Web Developers

Technology team attended JCPenney’s analyst meeting today in Plano, TX. CEO Marvin Ellison commented that the company has been saved and stabilized, that its management team has been modernized and upgraded, and that its strategy has been clarified. The company is ready to pursue growth and profitability again, he said.

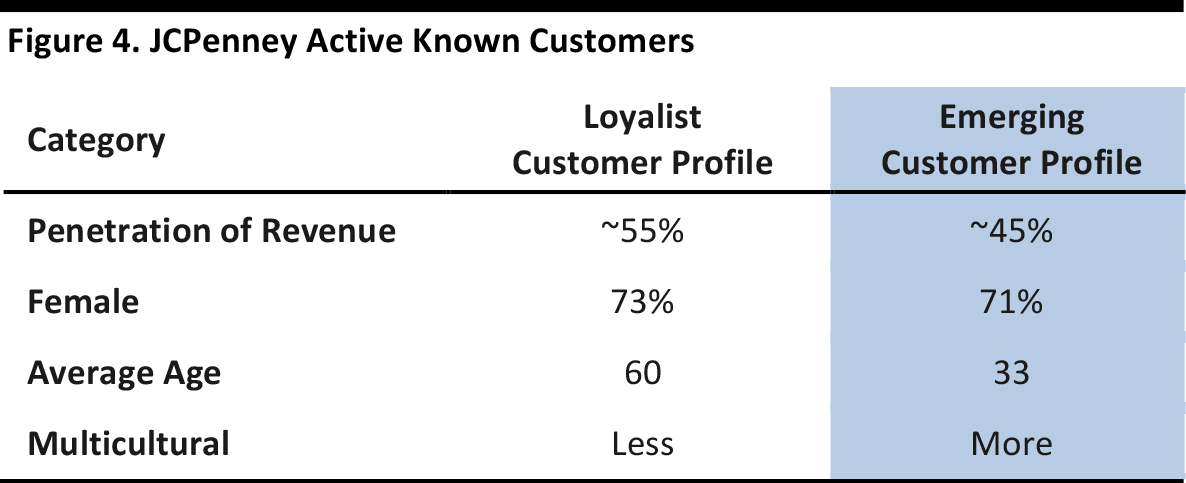

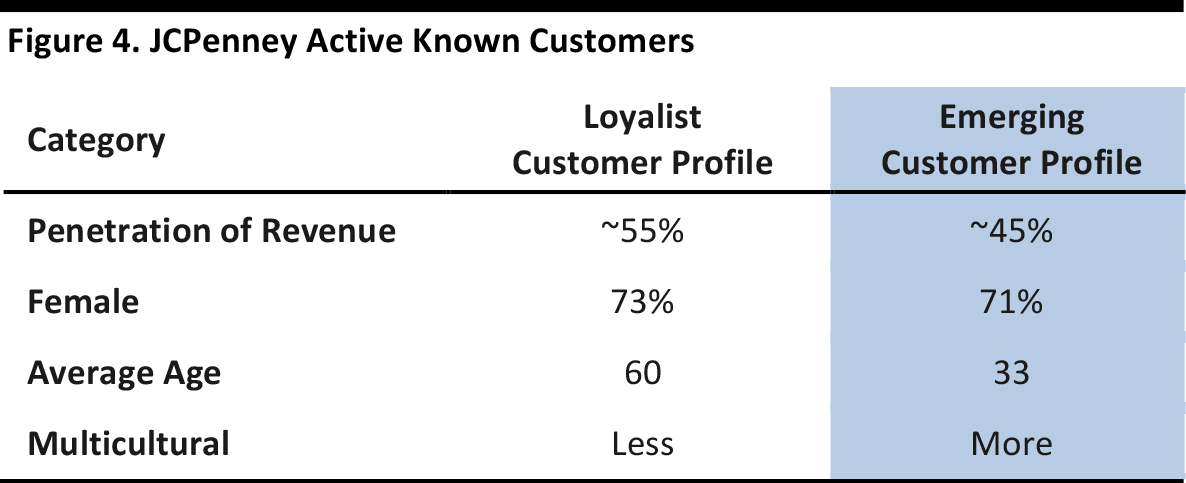

The management team is targeting the emerging JCPenney customer profile, who is a 33-year-old multicultural mom, and the team provided its strategy to target and keep her as a customer (women resembling this demographic profile account for 45% of the company’s sales). JCPenney’s medium-term strategy centers on understanding this customer, giving her what she wants, helping her find what she wants quickly, serving her needs both in-store and online, and delivering profitable results.

