Nitheesh NH

Introduction

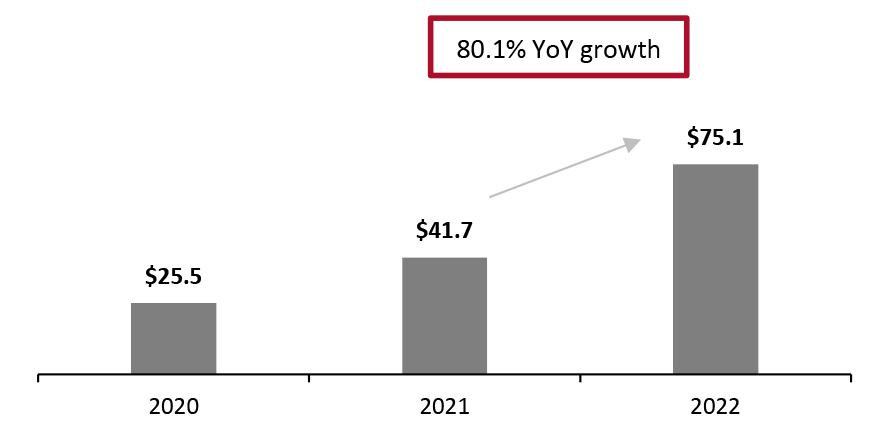

What’s the Story? Faced with ever-increasing competition and the slimmer margins that tend to come with expanded online sales, more retailers are turning to retail media to capitalize on burgeoning shopper data and create new revenue streams. Retail media is an evolved way of advertising whereby brands utilize retailers’ digital and physical channels to promote their products and spread awareness. These ads are often displayed in-store or featured on e-commerce sites—on the home, category, search results or product detail pages—as well as via external channels such as social media platforms Facebook and Instagram; retail media helps brands to boost their presence on the digital shelf. Retailers are increasingly racing toward the $75 billion high-margin prize in retail media. Retail giants Amazon and Walmart disclosed that their global retail advertising revenues in 2021 were $32.1 billion and $2.1 billion, respectively. Adoption is on the rise—and retail media networks aren’t just for retail giants anymore. Retailers of all sizes can use their first-party data to drive sales and bring in ad spend from their brand partners. In this report, we discuss the key drivers fueling the growth of the retail media industry and identify five key trends that we will watch moving forward. This report is sponsored by NielsenIQ, a global information services company and a provider of omnichannel measurements. We detail the company’s new division, NielsenIQ Activate, the Retail Media Intelligence platform, in a later section. Why It Matters More than ever, consumers are using digital channels for their day-to-day needs. However, changes in consumer privacy regulations have forced brands to re-evaluate the use of first-party data—the information that a company collects directly from its customers, prospects and users, either online or offline, through websites, apps, social media and surveys. Retailers own a significant share of first-party data that is crucial for brands and advertisers. Many are investing a share of their media dollars to reach shoppers through retailer-owned channels. We believe that retail media will be one of the fastest-growing advertising channels this year. Coresight Research estimates that the global retail media industry will total $75.1 billion in 2022, representing huge year-over-year growth, as shown in Figure 1.Figure 1. Estimated Global Retail Media Advertising Revenues (USD Bil.) [caption id="attachment_146911" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

