What’s the Story

Several multinational corporations from Asia, Europe and the US may shrink their sourcing and production in China. This report explored this new wave of foreign companies relocating their production lines out of China, following the impact of the US-China trade war in 2019.

Why It Matters

Tension has been recently rising between China and Western countries, including Australia, the EU, the UK and the US. US-China relations cooled amid the 2018–19 tariff conflict. Mistrust then started to build due to the Covid-19 pandemic and related controversy about China’s influence on the WHO (World Health Organization). Subsequently, China approved a national security law regarding Hong Kong. US President Donald Trump has responded by planning to revoke Hong Kong’s special trading status with the US.

Larry Kudlow, Director of the US National Economic Council at the White House, said in April that the US should “pay the moving costs” of American companies that want to move production out of China. Around 20% of the US retail supply chain is exposed to China, according to financial services company Cowen & Co.

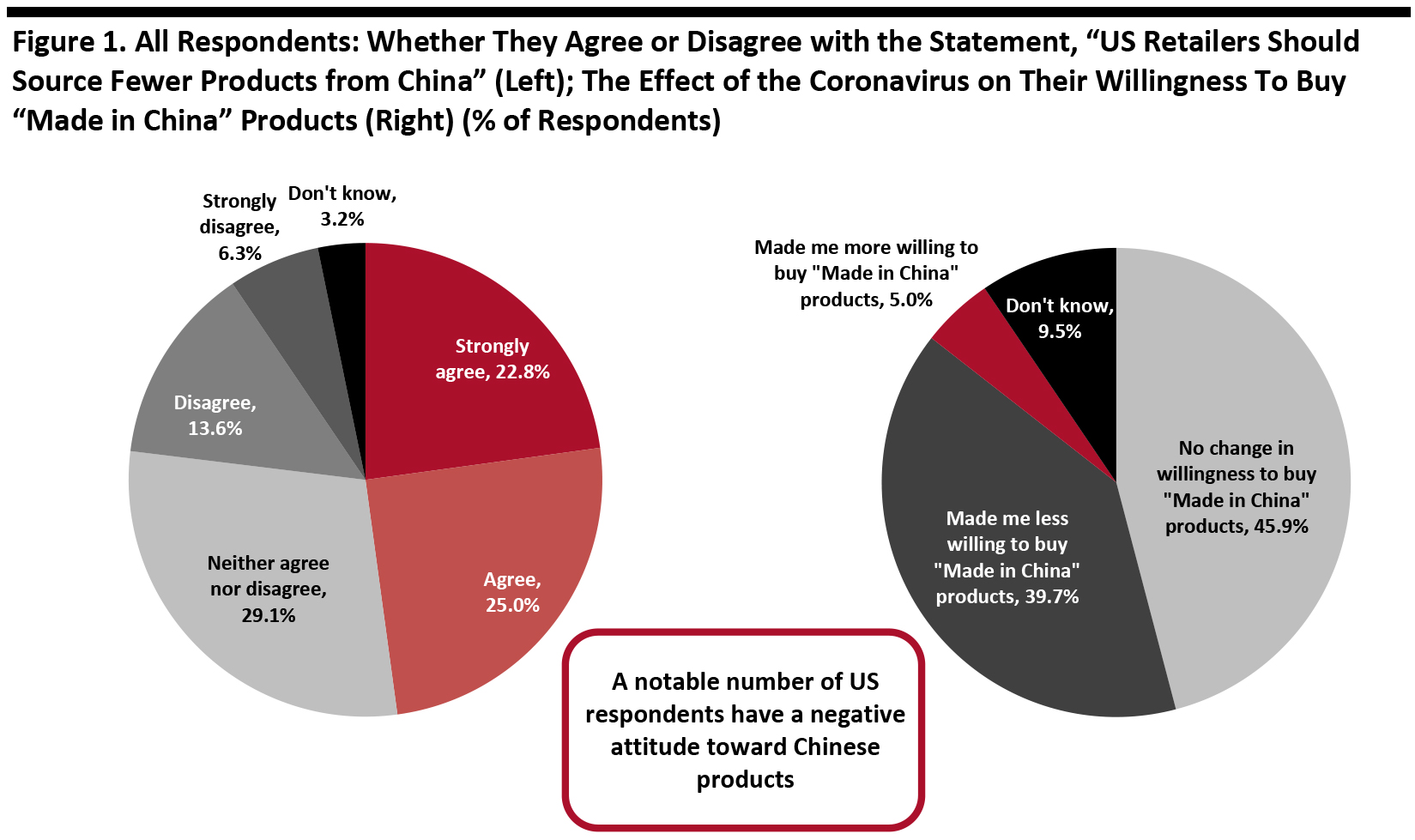

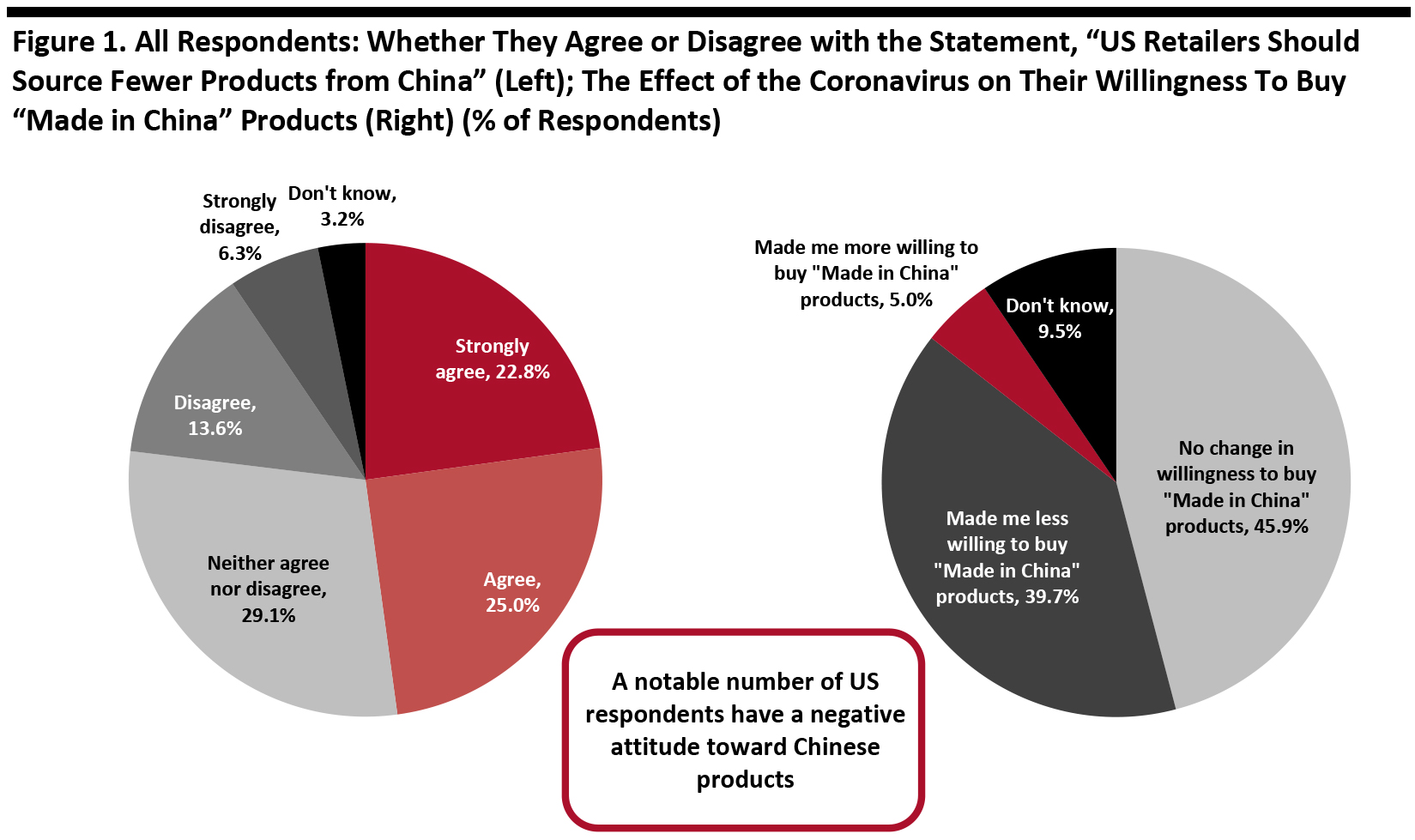

A Coresight Research survey of US consumers, conducted on June 3, 2020, showed the emerging negative sentiment toward Chinese products in America.

- Some 47.8% of respondents stated that they either agree or strongly agree with the statement, “US retailers should source fewer products from China.”

- Some 39.7% of respondents said that the coronavirus pandemic has made them less willing to buy “Made in China” products.

This indicates the mistrust among US consumers about China-made products and quantifies US backlash over China’s handling of the coronavirus.

