DIpil Das

What’s the Story?

Holiday shopping started earlier in 2020 than has typically been the case in previous years, and the ongoing coronavirus pandemic is driving brands and retailers to rethink how they can approach consumers and increase holiday sales this year. In this report, we discuss how beauty brands and retailers are approaching this holiday season and explore e-commerce and physical store trends as well as anticipated trending categories.Why It Matters

Beauty brands and retailers are reporting that e-commerce has seen continuous growth since the Covid-19 outbreak. This season more than ever, the beauty sector will be leveraging technology to engage online shoppers through livestreaming, e-gifting and virtual chats and also to engage the omnichannel shopper, beauty’s most valuable consumer.Outlook for the Beauty Sector: In Detail

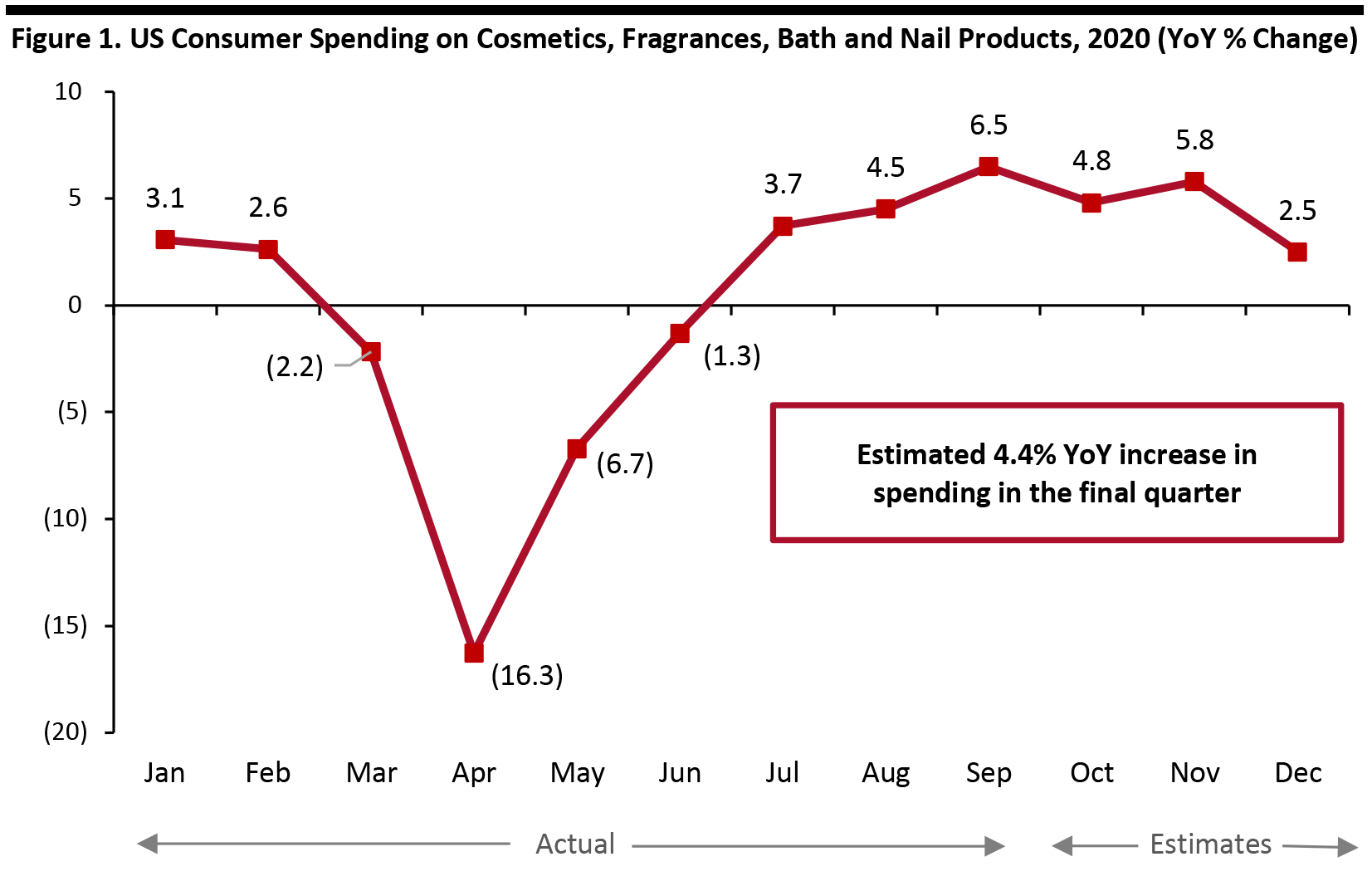

Our Estimates for the Holidays Coresight Research estimates that total fourth-quarter consumer spending on beauty products will rise by around 4.4% year over year. Our estimates are benchmarked to the US Bureau of Economic Analysis’ core beauty category of cosmetics, fragrances, and bath and nail products. As charted in Figure 1, the beauty category has seen solidly positive spending growth since July, with the year-over-year increase jumping to 6.5% in September (latest reported). We model a moderation in growth during the final quarter.- We expect that earlier holiday shopping and volatile comparatives from holiday 2020 will fuel a spike in growth in beauty sales in October and November. We expect October will have seen solid growth as consumers pull forward holiday spending. November will be against undemanding comparatives from one year earlier, when growth proved soft. The reverse is likely to be the case in December, as December 2019 spending growth proved strong, which will depress the year-over-year pace of change in the final month of 2020.

- This positive growth will make beauty one of the winning categories this holiday season, particularly as we estimate apparel spending to decline by about 5% year over year in the holiday quarter, as we noted in the previous 12 Weeks of Holidays report.

- Our beauty estimate is in the context of expected solidly positive total retail sales growth, of around 5%. We first published our holiday estimate in mid-October. Since then, new data have suggested further strength for retail: Recently released data for October showed US retail sales grew by a very strong 10.8% year over year, following 12.9% growth in September—suggesting that even our estimate for very solid growth in holiday sales could prove conservative.

Source: US Bureau of Economic Analysis/Coresight Research[/caption]

Retailers and Brands Are Leveraging Livestreaming and Influencers To Boost Holiday Sales

Livestreaming is the biggest trend in retail right now, particularly in beauty. The channel presents a highly visual means for influencers to connect with consumers by providing instructions on how to apply products, performing makeovers and offering information about ingredients and product efficacy. Livestreaming e-commerce is just taking off in the US but has exploded in China, reaching an estimated $63 billion across major platforms in 2019. We estimate that the US livestreaming e-commerce market will be approximately $5 billion across all categories in 2020—accounting for less than 1% of online retail sales—and will grow to $25 billion in 2023.

