DIpil Das

Introduction: The China Beauty Market and Beauty Consumer

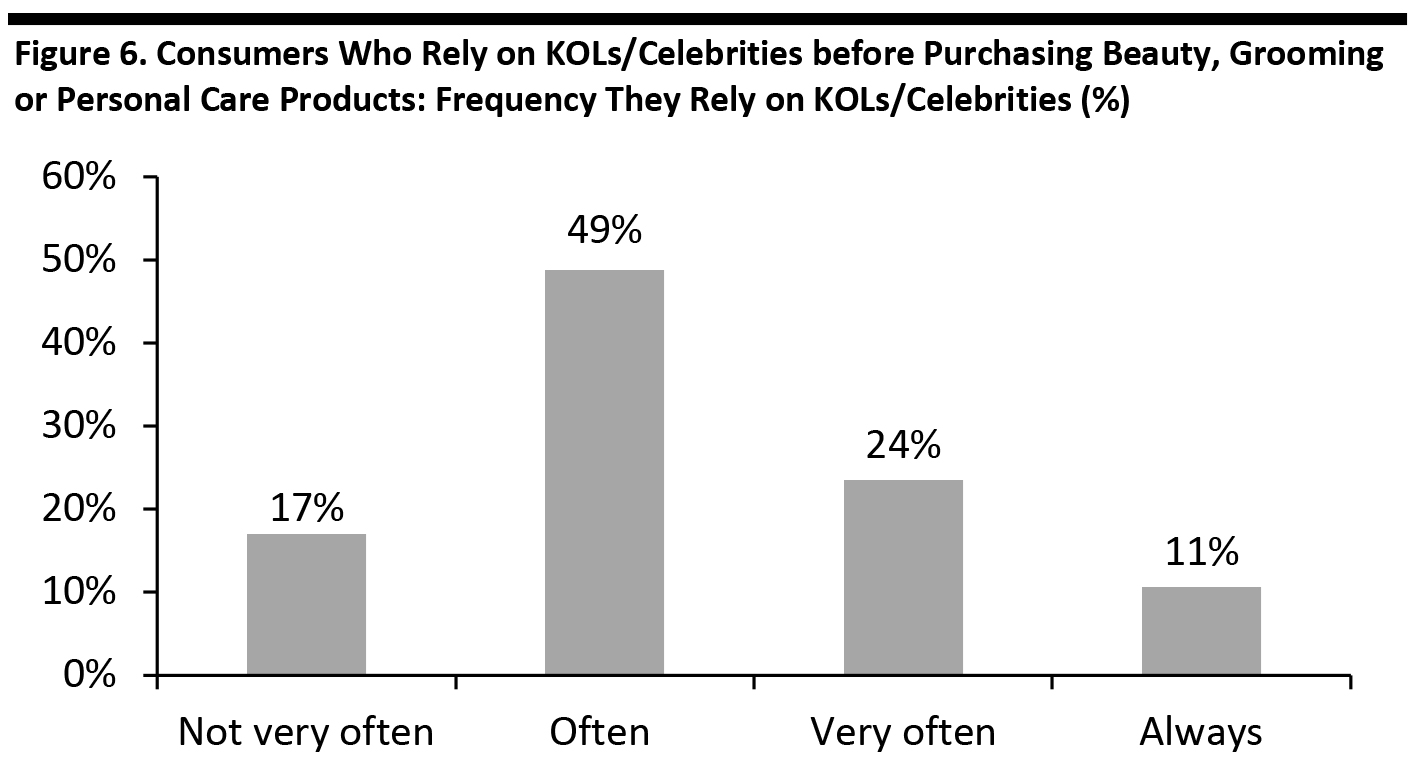

We conducted a proprietary survey in October 2019 of 1,000 consumers (male and female) in China who had bought beauty, grooming or personal care products in the past 12 months. This report highlights our findings on the beauty spending preferences of the China beauty consumer, which we compare against recent learnings from various sources following the coronavirus pandemic of 2020. The beauty, personal care and grooming market in China prior to the coronavirus crisis totaled ¥470 billion (about $66 billion) in retail sales in 2019, having grown at a CAGR of approximately 9% over a five-year period, according to market research firm Ifop Asia. Although impacted by the coronavirus pandemic, initial indicators show that China’s economy is rebounding, and the beauty industry is poised for a speedy recovery. First, the beauty consumer in China spends at least 50% of their total spending on beauty, grooming and personal care online. Secondly, the China beauty shopper is most interested in skin care, which proved to be a resilient category during the crisis as consumers focused on skin health. In addition, according to a March 2020 consumer survey from Chinese investment bank China Renaissance, 49% of 574 Chinese female beauty consumers plan to increase their spending on skin care following the pandemic. The beauty market also offers opportunities for brands to focus on alternative marketing strategies, including leveraging popular online media such as livestreaming; Alibaba’s Taobao reported that the number of livestream sessions hosted on the platform more than doubled during the coronavirus pandemic. Beauty brands can also include celebrities or key opinion leaders (KOLs) to engage with consumers and boost sales: Our proprietary survey found that roughly 49% of Chinese beauty consumers use KOLs/celebrities to inform their beauty purchasing decisions at least , with 83% of these “often,” “very often” and “always” relying on them.Chinese Beauty Consumer Spending on Personal Care Products

