DIpil Das

Introduction

What’s the Story? Coresight Research has identified inclusivity as a key trend to watch in retail and a component trend of Coresight Research’s RESET framework for change. That framework provides retailers with a model for adapting to a new world marked by consumer-centricity, in 2022 and beyond (see the appendix of this report for more details). We discuss the continuing evolution of the gender-free product category, including drivers of market growth, recent developments by major brands and retailers and considerations for retailers and brands entering the category. Why It Matters Gender identification, with consumers identifying beyond the two traditional genders of men and women, is becoming more of a focal point of diversity and inclusivity. Individuals’ gender identification may align with their birth sex (man/male and woman/female), but many other gender identities exist such as “gender-fluid,” “gender-neutral,” “non-binary,” “transgender” or “gender-free,” to name a few. Some individuals identify as gender fluid, meaning one’s gender identity or gender expression, or both, may change over time. Some individuals identify as non-binary, meaning they do not identify as either male or female. Diverse representation, including of gender, is an important consideration for product portfolios at varying price points across multiple retail categories, including apparel, footwear, accessories and beauty. The gender-free category continues to evolve through community, social, legal and retail channels. The consumer for gender-free products is not just an individual with one specific gender identity; the category and collections can appeal to all.The Evolving Gender-Free Category: Coresight Research Analysis