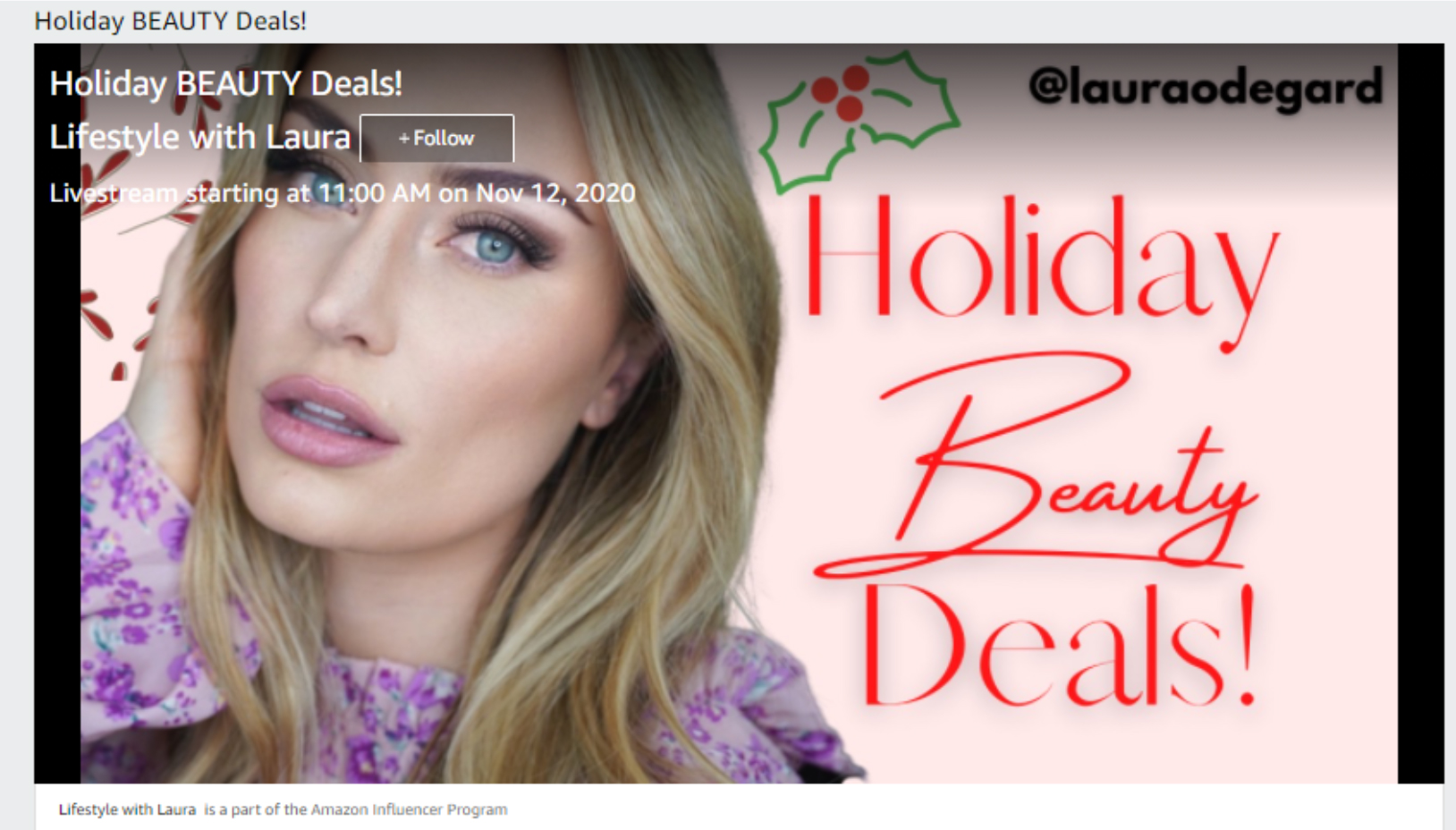

This holiday, beauty brands and retailers are leveraging influencers and livestreaming to introduce holiday products and to promote some of their bestselling products.

Source: US Bureau of Economic Analysis/Coresight Research[/caption]

Retailers and Brands Are Leveraging Livestreaming and Influencers To Boost Holiday Sales

Livestreaming is the biggest trend in retail right now, particularly in beauty. The channel presents a highly visual means for influencers to connect with consumers by providing instructions on how to apply products, performing makeovers and offering information about ingredients and product efficacy. Livestreaming e-commerce is just taking off in the US but has exploded in China, reaching an estimated $63 billion across major platforms in 2019. We estimate that the US livestreaming e-commerce market will be approximately $5 billion across all categories in 2020—accounting for less than 1% of online retail sales—and will grow to $25 billion in 2023.

This holiday, beauty brands and retailers are leveraging influencers and livestreaming to introduce holiday products and to promote some of their bestselling products.

- On November 2, during The Estée Lauder Companies Inc.’s earnings call for its first quarter of fiscal 2021 (ended September 30), management reported that MAC recently partnered with beauty influencers to debut its “Frosted Firework Collection,” which generated over 60 million impressions in the first 10 days after launching.

Estée Lauder has seen tremendous growth in the time that consumers are spending on shoppable livestreams, online chat and virtual try-ons. Even with physical stores open post lockdowns, sales on the company’s brand sites rose 60% during its first quarter of fiscal 2021. The sites hosted over 1 million virtual try-on sessions globally, with consumers spending more than 30 minutes on average in each session. The company has “magnificent plans” for holiday and began merchandising in October: To drive sales, the Estée Lauder and La Mer brands have launched holiday kits that include their bestselling hero products.

- L'Oréal reported e-commerce growth of 65% in the first half of 2020, with online representing 25% of total sales and accelerating every month even as stores reopened. Management said that its brands are creating more engaging consumer experiences, with digital services including virtual try-ons, teleconsultations and shoppable livestreaming. L’Oréal partnered with live-shopping solution Livescale in 2019 and continues to expand livestreaming in North America, where a one-hour live shopping event has earned up to 1.5 days’ worth of a brand’s revenue, according to the company.

Source: Amazon.com[/caption]

Beauty Brands and Retailers Are Using Online Technology To Make Gifting Easy

In addition to livestreaming, retailers and brands are ramping up technology efforts to connect with consumers, using online gifting, chat support and personalization. According to the National Retail Federation and Prosper Insights & Analytics Annual Survey, 60% of consumers expect to shop for gifts online this holiday, an increase of 56% over 2019. Beauty retailers are therefore looking to make it as easy as possible for shoppers to find and buy gifts online.

