What’s the Story?

Holiday shopping has started earlier in 2020 than has typically been the case in previous years, and the ongoing coronavirus pandemic is driving apparel and footwear retailers to rethink how they can approach consumers and increase holiday sales this year. In this report, we discuss the apparel and footwear sector’s expected performance during the holiday season, as well as the key strategies that retailers are employing to drive sales—including increasing their omnichannel capabilities, optimizing their supply chain, targeting specific categories and launching innovative marketing campaigns.

Why It Matters

Just over 29% of respondents said they are currently buying more apparel online than pre-crisis, according to our

latest US consumer survey, undertaken on November 3, 2020, creating opportunity for apparel retailers to expand their digital business. We analyze industry trends and provide insights into how retailers are responding to changes in consumer behavior and preparing for the holiday season.

Outlook for the Apparel and Footwear Sector: In Detail

Our Estimates for the Holidays

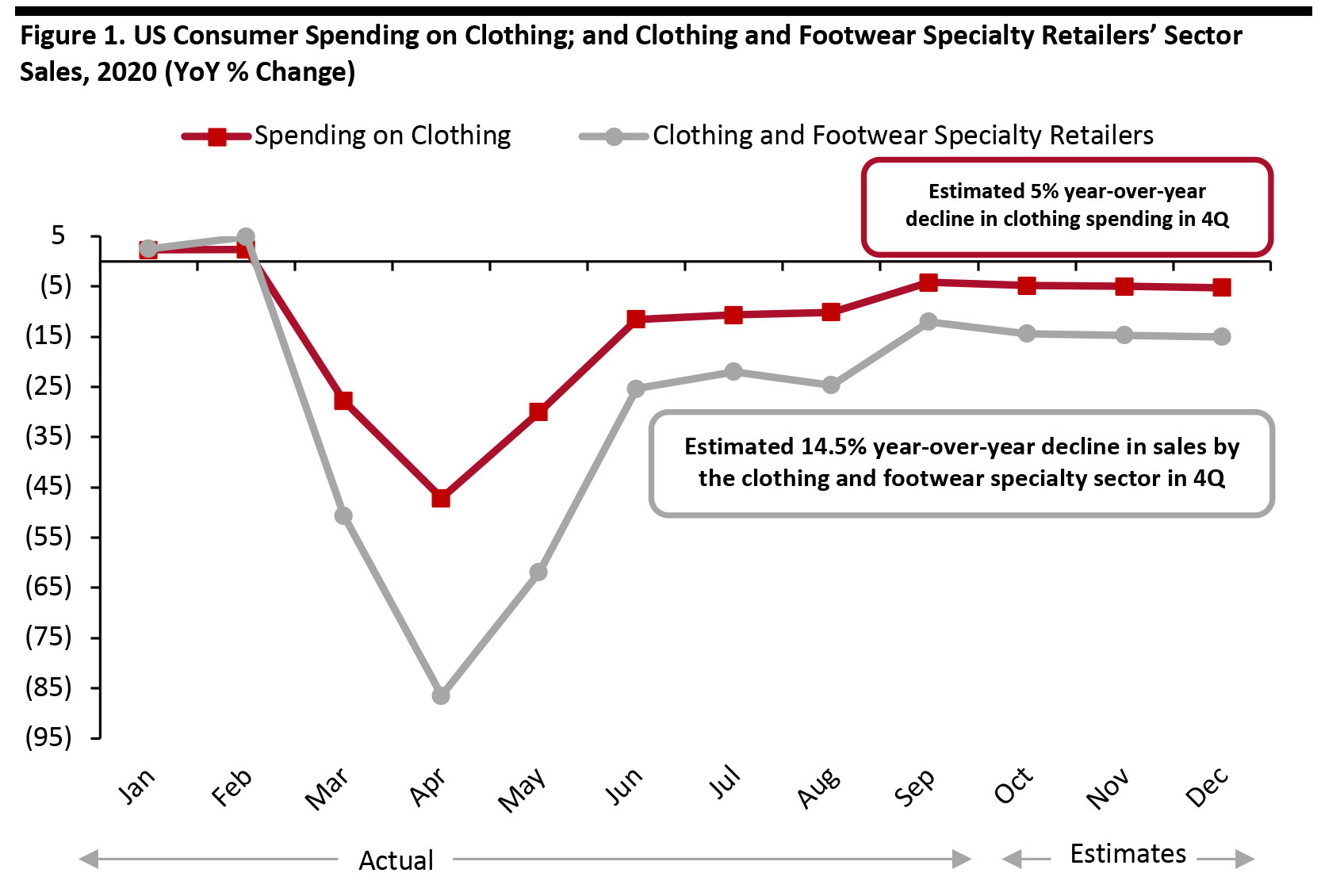

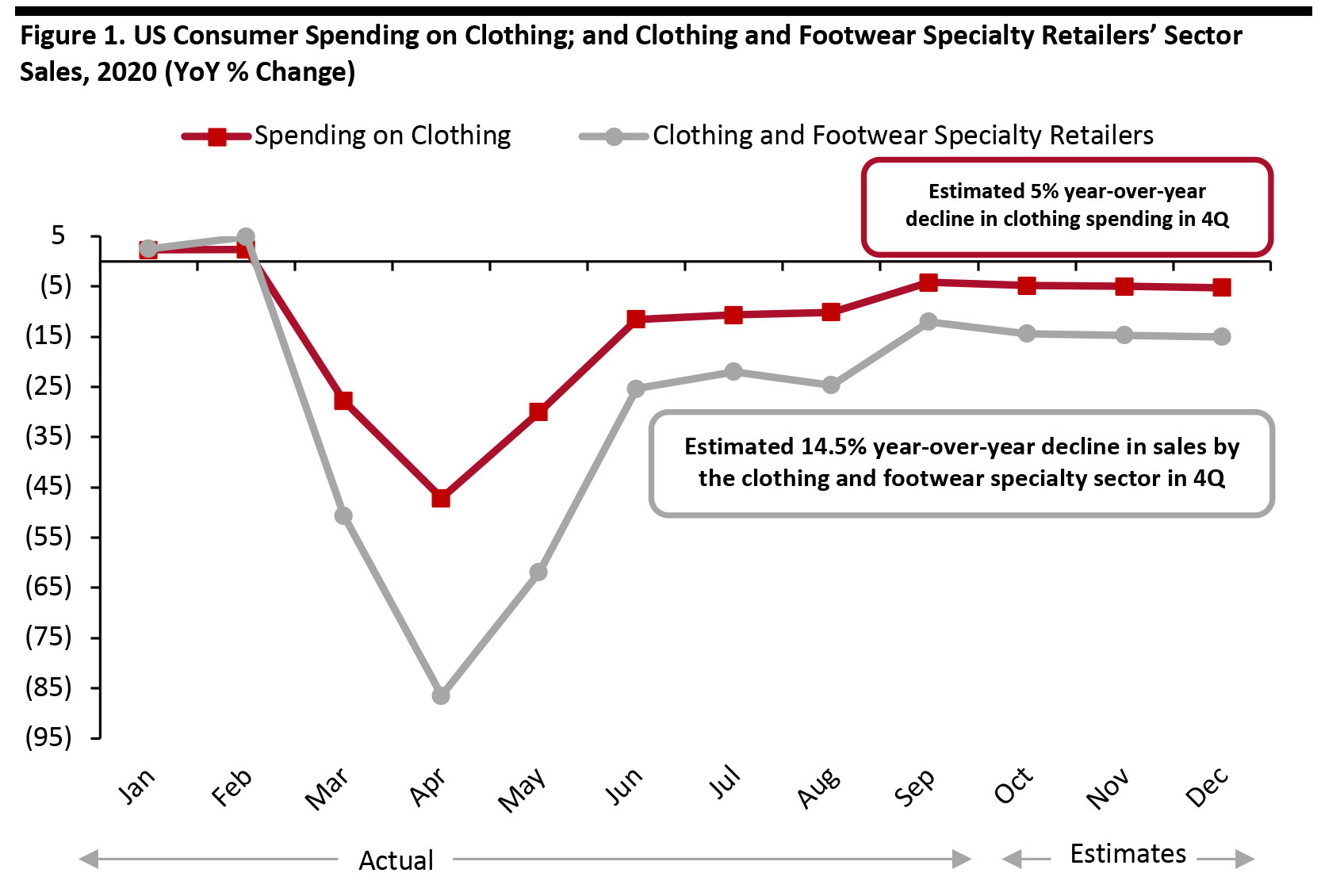

- Coresight Research estimates that total US consumer spending on clothing during the holiday period will see a decline of approximately 5% year over year, yielding total October—December sales of $74 billion. As charted below, this will be a significant improvement versus the late summer, as we expect gifting demand to prove more robust than everyday demand such as clothing for work or for attending social events.