[caption id="attachment_111720" align="aligncenter" width="700"]

Base: US Internet users aged 18+, surveyed on June 3, 2020

Base: US Internet users aged 18+, surveyed on June 3, 2020

Source: Coresight Research [/caption]

US retailers may need to urgently review the extent of their reliance on China as a manufacturing hub and to evaluate whether the “Made in China” label is a concern for their global consumer base.

Note that there is an eight-percentage-point gap between the two viewpoints described above—that US retailers should reduce their sourcing in China and that the Covid-19 pandemic has dampened consumers’ willingness to buy “Made in China” products. It is possible that a segment of US consumers already held negative views about sourcing in China prior to the coronavirus crisis, and their willingness to buy China-made products has therefore not changed.

Moving Sourcing out of China: In Detail

Below, we outline selected retailers’ recent moves in shifting sourcing away from China. These companies have not indicated that these shifts are due to political or consumer sentiment, and we present them as the potential vanguard of a more widespread shift of sourcing.

German Footwear Brand Von Wellx Shifts Production to India

In May 2020, German footwear brand Von Wellx decided to move its entire production from China to India. The brand is sold in more than 80 countries and has around 100 million customers across the globe. The brand was launched in India in 2019 and is available online and across 500 retail locations.

The shoemaker will build a manufacturing unit at Agra in Uttar Pradesh with Latric Industries. Von Wellx used to produce 3 million pairs of shoes annually in China. Latric Industries currently has a capacity of 500,000 pairs for Von Wellx annually—a shortfall of 2.5 million. Von Wellx expects to resume full manufacturing capacity in two years, with a first-phase investment of ₹1.1 billion ($14.5 million) over that time period. With its second-phase investment, the company will begin production of raw materials in the Indian plant, such as outsoles, specific fabrics and chemicals.

Apple Is Considering Relocating 20% of Production to India from China

American multinational technology company Apple has reportedly been in talks with Indian government officials to move 20% of its production capacity from China to India. A senior Indian government official said that Apple is expected to produce around $40 billion worth of smartphones in the country over the next five years—mostly for exports—through manufacturers Wistron and Foxconn.

The Indian government has unveiled a $7 billion scheme to bring electronics manufacturing to the country, 80% of which has been earmarked as production-linked incentives for mobile manufacturing activities. India hopes to increase production of mobile phones and their parts to around ¥132 billion by 2025.

Japanese Consumer Goods Company Iris Ohyama Relocates to Japan

Consumer-products manufacturer Iris Ohyama is moving production from China to Japan in June. The company currently produces face masks in Dalian and Suzhou, China, with materials procured from local companies. The total cost of launching mask production in Japan will be around ¥3 billion (around $27.5 million), and the company hopes that subsidy from the Japanese government will cover 75% of the expense.

Iris Ohyama is the first Japanese company to receive a government subsidy to shift production out of China. The Japanese government announced in April that it would provide $2.2 billion for companies that are reorganizing their supply chains, such as moving production back to Japan or diversitying their production bases into Southeast Asia.

What We Think

In the midst of political tension and negative consumer sentiment, we have seen some international companies moving sourcing out of China. This follows a general trend toward sourcing in other countries in recent years, due to rising labor costs in China and in the wake of the 2018–19 US-China tariff conflict.

Some Asian countries have been keen to offer policies and subsidies to incentivize multinationals to relocate: The Japanese government offers financial subsidies for Japanese companies to move sourcing back home or diversify their production bases to Southeast Asian countries; and India has launched a scheme to attract electronics manufacturing.

Other Asian countries are working to attract international companies to move out of China. On June 9, Indonesia was reportedly in talks with the US government to lure American companies operating in China. The government would offer space in its industrial parks, such as Kendal Industrial Park, which is a special economic zone with tax incentives.

It is also noteworthy how short a time it has been between this wave of moving sourcing out of China and the last wave in 2019. In October last year, two US consumer electronics companies, Tile and Fitbit, planned to move manufacturing out of China, citing pressures from the trade conflict. Should political rhetoric continue to ramp up and Western consumers retain or even increase negative sentiment, we could see many more companies follow suit in moving some or all of their production out of China. Retailers and brands must not only pay attention to politics and ease of trade on the supply side; they must consider the demand side—what their customers are thinking and whether they are paying more attention to the subject of sourcing.

Base: US Internet users aged 18+, surveyed on June 3, 2020

Base: US Internet users aged 18+, surveyed on June 3, 2020