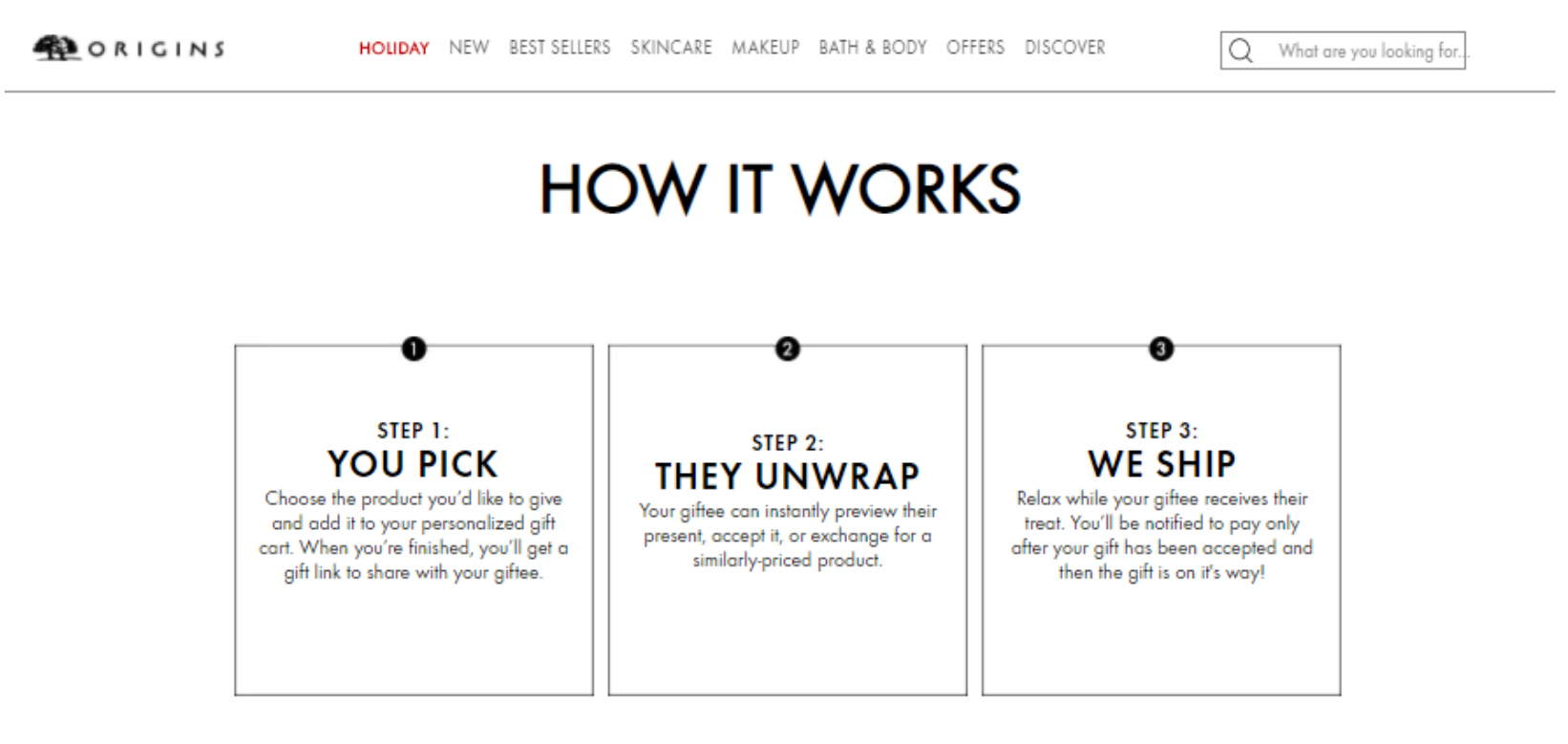

For the holiday season, Estée Lauder is leveraging technology across its brands to make gifting easy for consumers. For example, Origins, a skincare brand focused on natural ingredients, is offering consumers the ability to text or e-mail information about a gift purchase to the recipient, allowing them to either accept or exchange their product before it is gift-wrapped, as shown in the image below.

[caption id="attachment_119447" align="aligncenter" width="700"]

Source: Amazon.com[/caption]

Beauty Brands and Retailers Are Using Online Technology To Make Gifting Easy

In addition to livestreaming, retailers and brands are ramping up technology efforts to connect with consumers, using online gifting, chat support and personalization. According to the National Retail Federation and Prosper Insights & Analytics Annual Survey, 60% of consumers expect to shop for gifts online this holiday, an increase of 56% over 2019. Beauty retailers are therefore looking to make it as easy as possible for shoppers to find and buy gifts online.

