albert Chan

What’s the Story?

Physical locations are indispensable for brands and retailers in building lasting relationships with their shoppers. In order to meet customer demand and expectations, it is essential for CPG companies and retailers to carry the right product assortment—supplemented with strategically designed planograms and effective merchandising execution.

A shopper-centric approach to assortment and space planning can help retailers improve shopper experience, increase overall sales and build brand loyalty. In fact, increased sales conversion emerged as the topmost benefit of effective retail merchandising, according to Coresight Research’s August 2020 survey of global retail merchandising decision-makers, with over half of respondents (51%) citing it at as a benefit.

However, effective localization of assortment and space planning can be a very challenging task, and most retailers often fall short of harnessing the true potential of technologies such as artificial intelligence (AI) and modern approaches in machine learning (ML) and data science (DS, often called “operations research,” which is applied mathematics).

We believe that part of this problem is rooted in CPG companies’ and retailers’ inability to effectively analyze store-level data and merge their merchandising rules and category strategies. Most retailers and CPG companies (90%) are either “exploring” or “experimenting with” AI, according to a January 2020 study by AI solution provider Element AI. This means that the retail industry ranks lowest in terms of AI maturity, with other industries being ahead in formalizing, optimizing and transforming through AI.

Strategically trained and designed ML/DS algorithms can be used to analyze store-level data, enabling the age of precision in category management. There is significant incremental value in optimizing assortment at the store level—ensuring product availability is aligned with demand at each store location. In addition, retailers can apply store-level analysis to existing cluster (macro) approaches and dial up or reduce cluster count, as per their requirements.

In this report, we analyze the key industry trends that are impacting CPG companies and retailers and discuss how both can achieve the goal of customer-centricity through the hyper-localization of assortment.

This report is sponsored by HIVERY, an AI- and DS-powered solution that harnesses store-level data for category management optimization, enabling precision in category management and localized assortment.

Why It Matters

Optimization of key category management processes including merchandising and assortment planning can help retailers reduce costs and improve sales. For example, more than half of grocery retailers (51%) lose 5–10% of sales to poor in-store execution—such as infrequent stock replenishment, non-compliance with planograms and limited understanding of the impact of transferable demand (e.g., substitute goods)—according to an October 2019 Coresight Research survey of 200 global grocery retail decision-makers.

Effectively leveraging advanced technologies in ML and DS can improve assortment planning and space localization as well as automate planogram generation. By adopting these technologies, category management and retail merchandising professionals do not need to change their planning process; they only need to get smarter in the way they use store-level data. The key benefits of ML and DS include the following:

- Shopper-centricity—Retailers and CPG companies can deploy advanced ML and DS algorithms to understand shopper demand and preferences and thus ensure that stores are stocked with products that align with demand. This would translate to higher sales.

- Accurate forecasting—By analyzing store-level data, retailers can access shoppers’ behaviors and preferences. This leads to discovering “latent shopper segments”—purchase behavior/preferences across shopper segments that cannot be achieved with traditional methods used today. ML and DS models can decipher these latent shopper segments. More importantly, these technologies reveal the demand elasticity of these shopper segments (e.g., variations in demand due to changes in prices or adding/deleting stock-keeping units (SKUs) in a category) and how demand for specific SKUs is impacted in specific stores. Retailers and CPG companies can identify facets that shoppers seek in a product across locations and plan innovation before it actually becomes a “trend.” This gives retailers a competitive advantage that can help them retain market and category share.

- Better collaboration between retailers and CPG companies—A better and rapid understanding of shopper segments enables a more dynamic response to market changes and more effective product assortment plans. This can help CPG category professionals and retail buyers establish a dynamic strategic relationship, aligning manufacturing with demand and meeting both parties’ category goals. CPG companies would also be better positioned to understand the products that do well across specific stores and so could manage their resources more optimally. Leveraging advanced ML and DS technologies means that both parties could run multiple category strategies together and understand their impact before implementing the strategies quickly—within a few minutes.

