M&S, House of Fraser and Debenhams Take the Axe to Stores

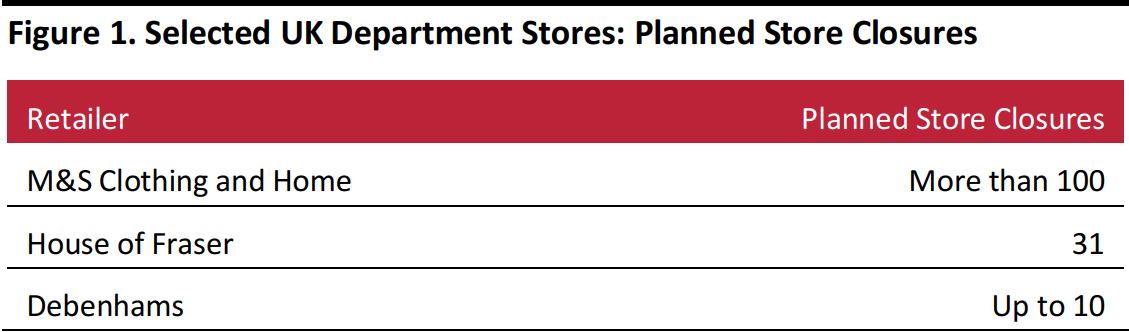

The UK department-store sector is seeing a raft of store closures as embattled mid-market players look to reduce their exposure to less-productive space in the face of underlying sales declines.

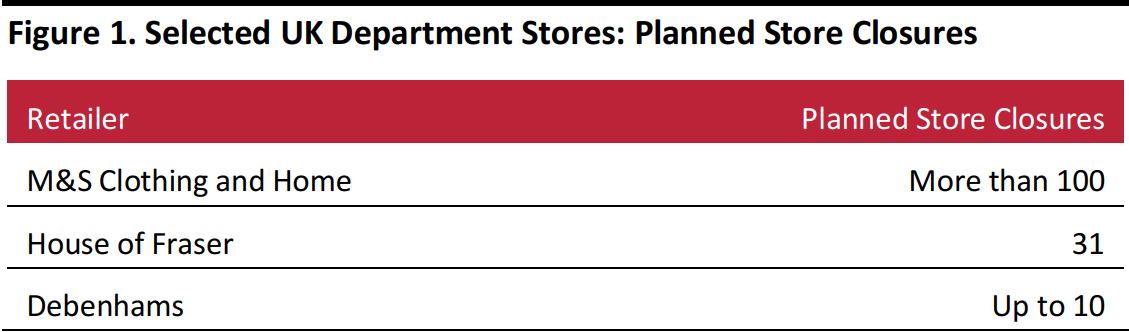

- M&S: On May 22, M&S announced plans to accelerate its closure program, which involves shuttering more than 100 of its Clothing and Home stores by 2022. This includes 21 that have already closed and 14 earmarked for closure in the current fiscal year.

- House of Fraser: On June 6, privately-owned House of Fraser announced plans for a CVA that proposes 31 store closures—more than half of its current 59 stores in the UK and Ireland.

- Debenhams: The retailer closed two stores in January and is reviewing a further eight for closure. At its interim results in March, the company stated that these 10 stores “could become unprofitable over time.” Debenhams opened one new UK store in January. It plans one UK opening in early FY19, which ends in August 2019.

- Debenhams also plans to rightsize a number of its stores, and at its latest results, stated that it is in discussion with landlords and sees opportunities for at least 30 stores to be slimmed down.

