DIpil Das

What’s the Story?

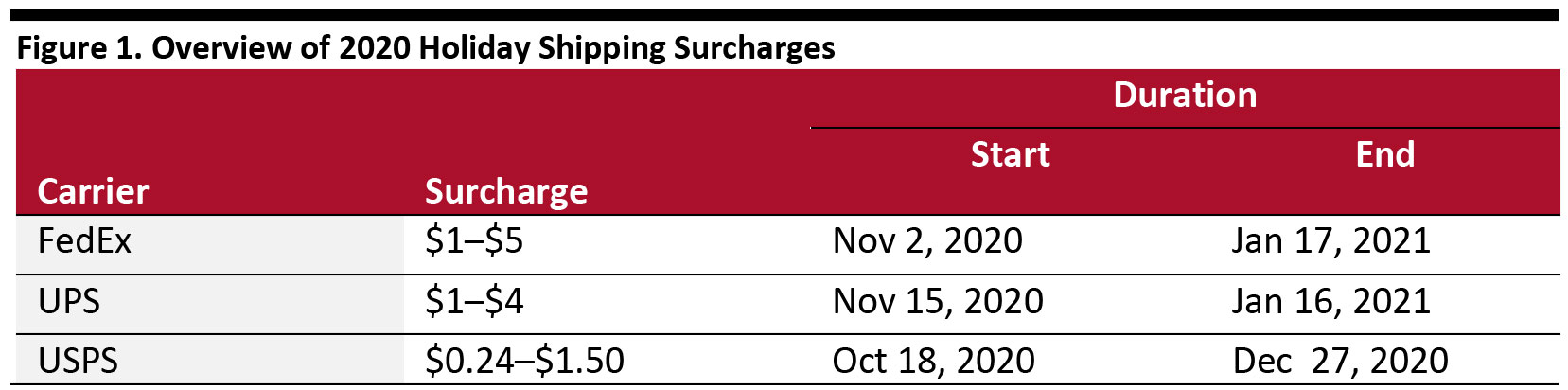

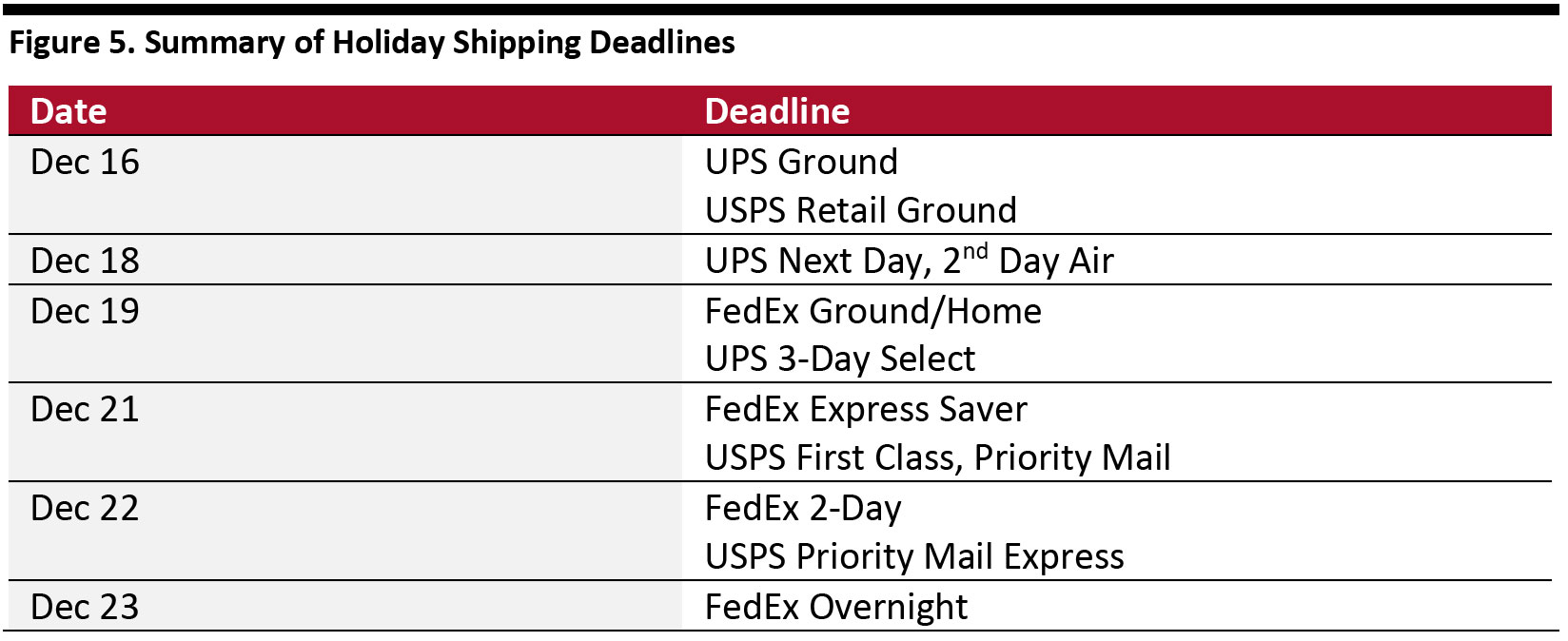

We count down to the holiday season with a 12-week series focused on the data, trends and observations surrounding the end-of-year peak. In the third week of the series, we discuss issues regarding shipping in the last mile. Shippers have seen surges in residential package delivery alongside the surge in US e-commerce sales. FedEx and UPS have both added capacity and seem confident that the peak shopping (and shipping) season will provide them with high-quality business. This is partly due to the implementation of holiday shipping surcharges, which run between $0.24 and $5.00 per parcel and apply within the timeframe of mid-October 2020 to mid-January 2021. Given the greater number of variables this year than last, consumers are well-advised to order early—as emphasized by Target’s message to its customers to start shopping in October. Ground-shipping deadlines fall a week before December 25, and the last day for overnight shipping appears to be December 23.Why It Matters

The shape and scale of consumer demand during the holiday peak is less certain than ever. Our holiday coverage aims to offer directional guidance. Despite the massive disruption from Covid-19, the holidays will still happen, and although half of consumers surveyed plan to spend less this holiday season according to Coresight Research’s August 17 survey, they will still spend. The holidays represent the largest shopping event of the year, and the NRF estimates that November and December typically account for around 20% of a retailer’s annual sales. Consumers will largely be shopping online, since 53.4% of consumers surveyed in our September 15 survey said that