Executive Summary

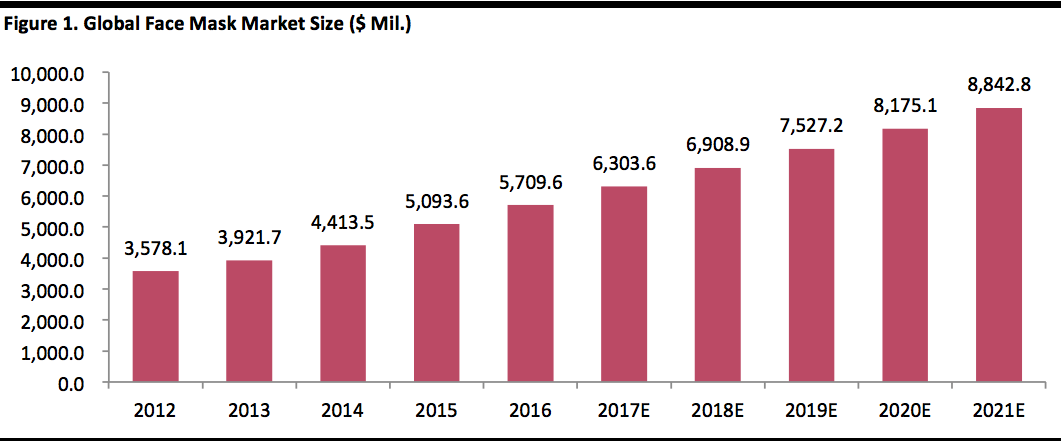

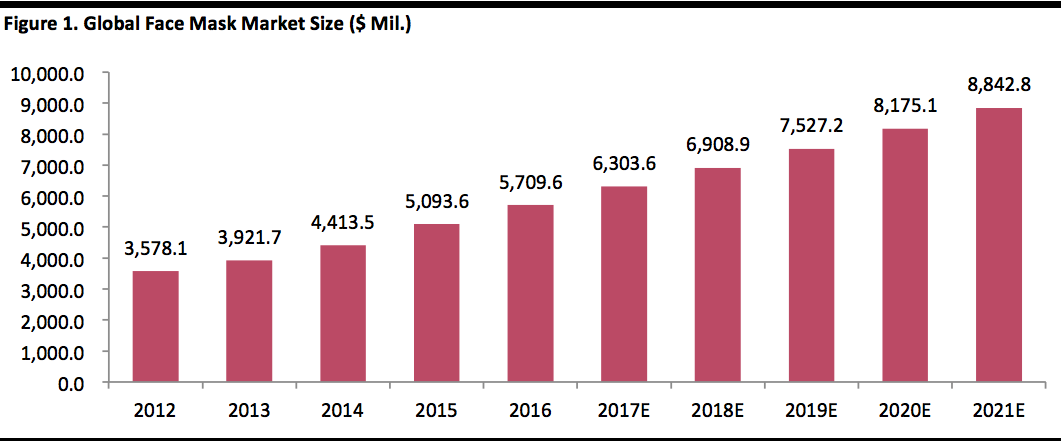

Face masks are a type of skincare product designed for the face to improve the general health of the skin or to treat specific skin conditions. According to data from Euromonitor International, the global face mask market was worth $5.7 billion in 2016, and is expected to grow at a CAGR of 9.1% from 2016 to 2021, to $6.3 billion in 2017 and $8.8 billion by 2021. The face mask market is skewed heavily toward the Asia-Pacific region, which was worth $4.8 billion of the market in 2016, representing a staggering 83.7% of global market share. This category is expected to continue to see stable growth through to 2021, driven primarily by Asia Pacific, and China in particular.

The face mask market in China is by far the largest market—valued at $2.7 billion in 2016, and representing 47.6% of the total global market. Despite its sheer size, the Chinese face mask market is expected to record robust double-digit growth to reach $4.7 billion by 2021, representing a CAGR of 11.7%.

One of the major drivers of the growing demand for face masks is the poor air quality in some countries in the Asia-Pacific region, particularly in China, which is the main market for the product. A 2015 study by L’Oréal found that there is a link between atmospheric pollution and premature skin ageing. Some 61% of consumers surveyed in China said they are very concerned about PM2.5 particles, according to Mintel, a market research firm.

[caption id="attachment_87108" align="aligncenter" width="720"]

Source: iStockphoto

Source: iStockphoto[/caption]

As would be expected, the face mask market is dominated by Asian companies. International brands have failed to compete with emerging Chinese local brands, that compete fiercely to capture market share. However, market share growth has come at the expense of lavish advertising budgets or price competition, which make entering the market organically quite challenging for companies that want to compete in the category.

We believe beauty brands could consider innovating at the product ingredient level in order to compete. One such area of opportunity is products that combat the effects of skin-damaging pollutants, which is a persistent issue consumers have voiced.

Introduction

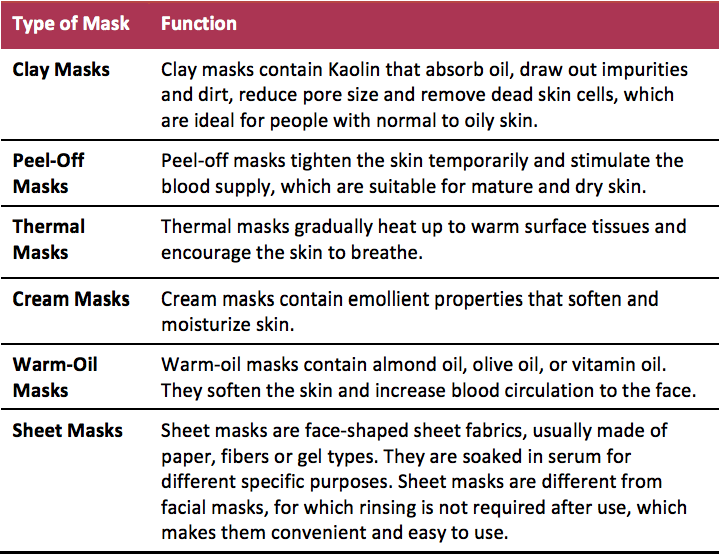

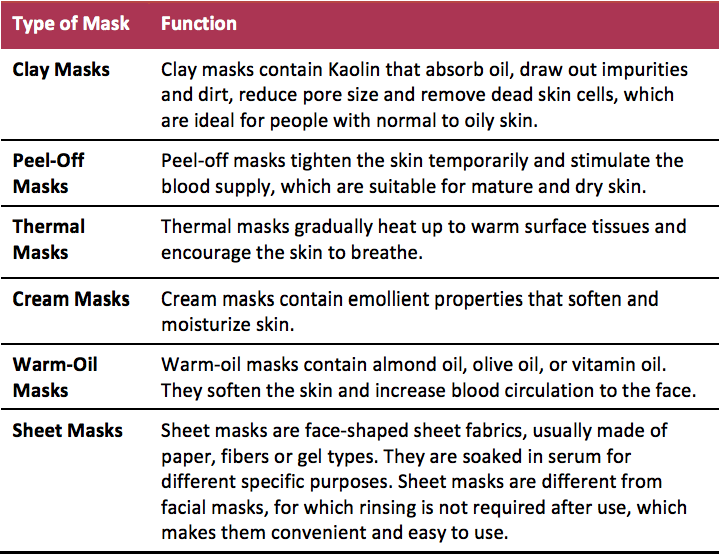

Face masks are a type of skin care product for the face that are used to improve the general health of the skin or to treat specific skin conditions. Face masks are mainly used for deep cleansing, hydration and brightening of the skin tone.

Modern technology has played a vital role in the development of face masks to extract the active ingredients of plants and applied with clay, cream, peel-off, warm-oil, thermal or face-shaped fabric, depending on the specific purpose and desired effect.

[caption id="attachment_87109" align="aligncenter" width="719"]

Source: Sheknows.com/FGRT

Source: Sheknows.com/FGRT[/caption]

[caption id="attachment_87110" align="aligncenter" width="720"]

Source: iStockphoto

Source: iStockphoto[/caption]

Market Overview

According to data from Euromonitor International, the global face mask market was worth $5.7 billion in 2016, and is expected to grow at a CAGR of 9.1% from 2016 to 2021, to $6.3 billion in 2017 and to $8.8 billion by 2021.