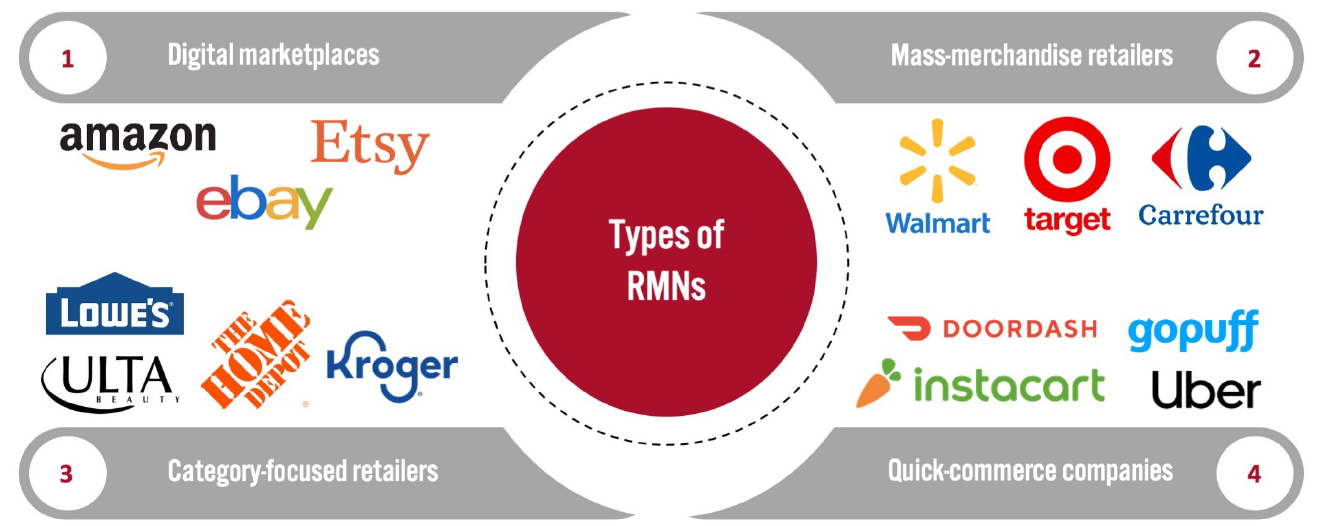

The drive to monetize shopper data and increase profit margins is attracting more retailers to start their own retail media networks (RMNs) or affiliate with networks organized by companies that aggregate retail channels. An RMN is a digital advertising business that enables brands and advertising partners to buy advertising space across the retailer’s properties or properties controlled by digital marketplaces or quick-commerce companies (see Figure 2).

Source: Coresight Research[/caption]

The drive to monetize shopper data and increase profit margins is attracting more retailers to start their own retail media networks (RMNs) or affiliate with networks organized by companies that aggregate retail channels. An RMN is a digital advertising business that enables brands and advertising partners to buy advertising space across the retailer’s properties or properties controlled by digital marketplaces or quick-commerce companies (see Figure 2).

Figure 2. Types of Retail Media Networks [caption id="attachment_146912" align="aligncenter" width="701"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

The Evolution of Retail Media: Coresight Research x NielsenIQ Activate Analysis

Key Market Drivers E-Commerce Growth Acceleration It is no surprise that we have witnessed significant growth in the overall e-commerce market, particularly coming out of the pandemic. The onset of the global pandemic in 2020 signaled a permanent shift in consumer behavior. Every aspect of life moved behind a screen, from work to play and everything in between. As consumers adapted to shopping for anything and everything online, their expectations regarding digital experiences grew exponentially—and they continue to evolve. This paradigm shift in consumer behavior is one of the critical factors responsible for the continued growth of the retail media industry. The Move Away from Third-Party Cookies Tightening consumer privacy standards and the phase-out of third-party cookies and mobile identifier restrictions have transformed marketers’ acquisition, retention and engagement with customers.- Social media sites Facebook and Twitter removed third-party data from their advertising platforms in 2018 and 2019, respectively, due to privacy regulations restricting the use of third-party cookies. In August 2019, Twitter issued a public apology to its users for using personal information for advertising purposes.

- In 2019, Mozilla Firefox blocked thousands of web trackers by default, protecting users from many websites, analytics companies and advertisers that want to follow their paths across the web.

- Google announced plans to block third-party cookies from Google Chrome in 2020. The company plans to completely stop tracking customer interactions on its browser by 2023.

- In 2020, Apple released a major update to Safari Intelligent Tracking Prevention, the privacy feature that allows its Safari web browser to block cookies. The update ensured that no advertiser or website could use commonplace tracking technology and blocked all kinds of third-party cookies.