- We estimate that clothing and footwear specialty retailers will underpace this total, with a 14.5% decline in total sales this holiday season. As shown below, the specialty sector has consistently underpaced total clothing spend since the onset of the coronavirus crisis, as consumers have switched to e-commerce and rival sectors such as mass merchants (Target has reported a bounce in apparel sales, for example). Store closures in the specialty sector will compound the decline in total sector sales.

We have seen an early start to holiday shopping in 2020 compared to previous years, with a number of shopping events providing a bump to performance—

Amazon’s Prime Day on October 13–14; rival events from retailers such as Target and Walmart; and the new

10.10 Shopping Festival. In addition, recently published data showed a notable improvement in apparel consumer spending and retail sales in September.

[caption id="attachment_119006" align="aligncenter" width="700"]

Source: US Bureau of Economic Analysis/US Census Bureau/Coresight Research

Source: US Bureau of Economic Analysis/US Census Bureau/Coresight Research[/caption]

Expanding Fulfillment Capabilities Through BOPIS and Curbside Pickup Options

Consumer demand for omnichannel shopping is continuing to grow, particularly with the implementation of social-distancing measures impacting the in-store experience. BOPIS and curbside pickup are omnichannel retail strategies that are gaining momentum among consumers. Apparel retailers are extending BOPIS and curbside pickup to more stores to meet the digital shift in fashion retail and to get prepared for holiday 2020. We expect BOPIS and curbside pickup to remain popular options post crisis.