[caption id="attachment_87111" align="aligncenter" width="720"]

Source: Euromonitor International/FGRT

Source: Euromonitor International/FGRT[/caption]

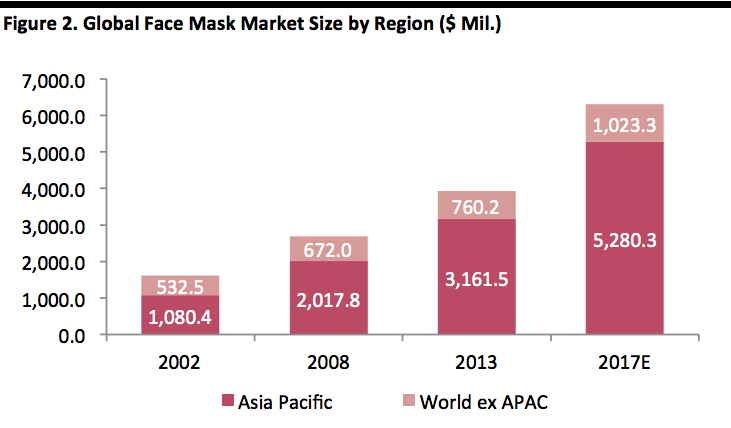

Asia Pacific Is the Major Market and Growth Engine

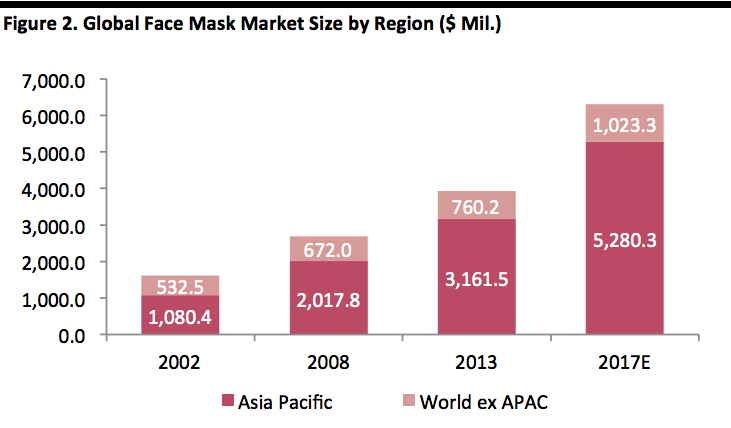

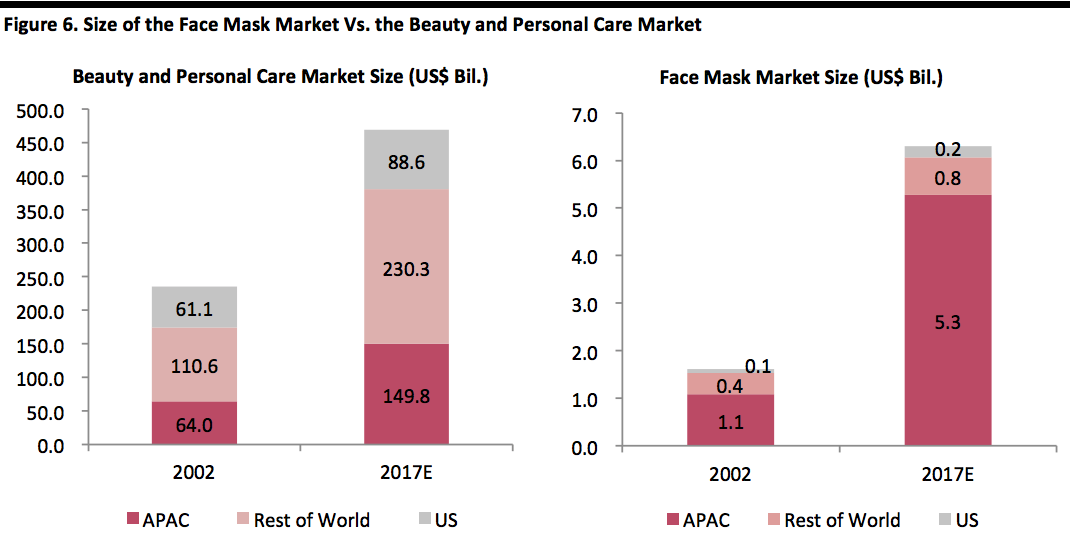

The Asia-Pacific market dominates the face mask market. It was worth $4.8 billion in 2016 and is expected to reach $5.3 billion in 2017, representing a staggering 83.7% share of the global market.

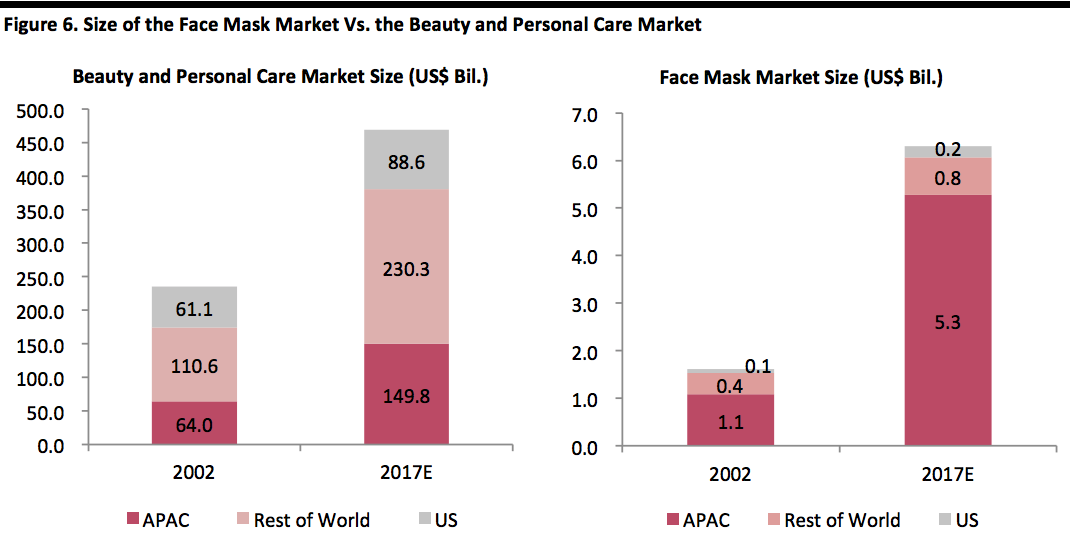

This category has experienced steady growth over the past decade and is expected to show stable growth through to 2021, driven primarily by Asia Pacific. Over the past 15 years from 2002 to 2017, the size of the face mask market in Asia Pacific has increased almost fourfold, from $1.1 billion in 2002 to $5.3 billion in 2017. In contrast, growth of the market in the rest of the world has been less dramatic, doubling from $0.5 billion in 2002 to $1.0 billion in 2017.

[caption id="attachment_87112" align="aligncenter" width="720"]

Source: Euromonitor International/FGRT

Source: Euromonitor International/FGRT[/caption]

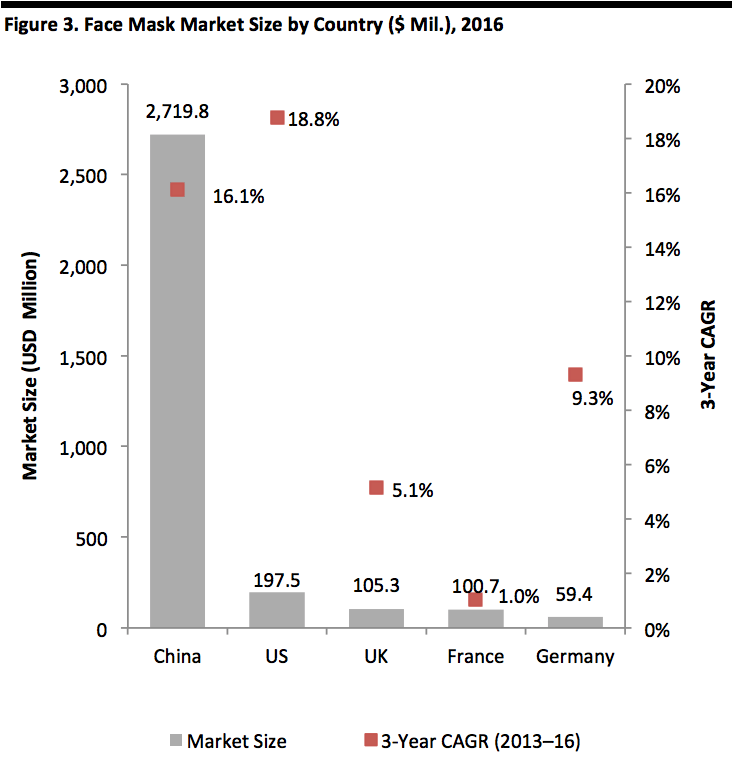

China Is the Largest Market for Face Masks

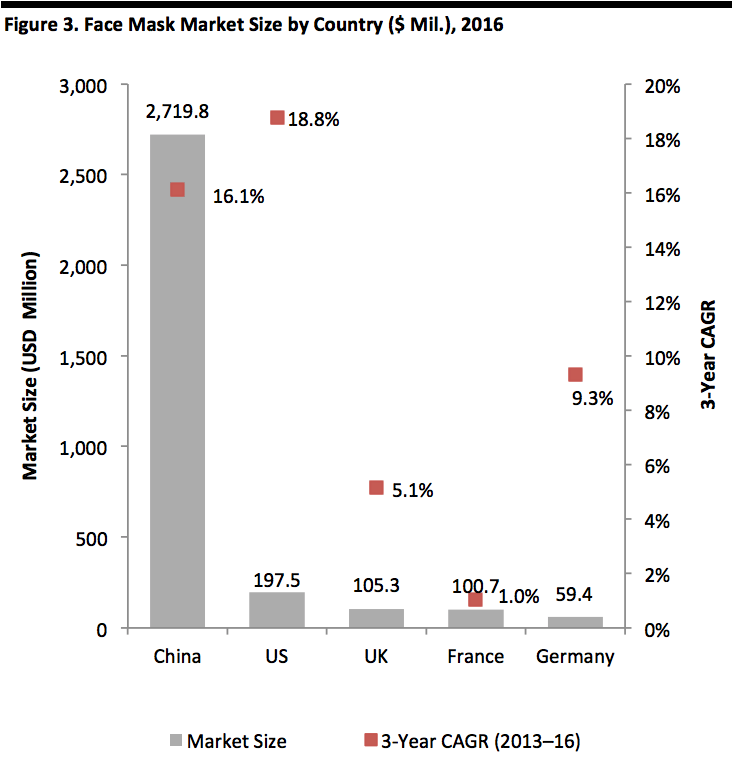

China stands out as the largest face mask market, valued at $2.7 billion in 2016, representing 47.6% of the global market, according to Euromonitor International. Despite its sheer market size, the Chinese face mask market is expected to experience double-digit growth from 2016 to 2021 to reach $4.7 billion, representing a CAGR of 11.7%.

