Nitheesh NH

What’s the Story?

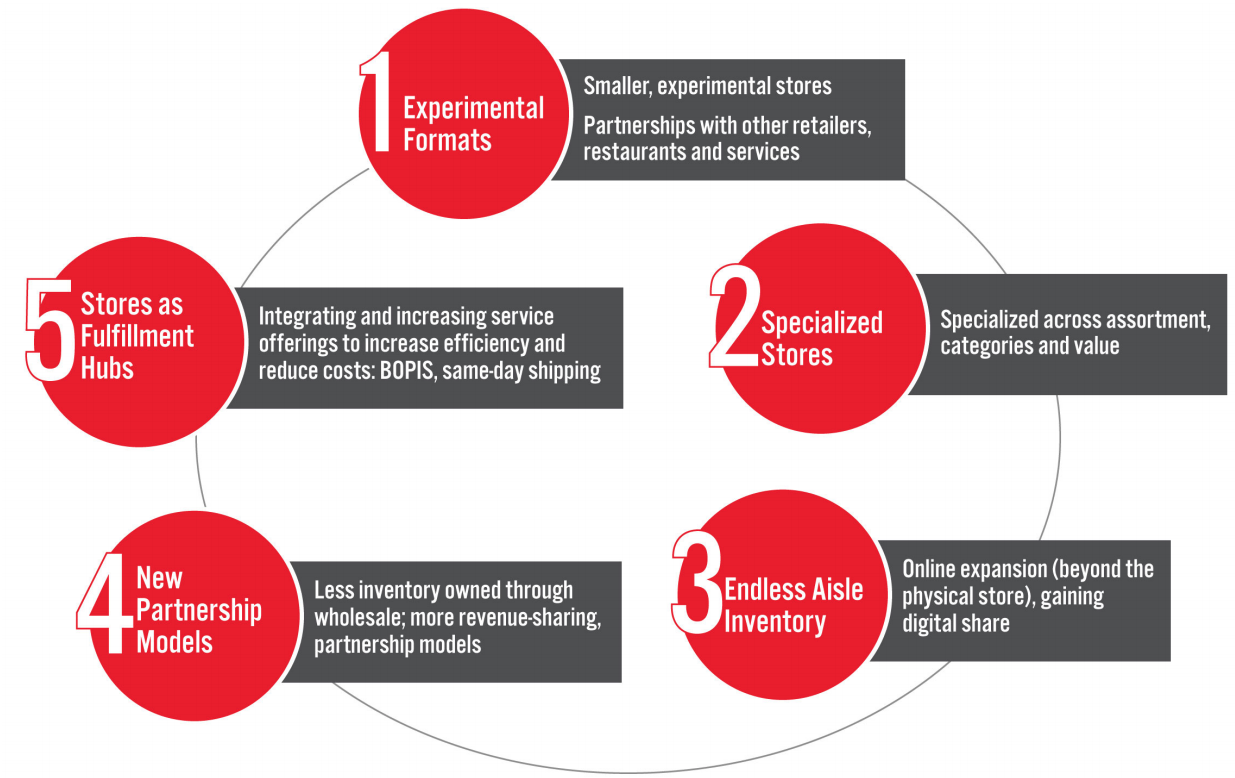

The department store, one of retail’s oldest and most iconic formats, has been reinventing itself. The US department store sector has struggled, as it is costly and exceedingly difficult to manage, operate and execute multicategory retail at scale. We have identified five key trends that are integral to the future of the US department store sector, covering experimental formats, specialized stores, endless aisle inventory, new partnership models and stores as fulfillment hubs. In this report, we discuss the backdrop of the digital era as a key influencer in the transformation of department stores and explore each of the five trends in detail.Why It Matters