Source: Company reports

Source: Company reports

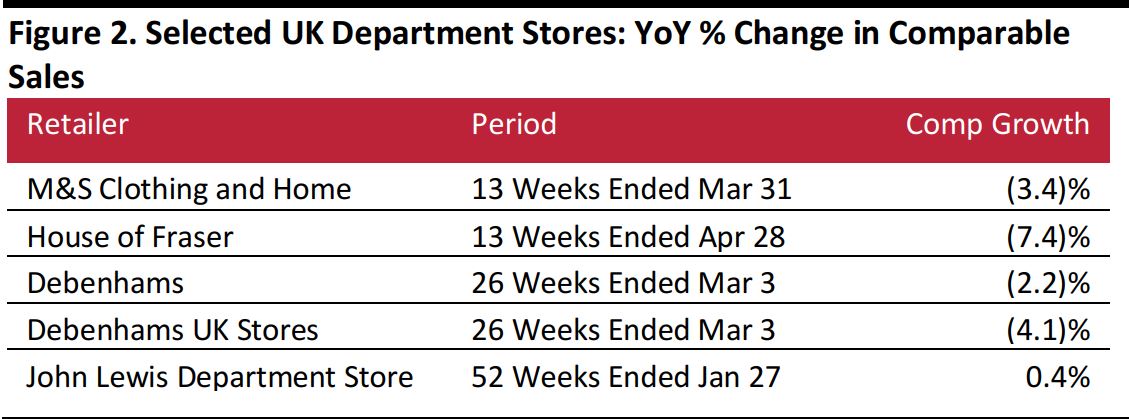

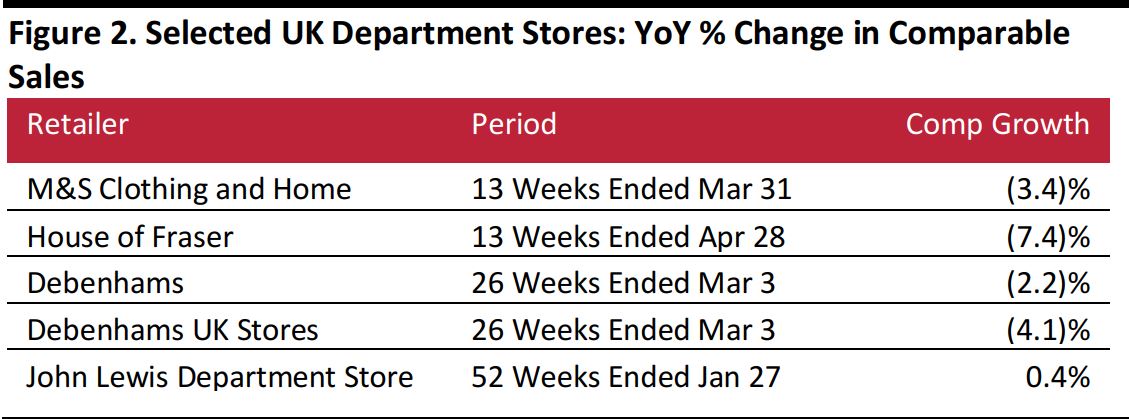

Dwindling comparable sales is a hallmark of each of these three retailers.On June 19, as we go to press, Debenhams issued its third profit warning of 2018 as comparable sales slid a further 1.7% in the 15 weeks ended June 16; we show figures for the prior period, including a breakout for UK stores, in the table below.

The reasons for the declining demand are the same in the UK as in other markets such as the US:

- Consumers have more choice of retailers than ever before and they are increasingly opting for specialized retailers that resonate with their lifestyle or identity.

- E-commerce has stolen department stores’ competitive advantage of choice and convenience.

Source: Company reports

Source: Company reports

John Lewis is the only mid-market department-store retailer that has not announced plans to close stores. In fact, it opened a new London store in March, will open a new store in Cheltenham in October and, in May, announced plans for a new store in Croydon, south of London.

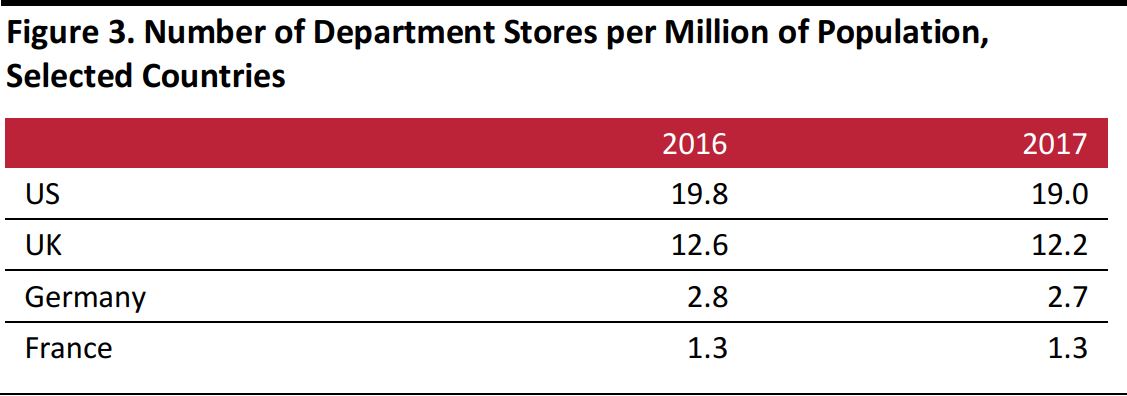

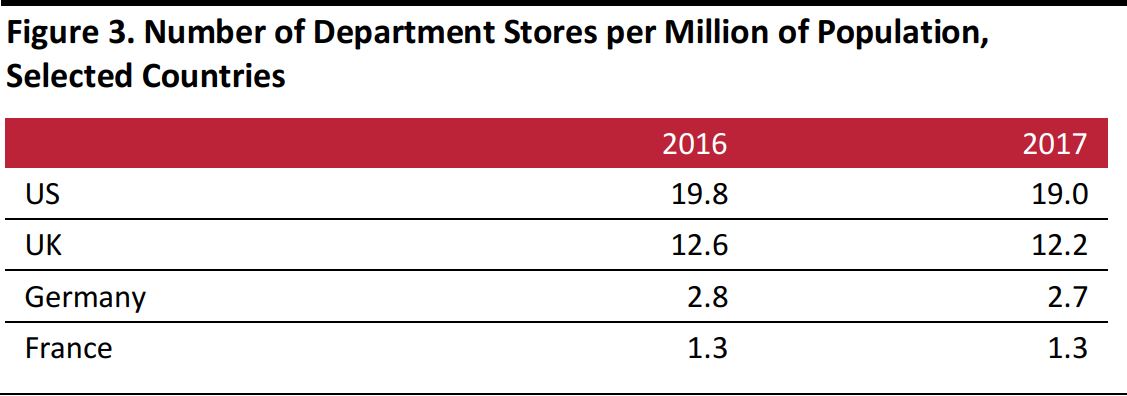

The UK sector’s problems are compounded by a high concentration of department stores relative to other European markets (if we assume M&S Clothing and Home stores are department stores—an assumption that we have made through this report). The UK sees a much higher number of department stores per million of population than Germany and France.

Source: Euromonitor International/US Census Bureau/Eurostat/Coresight Research

Source: Euromonitor International/US Census Bureau/Eurostat/Coresight Research

In the following sections, we discuss in more detail the strategies that M&S, Debenhams and House of Fraser have announced to revive their performance.