[caption id="attachment_87113" align="aligncenter" width="720"]

Source: Euromonitor International/FGRT

Source: Euromonitor International/FGRT[/caption]

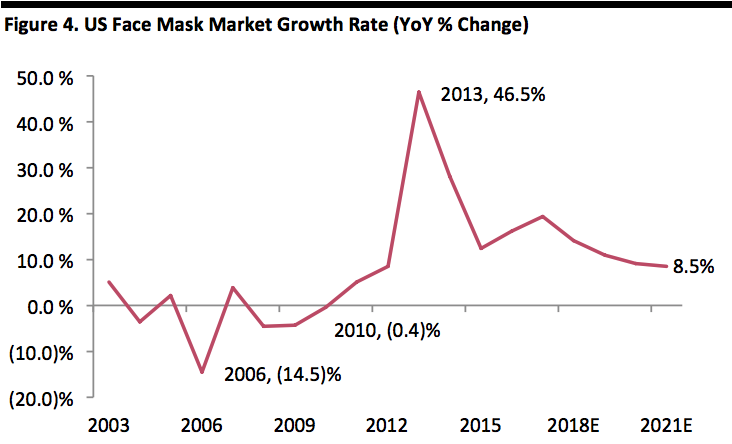

The Market in the West Is Small but Growing

Judging from the data, there is much less enthusiasm for face masks in the West. Recently, however, consumers in developed markets seem to be warming to the benefits of the product, likely attributable to influence from Asia.

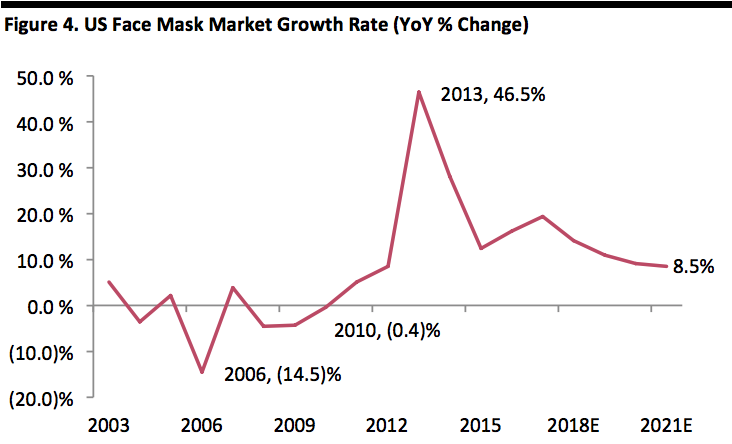

US: The US, which is the largest Western market, experienced stagnant or negative growth during 2003–2010, and a double-digit decline in 2006. However, since 2011, the face mask market has seen resilient growth, and is forecast to grow at a CAGR of 18.8% from 2016 to 2021, according to Euromonitor International. Despite the double-digit growth, the US represents only 3.5% of the global market.

[caption id="attachment_87114" align="aligncenter" width="720"]

Source: Euromonitor International/FGRT

Source: Euromonitor International/FGRT[/caption]

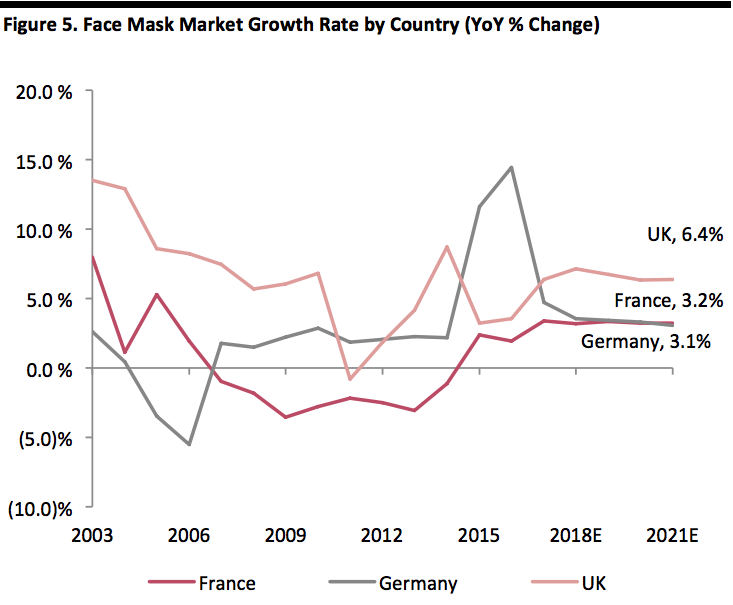

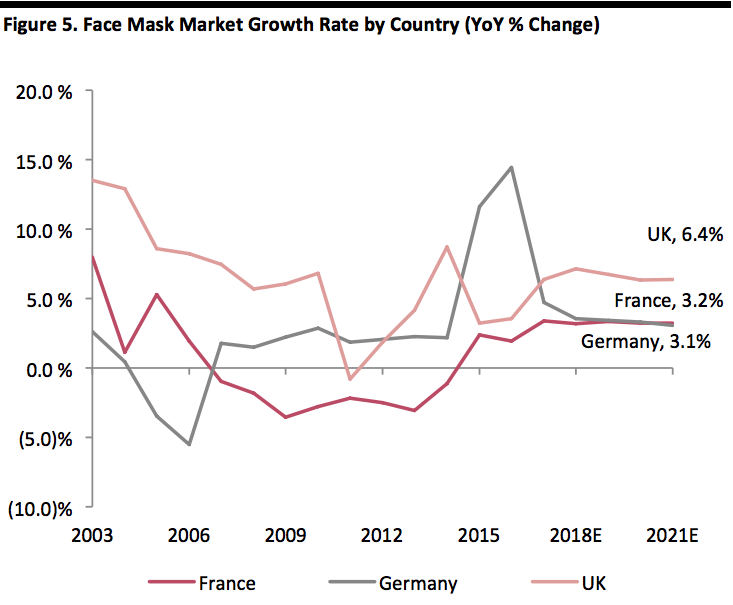

Europe: Valued at $503.2 million in 2016, Europe represented 8.8% of the global market, with the UK at $105.3 million, France at $100.7 million and Germany at $59.4 million

. The Asian influence has been less apparent in Europe, with only single-digit CAGRs in the major markets. However, when we look at the major European markets from 2004 to 2015, they mostly suffered stagnant or negative growth: with Germany experiencing negative growth in 2005 and 2006, and France between 2007 and 2014. The European market saw a general pickup starting in 2012, similar to the US market.

[caption id="attachment_87115" align="aligncenter" width="720"]

Source: Euromonitor International/FGRT

Source: Euromonitor International/FGRT[/caption]

Why Have Face Masks Become a Phenomenon?

The growing popularity of face masks is primarily due to: 1) the increasing purchasing power of a rising middle class; 2) pollution issues in many countries in the Asia-Pacific region; and 3) the skincare benefits and convenience that face masks provide.

1) The Increasing Purchasing Power of a Rising Middle Class

The growth of face mask sales in Asia Pacific has been fueled by the increasing purchasing power of the region’s rising middle class. According to a Brookings Institute’s estimation, the number of middle-class consumers in Asia Pacific grew from 525 million in 2009 to 1.4 billion in 2015, accounting for 46% of the world’s total middle-class population. This number is expected to grow to 3.5 billion in 2030, or 65% of the total number of the total global middle class.

This growing middle class has contributed to burgeoning consumer spending power, which stood at $12.3 trillion in 2015, and is expected to rise to $36.6 trillion by 2030, according to Brookings Institute. The higher spending power allows individuals to devote more spending to discretionary purchases, which entails higher spending on beauty and personal care products. Therefore, we can see that the market size for beauty and personal care products grew by 134% from 2002 to 2017, a much faster pace than in the US, which grew by 45% during the same period.

[caption id="attachment_87116" align="aligncenter" width="720"]

Source: Euromonitor International/FGRT

Source: Euromonitor International/FGRT[/caption]

However, we see much higher growth for the face mask category compared to the broader beauty and personal care market. In Asia Pacific, the market for face masks grew by 382% between 2002 and 2017, compared to 134% for the beauty and personal care market overall.

Air pollution is one reason for higher growth in the face mask market. A 2015 study by L’Oréal that was published in the International Journal of Cosmetic Science found that there is a linkage between atmospheric pollution and premature skin ageing, and that polluted air can impact skin quality in terms of increased sebum, lower vitamin E and an increase in lactic acid.

[caption id="attachment_87117" align="aligncenter" width="720"]

Source: Loreal-finance.com

Source: Loreal-finance.com[/caption]

Urban pollutants, especially particulate matter with diameters of 2.5 micrometers (PM2.5) and 10 micrometers (PM10), are fine particles coated with polyaromatic hydrocarbons (PAHs), heavy metals and other contaminants that are capable of penetrating deeper skin layers, inducing collagen and elastin breakdown, and the release of free radicals, causing signs of premature skin ageing that include cellular damage, dryness, inflammation and pigmentation.

According to the World Health Organization, over 99% of the urban population in China, India and Pakistan are regularly exposed to concentrations of PM2.5 above the recommended level. Survey data reveal that growing concerns about urban pollution among consumers. According to Mintel, 61% of consumers surveyed in China said they are very concerned about PM2.5 particles. The severe air pollution condition also partly explains the steady increase in demand for skin care products, particularly for face masks.