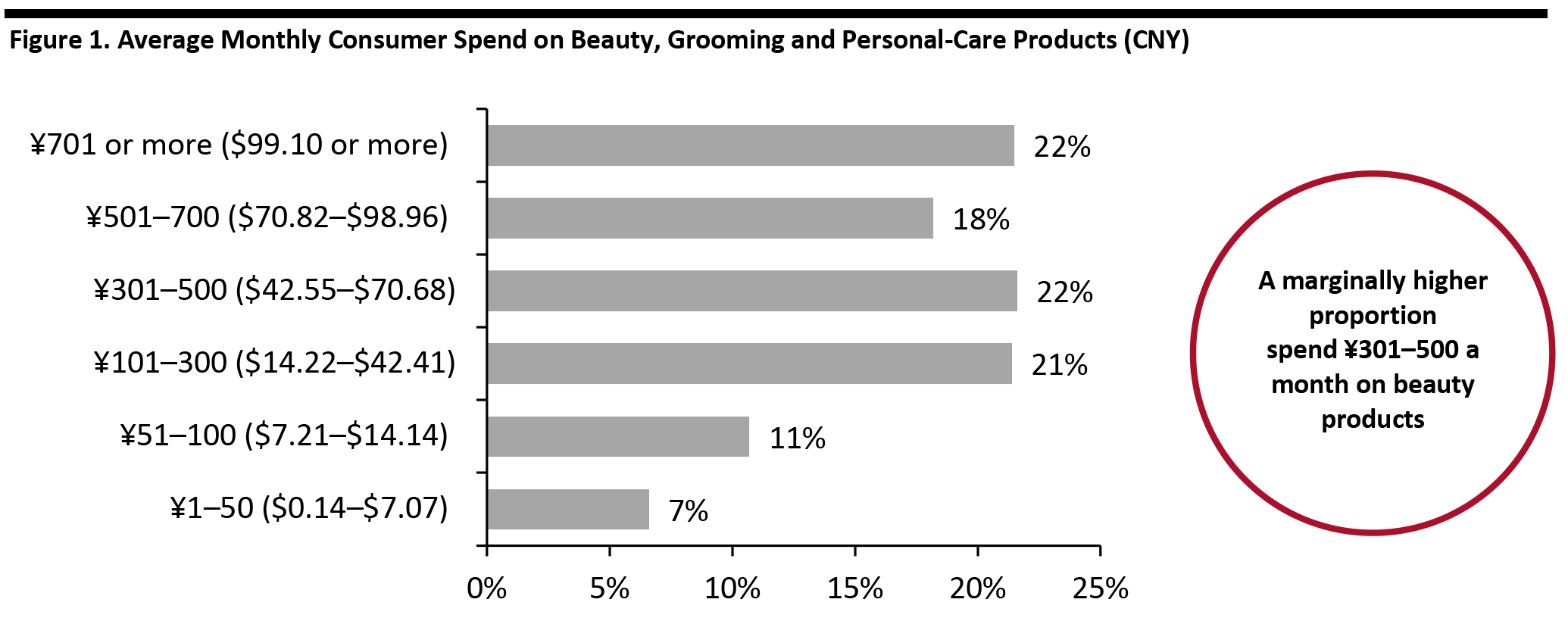

Our October 2019 survey found that average monthly spending by beauty consumers in China on beauty, grooming, and personal care products was relatively evenly distributed across levels of spending. The highest proportion of beauty consumers spend between ¥301 and ¥500 ($42.55–$70.68), although this lead is marginal, as shown in Figure 1. [caption id="attachment_109074" align="aligncenter" width="700"] Note: USD ranges do not run on between each level of spending, due to CNY conversion

Note: USD ranges do not run on between each level of spending, due to CNY conversion Base: 1,000 Internet users in China, aged 18+, who had purchased beauty, grooming or personal care products in the past 12 months

Source: Coresight Research [/caption]

The Most Purchased Beauty, Grooming and Personal Care Products: Cleansing Lotions, Masks and Lipstick