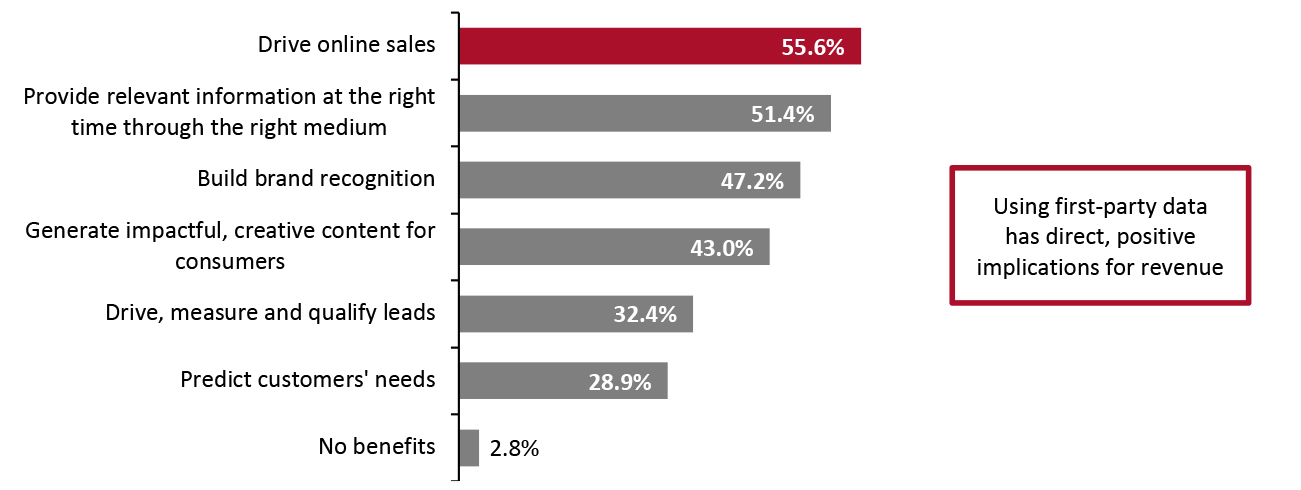

Figure 3. Benefits of Using First-Party Data (% of Respondents) [caption id="attachment_146913" align="aligncenter" width="701"]

Respondents were asked to select up to three options

Respondents were asked to select up to three options Base: 142 US-based executives whose organizations use first-party data for marketing purposes

Source: Coresight Research [/caption] Many retailers control a treasure trove of first-party data through their digital presence and opt-in loyalty programs. Members willingly share preferences, feedback and contextual information. Using this consumer data from retailers provides an opportunity for brands to derive actionable insights that can have a positive impact on revenue. 1. Retailers Are Launching RMNs To Generate Incremental Revenues Although e-commerce businesses have grown over the last few years, structurally, they have variable costs and generate lower margins than brick-and-mortar retail channels. In addition to managing competitive pricing, online businesses incur additional variable overhead costs in the form of shipping costs and handling returns. Retailers have typically focused on customer retention and loyalty to drive revenue, often turning to the last mile to provide competitive offerings that meet consumer expectations for convenience and speed in fulfillment—leading to an increase in fulfillment costs. Retailers must find a balance between increasing fulfillment capabilities while also generating higher margins each year. Furthermore, temporary forces such as labor shortages, rising product costs driven by inflation and supply chain issues increase the pressure on margins. RMNs ease these pressures on margins by allowing retailers to add high-margin advertising business to their revenue streams.

- During its fourth-quarter earnings release, Walmart CFO Brett Biggs said that the company’s retail media arm, Walmart Connect+, helped the company to achieve high margins amid rising margin pressure on its e-commerce business. Biggs confirmed that the retailer plans to scale Walmart Connect+. He said, “Walmart Connect+ advertising experienced robust sales growth this year with a strong pipeline of new advertisers and large growth opportunities ahead. We continue to make strong progress in some of our newer, higher-margin initiatives.”

- On February 3, 2022, Amazon announced that its global retail advertising segment generated revenues of $31.2 billion in 2021; revenues in the fourth quarter of 2021 grew by 32.0%.

- During Walmart’s earnings call for the fourth quarter of 2021, the company disclosed that its global advertising revenue for 2021 was $2.1 billion (of which $1.6 billion was generated by the media business). The company is planning to scale its high-margin retail media business and claims that it is an important factor for its growth.

