What’s the Story?

We count down to the holiday season with a 12-week series focused on the data, trends and observations surrounding the end-of-year peak. In the fifth week of the series, we look at Thanksgiving, which is a major online and offline shopping day. Thanksgiving is likely to be markedly different in 2020, due to consumers hosting smaller parties for dinner and shopping online rather than in stores, with many stores closing for the holiday this year.

Why It Matters

Although it is a time for families to spend time together, Thanksgiving Day has typically been a major shopping holiday in-store and online, since most people have the day off work. It also marks the beginning of the home stretch of the holiday shopping season.

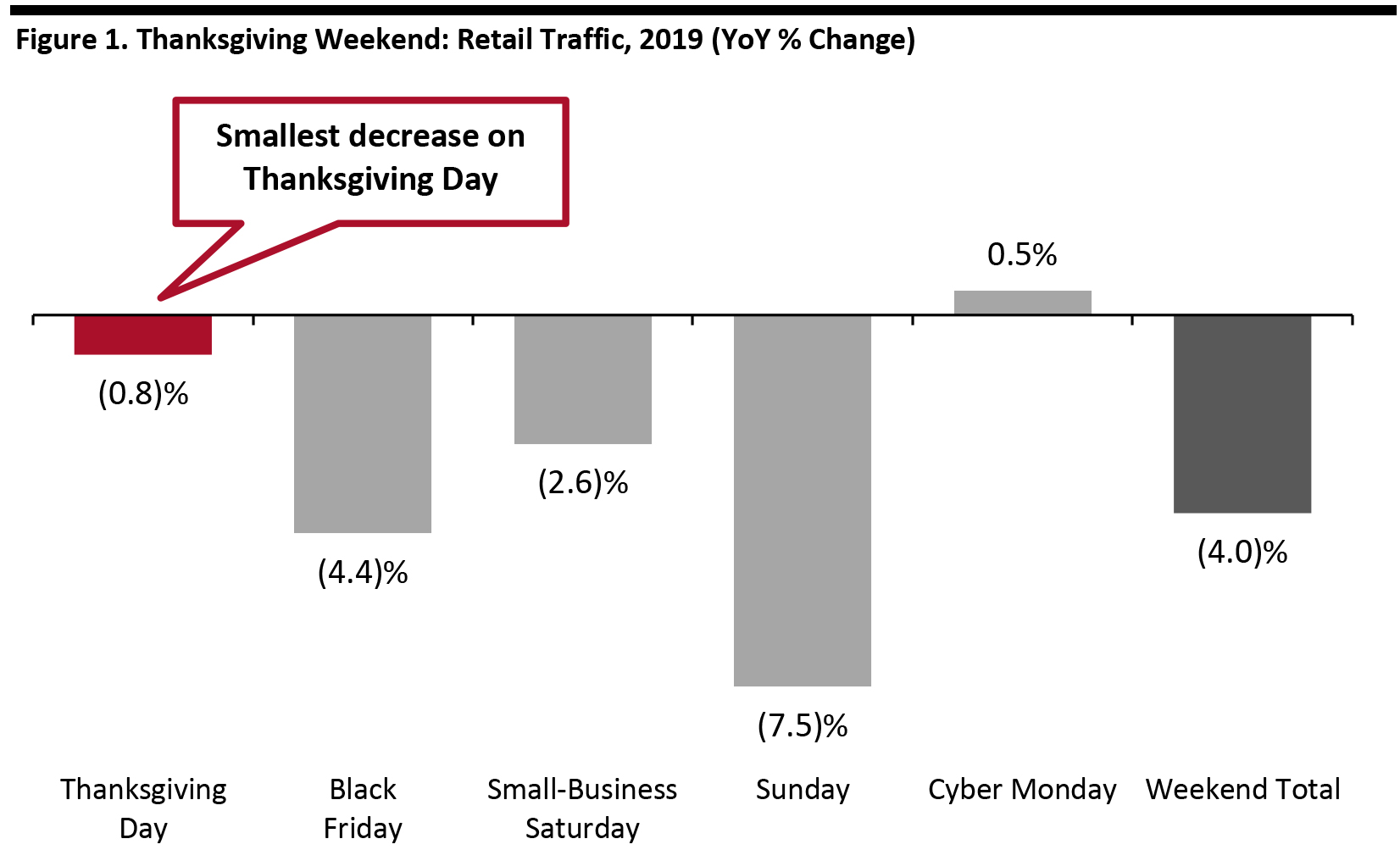

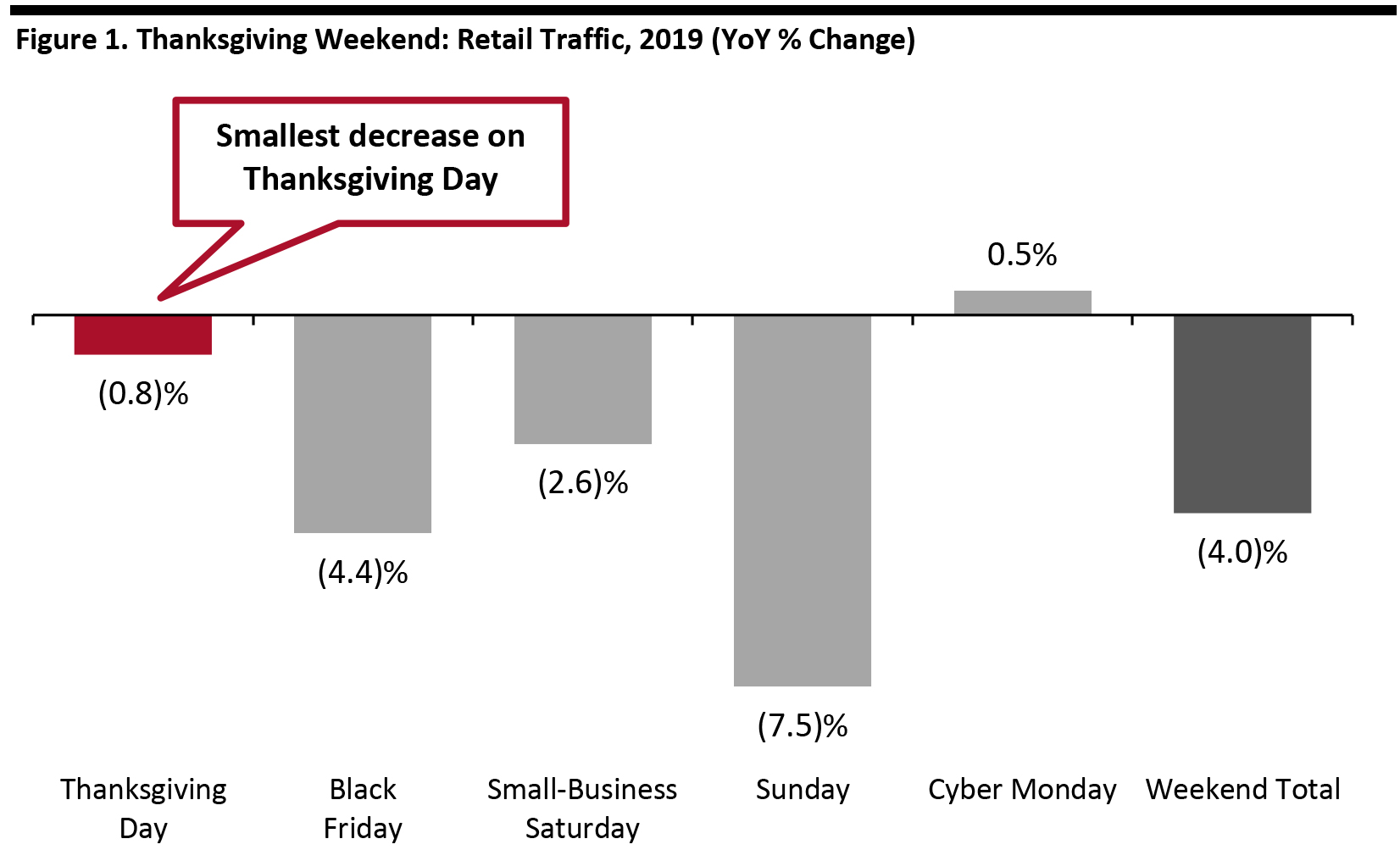

Figure 1 shows retail traffic changes for the days surrounding Thanksgiving in 2019. Although traffic for most days and the overall holiday weekend were down (except Cyber Monday), we see that the decline was the smallest for Thanksgiving Day, making it one of the most important in-store shopping days of the holiday weekend.

[caption id="attachment_118204" align="aligncenter" width="700"]

Source: Sensormatic Solutions

Source: Sensormatic Solutions[/caption]