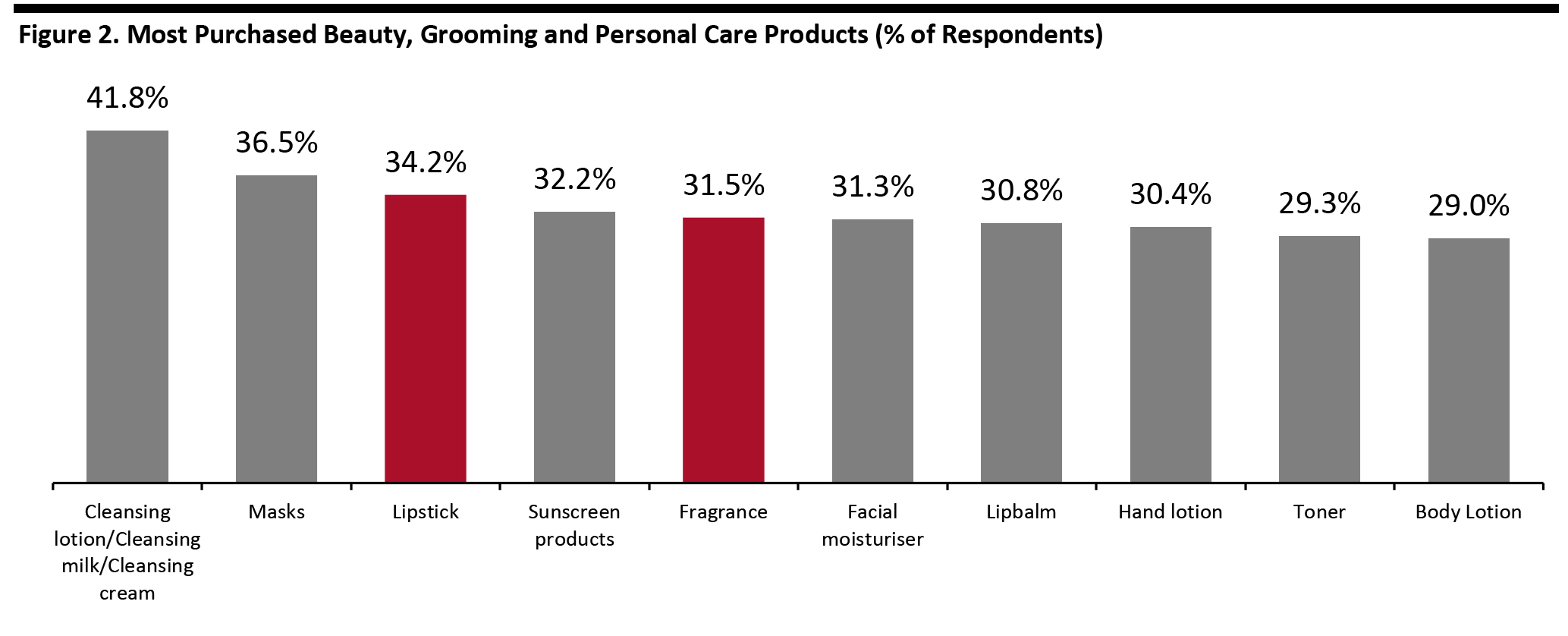

We asked shoppers to identify the beauty, grooming and personal care products they had purchased in the past 12 months. The list included skincare products, cosmetics and personal care products, including haircare items and shaving gels. The most popular beauty, grooming and personal care products purchased by Chinese consumers were cleansing lotions, masks and lipstick (see Figure 2). Notably, eight out of the top ten products (listed by the most respondents), are skincare-related items, including masks, sunscreen, moisturizer and toner. Furthermore, during the coronavirus pandemic, Chinese beauty consumers reported that their usage and consumption of skincare products remained unchanged, according to a survey conducted by Chinese beauty trade organization Jumeili in February 2020. Lipstick was the top cosmetic product (and third-most-purchased beauty product overall) among Chinese beauty consumers prior to the coronavirus crisis, with 34.2% of our survey respondents reporting a lipstick purchase within the past 12 months. Fragrance was the only other non-skincare-related product to feature in the top-ten list. [caption id="attachment_109075" align="aligncenter" width="700"] Base: 1,000 Internet users in China, aged 18+, who had purchased beauty, grooming or personal care products in the past 12 months

Base: 1,000 Internet users in China, aged 18+, who had purchased beauty, grooming or personal care products in the past 12 months Source: Coresight Research [/caption]

Top Beauty Trends: Skincare Routines, Natural/Organic Products, Fragrances, Male Grooming and Clean Beauty