For the holiday season, Estée Lauder is leveraging technology across its brands to make gifting easy for consumers. For example, Origins, a skincare brand focused on natural ingredients, is offering consumers the ability to text or e-mail information about a gift purchase to the recipient, allowing them to either accept or exchange their product before it is gift-wrapped, as shown in the image below.

[caption id="attachment_119447" align="aligncenter" width="700"] Source: origins.com[/caption]

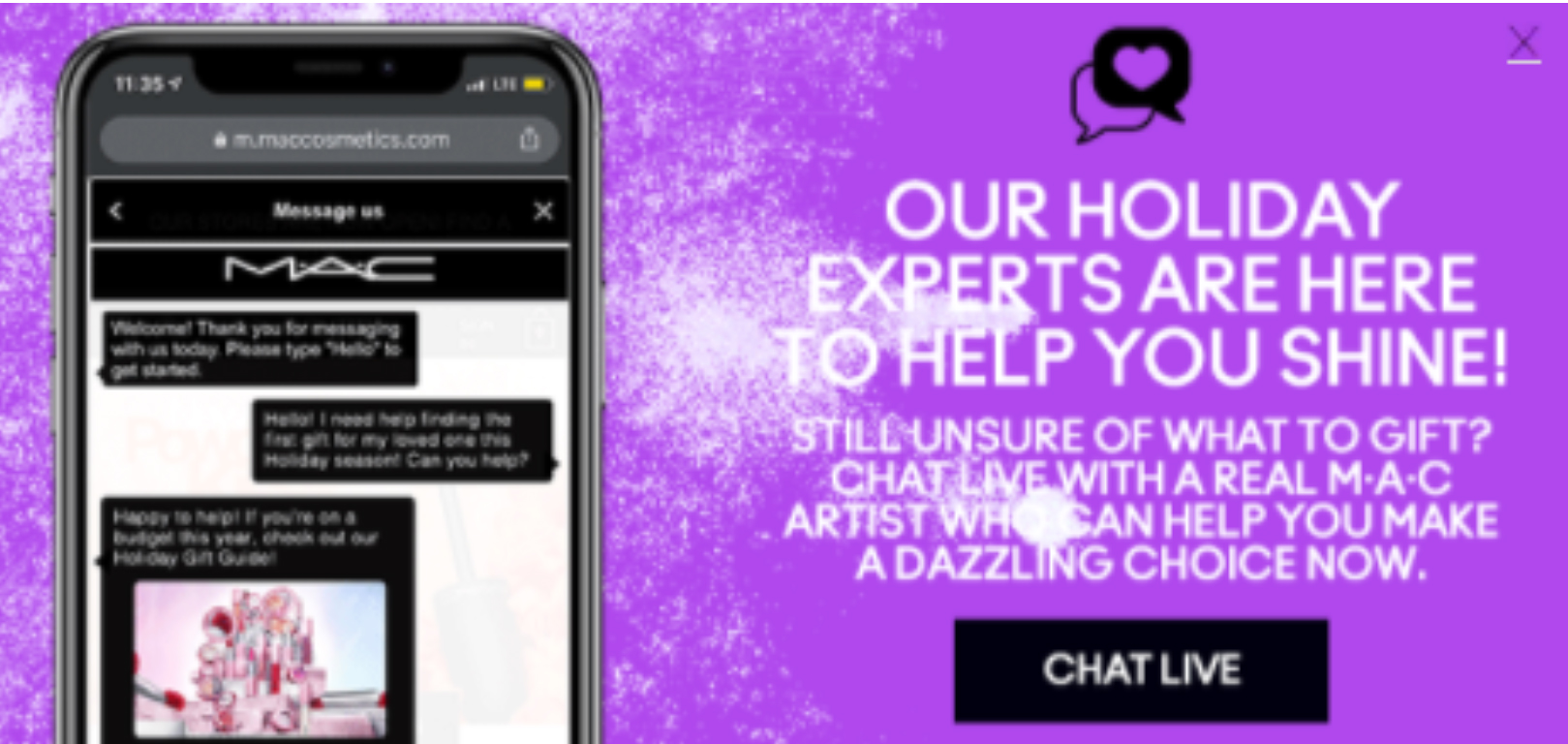

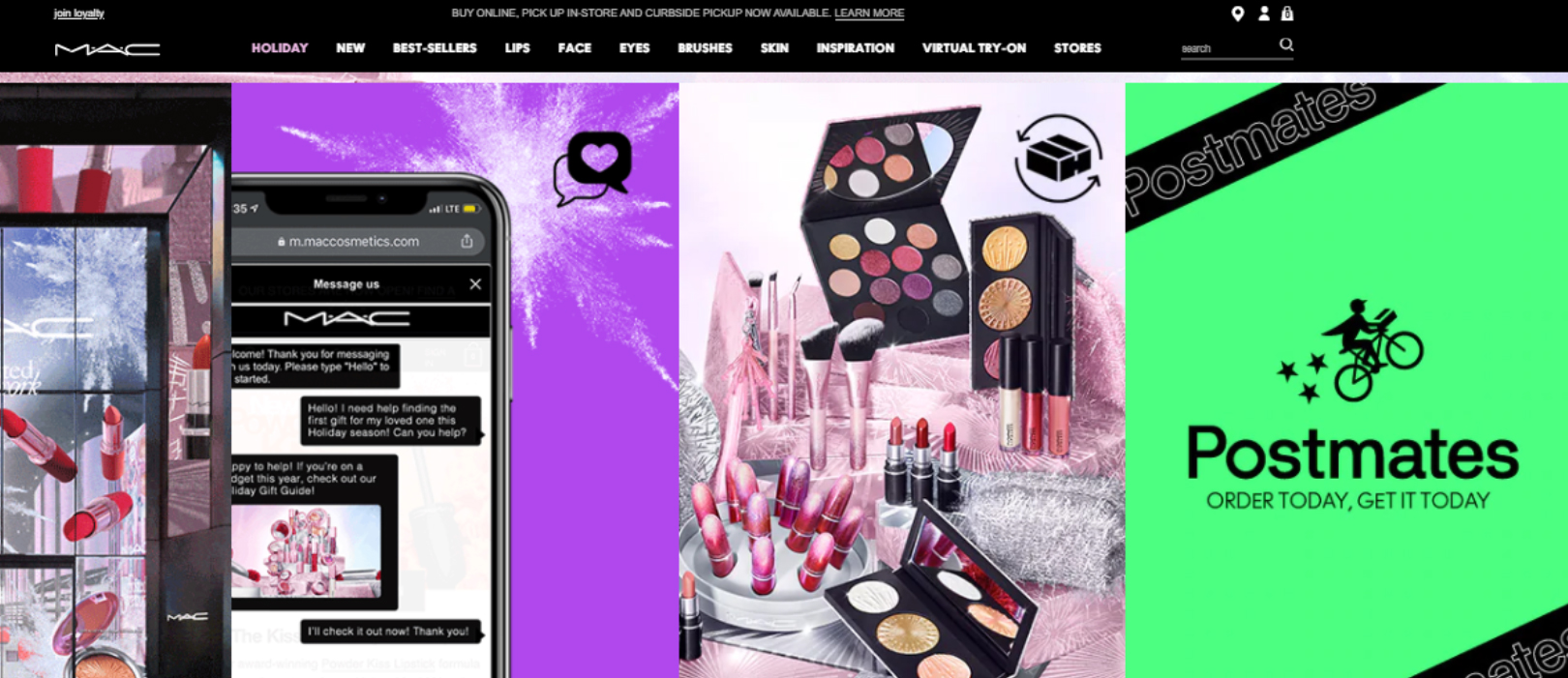

MAC is using live chat on its macosmetics.com website to engage with consumers as they shop for holiday; a pop-up box appears on the website (as shown below), reminding consumers that a MAC artist is available through live chat should consumers need beauty assistance as they shop online.

[caption id="attachment_119446" align="aligncenter" width="580"]

Source: origins.com[/caption]

MAC is using live chat on its macosmetics.com website to engage with consumers as they shop for holiday; a pop-up box appears on the website (as shown below), reminding consumers that a MAC artist is available through live chat should consumers need beauty assistance as they shop online.

[caption id="attachment_119446" align="aligncenter" width="580"] Source: Maccosmetics.com[/caption]

Source: Maccosmetics.com[/caption]

Five Beauty Trends This Holiday

Below, we discuss five of the biggest beauty categories and trends this holiday. 1. Skincare Sets This is set to be the biggest beauty trend this holiday season. Many beauty retailers and brands are promoting skincare bundles on their website landing pages—including skincare gift sets, stocking stuffers and skincare-focused advent calendars. Cosmetics brand e.l.f. Cosmetics plans to launch two skincare focused products on December 3 in conjunction with its newest brand, Keys Soulcare, Alicia Keys’ new lifestyle brand. According to e.l.f, skin care remains a major focus in its innovation pipeline; skincare consumption currently outpaces color cosmetics trends, with particularly strong skincare results on elfcosmetics.com. [caption id="attachment_119445" align="aligncenter" width="420"] Holy Hydration Face Cream

Holy Hydration Face Cream Source: elfcosmetics.com [/caption] 2. Beauty Tools and Devices While beauty tools and devices have always been popular during the holidays, we expect beauty tools to be a top gift this year, as self-care has become more of a priority for consumers amid Covid-19. With consumers conducting at-home beauty treatments rather than visiting spas and other beauty service providers, consumer devices are elevating to professional status. In September, market research firm NPD reported that sales of facial devices had grown by 8% year to date, with the largest sales gains in the higher-priced categories: devices priced at $75–$100 were up 26%, and devices priced between $150 and $175 were up 55%. In addition to facial devices, we expect growth this holiday to include upscale hair devices such as premium flat irons and hairdryers, as well as higher-priced manicure sets. We also expect brands to launch new skincare tools and technology as consumers are becoming hypervigilant about their skincare routines, in terms of health and hygiene. For example, Violet Grey has launched the Dermapore Pore Extractor & Serum Infuser, a new tool that “features an innovative stainless steel spatula that deep cleans and minimizes the appearance of pores by removing dirt, oil and blackheads. It also uses ultrasonic vibrations to boost circulation and enhance the penetration of active ingredients in a go-to product for a clearer, healthier complexion,” according to the brand. [caption id="attachment_119444" align="aligncenter" width="700"]

Dermapore Pore Extractor & Serum Infuser

Dermapore Pore Extractor & Serum Infuser Source: Violetgrey.com [/caption] 3. Brow, Lash and Eye Kits Eyes remain a beauty focus for consumers due to the need to wear masks during the pandemic. Sephora, Ulta Beauty and Target are offering brow, shadow and lash kits to capitalize on current demand for such makeup products. These kits create fun gifting opportunities for friends and stocking stuffers for teens. For example, Sephora is selling LashTash, a gift set comprising its 10 bestselling mascaras. [caption id="attachment_119443" align="aligncenter" width="700"]

Lashtash

Lashtash Source: Sephora.com [/caption] 4. CBD CBD (cannabidiol) sleep drops, gummies, oils and balms make good gifts for a friend or family member that is curious about trying CBD for its functional properties. CBD products in beauty retail include sleep care, skin care, cosmetics and even items designed to boost mental health. According to e.l.f Cosmetics, it is seeing strong sales of its Cannabis sativa Full-Spectrum CBD and Supers Collections (which include a CBD moisturizer, facial oil, lip oil, body cream and eye cream). The brand said that it sees a lot of growth in the CBD category. [caption id="attachment_119442" align="aligncenter" width="700"]

Full-Spectrum CBD Collection

Full-Spectrum CBD Collection Source: e.l.f Cosmetics [/caption] 5. Fragrance This category is always a great gift for a holiday, and this season, we expect fragrance to be an opportunity in the high-end fragrance and artisanal or niche fragrance segments. Estée Lauder reported this is a big opportunity for holiday, particularly in the brands Frédéric Malle, Jo Malone, Kilian, Le Labo and Tom Ford. Management reported that Le Labo is doing extraordinarily well everywhere in the world. Over one-quarter of consumers that purchased fragrance within the last year purchased within the holiday season, according to NPD Beauty, and over 35% of beauty fragrance sales for the entire year occurred between November and December. [caption id="attachment_119441" align="aligncenter" width="700"]

Le Labo’s Santal 26 fragrance

Le Labo’s Santal 26 fragrance Source: Lelabofragrances.com [/caption] Expanding Fulfillment Capabilities, Including BOPIS and Curbside Pickup Retailers continue to develop their fulfillment capabilities—a trend that was accelerated by the Covid-19 pandemic as consumer sought safe, contactless solutions. Retailers are making it as easy as possible for shoppers to pick up their orders quickly and conveniently through BOPIS and curbside pickup. Furthermore, acknowledging that the omnichannel shopper is the most valuable, many retailers are trying to attract these consumers by making the in-store experience seamless. Ulta Beauty, for example, reported at the 3rd Annual Wells Fargo Virtual Consumer Conference on September 15 that the omnichannel shopper spends three times that of a “physical-only” shopper over the course of a year. This holiday season, retailers with BOPIS and curbside-pickup services will be in demand more than ever, as some consumers may not feel comfortable shopping in stores yet and store capacity may be limited. We summarize the beauty retailers that are utilizing BOPIS and curbside pickup, and their expectations for the 2020 holiday season:

- Ulta Beauty—90% of Ulta’s 1,200 stores are off-mall locations that have implemented BOPIS and curbside pickup since 2019. Ulta’s CEO Mary Dillon reported at the Oppenheimer 20th Annual Consumer Growth and E-Commerce Conference in June 2020 that having BOPIS last holiday was a “great competitive advantage” for the retailer. For this holiday season, Ulta began testing a notification process to help expedite the curbside-pickup experience, with the goal of providing a more seamless experience for shoppers. Ulta has also pulled forward the opening of a fast-fulfillment center in Jacksonsville, Florida to support higher levels of e-commerce demand this holiday season. Since the beginning of the pandemic, curbside pickup and BOPIS have accounted for around 20% of the retailer’s total e-commerce orders, and online-only members represent 7.5% of its total members, 2.5 times the proportion in 2019.

- Sephora, with 460 standalone stores in the US and another 616 inside JCPenney stores, is offering in-store pickup, according to the retailer’s website. The majority of Sephora’s stores are located in malls, so Ulta Beauty has an advantage with curbside pickup. However, in February 2020, Sephora announced plans to open 100 smaller-format, off-mall stores in North America, with a focus on hair care and fragrance.

Source: Sephora.com[/caption]

Source: Sephora.com[/caption]

- Estée Lauder reported in its first-quarter 2021 earnings call that it has ramped up its online fulfillment capabilities and strengthened its capacity. The company is allocating seasonal fulfillment locations in its largest markets in anticipation of robust consumer demand for holiday. Estée Lauder has invested in technology to deploy more omnichannel capabilities in several markets. The MAC brand in the US has seen a dramatic uptick in BOPIS and has partnered with Postmates to launch same-day delivery in New York.

Source: Maccosmetics.com[/caption]

What We Think

Coresight Research estimates that total US consumer spending on beauty will increase by around 4.4% year over year during the holiday quarter, continuing the recent trend of solidly positive growth in category spending.

Beauty brands and retailers should look to boost sales in a competitive environment this holiday season by capitalizing on the top five consumer trends that we have identified in this report: skincare sets; beauty tools and devices; brow, lash, and eye kits; CBD products; and fragrance. These trends have been largely influenced by the ongoing Covid-19 pandemic, representing an opportunity for brands to launch new products and promotional campaigns in these product categories.

We expect beauty brands and retailers to leverage livestreaming and social media influencers this holiday to drive brand awareness and promote products. The highly visual nature of this selling channel lends itself to the beauty sector, as livestream hosts can demonstrate products application techniques. Beauty retailers including Estée Lauder have reported tremendous growth in online consumer engagement amid Covid-19, as shoppers turn to e-commerce. We expect that brands will lean on livestreaming this holiday to engage with consumers that remain reluctant to shop in brick-and-mortar stores, and use the channel to promote gifting ideas.

In terms of online-order fulfillment, beauty retailers should look to make the physical shopping experience as efficient and convenient as possible to encourage consumer spending. We believe that offering curbside pickup and BOPIS will provide a competitive advantage among beauty retailers this holiday.

Source: Maccosmetics.com[/caption]

What We Think

Coresight Research estimates that total US consumer spending on beauty will increase by around 4.4% year over year during the holiday quarter, continuing the recent trend of solidly positive growth in category spending.

Beauty brands and retailers should look to boost sales in a competitive environment this holiday season by capitalizing on the top five consumer trends that we have identified in this report: skincare sets; beauty tools and devices; brow, lash, and eye kits; CBD products; and fragrance. These trends have been largely influenced by the ongoing Covid-19 pandemic, representing an opportunity for brands to launch new products and promotional campaigns in these product categories.

We expect beauty brands and retailers to leverage livestreaming and social media influencers this holiday to drive brand awareness and promote products. The highly visual nature of this selling channel lends itself to the beauty sector, as livestream hosts can demonstrate products application techniques. Beauty retailers including Estée Lauder have reported tremendous growth in online consumer engagement amid Covid-19, as shoppers turn to e-commerce. We expect that brands will lean on livestreaming this holiday to engage with consumers that remain reluctant to shop in brick-and-mortar stores, and use the channel to promote gifting ideas.

In terms of online-order fulfillment, beauty retailers should look to make the physical shopping experience as efficient and convenient as possible to encourage consumer spending. We believe that offering curbside pickup and BOPIS will provide a competitive advantage among beauty retailers this holiday.