they were currently avoiding shopping centers and malls, though this figure has declined by 13 percentage points versus the peak on July 22. Coresight Research estimates that US online retail sales will climb by around one-third year over year in the holiday quarter, to represent around 21.5% of all US retail sales. Amid strong consumer demand, shipping capacity constraints are likely to be one inhibitor of growth.Holiday Shipping: In Detail

Expecting a busy holiday peak season centered on residential delivery, the three largest carriers have added capacity for the US system while levying seasonal shipping surcharges. Possibly in light of the US Postal Service’s (USPS) woes, Amazon is increasingly bringing delivery in-house through a network of independent delivery companies with trucks bearing the Amazon logo. Holiday Shipping Surcharges The big three carriers—FedEx, UPS and the USPS—have announced shipping surcharges this holiday season, which range from $0.24–$4.00 per parcel, as outlined below in Figure 1. The FedEx charges vary based on a peaking factor and whether they are passed on to USPS for final delivery (via its SmartPost service.) It is notable that the FedEx and UPS holiday surcharge periods extend into 2021, likely covering returns. [caption id="attachment_117484" align="aligncenter" width="700"] Source: Company reports[/caption]

Although UPS and FedEx did not levy per-package residential delivery surcharges for holiday 2019, the carriers did require fees for large shipments and those requiring additional handling. In 2019, FedEx proclaimed having required no holiday shipping surcharges for three years in a row. In 2018, UPS applied a holiday surcharge of $0.28 per parcel for ground shipments and $0.99 for air shipments.