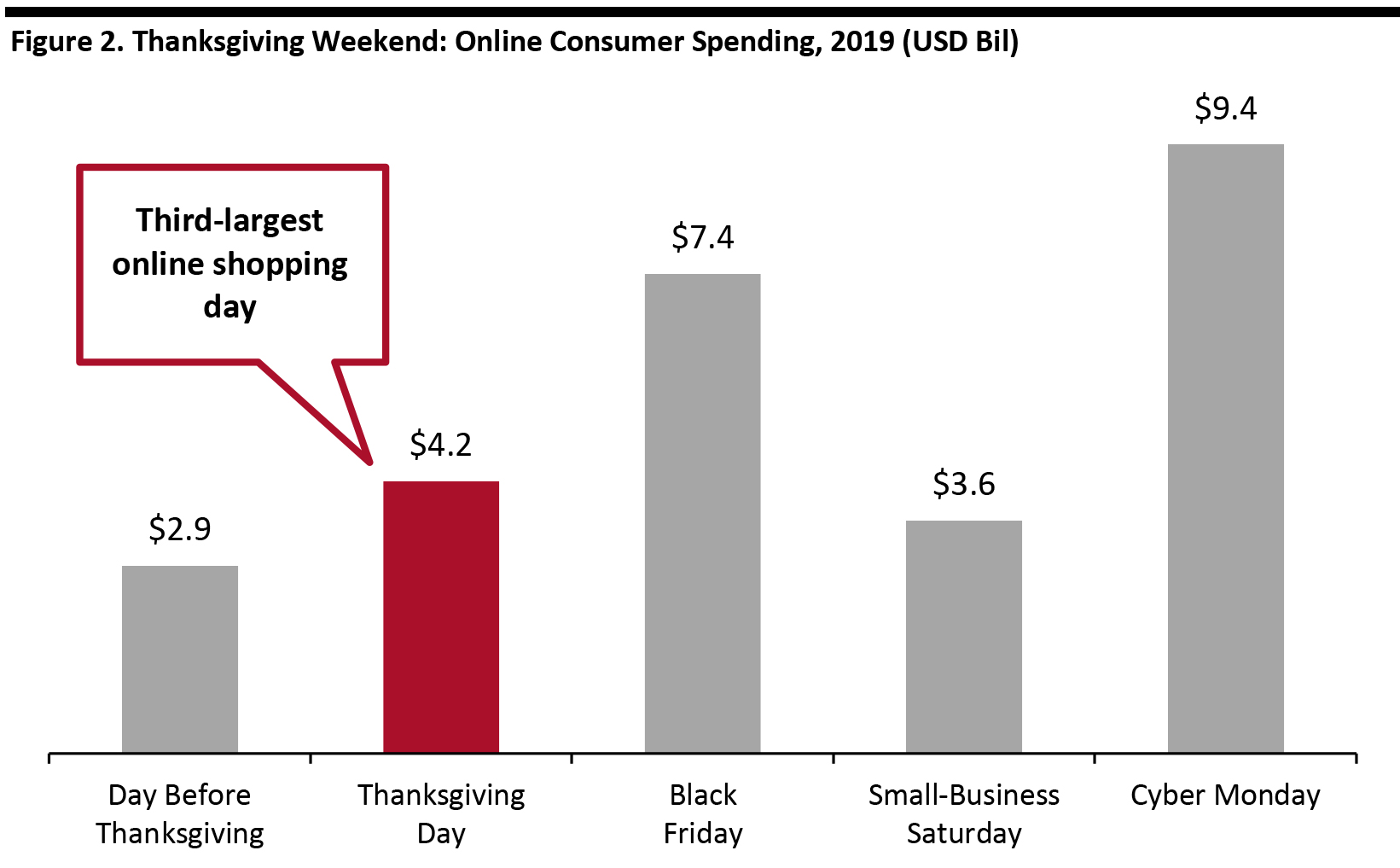

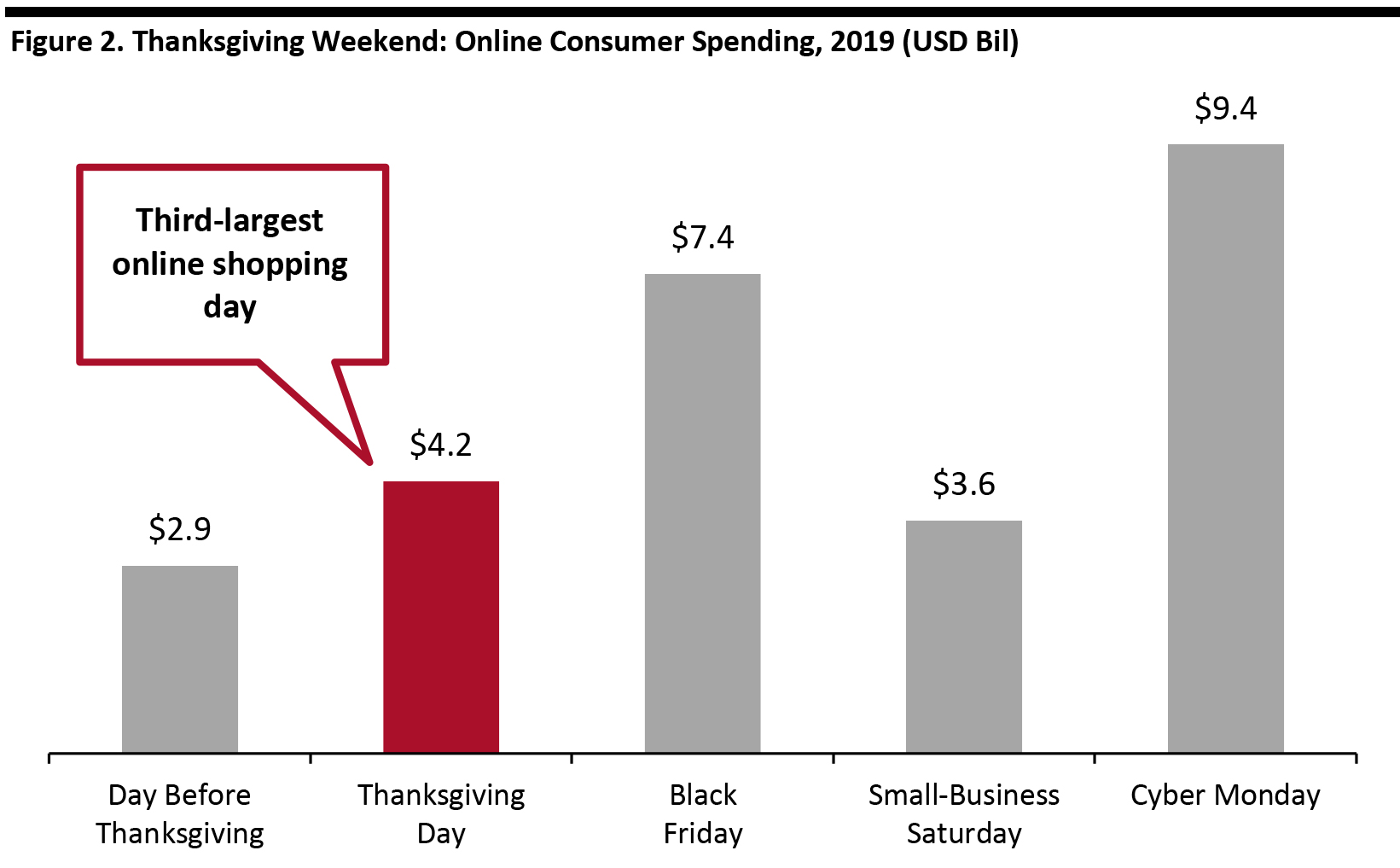

Looking at online shopping in Figure 2, we see that Thanksgiving Day was the third-largest day of the holiday weekend last year.

[caption id="attachment_118205" align="aligncenter" width="700"]

Source: Adobe

Source: Adobe[/caption]

Thanksgiving Preview: In Detail

US Thanksgiving always falls on the third Thursday of November, on November 26 this year. While the holiday shopping season encompasses November and December (and perhaps October this year), the period after Thanksgiving includes blockbuster shopping days such as Black Friday, Cyber Monday and Small-Business Saturday.

In-Store Shopping

This year, in-store shopping is likely to be subdued due to consumer safety concerns and several retailers closing on Thanksgiving Day, in contrast to prior years.

Last year, 39.6 million respondents planned to shop on Thanksgiving Day (up from 35.0 million in 2018), according to the NRF's Annual November Holiday Consumer Survey, conducted by Prosper Insights & Analytics.

This year, US store traffic is likely to continue to be down significantly during the holidays, following the year-to-date trend, as shown in our September 2020 US Retail Traffic and In-Store Metrics report. A large number of major retailers are closing stores on Thanksgiving Day, suggesting a much sharper total traffic decline but also that the implications of a total traffic decline on that day are irrelevant to many retailers.