Another Multiyear Turnaround Strategy at M&S

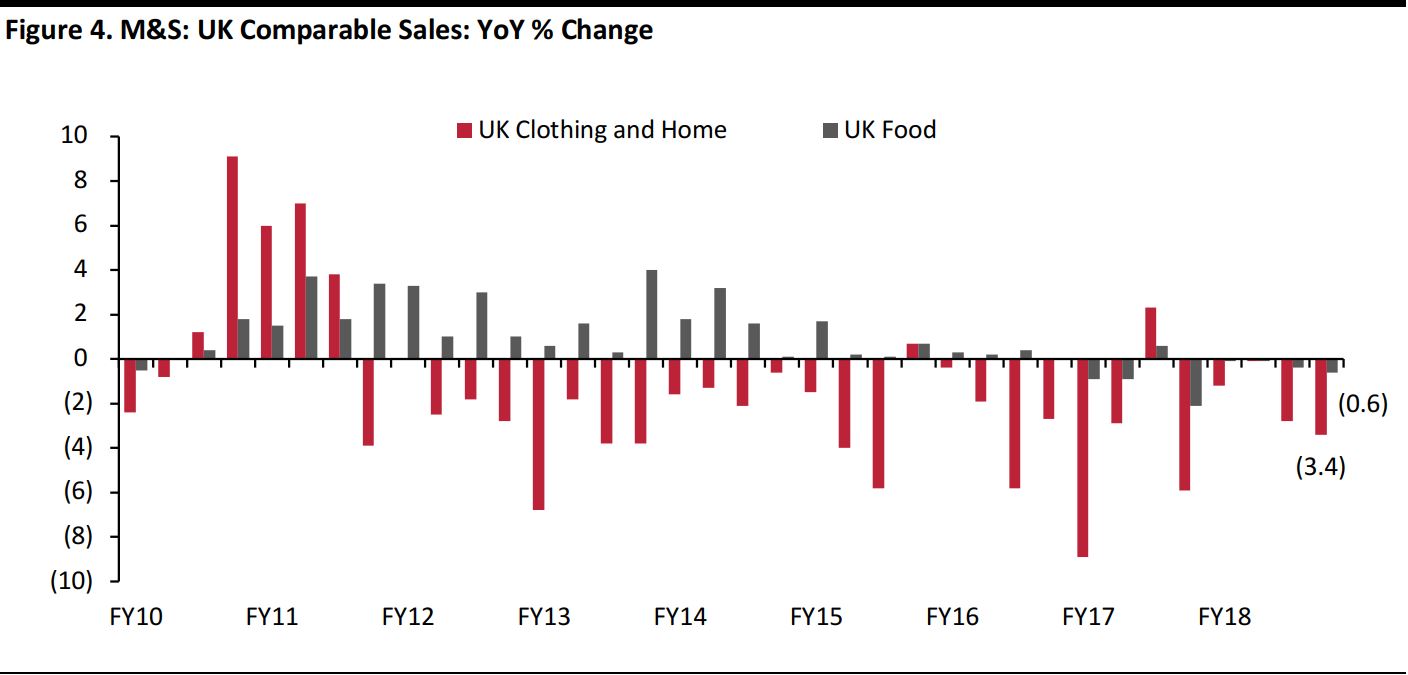

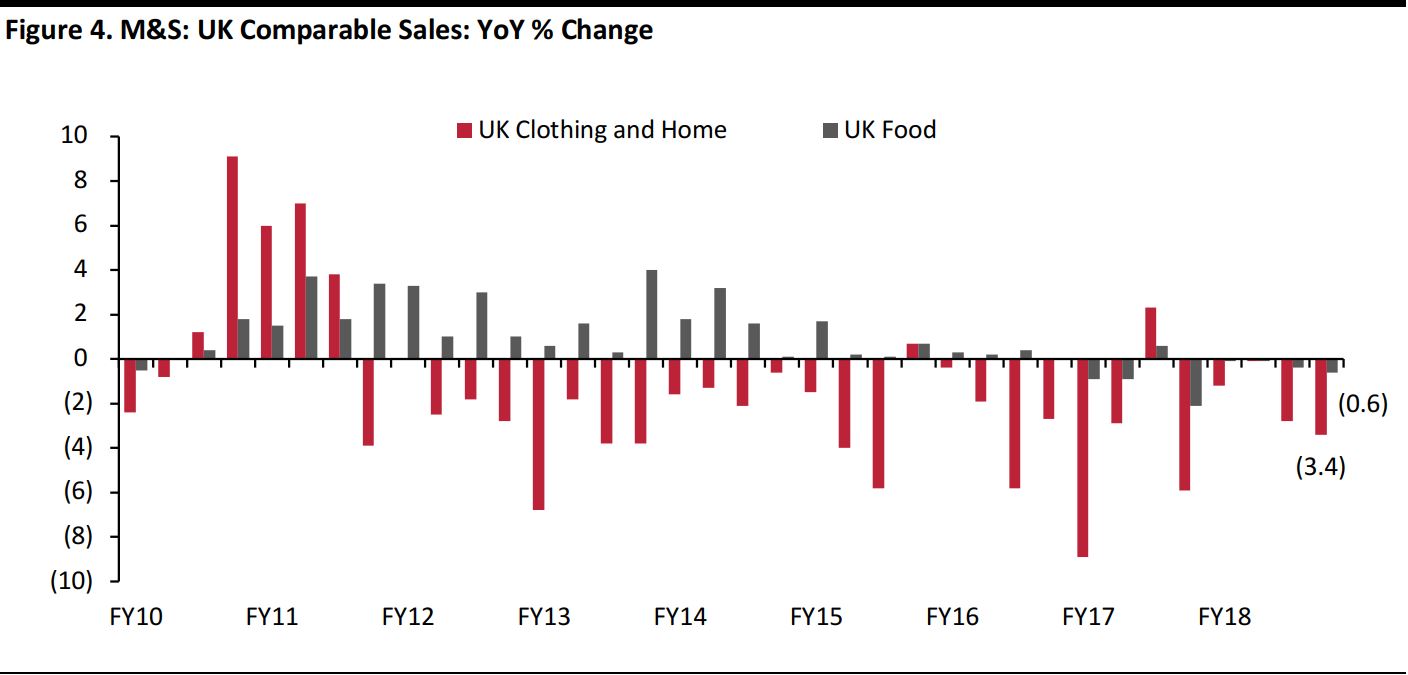

M&S Clothing and Home has struggled to grow underlying sales for a number of years. With the exception of the fourth quarter of fiscal 2015 and the third quarter of fiscal 2017, it has not posted positive comp growth since fiscal year 2011, as we show below.

M&S’s problems stem primarily from its position at the very heart of the mid-market, making it vulnerable to the fragmentation of spending to more specialized rivals: its large, outdated and undifferentiated stores exacerbate the weaknesses in its positioning. As a seller of only its own private labels, M&S does not face the challenge that many other department stores do—of selling other companies’ brands and so competing head-on with multibrande-commerce players such as Amazon and ASOS.

Through 4Q18

Source: Company reports

Through 4Q18

Source: Company reports

Steve Rowe assumed the role of M&S CEO in April 2016 and Archie Norman joined as Chairman in September 2017.

In November 2017, the new management team announced a new five-year transformation plan designed to “make M&S special again.” This includes:

- Focusing on becoming “the UK’s essential clothing retailer”: CEO Steve Rowe said that he wants M&S to “regain its heritage as a value and volume retailer” by lowering prices.

- Accelerating the company’s UK Clothing and Home space rationalization plan: M&S had already announced plans to close, relocate or downsize 105 stores.

- Repositioning M&S’s Food business: This includes slowing the opening rate of Simply Food stores.

- Becoming a digital-first organization: The goal is to generate one-third of Clothing and Home sales online by 2022. At the time of the announcement, 18% of Clothing and Home sales were online.

- Reducing the cost base: M&S’s goal is to become a lower-cost retailer.

Investors, analysts and commentators will recollect that the company’s previous CEO, Marc Bolland, implemented a three-year plan designed to transform M&S’s operations, and fortunes, between 2010 and 2013.

M&S updated on its progress in its latest plan