The global pandemic saw drastic shifts in the US retail landscape that hit the department store sector particularly hard. E-commerce saw huge growth, even in traditionally offline sectors: Digital sales at department stores comprised 43.7% of total sales in fiscal 2020 up from 23.5% in fiscal 2019, according to Coresight Research estimates based on Euromonitor International data. At the same time, we estimate that the US department store sector saw a steep decline in overall sales, of 33.2%, from $95.6 billion in 2019 to $63.9 billion in 2020. Physical retail sales were impacted the most severely, declining by 49.1% in 2020 to $35.9 billion, as department stores were deemed nonessential retail and therefore closed amid Covid-19 lockdowns. Digital sales were not able to sustain three department stores over the long term; JCPenney, Neiman Marcus and Stage Stores all filed for bankruptcy in May 2020. The balance of digital sales with physical store sales at department stores underpins the future of the department store sector—impacting physical format, inventory, product selections, services, fulfillment and vendor relationships. In order for the sector to survive, it will need to quickly act on the growth it is seeing in the digital channel and optimize its physical assets to be more asset-light while still maintaining a connection with consumers. The department store will need to take risks and not try to be everything to all consumers. This will involve more specialization in value, categories, assortments and geographic markets.The Future of the Department Store in the US

The Rise of E-Commerce Underpins the Future Trends in Department Stores Digital, not surprisingly, is the biggest driver of change in the retail industry as a whole, but the rise of e-commerce is arguably impacting the department store sector the most, as this sector relies heavily on physical retail sales due to expansive real estate portfolios. Here, we provide background context on the physical store portfolios of the US department store sector’s three major department stores—Kohl’s Macy’s and Nordstrom—and the rise of e-commerce at each. The size of a retailer’s physical store portfolio is important, as physical store assets are fixed and operating expenses are one of the most significant expenses. Department stores have traditionally been reliant on physical store traffic as their main source of revenue. As consumers are shopping digitally, the primary source shifted to online, so the balance of a department store’s physical store portfolio and e-commerce has become paramount—setting the stage for the trends of the future department store We summarize the physical store portfolios of the three major US department stores—Kohl’s, Macy’s and Nordstrom—in Figure 1. Figure 1. Kohl’s, Macy’s and Nordstrom: Physical Store Portfolios [wpdatatable id=1033]As of fiscal year ended January 30, 2021 Source: Company reports