Besides the external factors driving higher spending on skin care products, the solid growth in the face mask market is attributable to the convenient skin care benefits it brings. Lengthy traditional daily beauty routines, especially in Korea, can take up to hours every day. However, busy urban lifestyles allow less time for consumers to spend on their daily skin care routine. Face masks offer a quick solution that brings antiaging, hydration or deep cleansing functions within 15 minutes.

The Popularity of Face Sheet Masks in China

According to Mintel, 77% of women surveyed in China have used sheet masks in the six months to January 2016. FGRT believes the popularity of sheet masks is attributable to the convenience, hydration function and product innovation in materials.

[caption id="attachment_87118" align="aligncenter" width="720"]

Source: iStockphoto

Source: iStockphoto[/caption]

Convenience: Sheet masks are convenient to use. They come in individual single-use packets that can be applied directly on the face and do not require washing off after use. In comparison, traditional clay masks or cream masks require the clay or cream to be rubbed on the face and these masks also need to be rinsed off, which takes more time.

Hydration: Sheet masks have a hydration function and claim to relieve the damage caused by urban pollutants and help alleviate premature skin aging. Air pollutants can cause cellular damage and skin dryness. Using face masks to hydrate and moisturize the skin may help relieve skin dryness and alleviate the damage to skin cells.

Innovation in materials: The innovation of hydrogels and sheet fabric materials has further improved the sheet masks’ usefulness and functionality. Cotton is the usual material used for sheet masks. Compared with cotton, hydrogel has a better ability to lock in moisture and sticks more firmly on the face, allowing the skin to better absorb the ingredients applied.

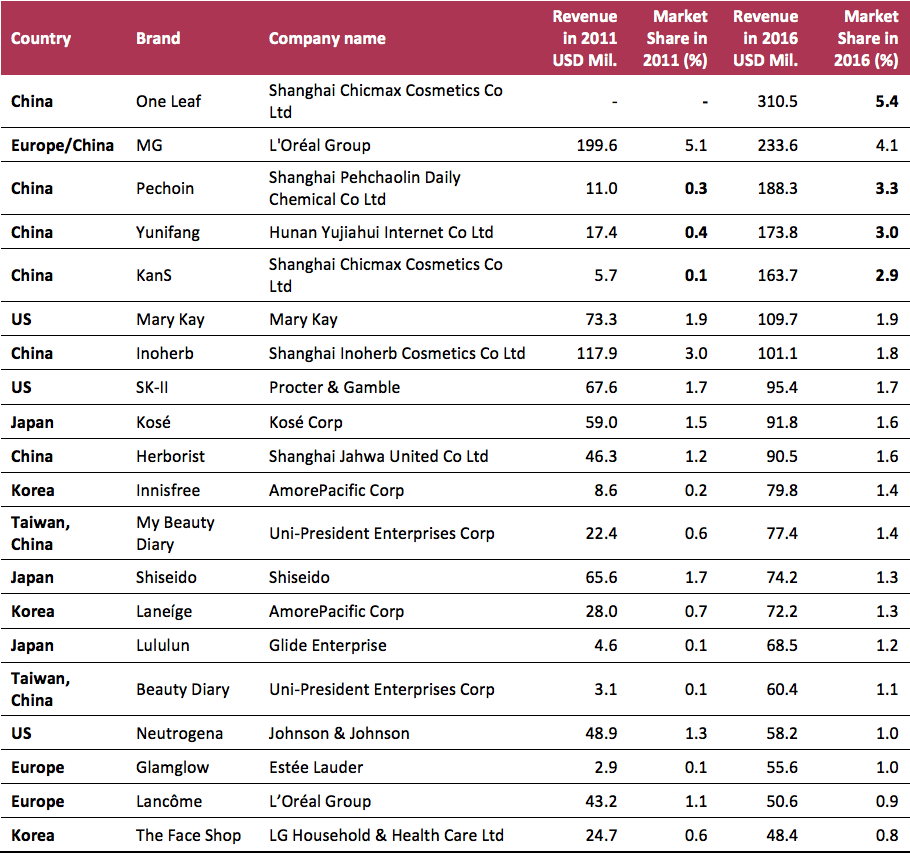

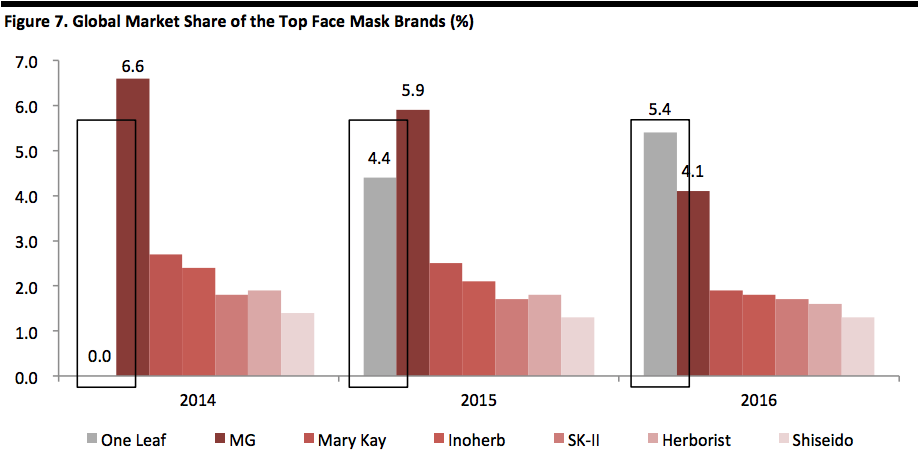

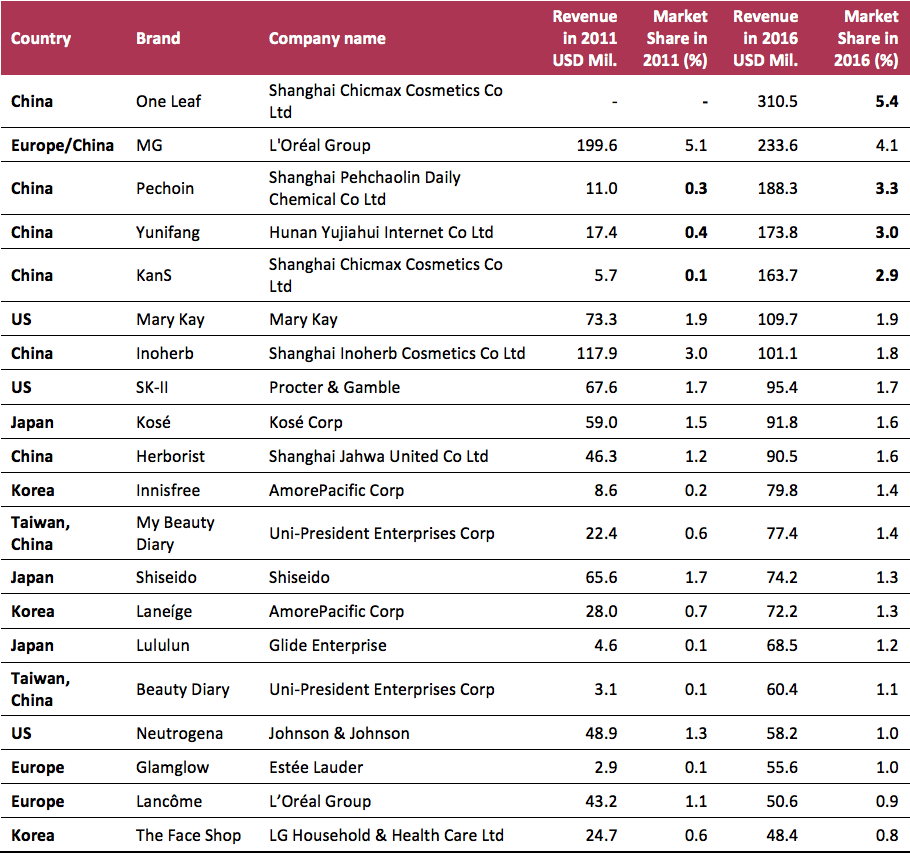

Chinese Brands Dominate the Top Face Mask Brands

The brand share chart shows the burgeoning growth and the success of Chinese brands in face mask market from 2011 to 2016. The top-five brands excluding MG (acquired by L’Oréal)—One Leaf, Pechoin, Yunifang and KanS—collectively had less than a 1% market share in 2011. These four brands saw rapid expansion in the five-year period from 2011 to 2016, capturing almost 15% share of the total market in 2016. The top brand, One Leaf, was started in 2014 and grew to generate revenues of more than $300 million in 2016.

Apart from L’Oréal, international brands have failed to compete with emerging local Chinese brands that have grown to capture the majority of the market.