at its fiscal 2018 results: management announced that it would accelerate the pace of change, which includes closing stores more quickly than it originally planned.

Debenhams Aims to Become a Destination for Social Shopping

Debenhams has also announced a plan to revive its performance, beyond simply cutting stores. Sergio Bucher joined Debenhams as CEO in October 2016, and in April 2017, he announced a new direction for the company. The company is now looking to:

- Become a destination for “social shopping,” with new services, experiences and products: This includes more food-service offerings (termed “Meet Me @Debenhams” in the company’s strategy), more beauty services and leveraging its “destination” accessories categories such as bags and swimwear.

- Be digital‐driven: The goal is “mobile unifying channels and interaction with customers.” The company upgraded its mobile site in the second half of fiscal 2017.

- Take a new approach to creating and managing its own brands, supported by a more innovative culture: The retailer has a number of long-standing Designers at Debenhams brands.

Source: Company reports

Source: Company reports

House of Fraser Responds to Sharp Downturn with CVA—But Is the Plan for Top-Line Recovery Enough?

The challenges at House of Fraser have emerged much more recently than those at Debenhams and M&S in particular. As recently as three years ago, even while e-commerce was booming, House of Fraser was reporting very strong underlying growth, as its position at the top of the mid-market appeared to provide it with greater resilience than its middle-ground peers.

- Reflecting its previous out performance, at Christmas 2015, House of Fraser reported strong comp growth of 5.3%.

- By Christmas 2016, comp growth had virtually halved, to 2.7%.

- By Christmas 2017, the company was declining to report comparable sales.

- In its recent filings for the year ended January 2018, House of Fraser again did not provide a figure for comp growth, although total UK and Ireland sales were down 5.9% on a store base that was presumably static.

- In its CVA announcement, the retailer noted a 7.4% comp decline in the 13 weeks ended April 28, 2018.

