albert Chan

What’s the Story?

Our The 12 Weeks of Holidays 2021 series counts down to this year’s holiday peak with new thematic research each week. In this report, we discuss early holiday selling trends from October as well as the macro indicators that traditionally impact consumer behavior and retail sales.

Why It Matters

The holiday season is a crucial time of the year for the retail industry: Retailers look to the fourth quarter to be bolstered by holiday sales. In 2020, US holiday-season retail sales (calendar fourth quarter) totaled $1.1 trillion, according to our analysis of US Census Bureau data, up 9.2% year over year—the highest annual growth since 2010 and comprising 28% of total US retail sales. The online channel accounted for 20% of holiday sales, with e-commerce sales having increased by 32.5% year over year, according to the US Census Bureau.

It is nearly two months since our initial holiday projections and time to revisit the macro backdrop. Coresight Research continues to expect a strong, 9%–10% year-over-year increase in total US retail sales for holiday 2021 (October–December quarter). October sales trends indicate that our initial projection for the season is achievable, driven by a consumer return to physical retail and still-strong online sales growth as well. Other macro-indicators remain solid, although consumer sentiment and inflation mar an otherwise rosy outlook.

A Mid-Holiday Macro Update and Review: Coresight Research Analysis

The Holiday Shopping Season Is Off to a Solid Start

October—the first month of the holiday quarter—saw year-over-year sales growth of 10.8%, remaining steady from 10.9% growth in September. (Coresight Research’s measure of core retail sales is the unadjusted year-over-year change, excluding gasoline and automobiles.)