[caption id="attachment_87119" align="aligncenter" width="720"]

Source: Euromonitor International

Source: Euromonitor International[/caption]

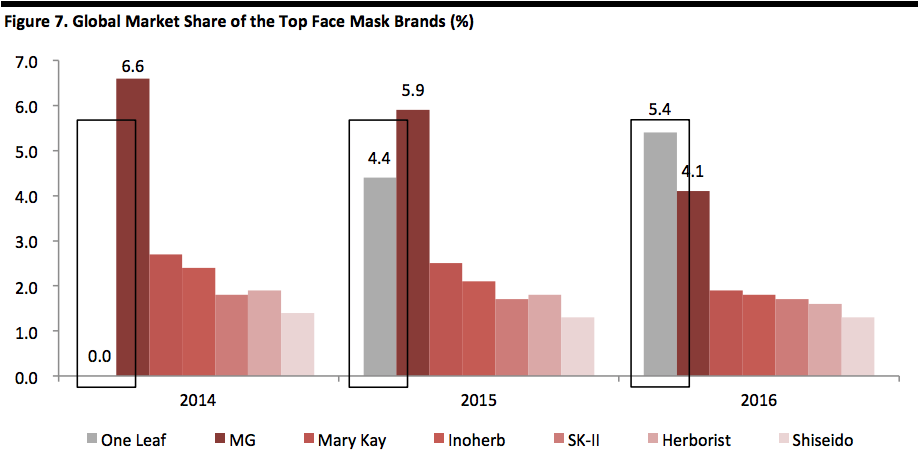

Marketing Strategies Of Successful Chinese Brands

Brands from China have been remarkably successful in capturing the opportunity in this product category. Part of their success can been attributable to their marketing strategies. In the following section, we analyze two case studies: Chinese brand One Leaf and Taiwanese brand My Beauty Diary.

One Leaf

The brand One Leaf, owned by Shanghai Chicmax Cosmetics Co, emerged in 2015 and reached $310.5 million in sales, or a 5.4% market share in 2016, at the expense of Western and Japanese brands.

[caption id="attachment_87120" align="aligncenter" width="720"]

Source: Euromonitor International/FGRT

Source: Euromonitor International/FGRT[/caption]

Ad Spending for Brand Building

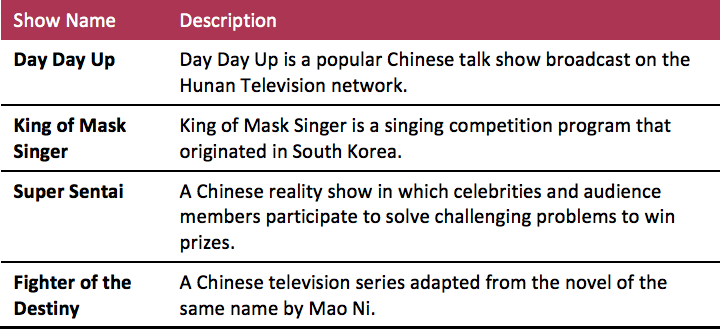

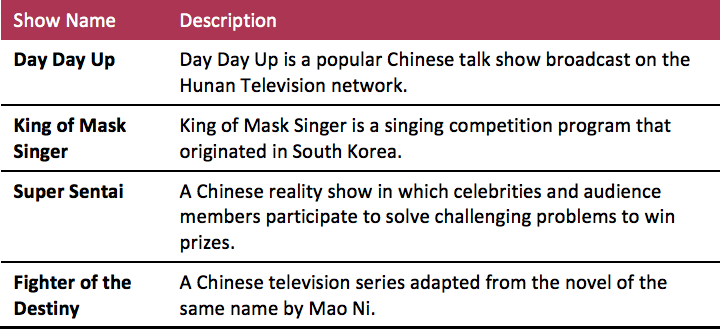

The success of One Leaf can be primarily attributed to spending on TV commercials and sponsorship of popular reality shows.

[caption id="attachment_87121" align="aligncenter" width="720"]

Source: FGRT

Source: FGRT[/caption]

According to 36kr, the brand’s ad spending to promote its face masks reached over ¥1 billion (approximately $150 million) during the two years between 2015 and 2016. Based on data from Euromonitor International, the ad spending over those two years translates into 28% of the brand’s revenues over the same period of time, which is a very high portion when compared to its peers. For example, Shiseido and Kosé Corp spend roughly 6%–7% of their revenues on advertising expenses for all beauty products. Given its substantial ad spend, One Leaf has become a prominent sponsor of popular reality shows and television series.

Integration of an Online Shopping Festival and a Popular Reality Show

In addition, One Leaf integrated a reality show and e-commerce to promote its brand in China. JD.com and Alibaba, the largest e-commerce players in China, organized a one-day shopping festival on June 18, 2016. One Leaf leveraged on the popular Chinese variety music show Come Sing With Me, hosted by Wang Han and Han Hong, to promote its brand. Cooperating with Tmall, the leading e-commerce platform in China, consumers could interact with the show by shaking their phones to get a free trial of One Leaf face masks on that day. The brand gained popularity following the innovative marketing campaign. In 2016, One Leaf’s sales on Tmall surpassed US$45 million, and in 2017, one-day sales on June 18 reached US$4.5 million.

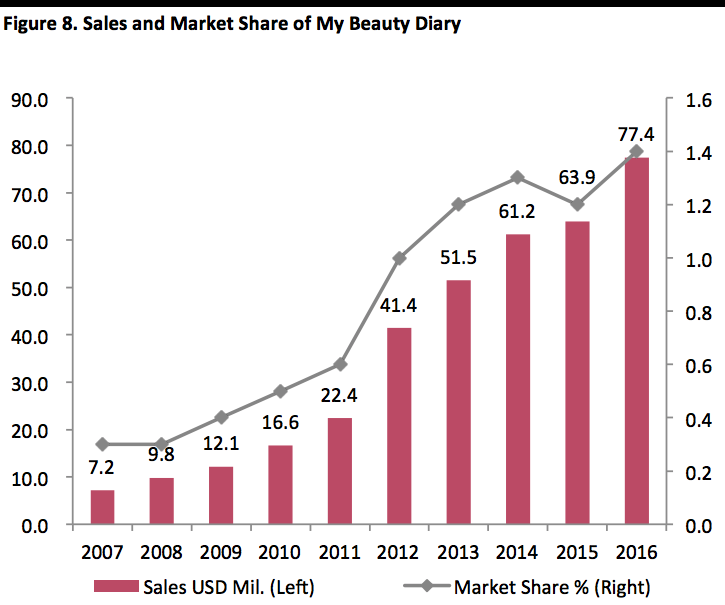

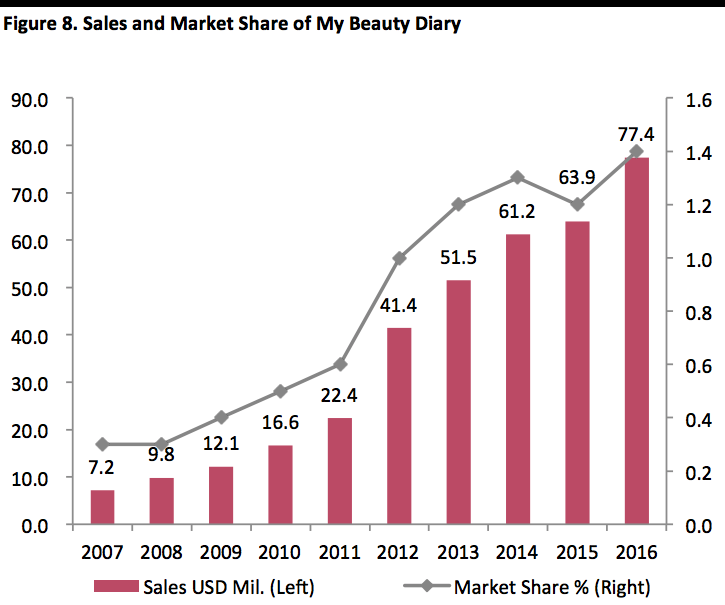

My Beauty Diary

In contrast with One Leaf’s tremendous ad spend and marketing effort, My Beauty Diary, owned by Uni-President Enterprises, has minimal ad spending or marketing budget. However, the brand has also experienced strong growth over the past decade, expanding its sales from US$7.2 million in 2007 to US$77.4 million in 2016.

[caption id="attachment_87122" align="aligncenter" width="720"]

Source: Euromonitor International/FGRT

Source: Euromonitor International/FGRT[/caption]

The brand’s low-price strategy is the recipe behind its strong growth. Uni-President Enterprises saw that consumers wanted to wear masks more often, but as brands were mostly focusing on face masks at premium pricing, the choices for face masks for mass market were limited. Therefore, the company developed face masks for mass market at lower pricing, targeting the younger generation aged 15–29.

Rather than using substantial ad spend to promote the brand, My Beauty Diary reaches its target customers through social media and video platforms. Millennials are attracted by the high-quality, low-price face masks and they share the products among their friends and on social media. According to Mintel, some of the strongest motivations for users to try new products include good word of mouth and natural ingredients. Beauty Diary’s high-quality, low-price offering has allowed it to promote the brand to its target customers without incurring substantial ad spend costs, which has helped it to take up considerable market share in the face mask market.