FedEx

FedEx reported 13% revenue growth in its fiscal first quarter, driven by a 36% increase in ground shipping. B2B shipping volumes steadily improved over the summer, with volume in August up year over year.

The carrier’s management team highlighted two trends that are impacting its industry:

Source: Company reports[/caption]

Although UPS and FedEx did not levy per-package residential delivery surcharges for holiday 2019, the carriers did require fees for large shipments and those requiring additional handling. In 2019, FedEx proclaimed having required no holiday shipping surcharges for three years in a row. In 2018, UPS applied a holiday surcharge of $0.28 per parcel for ground shipments and $0.99 for air shipments.

FedEx

FedEx reported 13% revenue growth in its fiscal first quarter, driven by a 36% increase in ground shipping. B2B shipping volumes steadily improved over the summer, with volume in August up year over year.

The carrier’s management team highlighted two trends that are impacting its industry:

- Air cargo capacity is dramatically reduced due to lower commercial airline capacity, with reductions to the Europe-to-Asia, transatlantic and transpacific lanes.

- Accelerations in e-commerce, with the US domestic market expected to hit 100 million packages per day by 2023, as compared to the previous projections of 2026.

- E-commerce volumes are expected to remain elevated, and the peak will set new records. To accommodate the surge in demand, FedEx is adding 70,000 positions, expanding facilities and increasing operations to seven days a week.

- FedEx is implementing peak shipping surcharges that spread delivery costs to users that take up the largest proportion of capacity. As shown in Figure 1 above, this will range from $1–$5 per package.

Source: Company reports[/caption]

