THE FUNDAMENTALS: THE COMPANIES AND THE MERGER

Earlier this year, Ahold announced its acquisition of Belgian competitor Delhaize that will create one of the largest food retailers in the US and a major player in Europe. We provide a deeper dive into the combination and the potential synergies, in this note.

About the Companies

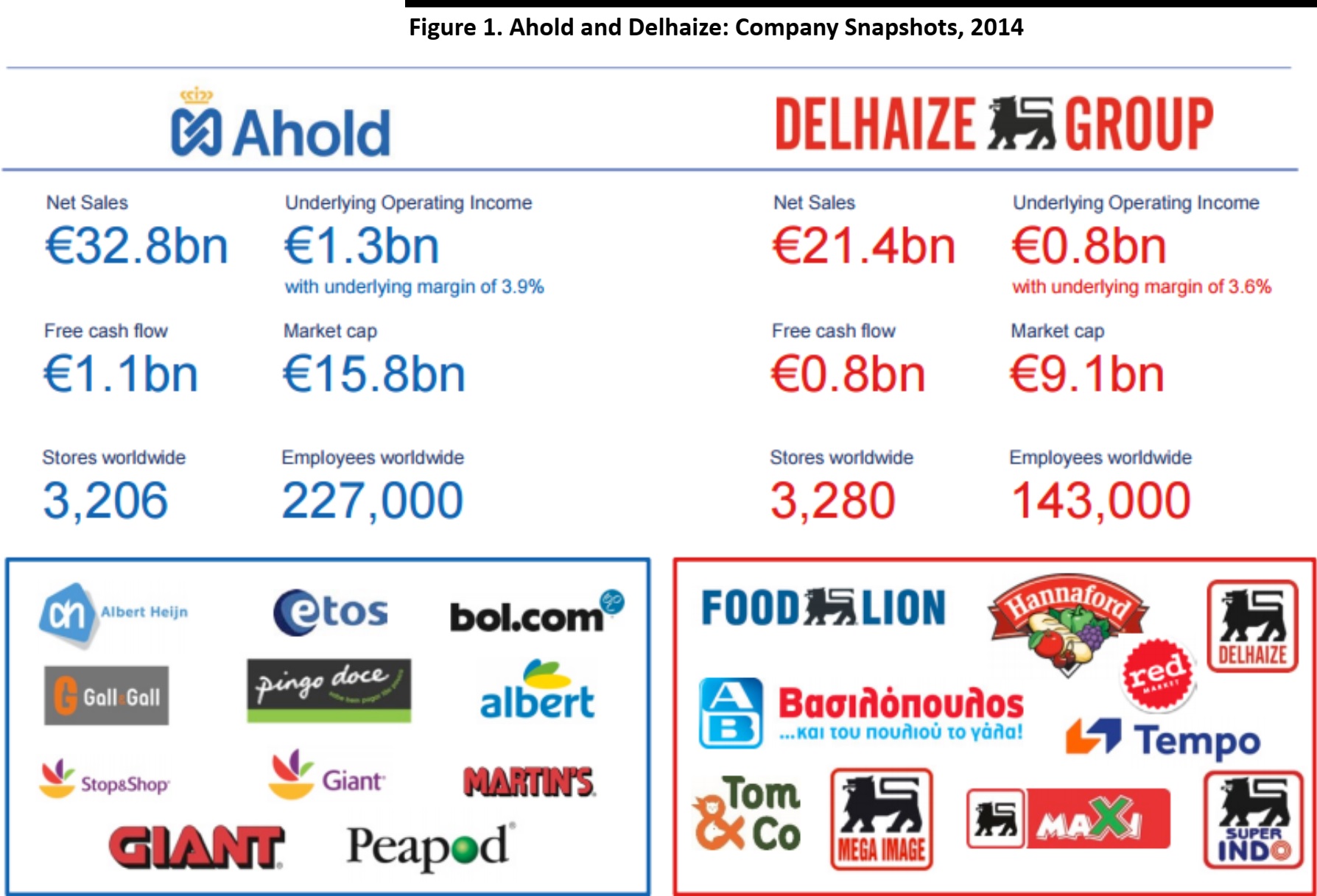

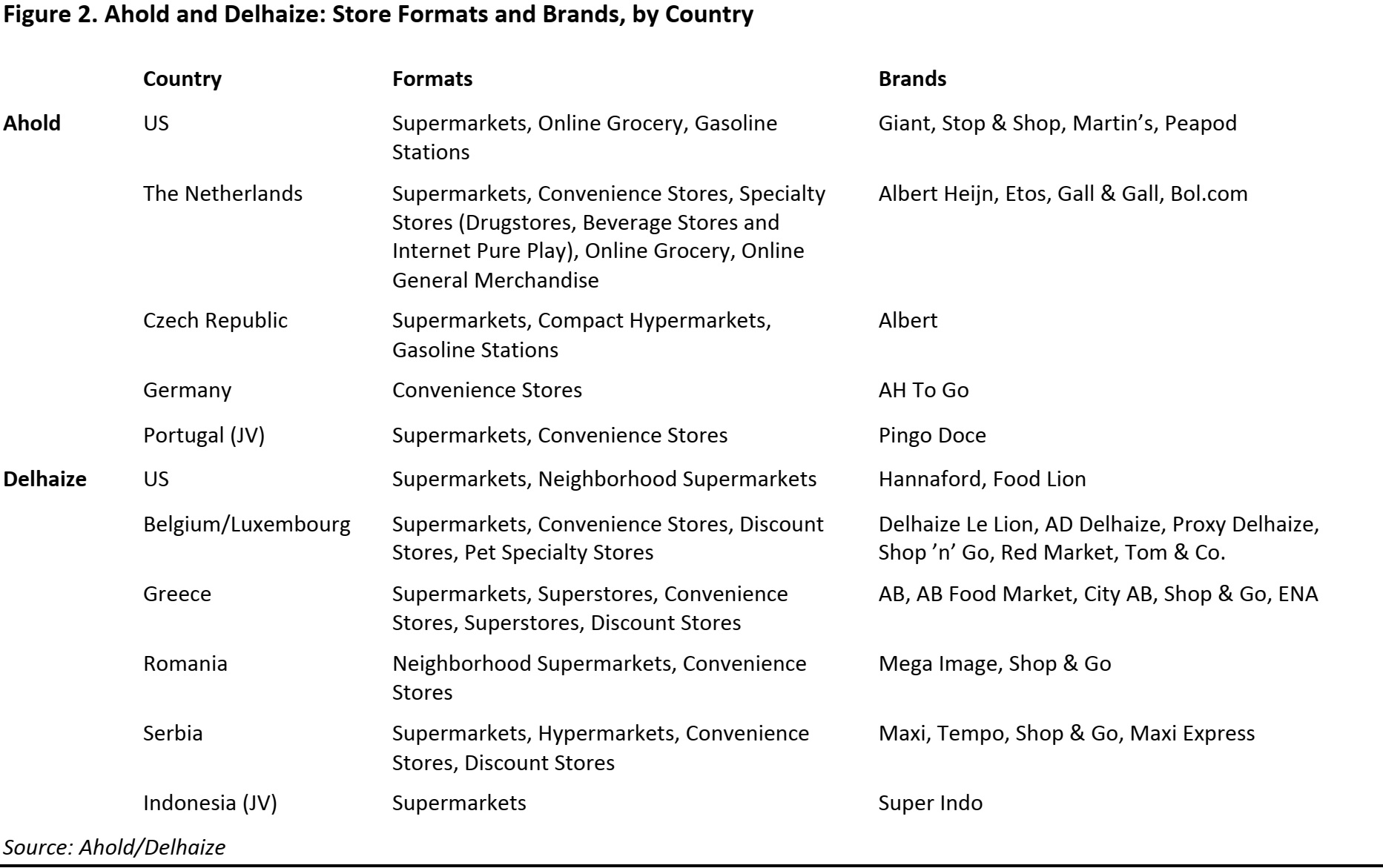

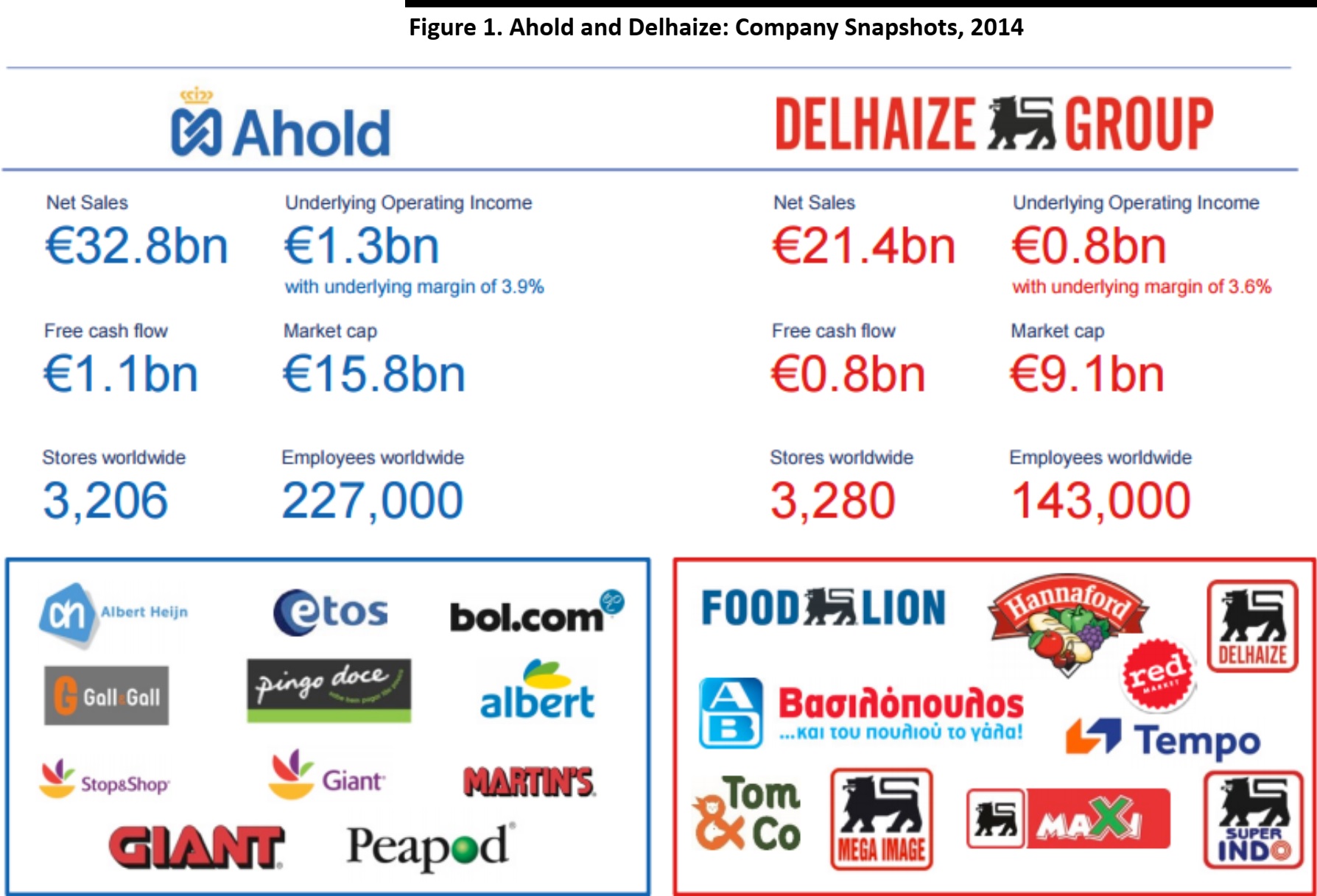

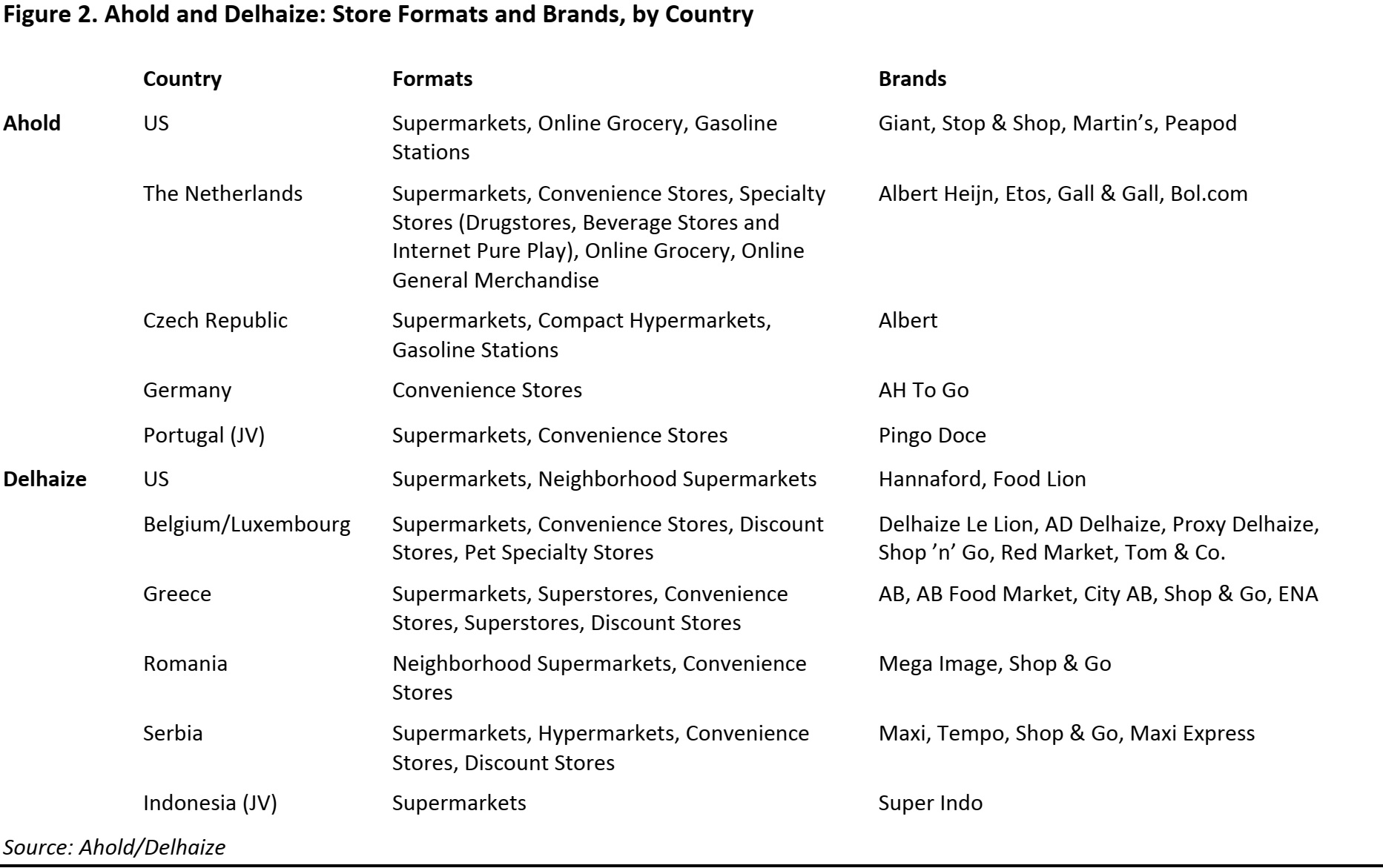

Ahold and Delhaize both operate supermarkets and convenience stores. While Ahold is headquartered in the Netherlands and Delhaize in Belgium, both generate roughly 60% of their revenues in the US under the Stop and Shop and Giant brands for Ahold and Food Lion and Hannaford for Delhaize. Ahold also operates the online grocery site Peapod.

Ahold and Delhaize generated €33 billion and €21 billion in revenues, respectively, in the fiscal year ended December 2014.

Both are multibrand, multiformat operators—indeed, neither operates any of their banners in more than one country, with the exception of Ahold’s AH To Go brand in the Netherlands and, to a very limited extent, in Germany.

Sales, underlying operating income, stores and employees exclude joint ventures (JVs).

Source: Ahold/Delhaize

About the Merger

The companies describe it as a merger of equals. Here are key features:

- Delhaize shareholders will receive 4.75 Ahold shares for each of their current shares.

- Prior to completion, €1 billion will be returned to Ahold shareholders via a capital return and a reserve stock split. Ahold will terminate its ongoing share buyback program.

- After completion, Ahold shareholders will own 61% of equity, and Delhaize shareholders will own the remaining 39%.

- After the merger, Ahold will be the listed entity and the company will be listed on the Euronext stock exchange in Amsterdam and Brussels.

- Completion is expected in mid-2016.

Ahold Delhaize will have a supervisory board and a management board. The former will be headed by Mats Jansson, current Chairman at Delhaize; the latter will see Dick Boer, the President and CEO of Ahold, become the CEO of Ahold Delhaize. Appointees to each board will come equally from Ahold and Delhaize incumbents.

