Introduction

The retail space in the UK has been marked by numerous retailers entering administration over the last year. Among those was 169-year-old British department store retailer House of Fraser. With House of Fraser’s owner Sanpower apparently unwilling to put new money into the business and in the absence of a rescue deal, Sports Direct finally bought the beleaguered retailer for £90 million on August 10, 2018.

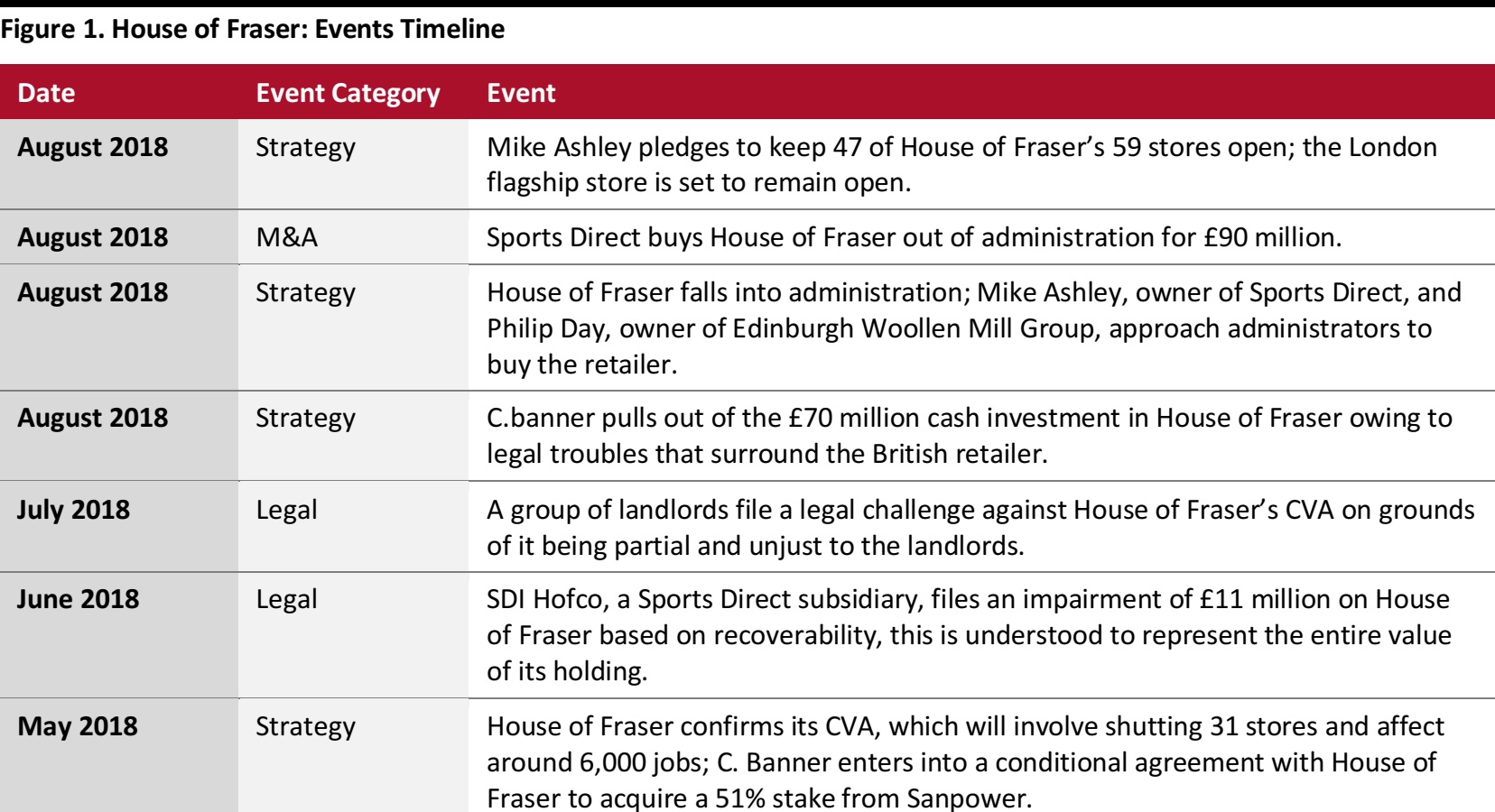

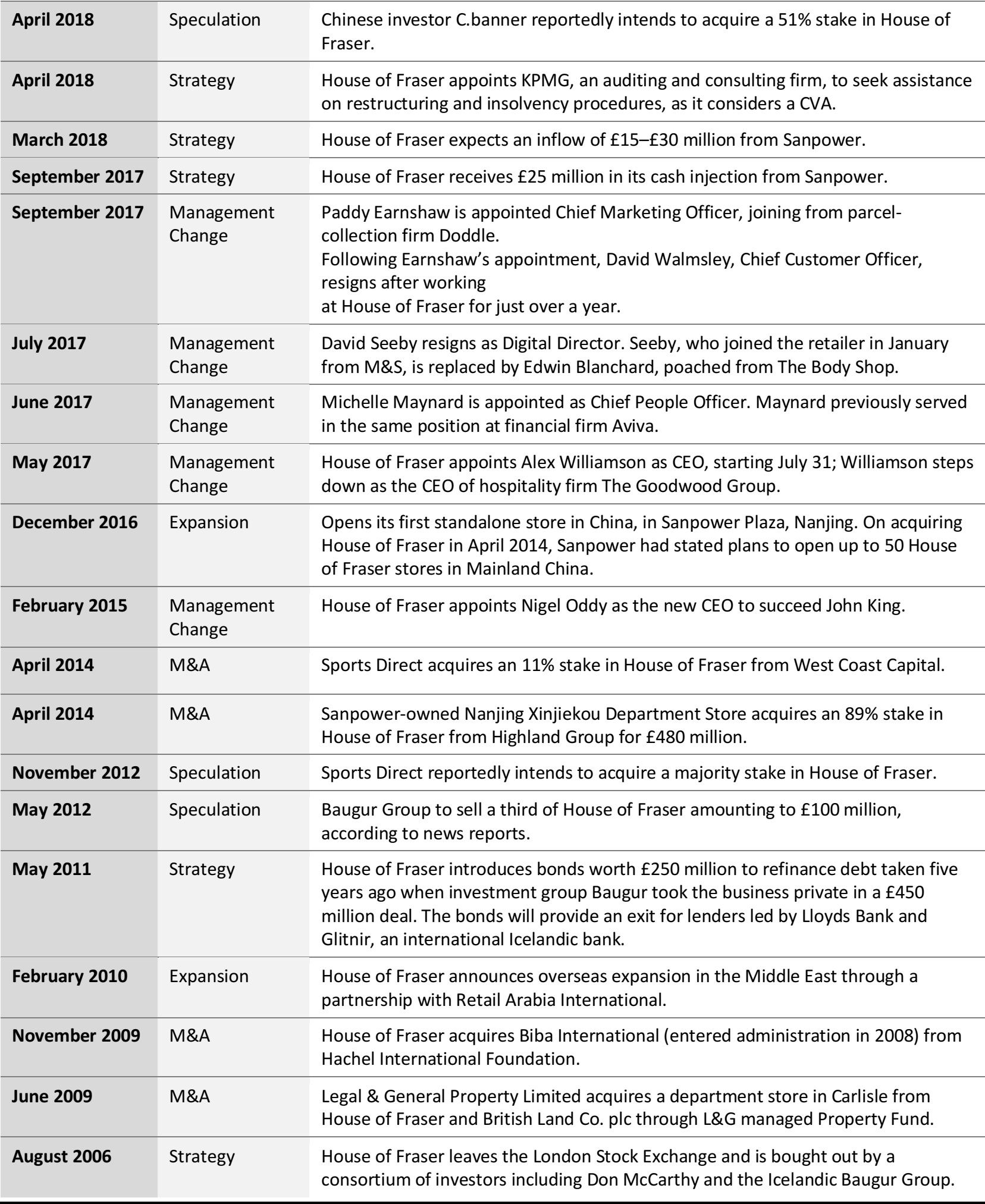

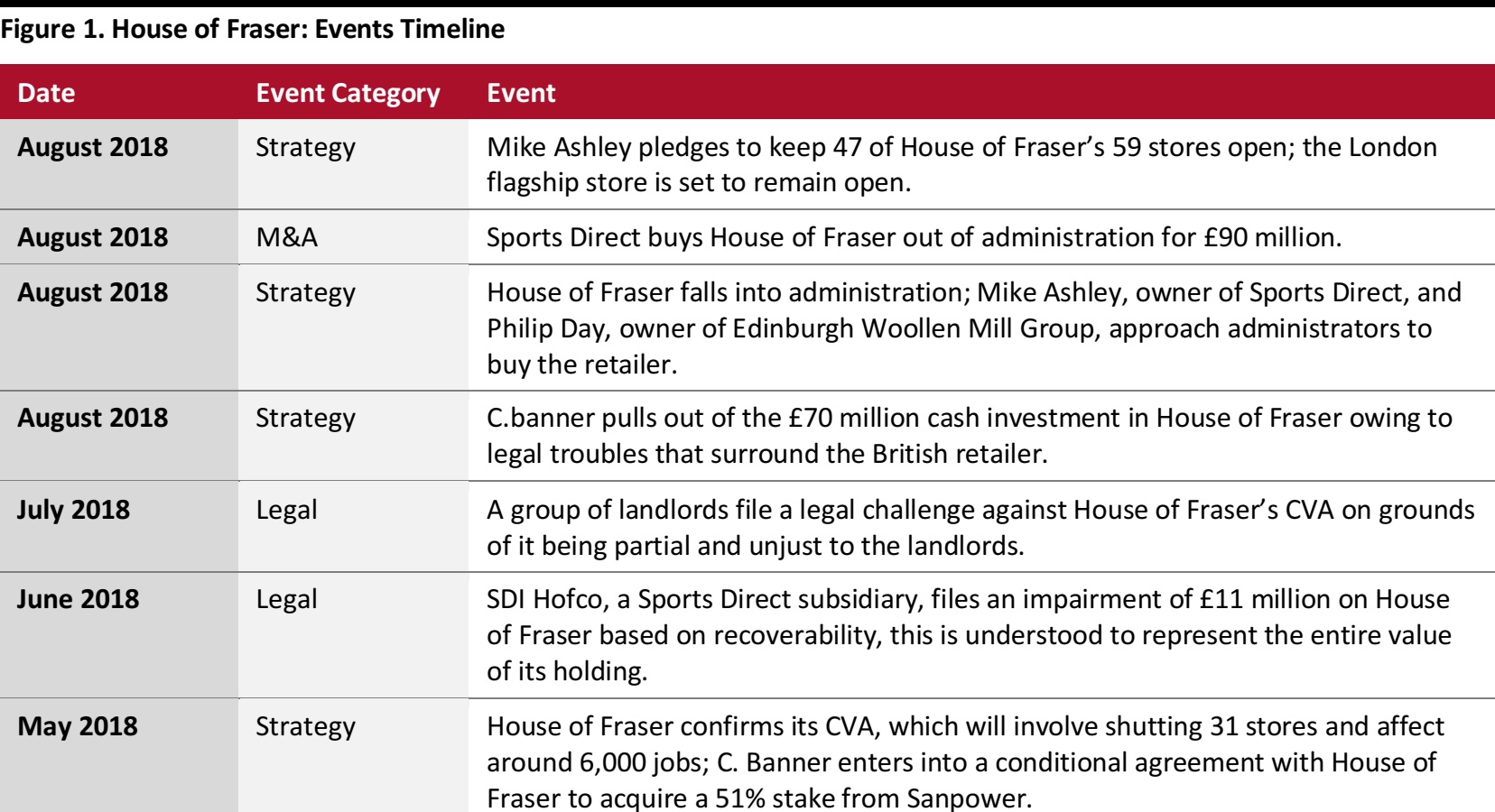

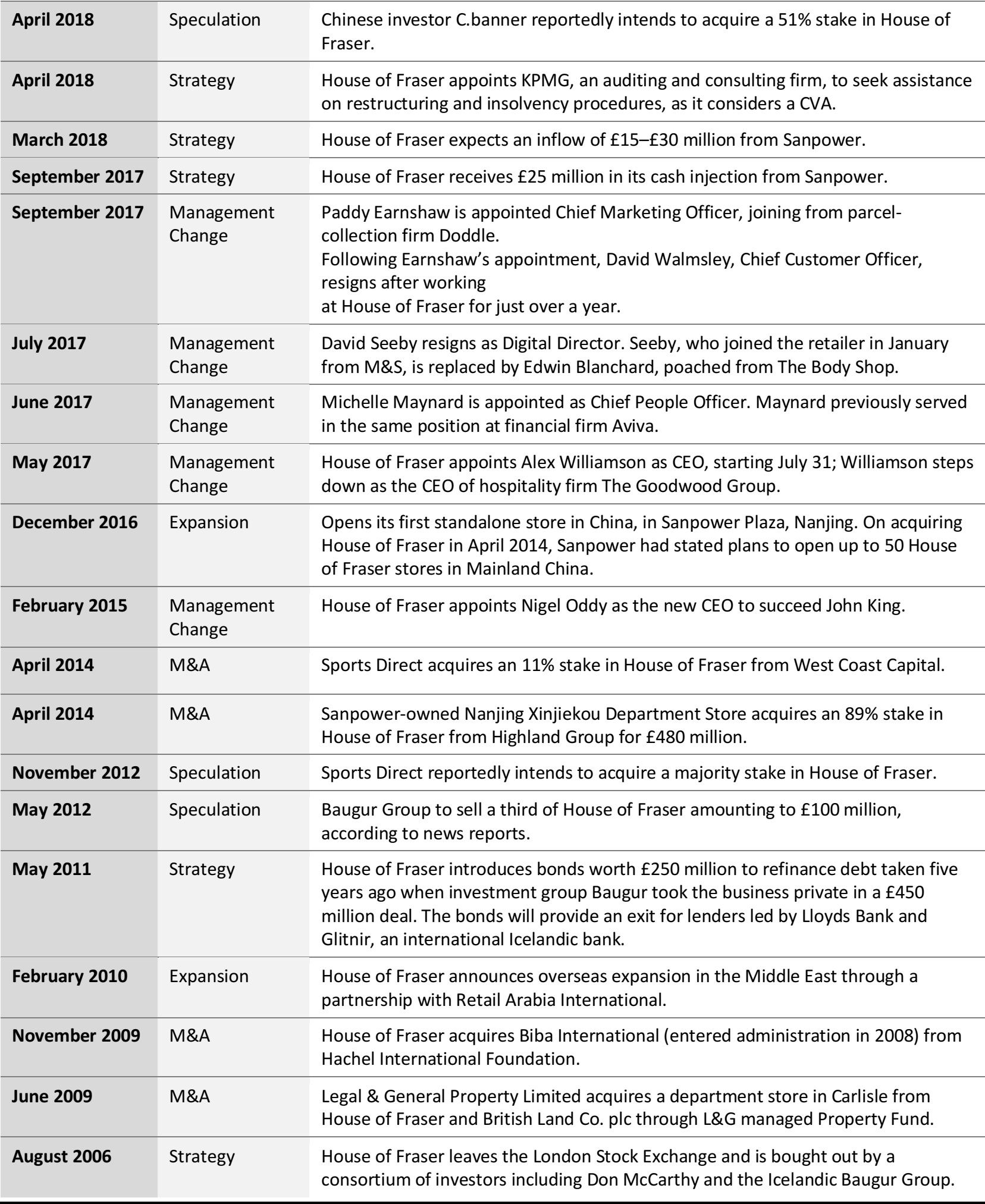

In this report, we briefly outline the fall of House of Fraser and some of the events that led to its company voluntary agreement (CVA) and an eventual administration. We also provide a timeline of key events in House of Fraser’s business history over the last decade.

New Owners, Management Changes and Indebtedness—Events that Led to House of Fraser’s Fall

Until recently, House of Fraser had been outperforming its industry peers, such as Debenhams and Marks & Spencer, even as market conditions grew challenging. In 2015 and 2016, House of Fraser was continuing to report solid comparable sales growth. Its troubles appear to have emerged much more recently than those at Debenhams or M&S. We discussed its sharp downturn in one of our earlier reports

The Decline of the UK Department Store—and Struggles in Germany, Too.

