DIpil Das

What’s the Story?

We count down to the holiday season with a 12-week series focused on the data, trends and observations surrounding the end-of-year peak. In the sixth week of the series, we look at Black Friday in the US, which is a major online and offline shopping day.Why It Matters

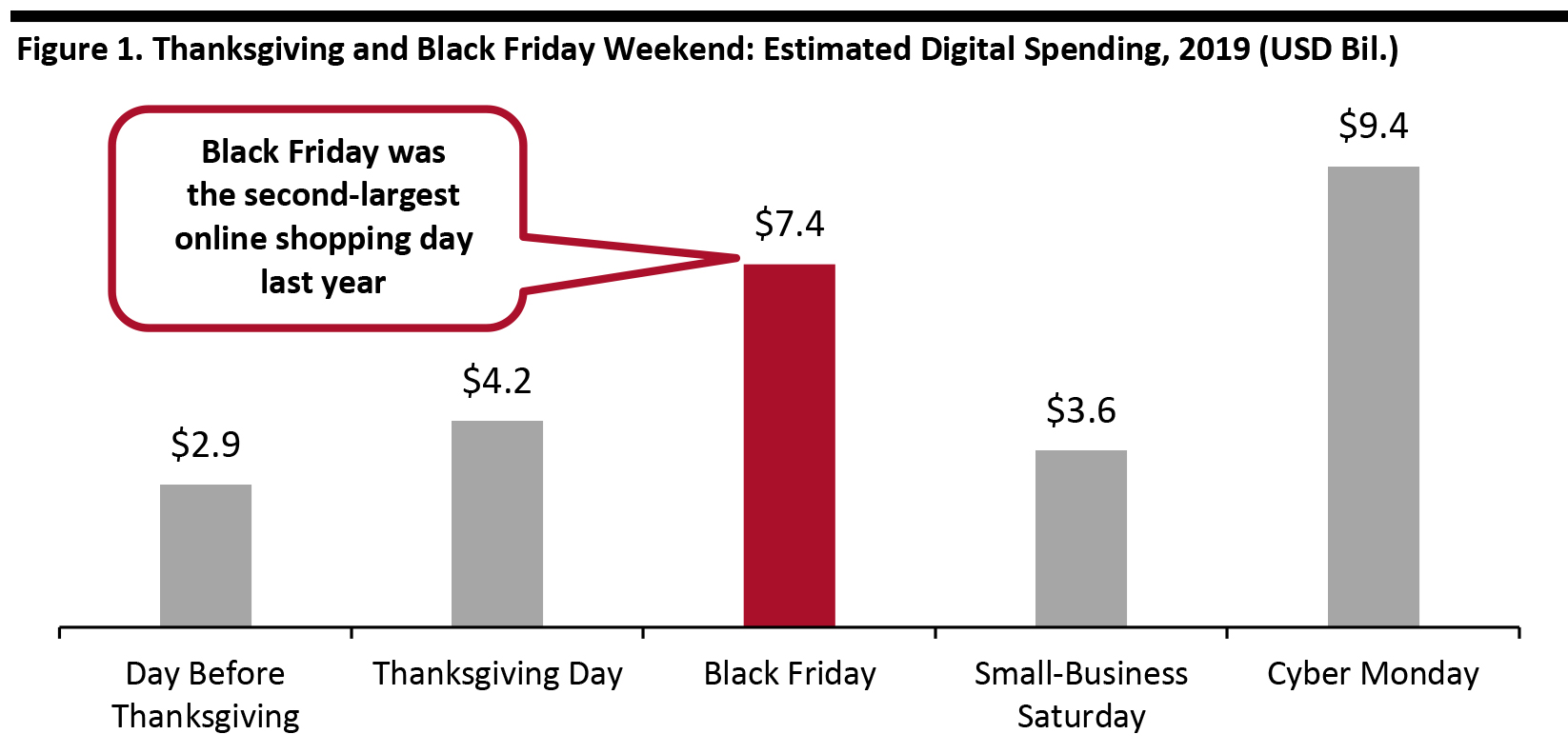

Black Friday shopping is on course to be significantly different this year in light of the Covid-19 pandemic. Doorbuster deals, a hallmark of Black Friday shopping, are likely to be absent from stores in the interest of consumer health and safety, prompting retailers to move a majority of their promotions online. Retailers are also extending their promotions to last nearly the entire month of November, giving shoppers little need to visit stores specifically on Black Friday. Black Friday falls two days earlier than it did last year, taking place on November 27, 2020. Typically, this is helpful to retailers as it increases the number of days in the traditional holiday shopping period before Christmas. This year, however, Black Friday’s place as the second-largest US online holiday shopping day (see Figure 1) and its significance in terms of kicking off holiday season shopping is likely to be threatened as other shopping events have pulled forward holiday spending—including Amazon’s Prime Day on October 13–14; competing sales days from Target, Walmart and other major retailers; and the new 10.10 Shopping Festival on October 9–12. [caption id="attachment_118607" align="aligncenter" width="700"] Source: Adobe Analytics/Coresight Research [/caption]

Source: Adobe Analytics/Coresight Research [/caption]

Black Friday 2020: What We Expect To See

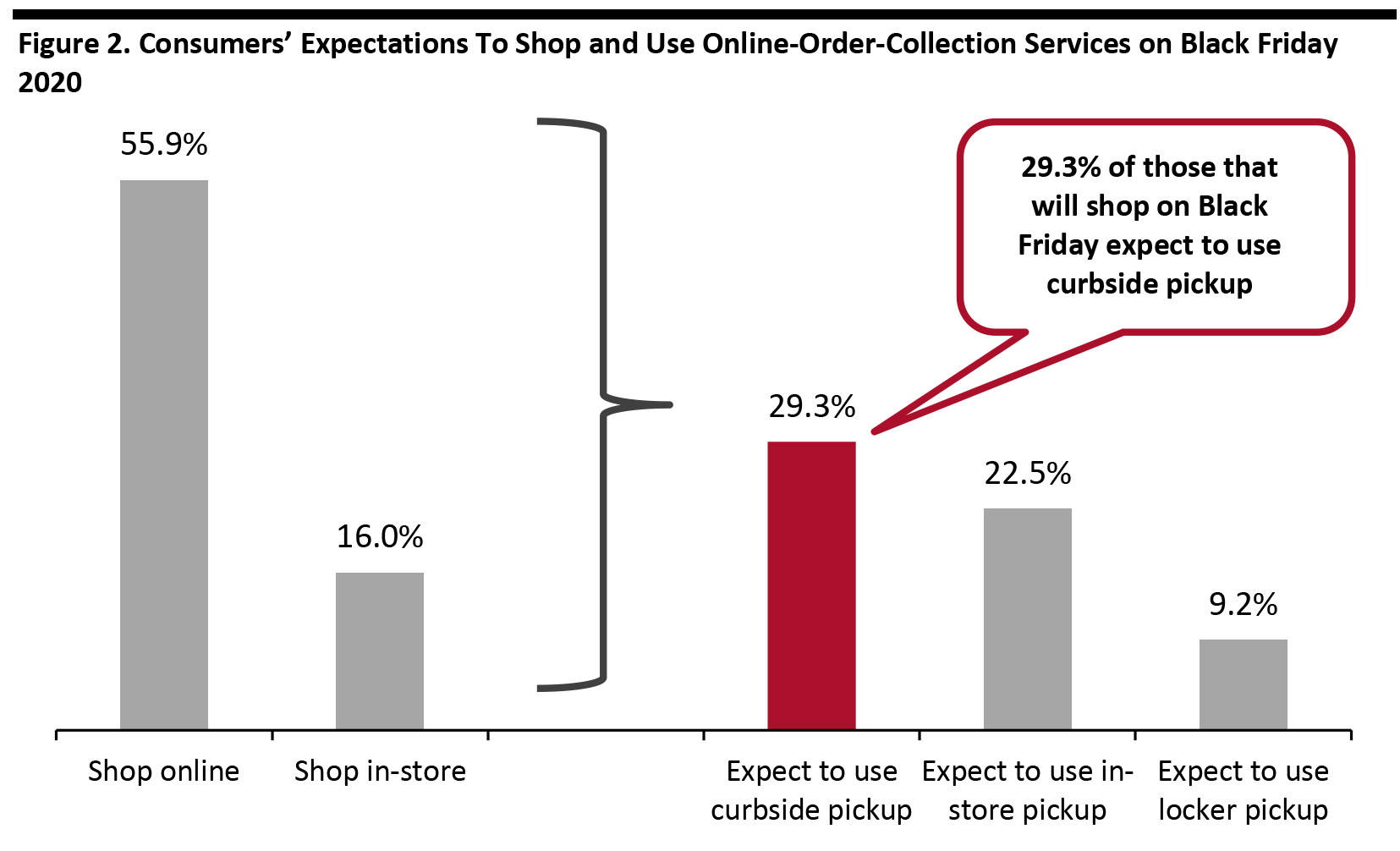

Black Friday was traditionally known for exciting in-store deals, but in recent years, e-commerce has taken a greater share of sales. This year, with the Covid-19 pandemic prompting a further spending shift to online, we expect digital sales on Black Friday to accelerate from 2019’s momentum of 21.0% growth and 2018’s 24.0% growth, according to Adobe Analytics. We expect this acceleration in Black Friday digital sales to contribute to our estimate of 33.5% growth in holiday retail sales, as published in our Holiday 2020: US Retail Outlook. Reduced In-Store Traffic; Consumers Opt for Contact-Light Collection Services We expect nonfood stores to see a roughly 50% decline in traffic on Black Friday compared to Black Friday 2019, as shoppers are likely to choose to shop online from the safe and convenient surroundings of their homes versus shopping in a crowded or controlled store environment. Long lines of people waiting for stores to open, shoppers jostling each other to grab “doorbuster” deals on televisions or other big-ticket items, and other such headline-grabbing sights that are typical to in-store shopping on Black Friday are likely to be absent this year. With e-commerce being the primary shopping channel, contact-light online-order-collection services, such as curbside pickup, will likely be popular among consumers; in-store or locker pickup could involve coming into close proximity with other shoppers, so may be used less. Our October 27 survey of US consumers found that:- About 63.0% expect to shop on Black Friday.

- 55.9% expect to shop online and only 16.0% expect to shop in stores on Black Friday.

- Nearly one-quarter do not expect to shop at all on Black Friday—whether in-store or online—while about 12.0% stated that they did not know if they would shop.

- 29.3% expect to use curbside pickup, and a smaller proportion expect to use in-store or locker pickup.

- A total of 48.0% expect to use some form of collection service; 26.5% do not expect to use collection services; and 25.5% did not know if they would.

Base: 419 US respondents aged 18+ who indicated that they would shop online or in-store on Thanksgiving or Black Friday

Base: 419 US respondents aged 18+ who indicated that they would shop online or in-store on Thanksgiving or Black Friday Shopping was defined as browsing or buying. Respondents could select both online and in-store options, and could select more than one type of collection service.

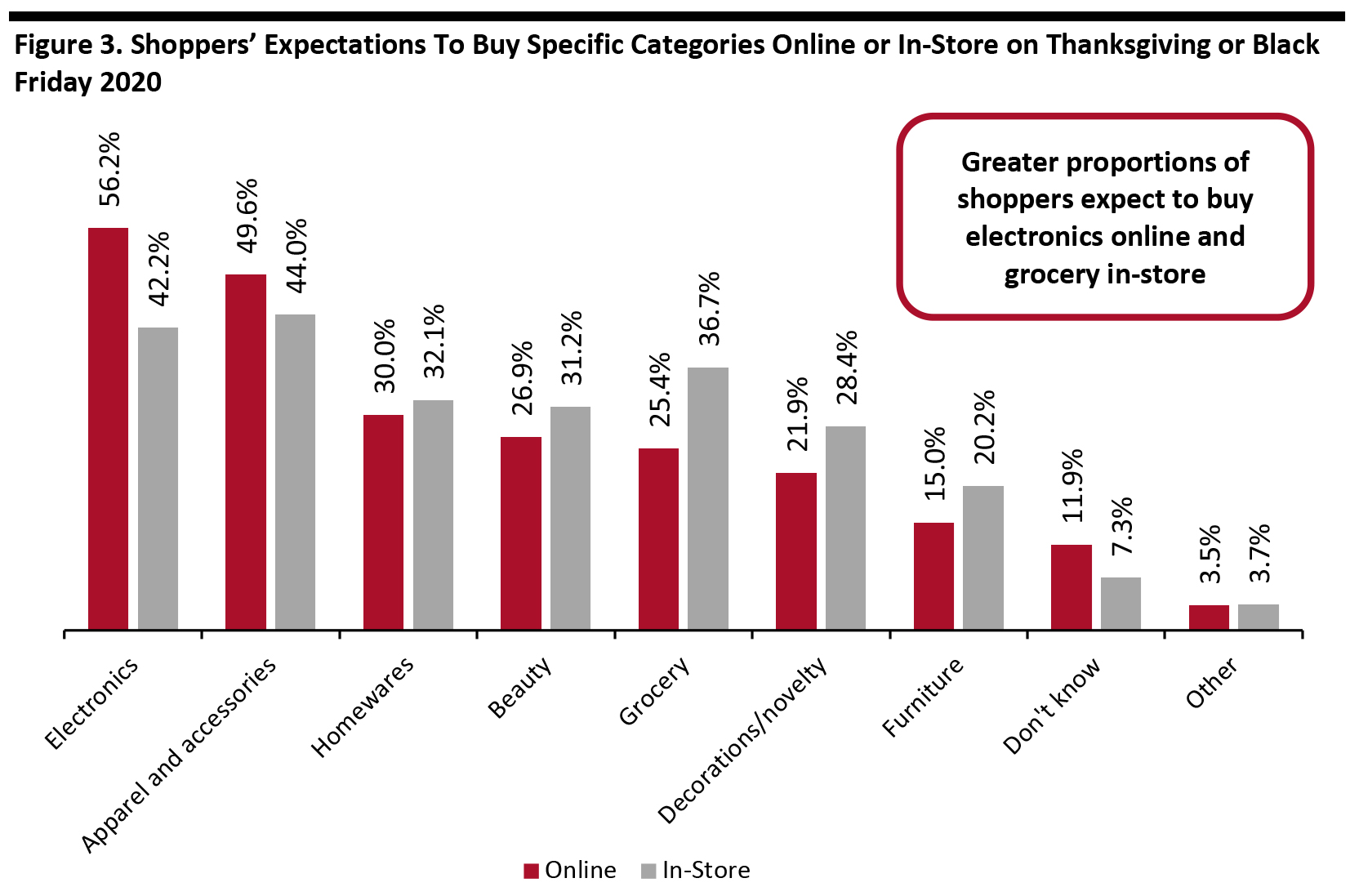

Source: Coresight Research [/caption] Small Gatherings and At-Home Celebrations May Boost Sales of Apparel and Home Goods During the winter holidays, consumers are likely looking to make their holiday celebrations meaningful, against the backdrop of an unprecedented year of uncertainty. Small gatherings at home, rather than going out for big parties, are likely to be the mainstay this year, prompting consumers to spend on decking up their house for the festive season. Shoppers may also look to reallocate some of the dollars saved on office clothing on comfortable occasion wear for their at-home gatherings. Shoppers Expect To Buy Electronics Online and Grocery Products In-Store In our October 27 survey, we asked those respondents who said they would shop in-store on either or both Thanksgiving and Black Friday what product categories they expect to browse or purchase. For those who said they would shop online, we asked what product categories they expect to browse or purchase online. We found that greater proportions of shoppers expect to buy electronics and apparel online compared to in-store. Shopping for electronics may not add much value to the physical visit if the shopper is unable to open the product in-store, and trying on clothing in stores could prolong the time spent being exposed to other shoppers or using fitting rooms that have been used by other shoppers—safety remains front of mind for many consumers. Grocery products have a shorter shelf life compared to electronics or clothing, hence shoppers may want to be able to handpick products that are fresh or have longer expiry dates. Our proprietary survey found that:

- 2% of Thanksgiving and Black Friday shoppers expect to buy electronics online, versus 42.2% that expect to buy them in-store.

- 6% expect to buy clothing, footwear and accessories online, versus 44.0% that expect to buy them in-store.

- 4% expect to buy groceries online, while 36.7% expect to buy them in-store.

Base: US respondents aged 18+ who indicated that they would shop online or in-store on Thanksgiving or Black Friday

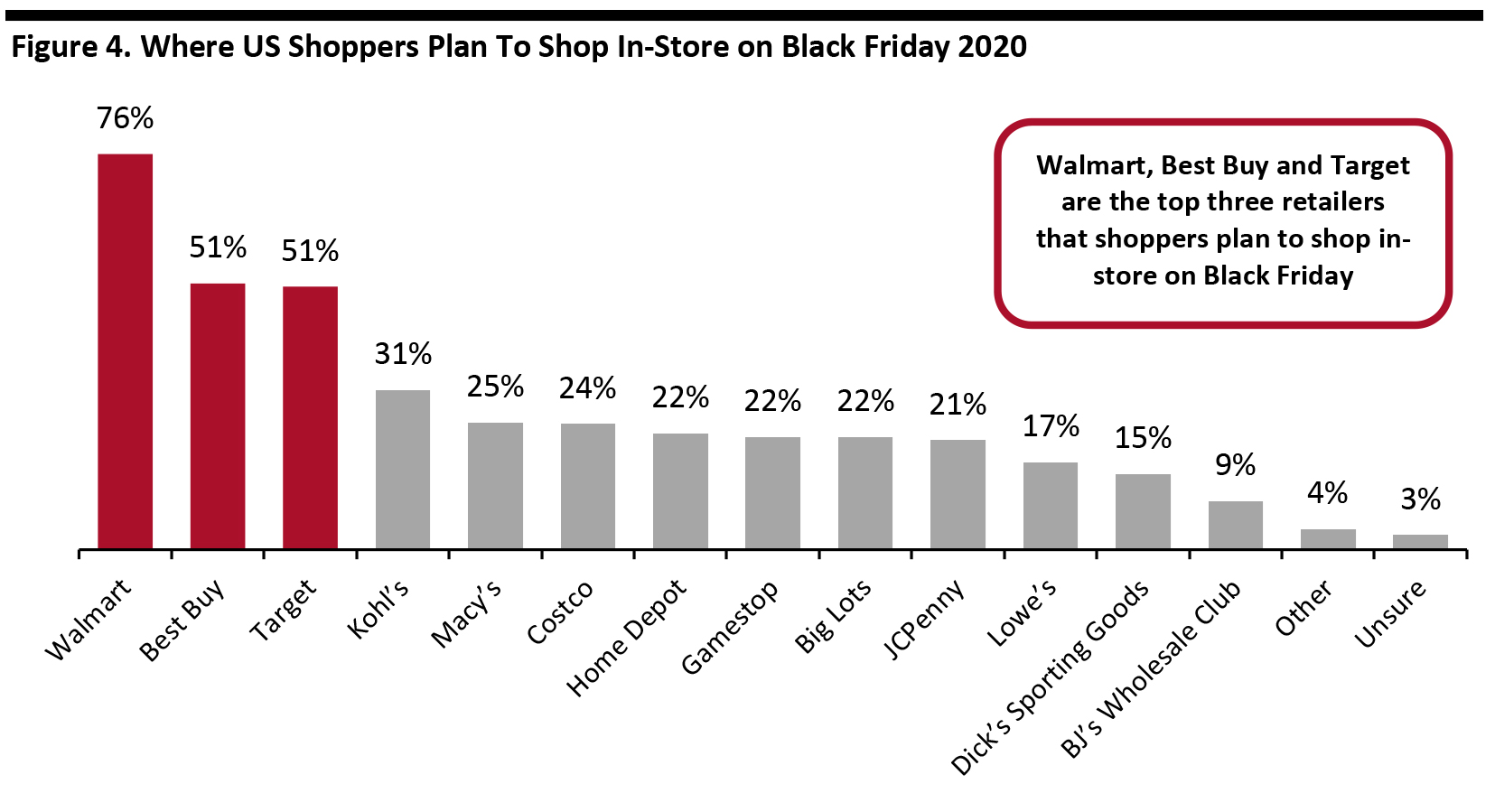

Base: US respondents aged 18+ who indicated that they would shop online or in-store on Thanksgiving or Black Friday Source: Coresight Research [/caption] In-Store Shoppers Will Choose Bigger, Spacious Stores To Maintain Social Distancing Reiterating the emphasis on safety amid Covid-19, shoppers will be wary of coming too close to other shoppers, so may choose to visit large stores with generously spaced aisles and shelves. Walmart, Best Buy and Target are the top three retailers that Black Friday shoppers expect to visit, according to a September survey of 2,000 US adults conducted by market research firm Drive Research (see Figure 4). All three retailers are sized to allow shoppers to browse comfortably:

- Walmart’s average store size for a Supercenter is 182,000 square feet, while its smaller-format Neighborhood Market stores are about 38,000 square feet.

- US Best Buy stores are about 39,000 square feet on average.

- Target’s larger stores span about 130,000 square feet on average, while the smaller stores are about 40,000 square feet.

Base: 2,000 US respondents aged 18+

Base: 2,000 US respondents aged 18+ Source: Drive Research [/caption]

Impact of Behavioral Changes on Future Black Fridays

We think that shoppers will want future Black Fridays to be similar to this year in the following ways:- Deals spread out over a longer period rather than a single day.

- Specific deals allocated to specific days of the week or month, to be able to browse and shop comfortably.

- Promotions available online so that consumers can avoid crowds and leverage order-collection services such as curbside pickup.

- Beginning holiday sales early: Retailers are running Black Friday sales for the whole month of November, with Amazon having kicked off its “Holiday Dash” deals on October 26, and BJ’s Wholesale Club, Home Depot, Sam’s Club, Target and Walmart beginning their deals in late October or early November. Dollar General will run a “One-Day-Only Early Holiday Savings” event on November 13, with deals on holiday décor, health and beauty, and food.

- Starting sales on online channels first and then in stores: Retailers such as Walmart are launching Black Friday deals online first, followed by in-store deals a few days later, thus encouraging consumers to shop online.

- Allocating specific days of sales for specific deals or categories: Retailers are taking various approaches to spread out holiday deals across the month and for specific categories. For example, BJ’s Wholesale Club is offering “Early Bird Savings: November 5–30, 2020” during which shoppers can avail deals on mattresses, bedroom sets, toys and fitness equipment, while stocks last. The company is running further deals through its “Black Friday Savings” event during November 20–30, 2020 on large kitchen appliances, tablets and laptops, and more deals during its “Cyber Week” on November 30–December 6, 2020. Walmart is running three events, starting November 4, with the focus of the first two on electronics and the third on toys, home, seasonal decor and apparel.

- Implementing in-store shopping safety measures: From waiting lines outside stores to contactless checkout, retailers have implemented measures to help consumers shop safely. Target is allowing shoppers to reserve their spot in line online; customers receive a text when it is their turn to enter a store. The company has rolled out over 1,000 additional MyCheckout devices to help staff process checkouts anywhere in-store and reduce chances of customers lining up at checkout.

- Focusing on hiring for fulfillment, distribution and collection roles: A number of retailers have focused their seasonal hires on fulfillment center roles this holiday season. Nordstrom is hiring 22,000 personnel for its fulfillment and distribution centers as well as its stores. Walmart is hiring 20,000 seasonal staff at its fulfillment centers. Target said it is hiring more seasonal staff at its distribution centers than last year to manage products sent to stores, as well as store staff, as it looks to ramp up its curbside- and store-pickup capacity.

What We Think

This year’s Black Friday will not just bear the mark of the coronavirus crisis, as all holiday shopping events have so far, but will also be displaced as “the” start of holiday shopping. Recognizing consumers’ preference to spread out shopping or shift seasonal shopping online, retailers have begun their holiday deals early, ramped up contact-light shopping services and implemented safety measures in stores. Implications for Brands/Retailers- Retailers must prepare their technological infrastructure to handle traffic surges to their websites as consumers increasingly shift to e-commerce.

- Retailers could look to provide deals and offers exclusively to online shoppers to help reduce crowds in stores and encourage consumers to shop online.

- Retailers should look to inform shoppers of store traffic in advance to help ease crowding and long waiting lines outside stores.

- Technology vendors should look to help retailers further adopt supply chain and delivery technology, as retailers expect a surge in online shopping like never before.