Transformation Plan

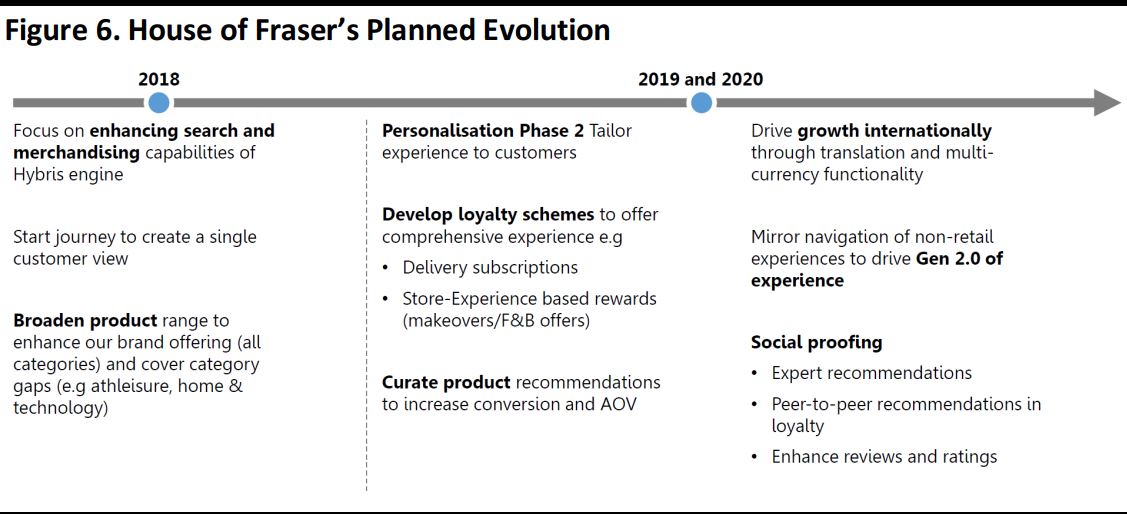

Store closures form the bulk of House of Fraser’s plan to turnaround its fortunes, although the company’s CVA presentation notes three prongs to its strategy:

- Create a smaller, higher-quality and more-focused store estate: It plans to close 31 of its 59 stores.

- Refocus towards concessions and own-bought brands to reaffirm its premium position: “We are and will be the house of brands,” said CEO Alex Williamson. This implies a move away from private labels, reversing recent attempts to grow private label’s share of sales.

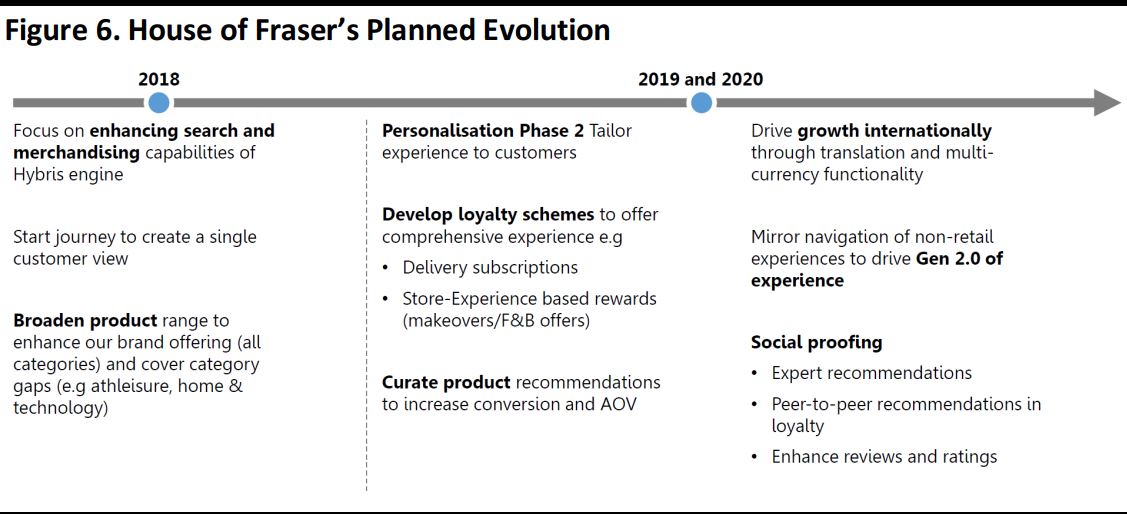

- Become an e-commerce-led retailer offering a seamless multichannel proposition.

The proposed transformation plan will see Chinese firm C.banner, the owner of toy retailer Hamley’s, become a 51% shareholder, taking majority ownership from Chinese peer Sanpower. Management has pledged that £70 million of new money will be made available to fund the transformation plan, working capital and general corporate purposes and the company states that the cash flow benefit from the CVA will fully fund the business during the transformation period.

The detail offered by management has focused on specific tech-driven incremental changes to its multichannel proposition (see below).

We wonder whether this is sufficient. As presented thus far, we feel that House of Fraser’s plan continues to lack a convincing, overarching strategy to transform the offering of the kind being implemented at M&S and Debenhams. While we believe that management is right to reaffirm the retailer’s position at the top end of the mid-market and pull back from a focus on private label that was unsuited to its proposition, we think the new plan does not answer a key question: in a world of e-commerce, what happens to retailers who simply focus on selling other companies’ brands?