Precision Category Management: In Detail

Pathway to Incremental Category Growth: How Industry Trends Align

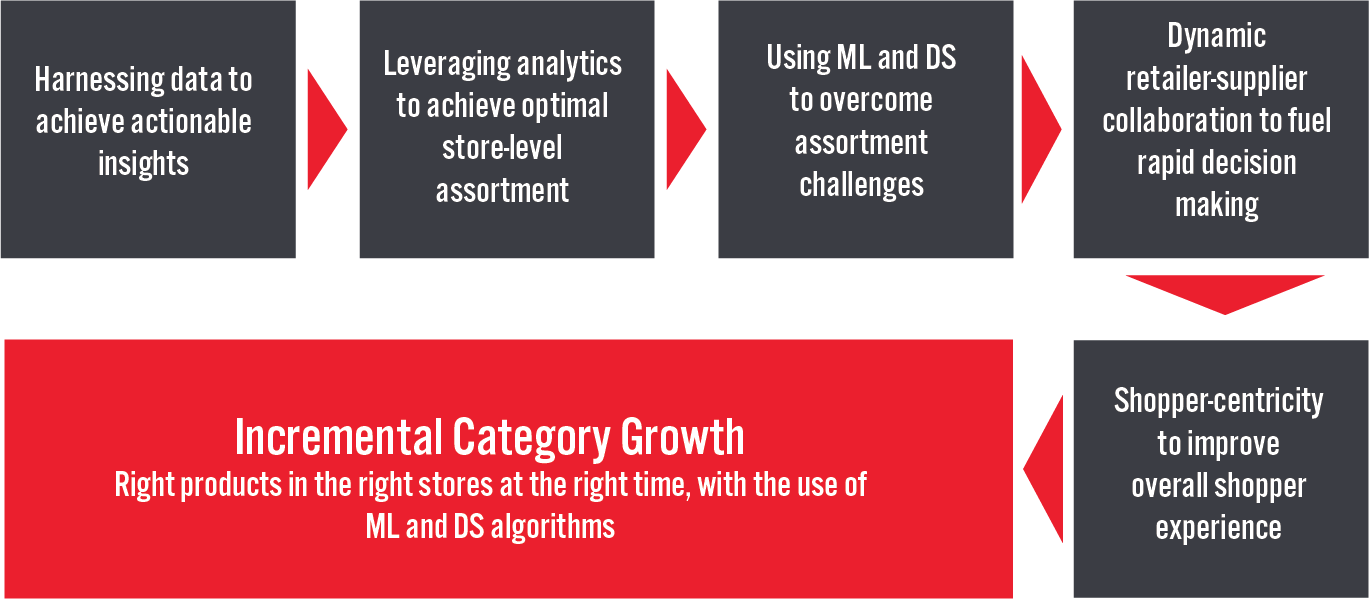

Incremental category growth requires having the availability of the right products at the right store at the right time. However, the pathway to executing this is not straightforward. Achieving shopper centricity—which eventually leads to incremental category growth—involves better analysis of data, optimal assortment at the individual store and SKU level, using advanced technologies in the form of ML and DS to overcome assortment challenges, and having a dynamic collaboration between retailers and suppliers (see Figure 1). We discuss each of these elements in detail later in this section.

Figure 1. Pathway to Incremental Category Growth [caption id="attachment_126509" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

The Ultimate Challenge: Leveraging Data To Extract Actionable Insights

Existing systems and processes cannot effectively handle velocity, variety and volume of data in order to extract actionable insights at the store level. The latest advances in algorithms and computing power allows for ingesting this data to discover patterns or relationships at a store and SKU level, at a rapid pace. This includes how SKUs within a category perform at a single store as well as shopper behavior within stores.

Furthermore, retailers and their CPG partners have been challenged in an unprecedented way by the impacts of the Covid-19 pandemic on operations across the supply chain. Variations in consumer demand across stores and geographies have been exacerbated by the pandemic, and consumer preferences continue to frequently shift across product categories.

Grocery retailers must incorporate data-driven insights and work collaboratively with their CPG partners by increasing transparency and sharing actionable insights. A more collaborative approach can help retailers and CPG companies monitor demand fluctuations in real time, improve inventory management and better align supply with demand. For example, consumer goods company PepsiCo recently expanded its Demand Accelerator (DX) initiative to improve its retail relationships through better data sharing.

Retailers are swamped with massive inflows of shopper data across channels. Processing this data to identify product demand at SKU and store levels can be highly challenging. Retailers also must consider external data flows that impact category management decisions, such as seasonality, impact of adding/removing a SKU to/from the category, and local demand and events. However, there are multiple challenges involved, such as an inability to integrate multiple data streams and applying organization-level merchandising rules and category objectives to analytical tool sets.