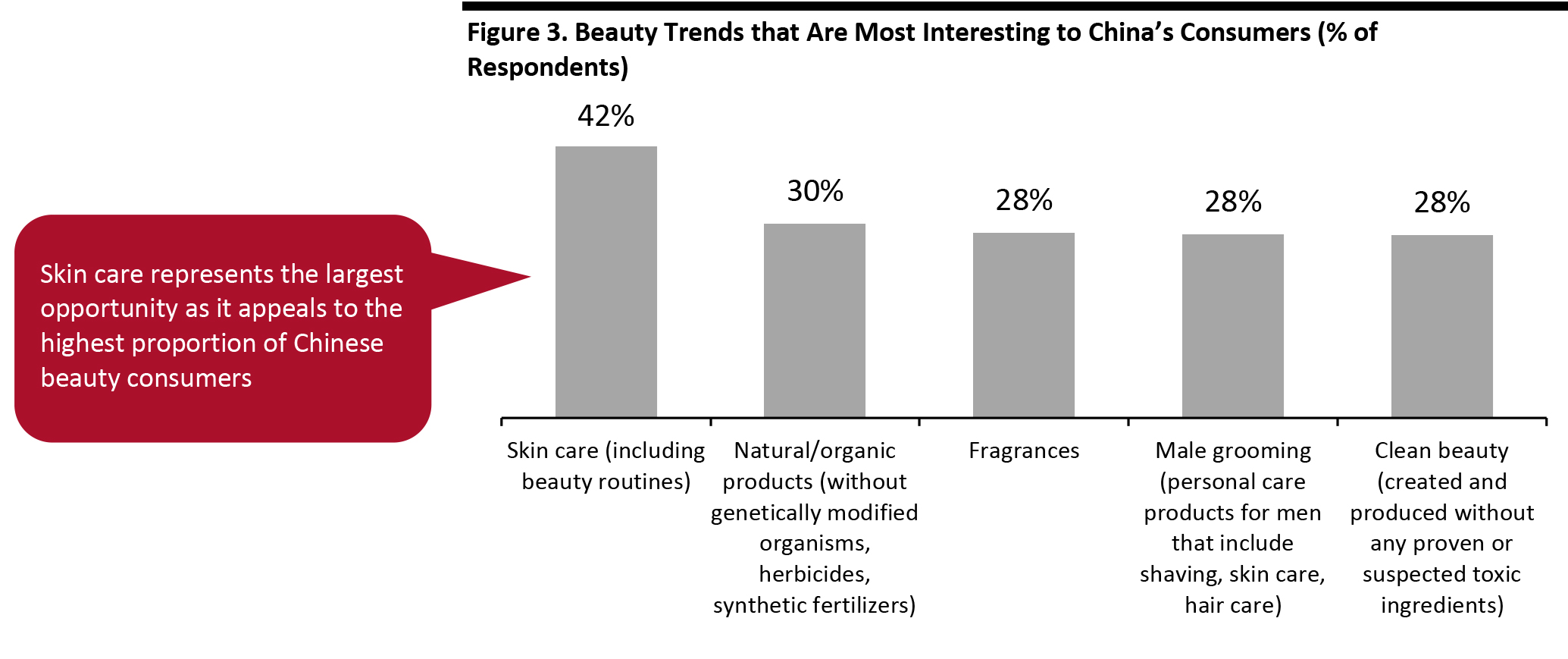

Again demonstrating the popularity of the skincare category among China’s beauty consumers, skincare routines were highlighted as the top beauty trend that most consumers are interested in. High proportions of survey respondents also claimed that they were interested in clean beauty, natural and organic products, fragrances and male grooming. According to the March 2020 consumer survey by China Renaissance, 49% of 574 Chinese female consumers plan to increase their spending on skin care following the coronavirus pandemic (compared to 32% for cosmetics), and 44% said their spending on skincare products will remain unchanged (compared to 52% for cosmetics). [caption id="attachment_109076" align="aligncenter" width="700"] Base: 1,000 Internet users in China, aged 18+, who had purchased beauty, grooming or personal care products in the past 12 months

Base: 1,000 Internet users in China, aged 18+, who had purchased beauty, grooming or personal care products in the past 12 months Source: Coresight Research [/caption] Notably, there are a few beauty trends that are causing a buzz in the West but which do not feature in the most interesting trends among Chinese beauty consumers: CBD-infused beauty and skin care (only 11% of our survey respondents stated they were interested), zero waste and sustainability (13% of respondents interested), and ingestibles (i.e., drinking products to boost beauty benefits; 17% interested).