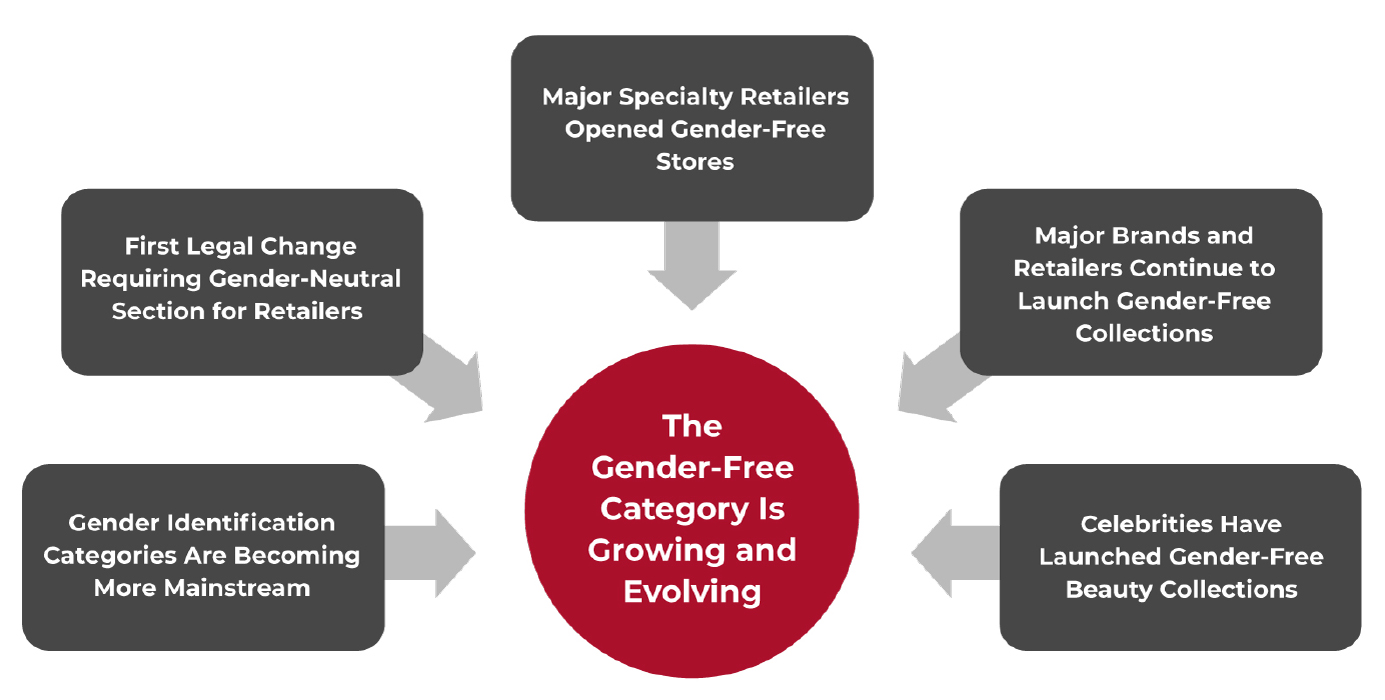

Coresight Research has identified evidence of the gender-product category evolving and gaining traction, which we summarize in Figure 1 and discuss in further detail in this report.Figure 1. Evidence of Gender-Free Product Category Growth [caption id="attachment_151125" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Mainstreaming of Gender-Identification Categories Beyond Men and Women

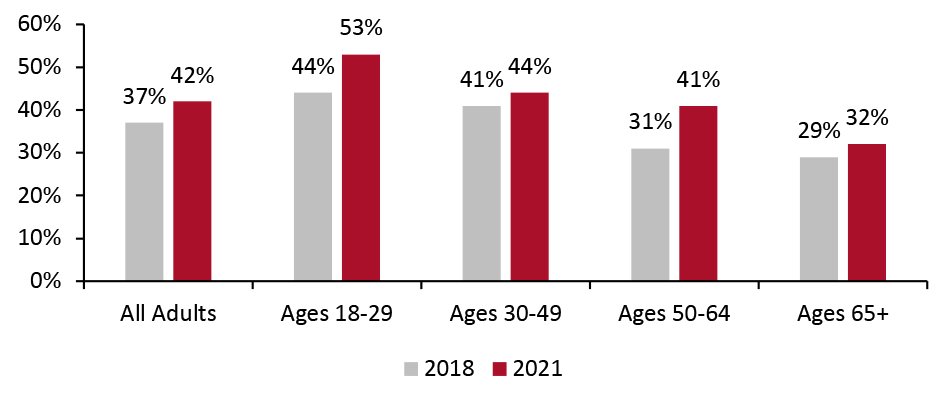

One of the biggest drivers of the gender-free category has been open conversations around gender identity. Conversations around gender-identification categories beyond men and women have accelerated over the past several years in workplaces and schools with one of the biggest changes around education and awareness around preferred pronoun usage. According to a June 2021 Pew Research Center survey, 42% of adults report that they know someone who goes by gender-neutral pronouns, up from 37% in 2018.

Various surveys suggest a generational shift in gender identity, with younger consumers reporting a higher incidence of varied gender identities compared to older individuals; as shown in Figure 2, over half of adults aged 18 to 29 report that they know someone who goes by gender-neutral pronouns, up nine percentage points from 2018. This is important to note because the younger consumer’s progressive outlook and expression of gender identity may inform purchasing decisions, too.

Source: Coresight Research[/caption]

Mainstreaming of Gender-Identification Categories Beyond Men and Women

One of the biggest drivers of the gender-free category has been open conversations around gender identity. Conversations around gender-identification categories beyond men and women have accelerated over the past several years in workplaces and schools with one of the biggest changes around education and awareness around preferred pronoun usage. According to a June 2021 Pew Research Center survey, 42% of adults report that they know someone who goes by gender-neutral pronouns, up from 37% in 2018.

Various surveys suggest a generational shift in gender identity, with younger consumers reporting a higher incidence of varied gender identities compared to older individuals; as shown in Figure 2, over half of adults aged 18 to 29 report that they know someone who goes by gender-neutral pronouns, up nine percentage points from 2018. This is important to note because the younger consumer’s progressive outlook and expression of gender identity may inform purchasing decisions, too.