- French supermarket chain Carrefour expects its retail media arm, Carrefour Links, to generate additional return on investment (ROI) of up to $223.5 million by 2026.

Figure 4. Selected Examples of Global RMNs [wpdatatable id=1958 table_view=regular]

Source: Company reports/Coresight Research 2. Strategic Partnerships Enable Retailers To Show Value to Their Brand Partners Not all retailers possess the resources, skills, tools or data sets needed to monitor, manage and analyze siloed customer data to create value for their brand partners. Technology providers such as NielsenIQ help retailers to set up their retail media business—from insights and analytics to activation, targeting and measurement. These technology platforms often leverage AI (artificial intelligence) to understand customer needs; align with brands on assortment and promotion; provide insights to optimize marketing and ad budgets; and connect customers with the right products at the right time and in a highly personalized manner. Retail media intelligence platforms gather data such as customer profiles and shopping behaviour to identify retention, win-back and cross-selling opportunities. For a measurement provider such as NielsenIQ, this also extends to supply chain, inflation, market dynamics data—creating an end-to-end platform. Innovative regional and specialty retailers are moving decisively to pursue strategic partnerships to build their retail media capabilities. Two notable examples are as follows:

- Online grocer FreshDirect began collaborating with ciValue, now a NielsenIQ company, in January 2022 to improve its insight-sharing program. FreshDirect will use the platform to gain insights into customer preferences and launch customer-centric marketing strategies.

- Michaels, a US-based specialty retailer, partnered with global retail media technology provider Criteo in February 2022. Criteo will enable Michaels to scale its retail media program with new capabilities, such as sponsored products and display and off-site advertising.

Figure 5. Selected Players in the Retail Media Technology Landscape [wpdatatable id=1959 table_view=regular]

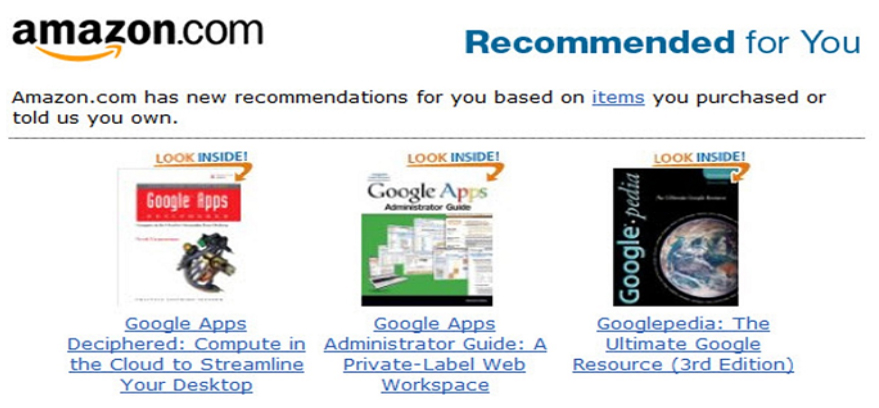

Source: Company reports/Coresight Research 3. Retail Media Allows Brands To Offer Personalized Promotions to Customers With retail media, advertisers can meet customers at the right time and at the right place. First-party retailer data allows brands to offer mass personalization at scale—communicating with individual customers and not stopping at customer segments. Delivering a connected personalized customer experience has become a “must-have” for brands to remain relevant and ahead of the competition. Personalization is extremely important for both brands and retailers—it helps to improve loyalty and increase sales. Through personalization, retailers help consumers to navigate choices at speed. When it comes to discounts and rewards, customers have come to expect personalized offers and relevant rewards. Offering personalization across promotions and recommendations in real time typically leads to an increase in sales and basket size. It also attracts customers to try new products and encourages them to buy more, leading to a sales uplift. Retailers need to invest in retail media intelligence platforms that allow them to predict, share, launch, analyze and manage offers across all channels in real time—as well as to scale their personalization program and reduce the time required to initiate campaigns. [caption id="attachment_146914" align="aligncenter" width="700"]

Amazon offers on-site recommendations to its customers

Amazon offers on-site recommendations to its customers Source: Company website [/caption] 4. Brands Use Retail Media To Gain Deeper Insights into Advertising Key Metrics Retail media allows advertisers to measure the impact of their ad spend to the point of purchase, offering closed-loop measurement (the ability to measure the impact of campaign activity on in-store action) that enables brand advertisers to tie a media campaign to real sales data.