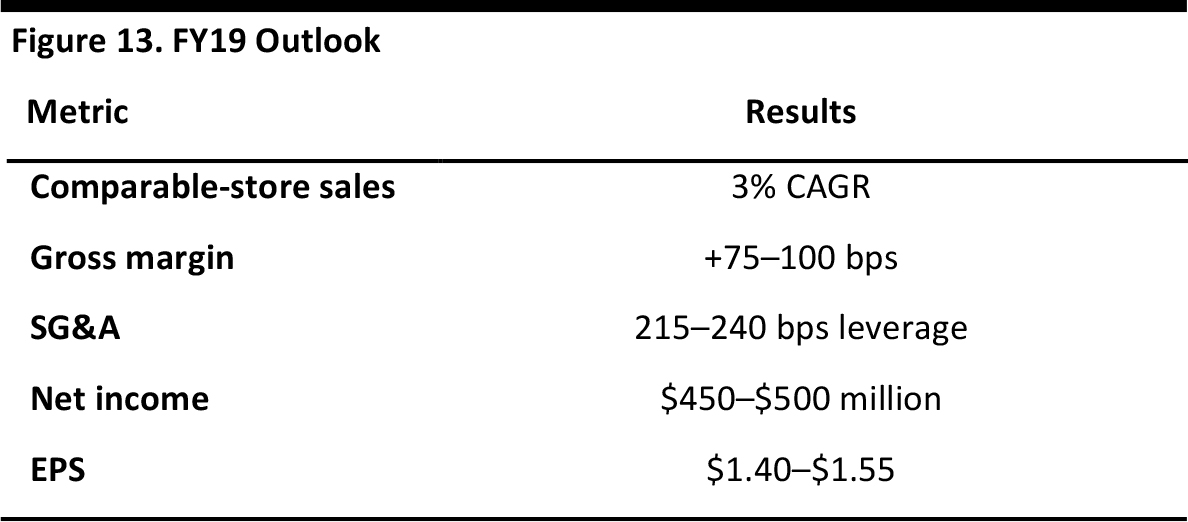

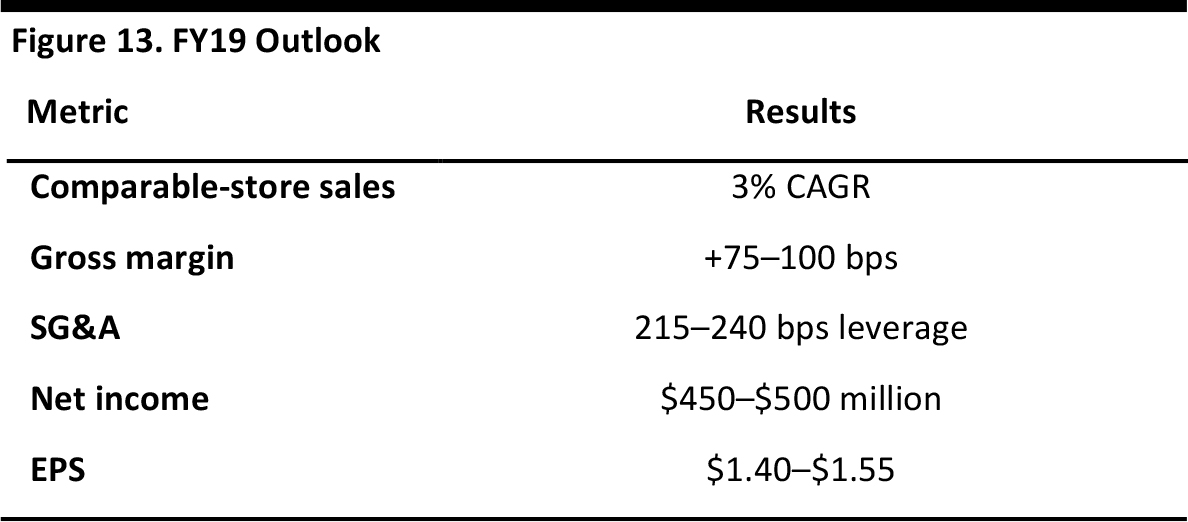

Although JCPenney has turned the corner, there is much work to do on the financial side, and the company is targeting a combination of revenue growth, gross margin expansion and expense reduction that should enable it to return to profitability this year and to generate EPS of $1.40–$1.55 in 2019.

CEO MARVIN ELLISON’S REMARKS

Marvin Ellison stated the goals for today’s analyst meeting:- Clarify the company’s strategic focus

- Define how JCPenney will remain relevant

- Outline the company’s financial targets beyond just achieving $1.2 billion in EBITDA next year

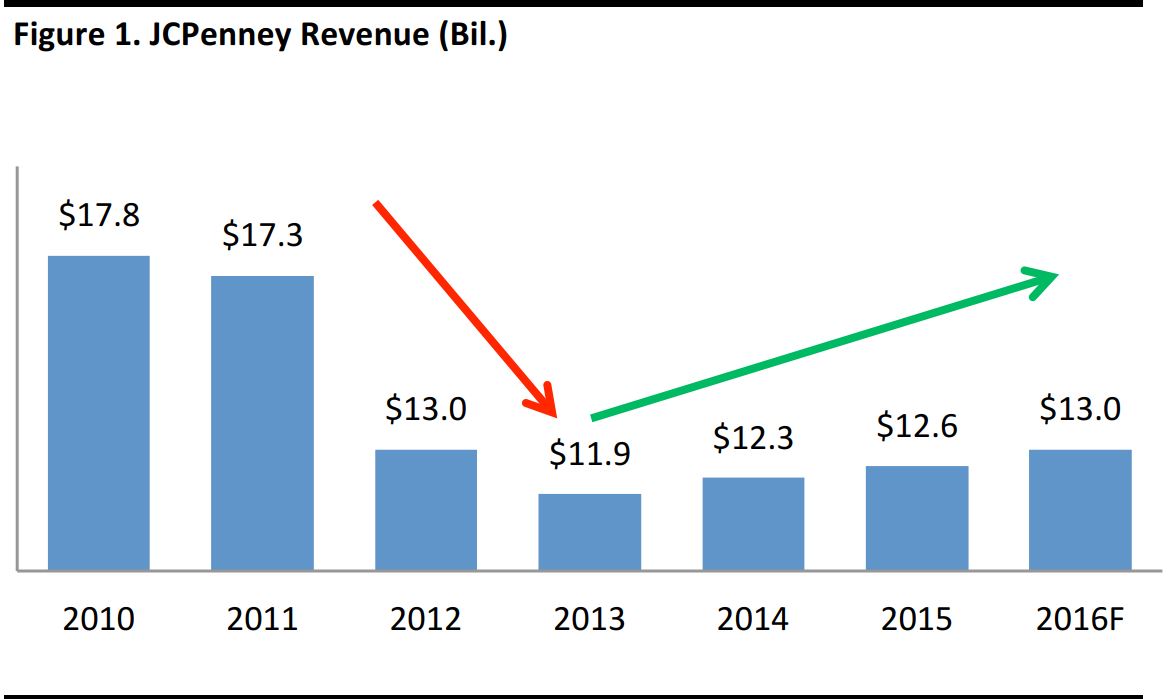

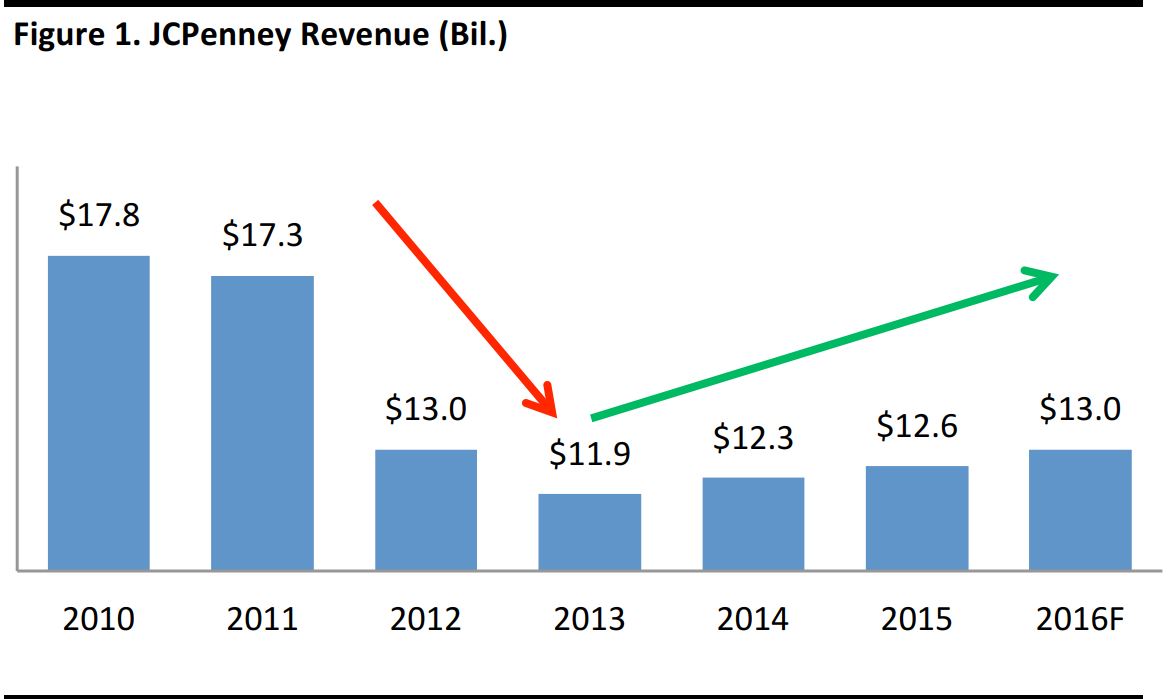

- The current environment appears quite negative for retailers, with headlines detailing mall closures, claiming that brick-and-mortar is dead and discussing how the Internet is hurting department stores. JCPenney’s annual revenues sharply declined in recent years, hitting a trough in 2013 before beginning to recover in 2014.

