Introduction

In this report, we provide an overview of the regulated cannabis market in the US and Canada, and the impact that regulation of the sale of recreational cannabis products has had on the economies of the geographies that have legalized the production, retailing and consumption of such products.

For the US market, we focus on the states that have fully legalized the cultivation, consumption and sale of cannabis products for both medical and recreational use through a regulated market. Moreover, we give an overview of the market in Canada, which is in the process of legalizing cannabis consumption for recreational use.

This report focuses in particular on the emerging legal recreational cannabis market, which, following the recent legalization in California and Canada, is expected to become a multi-billion-dollar business, attracting significant investments from other industries, including alcoholic drinks manufacturers looking to expand into this new, promising market.

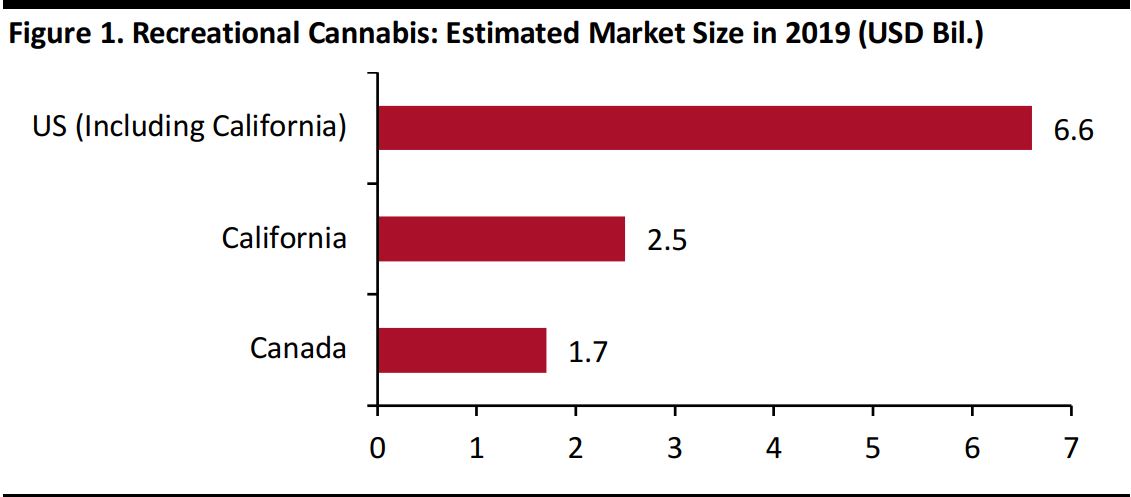

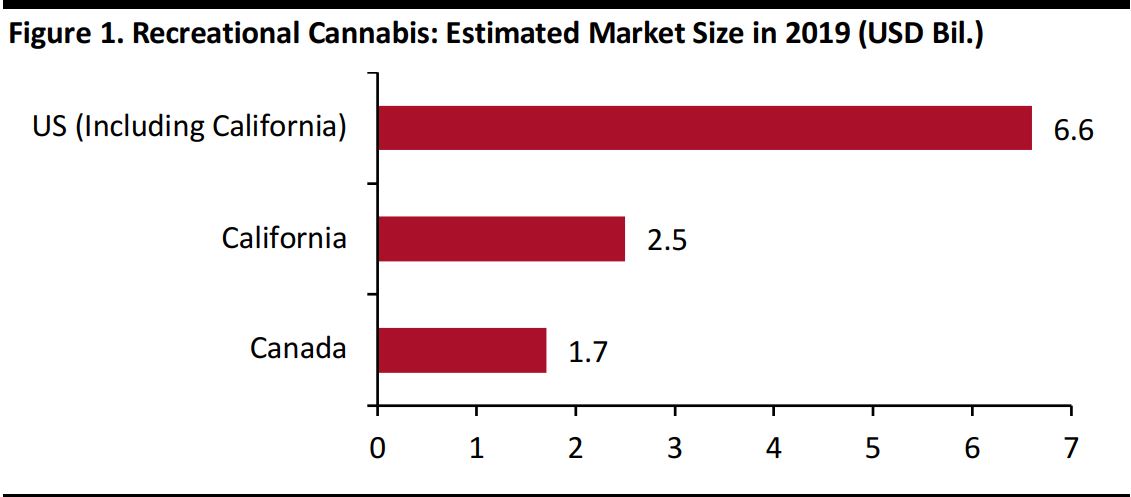

Figure 1 shows the expected market value of the recreational cannabis industry in 2019 in the US and Canada—where recreational cannabis retail sales will start in October 2018—and the key US market of California, which started recreational marijuana retail sales on January 1, 2018.

Source: New Frontier Data/Marijuana Business Daily/Coresight Research

Within the Americas, Uruguay is the one other nation that has legalized the cannabis market to date. This South American country fully legalized the production and sale of cannabis products back in December 2013, but the market is tightly controlled by the state. Retail distribution is done through pharmacies, while production is licensed by the government to two companies, International Cannabis Corporation and Simbiosys. This system leaves little room for other private enterprises to serve the market.

We have not looked at other countries such as the Netherlands and Spain, which, despite some having a very liberal attitude toward cannabis consumption, have not formally legalized the industry.