- Global CPG (consumer packaged goods) brand Kraft Heinz used retail media to promote its 2021 “Leave it to Lunchables” ad campaign, which yielded more than 3.6 million impressions, according to the company. The ad campaign ran across multiple platforms, including display ads on recipe pages, digital circulars and in-store kiosks. According to Kraft Heinz Senior Shopper Marketing Manager Desiree Casey, “It’s just a great way for [the company] to reach those independent customers and to be able to provide equity in advertising against our brands, amplifying what we already have going on in the circular and bringing it to life online.”

- Walmart’s demand-side platform, Walmart DSP (part of Walmart Connect+), delivered ~500% ROAS for Société Bic (known as BIC), a French disposable consumer product manufacturer. The company ran the campaign in December 2021 for three products: the Soleil Click 5 women’s disposable razor; the Comfort 3 Hybrid men’s razor; and BodyMark, a temporary-tattoo marker.

- Rich first-party data foundation

- Closed-loop retailer data to drive personalization

- Clear measurement and campaign attribution

- Actionable audience insights to inform merchandising decisions

- Walmart began using digital screens for in-store advertising (Wal-Mart TV) in 1998. In 2006, it launched the Walmart Smart Network, which uses upgraded digital technology to deliver ads in stores. The company has installed more than 170,000 digital display screens across its 4,700 stores globally. In January 2022, Walmart piloted its newly designed digital displays at Store 4108 in Springdale, Arkansas. The newly displayed digital screens offer contextual information about products and brands and are passively interactive—they display customer reviews when products are lifted from the shelves. The company has also placed QR codes throughout the store to enhance the in-store shopping experience.

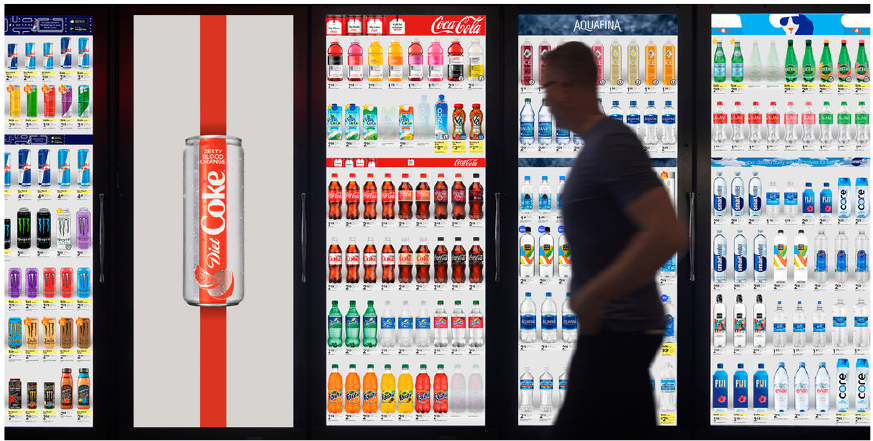

- Cooler Screens, a US-based digital in-store retail media company, has installed more than 10,000 screens across 700 retail locations in the US, enabling retailers and brands to display messages to their target audiences. The screens have sensors that can monitor the shopper and their activities—such as seeing the ads and selecting the products—enabling retailers to measure the effectiveness of the advertising campaign.

Cooler Screens installed in a retail outlet

Cooler Screens installed in a retail outlet Source: Company website [/caption] Several startups, such as Freeosk, offer an ad network wherein brands can buy digital ad slots on each vending machine to encourage people to purchase their products. Additionally, as part of their proximity marketing strategy, retailers can use mobile beacons to gather information about customer movements and send alerts to customers’ phones to optimize and personalize the in-store experience. Retailers can pair beacon-based apps and proximity marketing software to capture the geographic location of the user and then deliver relevant content based on their immediate environment.