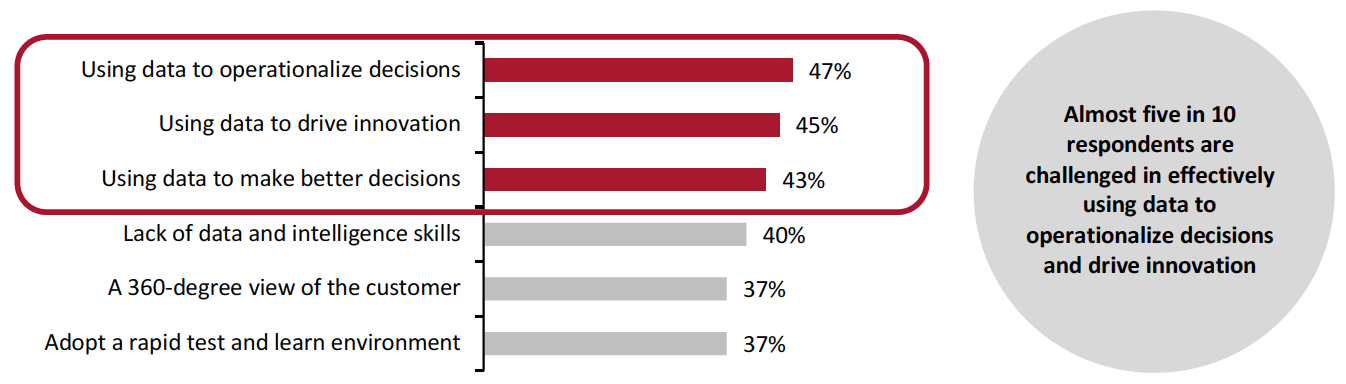

These challenges translate to the ineffective use of data and below-average results. Almost five in 10 senior executives employed in CPG companies globally cited using data to operationalize decisions and drive innovation as among the top three challenges in using data, according to a July 2020 study conducted by Adobe and Publicis Sapient. The same study indicates that 37% of the respondents from CPG companies are challenged in building a holistic view of shoppers.

Figure 2. CPG Companies: Primary Challenges* in Using Data To Maximize Value and Drive Profitable Growth (% of Respondents)

[caption id="attachment_126494" align="aligncenter" width="700"] *Challenges that were ranked in the “top three” by respondents

*Challenges that were ranked in the “top three” by respondentsBase: 120 respondents holding senior positions in CPG companies from France, Germany, the UK and the US, surveyed in July 2020

Source: Adobe and Publicis Sapient[/caption]

Technology, Data and Analytics: The Future of Retail Category Management

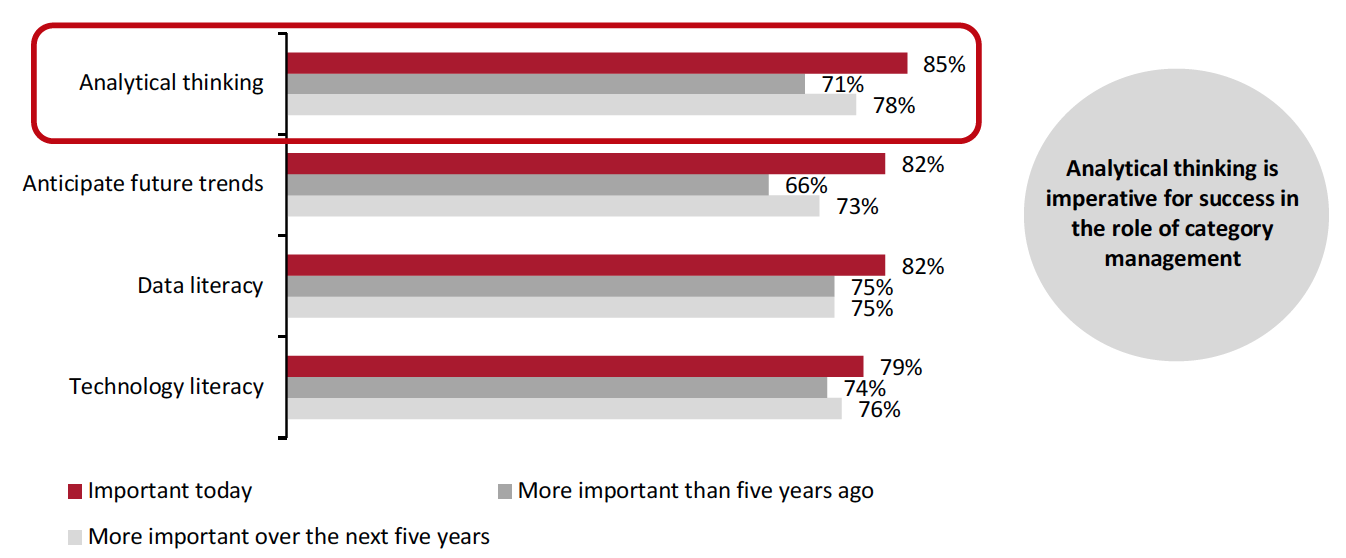

In December 2020, we surveyed grocery/drug retailers and CPG suppliers from France, Germany, the US and the UK about the key skills required to succeed as a category manager and their changing role over time. Our findings revealed the following:

- Fully 79% of respondents cited technology literacy as an important skill to succeed in category management today.

- The majority of respondents (74%) believe that technology literacy has a more important role to play in succeeding as a category manager today than it did five years ago.

- Over the next five years, the majority of respondents (76%) believe that technology literacy will play a more important role than it does today in determining the success in category management.

In addition, an overwhelming majority (85%) of the respondents cited analytical thinking as an important skill for succeeding in the role of category management today, and almost eight in 10 expect it to be more important over the next five years versus today.

We believe that having an analytical approach to data analysis, at the store level first, can help category management teams to extract the most out of available data, enabling them to run effective scenario simulations and implement optimal assortment strategies.

Figure 3. Skills for Succeeding in Retail Category Management: Level of Importance Today, Perceived Change in Importance over the Past Five Years and Expected Change in Importance over the Next Five Years (% of Respondents)

[caption id="attachment_126495" align="aligncenter" width="700"] Base: 110 grocery/drug retailers and CPG suppliers

Base: 110 grocery/drug retailers and CPG suppliersSource: Coresight Research[/caption]

Taking a pre-emptive approach is essential for category managers and CPG companies to respond to fast-changing consumer needs. In addition, this improves inventory management and helps build more sustainable and responsive supply chains. For end-to-end category success—which includes assortment optimization, visual merchandising, planograms and effective new product launches—retail category managers must be able to leverage advanced approaches in ML and DS.

Effective Assortment Strategy and Planning: Easier Said Than Done

Category planning is often a labor-intensive process. In fact, category reset processes—changing assortment, signage or merchandising to ensure the category is aligned with shopper demand—can take several months to complete. In addition, category reset involves many systems and resources on both the retail and CPG sides. This makes responding to market shocks or opportunities difficult.

Furthermore, when planning store assortment, category management teams must focus on a granular view of shoppers. For example, high-protein snacks may be doing well in a cluster of stores because of their vicinity to fitness centers, but adding an extra layer of data analysis may reveal that shoppers at a few specific stores in that cluster belong to a high-income group (protein-based snacks are usually expensive). This provides the retailer with an opportunity to expand its assortment under the snacks category by adding premium snacking options to the appropriate stores.

By analyzing store-level data first, retailers are able to optimize planograms at any cluster count. This analysis helps retailers generate incremental revenue and achieve higher operational efficiency.

The Covid-19 pandemic has added to the velocity of already-growing shopper data and added more pressure on retail category managers. We believe that leveraging advance methods in ML and DS and preforming rapid category strategy simulation can help retailers overcome assortment challenges. This allows category management professionals to make the right assortment decision to the SKU level regardless of cluster count used. We discuss key challenges in assortment planning in the table below.

Figure 4. Key Challenges in Assortment Planning

| Challenge | Description |

| Lack of predictive tools |

|

| Limited impact of localization on sales |

|

| Pricing and Promotion management |

|

| Product availability management |

|

| Limited customer segmentation |

|

| Slow stimulation and limited impact accuracy |

|

Source: Coresight Research

Speed in Decision-Making: A Pre-Requisite for Good Retailer-Supplier Collaboration