Figure 2. Percent of US Adults Who Know Someone Who Uses Gender-Neutral Pronouns [caption id="attachment_151126" align="aligncenter" width="701"]

Pew Research Online Survey, June 2021, 10,606 Adults

Pew Research Online Survey, June 2021, 10,606 Adults Source: Pew Research [/caption] Legal Changes Are Pushing the Category Forward In October 2021, California became the first state to sign a bill that requires large retailers with 500 employees or more to display “a reasonable selection” of toys and childcare items in a gender-neutral way, “regardless of whether they have been traditionally marketed either for girls or for boys.” Retailers may still have separate sections for girls and boys. The bill will take effect in 2024, providing further support for the gender-free category in the retail industry. Gender-Free Specialty Retailers Opened Stores Focusing on Teens and Kids Over the past year, the gender-free category transitioned from a retail category within a store to its own retail specialty store, focused on teens and kids.

- Gilly Hicks, an apparel retail banner within Abercrombie & Fitch, opened a gender-free apparel store in Columbus, Ohio in July 2021. The categories include underwear, loungewear and activewear “in patterns and colors that match everyone’s styles, regardless of gender identity” according to the company’s press release. Gilly Hicks is introducing its new Future Stretch fabric, which is designed to accommodate a variety of body types. The store is organized by fabric and its end-use, rather than by gender.

- PacSun, an apparel retailer, opened a gender-free kids’ apparel store in the Mall of America, Minnesota, in November 2021. The collection includes all apparel categories including tops, bottoms, shoes and accessories. According to Brie Olson, President of PacSun, in its press release, "At PacSun, we want our consumers to be free to express themselves and choose what they want to wear without boundaries, which was the driving factor behind introducing our PacSun Kids label, completely without gender."

- Olderbrother is an online eco-sustainable, casual gender-free apparel brand based in Portland, Oregon.

- Brooklyn-based online brand Kirrin Finch focuses on menswear-inspired designs for all consumers.

- Fluide is an online Brooklyn-based vegan, cruelty-free and paraben-free cosmetics brand designed for all skin shades and gender expressions.

- Mass market retailers are targeting Gen-Z consumers, with two of the five mass market retailers opening retail stores targeting kids and teens.

- Celebrities are launching gender-free beauty brands targeting Gen-Z consumers.

- Accessible luxury brands and luxury brands’ target customer is slightly older and includes a millennial consumer (ages 18–40, we estimate).

- Gender-free apparel styles in the mass market sector are focusing on more unisex, casual styles to include T-shirts, hoodies, and bottoms.

- The accessible luxury and luxury category includes fashion-forward styles including ready-to-wear fashion apparel and styles such as skirts, dresses and jackets.

Altazurra gender-free line, Altu Crop Shirt Jacket

Altazurra gender-free line, Altu Crop Shirt Jacket Source: Altu.com [/caption] In the table below, we summarize the retailer and brand launches by channel and type, gender-free target audience, price points and product category.

Figure 3. High-Level Overview of Major Brands and Retailers Gender-Free Category Launches, March 2020–Present [wpdatatable id=2114 table_view=regular]