E-Commerce Is a Lucrative Purchasing Channel for the China Consumer

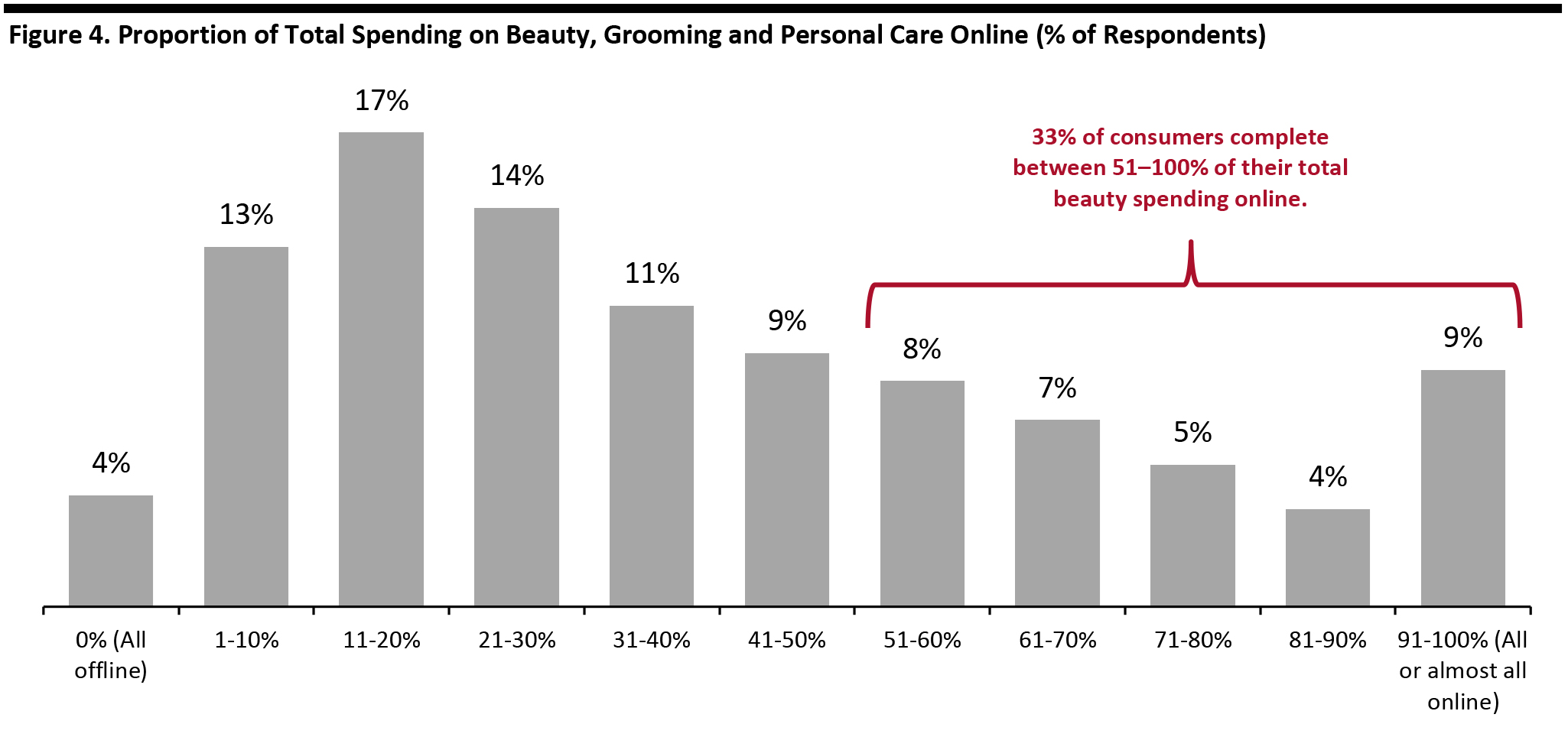

We asked consumers to estimate how much of their total spending on beauty, grooming and personal care is typically through e-commerce (versus in store or other offline channels). An overwhelming 96% of all respondents said they buy some proportion of their beauty, grooming and personal care products online: 33% spend over half of their total online; and 9% buy all, or almost all, of their products online. [caption id="attachment_109089" align="aligncenter" width="700"] Base: 1,000 Internet users in China, aged 18+, who had purchased beauty, grooming or personal care products in the past 12 months

Base: 1,000 Internet users in China, aged 18+, who had purchased beauty, grooming or personal care products in the past 12 months Source: Coresight Research [/caption]