The Result

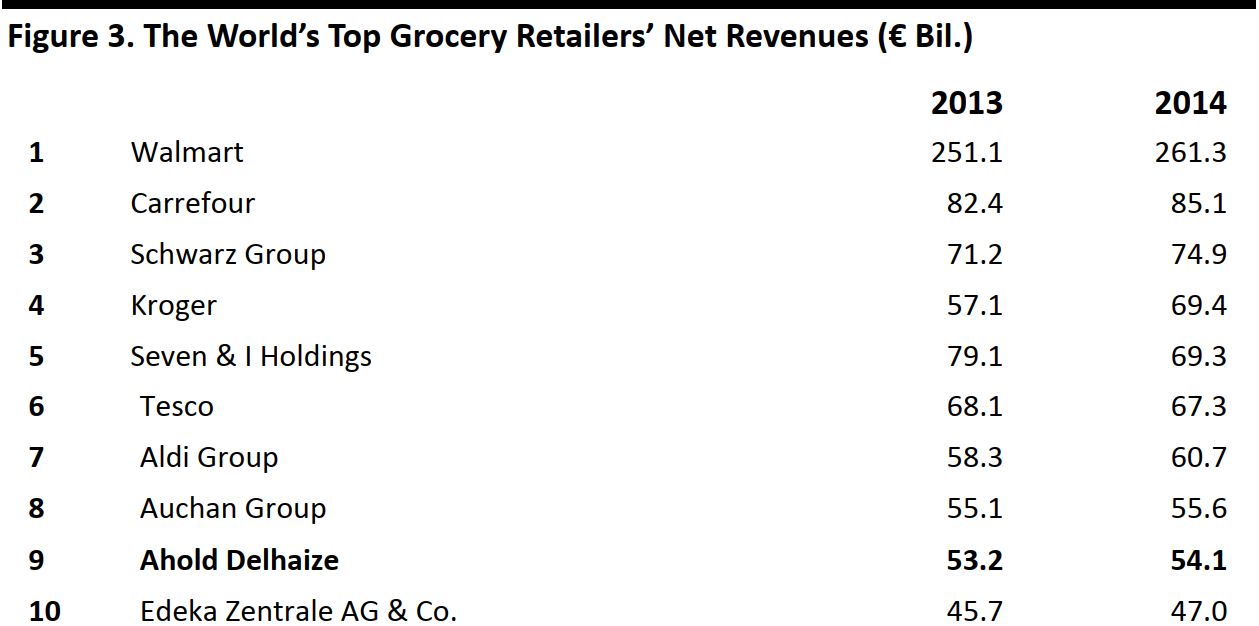

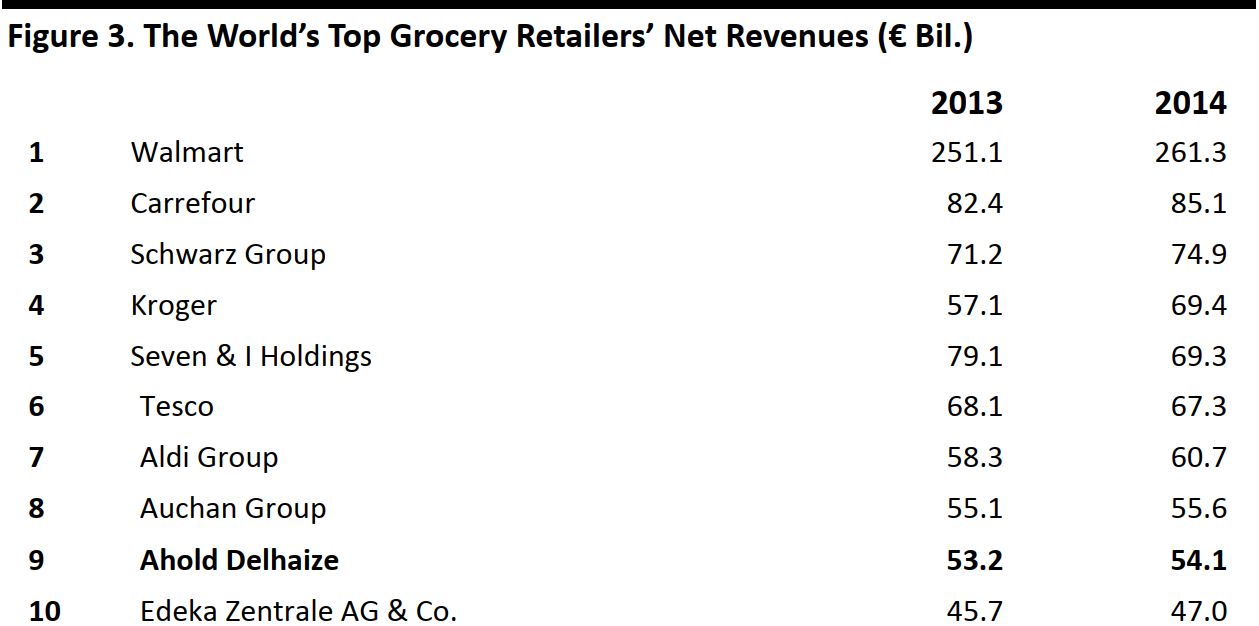

Ahold Delhaize will be the world’s ninth-biggest grocery retailer by revenues, according to Euromonitor International data. In the US, Ahold Delhaize will move into fourth position by revenues, between third-place Albertsons and fifth-place Publix.