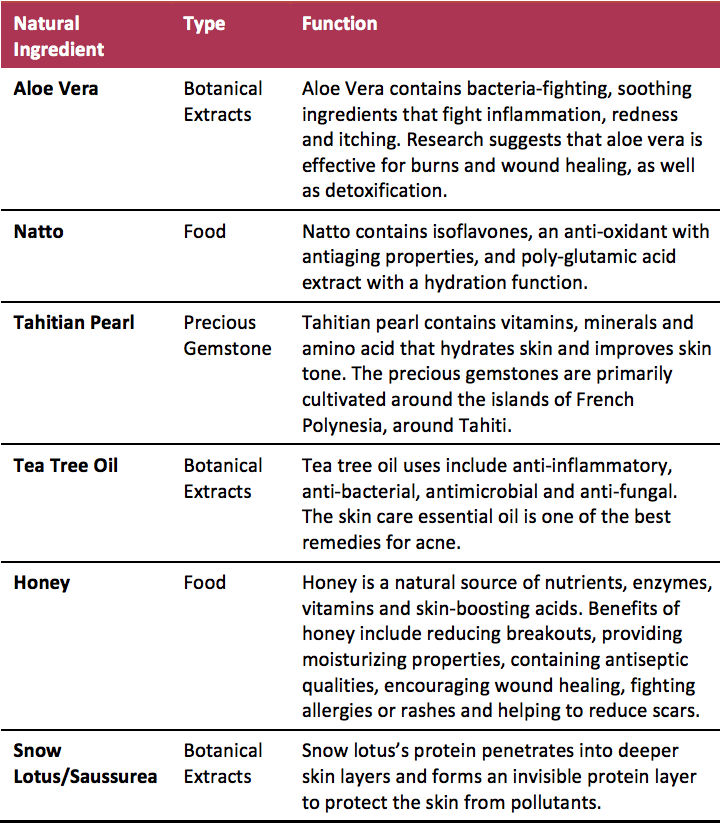

Face Mask Ingredients and Product Innovation

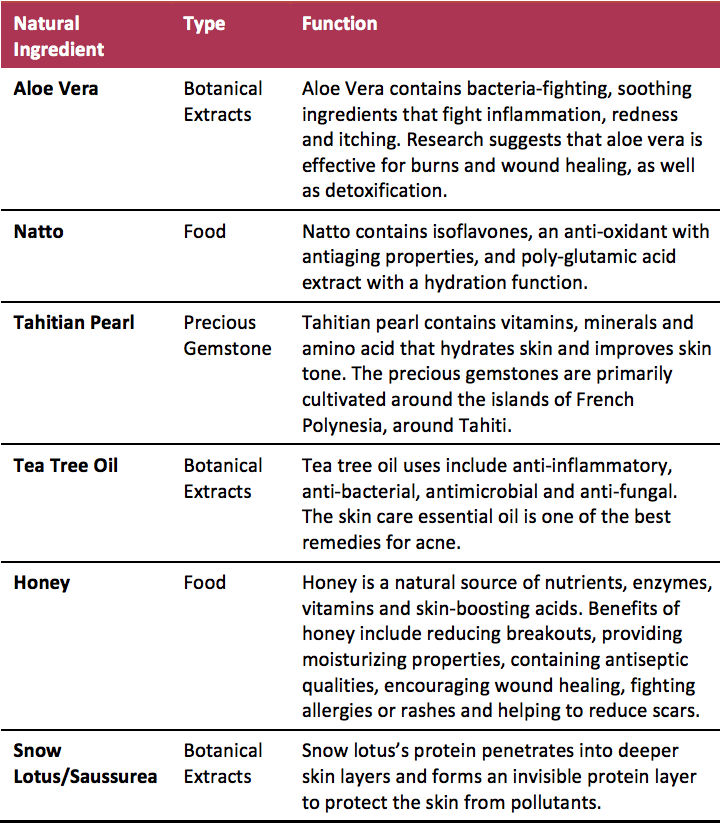

There is a long history of applying DIY face masks with natural ingredients as a type of facial skin care. The origin of face masks can be traced back to Cleopatra VII Philopator, the last active ruler of Ptolemaic Egypt, who applied natural ingredients to cleanse, nourish and rejuvenate her skin on a regular basis. Nowadays, consumers still use natural ingredients as face masks to improve their skin, but with the advent of modern technology to extract the active ingredients of plants or food, consumers can apply different types of face masks depending on their specific purposes.

As a rising middle class aspires for a higher quality of life, consumers tend to avoid chemical-based skin care products, while embracing natural ingredients. According to Mintel, natural ingredients are one of the strongest motivations for consumers to try new products. As a result, botanical extracts and food such as aloe vera and honey, which are used in DIY face masks, are popular as novel ingredients in commercialized face mask products.

[caption id="attachment_87123" align="aligncenter" width="720"]

Source: iStockphoto

Source: iStockphoto[/caption]

Beauty brands search for novel natural ingredients with unique skin care functions for new product development. The leading Taiwanese beauty brand, My Beauty Diary applied Tahitian pearl— which contains vitamins, minerals and amino acid to improve skin tone—in one of its new face mask products. The face mask launch was a great success, achieving total sales of 120 million packets over the four years to 2016.

[caption id="attachment_87124" align="aligncenter" width="720"]

Source: draxe.com/My Beauty Diary/Hua Niang/FGRT

Source: draxe.com/My Beauty Diary/Hua Niang/FGRT[/caption]

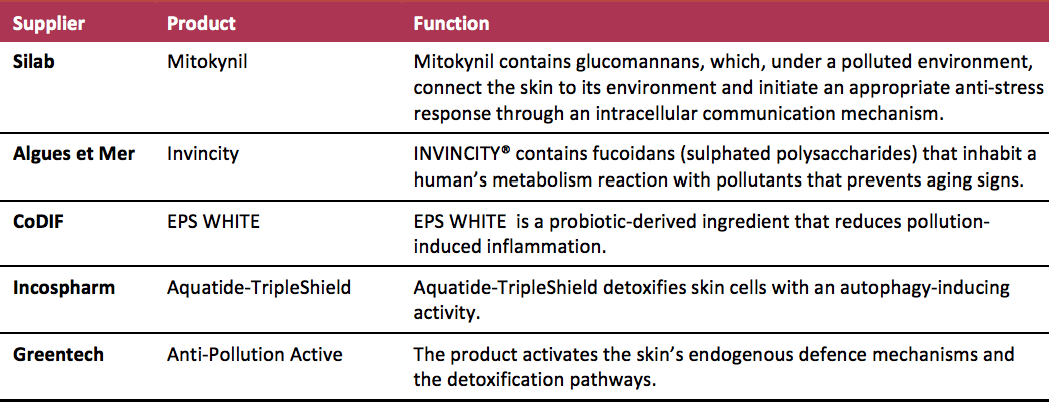

Ingredients for Combating Pollution

Having anti-pollution properties is a growing trend for face mask ingredients. As mentioned above, pollution levels have a direct relationship with skin problems, and therefore, products to combat the damage to skin caused by air pollution are increasingly desirable.

An anti-pollution product needs to create a film barrier between the skin and the pollutants. The Chinese beauty brand Hua Niang launched a product with extracts from snow lotus (saussurea) proteins that form an invisible layer to protect the skin from pollutants. There are also ingredient manufacturers that are producing ingredients with a similar function:

- TRI-K Industries, a manufacturer of cosmetic ingredients, commercialized PhytoVTM.

- Solabia Group rolled out Pollustop, which is a deacetylated branched polysaccharide with a high molecular weight, which forms a non-occlusive film on the skin’s surface.

- Covestro, a supplier of polymer materials, has manufactured a water-resistant, multifunctional polyurethane polymer coined as Baycusan.

- Lipotec also launched Pollushield, a cosmetic ingredient that combines a polymer with metal chelating properties to prevent the interaction of harmful ambient substances with the skin and that enhances antioxidative defenses.

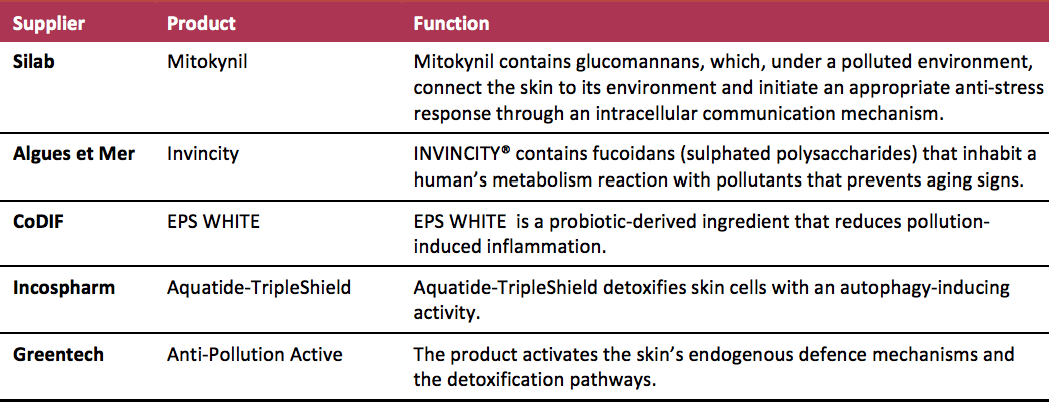

Besides creating a barrier from pollutants, ingredient suppliers also manufacture ingredients that activate or inhabit metabolism functions of skin cells to combat pollutants.

[caption id="attachment_87125" align="aligncenter" width="720"]

Source: Silab/Prospector/Algues et Mer/Euromonitor International/FGRT

Source: Silab/Prospector/Algues et Mer/Euromonitor International/FGRT[/caption]

Innovation from Startups

Wired Beauty—Connected Beauty Innovation

[caption id="attachment_87126" align="aligncenter" width="720"]

Source: Wired Beauty

Source: Wired Beauty[/caption]

Wired Beauty, a startup based in France, invented Mapo, a connected beauty mask that can monitor the face skin’s condition to determine the most suitable skin care product. Consumers may find it hard to choose a suitable skin care product based on the current condition of their skin. With Mapo, they can check their skin’s hydration level to determine the best skin care products for themselves.

Drunk Elephant—Embracing and Searching for Unique Natural Ingredients

Drunk Elephant, a startup found by Tiffany Masterson, develops nontoxic skincare products formulated without hazardous ingredients. The company rolled out two face mask products with a non-toxic natural formula—25% AHA and 2% BHA to refresh skin tone and texture—which boosted the company’s sales by 600% to an estimated $30 million in 2016, and which is expected to more than double sales by the end of 2017.

