albert Chan

What’s the Story?

Our The 12 Weeks of Holidays 2021 series counts down to this year’s holiday peak with new thematic research each week. In this report, we discuss the traditional launch of the holiday shopping season: the five days spanning Thanksgiving through Cyber Monday. We present our insights into consumer shopping behavior ahead the Thanksgiving weekend this year, which begins on Thursday, November 25.

Why It Matters

The holiday season is a crucial time of the year for the retail industry: Retailers look to the fourth quarter to be bolstered by holiday sales. Coresight Research expects a strong, 9%–10% year-over-year increase in total US retail sales for holiday 2021 (October–December quarter); retailers must be prepared across both the online and offline channels to capitalize on demand and realize growth potential.

The Thanksgiving weekend has traditionally marked the launch of the holiday shopping season, with heavy discounts on Black Friday and Cyber Monday encouraging consumers to shop. However, as consumers remain cautious about the Covid-19 pandemic and supply chain issues continue, brands and retailers must strategize effectively to drive Black Friday sales this year and ensure they meet customer expectations.

Thanksgiving and Black Friday Shopping Preview: Coresight Research Analysis

Impacts of the Covid-19 Pandemic: Consumer Concern and Early Deals

Although progress is being made to combat Covid-19—with Pfizer’s November 5, 2021, announcement that its oral antiviral treatment reduces the risk of hospitalization or fatality by 89%—the pandemic will continue to have substantial impacts on product availability and consumer shopping behaviors this holiday season.

Inefficiencies spanning the global supply chain will be a determining factor for multiple facets of holiday shopping: We are likely to be heading for an “IOS” holiday season, meaning one characterized by inflationary pressures, out-of-stock products and consumers spending more time at home (read our Holiday 2021: US Retail Outlook for more).

According to our annual survey of US holiday shoppers, conducted on September 28, 2021, 36.1% of holiday shoppers said they were concerned about product availability (and this metric rose to 37.3% in our weekly US Consumer Tracker survey on October 11, 2021), and 35.8% were concerned that online orders may not be delivered in time due to supply chain issues amid the pandemic.

This has driven many consumers to shop earlier for the holiday season this year—rather than beginning on Black Friday—to prioritize getting the right product on time over finding a bargain. Our holiday survey found that only 9.6% of US holiday shoppers plan to begin holiday shopping on Black Friday, with a huge 70.4% reporting that they will have already started by then.

We discussed the early start to the 2021 holiday season in our previous report in this series, The 12 Weeks of Holidays 2021: #5—Five Predictions for US Retail, in which we gave examples of how major US retailers Target and Walmart have been offering deals and promotions ahead of Black Friday this year. We have since seen many other brands and retailers adopt this strategy online, including American Eagle Outfitters, Old Navy and Macy’s (see the images below).

The typical Black Friday weekend has therefore been extended in the same way as the holiday season as a whole, with brands and retailers fighting for share of wallet by attracting consumers through early sales events. By spreading out the Black Friday period, retailers are looking to minimize supply chain impacts and ensure customer satisfaction with in-stock product availability and timely delivery.

[caption id="attachment_135716" align="aligncenter" width="550"] Source: Company websites[/caption]

Source: Company websites[/caption]