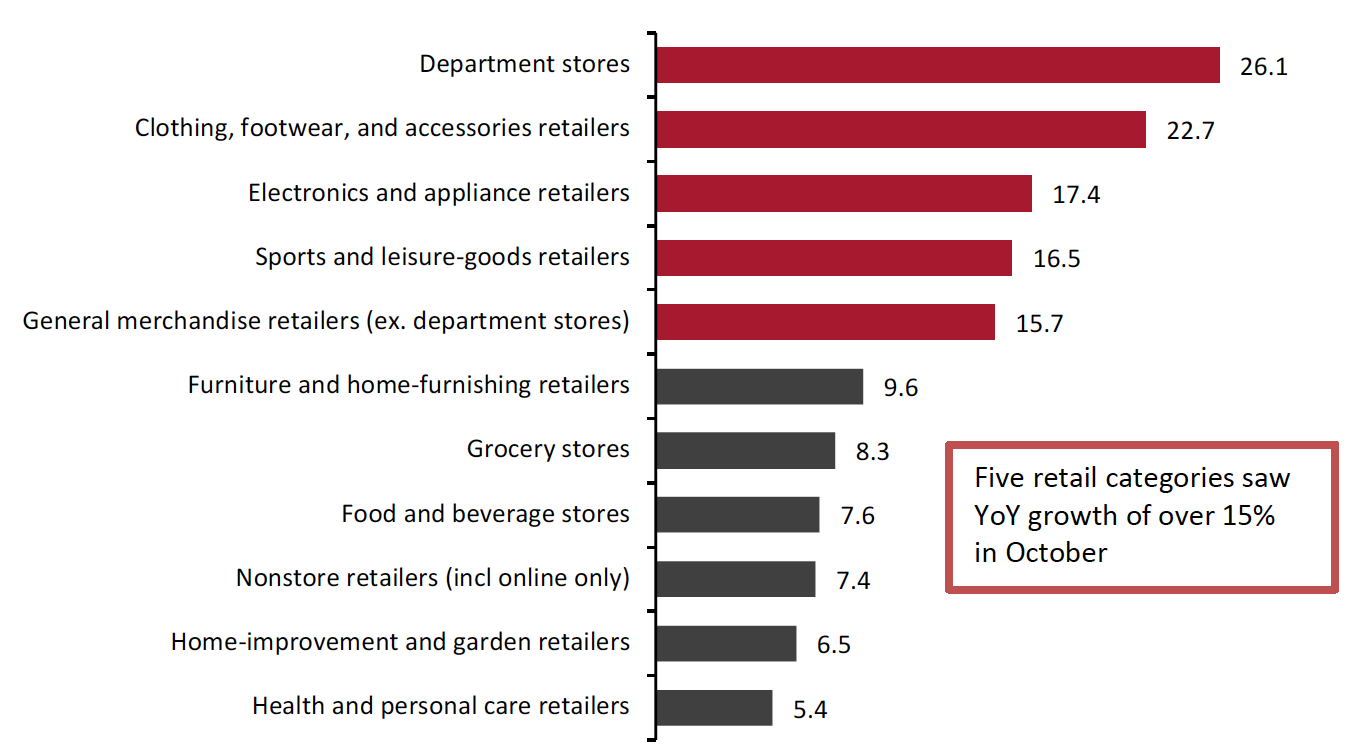

Department stores led the pack with a 26.1% year-over-year gain in October, exhibiting nascent signs of a department store renaissance, or at the very least, consumers returning to physical retail. Clothing, footwear and accessories retailers reported a 22.7% increase; this discretionary category is benefiting from pent-up demand, the need for new sizes and the urge for new fashions (read our holiday outlook for the US apparel sector for more on this). Other discretionary categories that saw high sales growth in October include electronics retailers and sports retailers (see Figure 1).

General merchandise retailers reported a solid mid-teen-percentage gain in October, at 15.7%. Walmart’s recently reported third-quarter sales show a year-over-year increase in US net sales of 9.3%, with US e-commerce up 8.0% during the quarter.

Nonstore retail sales slowed to 7.4% growth in October, as shoppers return to physical retail.

- Read our October 2021: US Retail Sales report, which presents US Census Bureau data in more detail.

Figure 1. US Retail Sales ex. Gasoline and Automobiles: October 2021 (YoY %) [caption id="attachment_136298" align="aligncenter" width="550"]

Source: US Census Bureau/Coresight Research[/caption]

Source: US Census Bureau/Coresight Research[/caption]

On a year-to-date basis versus the same period in 2019 (a two-year stack), sales at department stores rose 3.9% through October, according to recently reported US Census Bureau data, versus a 0.9% gain through August. Similarly clothing, footwear and accessories retailers experienced an acceleration, from a 9.6% two-year year-to-date increase through August 2021, to 11.1% through October. These results attest to a vibrant fashion and apparel market as consumers indulge in new fashions following Covid-19 lockdowns.

Figure 2. US Total Retail Sales ex. Gasoline and Automobiles: Year to Date Through October 2021 (% Change from Two Years Prior)

[caption id="attachment_136299" align="aligncenter" width="550"] Source: US Census Bureau/Coresight Research[/caption]

Source: US Census Bureau/Coresight Research[/caption]

A Balanced Picture of Leading Indicators: Negative Consumer Sentiment Offset by a Reduced Saving Rate

Using sources such as the US Census Bureau, the US Bureau of Economic Analysts (BEA), the US Bureau of Labor Statistics (BLS) and the US Department of Housing and Urban Development (HUD), we look at how key macroeconomic indicators of US retail sales may impact the industry through the holiday quarter.