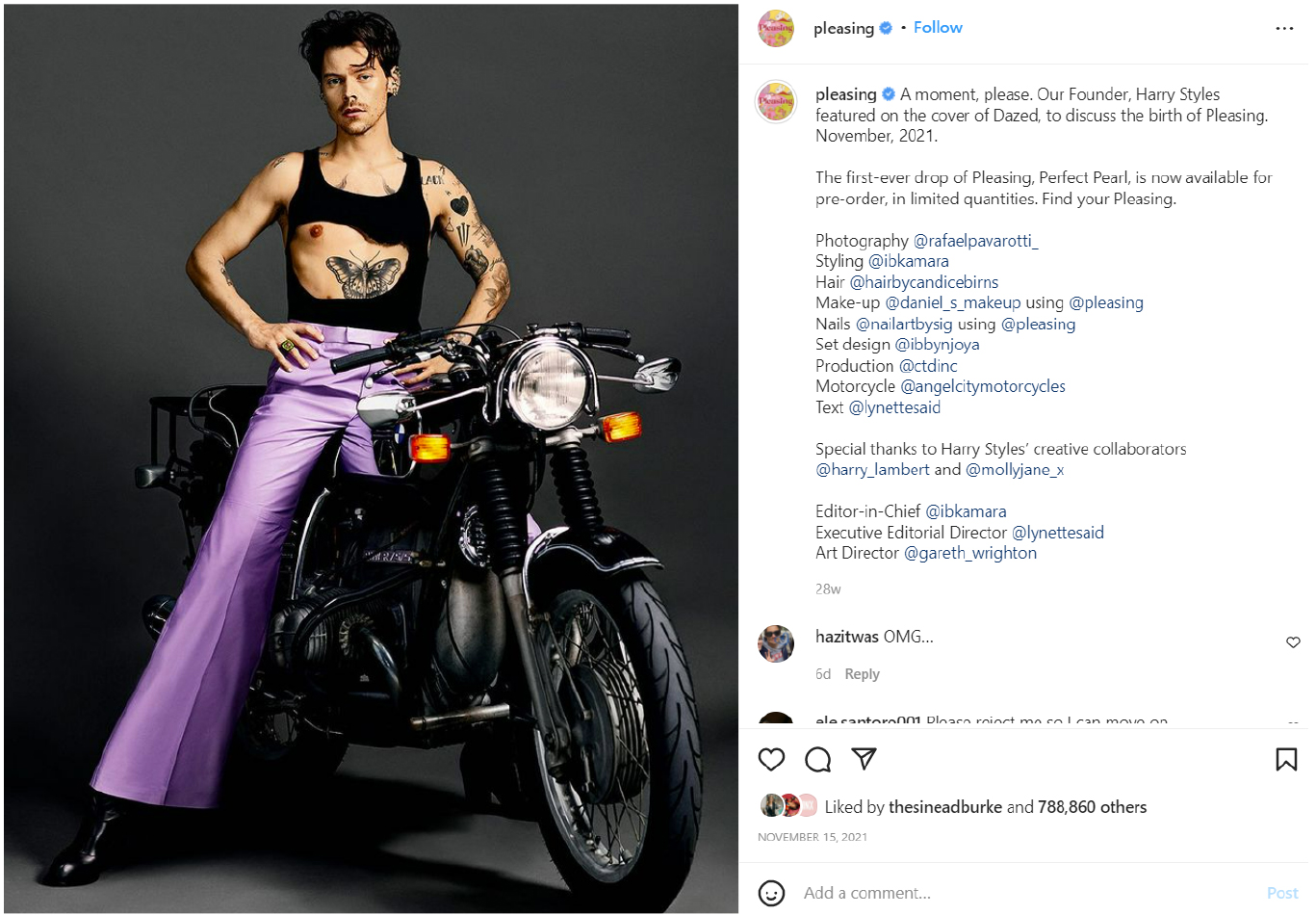

Source: Company reports/Coresight Research Celebrity Product Launches and Fashion Promotion Legitimize the Category Over the past several years, the gender-free category has been gaining recognition through the fashion choices of celebrities who celebrate individuality and expression. Celebrities are demystifying the gender-free category, helping to highlight that gender-free fashion is fashion regardless of one’s gender identity or pronoun and underscoring that fashion can be experimental and fun. The most notable category celebrant, British singer Harry Styles, continues to push the boundaries of the traditional view of masculinity and male fashion and promote expression with his fashion choices. In November 2021, Styles launched Pleasing, a vegan and cruelty-free brand including eye and facial serum, dual lip rollerball and nail color. [caption id="attachment_151128" align="aligncenter" width="700"]