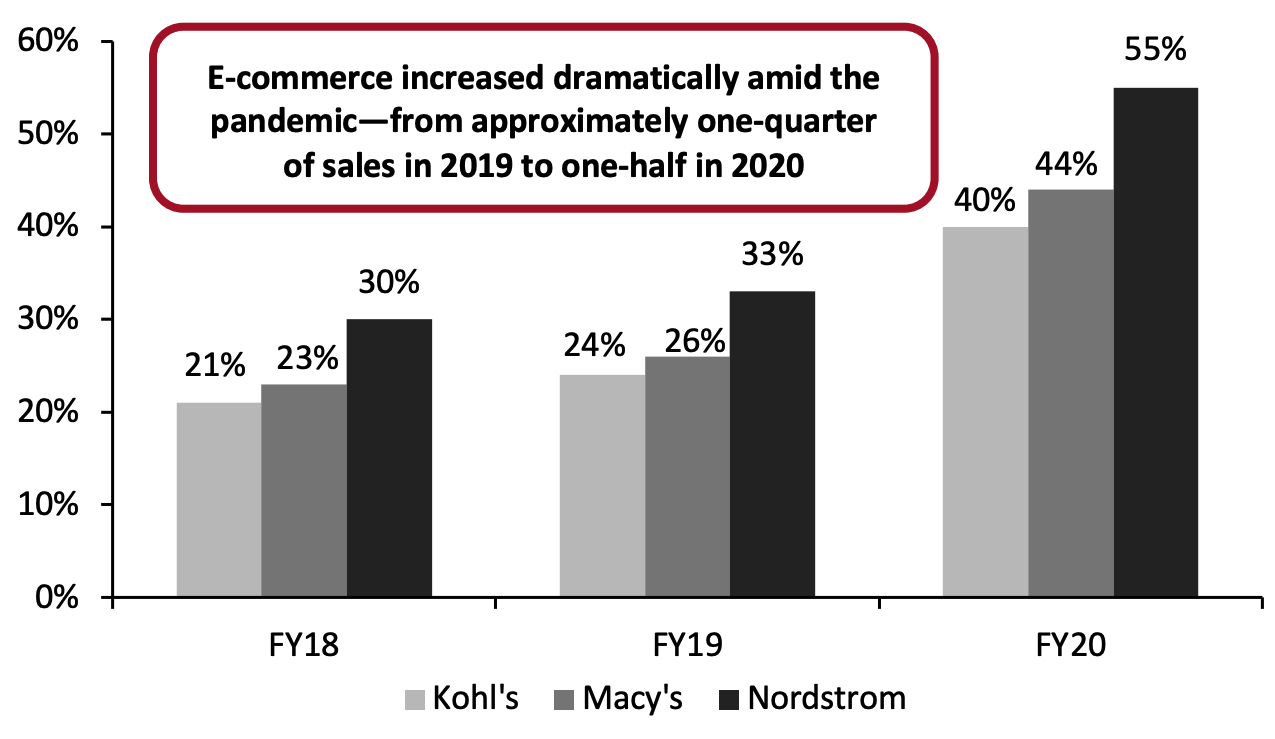

Macy’s is the most exposed of the three retailers in terms of its physical portfolio, because it has the largest total square footage of the three retailers, as well as the largest individual stores. Kohl’s is the least exposed, with an average store size of approximately 70,500 square feet—smaller than Macy’s and Nordstrom. Nordstrom falls in the middle in terms of its physical store exposure; although the company’s full-price stores are larger than Kohl’s, it has fewer stores than Macy’s, so its footprint is smaller. Managing the balance of digital and physical sales will be critical for the department store sector in the future. The three major US department stores have exhibited similar e-commerce growth patterns in recent years: Digital sales as a percentage of total sales ranged from 21% to 33% of sales in fiscal 2018 and 2019 before increasing to 40%–55% in fiscal 2020 (see Figure 2). Figure 2. Kohl’s, Macy’s and Nordstrom: E-Commerce Penetration (% of Total Sales) [caption id="attachment_128624" align="aligncenter" width="720"] Source: Company reports[/caption]

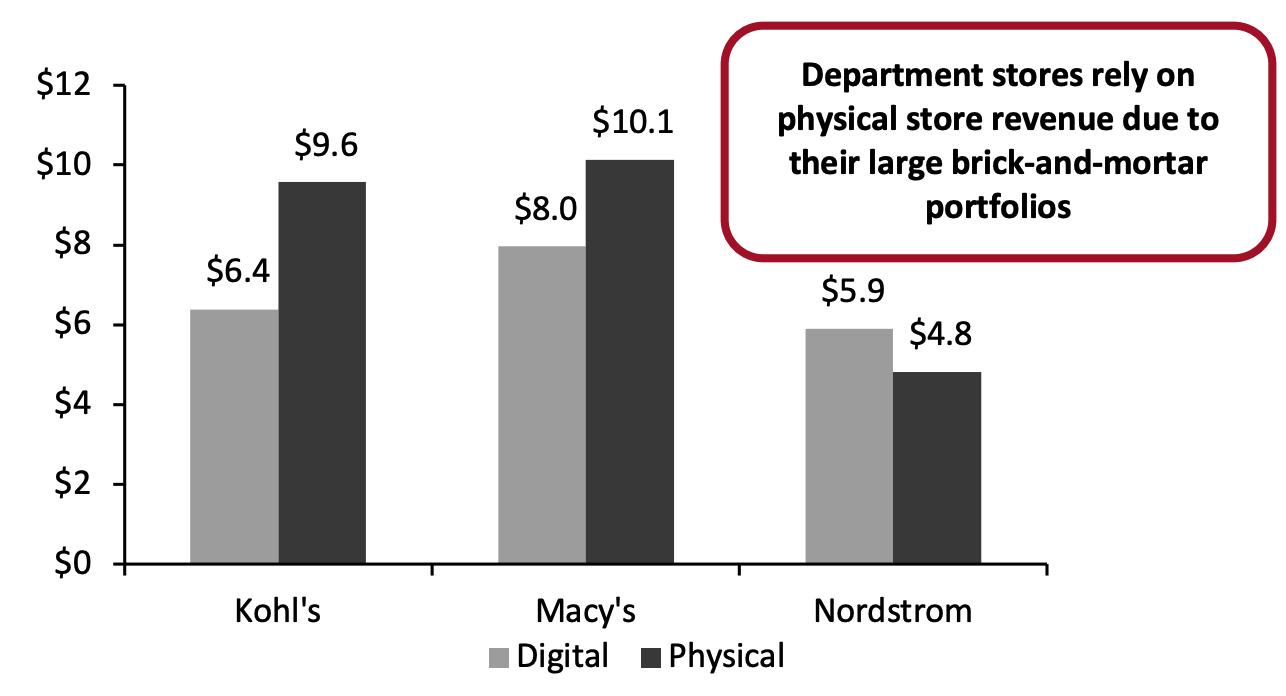

The revenues from digital and physical sales at each of the three companies in fiscal 2020 is shown in Figure 3. We present this data to highlight the significant proportions of revenue derived from digital sales in fiscal 2020, thus emphasizing the need for retailers to assess their online-to-physical store balance moving forward.