Source: Company reports

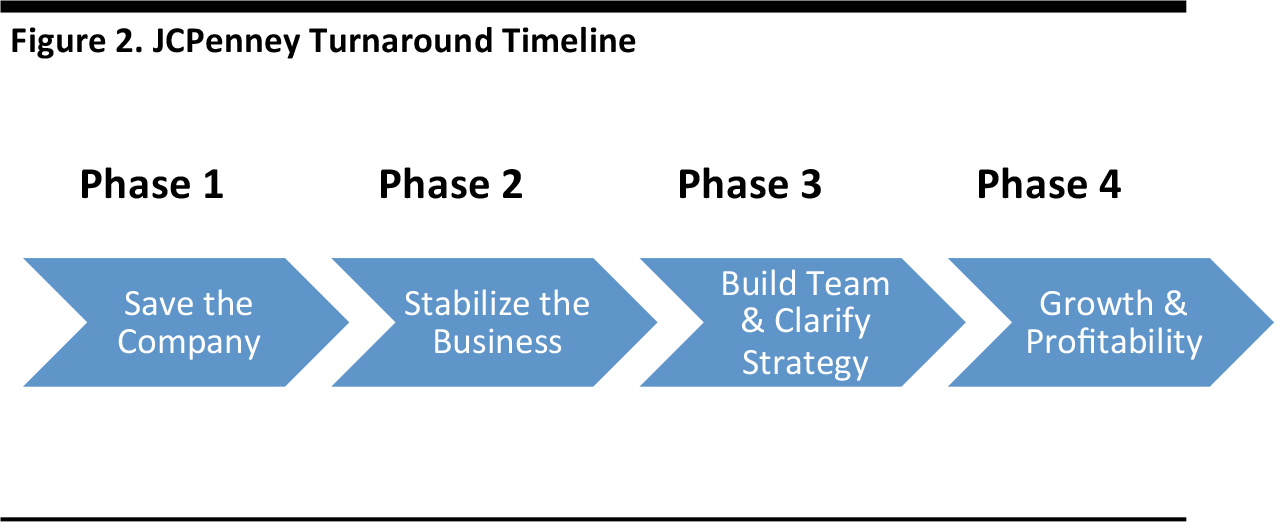

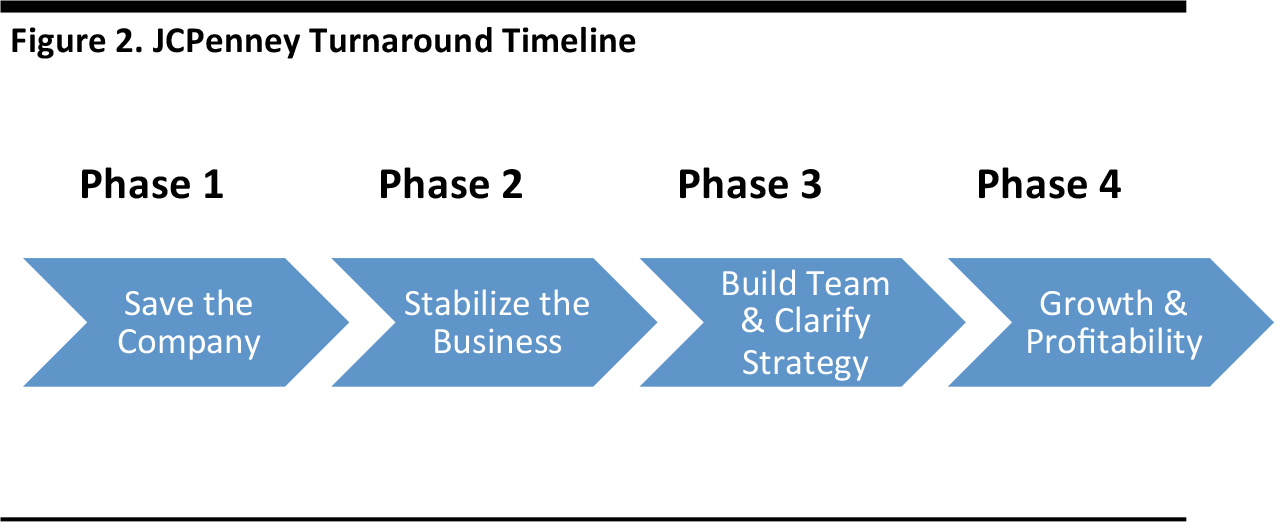

Ellison outlined the company’s timeline for a turnaround, as shown in the figure below.

Source: Company presentation

Now that the company has been saved and the business stabilized, the team built and the strategy clarified, management can focus on returning to growth and improving profitability. To achieve that goal, Ellison outlined five “steps to success,” which represent the major topics covered in today’s meeting:- Understand the customer

- Give the customer what she wants

- Help her find what she wants quickly

- Serve her needs both in-store and online

- Deliver profitable results

Understand the Customer—Mary Beth West, EVP, Chief Customer and Marketing Officer