Musician Harry Styles launched Pleasing in November 2021

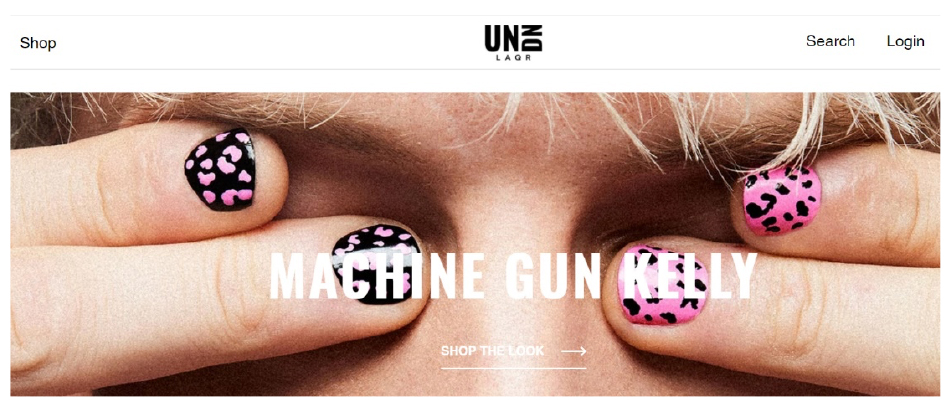

Musician Harry Styles launched Pleasing in November 2021 Source: Pleasing Instagram [/caption] In December 2021, musician Machine Gun Kelly launched UN/DN LAQR, a modern and industrial-designed nail color line encouraging self-expression, mixing colors and designs. In May 2021, Rapper Lil’ Yachty launched Crete, a gender-free nail color brand designed like a pen instead of a bottle. The brand’s motto is “for you, not them.” [caption id="attachment_151129" align="aligncenter" width="700"]

Musician Machine Gun Kelly launched the UN/DN LAQR nail color line in December 2021

Musician Machine Gun Kelly launched the UN/DN LAQR nail color line in December 2021 Source: UN/DR LAQR website[/caption] Education, Technical Design and Fit: Considerations for Entering the Category Education: Education, store merchandising, organizational responsibilities and marketing are all considerations for brands and retailers entering gender-free categories. Rob Smith founded The Phluid Project, the first gender-free retail community store, in March 2018 in New York City. It was created to “push the boundaries of what people are comfortable wearing and to create an inclusive space that rejects the binary of traditional retail,” he told Coresight Research. Smith transitioned his retail offerings spanning accessories, apparel, beauty, and footwear online in June 2020 to its website and The Phluid Project retail brand is sold in over 7,000 retail doors including Nordstrom, Saks Off Fifth and Target. Regarded as a pioneer and advocate for gender-free retail, Smith offers educational and training services to brands and retailers seeking to enter the gender-free category. In a phone interview, Smith emphasized the importance of education and said that before brands and retailers decide to design a gender-free collection, they should understand why they are launching the collection and who they are doing it for. He added the importance of working closely with the design and creative teams to determine who takes on the organizational roles within the company—for example, determining whether gender-free designs are the responsibility of the men’s or the women’s team’s responsibility.

Companies also need to think about where and how gender-free products will be displayed in the store. Smith said that while companies have the best-intentioned efforts, marketing can often get ahead of the customer store experience. He said that there is an opportunity for gender-free products to be presented and marketed in a way that consumers can shop a store by category instead of by gender. Smith said, “For example, retailers can achieve small wins including having a section titled dresses instead of women’s dresses.” Smith said, “Male and female can still exist. It is how you create the space in the middle that is still inclusive that creates a bigger business opportunity.”

Technical Design and Fit: Technical design and fit for gender-free apparel are new areas of consideration for apparel brands and retailers. Specifically, brands and retailers need to rethink not only their design styles, but also the sizes and fit. Emily Robertson Hood, a Senior Consultant at Alvanon, a digital fit technology solution company, told Coresight Research that retailers and brands in the gender-free apparel space are considering design choices involving prints, colors, and embellishments. Alvanon is also seeing brands consider flexible design elements to accommodate a range of heights and body shapes including ensuring that sleeves or trousers lengths can be adjusted to wearer height in a functional way or making the products adjustable through things like drawcords. Hood added that children’s is a great category because children’s body sizes and shapes are mostly the same until about the age of seven, so brands and retailers can be experimental with their designs. For brands and retailers seeking to enter the gender-free category, Hood said that working in a 3D platform—using an avatar that matches to the physical fit form—is a great way to virtually review prototypes while eliminating excess sampling. Avatars are available on Alvanon’s Body platform. She added that the ability for brands to digitize their size range using state-of-the-art technologies to create a 3D avatar portfolio helps brands scale products appropriately. While there will always be demand for a physical prototype, standard avatar size sets and 3D design help brands and retailers to get as close to their design and fit vision as possible before cutting into fabric. She added that while many suppliers are not on 3D platforms yet, they are still able to make decisions through virtual sample reviews. Having a product fitted on the same ‘body’—be it a physical fit form or an avatar—allows everyone involved in the development process to view the same body and scale.What We Think