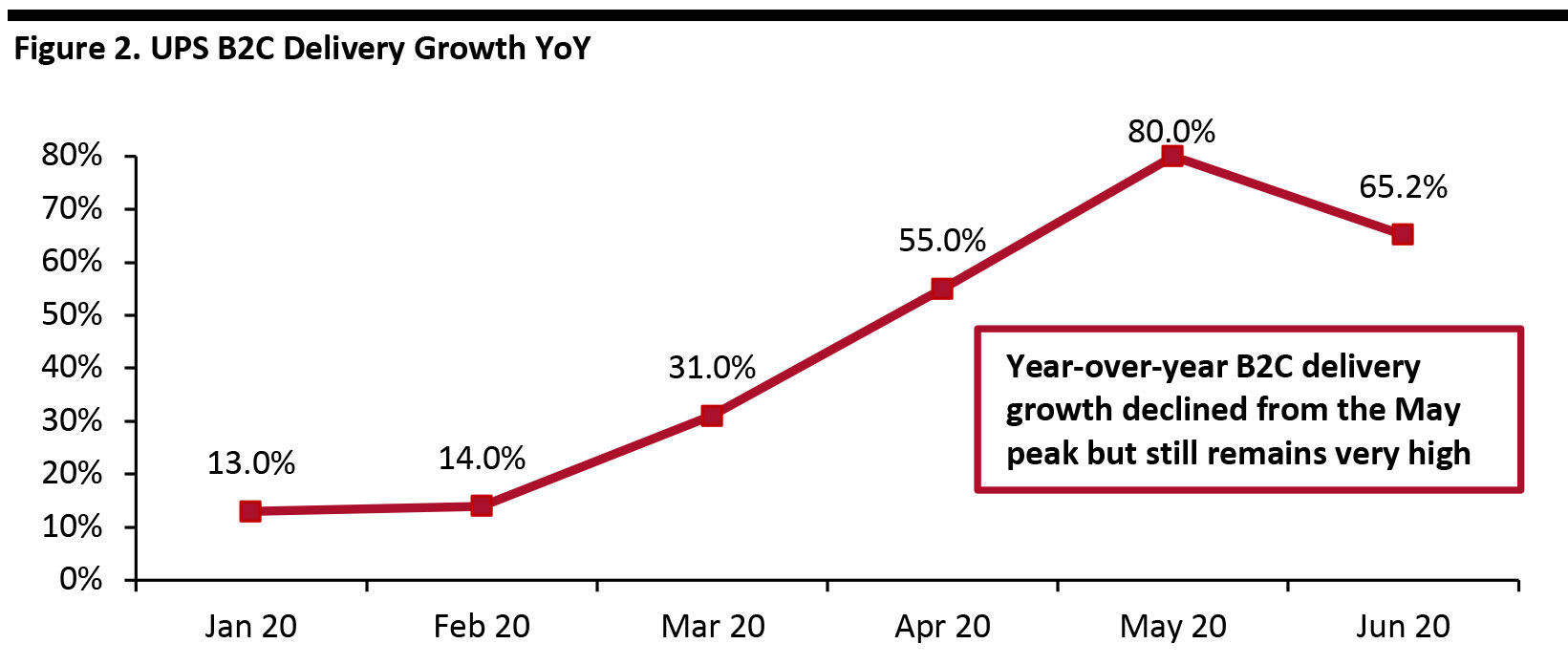

In its second-quarter earnings call on July 30, UPS management commented that the carrier had spent three years increasing capacity and automation, and capacity utilization in the US system stood at 85%. In the second quarter, the company met demand by flying 635 extra flights.

Looking towards the holidays, UPS also commented that its management approach was for quality, not quantity. The company’s management expressed confidence in its ability to handle the holiday season and commented that it was managing capacity constraints through pricing, as demonstrated by its $1–$5 per parcel holiday surcharges (see Figure 1 above.)

USPS

In line with other carriers, the USPS reported a 3.2% revenue increase in its second quarter ended June 30—driven by a 53.6% increase in Shipping and Packages. USPS reported delivery of 708 million pieces, an increase of 49.9%. The agency reported a net loss of $748 million in the quarter, including a controllable loss (excluding certain employee-related expenses) of $387 million.

In 2019 Amazon was the USPS’s largest customer, accounting for $3.9 billion in revenue, $1.6 billion in profit and 30% of its total volume, according to fact-checking statements obtained via a Freedom of Information Act request, filed by watchdog group American Oversight. Amazon has expressed concern about pricing uncertainty and the viability of USPS as a shipping partner, likely contributing to the company’s move toward bringing more delivery in-house.

The USPS is implementing a holiday surcharge of $1–$5 per package, as shown in Figure 1 above.

Amazon: Bringing Delivery In-House

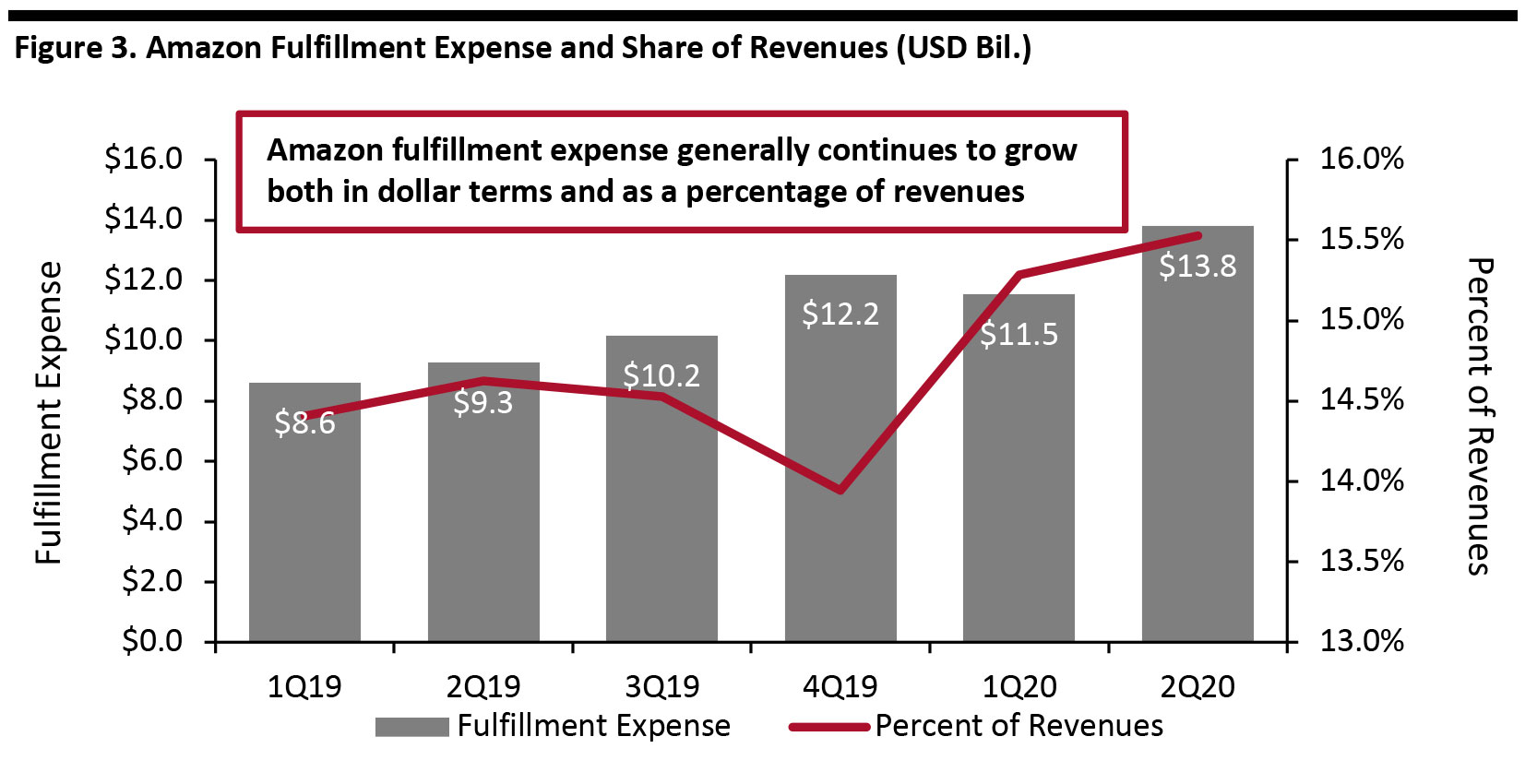

Amazon is delivering more and more of its own packages, in an apparent effort to reduce its fulfillment costs by eliminating outsourced delivery services. This is for good reason—in Figure 3 below we see that Amazon’s fulfillment expense is growing in dollar terms as well as a percentage of revenues, putting pressure on margins.

[caption id="attachment_117486" align="aligncenter" width="700"]

Source: Company reports[/caption]

In its second-quarter earnings call on July 30, UPS management commented that the carrier had spent three years increasing capacity and automation, and capacity utilization in the US system stood at 85%. In the second quarter, the company met demand by flying 635 extra flights.

Looking towards the holidays, UPS also commented that its management approach was for quality, not quantity. The company’s management expressed confidence in its ability to handle the holiday season and commented that it was managing capacity constraints through pricing, as demonstrated by its $1–$5 per parcel holiday surcharges (see Figure 1 above.)

USPS

In line with other carriers, the USPS reported a 3.2% revenue increase in its second quarter ended June 30—driven by a 53.6% increase in Shipping and Packages. USPS reported delivery of 708 million pieces, an increase of 49.9%. The agency reported a net loss of $748 million in the quarter, including a controllable loss (excluding certain employee-related expenses) of $387 million.