Retailers that have been at the forefront of adopting BOPIS and curbside pickup include Dick’s Sporting Goods and Levi Strauss & Co., which reported that 75% and 20% of digital sales, respectively, were fulfilled by stores in the recent quarter. Other retailers including American Eagle Outfitters, Gap Inc., L Brands and PVH Corp. are expanding their BOPIS and curbside pickup services.

BOPIS and curbside pickup options will also help apparel retailers save shipping costs and reduce delivery times. Increased shipping costs will be a headwind around the holidays when carriers have levied more fees. Retailers such as American Eagle Outfitters, Dick’s Sporting Goods and Foot Locker have stated that they are taking measures to control shipping costs and surcharges levied by carriers.

Labor costs are also a headwind, as apparel retailers such as American Eagle Outfitters, Gap Inc. and Urban Outfitters have hired new temporary workers in warehouses and stores. See the Coresight Research

US Holiday Retail 2020 Databank for information on the hiring plans of major US retailers.

Apparel Retailers Set To Double Efforts To Entice Online Shoppers

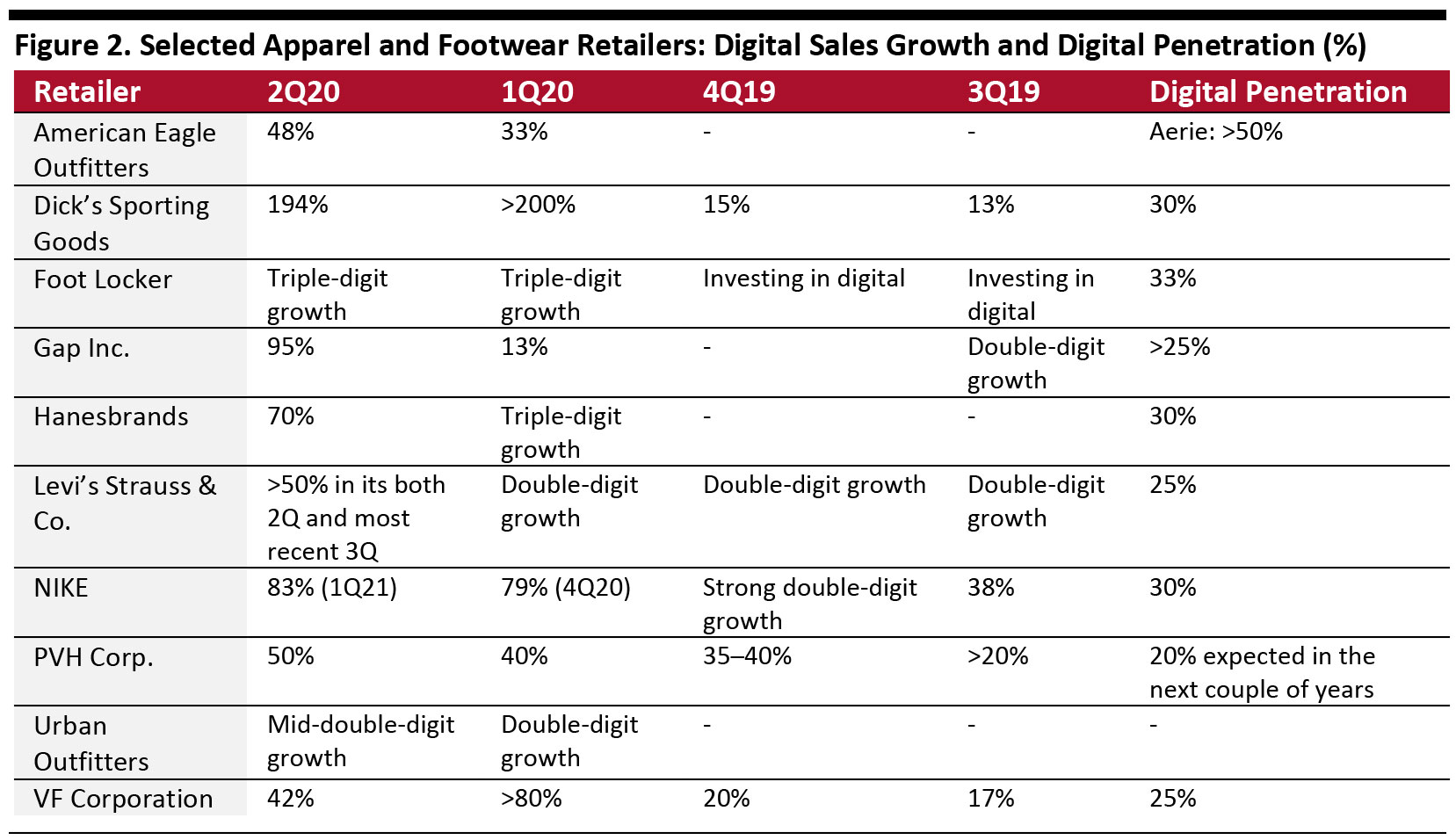

Customers have turned to digital retail during the pandemic, accelerating the growth of e-commerce. In the