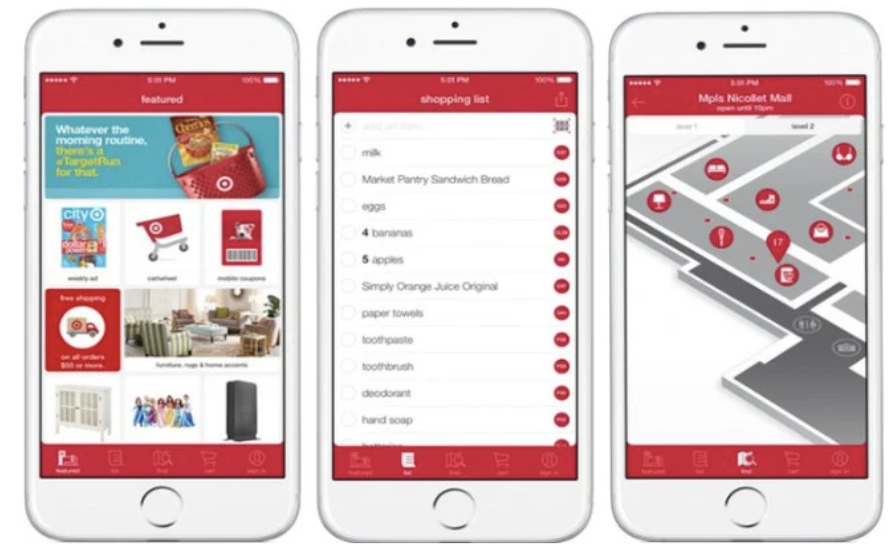

- Target uses this technology to map routes for customers to help them locate products on an aisle-by-aisle basis.

- Beauty retailer Sephora uses beacon technology combined with push notifications to alert customers that they can claim a free 15-minute in-store makeover, for example.

Target uses beacon technology to guide customers to the aisles where the products are located

Target uses beacon technology to guide customers to the aisles where the products are located Source: Company website [/caption]