A Combination of Pure Gold and Plant Stem Cell Technology for Anti-Aging

Adore Cosmetics develops high-end anti-aging skincare products by harnessing the power of pure gold and exclusive plant stem cell technology, harvested from a rare species of Swiss apple. A unique combination of visible 24-karat gold sprinkles and highly refined magnetic powder work to repair broken cellular connections. The anti-aging power is amplified by its exclusive Plant Stem Cell formula, as well as the added benefits of moisturizing sweet almond oil, aloe vera to soothe, shea butter to hydrate, and Vitamin E that fights free radicals and air pollution to freshen skin’s appearance.

Implications

The face mask market in Asia Pacific was worth $4.8 billion in 2016. Valued at $2.7 billion, China alone represents 47.6% of the global market, and is expected to grow to $4.7 billion by 2021. In recent years, international brands have been losing out to emerging Chinese brands who are chipping away at their market share. Based on a study of the marketing strategies of Chinese brands, competition in the category is fierce and represents a likely barrier to entry for new entrants.

One way beauty brands interested in capturing the Chinese consumer can compete is with innovative product offerings such as face masks with ingredients that combat pollutants’ damage to the skin, which is a primary concern among beauty consumers, particularly those in Asia Pacific.

Source: iStockphoto[/caption]

As would be expected, the face mask market is dominated by Asian companies. International brands have failed to compete with emerging Chinese local brands, that compete fiercely to capture market share. However, market share growth has come at the expense of lavish advertising budgets or price competition, which make entering the market organically quite challenging for companies that want to compete in the category.

We believe beauty brands could consider innovating at the product ingredient level in order to compete. One such area of opportunity is products that combat the effects of skin-damaging pollutants, which is a persistent issue consumers have voiced.

Source: iStockphoto[/caption]

As would be expected, the face mask market is dominated by Asian companies. International brands have failed to compete with emerging Chinese local brands, that compete fiercely to capture market share. However, market share growth has come at the expense of lavish advertising budgets or price competition, which make entering the market organically quite challenging for companies that want to compete in the category.

We believe beauty brands could consider innovating at the product ingredient level in order to compete. One such area of opportunity is products that combat the effects of skin-damaging pollutants, which is a persistent issue consumers have voiced.

Source: Sheknows.com/FGRT[/caption]

[caption id="attachment_87110" align="aligncenter" width="720"]

Source: Sheknows.com/FGRT[/caption]

[caption id="attachment_87110" align="aligncenter" width="720"] Source: iStockphoto[/caption]

Source: iStockphoto[/caption]

Source: Euromonitor International/FGRT[/caption]

Source: Euromonitor International/FGRT[/caption]

Source: Euromonitor International/FGRT[/caption]

Source: Euromonitor International/FGRT[/caption]

Source: Euromonitor International/FGRT[/caption]

Source: Euromonitor International/FGRT[/caption]

Source: Euromonitor International/FGRT[/caption]

Europe: Valued at $503.2 million in 2016, Europe represented 8.8% of the global market, with the UK at $105.3 million, France at $100.7 million and Germany at $59.4 million. The Asian influence has been less apparent in Europe, with only single-digit CAGRs in the major markets. However, when we look at the major European markets from 2004 to 2015, they mostly suffered stagnant or negative growth: with Germany experiencing negative growth in 2005 and 2006, and France between 2007 and 2014. The European market saw a general pickup starting in 2012, similar to the US market.

[caption id="attachment_87115" align="aligncenter" width="720"]

Source: Euromonitor International/FGRT[/caption]

Europe: Valued at $503.2 million in 2016, Europe represented 8.8% of the global market, with the UK at $105.3 million, France at $100.7 million and Germany at $59.4 million. The Asian influence has been less apparent in Europe, with only single-digit CAGRs in the major markets. However, when we look at the major European markets from 2004 to 2015, they mostly suffered stagnant or negative growth: with Germany experiencing negative growth in 2005 and 2006, and France between 2007 and 2014. The European market saw a general pickup starting in 2012, similar to the US market.

[caption id="attachment_87115" align="aligncenter" width="720"] Source: Euromonitor International/FGRT[/caption]

Source: Euromonitor International/FGRT[/caption]

Source: Euromonitor International/FGRT[/caption]

However, we see much higher growth for the face mask category compared to the broader beauty and personal care market. In Asia Pacific, the market for face masks grew by 382% between 2002 and 2017, compared to 134% for the beauty and personal care market overall.

Air pollution is one reason for higher growth in the face mask market. A 2015 study by L’Oréal that was published in the International Journal of Cosmetic Science found that there is a linkage between atmospheric pollution and premature skin ageing, and that polluted air can impact skin quality in terms of increased sebum, lower vitamin E and an increase in lactic acid.

[caption id="attachment_87117" align="aligncenter" width="720"]

Source: Euromonitor International/FGRT[/caption]

However, we see much higher growth for the face mask category compared to the broader beauty and personal care market. In Asia Pacific, the market for face masks grew by 382% between 2002 and 2017, compared to 134% for the beauty and personal care market overall.

Air pollution is one reason for higher growth in the face mask market. A 2015 study by L’Oréal that was published in the International Journal of Cosmetic Science found that there is a linkage between atmospheric pollution and premature skin ageing, and that polluted air can impact skin quality in terms of increased sebum, lower vitamin E and an increase in lactic acid.

[caption id="attachment_87117" align="aligncenter" width="720"] Source: Loreal-finance.com[/caption]

Urban pollutants, especially particulate matter with diameters of 2.5 micrometers (PM2.5) and 10 micrometers (PM10), are fine particles coated with polyaromatic hydrocarbons (PAHs), heavy metals and other contaminants that are capable of penetrating deeper skin layers, inducing collagen and elastin breakdown, and the release of free radicals, causing signs of premature skin ageing that include cellular damage, dryness, inflammation and pigmentation.

According to the World Health Organization, over 99% of the urban population in China, India and Pakistan are regularly exposed to concentrations of PM2.5 above the recommended level. Survey data reveal that growing concerns about urban pollution among consumers. According to Mintel, 61% of consumers surveyed in China said they are very concerned about PM2.5 particles. The severe air pollution condition also partly explains the steady increase in demand for skin care products, particularly for face masks.

Besides the external factors driving higher spending on skin care products, the solid growth in the face mask market is attributable to the convenient skin care benefits it brings. Lengthy traditional daily beauty routines, especially in Korea, can take up to hours every day. However, busy urban lifestyles allow less time for consumers to spend on their daily skin care routine. Face masks offer a quick solution that brings antiaging, hydration or deep cleansing functions within 15 minutes.

Source: Loreal-finance.com[/caption]

Urban pollutants, especially particulate matter with diameters of 2.5 micrometers (PM2.5) and 10 micrometers (PM10), are fine particles coated with polyaromatic hydrocarbons (PAHs), heavy metals and other contaminants that are capable of penetrating deeper skin layers, inducing collagen and elastin breakdown, and the release of free radicals, causing signs of premature skin ageing that include cellular damage, dryness, inflammation and pigmentation.

According to the World Health Organization, over 99% of the urban population in China, India and Pakistan are regularly exposed to concentrations of PM2.5 above the recommended level. Survey data reveal that growing concerns about urban pollution among consumers. According to Mintel, 61% of consumers surveyed in China said they are very concerned about PM2.5 particles. The severe air pollution condition also partly explains the steady increase in demand for skin care products, particularly for face masks.

Besides the external factors driving higher spending on skin care products, the solid growth in the face mask market is attributable to the convenient skin care benefits it brings. Lengthy traditional daily beauty routines, especially in Korea, can take up to hours every day. However, busy urban lifestyles allow less time for consumers to spend on their daily skin care routine. Face masks offer a quick solution that brings antiaging, hydration or deep cleansing functions within 15 minutes.

Source: iStockphoto[/caption]

Convenience: Sheet masks are convenient to use. They come in individual single-use packets that can be applied directly on the face and do not require washing off after use. In comparison, traditional clay masks or cream masks require the clay or cream to be rubbed on the face and these masks also need to be rinsed off, which takes more time.

Hydration: Sheet masks have a hydration function and claim to relieve the damage caused by urban pollutants and help alleviate premature skin aging. Air pollutants can cause cellular damage and skin dryness. Using face masks to hydrate and moisturize the skin may help relieve skin dryness and alleviate the damage to skin cells.

Innovation in materials: The innovation of hydrogels and sheet fabric materials has further improved the sheet masks’ usefulness and functionality. Cotton is the usual material used for sheet masks. Compared with cotton, hydrogel has a better ability to lock in moisture and sticks more firmly on the face, allowing the skin to better absorb the ingredients applied.

Source: iStockphoto[/caption]

Convenience: Sheet masks are convenient to use. They come in individual single-use packets that can be applied directly on the face and do not require washing off after use. In comparison, traditional clay masks or cream masks require the clay or cream to be rubbed on the face and these masks also need to be rinsed off, which takes more time.

Hydration: Sheet masks have a hydration function and claim to relieve the damage caused by urban pollutants and help alleviate premature skin aging. Air pollutants can cause cellular damage and skin dryness. Using face masks to hydrate and moisturize the skin may help relieve skin dryness and alleviate the damage to skin cells.

Innovation in materials: The innovation of hydrogels and sheet fabric materials has further improved the sheet masks’ usefulness and functionality. Cotton is the usual material used for sheet masks. Compared with cotton, hydrogel has a better ability to lock in moisture and sticks more firmly on the face, allowing the skin to better absorb the ingredients applied.