Declines in store traffic have moderated over the past five months, yet traffic was down 34.1% year over year in September, versus down 40.8% in August, according to RetailNext. Extrapolating this trend and considering consumer health concerns, the decline in traffic this year is likely to be much greater than last year.

Either due to customer/employee safety concerns or expectations of soft demand, many retailers have announced that they will be closed on Thanksgiving Day 2020, including Best Buy, Home Depot, JCPenney, Lowe’s, Macy’s, Target and Walmart. This marks the first time that Walmart has closed on Thanksgiving Day in 30 years.

A more extensive list of retailers’ Thanksgiving and Black Friday operating plans is included in the Coresight Research US Holiday Retail 2020 Databank, which also includes data around holiday hiring and consumer shopping and spending expectations.

Even for stores that will remain open, consumers are still skittish about entering physical stores, according to our survey of US consumers, conducted in September. Among holiday shoppers:

- 29.3% expect to shop from fewer stores to reduce visits to public places.

- 24.9% expect to shift some or all spending to e-commerce.

Sensormatic Solutions’ ShopperTrak traffic analytics division predicts that Black Friday (November 27) will be the number-one busiest shopping day in the US and that the Saturday after Thanksgiving (November 28) will be the seventh busiest shopping day this season.

Of the shoppers planning to visit stores, the Coresight Research survey found the following:

- 22.1% expect to use curbside pickup services.

- 20.8% are more likely to purchase from retailers that follow strict in-store safety precautions.

- 19.8% expect to use in-store pickup services for some online purchases.

E-Commerce Shopping

As shown in Figure 2, Thanksgiving Day is a major online shopping day. In 2019, US consumers spent $4.2 billion online on Thanksgiving, up 14.5% from the prior year, as part of $142.5 billion in total online holiday spending (up 13.1%), according to Adobe. Building on the growth of e-commerce last year, we are likely to see further acceleration this year due to the greater adoption of e-commerce in general amid the Covid-19 pandemic, as well as consumer safety concerns about entering stores, and major stores staying closed. We expect the acceleration in Thanksgiving e-commerce to contribute to our estimate of 33.5% growth in holiday retail sales, as published in our Holiday 2020: US Retail Outlook.

Shifts in Product Mix Toward At-Home Food Consumption

Consumer reluctance to enter restaurants, visit public spaces and travel is likely to dramatically change the hosting of Thanksgiving dinners. Consumers are more likely to have dinner at home, rather than traveling long distances or visiting friends. We have seen large shifts in consumer demand earlier this year result in shortages of key items.

Coresight Research estimates that food retail sales will increase by 9.0–9.5% during the holiday quarter, driven by a 60+% year increase in online food purchases. Food will contribute 2.4 percentage points to our 5% growth estimate for total retail.

Will There Be a “Big Bird” Problem?

The Thanksgiving turkey is the centerpiece of the holiday celebration. With people electing to eat at home, we are likely to see increased demand for more, smaller turkeys that are suitable for smaller family gatherings—potentially resulting in a retail surplus of larger turkeys.

According to a recent survey of US consumers by market research firm Numerator, 68% of respondents said that they plan to celebrate Thanksgiving differently this year (such as with immediate family or in smaller groups). Consumer research conducted by Butterball and Hormel Foods—which together typically sell more than 40 million turkeys for Thanksgiving—also indicates that smaller gatherings will replace larger ones, as reported by The New York Times. Moreover, 30% of respondents stated that they plan to host only their immediate family for dinner, compared to 18% last year.

The number of turkeys raised in the US is forecast at 222 million in 2020, down 3% from 2019, and ready-to-cook turkey production during October to December this year is estimated at 1.45 billion pounds, according to the US Department of Agriculture.

For this year’s Thanksgiving celebrations, consumer demand is shifting toward smaller turkeys for smaller gatherings, possibly creating a surplus of larger turkeys and thus creating a “big bird” problem.

What We Think

Thanksgiving 2020, like everything thus far this year, is likely to be different. Due to consumers’ reluctance to enter stores and public spaces, they are even more likely to shop online on that key shopping day. Retailers have recognized this preference, and many are giving health-sensitive consumers and employees a break on Thanksgiving, keeping stores closed in contrast to prior years.

Implications for Brands/Retailers

- Retailers need to prepare infrastructure and inventory for surges in online shopping on Thanksgiving Day, as consumers stay home and stores are closed.

- Although retail traffic was down year over year in 2019, Thanksgiving Day was the least weak of the holiday weekend (except for Cyber Monday), so retailers that remain open this year could still benefit from traffic.

- Many retailers are prudently building safety stock of holiday, seasonal, and health- and safety-related merchandise to handle surges in demand.

- There will likely be a demand surge in Thanksgiving-related products, particularly small birds suited for small family gatherings, as consumers avoid travel and large gatherings, preferring instead to celebrate at home.

Implications for Technology Vendors

- Technology vendors can help retailers increase their online capacity to accommodate an estimated 33.5% increase in holiday sales this year (Coresight Research estimate).

- Vendors can also help retailers enhance supply chain flexibility so as to accommodate future expected and unexpected shifts in demand.

Other Coresight Research Coverage

For more information on our estimations for the 2020 holiday season, please see our report Holiday 2020: US Retail Outlook—Five Reasons Why We’re Looking for 5% Growth.

Source: Sensormatic Solutions[/caption]

Looking at online shopping in Figure 2, we see that Thanksgiving Day was the third-largest day of the holiday weekend last year.

[caption id="attachment_118205" align="aligncenter" width="700"]

Source: Sensormatic Solutions[/caption]

Looking at online shopping in Figure 2, we see that Thanksgiving Day was the third-largest day of the holiday weekend last year.

[caption id="attachment_118205" align="aligncenter" width="700"] Source: Adobe[/caption]

Source: Adobe[/caption]