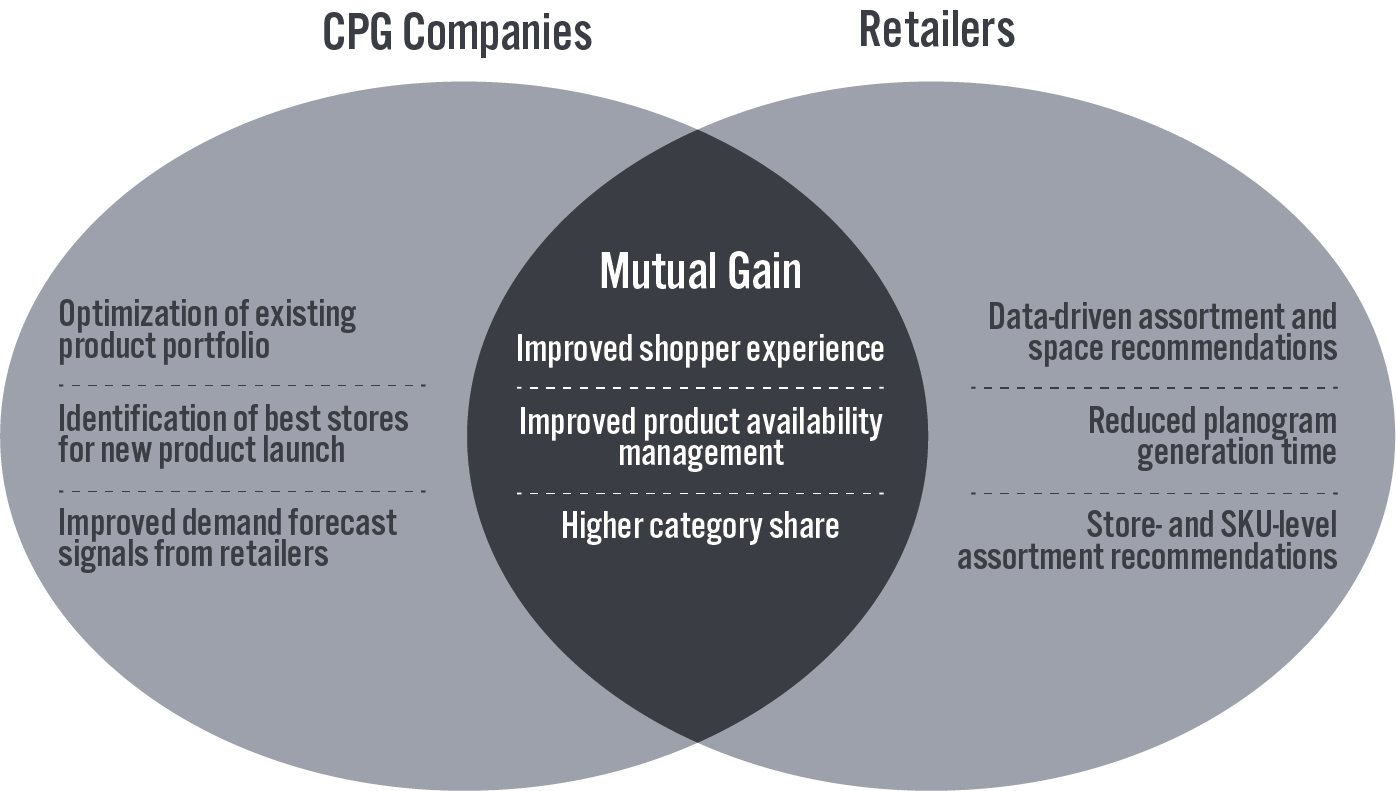

Collaboration between retailers and CPG companies is instrumental in determining their mutual success. Good collaboration is aimed at enhancing the strategic value between CPG companies and retailers, such as assortment optimization, promotional calendars and competitive pricing. A rapid approach to decision-making can prime the collaboration for even higher gains, including improved shopper-centricity and operational efficiency at an organization level. In addition, the ability to quickly stimulate category strategies helps retailers increase the market share of the category and helps CPG companies grow their category share.

With increased channel competition, the emergence of private labels and the foray of Amazon into physical grocery stores, both retailers and CPG companies understand the importance of delivering optimal customer experience. Through transparent collaboration, retailers and CPG companies can enhance the shopper experience. In fact, improved customer service—the ability to meet the needs of shoppers—emerged as the topmost advantage of good retailer-supplier collaboration, with 37% of respondents citing it as a key advantage, according to a March 2020 Coresight Research survey of 210 grocery/drug retailers and CPG suppliers.

Figure 5. Topmost Advantages of Good Retailer-Supplier Collaboration [caption id="attachment_126497" align="aligncenter" width="550"]

Base: 210 grocery/drug retailers and CPG suppliers surveyed in March 2020

Base: 210 grocery/drug retailers and CPG suppliers surveyed in March 2020Note: Ranks determined through weighted averages; respondents could rank on a scale of one to five, with rank one carrying the highest weight

Source: Coresight Research[/caption]

An important facet of collaboration is to achieve a singular view of the shopper through data sharing. However, we believe that category insights need to be auditable and justifiable. In other words, it is essential to understand how recommendations are created and the rules that are applied to datasets.

Meeting Shopper Expectations: Retailers Fall Short

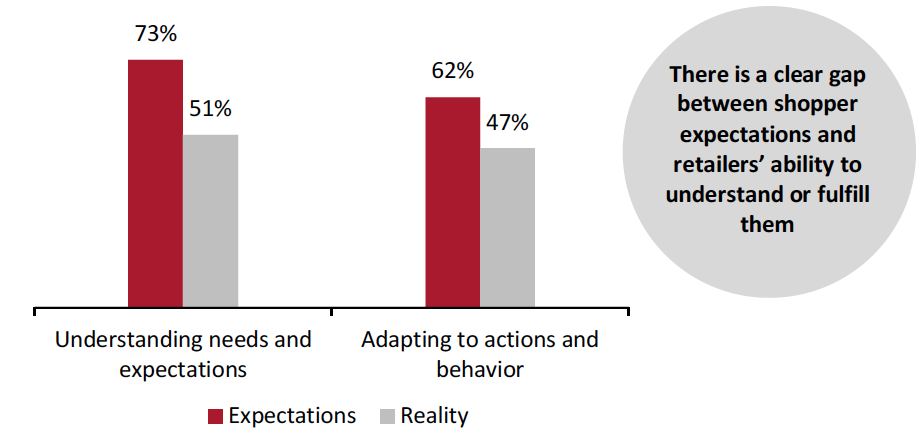

Spoilt by multiple shopping channels, a wide range of products and rapid delivery services, shoppers increasingly expect to have better experiences when they shop. In fact, 84% of shoppers believe that the experience that a company provides is as important as its products or services, according to an April 2019 survey of 8,022 global consumers conducted by Salesforce.

The study also revealed the following findings:

- 73% of consumers expect retailers to understand their needs and expectations, but only 51% believe that retailers generally understand them.

- 62% of consumers expect retailers to adapt to their actions and behavior, but only 47% feel that companies do this.

Figure 6. Shoppers’ Expectations of Retailers vs. Their Perceptions of Whether Expectations Are Met (% of Respondents) [caption id="attachment_126498" align="aligncenter" width="550"]

Base: 8,022 global consumers surveyed in April 2019

Base: 8,022 global consumers surveyed in April 2019Source: Salesforce[/caption]

A manual approach cannot keep up with the complications of data layering and the wide variety of data that is overwhelming retailers. Advanced data science approaches including ML and operations research—advanced analytical methods for decision-making—can help retailers unveil a whole new relationship with their shoppers by drawing actionable inferences from the data.

HIVERY: Optimizing Category Management

Company Overview

HIVERY is a provider of AI-driven solutions for optimizing category management processes such as rapid category simulation, assortment planning, promotion, pricing, space planning and planogram generation. HIVERY’s ML/DS models are acquired from Australia’s national science agency, Commonwealth Scientific and Industrial Research Organization (CSIRO)—more specifically, from CSIRO’s Data61, which is a data innovation network for multiple industries in the country through the application of science and technology.