Online Is the Channel of Choice

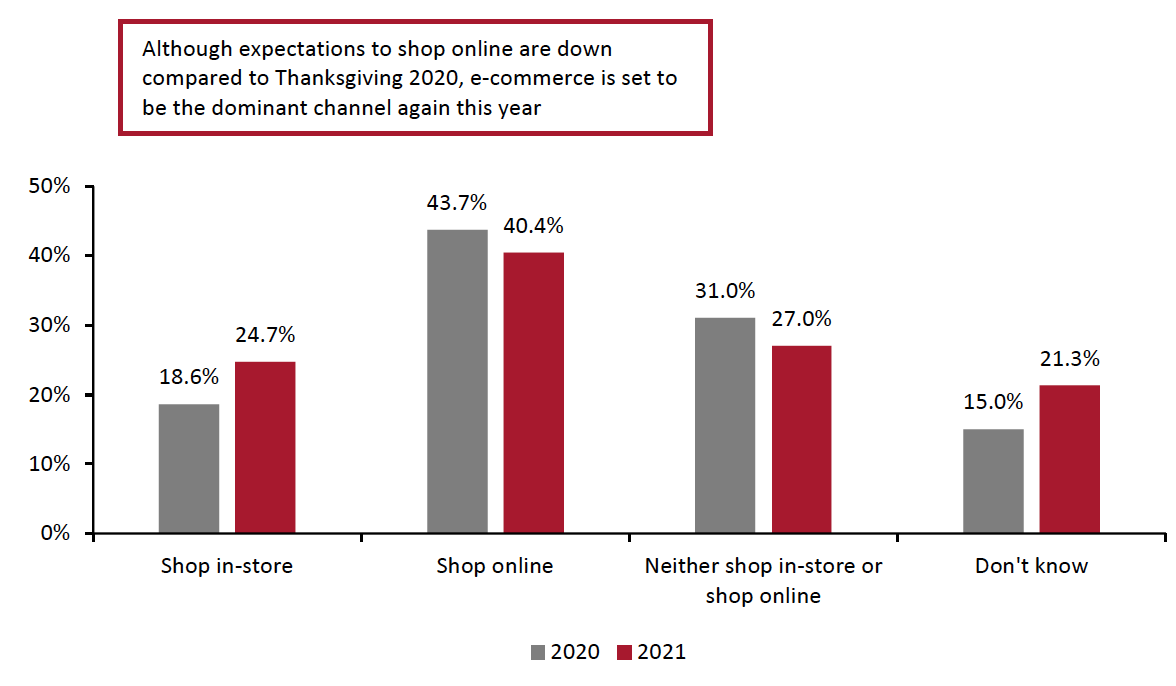

Thanksgiving Day

A Coresight Research survey of US consumers conducted on November 1, 2021, found that a higher proportion of consumers intend to shop this Thanksgiving holiday than last year (from 62.3% in 2020 to 65.1% in 2021). Around one-quarter of respondents plan to shop in-store on Thanksgiving Day this year—up significantly from 18.6% of respondents in 2020. However, the bulk of consumers still plan to shop online (see Figure 1).

Figure 1. Where US Consumers Expect To Shop on Thanksgiving Day (% of Respondents)

[caption id="attachment_135717" align="aligncenter" width="700"] Base: 419 US respondents aged 18+, surveyed on October 27, 2021; 470 US respondents aged 18+, surveyed on November 1, 2021

Base: 419 US respondents aged 18+, surveyed on October 27, 2021; 470 US respondents aged 18+, surveyed on November 1, 2021Source: Coresight Research[/caption]

Although we expect that consumer concern around the pandemic will be a key reason for consumers to shop online (as they avoid public places), store closures will also limit the options for in-store shopping on Thanksgiving. Retailers have adopted an omnichannel approach to holiday shopping that allows more retail workers to enjoy Thanksgiving with family and friends, while offering online shopping for consumers.

Below, we list major retailers and shopping center managers that have announced their stores will be closed on Thanksgiving Day.

| Aldi | Dick’s Sporting Goods | Publix |

| Bed Bath & Beyond | Dierbergs | REI |

| Best Buy | Foot Locker | Sam‘s Club |

| BJ’s Wholesale | Home Depot | Simon Property Group |

| Boscov’s | Kohl’s | Target |

| Costco | Lowe’s | Trader Joe’s |

| Destiny USA | Macy’s | Walmart |

Below, we list major retailers and shopping center managers that have traditionally remained open on Thanksgiving Day but have not yet indicated plans for Thanksgiving 2021.