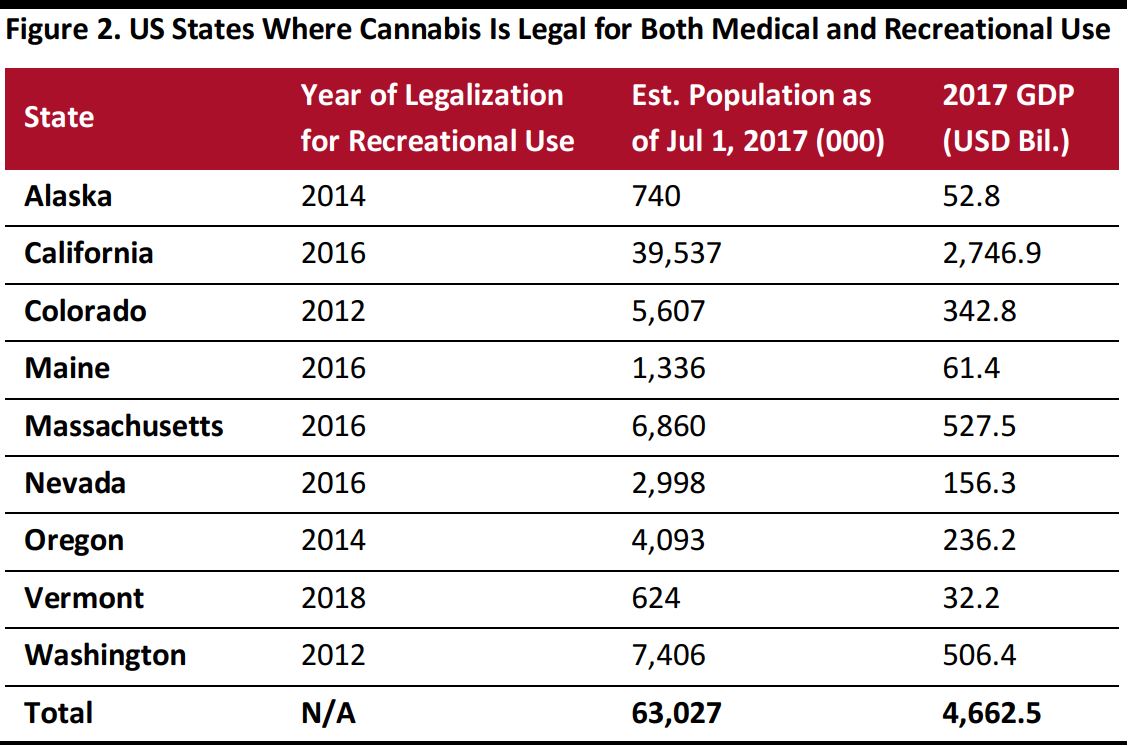

Cannabis-Friendly States: One-Quarter of the US Economy

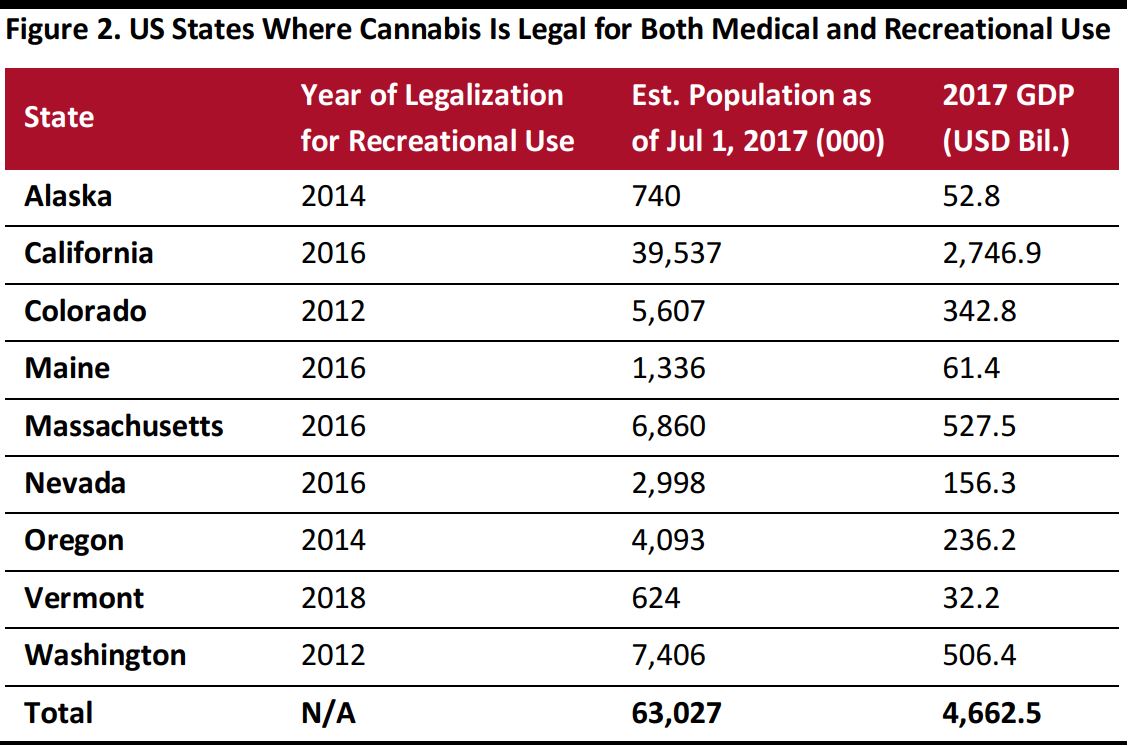

Since 1996, the US has seen a wave of laws aimed at regulating the production, trade and consumption of cannabis products. California’s Proposition 215 in 1996 was the first legislation in the US to legalize medical marijuana usage and cultivation. Since 2012, a number of US states have legalized recreational use of cannabis products. According to public charity ProCon.org, as of 2018, cannabis is legal for medical use in 30 states. Of these, the nine states listed below have also legalized recreational use of cannabis products. Cannabis is also legal for both medical and recreational use in the District of Columbia, but law prohibits its commercial sale.

Source: The Guardian/USA Today/BusinessInsider.com/CNN.com/The Boston Globe/The Washington Post/US Bureau of Economic Analysis/US Census Bureau/Coresight Research

To provide a sense of the scale of the cannabis market in the US, we included the population and the GDP of each state listed above. Considered together, the states where cannabis is legal for both medical and recreational use represent about 20% of the total US population and 24% of total US GDP. California’s economy alone is so large that it compares in absolute terms with some of the world’s most advanced economies, such as France and the UK. Sales of recreational cannabis in California started to be legal on January 1, 2018 under the Proposition 64 that legalized recreational cannabis use in California and that became law in November 2016.