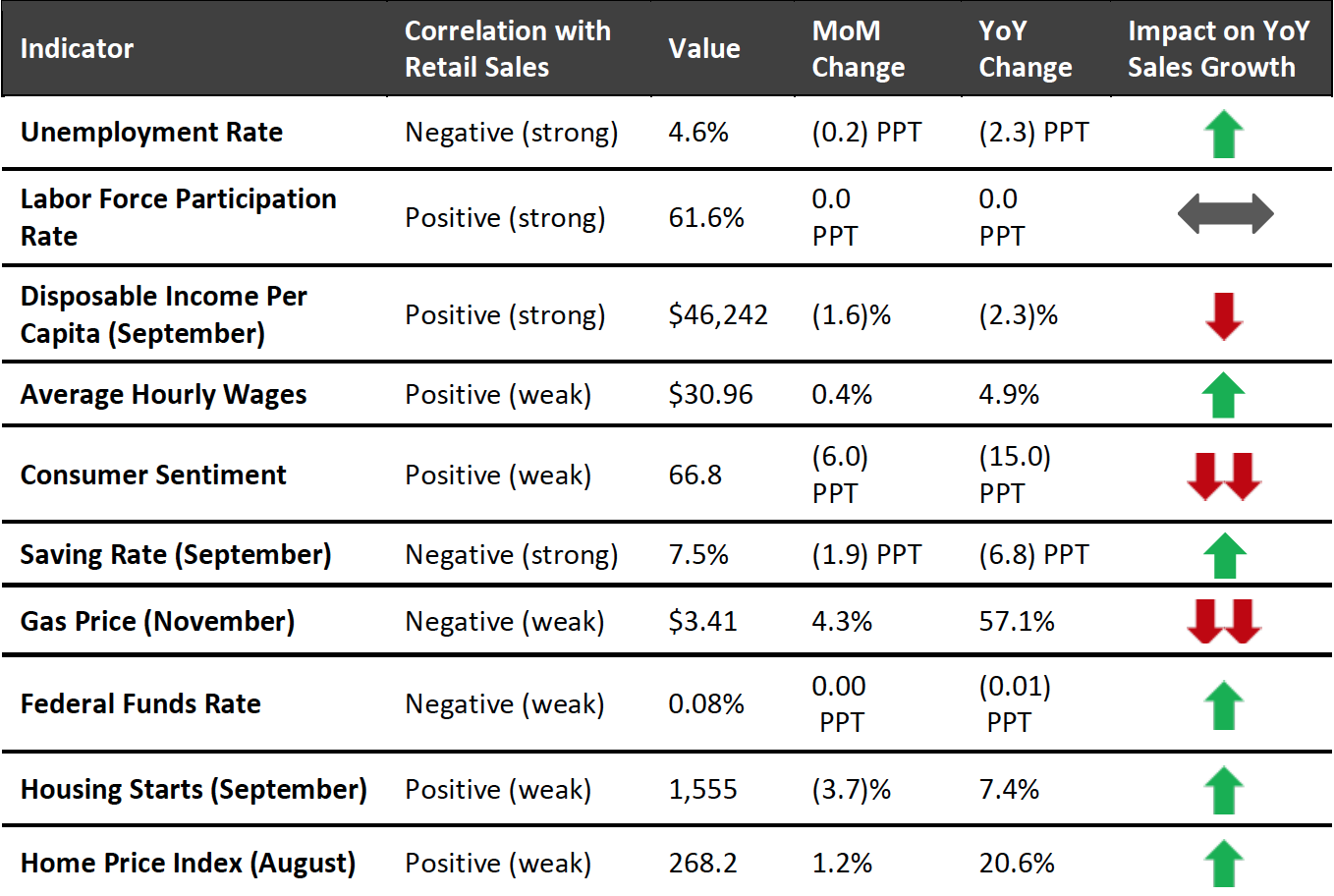

Consumer sentiment fell to its lowest level in 10 years in October 2021, at 66.8, according to the University of Michigan Consumer Sentiment Index. In isolation, this could derail a robust holiday shopping season, but a 4.9% increase in hourly wages, a still-high saving rate of 7.5% (in September, the latest available data), and the wealth effect of the 20.6% increase in the Home Price Index (in August, the latest available data) and the robust stock market returns of the last 12 months point to a solid holiday shopping season.

Covid-19 fatigue could well be driving some portion of the negative consumer sentiment, and Pfizer’s November 5, 2021, announcement that its oral antiviral treatment reduces the risk of hospitalization or fatality by 89% could lift the next sentiment reading.

Since our US holiday outlook report, published on September 21, 2021, unemployment has dropped from 5.2% in September to 4.6% in October. The labor force participation rate is firm at 61.6%. Worker mobility is a positive factor when considering retail sales this holiday, along with the increase in hourly wages.

Gas prices continue to rise, standing at $3.41 in early November, versus $3.18 in early September and up 57.1% year over year. Disposable per capita income, at $46,262, trended down in September from July’s $47,012, but on a year-over-year basis, the decline softened from (3.9)% to (2.3)%. Consumers are accessing their savings to maintain their lifestyles and pay inflationary prices at the pump and for groceries in stores.

We present the most recent data for the leading indicators of US retail sales in Figure 3.

Figure 3. US: Leading Indicators of Retail Sales, as of November 15, 2021

[caption id="attachment_136300" align="aligncenter" width="550"] Latest available data from October unless otherwise indicated

Latest available data from October unless otherwise indicatedSource: BEA/BLS/Federal Reserve Board of Governors/S&P/University of Michigan/US Energy Information Administration/Coresight Research[/caption]

An “IOS” Holiday Season

We have previously outlined our expectations for an “IOS” holiday season this year, meaning one characterized by inflationary pressures, out-of-stock products and consumers spending more time at home. We are seeing current trends reinforce this outlook, as we discuss below.