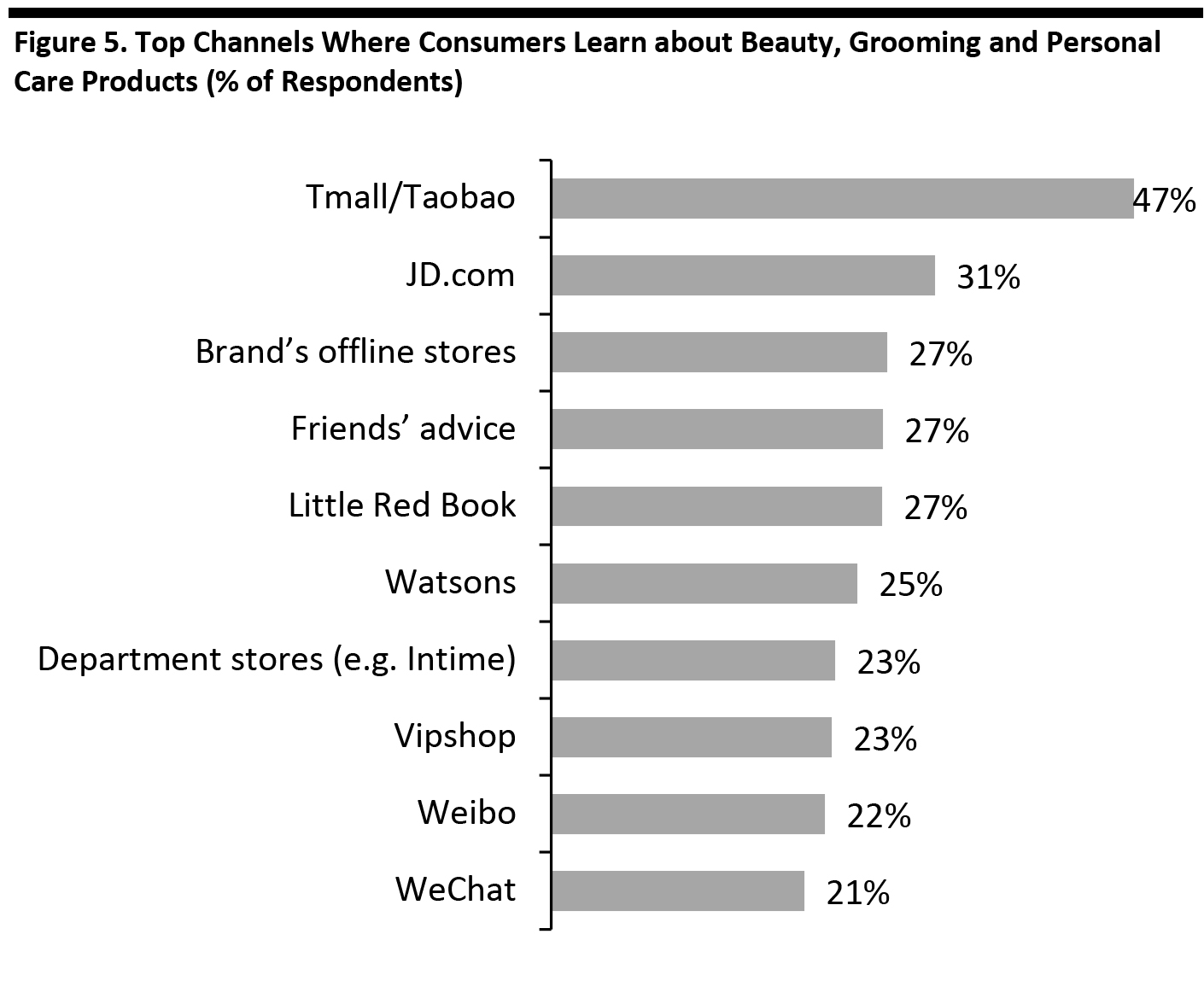

Learning about Beauty Products

Examining the preferences of China’s beauty consumers in discovering beauty, grooming and personal care products, our survey found that 47% of respondents learn through Tmall/Taobao, making Alibaba’s platforms the most used source of information. JD.com ranked second, used by 31% of consumers to learn about beauty products. We list the top ten channels identified in our survey, according the percentage of respondents that use these sources. [caption id="attachment_109078" align="aligncenter" width="700"] Base: 1,000 Internet users in China, aged 18+, who had purchased beauty, grooming or personal care products in the past 12 months

Base: 1,000 Internet users in China, aged 18+, who had purchased beauty, grooming or personal care products in the past 12 months Source: Coresight Research [/caption] During the coronavirus pandemic, Tmall and JD.com remained the most preferred channels for consumers to discover and purchase beauty products: According to Jumeili’s February 2020 survey, over 90% of Chinese beauty consumers use these two destinations for beauty education and fulfillment.