Figure 3. Kohl’s, Macy’s and Nordstrom: Digital and Physical Sales, FY20 (USD Bil.)

[caption id="attachment_128625" align="aligncenter" width="720"]

Source: Company reports[/caption]

The revenues from digital and physical sales at each of the three companies in fiscal 2020 is shown in Figure 3. We present this data to highlight the significant proportions of revenue derived from digital sales in fiscal 2020, thus emphasizing the need for retailers to assess their online-to-physical store balance moving forward.

Figure 3. Kohl’s, Macy’s and Nordstrom: Digital and Physical Sales, FY20 (USD Bil.)

[caption id="attachment_128625" align="aligncenter" width="720"] Source: Company reports[/caption]

Five Department Store Trends of the Future

We have identified five key trends that are integral to the future of the department store sector, which we summarize in Figure 4. We explore each of the five trends in detail below.

Figure 4. Department Store Trends of the Future

[caption id="attachment_128626" align="aligncenter" width="720"]

Source: Company reports[/caption]

Five Department Store Trends of the Future

We have identified five key trends that are integral to the future of the department store sector, which we summarize in Figure 4. We explore each of the five trends in detail below.

Figure 4. Department Store Trends of the Future

[caption id="attachment_128626" align="aligncenter" width="720"] Source: Coresight Research[/caption]

1. Experimental Formats

Less Traditional, Smaller and More Experimental

Department store formats will be smaller and more experimental as retailers will optimize their physical retail portfolios. Department stores are balancing the relationship between physical stores and the digital channel, and the optimal amount of physical space that department stores will maintain in the future will likely decrease. This will involve the integration of two different formats into their portfolios: (1) smaller stores that provide a reduced assortment compared to full-size stores but still offer department stores a presence and are less real estate heavy; (2) showroom stores that hold no inventory and offer local customer services.

Department stores recognize the synergistic importance of stores to their digital presence: Each channel reinforces the other—for example, consumers can pick up online orders in-store, search for items online and try them on in-store, and receive styling advice from associates online and in-store. Macy’s reported on its fourth-quarter earnings call of fiscal 2020, held in February 2021, that when it closes a store, its digital sales drop significantly in that market. Nordstrom reported that it is focusing on connecting its digital and physical assets, concentrating on its top 20 markets, which account for 75% of its sales.

We are already seeing department stores launch such formats:

Source: Coresight Research[/caption]

1. Experimental Formats

Less Traditional, Smaller and More Experimental

Department store formats will be smaller and more experimental as retailers will optimize their physical retail portfolios. Department stores are balancing the relationship between physical stores and the digital channel, and the optimal amount of physical space that department stores will maintain in the future will likely decrease. This will involve the integration of two different formats into their portfolios: (1) smaller stores that provide a reduced assortment compared to full-size stores but still offer department stores a presence and are less real estate heavy; (2) showroom stores that hold no inventory and offer local customer services.

Department stores recognize the synergistic importance of stores to their digital presence: Each channel reinforces the other—for example, consumers can pick up online orders in-store, search for items online and try them on in-store, and receive styling advice from associates online and in-store. Macy’s reported on its fourth-quarter earnings call of fiscal 2020, held in February 2021, that when it closes a store, its digital sales drop significantly in that market. Nordstrom reported that it is focusing on connecting its digital and physical assets, concentrating on its top 20 markets, which account for 75% of its sales.

We are already seeing department stores launch such formats:

- Macy’s opened its second off-mall concept store “Market at Macy’s” in January 2021. The smaller format measures 20,000 square feet compared to the retailer’s 100,000-plus-square-foot anchor stores. These local, smaller stores will enable Macy’s to retain a brick-and-mortar presence while lightening the real estate burden.

- Nordstrom already operates seven Nordstrom Local showroom stores. The small-format stores hold no inventory but instead provide services such as online order pickup, alterations, returns and exchanges, and styling assistance.