California to Drive the Expansion of the US Cannabis Industry

Data on the actual size of the cannabis industry in the US are still scarce, given the limitations on the way information is collected. The US federal government does not track the cannabis market, as cannabis cultivation and sale are still not legal at the federal level. In addition, there are differences in the way each state approaches the industry: most companies that operate in the cannabis sector are privately owned and tax returns for medical dispensaries are not publicly available—all of which make data collection difficult.

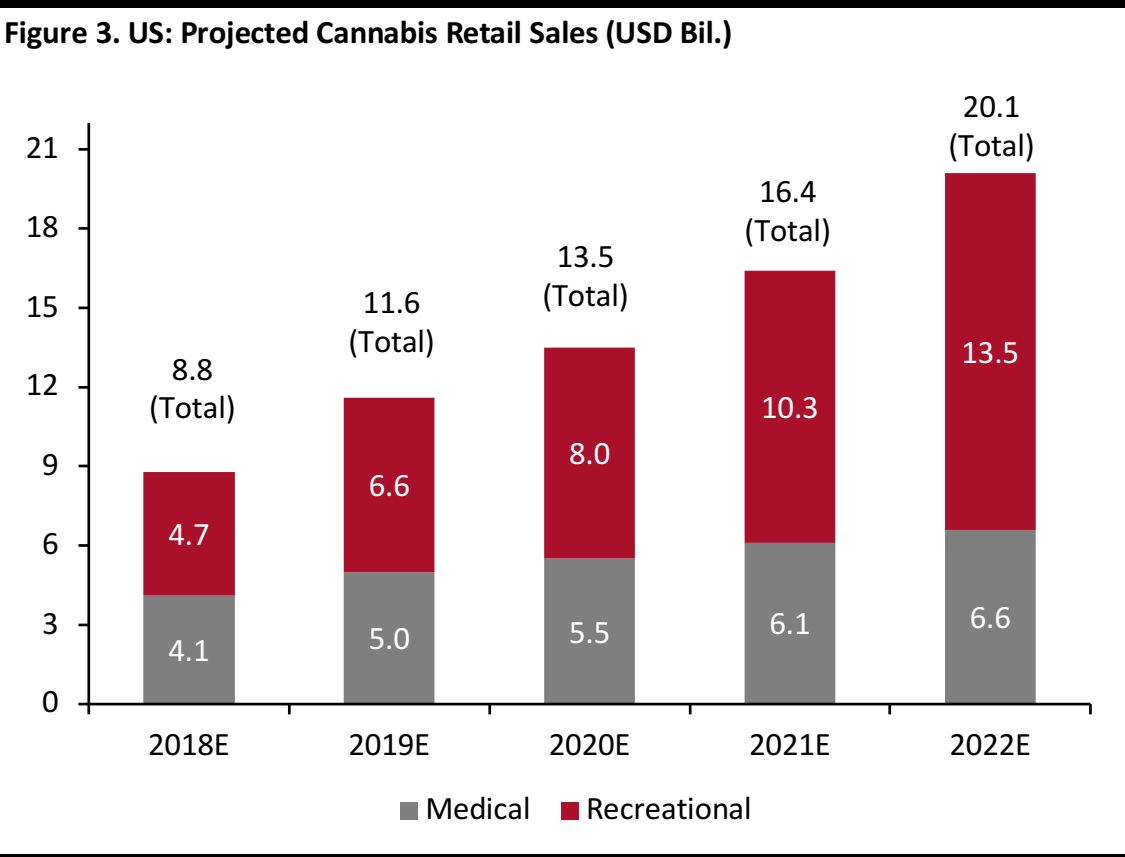

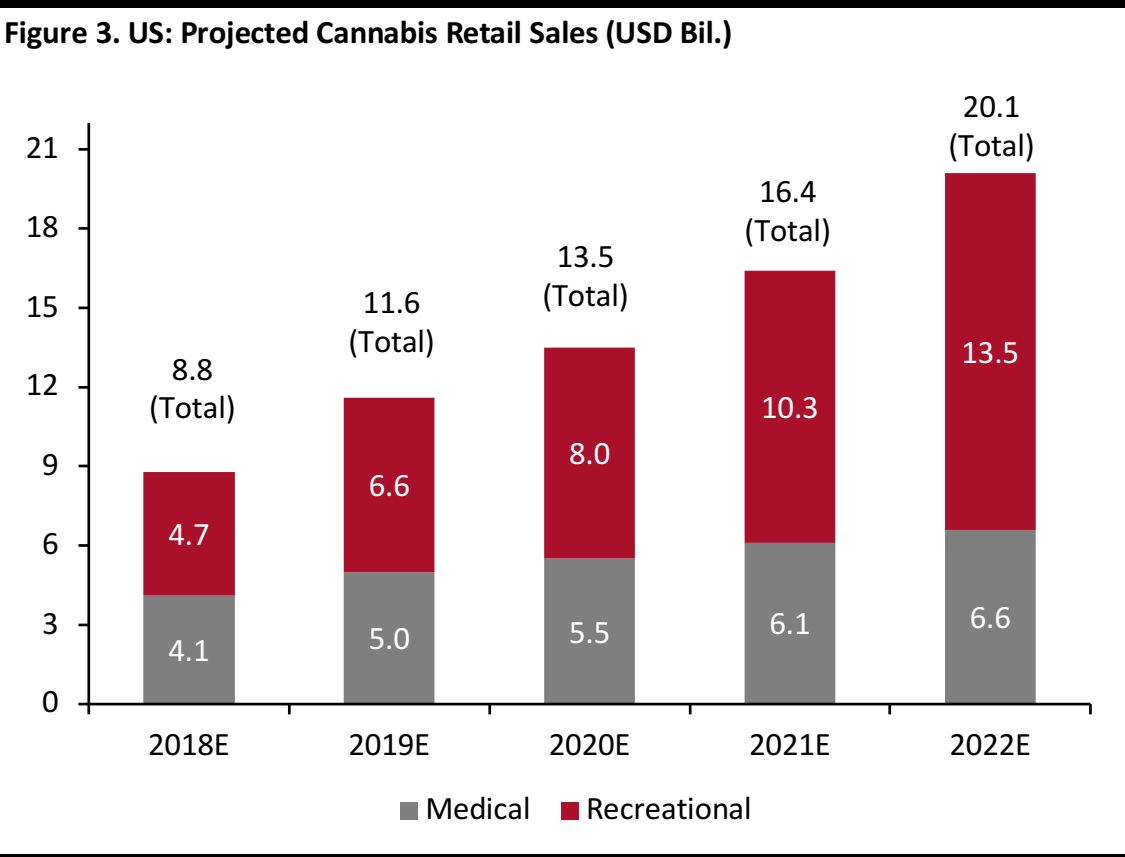

Marijuana Business Daily estimated that legal recreational cannabis sales in the US will amount to $4.2–$5.1 billion in 2018, an 80% increase versus the previous year’s estimate, and that the total market—including both medical and recreational cannabis—will reach $7.9–$9.7 billion in 2018. US recreational cannabis retail sales will reach $12–$15 billion by 2022, and the combined medical and recreational cannabis market will reach $18–$22 billion by 2022, the publication further estimated.