Mary Beth West divided her remarks into four parts:- Brand platform

- Serving our customers

- Marketing strategies

- Loyalty program

Source: Company presentation

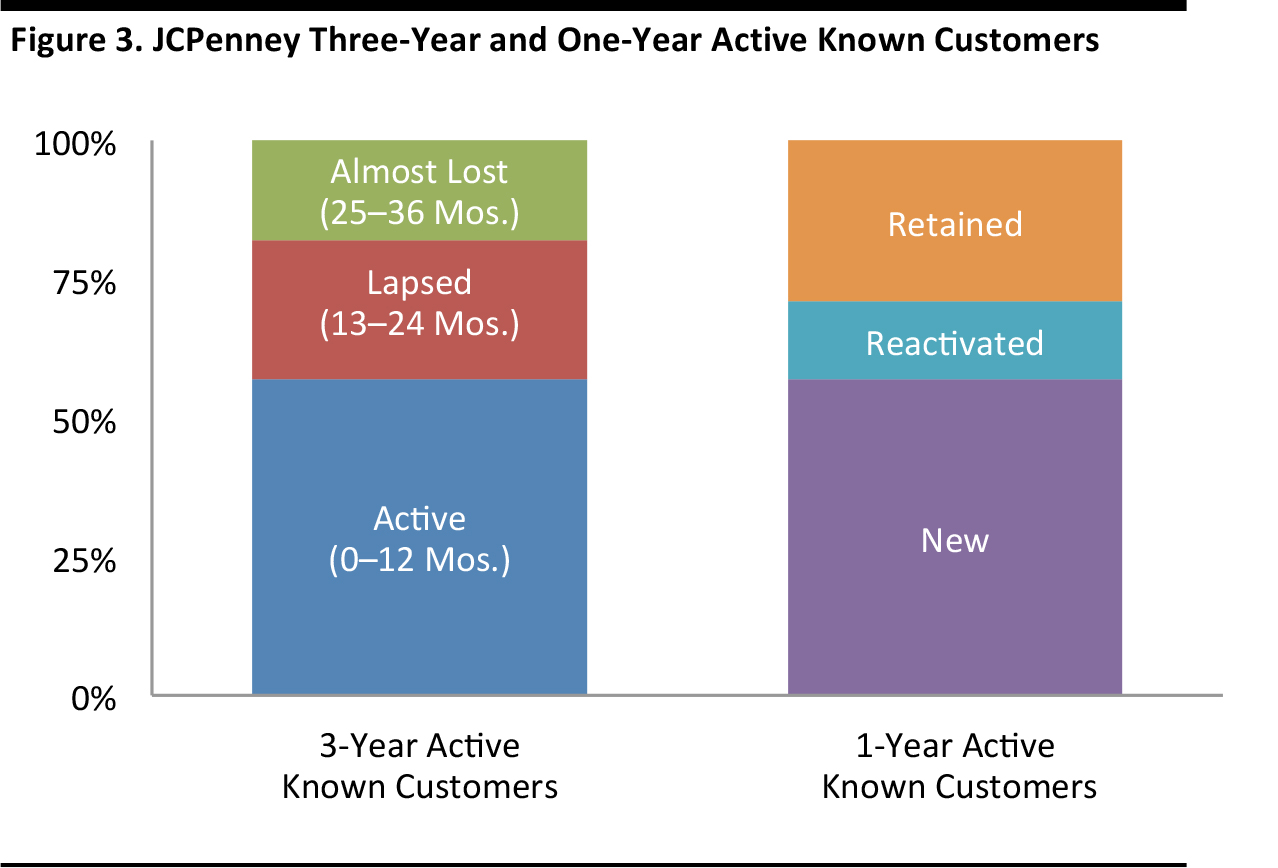

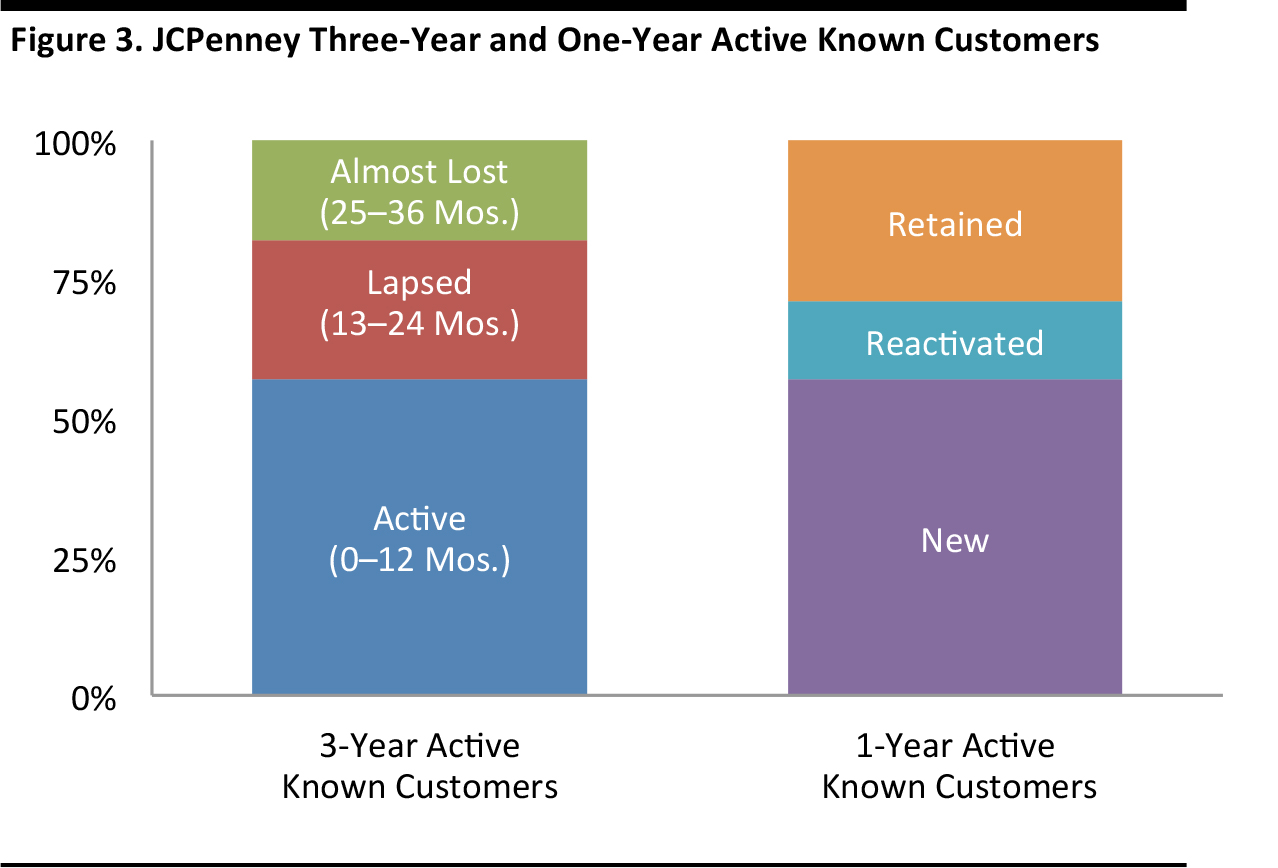

JCPenney has a name, address and payment method on file for its active known customers (which represent 75% of sales). The table below breaks down JCPenney’s typical loyalist customers, as well as its emerging customers (which the company is targeting).

Source: Company presentation

The average JCPenney customer is female, so management consistently referred to the typical customer as a “she” during the meeting. The company has profiled this emerging customer as the “Modern American Mom” (MAM); customers fitting this profile account for 45% of sales, and their share is growing. The MAM has the following additional characteristics (bolding is company’s own):- She is a modern woman…with modern tastes, behaviors and expectations