- Kohl’s announced in December 2020 that it is partnering with beauty retailer Sephora to bring 850 shop-in-shops to Kohl’s locations.

- Target announced in February 2021 that it will open Apple mini shops in 17 of its stores by the end of the fall. Target is also partnering with Ulta Beauty to bring shop-in-shops to 100 of its stores, which it announced in November 2020.

- Neighborhood Goods has its own restaurants in each of its locations and reported that its restaurants bring consumers into its stores.

- Restoration Hardware has opened four- and five-star restaurants at seven of its locations. The company reported that its restaurants are revenue generators and traffic drivers.

- Kohl’s partnered with Amazon in 2017 to allow consumers to make returns at Kohl’s stores. The company reported in its fourth-quarter earnings report for fiscal 2020 (dated March 2, 2021) that its Amazon Returns program helped bring in 2 million new customers to Kohl’s in fiscal 2020 and drove traffic to the store.

- Activewear retailer Lululemon is known not only for its activewear but as a leader in the sports community, as the company hosts weekly runs, holds yoga classes and sponsors annual events including marathons, yoga festivals and 10-kilometer races.

A Lululemon Global Ambassador teaching yoga at the Lincoln Park Store, Chicago, in February 2020

A Lululemon Global Ambassador teaching yoga at the Lincoln Park Store, Chicago, in February 2020Source: Instagram[/caption] We expect department stores to continue to partner with retailers and offer food and other services to make their physical stores more appealing destinations for consumers. They are likely to do this on a localized basis, and then determine which models are traffic drivers and have the potential to be replicated in other markets. For example, one store may include a favorite local coffee shop or diner in a smaller-format store, which may attract customers to eat or drink and then shop, while another store may collaborate with a local nail salon. A fitness-focused department store may partner with a local runners’ club to attract consumers at specific times every week; and a fashion-focused department store can host a fashion series or contest if there is a leading fashion school in the area with emerging designers. 2. Specialized Stores: Assortment, Categories and Value The department store will no longer be everything to everyone. Consumers are looking for one, or a combination, of three main qualities: value, brand affinity and design/fit. Consumers are shopping less for middle-market mass apparel, so department stores will need to become more specialized in the categories they serve, the brands and designs they sell and the value that they bring, in order to remain competitive. The three major US department store retailers have recognized these shifts in consumer spending and are making moves to specialize in value, category and assortment. Macy’s and Nordstrom reported that their consumers are polarized in spending across value and luxury, with opportunities in both channels. Macy’s reported on an earnings call in November 2020 that the luxury trend has continued across Macy’s and Bloomingdale’s as the consumer has shifted spending from experiences to products, and the company’s Backstage store-within-store locations were also performing well. Nordstrom reported at its Investor Day in February 2021 that it performed a robust evaluation of its customers, reporting strength in its luxury customer base; the company sees opportunities to grow its value segment at Nordstrom Rack for the consumer that is more focused on price. Kohl’s is focusing on activewear, a trending category, aiming to increase the category from 20% to 30% of its business. Nordstrom is also focusing on athleisure, performance wear and fitness gear categories, introducing new brands and products. Nordstrom announced on March 1 that it is partnering with smart home gym and fitness trainer Tonal to bring the experience into 40 of its stores. This is an example of the company further specializing in fitness, and expanding into a new area of consumer experience. [caption id="attachment_128628" align="aligncenter" width="720"]