Figure 3 shows the midpoint of the annual sales value ranges estimated by Marijuana Business Daily for the US cannabis market for 2018–2022. The graph indicates that total cannabis sales will grow by 128% over the period to 2022, while recreational marijuana sales will grow by 187%.

Source: Marijuana Business Daily/Coresight Research

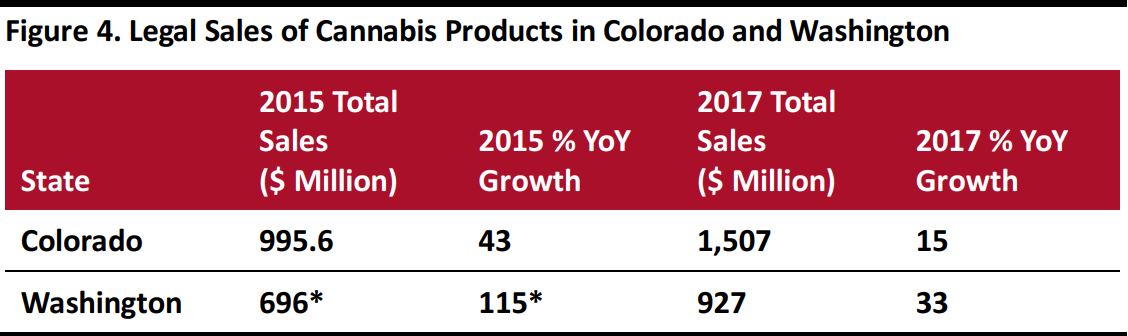

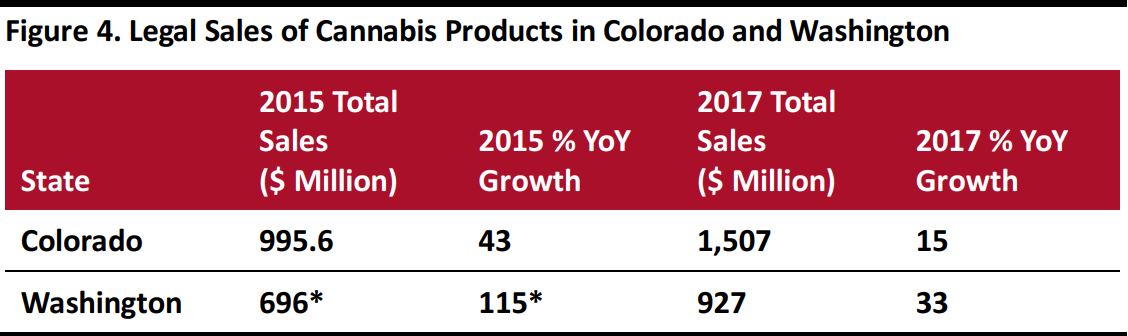

Historical data for the recreational cannabis market is available for the states of Colorado and Washington, which pioneered the regulation of the recreational cannabis business in 2012. Figures for the two states (shown in figure 4) show the remarkable growth of the market in the years following legalization. However, signs of maturity have started to appear. For example, in Colorado, legal sales of cannabis products went from a 43% growth in 2015 to just a 15% growth in 2017, according to the Colorado Department of Revenue.