Source: Euromonitor International[/caption]

Source: Euromonitor International[/caption]

Source: Euromonitor International/FGRT[/caption]

Ad Spending for Brand Building

The success of One Leaf can be primarily attributed to spending on TV commercials and sponsorship of popular reality shows.

[caption id="attachment_87121" align="aligncenter" width="720"]

Source: Euromonitor International/FGRT[/caption]

Ad Spending for Brand Building

The success of One Leaf can be primarily attributed to spending on TV commercials and sponsorship of popular reality shows.

[caption id="attachment_87121" align="aligncenter" width="720"] Source: FGRT[/caption]

According to 36kr, the brand’s ad spending to promote its face masks reached over ¥1 billion (approximately $150 million) during the two years between 2015 and 2016. Based on data from Euromonitor International, the ad spending over those two years translates into 28% of the brand’s revenues over the same period of time, which is a very high portion when compared to its peers. For example, Shiseido and Kosé Corp spend roughly 6%–7% of their revenues on advertising expenses for all beauty products. Given its substantial ad spend, One Leaf has become a prominent sponsor of popular reality shows and television series.

Integration of an Online Shopping Festival and a Popular Reality Show

In addition, One Leaf integrated a reality show and e-commerce to promote its brand in China. JD.com and Alibaba, the largest e-commerce players in China, organized a one-day shopping festival on June 18, 2016. One Leaf leveraged on the popular Chinese variety music show Come Sing With Me, hosted by Wang Han and Han Hong, to promote its brand. Cooperating with Tmall, the leading e-commerce platform in China, consumers could interact with the show by shaking their phones to get a free trial of One Leaf face masks on that day. The brand gained popularity following the innovative marketing campaign. In 2016, One Leaf’s sales on Tmall surpassed US$45 million, and in 2017, one-day sales on June 18 reached US$4.5 million.

My Beauty Diary

In contrast with One Leaf’s tremendous ad spend and marketing effort, My Beauty Diary, owned by Uni-President Enterprises, has minimal ad spending or marketing budget. However, the brand has also experienced strong growth over the past decade, expanding its sales from US$7.2 million in 2007 to US$77.4 million in 2016.

[caption id="attachment_87122" align="aligncenter" width="720"]

Source: FGRT[/caption]

According to 36kr, the brand’s ad spending to promote its face masks reached over ¥1 billion (approximately $150 million) during the two years between 2015 and 2016. Based on data from Euromonitor International, the ad spending over those two years translates into 28% of the brand’s revenues over the same period of time, which is a very high portion when compared to its peers. For example, Shiseido and Kosé Corp spend roughly 6%–7% of their revenues on advertising expenses for all beauty products. Given its substantial ad spend, One Leaf has become a prominent sponsor of popular reality shows and television series.

Integration of an Online Shopping Festival and a Popular Reality Show

In addition, One Leaf integrated a reality show and e-commerce to promote its brand in China. JD.com and Alibaba, the largest e-commerce players in China, organized a one-day shopping festival on June 18, 2016. One Leaf leveraged on the popular Chinese variety music show Come Sing With Me, hosted by Wang Han and Han Hong, to promote its brand. Cooperating with Tmall, the leading e-commerce platform in China, consumers could interact with the show by shaking their phones to get a free trial of One Leaf face masks on that day. The brand gained popularity following the innovative marketing campaign. In 2016, One Leaf’s sales on Tmall surpassed US$45 million, and in 2017, one-day sales on June 18 reached US$4.5 million.

My Beauty Diary

In contrast with One Leaf’s tremendous ad spend and marketing effort, My Beauty Diary, owned by Uni-President Enterprises, has minimal ad spending or marketing budget. However, the brand has also experienced strong growth over the past decade, expanding its sales from US$7.2 million in 2007 to US$77.4 million in 2016.

[caption id="attachment_87122" align="aligncenter" width="720"] Source: Euromonitor International/FGRT[/caption]

The brand’s low-price strategy is the recipe behind its strong growth. Uni-President Enterprises saw that consumers wanted to wear masks more often, but as brands were mostly focusing on face masks at premium pricing, the choices for face masks for mass market were limited. Therefore, the company developed face masks for mass market at lower pricing, targeting the younger generation aged 15–29.

Rather than using substantial ad spend to promote the brand, My Beauty Diary reaches its target customers through social media and video platforms. Millennials are attracted by the high-quality, low-price face masks and they share the products among their friends and on social media. According to Mintel, some of the strongest motivations for users to try new products include good word of mouth and natural ingredients. Beauty Diary’s high-quality, low-price offering has allowed it to promote the brand to its target customers without incurring substantial ad spend costs, which has helped it to take up considerable market share in the face mask market.

Source: Euromonitor International/FGRT[/caption]

The brand’s low-price strategy is the recipe behind its strong growth. Uni-President Enterprises saw that consumers wanted to wear masks more often, but as brands were mostly focusing on face masks at premium pricing, the choices for face masks for mass market were limited. Therefore, the company developed face masks for mass market at lower pricing, targeting the younger generation aged 15–29.

Rather than using substantial ad spend to promote the brand, My Beauty Diary reaches its target customers through social media and video platforms. Millennials are attracted by the high-quality, low-price face masks and they share the products among their friends and on social media. According to Mintel, some of the strongest motivations for users to try new products include good word of mouth and natural ingredients. Beauty Diary’s high-quality, low-price offering has allowed it to promote the brand to its target customers without incurring substantial ad spend costs, which has helped it to take up considerable market share in the face mask market.

Source: iStockphoto[/caption]

Beauty brands search for novel natural ingredients with unique skin care functions for new product development. The leading Taiwanese beauty brand, My Beauty Diary applied Tahitian pearl— which contains vitamins, minerals and amino acid to improve skin tone—in one of its new face mask products. The face mask launch was a great success, achieving total sales of 120 million packets over the four years to 2016.

[caption id="attachment_87124" align="aligncenter" width="720"]

Source: iStockphoto[/caption]

Beauty brands search for novel natural ingredients with unique skin care functions for new product development. The leading Taiwanese beauty brand, My Beauty Diary applied Tahitian pearl— which contains vitamins, minerals and amino acid to improve skin tone—in one of its new face mask products. The face mask launch was a great success, achieving total sales of 120 million packets over the four years to 2016.

[caption id="attachment_87124" align="aligncenter" width="720"] Source: draxe.com/My Beauty Diary/Hua Niang/FGRT[/caption]

Source: draxe.com/My Beauty Diary/Hua Niang/FGRT[/caption]

Source: Silab/Prospector/Algues et Mer/Euromonitor International/FGRT[/caption]

Source: Silab/Prospector/Algues et Mer/Euromonitor International/FGRT[/caption]

Source: Wired Beauty[/caption]

Wired Beauty, a startup based in France, invented Mapo, a connected beauty mask that can monitor the face skin’s condition to determine the most suitable skin care product. Consumers may find it hard to choose a suitable skin care product based on the current condition of their skin. With Mapo, they can check their skin’s hydration level to determine the best skin care products for themselves.

Drunk Elephant—Embracing and Searching for Unique Natural Ingredients

Drunk Elephant, a startup found by Tiffany Masterson, develops nontoxic skincare products formulated without hazardous ingredients. The company rolled out two face mask products with a non-toxic natural formula—25% AHA and 2% BHA to refresh skin tone and texture—which boosted the company’s sales by 600% to an estimated $30 million in 2016, and which is expected to more than double sales by the end of 2017.

A Combination of Pure Gold and Plant Stem Cell Technology for Anti-Aging

Adore Cosmetics develops high-end anti-aging skincare products by harnessing the power of pure gold and exclusive plant stem cell technology, harvested from a rare species of Swiss apple. A unique combination of visible 24-karat gold sprinkles and highly refined magnetic powder work to repair broken cellular connections. The anti-aging power is amplified by its exclusive Plant Stem Cell formula, as well as the added benefits of moisturizing sweet almond oil, aloe vera to soothe, shea butter to hydrate, and Vitamin E that fights free radicals and air pollution to freshen skin’s appearance.

Source: Wired Beauty[/caption]

Wired Beauty, a startup based in France, invented Mapo, a connected beauty mask that can monitor the face skin’s condition to determine the most suitable skin care product. Consumers may find it hard to choose a suitable skin care product based on the current condition of their skin. With Mapo, they can check their skin’s hydration level to determine the best skin care products for themselves.

Drunk Elephant—Embracing and Searching for Unique Natural Ingredients

Drunk Elephant, a startup found by Tiffany Masterson, develops nontoxic skincare products formulated without hazardous ingredients. The company rolled out two face mask products with a non-toxic natural formula—25% AHA and 2% BHA to refresh skin tone and texture—which boosted the company’s sales by 600% to an estimated $30 million in 2016, and which is expected to more than double sales by the end of 2017.

A Combination of Pure Gold and Plant Stem Cell Technology for Anti-Aging

Adore Cosmetics develops high-end anti-aging skincare products by harnessing the power of pure gold and exclusive plant stem cell technology, harvested from a rare species of Swiss apple. A unique combination of visible 24-karat gold sprinkles and highly refined magnetic powder work to repair broken cellular connections. The anti-aging power is amplified by its exclusive Plant Stem Cell formula, as well as the added benefits of moisturizing sweet almond oil, aloe vera to soothe, shea butter to hydrate, and Vitamin E that fights free radicals and air pollution to freshen skin’s appearance.