- She is representative of today’s multicultural America

- She is a mom

- Creating disruption

- Providing utility

- Attaching to culture

- Delivering experiences

- Reinventing the loyalty program

- Understanding its customer

- Capitalizing on growing consumer trends

- Balancing retention and acquisition

- Rewarding her loyalty

Give the Customer What She Wants—John Tighe, Chief Merchant

John Tighe outlined JCPenney’s merchandising strategy:- Win with value

- Be her beauty solution

- Become a destination for special sizes

- Refresh her home

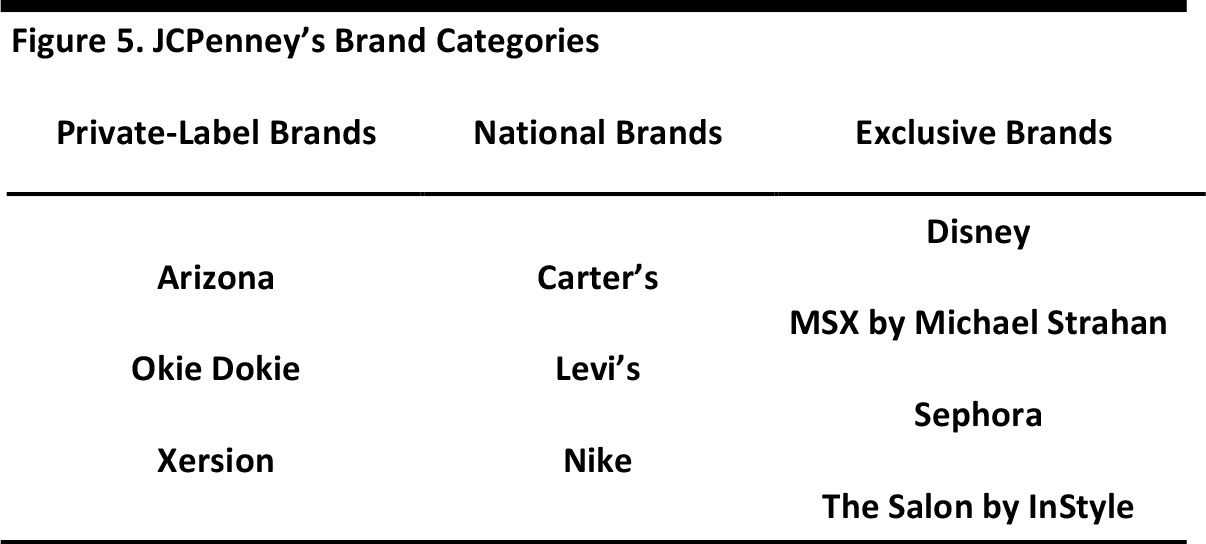

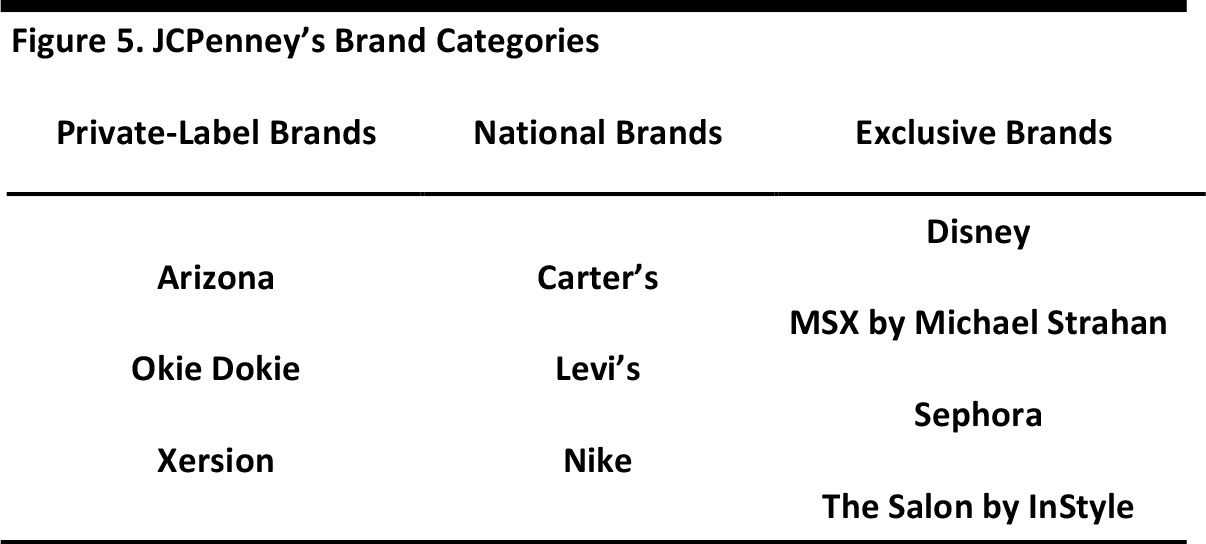

Source: Company presentation

Indeed, the penetration of private labels is expected to grow from 52% in 2015, to 55%–60% in 2016, to 60%–65% in 2017, to 65%–70% in 2017. Tighe showed several examples of private-label products that are comparable to national-brand products, but are priced as low as half as much. The company’s private-brand portfolio also includes household appliances such as its Cooks brand of coffeemakers. Be Her Beauty Solution Tighe outlined JCPenney’s exclusive agreement with Sephora, under which Sephora stores-within-stores are contained within JCPenney stores. Become a Destination for Special Sizes “Special sizes” is JCPenney’s term for plus sizes, and the company offers the following special-sizes brands:- Boy Husky

- Juniors’ Plus

- Boutique+ (for women)

- The Foundry Supply Co. (for men; #3 in terms of market share)

- Appliances

- Ashley Furniture

- Empire Today flooring

- Soft home

- Window coverings

Help Her Find What She Wants Quickly—Joe McFarland, EVP, Stores

Joe McFarland outlined four ways in which JCPenney can help its customer shop more efficiently:- Simplification

- Customer service

- Technology

- In-store experiences

Mike Amend—EVP, Omnichannel

Mike Amend noted that JCPenney’s omni-channel/technology enhancements in 2016 include providing customers with the option to:- Buy online, pick up in store

- Make salon appointments and receive coupons on a smartphone

Source: Company presentation

Serve Her Needs Both In-Store and Online—Mike Robbins, EVP, Supply Chain

As of 2015, JCPenney’s supply chain was siloed; planning and allocation was separate from sourcing and from logistics and fulfillment. For 2016–2019, however, focus areas include:- Ship to store: improving shipment times from the current four–seven days to one–two days

- Save the sale: if a particular fulfillment center is out of stock, an item can be shipped from another store to the customer