*2016

Source: Colorado Department of Revenue/502 Data/Coresight Research

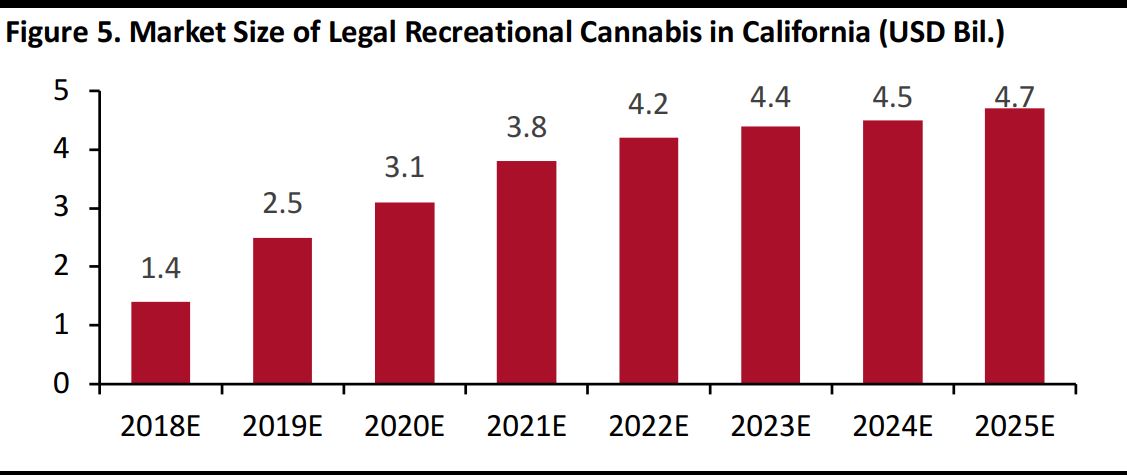

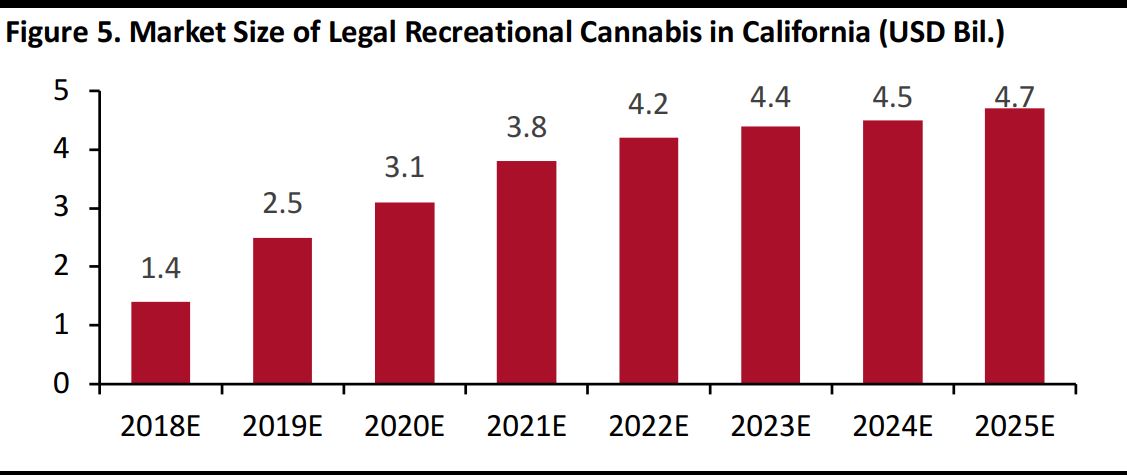

The legalization of the recreational use of cannabis products in California is expected to drive the growth of the US cannabis industry. Figure 5 below shows that the California market for recreational cannabis should grow 79% in 2018, the first year of legal recreational cannabis sales, and that the market will reach a total value of $4.7 billion by 2025, according to specialist research and insight firm New Frontier Data.

Source: New Frontier Data

The growth estimates outlined above reflect the fact that the legal cannabis market is likely to increase substantially for the next few years, as it is a new market that will be going through the first stage of growth. In the longer run, growth is expected to slow down as the market matures.

Canada: A Large Market Opens Up

The government of Canada is also legalizing cannabis products for recreational use, and it introduced legislation in April 2017 (Cannabis Act) proposing adults to be allowed to buy small amounts of cannabis for personal use. The Act is expected to become effective from October 17, 2018, as announced by Canadian Prime Minister Justin Trudeau. Canada legalized medical use of cannabis in 2001.

With a GDP of $1.7 billion and a population of 37 million in 2017, Canada is a large economy that approaches the size of California’s, and is the first G7 country to regulate the cannabis market.