In 2019 Amazon was the USPS’s largest customer, accounting for $3.9 billion in revenue, $1.6 billion in profit and 30% of its total volume, according to fact-checking statements obtained via a Freedom of Information Act request, filed by watchdog group American Oversight. Amazon has expressed concern about pricing uncertainty and the viability of USPS as a shipping partner, likely contributing to the company’s move toward bringing more delivery in-house.

The USPS is implementing a holiday surcharge of $1–$5 per package, as shown in Figure 1 above.

Amazon: Bringing Delivery In-House

Amazon is delivering more and more of its own packages, in an apparent effort to reduce its fulfillment costs by eliminating outsourced delivery services. This is for good reason—in Figure 3 below we see that Amazon’s fulfillment expense is growing in dollar terms as well as a percentage of revenues, putting pressure on margins.

[caption id="attachment_117486" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

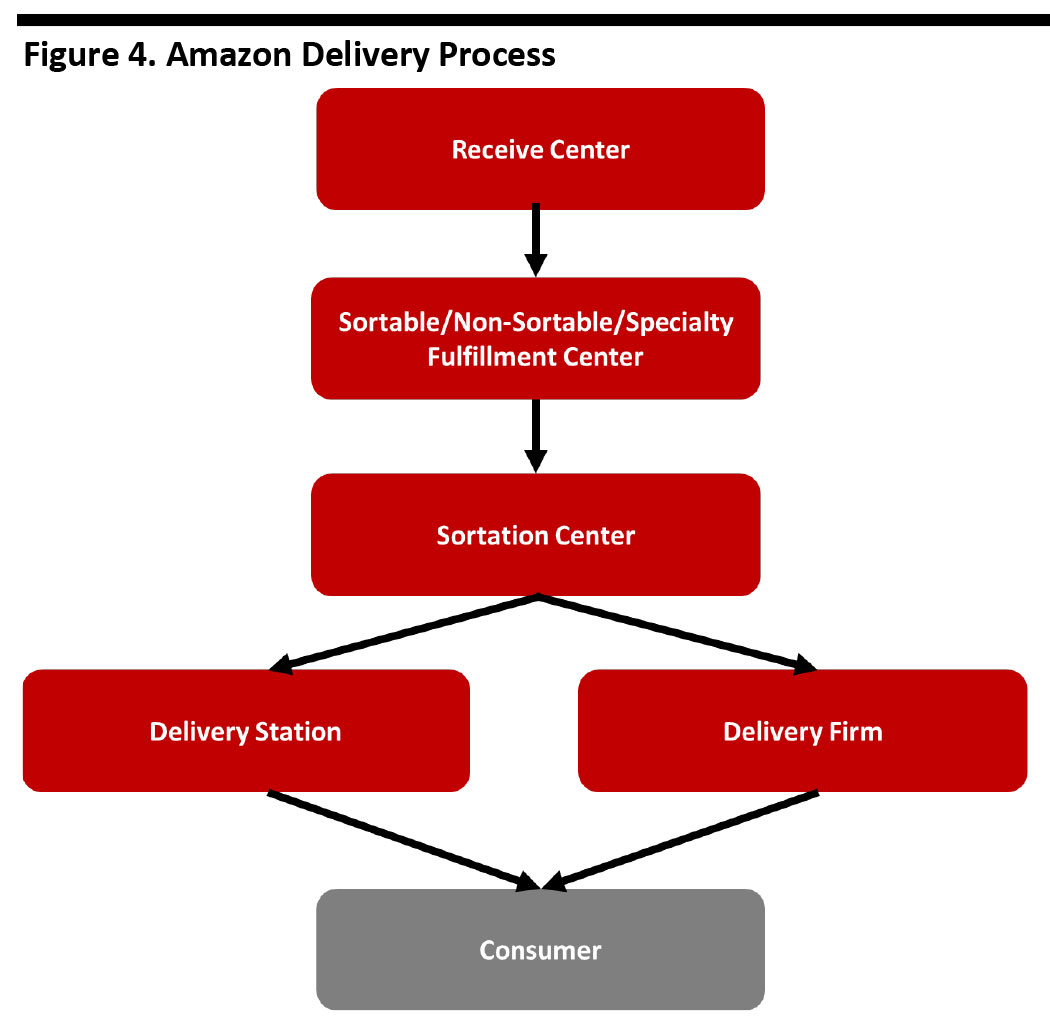

Amazon now delivers 67% of its own packages directly to consumers, up from 50% in 2019, according to consulting firm MWPVL International. The firm estimates that Amazon in-house delivery could reach 85% of capacity by 2023. The stages in Amazon’s delivery process are illustrated in Figure 4 below.

[caption id="attachment_117488" align="aligncenter" width="480"]

Source: Company reports/Coresight Research[/caption]

Amazon now delivers 67% of its own packages directly to consumers, up from 50% in 2019, according to consulting firm MWPVL International. The firm estimates that Amazon in-house delivery could reach 85% of capacity by 2023. The stages in Amazon’s delivery process are illustrated in Figure 4 below.

[caption id="attachment_117488" align="aligncenter" width="480"] Source: Company reports/Coresight Research[/caption]

Amazon started offering funding to delivery entrepreneurs in summer 2018—beginning the move toward carrying out its own delivery with just one van. Delivery vans bearing the Amazon logo are now ubiquitous throughout residential neighborhoods in the US.

[caption id="attachment_117489" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Amazon started offering funding to delivery entrepreneurs in summer 2018—beginning the move toward carrying out its own delivery with just one van. Delivery vans bearing the Amazon logo are now ubiquitous throughout residential neighborhoods in the US.