- Organizational alignment

- Omni-channel growth and profitability

- Global initiatives to drive in-stocks, speed and gross margin

- Technology enhancements

Deliver Profitable Results—Ed Record, Chief Financial Officer

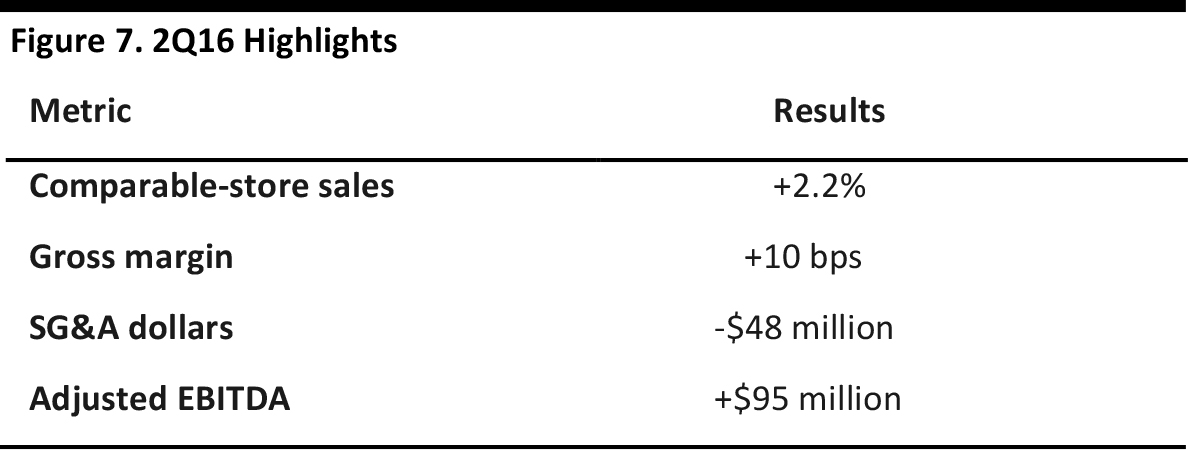

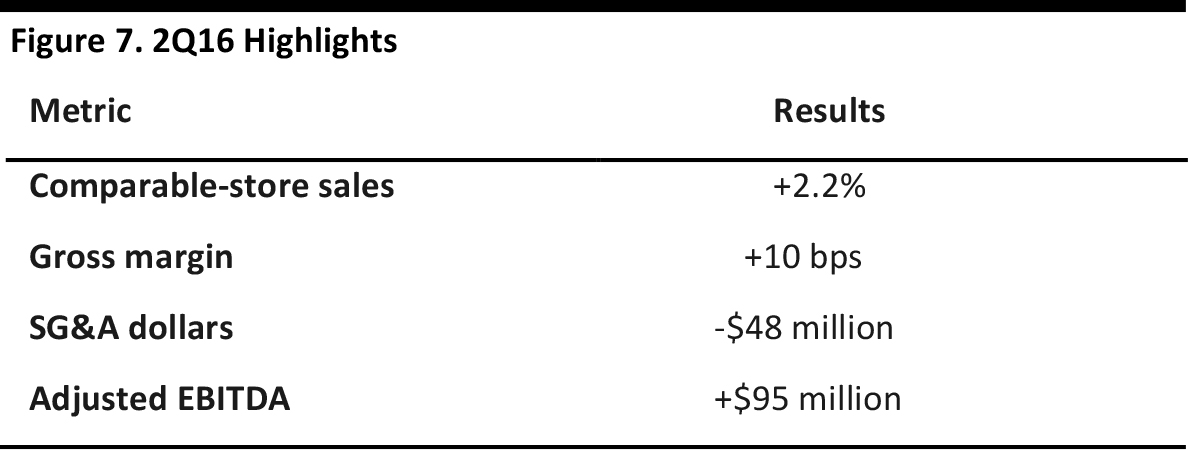

2016 Financial Review Ed Record offered some highlights from the second quarter:

Source: Company presentation

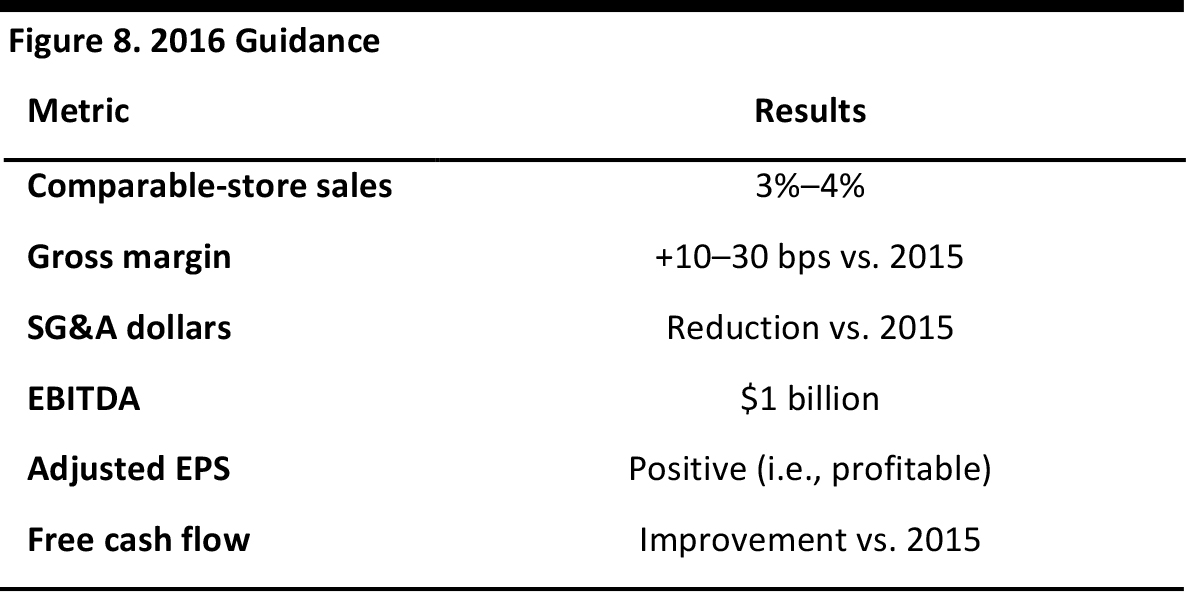

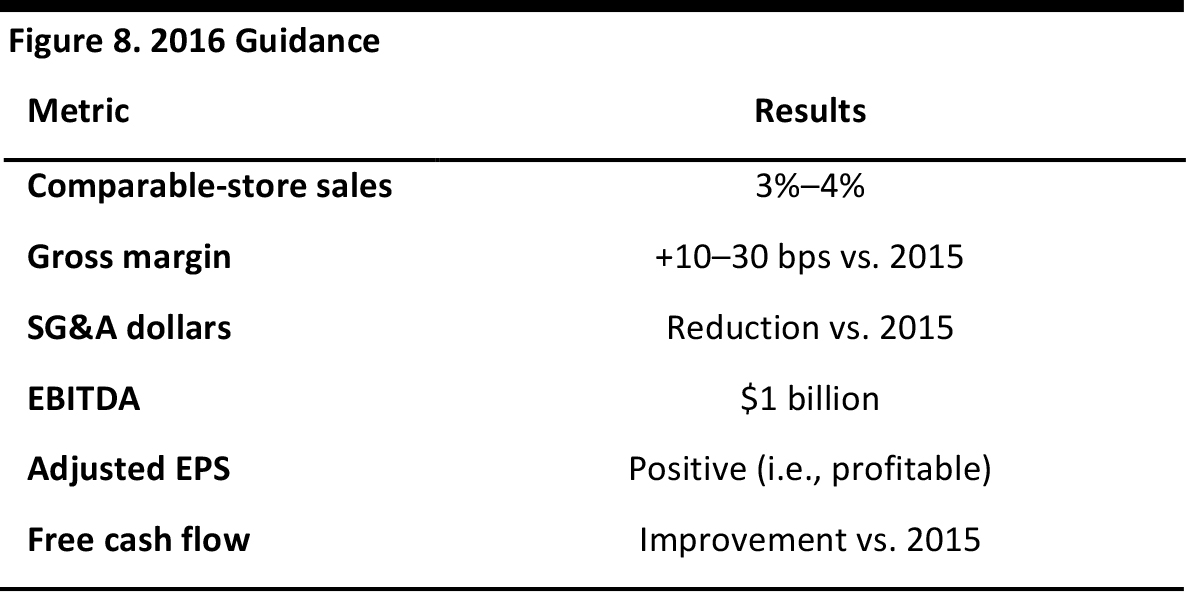

JCPenney’s 2.2% comps in the second quarter were superior to the competitor average of (2.7)%. Record also reiterated the company’s 2016 guidance:

Source: Company presentation

Record also highlighted that JCPenney’s EBITDA has exceeded the forecast provided at the company’s analyst meeting two years ago. Business Drivers Record outlined several revenue opportunities that could contribute $1.2–$1.7 billion of revenue during 2016–2019:

Source: Company presentation

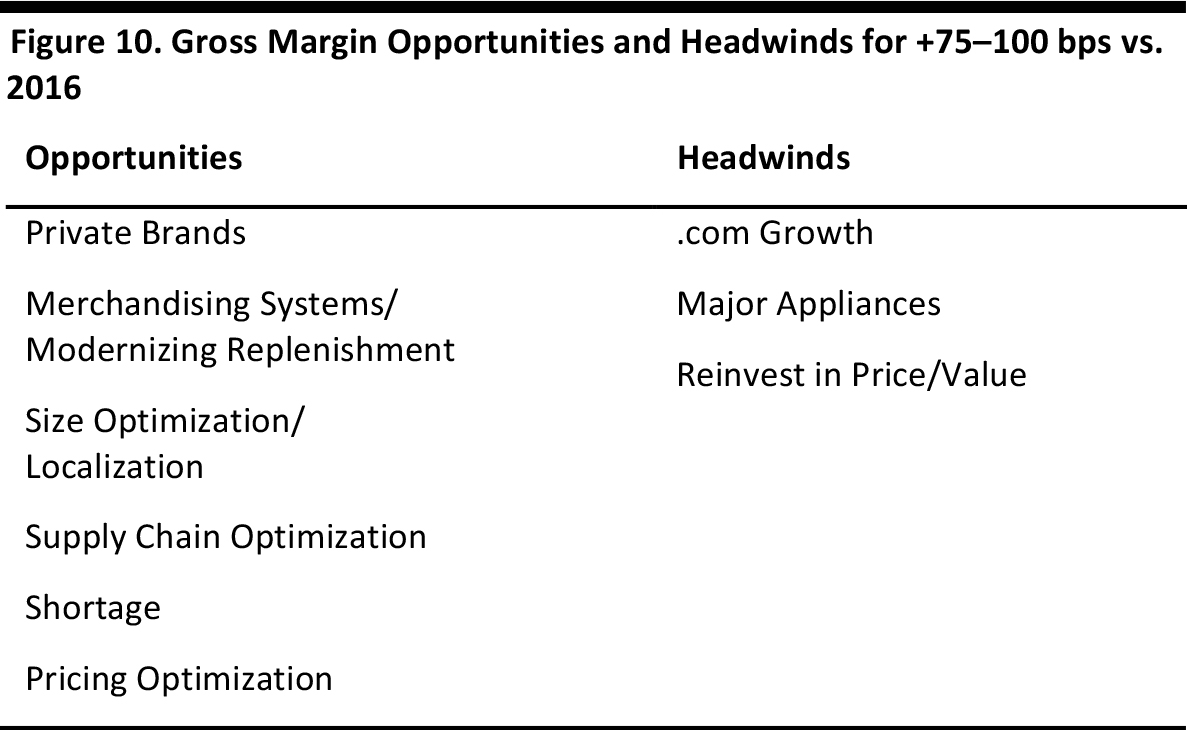

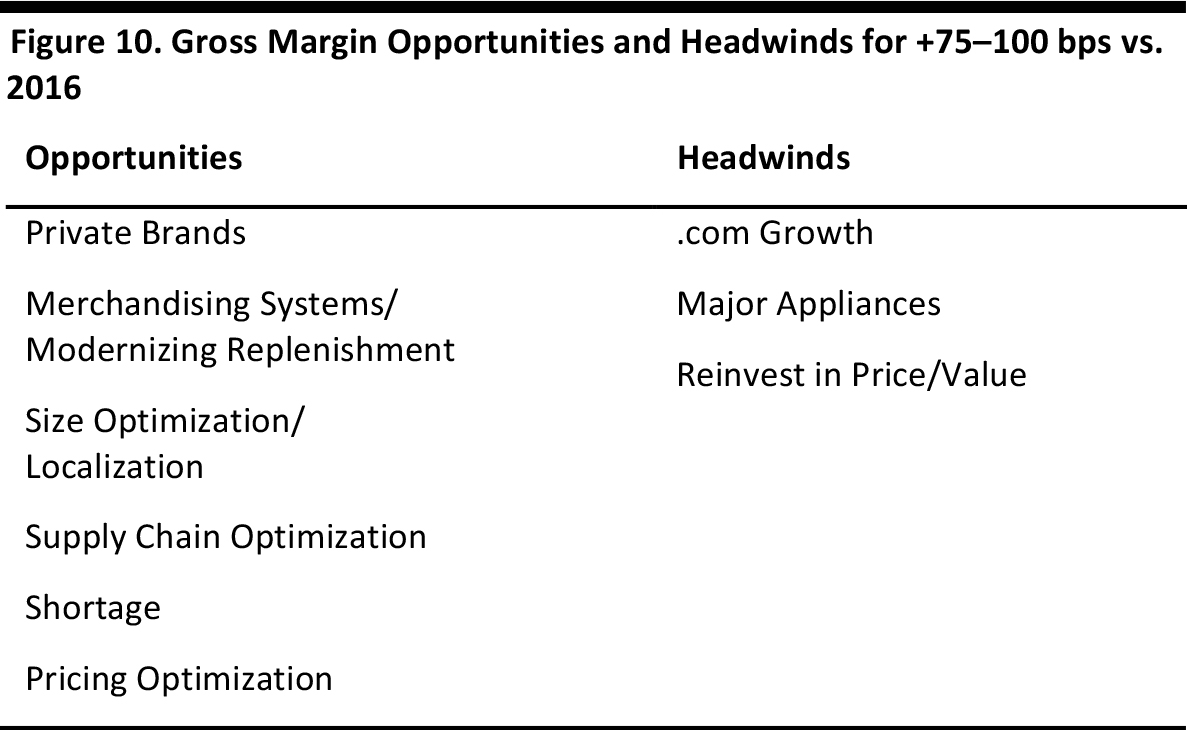

At the same time, management envisions opportunities to improve gross margins, which may be offset by certain headwinds:

Source: Company presentation

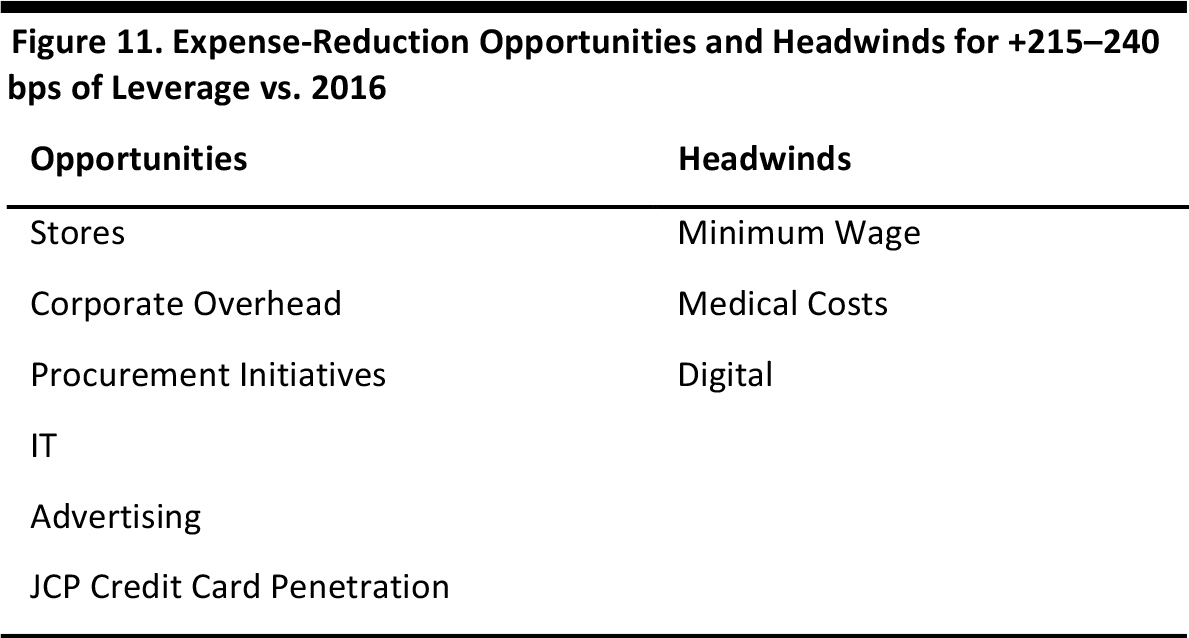

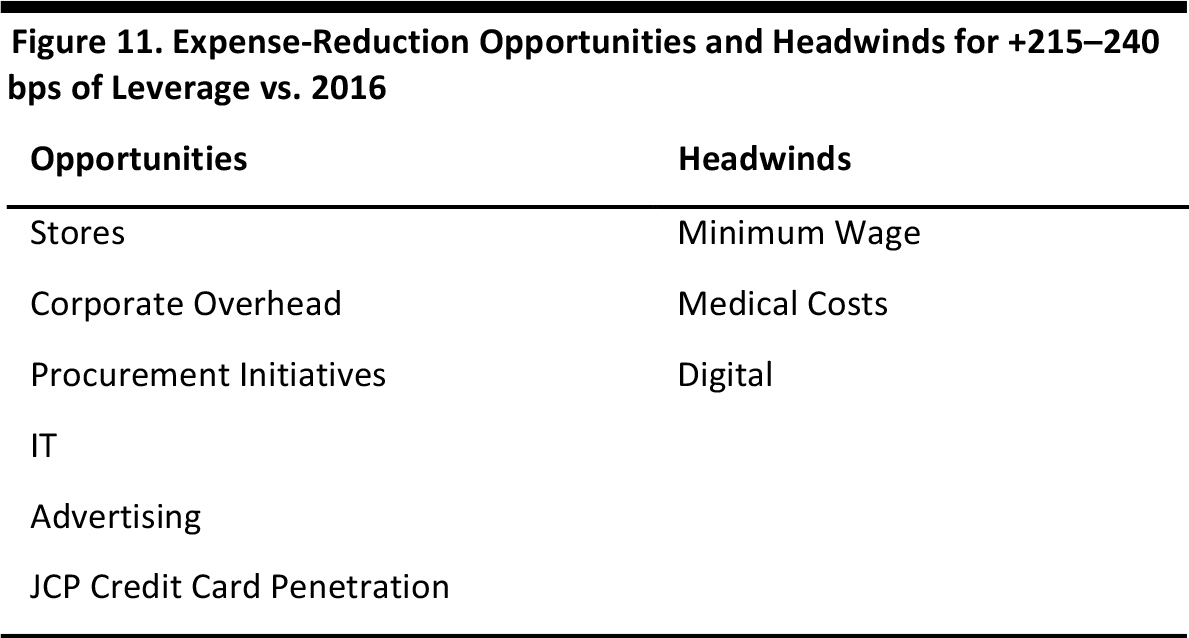

Moreover, there are several opportunities to reduce expenses (which, again, may be offset by headwinds):

Source: Company presentation

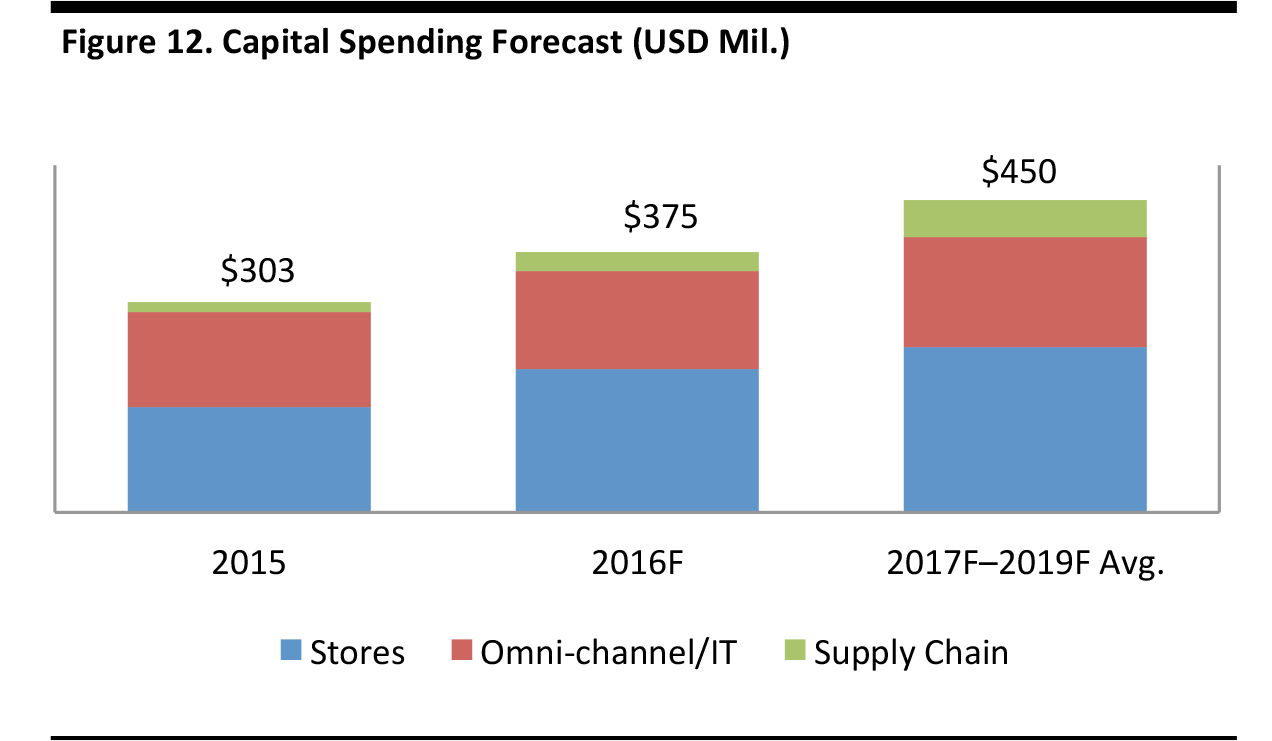

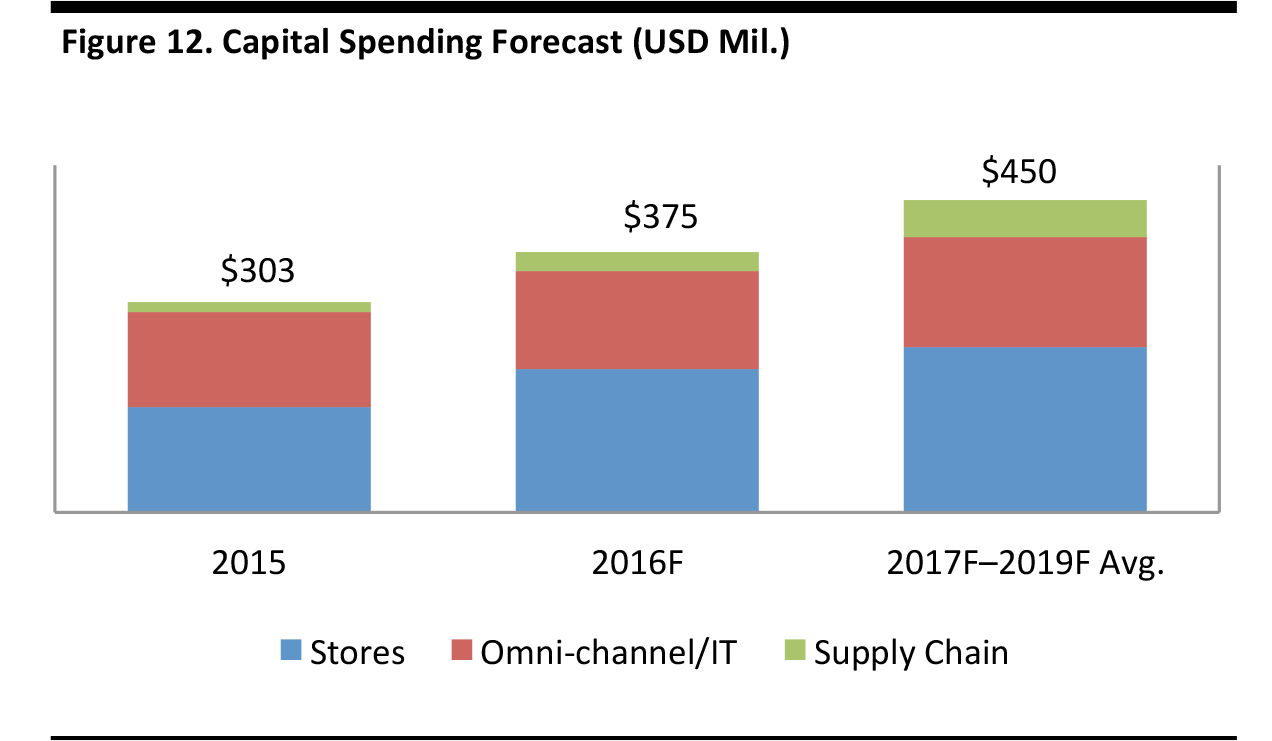

At the same time, JCPenney plans to step up capital spending to fuel growth.

Source: Company presentation

Finally, Record provided the company’s forecast for 2019: