Introduction

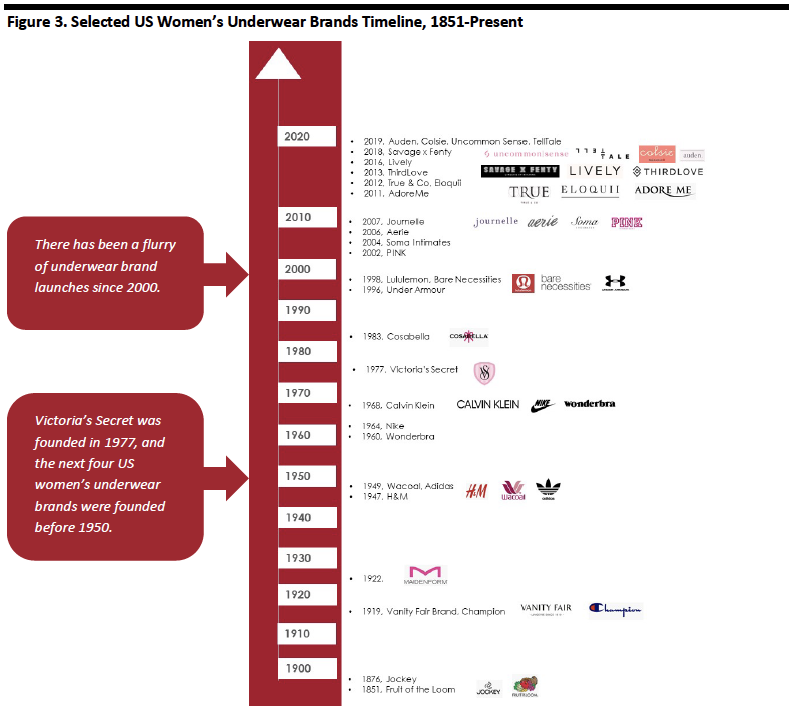

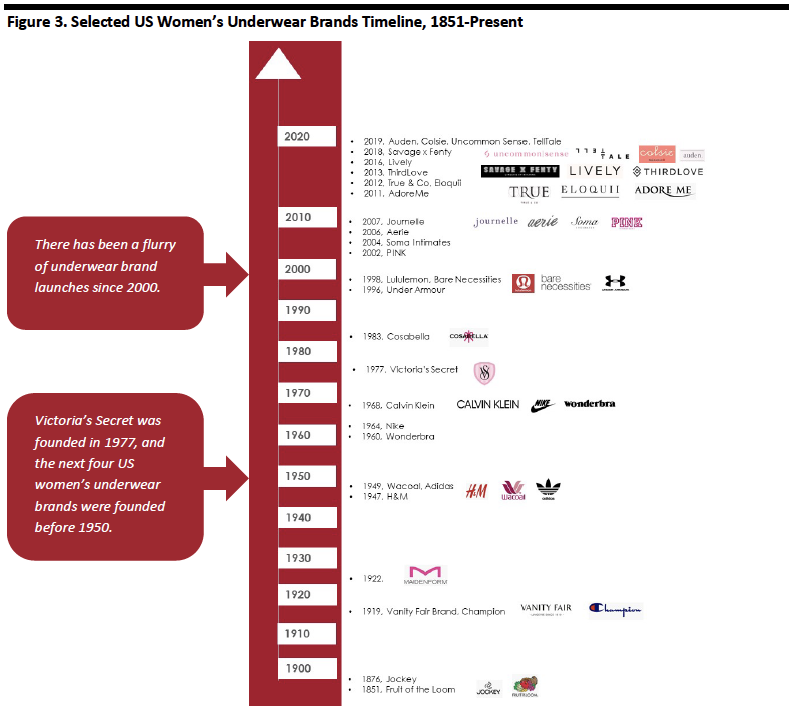

It is an understatement to say that the US women’s underwear market is in a state of change. Even within a two-week period during the writing of this report, two new women’s direct-to-consumer underwear brands—Telltale and Uncommon Sense—launched.

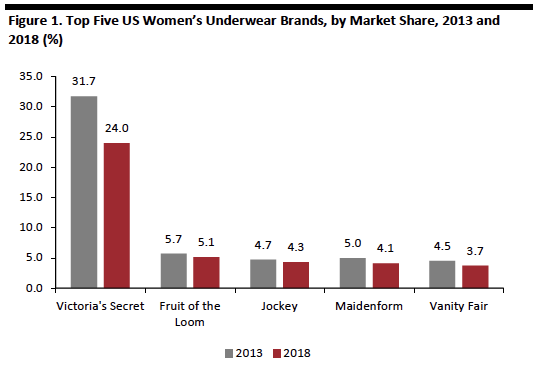

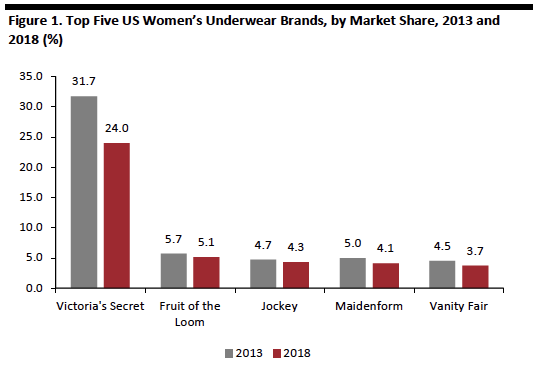

Four of the five top traditional women’s underwear brands are industry legacies and were introduced before 1940; Victoria’s Secret, the number-one US women’s retailer with 24% of the market in 2018, opened in 1977.

Over the past 10 years, numerous new brands have launched with a focus on a new definition of sexy that emphasizes feelings of confidence and body positivity instead of having the “perfect” figure. Brands are focusing on fit, comfort and inclusive designs.

Brands are involving the consumer as part of the design process to help inform fit, style and design. They are also using consumers as ambassadors to post authentic feedback and original content on social networks.

How Big Is the US Women’s Underwear Market?

The US women’s underwear market totaled $13.1 billion in 2018 and is expected to grow to $17.3 billion in 2023, according to Euromonitor International. This reflects a predicted 5.8% compound annual growth rate (CAGR) from 2018 to 2023, higher than the market’s CAGR of 3.5% from 2013 to 2018.

Included in this market value are all items worn next to the skin and under women’s outer clothing. According to Euromonitor’s definition, the category includes bra and brief separates, lingerie sets, basques and corsets, camisoles, bodysuits, slips, suspender belts, garters, and shapewear, as well as thermals and sports bras.

The State of the US Underwear Market

The Top Five Women’s US Underwear Retailers and Brands Are Losing Market Share

Victoria’s Secret is the top women’s underwear retailer in the US, with 24.0% of the market in 2018. However, the company’s market share has gradually declined since 2013, when it held 31.7%. Victoria’s Secret announced that it was closing 50 stores in 2019.

The subsequent four US women’s underwear brands also have each lost market share from 2013 to 2018, as shown in Figure 1. The combined market share of the top five women’s underwear brands in 2013 was 51.6%, whereas in 2018 it fell to 41.2%.

[caption id="attachment_88553" align="aligncenter" width="534"]

Source: Euromonitor International

Source: Euromonitor International[/caption]

Why Is the US Women’s Underwear Market Changing?

The US women’s underwear industry is undergoing significant shifts, and the channels, retailers, and brands where women shop for underwear are blurring and realigning.

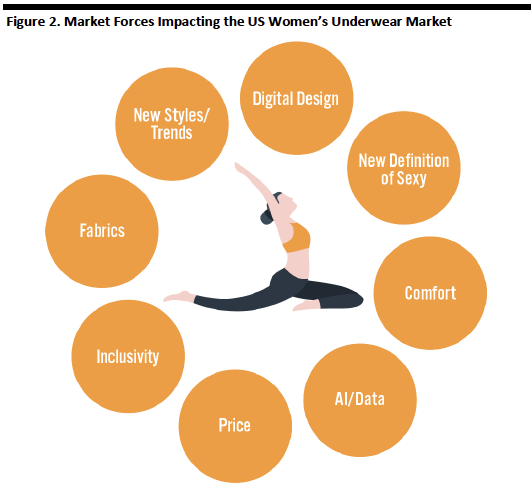

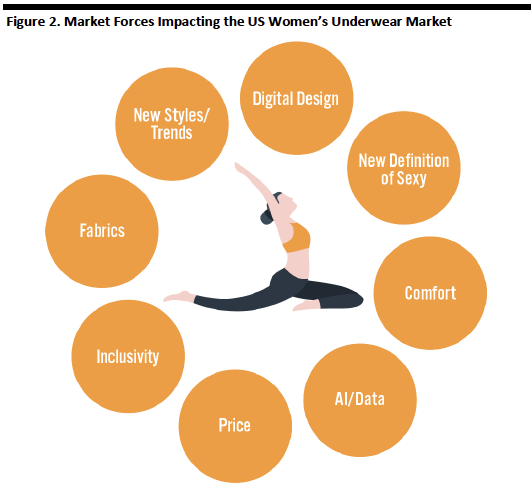

Various forces are impacting the market—both on the customer (demand) side and on the production (supply chain) side, as highlighted in Figure 2.

Customer preferences and sentiment are evolving, which impacts styles. The definition of what the consumer deems “sexy” is changing, and this in turn demands that brands give their designs a new relevancy and inclusivity for consumers. On the supply side, e-commerce allows more niche players to enter the market, and technology provides new channels for brands to understand and respond to customers.

[caption id="attachment_88554" align="aligncenter" width="532"]

Source: Coresight Research

Source: Coresight Research[/caption]

Below is a brief overview of the market forces that are impacting the US women’s underwear industry:

- Evolving Definition of Sexy: Today “sexy” is associated with a confident, strong, assertive woman who feels comfortable with how she looks.

- E-Commerce: The platform provides an entry point for new underwear brands to enter the market.

- Technology and Digital Design: Underwear brands are leveraging technology and digital design to understand, and respond to, customer trends. Brands are utilizing social media networks to identify the styles and colors that are trending.

- Data, AI and Fit: Underwear brands are using consumer data to customize fit based on millions of consumer surveys. For example, the data informs bra sizes, creating new fit options and sizes.

- Fabric Innovations: Fabric technology is continuing to up the ante in the underwear category. This includes microfiber technology, moisture wicking, spandex and no-seam fabric, to name a few.

- Inclusive Sizing and Body Positivity: Brand entrants are focusing on extended sizes and customers’ feelings of body confidence and body positivity. Some intimates brands such as Aerie encourage customers to post on social media unfiltered images of themselves wearing their products.

- Price Competitiveness: Selection and expanded product availability is increasing brand competitiveness and, therefore, helping to reduce prices in the intimates category. For example, bras are available at every price point today—as low as $3.00 at Walmart—and in every style imaginable.

- Design Innovations: Boundaries are blurred between sport and non-sport designs as brands and retailers are mixing the lines; the sports bra is now worn as an everyday bra, and the everyday bra is being designed with sportier elements such as wider elastic bands, multiple straps and no wires. This is just one example where the intimates category is exploding with new ideas, colors, patterns, and style elements.

Taken together, these forces are causing shifts in the US intimates’ industry landscape, with an increasing number of new entrants to category over the past 10 years, as shown in the timeline in Figure 3.

[caption id="attachment_88555" align="aligncenter" width="700"]

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research[/caption]

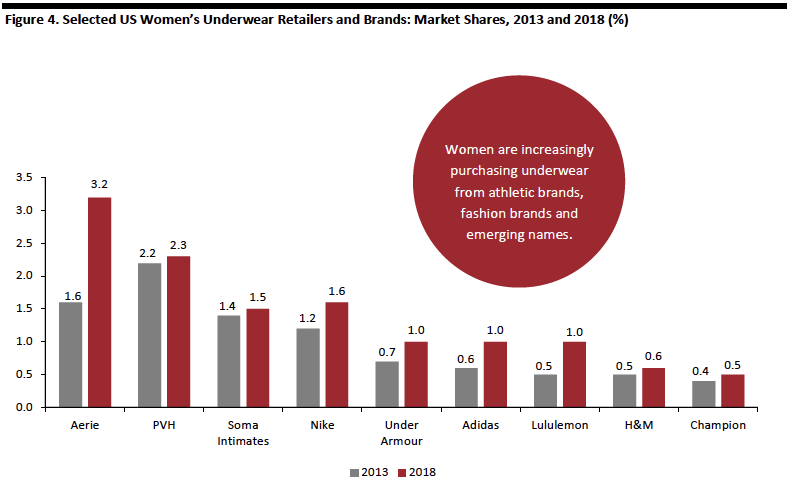

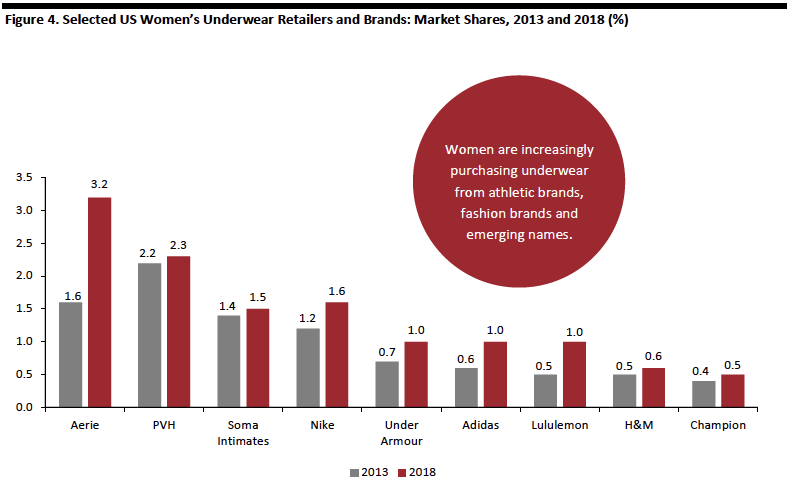

Athletic Brands and “Fashion” Brands Are Increasing Their Market Share in the Underwear Space, as the Consumer Shops for Sports Bras, Comfort and Fashion Trends

As the US women’s underwear market expands, there are increasing options for women to buy underwear from a variety of channels and retailers. Figure 4 highlights selected US women’s underwear retailers that showed gradual market-share growth from 2013 to 2018. The total market share of these nine retailers and brands grew by 3.6 percentage points, from 9.1% in 2013 to 12.7% in 2018.

Women are seeking out underwear from less traditional retailers and brands, including athletic retailers such as Under Armour, Nike, and Adidas; fast-fashion brands such as H&M and Zara; teen retailers including Aerie; and online brands (which we discuss in the next section).

[caption id="attachment_88556" align="aligncenter" width="700"]

Source: Euromonitor International

Source: Euromonitor International[/caption]

Five of these nine brands and retailers with increasing market shares are athletic brands: Nike, Under Armour, Adidas, Lululemon and Champion. Two of the brands—PVH and Soma Intimates—are fashion players, and one of the US underwear retailers, H&M, provides value for the consumer.

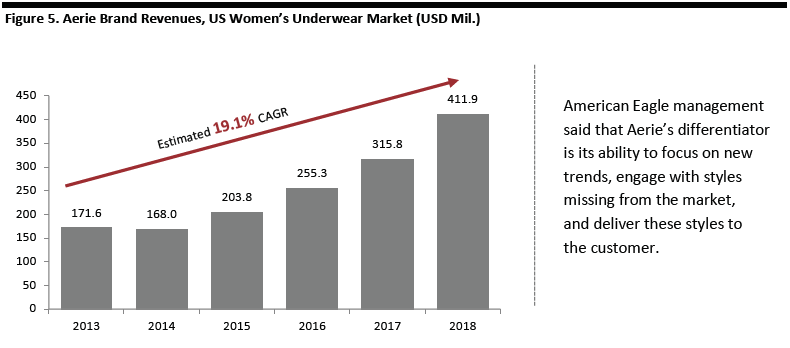

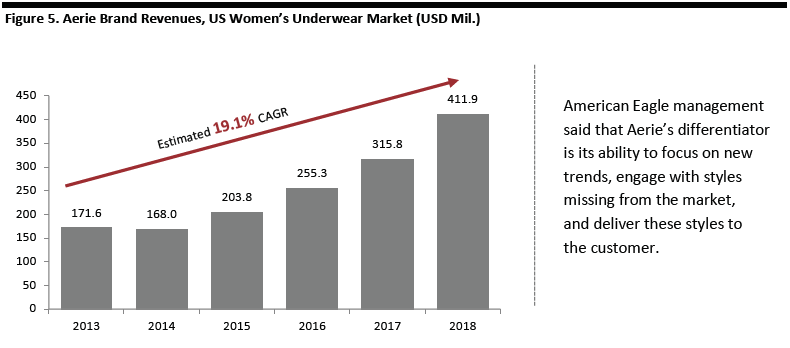

American Eagle’s Aerie Teen-Focused Women’s Brand Has Grown at a 19.1% CAGR from 2013 to 2018, Focusing on “Real Women” and Body Confidence

Aerie is considered a women’s underwear pioneer in the body confidence movement. Its slogan is #AerieREAL and its underwear brand is focused on body positivity for “every girl.” It focuses on girl power and encourages women to post unretouched photos of themselves on its website to show the “real Aerie girl.” Its merchandise is available in 30 sizes.

Aerie has seen the most significant market share growth out of all of the US underwear brands from 2013 to 2018, doubling its market share from 1.6% in 2013 to 3.2% in 2018, according to company reports. Aerie has grown revenues at an estimated 19.1% compound annual growth rate (CAGR) over the five years from 2013 to 2018, as shown in Figure 5.

[caption id="attachment_88557" align="aligncenter" width="700"]

Source: Company reports

Source: Company reports[/caption]

As of February 2, 2019, the Aerie brand operated 115 stand-alone stores and 147 side-by-side stores connected to American Eagle (AE) brand stores, and the company plans to open 60–70 locations in 2019. Management stated on its 4Q18 earnings call in March 2019 that Aerie’s differentiator is its ability to focus on new trends, engage with styles missing from the market, and deliver these new styles to the customer.

The Sports Bra Market is Growing; One-Third of Millennial “Bra Dollars” Were Spent on Sports Bras in 2018

As we noted above, athletic retailers including Nike, Under Armour, Adidas, Lululemon and Champion have increased market share in the women’s underwear market. According to market research firm NPD, one-third of millennial “bra dollars,” or the total dollars millennials spent in the bra category, went to sports bras in 2018. Furthermore, NPD reported that the sales of sports bras continue to grow.

We believe that this is due to the elevated focus from athletic brands on fit technology and fabrics to maximize the comfort of sports bras. Brands and retailers are reporting that they are incorporating the use of athletes, brand ambassadors and customers in their fit and design processes, which helps to improve products. For example Lululemon, Adidas and Nike recently reported the following in the sports bra category:

- At Lululemon’s Investor Day in April 2019, the company stated that sports bras are a growth category for the company, with a “ton of unmet needs.” Lululemon’s roots are in designing yoga bras with a lot of strappy back details. The company is expanding into more supportive categories that include running and training bras. It reported that customers who have bought a high-support bra are more likely to make a repeat purchase. Management said it believes that in the future its bra business can be as big as its women’s bottoms business, its largest category by revenue today.

- In April 2019, Adidas launched its first sports bra constructed of Primeknit material, targeted for “flexibility, comfort, and support.” The company reported that the bra was co-created with Adidas’s global network of female athletes and follows years of research by its Advanced Concepts Team studying the female body in motion to fine tune the amount of flexibility and support required.

- Nike announced in March 2019 that it would debut 40 new sports bra styles over the next year, with most of the styles focusing on a range of new sizes up to 44G. Nike reported that it launched its plus-size sports bras in the fourth quarter of this year “to an amazing start.” Most of these sports bras will use Nike’s new FE/NOM Flyknit technology, which the company introduced in 2017 and weighs 30% less than the material used in other sports bras in Nike’s portfolio.

[caption id="attachment_88558" align="aligncenter" width="328"]

Source: Nike.com

Source: Nike.com[/caption]

Digitally Native Intimates Brands Are Taking the Most Significant Market Share Away From Traditional Intimates Retailers

Over the past five years, digitally native and small brands have grown significantly and they continue to take market share from traditional retailers. According to Euromonitor International, the “Other” segment—which represents the aggregate market share for all nonmajor brands—grew from 28.1% of the market in 2013 to 36.2% in 2018.

The Definition of Sexy Today Includes Inclusivity and Body Positivity, Impacting Every Aspect of Innovation in the Intimates Category

Body positivity and inclusivity are two notable forces in the intimates category, sparking change in nearly every aspect of the category—particularly in the evolving definition of sexiness. This includes the empowerment of women of all sizes and a growing conversation across the industry, encouraging women to feel confident and sexy at any size. Gone are antiquated images and stereotypes of “sexy” women wearing lacy lingerie. The definition of sexy today has evolved into how a woman feels and less how she looks. The conversation now includes words such as “confident,” “strong,” “athletic,” “powerful” and “assertive.”

Intimate Brands Are Innovating Around Fit and Inclusive Sizing

Body positivity is the thread that has been running through emerging intimates brands.

Below are highlights from intimates market entrants over the past 15 years with a focus on fit, inclusivity, and body positivity:

- Adore Me, launched in 2011, has petite to plus-sized monthly lingerie subscription boxes. According to a February 27, 2019, Retail Dive article, the company reported that approximately 25% of its loyal customer base buy plus sizes, which make up around 25% of the assortment. Adore Me reported that, as of November 2018, it has a customer base of more than 11 million women, mostly urban millennials.

- ThirdLove, a digitally native e-commerce store that is credited with inventing half-cup sizes and offers more than 70 bra sizes (compared with 30 sizes that are offered by many brands) launched in 2013. In 2018, the company added 24 inclusive sizes to the wide range it already offered. ThirdLove reported that it had a waitlist of more than 1.3 million customers for its new range of sizes and added that at least 67% of American women wear a dress size 14 or higher, with the average American woman wearing a 34E (34DD) bra size. The company does not label its garments as “plus-size”—they are just “sizes.” ThirdLove uses customer survey data to help inform its product design.

[caption id="attachment_88559" align="aligncenter" width="360"]

Source: ThirdLove.com

Source: ThirdLove.com[/caption]

- Target launched three private-label intimates and sleepwear brands in March 2019: Auden, Colsie, and Stars Above. The company reported that it met with women aged 16 to 54 to have conversations about intimates and what they were seeking. Auden is a line of bras and underwear with 40 to 50 available sizes ranging from 32AA to 46G. Stars Above includes 125 pajamas ranging from XS to 3X, and Colsie features intimates and loungewear ranging from sizes XS to 3X. Colsie and Auden are targeted to teens.

Intimates Brands Are Building Communities Through Alternate Channels: Ambassadors, Social Media, Events and Experiential Stores

Today, an underwear brand is more than the physical product. Brands are building communities that incorporate social media, events, and brand ambassadors.

- Lively, a digitally native brand that launched in 2016, has more than 68,000 brand ambassadors. Its CEO and founder, Michelle Cordeiro Grant, said, “Our ambassador community is truly the heart and soul of our brand. We began building this community months before we even sold our first product in 2016. For us, they are a lifeline for all of our key decisions including what product to make next, where to launch our next store and most importantly how to constantly evolve while maintaining our core values.” The company’s ambassadors host Lively events in their local communities, which helps to further the Lively brand message.

[caption id="attachment_88560" align="aligncenter" width="464"]

Source: Lively.com

Source: Lively.com[/caption]

- Lululemon’s Sweatlife Community has more than 2,000 global ambassadors and 15,000 legacy ambassadors. Its typical ambassador program takes two years, and the company maintains the relationships with its ambassadors. At its investor day, Lululemon highlighted that its ambassadors are authentic and have always been an integral part of the company since its inception. Management reported that “community” is a trend in the wider marketplace: People are looking to participate in events and communities. The brand was founded on the principle of people getting together to do yoga, run and attend events. Management said its community actively influences the company’s product innovations and designs. The company hosts more than 4,000 events annually and announced it will open a 20,000-square-foot experiential store in Lincoln Park, Chicago in July 2019. The store will offer all-day classes, provide a place for coffee, juices and smoothies, and will also host more than 45 ambassadors when the store opens.

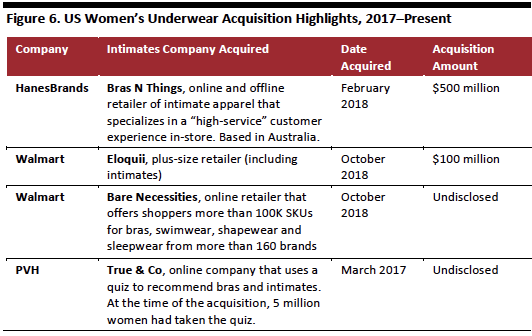

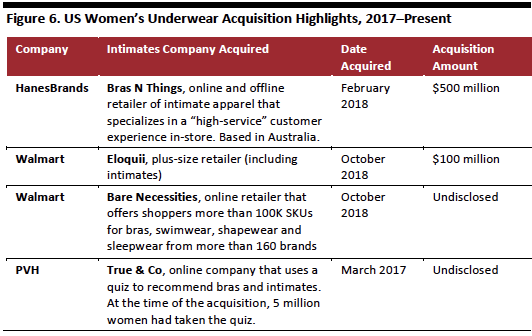

There Is Significant Opportunity in the Women’s Underwear Space as Large Retailers Acquire Intimates Brands to Broaden Their Portfolios

Major retailers are expanding their portfolios by acquiring intimate apparel brands. For example, in October 2018 Walmart expanded its portfolio with the acquisitions of plus-size retailer Eloquii and Bare Necessities, an online retailer that has more than 100,000 products from over 160 brands. Traditional retailers are increasingly seeking digitally native brands to complement and update their underwear offerings to help to remain on trend and be seen as current.

[caption id="attachment_88563" align="aligncenter" width="532"]

Source: Company reports

Source: Company reports[/caption]

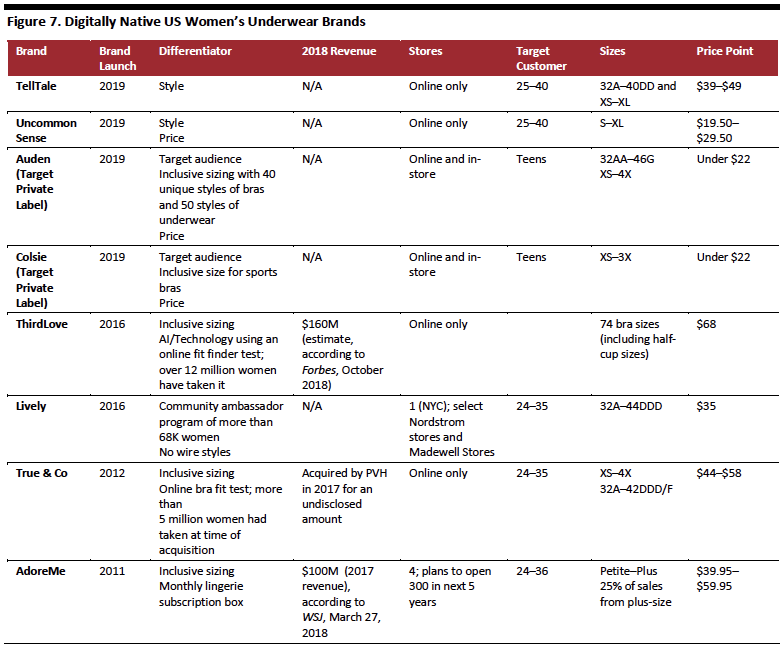

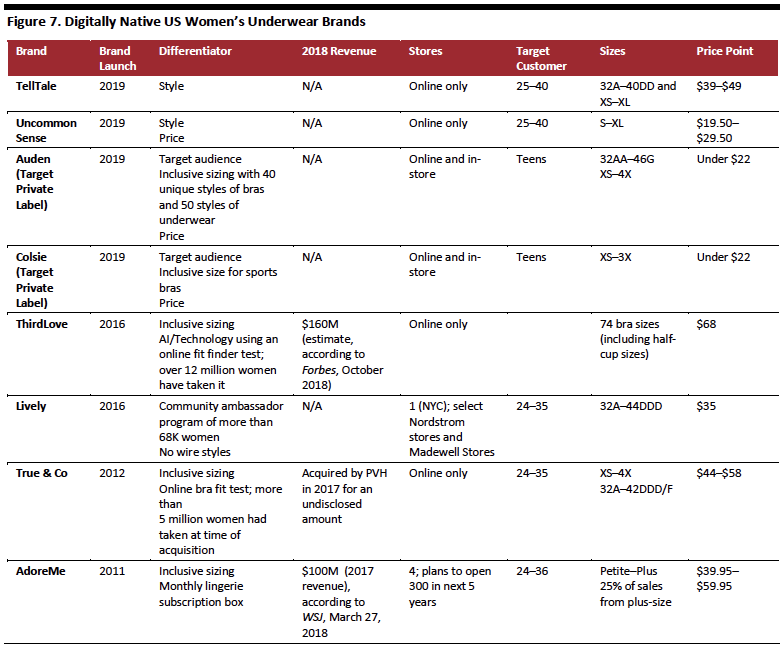

Digitally Native Brands Are Focusing on Technology to Improve Fit, Inclusivity, New Styles and Community

Figure 7 provides a high-level summary of selected US women’s digitally native brands that have entered the market in the past 10 years. As shown, brands are focusing on fit, inclusive sizing, competitive pricing, community, and bringing new styles to the market.

[caption id="attachment_88564" align="aligncenter" width="700"]

Source: Company reports/WSJ/Retail Dive/Coresight Research

Source: Company reports/WSJ/Retail Dive/Coresight Research[/caption]

Key Insights

- The $13.1 billion US women’s underwear market is undergoing a state of change. Over the past five years, the top five US women’s brands have lost market share, falling from 51.6% in 2013 to 41.2% in 2018.

- Victoria’s Secret, the top women’s underwear retailer in the United States, with 24.0% of the market in 2018, has gradually declined since 2013 when it held 31.0% of the market.

- Body positivity and inclusivity are two notable market forces in intimates, impacting change in nearly every aspect of the category—particularly in the evolving definition of sexy. Other market forces include customers’ emphasis on comfort and fit, new designs, and technology that enables new entrants to understand and respond to customer trends.

- Digitally native and small brands are taking the most significant market share from traditional US women’s underwear brands. This group grew from 28.1% of the market in 2013 to 36.2% of the market in 2018, according to Euromonitor International.

- Athletic retailers including Nike, Under Armour, Adidas, Lululemon and Champion have increased market share in women’s underwear from 2013 to 2018. According to NPD, one-third of millennial “bra dollars” in 2018 were spent on sports bras.

- Major retailers are acquiring underwear brands. Since 2017, Walmart, PVH and HanesBrands have acquired four brands in total. Digitally native brands are focusing on technology to improve fit, inclusive sizing, competitive pricing, community, and bringing new styles to the market.

Source: Euromonitor International[/caption]

Source: Euromonitor International[/caption]

Source: Coresight Research[/caption]

Below is a brief overview of the market forces that are impacting the US women’s underwear industry:

Source: Coresight Research[/caption]

Below is a brief overview of the market forces that are impacting the US women’s underwear industry:

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Source: Euromonitor International[/caption]

Five of these nine brands and retailers with increasing market shares are athletic brands: Nike, Under Armour, Adidas, Lululemon and Champion. Two of the brands—PVH and Soma Intimates—are fashion players, and one of the US underwear retailers, H&M, provides value for the consumer.

American Eagle’s Aerie Teen-Focused Women’s Brand Has Grown at a 19.1% CAGR from 2013 to 2018, Focusing on “Real Women” and Body Confidence

Aerie is considered a women’s underwear pioneer in the body confidence movement. Its slogan is #AerieREAL and its underwear brand is focused on body positivity for “every girl.” It focuses on girl power and encourages women to post unretouched photos of themselves on its website to show the “real Aerie girl.” Its merchandise is available in 30 sizes.

Aerie has seen the most significant market share growth out of all of the US underwear brands from 2013 to 2018, doubling its market share from 1.6% in 2013 to 3.2% in 2018, according to company reports. Aerie has grown revenues at an estimated 19.1% compound annual growth rate (CAGR) over the five years from 2013 to 2018, as shown in Figure 5.

[caption id="attachment_88557" align="aligncenter" width="700"]

Source: Euromonitor International[/caption]

Five of these nine brands and retailers with increasing market shares are athletic brands: Nike, Under Armour, Adidas, Lululemon and Champion. Two of the brands—PVH and Soma Intimates—are fashion players, and one of the US underwear retailers, H&M, provides value for the consumer.

American Eagle’s Aerie Teen-Focused Women’s Brand Has Grown at a 19.1% CAGR from 2013 to 2018, Focusing on “Real Women” and Body Confidence

Aerie is considered a women’s underwear pioneer in the body confidence movement. Its slogan is #AerieREAL and its underwear brand is focused on body positivity for “every girl.” It focuses on girl power and encourages women to post unretouched photos of themselves on its website to show the “real Aerie girl.” Its merchandise is available in 30 sizes.

Aerie has seen the most significant market share growth out of all of the US underwear brands from 2013 to 2018, doubling its market share from 1.6% in 2013 to 3.2% in 2018, according to company reports. Aerie has grown revenues at an estimated 19.1% compound annual growth rate (CAGR) over the five years from 2013 to 2018, as shown in Figure 5.

[caption id="attachment_88557" align="aligncenter" width="700"] Source: Company reports[/caption]

As of February 2, 2019, the Aerie brand operated 115 stand-alone stores and 147 side-by-side stores connected to American Eagle (AE) brand stores, and the company plans to open 60–70 locations in 2019. Management stated on its 4Q18 earnings call in March 2019 that Aerie’s differentiator is its ability to focus on new trends, engage with styles missing from the market, and deliver these new styles to the customer.

The Sports Bra Market is Growing; One-Third of Millennial “Bra Dollars” Were Spent on Sports Bras in 2018

As we noted above, athletic retailers including Nike, Under Armour, Adidas, Lululemon and Champion have increased market share in the women’s underwear market. According to market research firm NPD, one-third of millennial “bra dollars,” or the total dollars millennials spent in the bra category, went to sports bras in 2018. Furthermore, NPD reported that the sales of sports bras continue to grow.