Source: Euromonitor International/Ahold/Delhaize/FBIC Global Retail & Technology

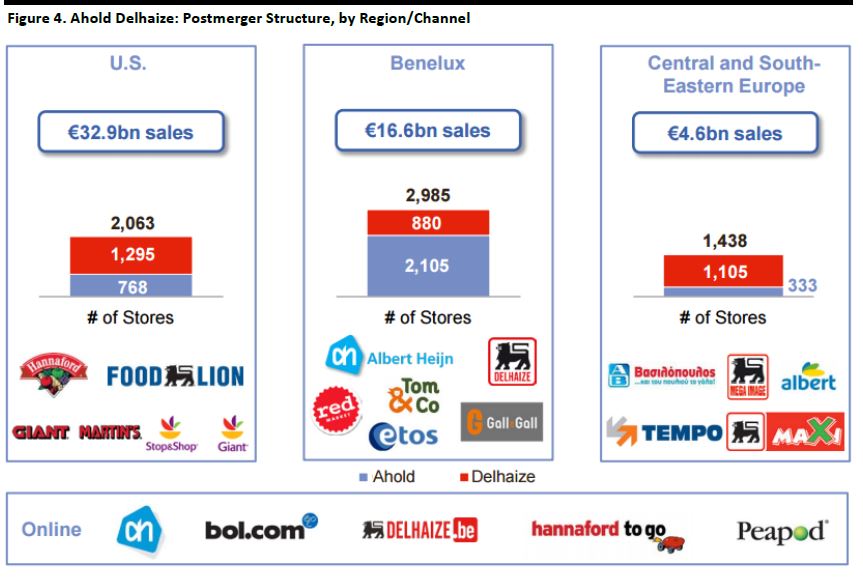

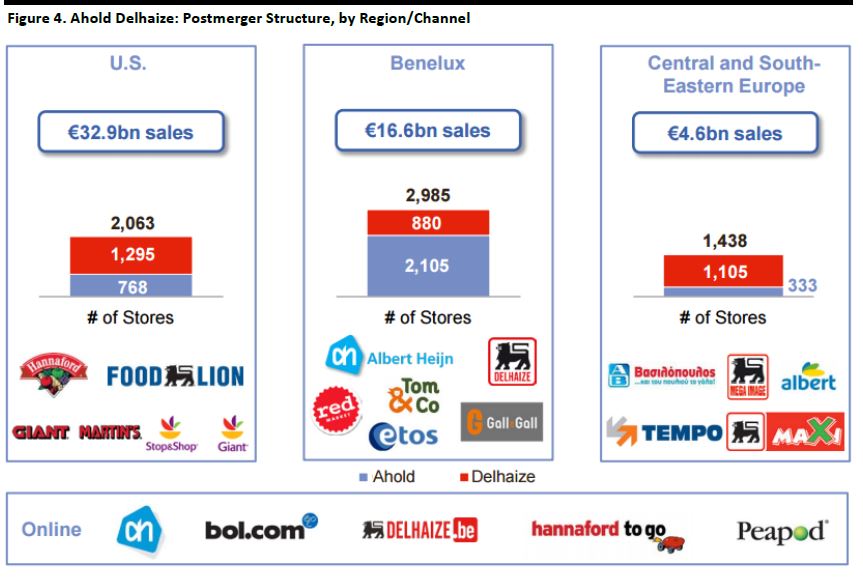

Based on 2014 revenues, fully 61% of postmerger sales will come from the US. The Benelux heartlands will account for a further 31%, leaving the rest of Europe to contribute the final 8% of revenues. This is how the new group will look

Source: Ahold/Delhaize

Financial Benefits

Pro forma, Ahold Delhaize reported 2014 revenues of €54.1 billion, underlying EBITDA of €4.0 billion, underlying EBIT of €2.5 billion, net income of €1.3 billion and net debt of €2.3 billion.

- The company has said it expects to realize synergies “quickly,” enhancing EBIT and EBITDA. It expects the merger to be earnings accretive in its first year after completion.

- The merger will result in a “highly cash generative company,” according to Ahold and Delhaize, with a policy of paying out 40%–50% of adjusted net income in dividends.

- Ahold and Delhaize have identified €500 million of savings that can be made across the first three years. Some 50%–60% of this will come from direct sourcing, due to greater volumes, comparing terms and centralizing buying. Indirect sourcing (procurement) will contribute 15%–20% of the total, while general and administrative cost savings will make up the remaining 25%–30%.

One area the company will not be seeking to rationalize is its plethora of banners. Both companies indicated that a cull of brands is not planned, as Ahold Delhaize will continue its forebears’ traditions of localized and specialized banners.