Understanding Clusters: Shopper-Centric Assortment Planning

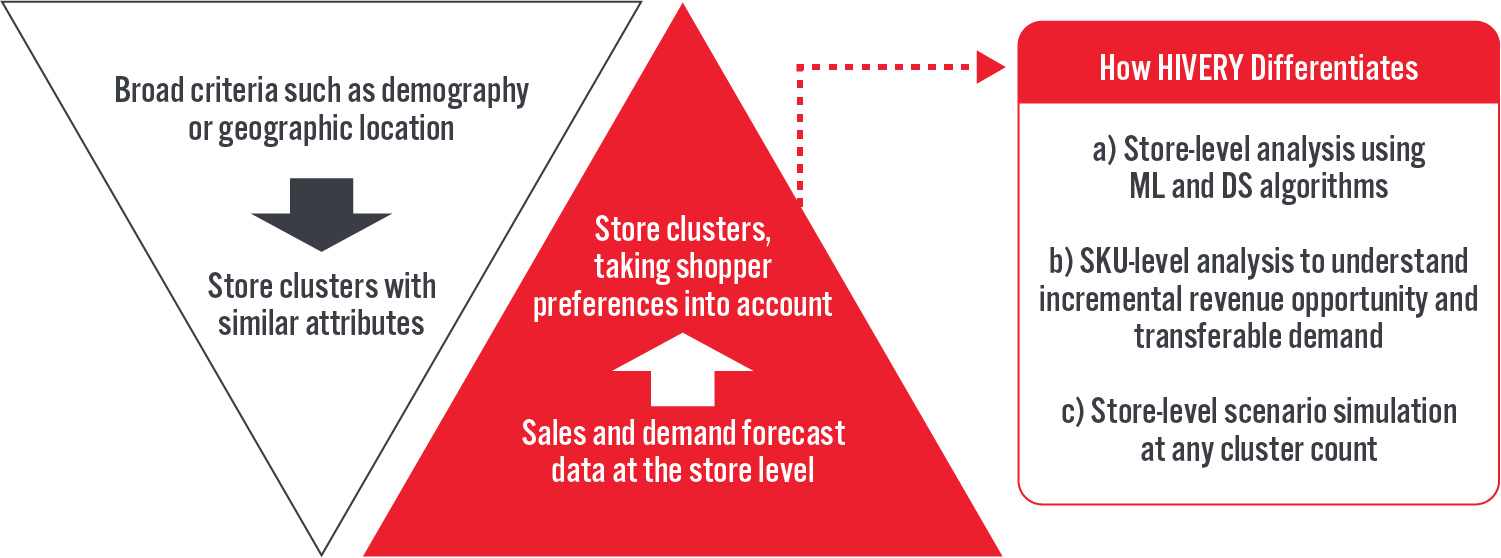

Two commonly known assortment methods are top-down and bottom-up clustering of stores, with the former being simpler and, as a result, slightly limited in its effect of localizing assortment.

Top-down clustering: Top-down clusters incorporate very broad criteria to define store clusters such as geographic location, store size and shopper demography. This type of clustering approach to assortment fails to incorporate key underlying shopper trends and preferences, which in turn leads to ineffective localization.

Bottom-up clustering: As the name suggests, bottom-up clustering keeps store data at the center of identifying patterns and then prepares clusters.

HIVERY uses the bottom-up approach to assortment planning and leverages ML and DS algorithm which enable it to take consumer preferences and behavior into account. HIVERY generates localized assortments at the store level and helps retailers understand incremental revenue opportunities at each store. This helps retailers optimize assortments to match shopper demand accurately while improving the customer experience. This approach also improves collaboration between retailers and CPG companies and helps in enhancing joint business planning—developing joint category strategies and tactics in addition to sharing category plans aimed towards identifying mutual opportunities—by creating a singular view of the shopper.

Figure 7. Assortment Optimization Methods: Top-Down Clustering (Left) vs. Bottom-Up Clustering (Right) of Stores

[caption id="attachment_126499" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

HIVERY: Key Offerings

HIVERY offers three different solutions: HIVERY Curate, HIVERY Enhance and HIVERY Promote.

- HIVERY Curate: HIVERY Curate is a software-as-a-service (SaaS) AI platform that helps retail category managers optimize product assortment across their entire store fleet. HIVERY Curate uses ML algorithms and data analytics to offer simultaneous optimization of assortment and space planning at the store level—enabling retailers to hyper-localize their product assortment.In addition, it allows retailers to incorporate their merchandising rules or category strategy such as store-level volume or revenue to HIVERY Curate’s optimization engine. Retailers are then able to simulate multiple scenarios of assortment planning and planogram generation using HIVERY Curate and choose the options that are most beneficial to them.

- HIVERY Enhance: HIVERY Enhance is an assortment optimization solution for vending-machine operators. It incorporates existing VMS data along with historical data and runs ML algorithms on the data to optimize assortment and planograms, all at the individual vending-machine level. In one case, it helped a vending machine operator achieve an additional operating income of A$1,870 ($1,423) per annum from a vending machine at the Sydney Airport, according to HIVERY.

- HIVERY Promote: HIVERY Promote uses AI and ML to help retailers create promotional calendars based on retailers’ sales data and previous pricing, while focusing on meeting business goals and revenue targets. HIVERY Promote’s prediction engine routinely increases its prediction accuracy by around 40% of its initial accuracy level as it includes factors such as performance of an ongoing promotion, competitors’ pricing, price elasticity of demand and cross-channel effects.