Alternative Marketing Channels: Livestreaming Presents Opportunities Post Coronavirus

As shown above in Figure 5, our pre-coronavirus survey found that 21% of consumers learn about beauty products through social media platform WeChat—a channel that only just made it into the top ten list. Furthermore, 19% of respondents said they discover beauty through KOLs/celebrities and 17% through short-video platform TikTok. However, the coronavirus pandemic saw brands and retailers across multiple sectors prioritize digital channels due to temporary store closures. Beauty brands stepped up efforts to engage with consumers and boost sales through alternative online channels, such as livestreaming and private WeChat group traffic. Taobao Live, Alibaba’s livestreaming platform, reported that the number of livestream sessions on its app doubled during the coronavirus epidemic, and in early February, livestream sessions on the platform had increased by 110% compared to the same time the previous year. One innovative example of a brand leveraging alternative marketing channels during the coronavirus crisis is Forest Cabin Cosmetics (Lin Qinxuan). The Shanghai-based skincare brand has 300 physical locations in China but saw over half of its stores close during the coronavirus outbreak—and sales fell by 90%. Utilizing DingTalk (Alibaba’s enterprise communication and collaboration app), Forest Cabin transitioned its associates to digital brand shopping advisors, who also used livestreaming to engage with customers on Taobao. This move saved the company from bankruptcy, and the online channel now represents 90% of the brand’s sales, compared to just 25% prior to the coronavirus pandemic. For more on Forest Cabin Cosmetics’ strategy and other successful initiatives involving livestreaming in China, read our Beauty Insights report.KOLs and Celebrities Influence Beauty Purchasing Decisions

In our proprietary survey, we asked consumers if KOLs and celebrities inform their purchasing decisions for beauty, grooming and personal care products: 49% of respondents stated that they do. Exploring the influence of KOLs in China further, we asked how often these consumers rely on KOLs/celebrities when making beauty purchasing decisions—as shown in Figure 6, 83% of those who rely on KOLs stated that they do so “often,” “very often,” or “always.” [caption id="attachment_109079" align="aligncenter" width="700"] Percentages may not sum to 100 due to rounding

Percentages may not sum to 100 due to rounding Base: 488 Internet users in China, aged 18+, who had purchased beauty, grooming or personal care products in the past 12 months and who stated that they rely on KOLs/celebrities to inform their beauty purchasing decisions

Source: Coresight Research [/caption] As livestreaming and alternative marketing channels grow, we expect that KOLs, micro-influencers and celebrities will become a more lucrative means for beauty brands to engage with consumers. Understanding that a high proportion of China’s beauty consumers are using KOLs and celebrities to inform their purchasing decisions, beauty brands should look to incorporate KOLs into their marketing strategies.