The gender-free category spanning apparel, accessories, footwear and beauty has continued to expand over the last year, with 13 major retailers and brands launching products/collections since June 2021. Coresight Research believes that the gender-free category is a long-term development that is being supported by dialogue about gender identity and younger consumers’ openness about expressing gender identity. Coresight Research expects that gender-free innovations will evolve beyond unisex branding to also include inclusive style designs that will incorporate both traditional feminine design elements, colors and patterns and traditional masculine design elements, colors and patterns. Retailers and brands should also bear in mind that the target consumers of gender-free products and collections are not necessarily aligned with consumers’ personal gender identification: The category can appeal to all. As retailers and brands consider entering the category, there are considerations including education, which spans understanding the consumer, organizational responsibilities, marketing and store merchandising, as well as design and technical considerations. As consumers are becoming more open about gender identity and gender expression, we expect to see an additional evolution in menswear and womenswear collections with more design opportunities for retailers and brands in their menswear and womenswear collections to incorporate what are considered more feminine design elements, colors and patterns into menswear and more masculine design elements into womenswear. Implications for Brands/Retailers- We see the gender-free category continuing to expand with opportunities geared toward the Gen-Z consumer. This will have implications for how products are merchandised and presented in stores as retailers and brands will need to think strategically about where the gender-free category will be placed in the store as it is not organized by gender.

- There are opportunities to expand to more categories including jewelry and beauty.

- As the gender-free category is expanding to physical retail stores, real estate providers can work with retailers and brands to determine opportunities. Real estate providers can also work with retailers and brands to determine shop-in-shop opportunities with other retailers.

- Products can be marketed differently in stores, more by category and less by gender, which can create opportunities for real estate firms in helping stores to help reconfigure space.

- The gender-free category is a new category requiring different fit and sizing technology solutions that brands and retailers do not currently have. For example, to accommodate a gender-free size requires new sizing and fit standards and patterns. 3D sizing technology companies have an opportunity to partner with retailers and brands to work on establishing a gender-free category.

Appendix: About Coresight Research’s RESET Framework

Coresight Research’s RESET framework for change in retail serves as a call to action for retail companies. The framework aggregates the retail trends that our analysts identify as meaningful for 2022 and beyond, as well as our recommendations to capitalize on those trends, around five areas of evolution. To remain relevant and stand equipped for change, we urge retailers to be Responsive, Engaging, Socially responsible, Expansive and Tech-enabled. Emphasizing the need for consumer-centricity, the consumer sits at the center of this framework, with their preferences, behaviors and choices demanding those changes. RESET was ideated as a means to aggregate more than a dozen of our identified retail trends into a higher-level framework. The framework enhances accessibility, serving as an entry point into the longer list of more specific trends that we think should be front of mind for retail companies as they seek to maintain relevance. Retailers can dive into these trends as they cycle through the RESET framework. The components of RESET serve as a template for approaching adaptation in retail. Companies can consolidate processes such as the identification of opportunities, internal capability reviews, competitor analysis and implementation of new processes and competencies around these RESET segments. Through 2022, our research will assist retailers in understanding the drivers of evolution in retail and managing the resulting processes of adaptation. The RESET framework’s constituent trends will form a pillar of our research and analysis through 2022, with our analysts dedicated to exploring these trends in detail. Readers will see this explainer and the RESET framework identifier on further reports as we continue that coverage.Appendix Figure 1. RESET Framework [caption id="attachment_143517" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]