[caption id="attachment_117489" align="aligncenter" width="700"] Amazon delivery van

Amazon delivery van Source: Coresight Research [/caption] To help speed up delivery, Amazon is planning to open 1,000 small delivery hubs in cities and suburban areas around the US, bringing its total to 1,500, according to Bloomberg. In addition, Amazon is also hiring aggressively—in September it announced plans to hire another 100,000 full- and part-time operations employees, in addition to the 175,000 employees it has hired since the start of the pandemic. Amazon is also expanding its fleet of airplanes. In June, the company announced its lease of 12 Boeing 757-300 converted cargo planes, with one joining its fleet of 70 aircraft in May and the remaining 11 to be added in 2021. Holiday Shipping Deadlines Christmas falls on a Friday in 2020, which offers four business days preceding the holiday for delivery. Ground-delivery deadlines fall at least a week before, and express-shipping cutoffs fall before December 24, as shown in the table below. [caption id="attachment_117490" align="aligncenter" width="700"]

Source: Company reports[/caption]

Source: Company reports[/caption]

What We Think

This is set to be a holiday season like no other in recent memory, with consumers likely ordering more goods online, in addition to current heightened e-commerce demand. Despite carriers’ addition of holiday shipping surcharges, consumers likely cannot wait until the last minute and expect parcels to be delivered on time. Thus, retailers such as Target have encouraged shoppers to start shopping in October. Implications for Brands/Retailers- Brands and retailers may need to take additional measures to ensure that they have adequate holiday inventory, which could cause disruptions in cases where they made conservative holiday orders during the peak of the lockdown.

- Retailers would be well-served to encourage consumers to shop early so as to ensure securing hot holiday merchandise and not be disappointed due to potential shipping issues.

- Brands and retailers will also have to execute fulfillment successfully to accommodate potentially high or variable volumes.

- Vendors of e-commerce and supply-chain software will need to work with retailers, as they did during the lockdown, to ensure that supply-chain platforms are tuned and remain flexible in case of shifts in demand or even shortages.