Source: Company reports

Source: Company reports

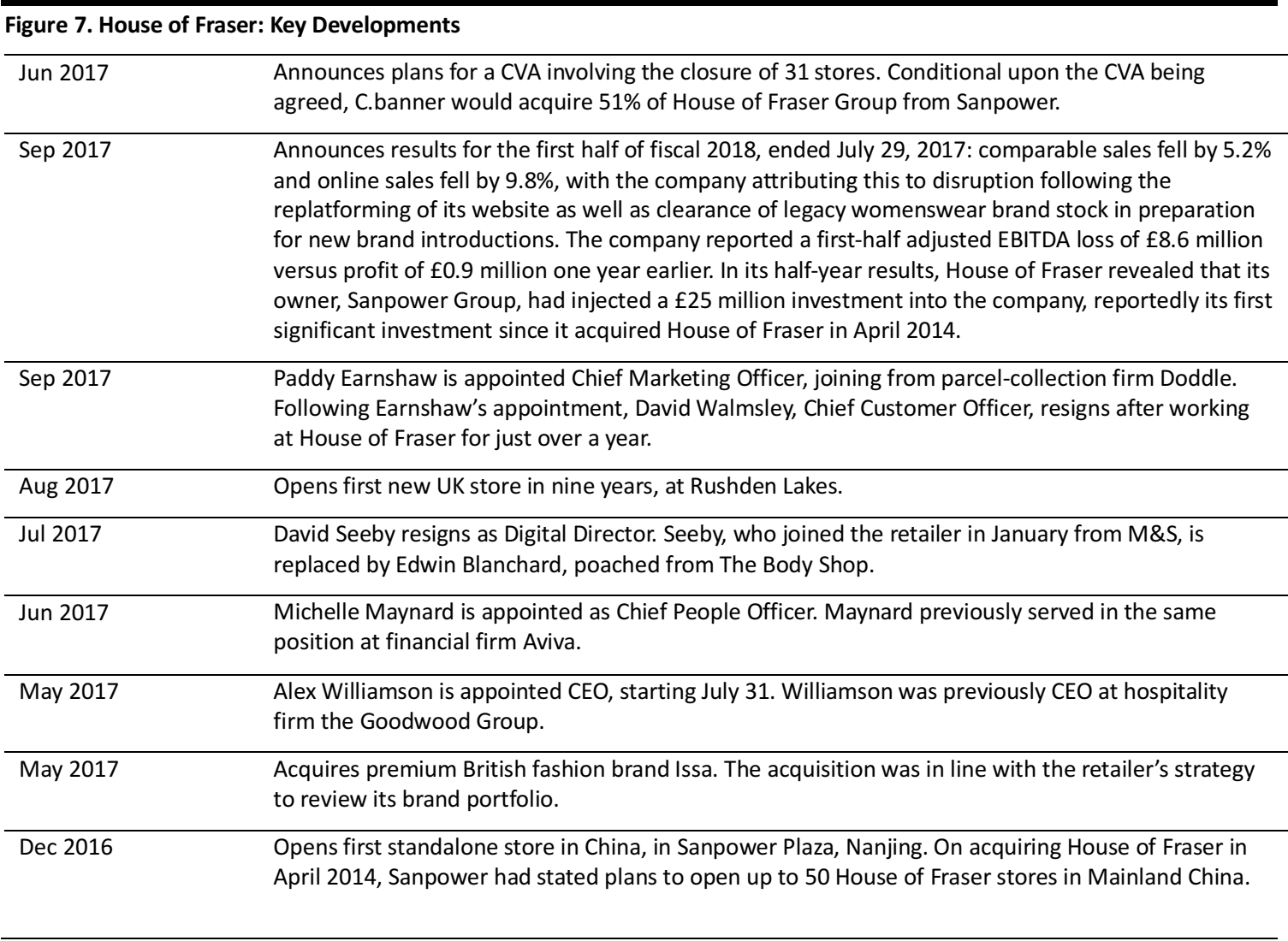

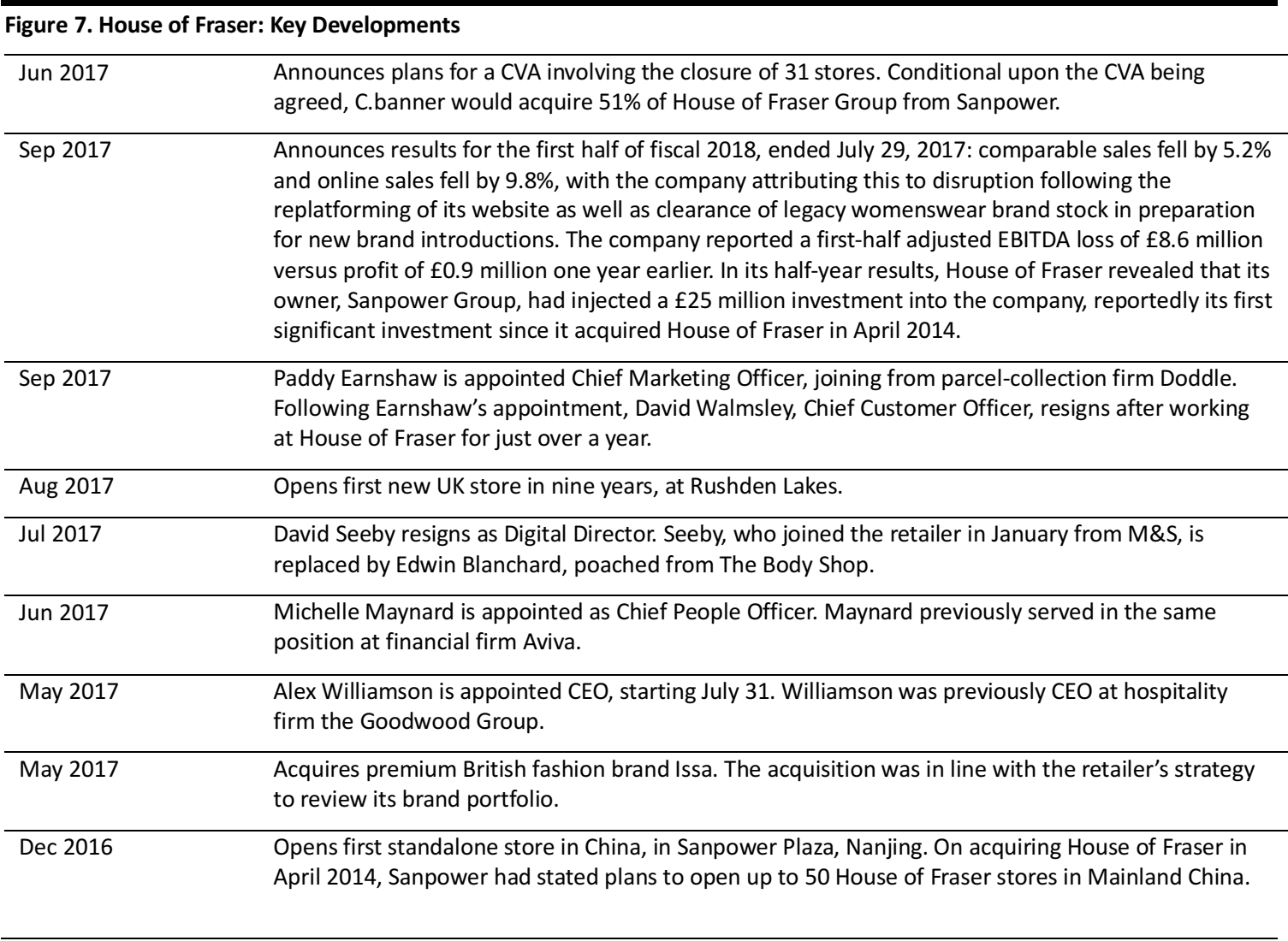

Timeline of Changes at House of Fraser

It is hard not to note that the slowdown and subsequent decline in sales at House of Fraser began shortly after its acquisition by Sanpower in April 2014 and a subsequent clear-out of existing management.

When Sanpower acquired the retailer in 2014, it touted a major investment in launching a chain of stores in China, but that chain has not materialized, and there is currently just one standalone House of Fraser store in China. Sanpower’s £25 million investment in the business in late 2017 was reportedly its first cash injection since the acquisition. In addition, 2016 and 2017 saw a clearing out of much of House of