Inflationary Pressures

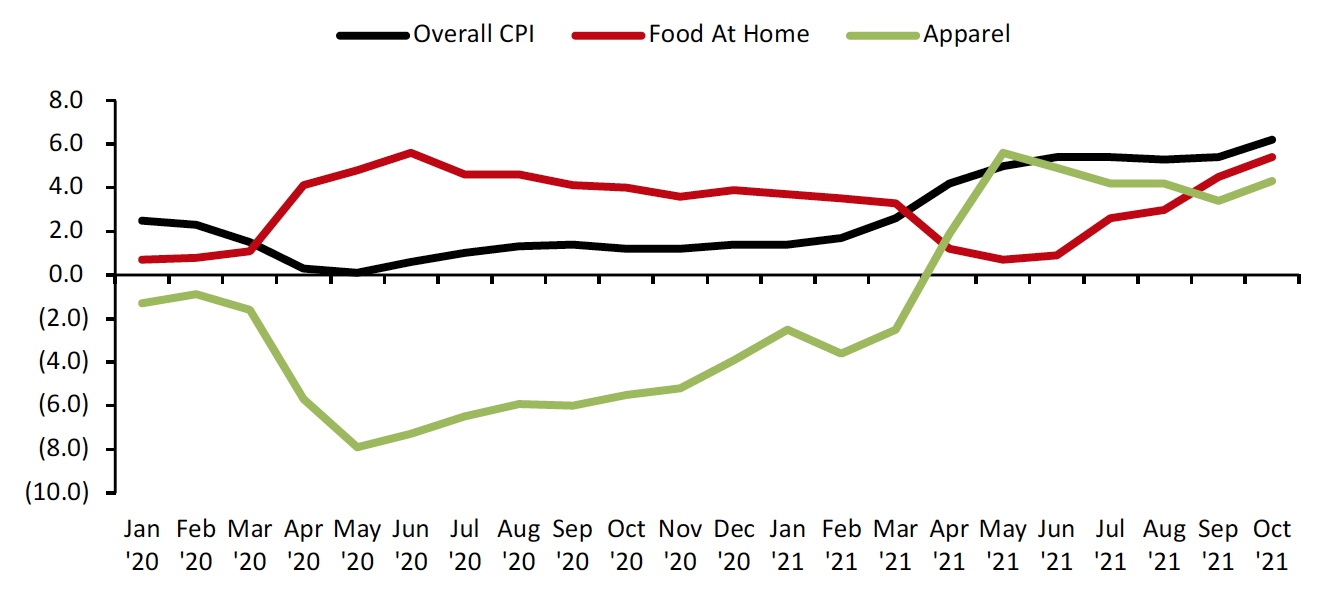

The Consumer Price Index (CPI) is trending high across both food-at-home and apparel sectors, as well as nonretail categories (gas, energy costs, autos and airline tickets), according to the BLS.

Inflation has been a non-event generally, with the annual CPI averaging 1.7% in the past 10 years and 2.2% since 2000, making the 6.2% October 2021 reading an outlier (see Figure 4).

- Read our separate report, Price Jumps and Input Cost Increases: Analyzing Inflation Across US Food, Apparel and Furniture Retail.

Figure 4. US Consumer Price Index: Overall, for Food at Home and for Apparel (YoY % Change)

[caption id="attachment_136301" align="aligncenter" width="550"] Source: Bureau of Labor Statistics/Coresight Research[/caption]

Source: Bureau of Labor Statistics/Coresight Research[/caption]

Out-of-Stock Products

While inflation is worrisome, for some discretionary goods such as apparel, the higher CPI partly reflects an annualizing of deflation amid depressed demand in 2020—and provides the prospect of some moderation in the year-over-year change once that annualization effect falls away and as the global supply chain recovers from the impacts of the pandemic.

However, this year, there is growing concern that product availability (supply) will not meet consumer demand. According to our annual survey of US holiday shoppers, conducted on September 28, 2021, 36.1% of holiday shoppers said they were concerned about product availability (and this metric rose to 37.3% in our weekly US Consumer Tracker survey on October 11, 2021), and 35.8% were concerned that online orders may not be delivered in time due to supply chain issues amid the pandemic. As we enter the retail earnings season, we will be listening for data on inventory levels and potential stockouts that will impact holiday sales.