NielsenIQ Activate: A Unique Retail Media Intelligence Platform

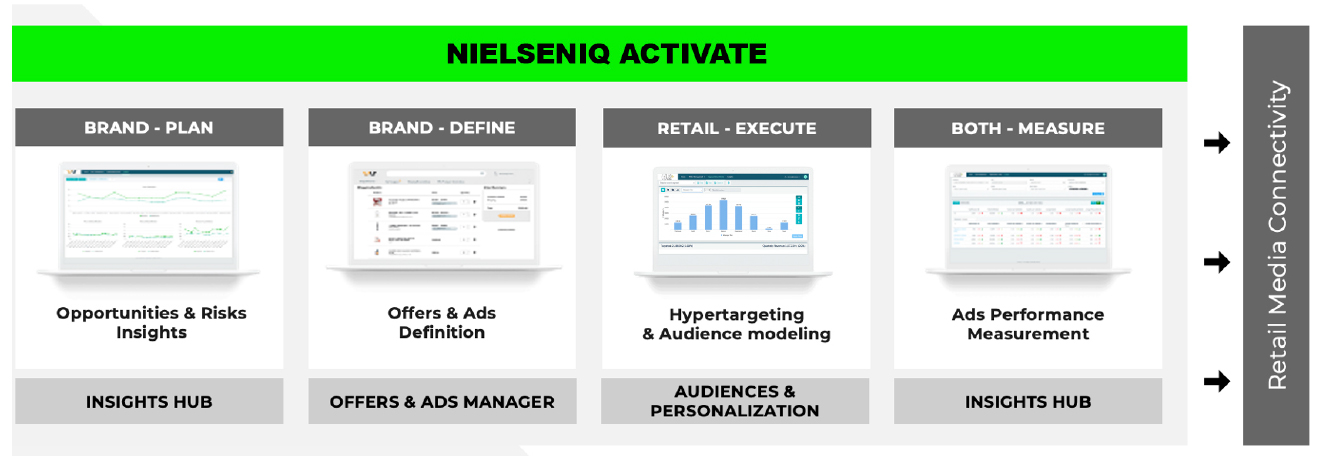

NielsenIQ, a global information services company and a provider of omnichannel measurements, acquired ciValue, the Retail Media Intelligence platform, in March 2022. NielsenIQ Activate enables retailers to create sustainable revenues by monetizing their retail media assets across physical and digital channels, and gain credibility to inform brands with the insights they need to command their customers’ attention, take action on those insights, and measure the ROI of their activities across all channels. NielsenIQ Activate is a software-as-a-service (SaaS) platform that can be up and running in 60 days, according to the company. It comprises dedicated applications for hyper-targeted audience building, offer and ads management, and end-to-end measurement. The self-serve collaboration platform helps organizations to understand customers’ needs and deliver a personalized experience. NielsenIQ Activate enables retailers and brands to increase their share of wallet by using real-time customer data and insights, and by empowering them with the right set of activations to act on it and measure it. [caption id="attachment_146917" align="aligncenter" width="701"] NielsenIQ Activate retail media intelligence flow

NielsenIQ Activate retail media intelligence flow Source: NielsenIQ Activate [/caption] Case Study Super-Pharm, one of the largest drugstore chains in EMEA, partnered with NielsenIQ, a Nielsen company, to develop campaigns that would be beneficial to all parties—the retailer, supplier and customer. The company wanted to expand its leading loyalty program to digital channels, and to customers who were not member of the program. In doing so, it also wanted to work very closely with brand partners, share insightful data and increase supplier-funded collaborations. Leveraging its existing personalization program, the company decided to start amplifying its promotions on social media and on its app. Through the NielsenIQ Activate AI-driven collaborative platform, Super-Pharm was able to share critical customer data with its suppliers to inform their marketing strategies, and enable them to directly create audiences. Suppliers gained access to the Super-Pharm portal, which offered them full access to customer reports. With better understanding of customer behavior, suppliers were able to understand risks and opportunities, and offer effective content to customers. With the help of NielsenIQ Activate, Super-Pharm was able to achieve a 2X increase in supplier funding toward joint marketing initiatives. According to Hilla Milo, Director of Personal Marketing at Super-Pharm, “The solution enables collaboration between the loyalty team members, who are most knowledgeable about the customers, and the suppliers, who know the most about the products, in a single system—and all for the good of the customers.”

What We Think

We believe that the relevance and popularity of retail media will continue to grow and become a mainstream revenue channel for retailers. We expect to see retailers of all sizes enter into partnerships with technology providers to generate additional revenues from vast amounts of insightful customer data. These technology providers can help retailers to successfully set up, run and manage their RMNs. Implications for Retailers and Brands- The retail media market is expanding, and there are multiple retailers that have established RMNs in an effort to monetize their digital and media assets. RMNs that offer access to consumer data with closed-loop measurement are likely to win.

- Brand marketers are motivated to leverage retail media advertising to promote their brands, measure outcomes and gain access to valuable, first-party consumer data.

- Partnering with retail media platforms allows retailers to expand their retail media advertising revenues quickly by connecting brands to the right customers with the right messages at the right moments in the shopping process.

- Retailers that adopt solutions that incorporate self-serve platforms to gain insights, activate ads and measure campaigns can enable brands to build and deliver high-quality ads without reliance upon intermediaries—thus cutting costs.

About NielsenIQ NielsenIQ is the leader in providing the most complete, unbiased view of consumer behavior, globally. Powered by a groundbreaking consumer data platform and fueled by rich analytic capabilities, NielsenIQ enables bold, confident decision-making for the world’s leading consumer goods companies and retailers. Using comprehensive data sets and measuring all transactions equally, NielsenIQ gives clients a forward-looking view into consumer behavior in order to optimize performance across all retail platforms. The company’s open philosophy on data integration enables the most influential consumer data sets on the planet. NielsenIQ delivers the complete truth. NielsenIQ, an Advent International portfolio company, has operations in nearly 100 markets, covering more than 90% of the world’s population. For more information, visit NielsenIQ.com.