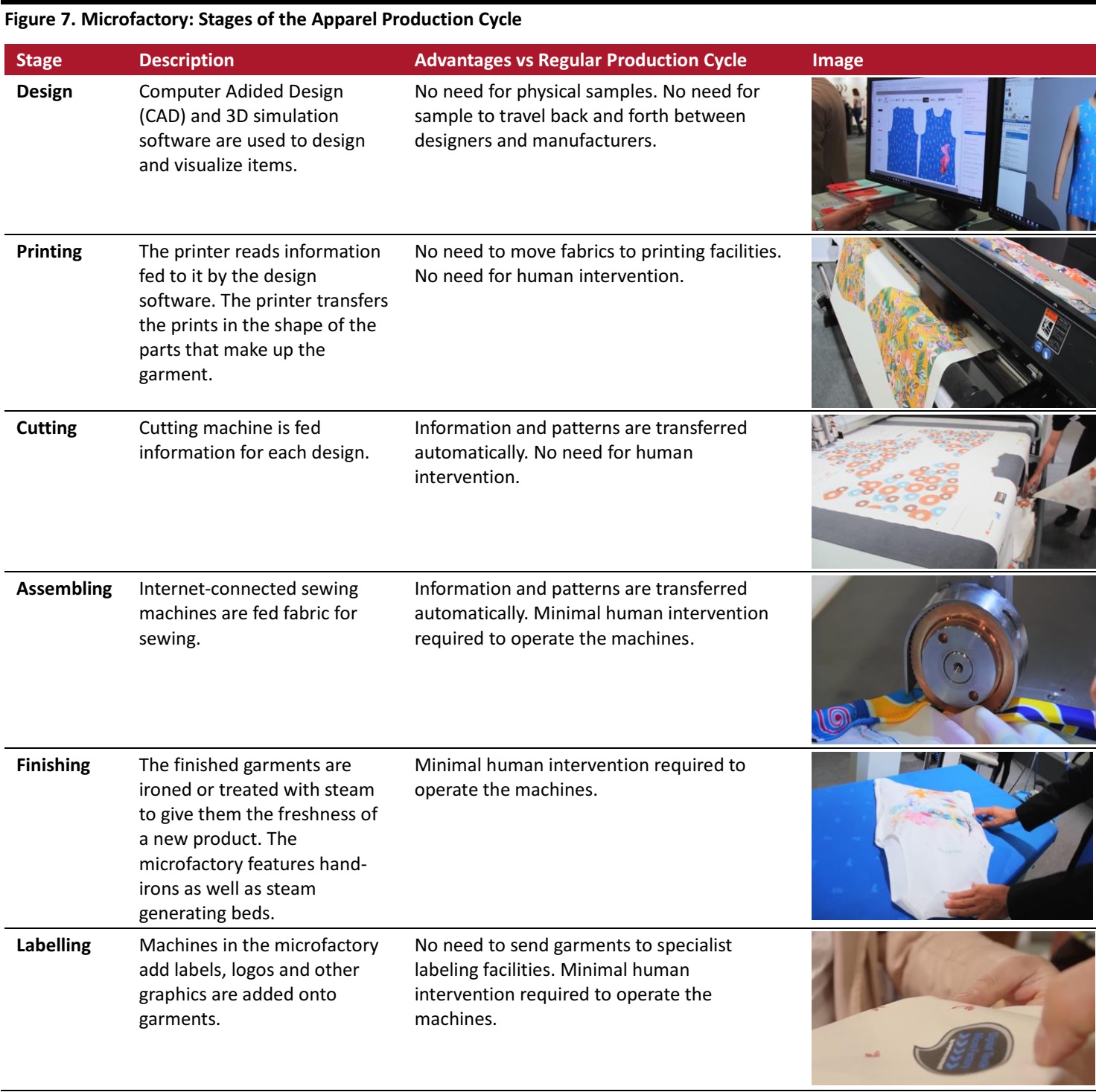

Microfactory: A Smaller and Faster Production Facility

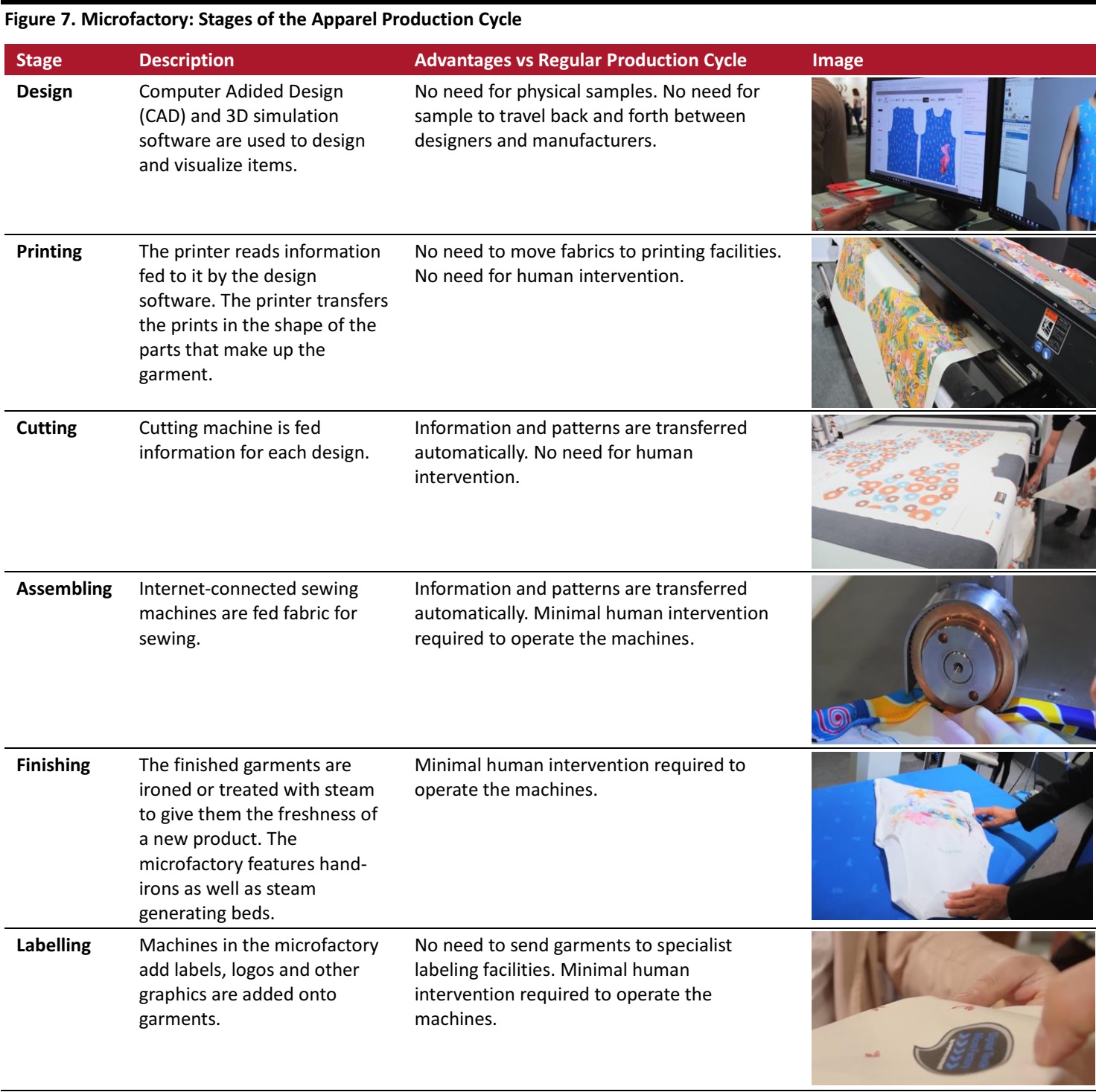

What Adidas is doing with microfactory facility testing shows how smaller onshore and high-tech production sites are likely to become a key component in the apparel value chain of the future. Apparel manufacturers will likely set up microfactories, innovative,agile and versatile production facilities that will enable companies to respond faster to shifting consumer demand.

Apparel digital microfactories are integrated production facilities which focus on creating custom clothing fast to meet local demand. All the processes from designing to the finished products are done under one roof, as opposed to traditional production which happens in different locations.

The advantages of microfactories over the traditional mass production facilities are:

- Efficiency and flexibility: Microfactories offer an integrated approach to apparel production as designing, 3D simulation, printing and cutting are all combined into one process through digitalization.

- Reduced human error and improved cost efficiency: Producing in microfactories using an almost entirely automated process significantly reduces the likelihood of human error - and the cost of fixing those human errors.

- Enhanced speed to market: Micorfactories significantly reduce the time needed for an idea to go from design to store shelves, thanks to the all-under-one-roof process.

The German Institute for Textile and Fibre Research presented a digital textile microfactory prototype at the 2017 Texprocess Trade Fair in Frankfurt, Germany. Figure 7 shows the microfactory apparel production cycle.

Source: Texprocess/YouTube/Coresight Reseach

Key Takeaways: The Future of Sourcing is a Technology-Enabled Combination of Offshore and Onshore Manufacturing

The adoption of technology in apparel sourcing has been slower than in other sectors. However recent changes in the business environment in which firms operate and progress in technology have accelerated digitalization in the apparel supply chain. This process is redefining the way apparel is produced and sourced.