Tonal inside a Nordstrom store

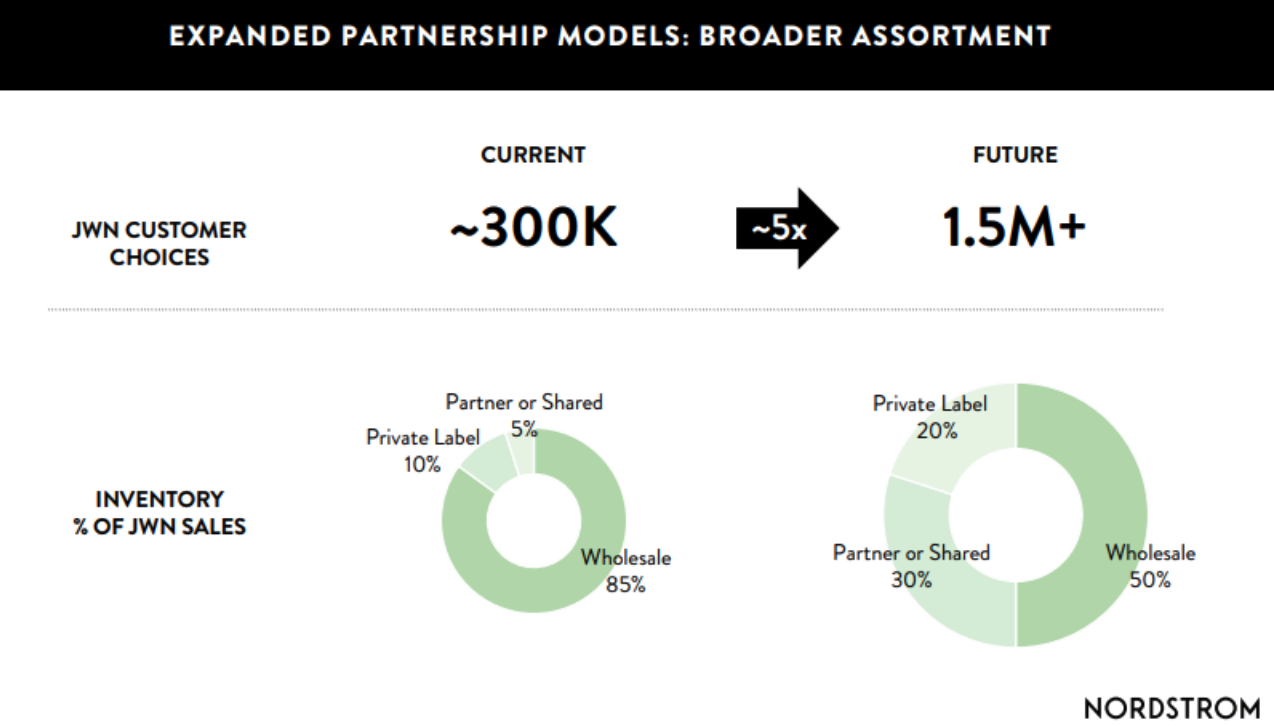

Tonal inside a Nordstrom storeSource: Nordstrom [/caption] Furthermore, Nordstrom Rack, Nordstrom’s off-price model, has specialized its “price, brand and hybrid” stores depending on the geographic market they serve, to attract new consumers to the brand. This same trend could apply to full-price department stores. In order to stay competitive, we expect department stores to further specialize in local markets. 3. Endless Aisle Inventory: Online Expansion We expect department stores to broaden their online catalogs to get a bigger piece of the digital pie—attracting new customers by adding merchandise options not offered in-store. Online expansion provides several benefits for the department store and its customers. It allows department stores to add greater category depth by offering consumers additional styles, brands and designers online that the department store does not have physical space to carry in its inventory or in-store. Nordstrom reported at its recent Investor Day that the company is going to increase its online assortment from approximately 300,000 customer choices to more than 1.5 million over the next three to five years. This will reflect its transition from a store-based model to a digital-first merchandising model. Nordstrom generates more than 50% of its sales digitally and is focusing on building out is product catalog online. The company said that today, its total online business is three times what is offered in its physical stores; in the future, Nordstrom sees potential for its online assortment to be 20 times what is offered in stores. [caption id="attachment_128629" align="aligncenter" width="720"]

Source: Nordstrom[/caption]

Macy’s reported in its quarterly earnings report in February 2021 that it plans to grow its online business to $10 billion by 2023, up from $3 billion in 2020.