We believe that this is due to the elevated focus from athletic brands on fit technology and fabrics to maximize the comfort of sports bras. Brands and retailers are reporting that they are incorporating the use of athletes, brand ambassadors and customers in their fit and design processes, which helps to improve products. For example Lululemon, Adidas and Nike recently reported the following in the sports bra category:

Source: Company reports[/caption]

As of February 2, 2019, the Aerie brand operated 115 stand-alone stores and 147 side-by-side stores connected to American Eagle (AE) brand stores, and the company plans to open 60–70 locations in 2019. Management stated on its 4Q18 earnings call in March 2019 that Aerie’s differentiator is its ability to focus on new trends, engage with styles missing from the market, and deliver these new styles to the customer.

The Sports Bra Market is Growing; One-Third of Millennial “Bra Dollars” Were Spent on Sports Bras in 2018

As we noted above, athletic retailers including Nike, Under Armour, Adidas, Lululemon and Champion have increased market share in the women’s underwear market. According to market research firm NPD, one-third of millennial “bra dollars,” or the total dollars millennials spent in the bra category, went to sports bras in 2018. Furthermore, NPD reported that the sales of sports bras continue to grow.

We believe that this is due to the elevated focus from athletic brands on fit technology and fabrics to maximize the comfort of sports bras. Brands and retailers are reporting that they are incorporating the use of athletes, brand ambassadors and customers in their fit and design processes, which helps to improve products. For example Lululemon, Adidas and Nike recently reported the following in the sports bra category:

Source: Nike.com[/caption]

Digitally Native Intimates Brands Are Taking the Most Significant Market Share Away From Traditional Intimates Retailers

Over the past five years, digitally native and small brands have grown significantly and they continue to take market share from traditional retailers. According to Euromonitor International, the “Other” segment—which represents the aggregate market share for all nonmajor brands—grew from 28.1% of the market in 2013 to 36.2% in 2018.

The Definition of Sexy Today Includes Inclusivity and Body Positivity, Impacting Every Aspect of Innovation in the Intimates Category

Body positivity and inclusivity are two notable forces in the intimates category, sparking change in nearly every aspect of the category—particularly in the evolving definition of sexiness. This includes the empowerment of women of all sizes and a growing conversation across the industry, encouraging women to feel confident and sexy at any size. Gone are antiquated images and stereotypes of “sexy” women wearing lacy lingerie. The definition of sexy today has evolved into how a woman feels and less how she looks. The conversation now includes words such as “confident,” “strong,” “athletic,” “powerful” and “assertive.”

Intimate Brands Are Innovating Around Fit and Inclusive Sizing

Body positivity is the thread that has been running through emerging intimates brands.

Below are highlights from intimates market entrants over the past 15 years with a focus on fit, inclusivity, and body positivity:

Source: Nike.com[/caption]

Digitally Native Intimates Brands Are Taking the Most Significant Market Share Away From Traditional Intimates Retailers

Over the past five years, digitally native and small brands have grown significantly and they continue to take market share from traditional retailers. According to Euromonitor International, the “Other” segment—which represents the aggregate market share for all nonmajor brands—grew from 28.1% of the market in 2013 to 36.2% in 2018.

The Definition of Sexy Today Includes Inclusivity and Body Positivity, Impacting Every Aspect of Innovation in the Intimates Category

Body positivity and inclusivity are two notable forces in the intimates category, sparking change in nearly every aspect of the category—particularly in the evolving definition of sexiness. This includes the empowerment of women of all sizes and a growing conversation across the industry, encouraging women to feel confident and sexy at any size. Gone are antiquated images and stereotypes of “sexy” women wearing lacy lingerie. The definition of sexy today has evolved into how a woman feels and less how she looks. The conversation now includes words such as “confident,” “strong,” “athletic,” “powerful” and “assertive.”

Intimate Brands Are Innovating Around Fit and Inclusive Sizing

Body positivity is the thread that has been running through emerging intimates brands.

Below are highlights from intimates market entrants over the past 15 years with a focus on fit, inclusivity, and body positivity:

Source: ThirdLove.com[/caption]

Source: ThirdLove.com[/caption]

Source: Lively.com[/caption]

Source: Lively.com[/caption]

Source: Company reports[/caption]

Digitally Native Brands Are Focusing on Technology to Improve Fit, Inclusivity, New Styles and Community

Figure 7 provides a high-level summary of selected US women’s digitally native brands that have entered the market in the past 10 years. As shown, brands are focusing on fit, inclusive sizing, competitive pricing, community, and bringing new styles to the market.

[caption id="attachment_88564" align="aligncenter" width="700"]

Source: Company reports[/caption]

Digitally Native Brands Are Focusing on Technology to Improve Fit, Inclusivity, New Styles and Community

Figure 7 provides a high-level summary of selected US women’s digitally native brands that have entered the market in the past 10 years. As shown, brands are focusing on fit, inclusive sizing, competitive pricing, community, and bringing new styles to the market.

[caption id="attachment_88564" align="aligncenter" width="700"] Source: Company reports/WSJ/Retail Dive/Coresight Research[/caption]

Source: Company reports/WSJ/Retail Dive/Coresight Research[/caption]