In that report, we note how only just three years ago, House of Fraser was reporting very strong underlying growth:

- At Christmas 2015, House of Fraser reported strong comp growth of 5.3%.

- By Christmas 2016, comp growth had virtually halved, to 2.7%.

- By Christmas 2017, the company was declining to report comparable sales.

- In its filings for the year ended January 2018, House of Fraser again did not provide a figure for comp growth, although total UK and Ireland sales were down 5.9% on a store base that was presumably static.

- In its CVA announcement, the retailer noted a 7.4% comp decline in the 13 weeks ended April 28, 2018.

Among several factors, House of Fraser also succumbed to the rising costs of business and was unable to secure investments from its wealthy owner as it was heavily indebted. The company’s total liabilities amounted to £836 million in the year ended January 2017

. Its long-term liabilities were worth some £466 million, and current liabilities, which include payments to suppliers, were worth £370 million. During the same year, its current assets amounted to £243 million, implying a working capital deficit of £127 million. In fiscal year 2016, House of Fraser’s balance sheet indicates a working capital deficit of some £76 million. It is likely to have racked up more debts to suppliers as well as bondholders and other long-term lenders over the past year. Its inability to fulfil its day-to-day trading operations, let alone long-term debts, could have been a trigger for its demise.

It is hard to ignore that House of Fraser’s decline, which includes the reversal of fortunes in its topline, followed its acquisition by Chinese conglomerate Sanpower in April 2014.

Sanpower bought an 89% stake in House of Fraser through its retail unit Nanjing Xinjiekou Department Store and announced plans to launch a chain of stores in China. That plan did not materialize and there is currently just one House of Fraser store in China.

In addition, 2016 and 2017 also saw a subsequent reorganization of top management and many of those roles—most notably that of CEO—were filled by personnel from nonretail backgrounds.

Alex Williamson, who was previously the CEO at hospitality firm The Goodwood Group, replaced Nigel Oddy as House of Fraser CEO in July 2017. Shortly thereafter, Michelle Maynard was appointed as Chief People Officer; Maynard previously served in the same position at financial firm Aviva. Edwin Blanchard, poached from The Body Shop, joined as Digital Director and Paddy Earnshaw, from parcel-collection firm Doddle, was appointed Chief Marketing Officer.

Sanpower announced a £25 million investment in the business in late 2017, and this was reportedly its first cash injection since the acquisition. The second injection of £30 million came in March 2018, . After failed attempts of raising fresh funds, and with Sanpower apparently reluctant to invest further, House of Fraser announced its CVA in May 2018.

Chinese investor C.banner entered into an agreement to acquire a 51% stake in House of Fraser conditional upon the CVA progressing. This deal fell apart owing to legal filings against the British retailer by a group of landlords that opposed the CVA. The matter was settled out of court, but House of Fraser’s inability to finalize a deal saw it fall into administration. Sports Direct bought the company out of administration for £90 million, replacing its previous 11% stake with complete ownership.

Source: S&P Capital IQ/ company reports/Coresight Research

The Way Ahead

Sports Direct’s acquisition of House of Fraser saved the heritage department store retailer from becoming another high street casualty. The fate of 59 stores and around 17,000 employees now rests on Mike Ashley’s decisions. He has pledged to keep some 47 stores open, which is around 80% of the existing count, as well as introduce “cool brands of the moment.”

We will be watching what Ashley does with Debenhams, another high street retailer, in which he owns a 29% stake and is just a few percentage-points short of the threshold required to initiate a takeover bid. Some commentators have pointed to the possibility of a House of Fraser-Debenhams merger, but we think this would be highly unwise. We have long pointed to a number of problems with this previously mooted idea:

- Debenhams and House of Fraser have very different shopper bases: Consumer surveys show that House of Fraser attracts a notably younger, more-affluent shopper than mid-market peers such as Debenhams.

- Beyond store closures and back-office functions, we see few opportunities for synergies, and certainly little likelihood that such a merger would boost these banners’ appeal to shoppers.