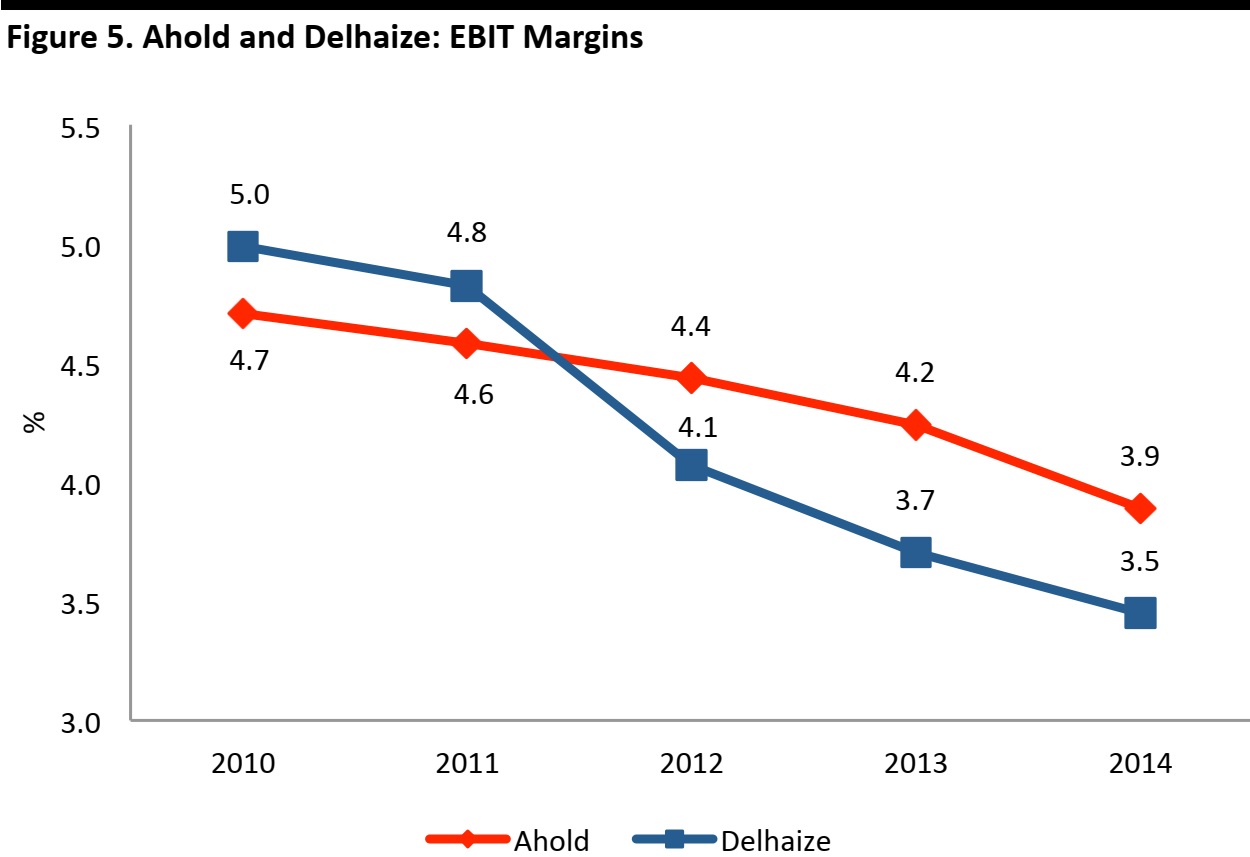

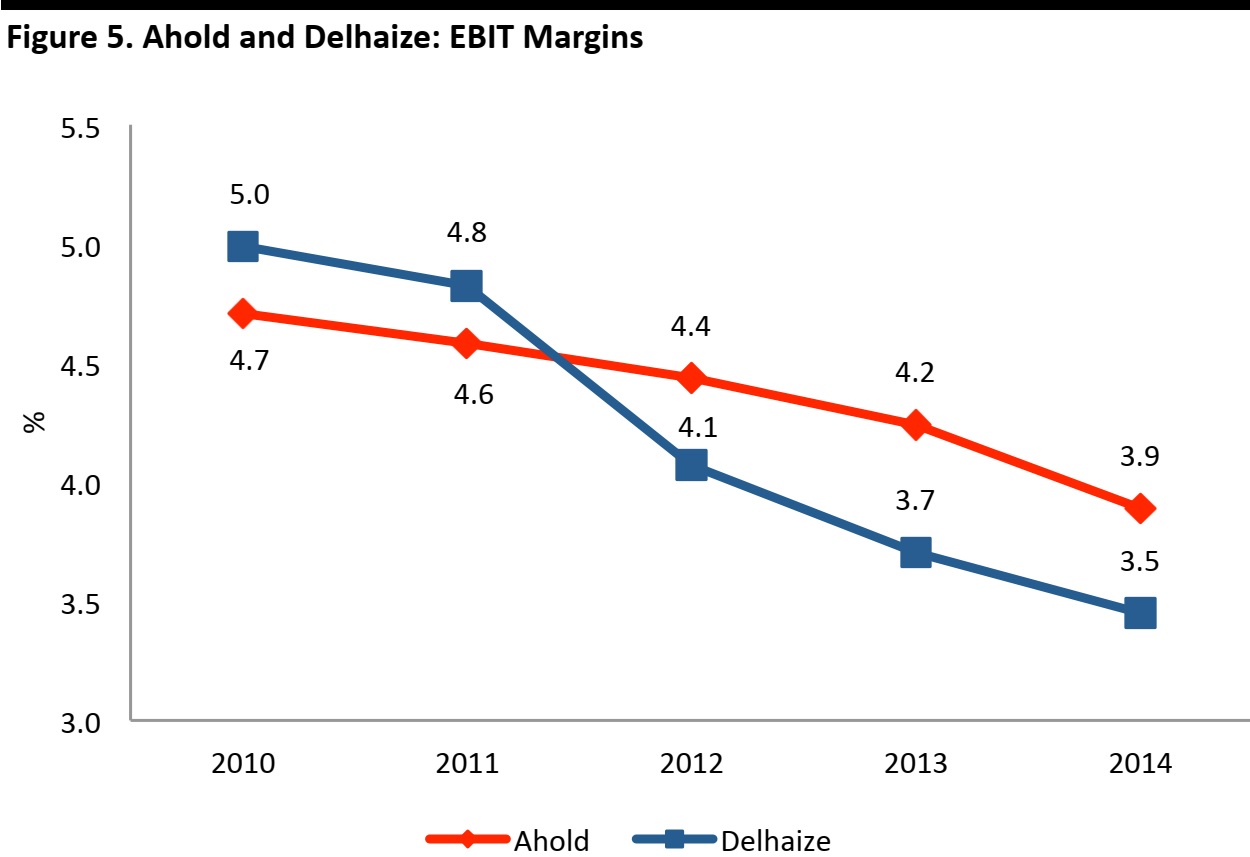

Savings will be welcomed by investors, given that both firms have been under margin pressures as price investment has proved more necessary. Annual cost savings of €500 million will equate to a boost of around 100 basis points on Ahold Delhaize’s operating margin, we estimate.