Fraser’s existing senior management, and some of those roles—most notably that of CEO—have been filled by people from nonretail backgrounds.

We note a number of key developments, including management changes, below.

Source: Company reports

Source: Company reports

In Germany, Galeria Kaufhof’s Sales Declines Deepen

The UK department store sector is, of course, not alone in facing challenges. The troubles of the US sector are well documented, with Macy’s, JCPenney, Sears and Lord & Taylor

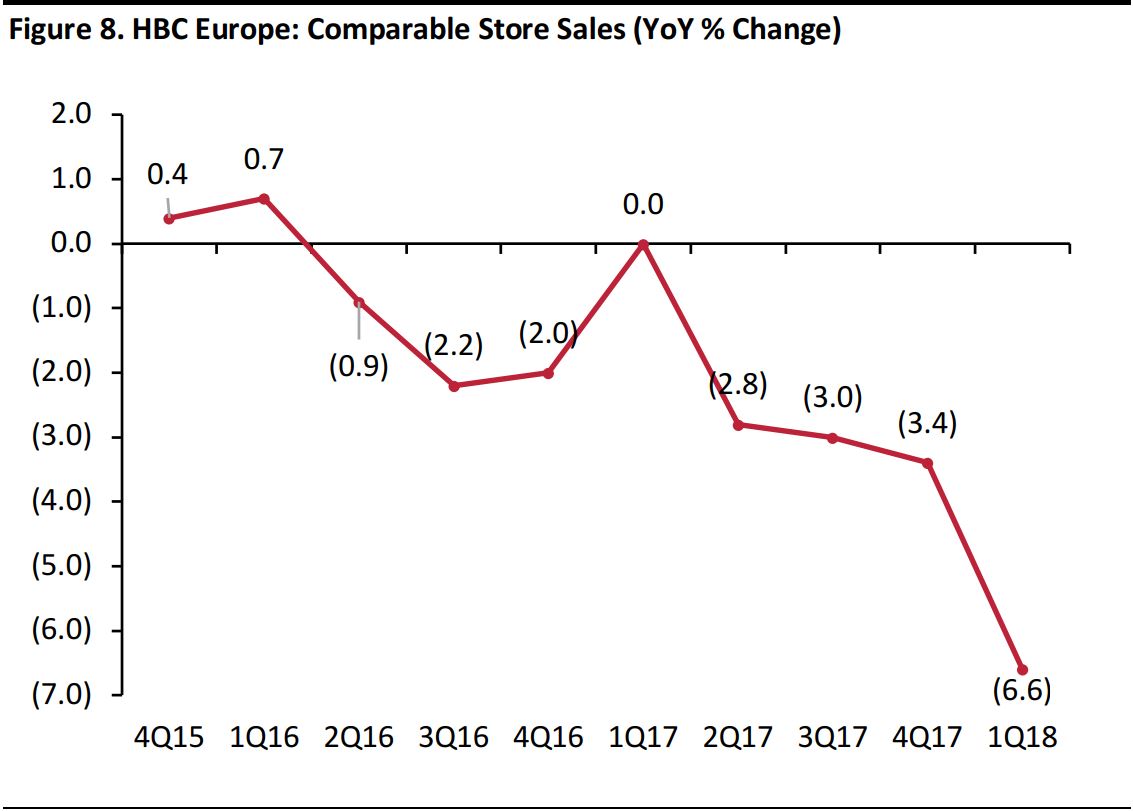

all closing stores. Germany, too, is facing similar difficulties. The German department store sector is dominated by two mid-market retailers: Karstadt, which is privately owned, and market-leader Galeria Kaufhof, which has been owned by HBC since September 2015.