4. New Partnership Models: Less Inventory Held Through New Models

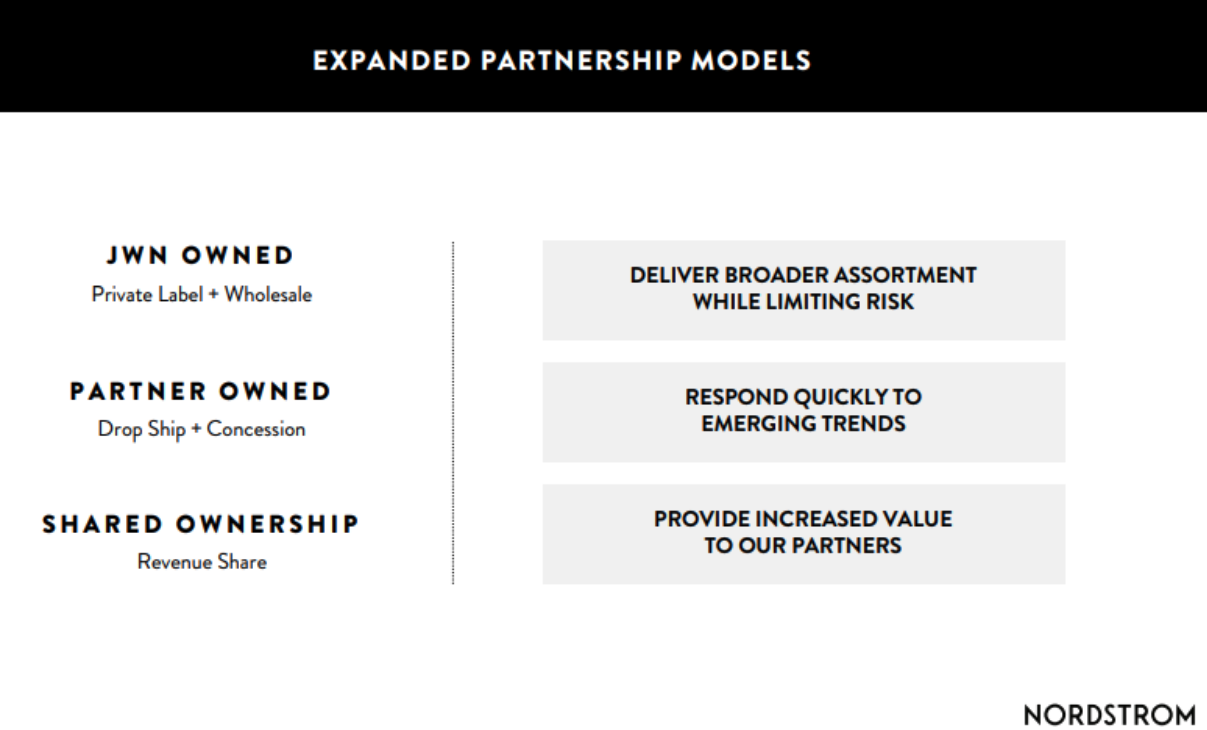

Through the shift to digital, department stores will hold less inventory from outside vendors, reducing risk and exposure. This will be achieved by reducing wholesale arrangements and increasing more revenue-sharing arrangements, including dropshipping and revenue-sharing models. Nordstrom announced at its recent Investor Day that it is reducing its wholesale arrangements from 85% to 50%, increasing partner or shared arrangements from 5% to 30%, and increasing its private-label business from 10% to 20%.

[caption id="attachment_128630" align="aligncenter" width="720"]

Source: Nordstrom[/caption]

Macy’s reported in its quarterly earnings report in February 2021 that it plans to grow its online business to $10 billion by 2023, up from $3 billion in 2020.

4. New Partnership Models: Less Inventory Held Through New Models

Through the shift to digital, department stores will hold less inventory from outside vendors, reducing risk and exposure. This will be achieved by reducing wholesale arrangements and increasing more revenue-sharing arrangements, including dropshipping and revenue-sharing models. Nordstrom announced at its recent Investor Day that it is reducing its wholesale arrangements from 85% to 50%, increasing partner or shared arrangements from 5% to 30%, and increasing its private-label business from 10% to 20%.

[caption id="attachment_128630" align="aligncenter" width="720"] Source: Nordstrom[/caption]

New partnership models are a trend that we expect to take hold across the department store sector and wider retail industry, as retailers are seeking to increase efficiency.

Macy’s reported that delivery costs, specifically carrier costs, comprised one of its biggest costs associated with digital in the fourth quarter of fiscal 2020. Working with third parties in dropshipping arrangements would help offset some of these costs.