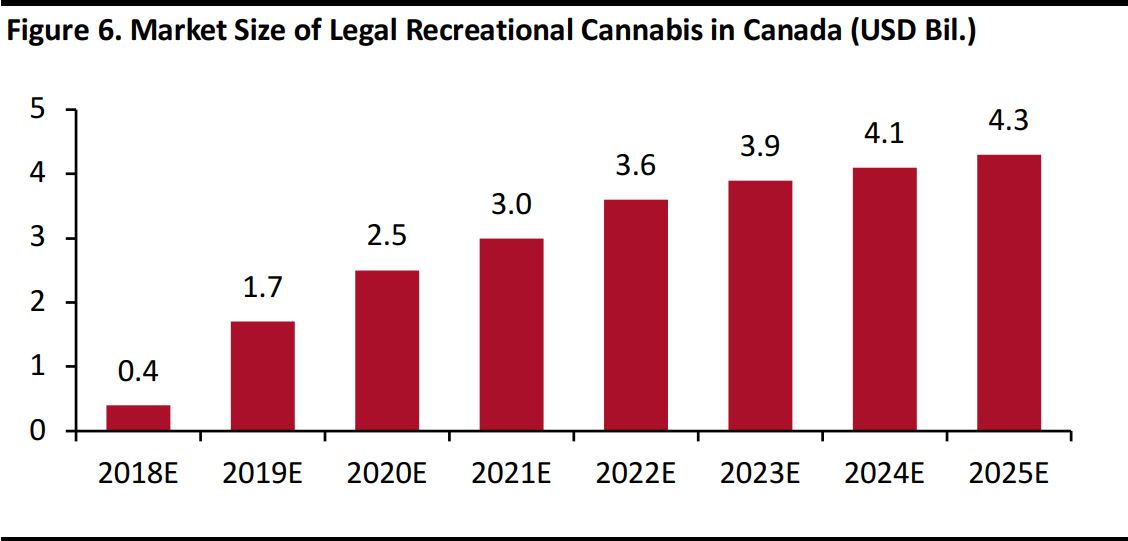

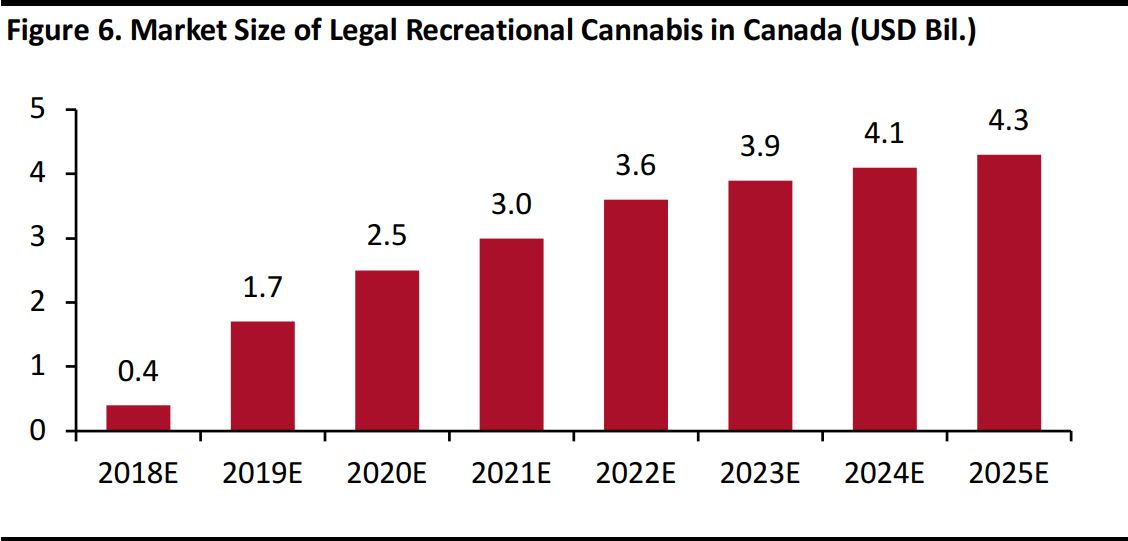

The legalization of recreational cannabis use in a large market such as Canada will further expand the opportunities for companies operating in the industry. Figure 6 shows that the market size of legal recreational cannabis in Canada is expected to grow at an average rate of 40% to reach $4.3 billion in 2025, according to New Frontier Data.

Source: New Frontier Data

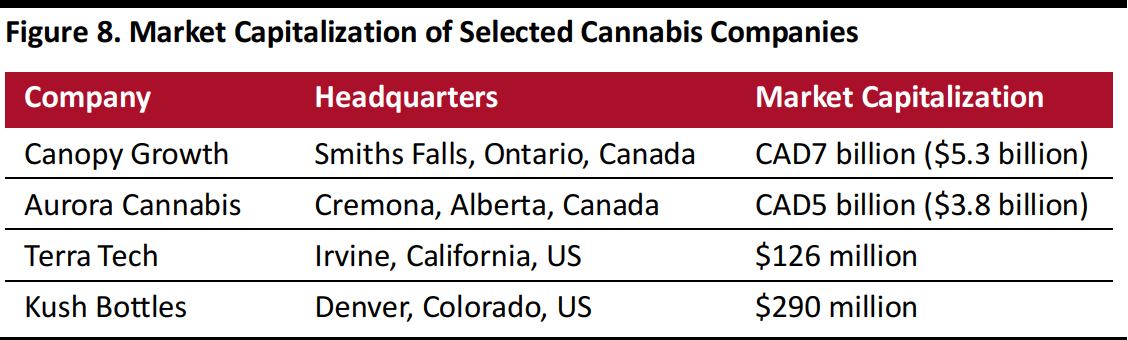

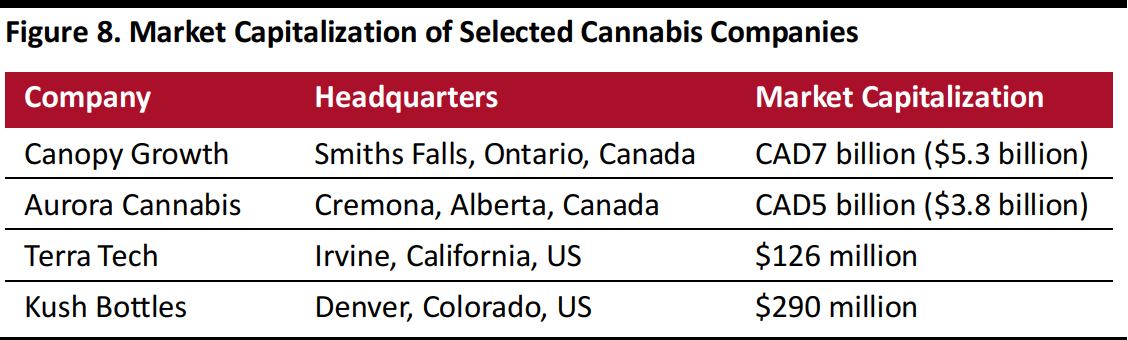

Unlike in the US where cannabis is legal only at the state level, legalization occurred at the federal level in Canada. The lack of legislative ambiguity has created a conducive environment for the industry to grow there, and enabled, for example, companies that are directly involved in cannabis production and trade to go public and access the capital market. Examples of cannabis

companies listed on the Toronto Stock Exchange include Canopy Growth and Aurora Cannabis, both having as part of their business the direct production of medical cannabis. By contrast, US-listed companies, such as Terra Tech and Kush Bottles, do not “touch the plant” but provide equipment and services for the cannabis industry. Listing companies in the US that produce and distribute cannabis is not possible, as it would violate federal laws that still consider cannabis illegal.

Canada’s central government is leaving it to the provinces to regulate how recreational cannabis will be sold from October 17, 2018, and the opportunities for the cannabis industry will be determined by the way regulations will be implemented. At the time of writing, regulation at the provincial level was still in the making. For example, in Ontario, Canada’s most populous province and largest medical cannabis market, customers will be able to buy recreational cannabis legally only online from the government-run Ontario Cannabis Store’s website, according to the Government of Ontario.

However, on August 14, 2018, Marijuana Business Daily reported that the province is planning to allow a network of privately-owned stores to be in place by April 1, 2019. This leaves scope for private business to enter the cannabis retail market in the province. For example, Canopy Growth is planning to expand into recreational cannabis retailing in Ontario through the acquisition of Hiku Brands, a company that operates lifestyle stores Tokyo Smoke, which, although they do not sell cannabis at present, could be converted into recreational cannabis retail stores, pending licensing, within months, according to Marijuana Business Daily.