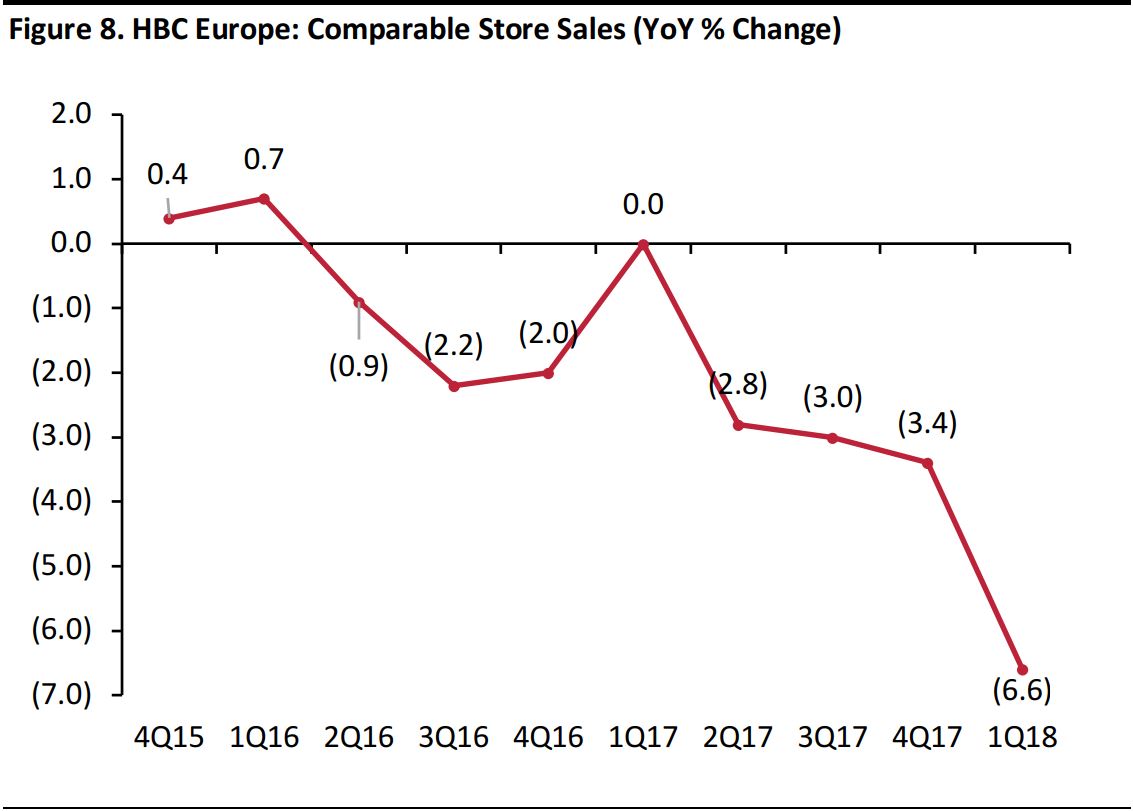

Under HBC’s ownership, Galeria Kaufhof has seen sales fall and costs rise. Comparable store sales growth has tended to go further into negative territory. Most recently, on June 5, HBC reported a 6.6% slump in comparable sales at Galeria Kaufhof. This marked a considerable weakening from already-poor comps of (3.4)% in the prior quarter.

Galeria Kaufhof was reporting negative operating margins before HBC stopped splitting out operating profit for its European operations at the start of 2017: at its last reported point, 4Q16, HBC Europe was posting a (5)% operating margin.

Given such a dismal performance, we wonder whether Galeria Kaufhof will follow its UK peers in implementing a store-closure program.

Source: Company reports

Source: Company reports

We perceive a lack of overarching strategy to drive sales growth at Galeria Kaufhof: parent company HBC appears to be focused on a broad, groupwide strategy, rather than banner-level strategies.Galeria Kaufhof is making selective store refurbishments, adding in some new concession brands and trying to grow online sales, but these seem to be “maintenance” tactics that do not address the fundamental challenges mid-market retailers are facing. Kaufhof arguably needs to clarify its purpose with the kind of strategic overhaul its British peers M&S and Debenhams are implementing.

Finding the Answer

Closing stores may support profits and free up cash to invest in fewer, better stores, but it does nothing directly to boost the appeal of the department-store format. In an age when consumers have near unlimited choice, retailers must find answers to the question: what is a department store for? We think that some major operators in the UK and Germany are still not addressing that question with sufficient urgency.

Consolidation has long been suggested. In the UK, a merger of Debenhams and House of Fraser has been repeatedly mooted by commentators over a number of years. We see this as very unlikely,given the plans for House of Fraser, and we have long pointed to a number of problems with this idea:

- Debenhams and House of Fraser have very different shopper bases: Consumer surveys show that House of Fraser attracts a notably younger, more-affluent shopper than mid-market peers such as Debenhams.

- Beyond store closures and back-office functions, we see few opportunities for synergies, and certainly little likelihood that such a merger would boost these banners’ appeal to shoppers.

In Germany, Signa Holding, the owner of Karstadt, made a bid for Galeria Kaufhof in late 2017. That bid was rejected by HBC in early 2018. There appears to be much more overlap in proposition and shopper base between Karstadt and Galeria Kaufhof than between Debenhams and House of Fraser in the UK. However, the fundamental question is the same in Germany as in the UK: how would such a merger boost the appeal of department stores to consumers? We have yet to see a convincing answer to that question.

Source: Company reports

Source: Company reports Source: Company reports

Source: Company reports Source: Euromonitor International/US Census Bureau/Eurostat/Coresight Research

Source: Euromonitor International/US Census Bureau/Eurostat/Coresight Research Through 4Q18

Source: Company reports

Through 4Q18

Source: Company reports Source: Company reports

Source: Company reports Source: Company reports

Source: Company reports Source: Company reports

Source: Company reports Source: Company reports

Source: Company reports