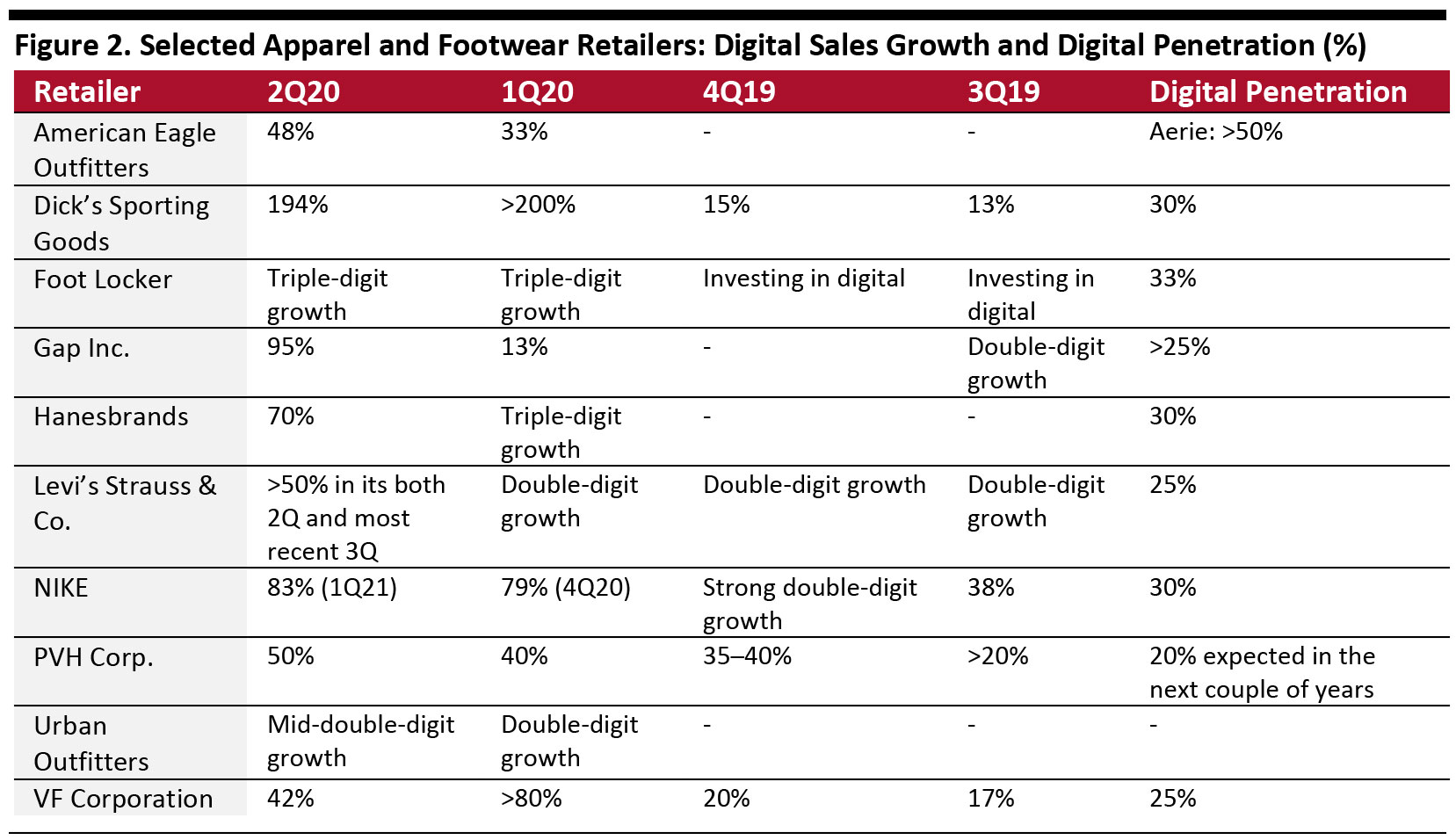

Coresight 100 (our focus list of the largest and most influential companies in the global retail ecosystem), 61.5% of apparel companies have already achieved more than 25% digital sales penetration, according to recent earnings releases, and all companies aim to increase this penetration within the next three years to respond to consumer demand. We expect to see apparel retailers make more efforts to entice online shoppers this holiday season.

Retailers such as American Eagle Outfitters, Levi’s and NIKE were already expanding their e-commerce offerings prior to the pandemic. Less digitally advanced retailers such as Dick’s Sporting Goods, Hanesbrands and Urban Outfitters are in the process of growing their digital capabilities.

[caption id="attachment_119007" align="aligncenter" width="700"]

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research[/caption]

Casual and Comfort Likely To Be Winning Trends

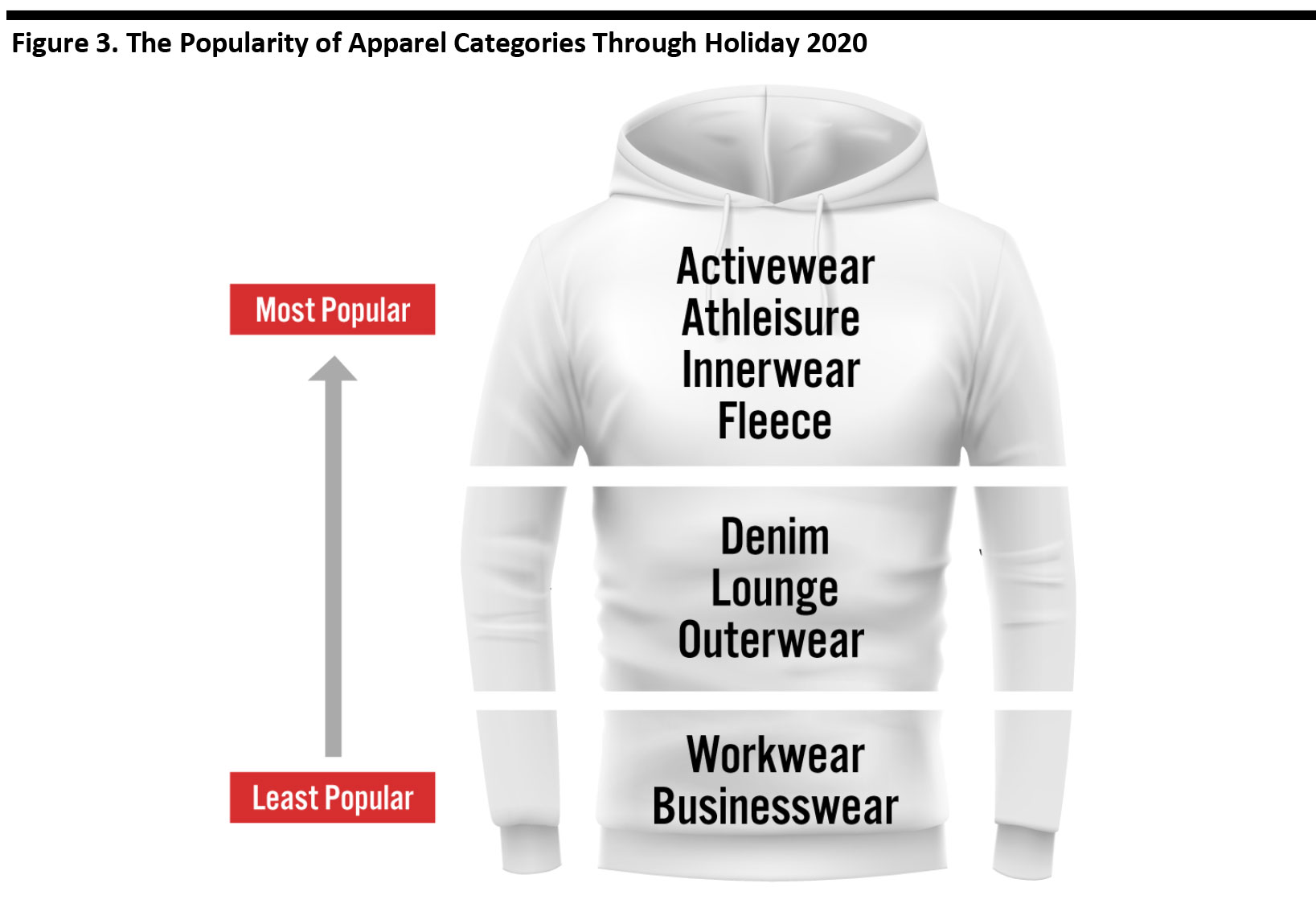

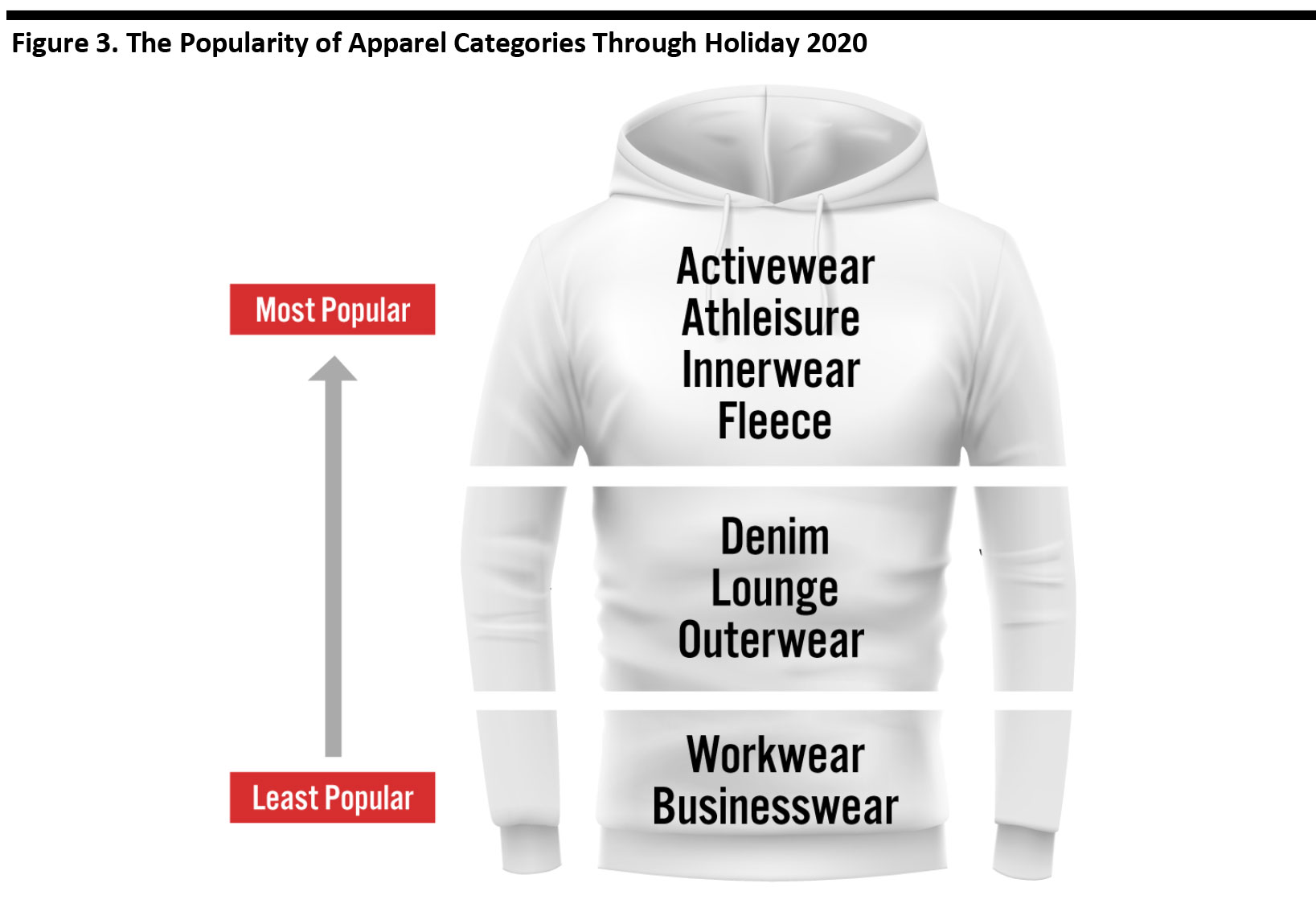

The shift toward working from home in the wake of the coronavirus crisis has accelerated the casualization trend in US, with significant impacts for the apparel market. For the rest of the year, including holiday, casual and comfort apparel is expected to become more mainstream.

Based on retailers’ reported top-performing apparel styles and future expectations (summarized in Figure 4), we conclude that activewear, athleisure, innerwear and fleece will be the most popular categories this holiday season. Retailers including American Eagle Outfitters, Dick’s Sporting Goods, Gap Inc., Hanesbrands, and PVH Corp. have reported that they intend to focus on these categories for the rest of the year. Workwear and businesswear are the least popular apparel styles among consumers.

[caption id="attachment_119008" align="aligncenter" width="700"]

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research[/caption]

How Apparel and Footwear Retailers Are Preparing for the Holidays

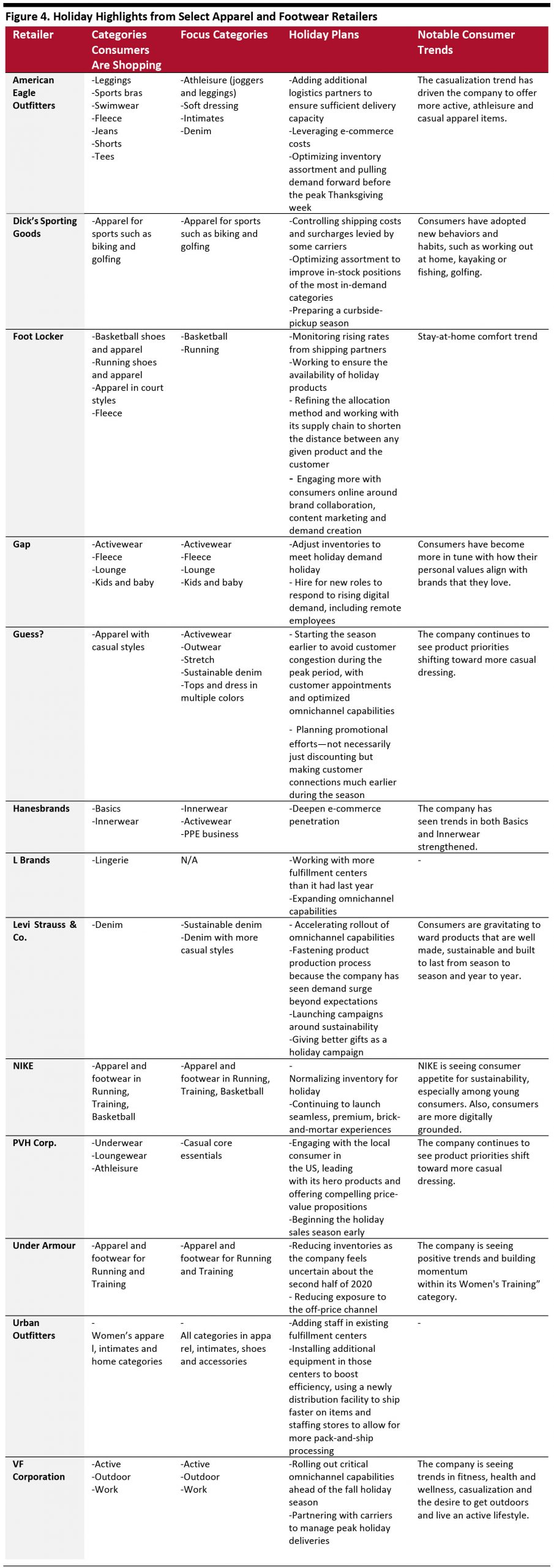

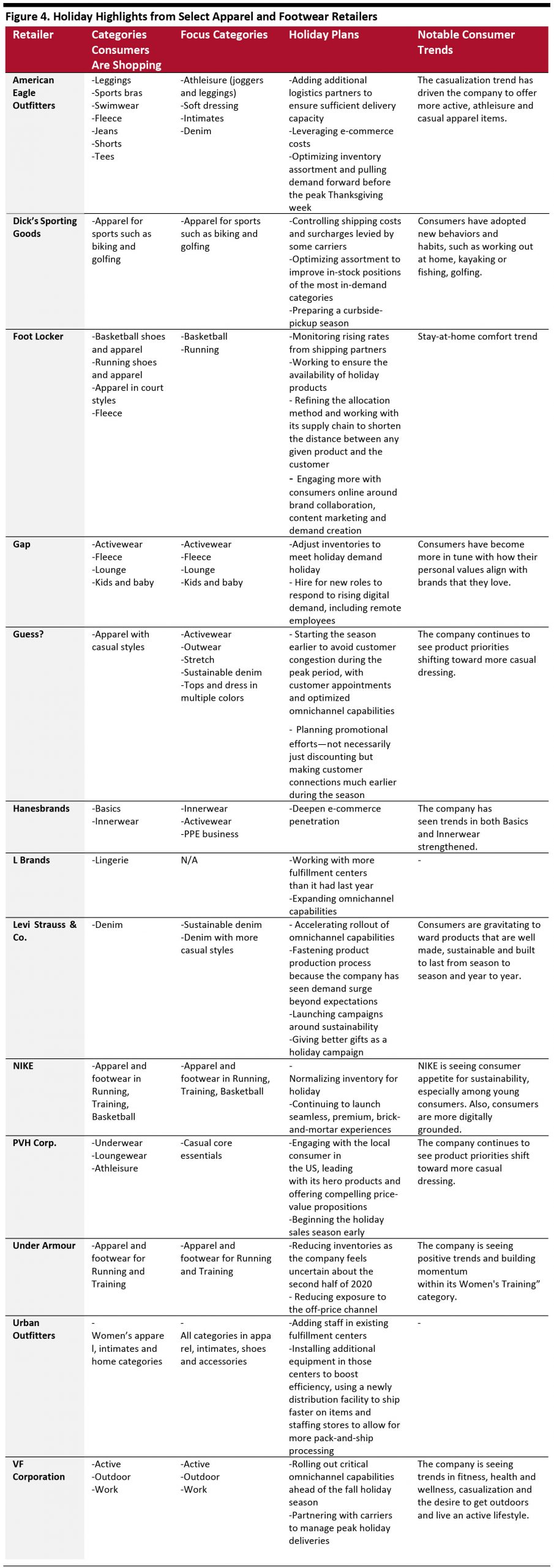

In Figure 4, we provide insights into how select apparel and footwear retailers (in the Coresight 100) are preparing for the holidays, through their operations, inventory and fulfillment, marketing strategies and promotions.

[caption id="attachment_119009" align="aligncenter" width="700"]

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research[/caption]

What We Think

- We estimate that total US consumer spending on clothing during the holiday period will see a decline of 5% year over year, with total October—December spending of $74 billion. Clothing and footwear specialty retailers will underpace this total, seeing an estimated 14.5% decline.

- To keep up with changed consumer shopping behaviors that are expected to persist during the holidays and even post pandemic, apparel retailers and brands could deepen their omnichannel capabilities, such as by offering curbside pickup and alternative fulfillment options for online orders.

- Apparel retailers and brands should optimize their assortment and promote products to align with consumer preferences and thus boost sales—such as meeting the increased demand for comfortable and casual apparel.

Other Coresight Research Coverage

We explore the continued impacts of the Covid-19 crisis on the US apparel retail sector for the rest of 2020 and 2021 in our recent

US Apparel Retail: Post-Crisis Outlook report.

Source: US Bureau of Economic Analysis/US Census Bureau/Coresight Research[/caption]

Expanding Fulfillment Capabilities Through BOPIS and Curbside Pickup Options

Consumer demand for omnichannel shopping is continuing to grow, particularly with the implementation of social-distancing measures impacting the in-store experience. BOPIS and curbside pickup are omnichannel retail strategies that are gaining momentum among consumers. Apparel retailers are extending BOPIS and curbside pickup to more stores to meet the digital shift in fashion retail and to get prepared for holiday 2020. We expect BOPIS and curbside pickup to remain popular options post crisis.

Retailers that have been at the forefront of adopting BOPIS and curbside pickup include Dick’s Sporting Goods and Levi Strauss & Co., which reported that 75% and 20% of digital sales, respectively, were fulfilled by stores in the recent quarter. Other retailers including American Eagle Outfitters, Gap Inc., L Brands and PVH Corp. are expanding their BOPIS and curbside pickup services.

BOPIS and curbside pickup options will also help apparel retailers save shipping costs and reduce delivery times. Increased shipping costs will be a headwind around the holidays when carriers have levied more fees. Retailers such as American Eagle Outfitters, Dick’s Sporting Goods and Foot Locker have stated that they are taking measures to control shipping costs and surcharges levied by carriers.

Labor costs are also a headwind, as apparel retailers such as American Eagle Outfitters, Gap Inc. and Urban Outfitters have hired new temporary workers in warehouses and stores. See the Coresight Research US Holiday Retail 2020 Databank for information on the hiring plans of major US retailers.

Apparel Retailers Set To Double Efforts To Entice Online Shoppers

Customers have turned to digital retail during the pandemic, accelerating the growth of e-commerce. In the Coresight 100 (our focus list of the largest and most influential companies in the global retail ecosystem), 61.5% of apparel companies have already achieved more than 25% digital sales penetration, according to recent earnings releases, and all companies aim to increase this penetration within the next three years to respond to consumer demand. We expect to see apparel retailers make more efforts to entice online shoppers this holiday season.

Retailers such as American Eagle Outfitters, Levi’s and NIKE were already expanding their e-commerce offerings prior to the pandemic. Less digitally advanced retailers such as Dick’s Sporting Goods, Hanesbrands and Urban Outfitters are in the process of growing their digital capabilities.

[caption id="attachment_119007" align="aligncenter" width="700"]

Source: US Bureau of Economic Analysis/US Census Bureau/Coresight Research[/caption]

Expanding Fulfillment Capabilities Through BOPIS and Curbside Pickup Options

Consumer demand for omnichannel shopping is continuing to grow, particularly with the implementation of social-distancing measures impacting the in-store experience. BOPIS and curbside pickup are omnichannel retail strategies that are gaining momentum among consumers. Apparel retailers are extending BOPIS and curbside pickup to more stores to meet the digital shift in fashion retail and to get prepared for holiday 2020. We expect BOPIS and curbside pickup to remain popular options post crisis.

Retailers that have been at the forefront of adopting BOPIS and curbside pickup include Dick’s Sporting Goods and Levi Strauss & Co., which reported that 75% and 20% of digital sales, respectively, were fulfilled by stores in the recent quarter. Other retailers including American Eagle Outfitters, Gap Inc., L Brands and PVH Corp. are expanding their BOPIS and curbside pickup services.

BOPIS and curbside pickup options will also help apparel retailers save shipping costs and reduce delivery times. Increased shipping costs will be a headwind around the holidays when carriers have levied more fees. Retailers such as American Eagle Outfitters, Dick’s Sporting Goods and Foot Locker have stated that they are taking measures to control shipping costs and surcharges levied by carriers.

Labor costs are also a headwind, as apparel retailers such as American Eagle Outfitters, Gap Inc. and Urban Outfitters have hired new temporary workers in warehouses and stores. See the Coresight Research US Holiday Retail 2020 Databank for information on the hiring plans of major US retailers.

Apparel Retailers Set To Double Efforts To Entice Online Shoppers

Customers have turned to digital retail during the pandemic, accelerating the growth of e-commerce. In the Coresight 100 (our focus list of the largest and most influential companies in the global retail ecosystem), 61.5% of apparel companies have already achieved more than 25% digital sales penetration, according to recent earnings releases, and all companies aim to increase this penetration within the next three years to respond to consumer demand. We expect to see apparel retailers make more efforts to entice online shoppers this holiday season.

Retailers such as American Eagle Outfitters, Levi’s and NIKE were already expanding their e-commerce offerings prior to the pandemic. Less digitally advanced retailers such as Dick’s Sporting Goods, Hanesbrands and Urban Outfitters are in the process of growing their digital capabilities.

[caption id="attachment_119007" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Casual and Comfort Likely To Be Winning Trends

The shift toward working from home in the wake of the coronavirus crisis has accelerated the casualization trend in US, with significant impacts for the apparel market. For the rest of the year, including holiday, casual and comfort apparel is expected to become more mainstream.

Based on retailers’ reported top-performing apparel styles and future expectations (summarized in Figure 4), we conclude that activewear, athleisure, innerwear and fleece will be the most popular categories this holiday season. Retailers including American Eagle Outfitters, Dick’s Sporting Goods, Gap Inc., Hanesbrands, and PVH Corp. have reported that they intend to focus on these categories for the rest of the year. Workwear and businesswear are the least popular apparel styles among consumers.

[caption id="attachment_119008" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Casual and Comfort Likely To Be Winning Trends

The shift toward working from home in the wake of the coronavirus crisis has accelerated the casualization trend in US, with significant impacts for the apparel market. For the rest of the year, including holiday, casual and comfort apparel is expected to become more mainstream.

Based on retailers’ reported top-performing apparel styles and future expectations (summarized in Figure 4), we conclude that activewear, athleisure, innerwear and fleece will be the most popular categories this holiday season. Retailers including American Eagle Outfitters, Dick’s Sporting Goods, Gap Inc., Hanesbrands, and PVH Corp. have reported that they intend to focus on these categories for the rest of the year. Workwear and businesswear are the least popular apparel styles among consumers.

[caption id="attachment_119008" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

How Apparel and Footwear Retailers Are Preparing for the Holidays

In Figure 4, we provide insights into how select apparel and footwear retailers (in the Coresight 100) are preparing for the holidays, through their operations, inventory and fulfillment, marketing strategies and promotions.

[caption id="attachment_119009" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

How Apparel and Footwear Retailers Are Preparing for the Holidays

In Figure 4, we provide insights into how select apparel and footwear retailers (in the Coresight 100) are preparing for the holidays, through their operations, inventory and fulfillment, marketing strategies and promotions.

[caption id="attachment_119009" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]