Source: S&P Capital IQ/FBIC Global Retail & Technology

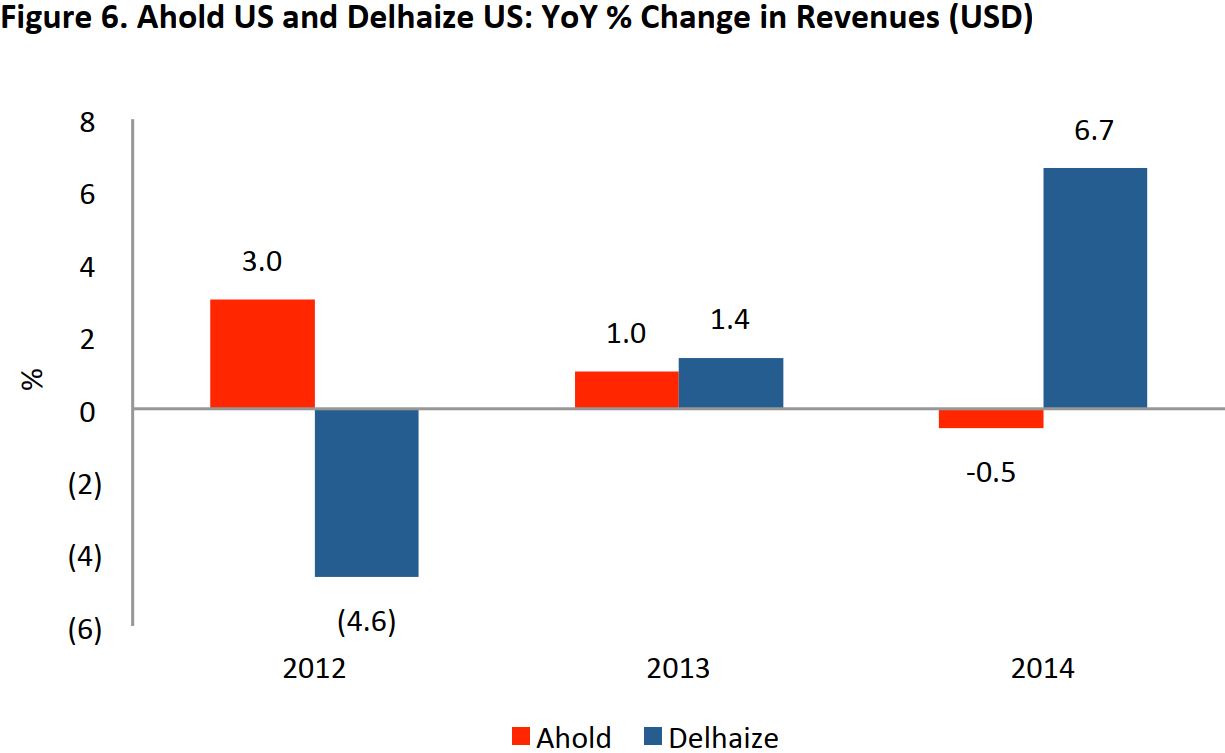

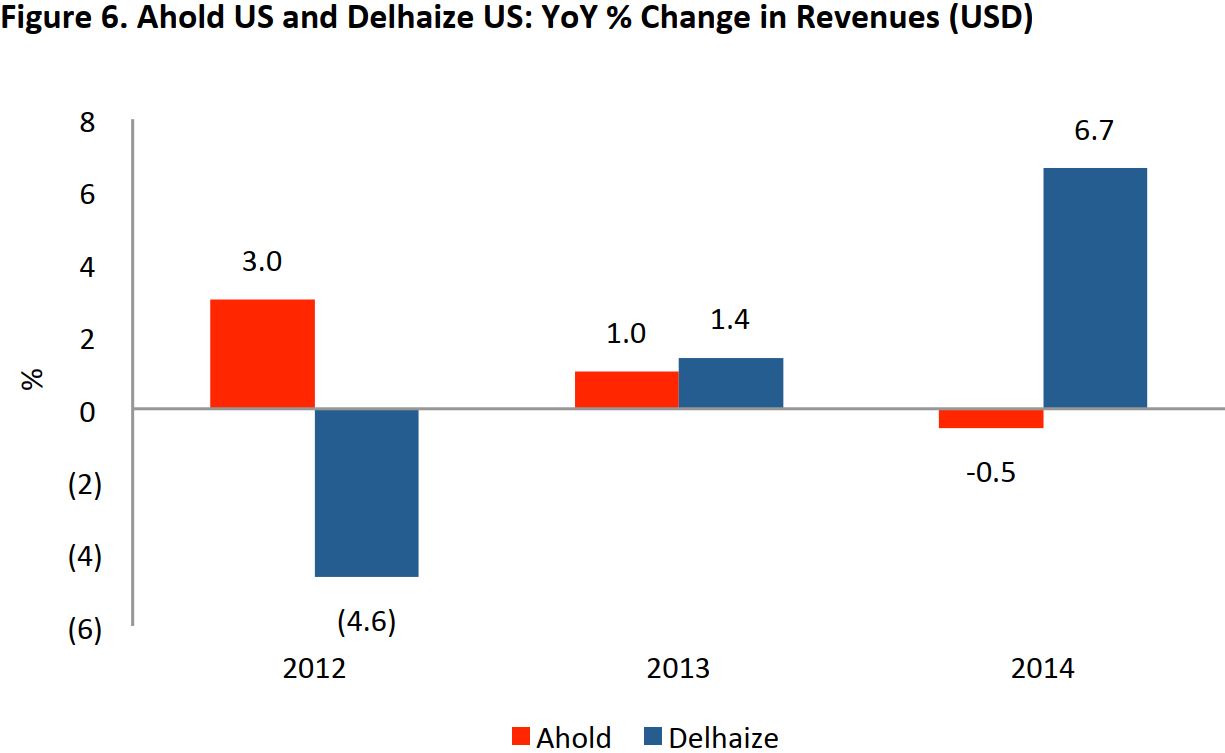

Top-line growth in the US market will also likely be a priority, particularly for Ahold’s stores. Delhaize has been outperforming Ahold in the US, and the two companies’ revenue trends have been heading in opposite directions.