Consumers Spending More Time at Home

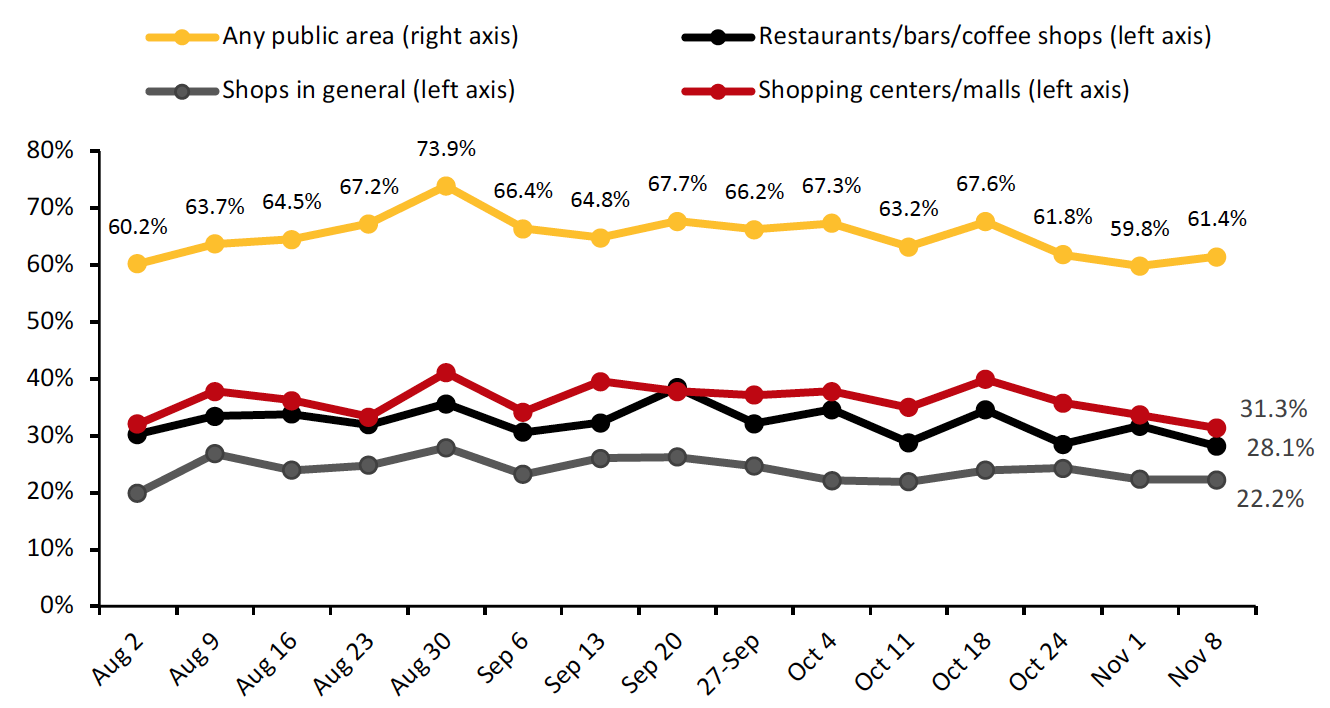

Since early July 2021, US consumers have been retreating from public places such as shops, malls, restaurants and public transport. As of November 8, 2021, 61.4% of US consumers in our latest weekly survey said that they are avoiding any kind of public place; this metric is up 8.6 percentage points from its July 5, 2021, low, but down 3.3 percentage points since the writing of our US holiday outlook report in September.

Looking specifically at retail locations, our latest survey found that 31.3% of respondents are avoiding shopping centers and malls, and 22.2% are avoiding shops in general—up 5.5 and 5.9 percentage points, respectively, from the lows in July.

Avoidance, both overall and for these specific places, had increased prior to the Labor Day weekend in September but has stabilized in the past two months. With Black Friday around the corner (next week), we could well see a continued drop in avoidance as shoppers return to stores.

Figure 5. US Consumers’ Avoidance of Public Places, Overall and for Selected Options (% of Respondents)

[caption id="attachment_136302" align="aligncenter" width="550"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

What We Think

Covid-19 moved the traditional start of the holiday season earlier in the year in 2020, and October sales results indicate that the same has happened in 2021.

Based on the volume of cash in consumers’ pockets along with pent-up demand, recent trajectories in retail and most macroeconomic indicators, we expect solid demand to be sustained into the holiday peak. However, consumers are concerned about inflationary prices this holiday shopping season, so retailers must underscore price/value and create a sense of urgency to purchase, which the growing awareness of supply chain delays and product shortages supports.

Avoidance of public places has stabilized in the past two months, indicating a return to physical stores in time for Black Friday and the peak holiday shopping season. Should we see a strong winter peak in Covid-19 infections, we expect consumers to pull back more radically on public activities and spending on services. This would likely prove a net benefit to retail as discretionary spending will be redirected toward goods, but it could heighten inventory challenges for some retailers. We expect any such behavior to contribute to sustained strength in e-commerce, and retailers must expand capacity to meet heightened online demand or consider partnerships with third-party fulfillment services.