The benefits of HIVERY’s solutions extend to both retailers and CPG companies. In addition, the benefits promote a more strategic collaboration between both retailers and CPG companies as it improves the following:

- Overall product availability management, which is a result of improved inventory management and understanding of product demand across stores

- Shopper experience, by enabling both retailers and suppliers to better forecast demand across stores, which helps in generating localized assortments and planograms across stores

- Category understanding at the SKU level, which enables retailers and CPG companies to benefit from store-specific assortment optimization

Figure 8. Benefits of HIVERY’s Solutions for Retailers and CPG Companies [caption id="attachment_126500" align="aligncenter" width="700"]

Source: HIVERY/Coresight Research[/caption]

Source: HIVERY/Coresight Research[/caption]

How HIVERY’s Store-Specific Approach Increases Sales: A Case Study

HIVERY assisted a CPG company in determining store-level opportunities to decrease labor costs and increase assortment in a non-alcoholic beverage category.

The problem: Highly compressed days of supply (DOS)—on-shelf availability of the stock before running out if sales continue at the same rate as in the recent past—for a non-alcoholic beverage category. The CPG company believed that determining DOS at the store level would be an opportunity to decrease labor and improve assortment at stores that have a high DOS.

How HIVERY Curate helped: HIVERY Curate leveraged store-level data including universal product code (UPC) data to understand store-specific Days of supply (DOS). Using this, HIVERY has helped the CPG company to expand assortment in stores where the DOS was higher than average and decrease labor at stores that had a lower-than-average DOS.

The outcome: The CPG company worked with its buyer to secure testing of store-level assortment modules for 300 stores. The 300 test stores achieved $6.3 million in annual sales due to optimized assortment and DOS.

HIVERY: Market Positioning

Below, we analyze HIVERY’s market positioning, current opportunities in the market and its key growth drivers.

HIVERY’s key competitive advantages include the following:

- Model flexibility: HIVERY’s optimization solutions are highly flexible and allow retailers to add an unlimited number of merchandising rules/constraints and category objectives into the engine to generate assortment strategies and compare and select the optimal plan. This enables retailers and CPG companies to keep goals and objectives intact when localizing assortment across individual stores.

- Extends beyond bottom-up clusters: HIVERY uses store-level data and insights to identify unobservable “latent shopper segments” across stores, which is not possible with today's traditional category management solutions. This approach ensures that the assortment is optimized to match shopper demand at each individual store, thus making localization highly effective while ensuring shopper-centricity. In addition, CPG companies can identify shopper trends, which can help in effective new product launches.

- Localized assortment at any cluster count and built-in transferable demand: HIVERY offers product assortment recommendations at the SKU and store level. In addition, the engine automatically includes and incorporates transferable demand impact. This provides insights into how any SKUs will perform when added to/removed from the category, which ensures retailers and CPG companies do not miss out on incremental revenue opportunities.

- Speed and accuracy: HIVERY offers assortment recommendations and planograms in minutes, even when complex merchandising rules or other product-level conditions are applied to the algorithm. At the time of writing, HIVERY had achieved holdout error rates as low as 15%, according to the company. This means that when predicting sales volumes on data which have been withheld from the training of the algorithms, the predictions are within +/-15% of the actual value. The company expects the model’s accuracy predictions to improve further with time, as more data is ingested into the system.

- Simulation-based optimization: Given the model flexibility mentioned above, HIVERY’s category simulation engine allows retailers and CPG companies to see the impact of any decision before executing it in the market. Whether it is testing a new category goal, relaxing a merchandising rule, determining the impact of a new promotional campaign or launching a new product innovation, HIVERY Curate is able to rapidly show both revenue and volume impact of that strategy and select the option that best aligns with the overall retail strategy.

- Auditability: HIVERY’s assortment recommendations are fully auditable. This allows retailers and CPG companies to justify category actions to a granular level and simplifies decision-making.

Figure 9. HIVERY : Competitive Advantage Matrix

| Positioning | Opportunities |

|

|

| Growth Drivers | Unique Attributes |

|

|

Source: Coresight Research

What We Think

We believe that shopper-centricity will play a pivotal role in determining the long-term success of grocery retailers and CPG companies. The Covid-19 pandemic has surfaced the importance of having flexible and responsive supply chains. In this context, we believe that there is an unprecedented need to act swiftly to change consumer demand and identify underlying opportunities in existing categories. In other words, taking a pre-emptive approach is the need of the hour.

We believe that success in category management depends not just on advanced technologies but on their effective usage. Retailers must be able to effectively integrate multiple data streams to draw actionable insights from data, while keeping the shopper at the core of every decision.

With increased uncertainty around shopper behavior, it is imperative for CPG companies to keep track of how their products perform across stores. In doing so, the CPG companies must be able to adapt quickly to changing consumer habits or risk losing their category share to more digitally adept competitors.