5. Stores as Fulfillment Hubs To Increase Efficiency and Reduce Shipping Costs

The department store will evolve into a fulfillment and services hub in order to stay competitive. The role of the retail store has been changing to serve more purposes than a consumer-facing retail service center for shopping and order pickup. In order to maximize efficiency, retailers are increasingly using stores to fulfill digital orders to help to reduce the cost of shipping. Therefore, retail stores are becoming micro-fulfillment centers for digital orders. In order for department store retailers to remain competitive and make the most use of its physical store space and increase online sales, they will need to evolve stores into fulfillment centers and service hubs.

Below, we provide an industry example from a big-box retailer Target, which has been transitioning its stores to fulfillment hubs since 2017 and is seen as an industry leader in digital and physical store integration.

Target’s store-as-a-hub model sees its stores fulfill over 75% of digital orders. This model is the foundational element of the company’s strategic plan, which it announced at the beginning of 2017. Target is leveraging its stores to reduce the cost of shipping while also offering multiple ways to fulfill orders through its fully integrated digital and physical store capabilities—such as BOPIS (buy online, pick up in-store), ship from store and same-day delivery.

Retailers are analyzing Target’s digital and physical integration playbook, as the company’s comparable sales increased by 19.3% year over year for fiscal 2020, with store comps up 7.2% and digital comps up 145%, as reported on Target’s fourth-quarter earnings call on March 2, 2021. Digital same-day services grew by 235% for the year—an increase of $10 billion—and the company gained $9 billion in market share. Within digital, Target said that it saw 600% growth in drive-up services and that the typical customer purchased 30% more when they used drive-up services. Management highlighted that even order pickup, which has been around for years, grew at 70% in fiscal year 2020. Shipt, the company’s same-day delivery service, grew more than 300%.

Target ships orders from the back of its local stores; the company reported that this saves 40% of the cost of shipping from a warehouse, which is an economic advantage as digital sales account for a high proportion of total revenue. Between same-day services and packages shipped to customers, about 75% of digital sales were fulfilled by stores, the company stated in its third-quarter 2020 earnings report released in November 2020.

Source: Nordstrom[/caption]

New partnership models are a trend that we expect to take hold across the department store sector and wider retail industry, as retailers are seeking to increase efficiency.

Macy’s reported that delivery costs, specifically carrier costs, comprised one of its biggest costs associated with digital in the fourth quarter of fiscal 2020. Working with third parties in dropshipping arrangements would help offset some of these costs.

5. Stores as Fulfillment Hubs To Increase Efficiency and Reduce Shipping Costs

The department store will evolve into a fulfillment and services hub in order to stay competitive. The role of the retail store has been changing to serve more purposes than a consumer-facing retail service center for shopping and order pickup. In order to maximize efficiency, retailers are increasingly using stores to fulfill digital orders to help to reduce the cost of shipping. Therefore, retail stores are becoming micro-fulfillment centers for digital orders. In order for department store retailers to remain competitive and make the most use of its physical store space and increase online sales, they will need to evolve stores into fulfillment centers and service hubs.

Below, we provide an industry example from a big-box retailer Target, which has been transitioning its stores to fulfillment hubs since 2017 and is seen as an industry leader in digital and physical store integration.

Target’s store-as-a-hub model sees its stores fulfill over 75% of digital orders. This model is the foundational element of the company’s strategic plan, which it announced at the beginning of 2017. Target is leveraging its stores to reduce the cost of shipping while also offering multiple ways to fulfill orders through its fully integrated digital and physical store capabilities—such as BOPIS (buy online, pick up in-store), ship from store and same-day delivery.

Retailers are analyzing Target’s digital and physical integration playbook, as the company’s comparable sales increased by 19.3% year over year for fiscal 2020, with store comps up 7.2% and digital comps up 145%, as reported on Target’s fourth-quarter earnings call on March 2, 2021. Digital same-day services grew by 235% for the year—an increase of $10 billion—and the company gained $9 billion in market share. Within digital, Target said that it saw 600% growth in drive-up services and that the typical customer purchased 30% more when they used drive-up services. Management highlighted that even order pickup, which has been around for years, grew at 70% in fiscal year 2020. Shipt, the company’s same-day delivery service, grew more than 300%.

Target ships orders from the back of its local stores; the company reported that this saves 40% of the cost of shipping from a warehouse, which is an economic advantage as digital sales account for a high proportion of total revenue. Between same-day services and packages shipped to customers, about 75% of digital sales were fulfilled by stores, the company stated in its third-quarter 2020 earnings report released in November 2020.