Regulatory Ambiguity Could Hinder Future Growth in the US

While the Canadian regulatory environment is more straightforward and conducive for business growth, the ambiguity regarding the legal status of the cannabis industry in the US is the main threat to its future expansion in the country. While many states have legalized the medical and recreational use of marijuana, the production, trade and consumption of cannabis are still illegal at the federal level, leaving a window of uncertainty that affects operators within the industry. In particular:

- Cannabis businesses remain concerned about possible intervention to enforce federal laws. The threat of federal intervention is the top concern within the American marijuana industry, according to a survey undertaken in 2017 by Marijuana Business Daily.

- Cannabis businesses cannot access banking services, since banks need to comply with federal laws that still consider cannabis firms’ activities as violations of federal drug laws. Banks could face penalties for enabling marijuana sales transactions. Accordingly, very few banks currently offer banking services to firms related to the cannabis business.

This lack of access to banking services has had severe consequences for cannabis businesses. Since they cannot access banking services, cannabis businesses must operate on a cash basis, which raises safety concerns, as the businesses become easy targets for thieves. Moreover, US cannabis businesses cannot rely on banks for access to funding, and institutional investors are prevented from investing in the industry. As a result, the US cannabis industry mostly relies on private investors, venture capital and private-equity firms for funding.

The Cannabis Industry Is Good for the Economy

By generating revenue and jobs, the regulated cannabis industry contributes to the economy of those geographies in which it operates. The legal cannabis industry generates tax revenues for state and local authorities and jobs for the local workforce. Income earned by employees in the cannabis industry is, in turn, spent on products and services such as groceries and housing. The real estate sector benefits from the space used as business premises by retailers and growers. Ancillary industries, such as plant-growing equipment providers and logistics services, also benefit from the growth of the cannabis industry, while cannabis-related tourism provides a further economic benefit.

In its publication, “Annual Marijuana Business Factbook 2018,” Marijuana Business Daily estimated that the total economic impact of the legal cannabis industry on the US economy will be $28–$34 billion in 2018 and will soar to $75 billion annually by 2022.

An estimated 125,000–160,000 full-time workers are employed in the cannabis sectors, according to Marijuana Business Daily. These figures include workers directly employed in the industry as well as those in ancillary companies that generate a sizeable share of their business from the cannabis industry. Moreover, Marijuana Business Daily expects 340,000 full-time jobs to be created within the industry by 2022, growth of 21% per year.

Cannabis business is also beneficial for the public finances of the states that legalized the industry. Retail of both medical and recreational cannabis generated $745 million in tax revenues in the US, and it is expected to generate $2.3 billion in tax revenues by 2020, according to New Frontier Data. In Canada, the federal Government estimated CAD400 million ($306 million) in tax revenues in the first two years following the legalization of recreational cannabis use, Bloomberg reported on December 12, 2017.