The apparel sourcing of the future will enable retailers to optimize the supply chain for speed—rather than only cost. Speed to market is already a priority for apparel brands and retailers, and soon may surpass cost as the key factor in apparel sourcing engineering.

Onshore and nearshore manufacturing will coexist and complement offshore production, which will be also transformed and improved by technology and will evolve with the use of technology for increased efficiency, speed, transparency and sustainability.

We believe that the apparel sourcing of the future will be characterized by:

- Greater transparency: Technology will make offshore sourcing more transparent, traceable and sustainable.

- Automation: Robotics in production lines will reduce costs, improve efficiency and increase speed.

- Nearshoring and onshoring: Automation will enable production closer to the end market to ensure faster response to consumer demand and allow more customization.

- Microfactories: Fully automated production facilities will enable very rapid responses to the changes in local consumer demand.

The recipe for success for apparel brands and retailers will be a technology-enabled combination of offshore and onshore sourcing. Companies that currently rely mostly on the traditional offshore mass market model for sourcing should look at examples of brands such as Adidas and Levi’s and start experimenting with local production of small batches of customized or limited-edition collections.

Source: Inspectorio

Source: Inspectorio The figure refers to a non-fast-fashion apparel supply chain with production in China and an end market in the US or Europe. Stages tend to overlap. The duration of the stages can vary substantially in different companies.

Source: Coresight Research

The figure refers to a non-fast-fashion apparel supply chain with production in China and an end market in the US or Europe. Stages tend to overlap. The duration of the stages can vary substantially in different companies.

Source: Coresight Research Source: Coresight Research

Source: Coresight Research Source: Grabit

Source: Grabit Source: Softwear Automation

Source: Softwear Automation