Source: S&P Capital IQ/FBIC Global Retail & Technology

WHAT WE THINK

Complementary Businesses

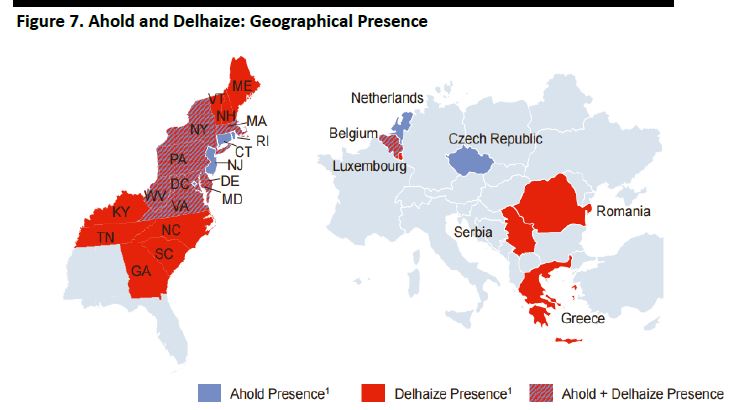

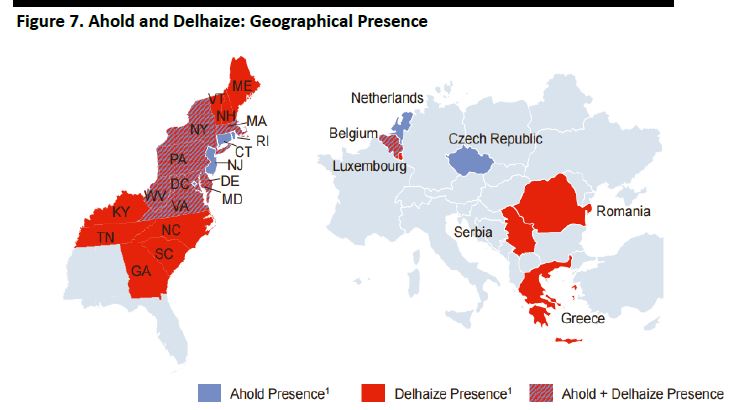

The firms described the merger as one of “two companies with complementary cultures, similar values and neighboring geographies.” A rundown of features certainly suggests commonalities:

- Both are second-tier European grocers originating from Benelux.

- Both have a presence in similar areas of the US, as well as in smaller European markets. Yet geographical overlap is relatively minimal.

- Both operate multiple banners, including different brands in each country in which they operate.

- Both operate different formats, with supermarkets and convenience stores the common link.

*Excludes JVs.

Source: Ahold/Delhaize

As we note below, we think elements of their complementary natures—notably online grocery and neighborhood supermarket formats—offer potential for scaling up within the new company.

Growth Opportunities in the US

We do not expect the merger to be simply about stripping out costs to boost margins. We think top-line growth can be strengthened by the combination. And given that Ahold Delhaize will be generating some 61% of revenues from the US, growing sales in America will be key. In terms of the proposition to US customers, we see three areas for development:

- Online grocery retailing: Delhaize’s Hannaford brand has only just begun rolling out its Hannaford To Go grocery pickup service. Ahold owns the Peapod grocery delivery service, giving it a stronger legacy of online grocery retailing, whose learnings can be applied to new regions. Given the underdeveloped nature of e-grocery in the US market, Ahold Delhaize could position itself at the forefront of this channel, ahead of rivals such as Kroger.

- Proximity store formats: Both groups operate convenience stores, but Delhaize also operates neighborhood supermarkets and grocery discounter stores. Smaller-store formats appear to be a growth channel in the US, helped by the trends of greater urban living and more online shopping. Here, though, Ahold Delhaize will face competition from the likes of Walmart Neighborhood Market stores.

- Fresh foods and private labels: Fresh foods and healthy or “natural” private label brands are growth areas in American grocery, as we showed in our report The Middle-Aisles Exodus: US Shoppers Flee to Healthier, More Natural Foods. Walmart and Target are among those improving their offering in fresh foods, but Kroger has been the big winner here. Kroger has seen strong growth in its natural foods department and success for its billion-dollar Simple Truth range of organics and whole foods. But swathes of Ahold Delhaize’s Northeastern US coverage area are not served by Kroger, providing opportunities for the newly merged company. In their conference call announcing the merger, the companies noted their overlapping expertise in fresh and private label goods, and the combining of capabilities gives Ahold Delhaize an opportunity to bolster its presence in these categories.

So, we see the merged company as one that will be more capable of responding to changing consumer demands—for convenience, for home delivery and for healthier foods—than the constituent firms are independently.

the top 10 grocery retailers accounted for just 51% of the sector in the US in 2014; this compares to a top-10 share of 76% in France and 75% in Germany in the same year.

The newly merged company will take a US grocery market share of 4.1%, according to Euromonitor data for 2014, pushing it into fourth place behind the newly enlarged Albertsons, which enjoys a 5.7% share. Once the merger is completed, second-place Kroger, third-place Albertsons and fourth-place Ahold Delhaize will have all been substantially bolstered by mergers in the space of only a couple of years. We do not expect M&A activity to stop there, given the room for further market concentration.

Outlook: Synergies, Opportunities and Consolidation

Ahold and Delhaize are, at least superficially, strikingly similar: Benelux-founded, but with around 60% of revenues generated in the Eastern US, both operate multiple formats and multiple brands. Geographical overlap is minimal, but cultural overlap looks to be substantial.

Proximity formats and online grocery retailing are expected to be areas for rollout, with the latter bolstered by Ahold’s ownership of Peapod. Fresh foods and private labels stand to be strengthened, too.

The merger is another step toward consolidation of the fragmented US grocery sector, and we do not expect this to be the last major M&A deal in American grocery in the near future.