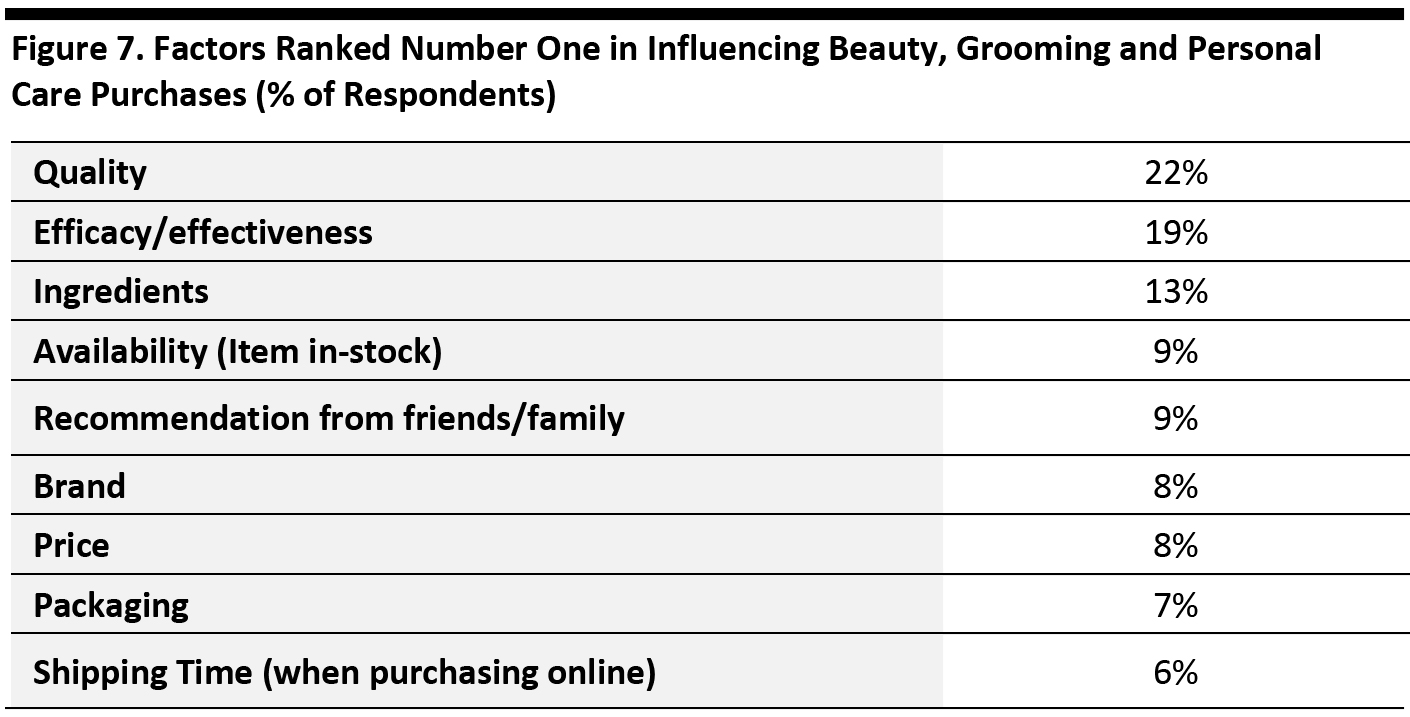

Top Factors Influencing Beauty Purchases: Quality, Efficacy and Ingredients

We presented our survey participants with a set selection of factors that may influence their decisions when purchasing beauty, grooming or personal care products; we asked them to rank these in order of importance. Figure 7 shows the proportions of respondents that chose each factor as their number-one influencer: quality proved to be the most important factor for the most Chinese beauty consumers in buying beauty products. It is perhaps unsurprising that price ranked fairly low in the results, considering our finding that 61% of respondents spend over ¥301 ($42.55) on beauty products a month, on average (see Figure 1). [caption id="attachment_109080" align="aligncenter" width="700"] Note: Percentages may not sum to 100 due to rounding

Note: Percentages may not sum to 100 due to rounding Base: 1,000 Internet users in China, aged 18+, who had purchased beauty, grooming or personal care products in the past 12 months

Source: Coresight Research [/caption] Following the coronavirus pandemic, it seems that quality has become even more important to consumers: According to Jumeili’s February 2020 survey, 47% of Chinese beauty consumers stated they will pay more attention to product quality, making it the highest-ranked factor.

Key Insights

Our survey research indicates that China’s beauty consumers are interested in skincare products, and their purchasing decisions are primarily influenced by quality, as well as by KOL/celebrity recommendations. The coronavirus pandemic caused retail disruption, but early recovery signs are showing that there are opportunities for beauty brands to strengthen their digital presence and explore alternative marketing opportunities, building on their online experiences during the crisis. We summarize our findings about China’s beauty consumer below, combined with consumer and brand behavior following the coronavirus pandemic:- China is a lucrative beauty, grooming and personal care market, with consumers willing to spend in this category. In terms of average monthly spend on beauty, grooming and personal care products, the most frequent category response by survey respondents was ¥301–500 ($42.55–$70.68), with 22% choosing this range.

- Lipsticks are the most popular cosmetic product among China’s beauty consumers. Our survey respondents purchased lipsticks more than any other cosmetic product, with 34.2% reporting a purchase within the prior 12 months of the survey. The only other non-skincare-related product to make the most-purchased list was fragrance, with 30.4% of respondents having bought fragrances in the same period.

- Beauty brands and retailers should focus on skin care in the China market. Of the top ten most-purchased products identified in our survey, eight were focused on skin health, skin care and personal care. The skincare market has also proved to be resilient in China, as consumers continued to focus on their skin health during the coronavirus pandemic. Post crisis, 49% of respondents plan to increase their spending on skin care, according to China Renaissance’s March 2020 survey.

- The five most popular beauty trends among China’s beauty consumers are skincare routines, natural/organic products, fragrances, male grooming and clean beauty. Our survey respondents were less interested in some trends that are gaining attention in the West, such as CBD-infused beauty and skincare products, zero waste/sustainability and ingestibles.

- Beauty brands should look to convey quality, as this is the most important factor to China’s consumers. To do this, brands could emphasize brand story, ingredients, cleanliness, standards, pride and overall company heritage. Our survey found that quality is the key influencer for consumers when choosing a beauty, grooming or personal care product, with 22% of respondents choosing this as the primary factor. Furthermore, post coronavirus, consumers will pay more attention to product quality, according to Jumeili’s survey findings.

- Beauty brands could diversify their marketing strategies to leverage livestreaming and alternative channels. Taobao reported that it had seen a 100% year-over-year increase in livestreaming sessions in early February 2020, during the coronavirus pandemic. Chinese beauty brand Forest Cabin Cosmetics is an example of a brand that capitalized on the livestreaming trend to reach consumers during the period of temporary store closures—increasing its online presence from 25% to 90% of sales. Beauty brands could also look to incorporate KOLs and celebrities into their marketing strategies; 83% of those survey respondents who use KOLs to inform their purchasing decisions of beauty products rely on them “often,” “very often,” or “always.”

- Beauty brands should consider using major online platforms to sell beauty, personal care and grooming products. Nearly 47% of China’s beauty consumers discover beauty products on Tmall.com, and 31% learn about beauty on JD.com. E-commerce is a lucrative channel for beauty, with over one-third of our survey respondents spending more than half of their beauty budgets online.