Competition Intensifies as the Market Expands

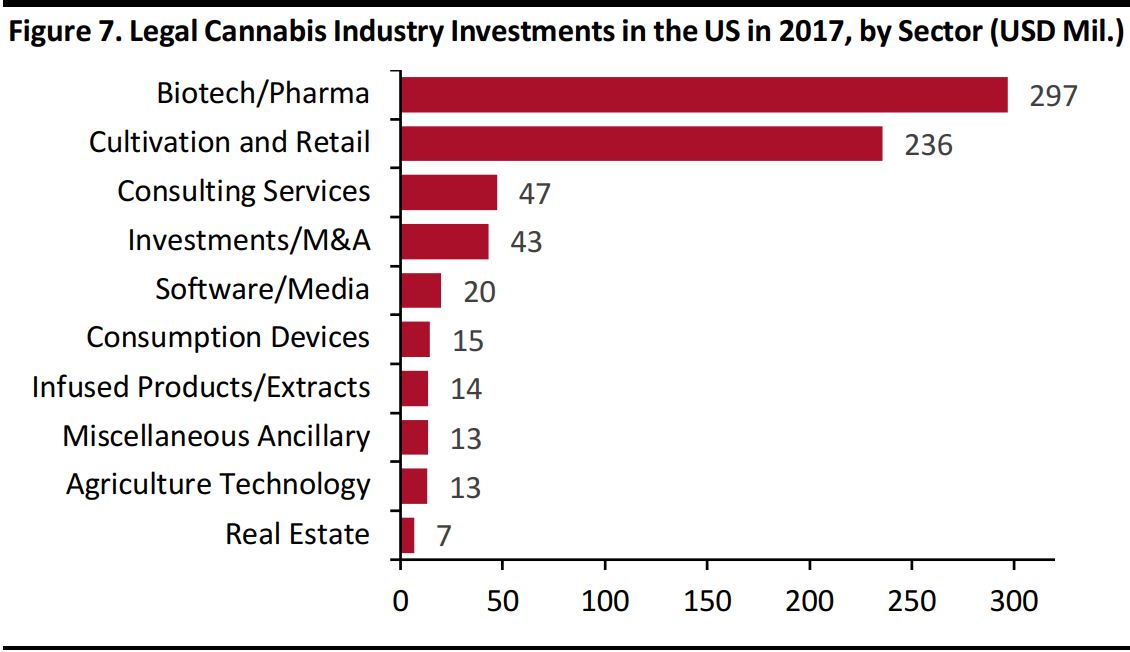

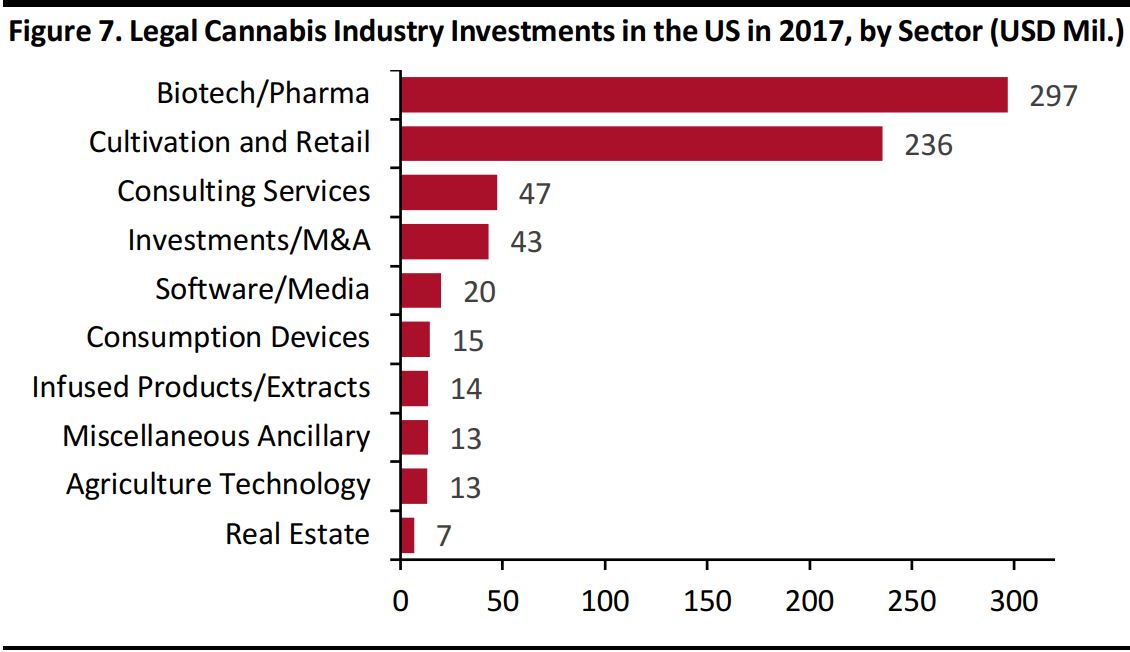

With the market for recreational marijuana projected to grow fast, investment in the industry is also continuing to grow. In 2017, more than $700 million was invested in the cannabis industry, according to our analysis of New Frontier Data’s figures, shown in figure 7 (a breakdown of investments by segment). Marijuana Business Daily expects investment to ramp up rapidly in 2018, with the average company investing $2 million in the cannabis business from an average of $750,000 in 2017.

Includes Both Medical and Recreational Cannabis

Source: New Frontier Data

However, companies entering the market are confronted with increasing competition. Marijuana Business Daily estimated that there were 48,000–66,000 cannabis businesses in the US in 2017, up from 21,000–33,000 in 2016. At the time of writing, there were 1,490 companies listed as “marijuana startups” on new business directory AngelList, up from 859 companies when we ran the same exercise one year ago.

As more companies and investment funds enter the market, the barriers to entry for new businesses are increasing. However, consolidation is the real threat to the survival of the smaller companies in the industry, in particular, as larger and better-funded Canadian companies enter the US market. Mainly because of the clearer regulatory environment in which they operate in their domestic market, Canadian companies have been able to access more capital than their US counterparts, as shown in figure 8.

Market capitalization as of August 8, 2018

Source: Bloomberg

Canada shows already a market leaning towards consolidation, with investments and acquisitions progressing fast. In July 2018, Aurora Cannabis acquired Ontario-based medical cannabis company MedReleaf for $2.5 billion, according to specialist financial publication The Motley Fool, the largest deal in the industry at the time, but that was surpassed shortly after by alcoholic drinks manufacturer Constellation Brands’ $4 billion investment in Canopy Growth, announced by the two companies on August 15, 2018.

With this investment, Constellation Brands is strengthening its partnership with the Canadian cannabis firm, started with a first investment of about $200 million in October 2017, for the development of cannabis-infused

drinks. Constellation Brands’ competitors are also partnering up with Canadian cannabis companies. For example, Molson Coors announced on August 1, 2018, a partnership with Canadian cannabis producer Hydropothecary Corp. “to pursue opportunities to develop non-alcoholic, cannabis-infused beverages for the Canadian market following legalization.”

In another deal announced on May 14, 2018, Canopy Growth agreed to buy a 33% stake in greenhouse operator BC Tweed Joint Venture, according to Bloomberg. The top eight cannabis producers in Canada are expected to produce more than 70% of all cannabis in the country by 2021, The Motley Fool reported on June 23, 2018.

Despite being in its early days of legalization for recreational use, California is already seeing a development within its cannabis market that will lead to an environment less conducive for smaller businesses. A study published by Marijuana Business Daily on June 18, 2018, showed that 20% of the cultivation licences released in California are held by just 12 licensees. This shows how big cannabis businesses are concentrating licences in preparation for market entry, a strategy that aims to flood the market with the intention of creating brand loyalty and to drive prices down to erode margins, making it difficult for smaller companies with less capital to survive, according to The Motley Fool.

Key Takeaways

The cannabis industry continues to be fast-growing. Legal recreational cannabis sales in the US are expected to amount to $4.2–$5.1 billion in 2018, an 80% increase versus the previous year’s estimate. The total market is expected to reach $7.9–$9.7 billion in 2018, according to Marijuana Business Daily.

Signs of maturity have started to appear in states that legalized recreational cannabis first. For example, in Colorado, legal sales of cannabis products went from a 42.5% growth in 2015 to just a 15% growth in 2017, according to the Colorado Department of Revenue.

California is expected to drive the growth of the US cannabis industry. In the state, the market for recreational cannabis is estimated to grow by 79% in 2018 to reach a total value of $4.7 billion by 2025, according to New Frontier Data.

In Canada, where legal sales of recreational cannabis will start in October 17, 2018, the market size of legal recreational cannabis is expected to grow at an average rate of 40%, to reach $4.3 billion in 2025. The more straightforward regulatory environment in Canada has enabled cannabis companies to grow more than their US counterparts. Firms including Canopy Growth and Aurora Cannabis are now public companies with multi-billion dollars in capitalization and are pursuing consolidation strategies through acquisitions.

Consolidation of the cannabis industry is increasing in both the US and Canada, and is expected to threaten the survival of smaller companies trying to make their mark in the industry. Large Canadian cannabis companies such as Canopy Growth and Aurora Cannabis are engaged in acquisitions of smaller players, and in California, we are seeing large businesses concentrating licences in preparation for market entry.