| Big Lots | Dollar Tree | Gap Inc. |

| Brookfield Property | Five Below | The Kroger Co. |

| CVS | Grocery Outlet | Victoria’s Secret |

| Dollar General | Macerich Company | Walgreens |

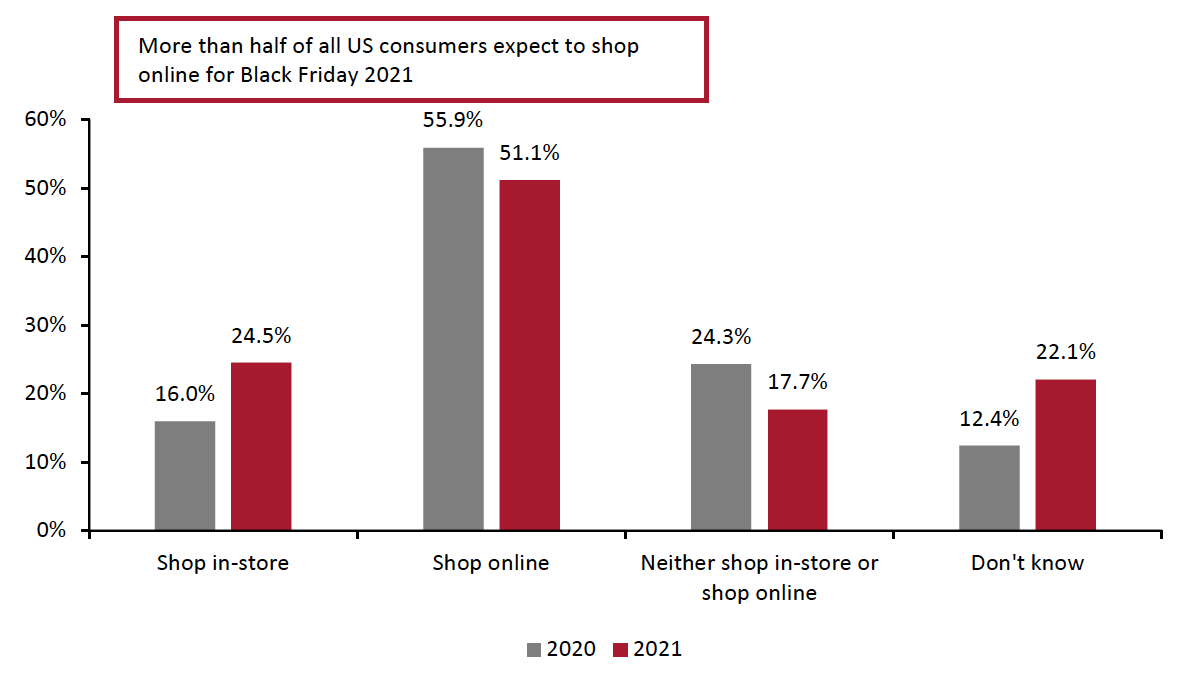

Black Friday

Shopping trends for Thanksgiving Day are reflected in expectations for shopping on Black Friday, too: A higher proportion of US consumers expect to shop in-store this year than last year, according to our November 1, 2021, survey. However, more than double the proportion of US consumers this year reported plans to shop online than those that will shop in-store (see Figure 2).

Consumers’ intentions to shop online are lower than last year, in tandem with the increase in in-store shopping intentions. This is supported by recent quarterly reports from e-commerce players Amazon and Wayfair, which revealed weak, single-digit growth in product sales and a double-digit decline in US revenues, respectively, as consumers return to in-store shopping.

This Black Friday, across online and in-store, 75.5% of respondents expect to shop, up from 71.8% in 2020.

- A separate report in this series, The 12 Weeks of Holidays 2021: #4 Online vs Offline Shopping, further explores US consumers’ intentions to shop by channel during the overall 2021 holiday season.

Figure 2. Where US Consumers Expect To Shop on Black Friday (% of Respondents)

[caption id="attachment_135718" align="aligncenter" width="700"] Base: 419 US respondents aged 18+, surveyed on October 27, 2021; 470 US respondents aged 18+, surveyed on November 1, 2021

Base: 419 US respondents aged 18+, surveyed on October 27, 2021; 470 US respondents aged 18+, surveyed on November 1, 2021Source: Coresight Research[/caption]

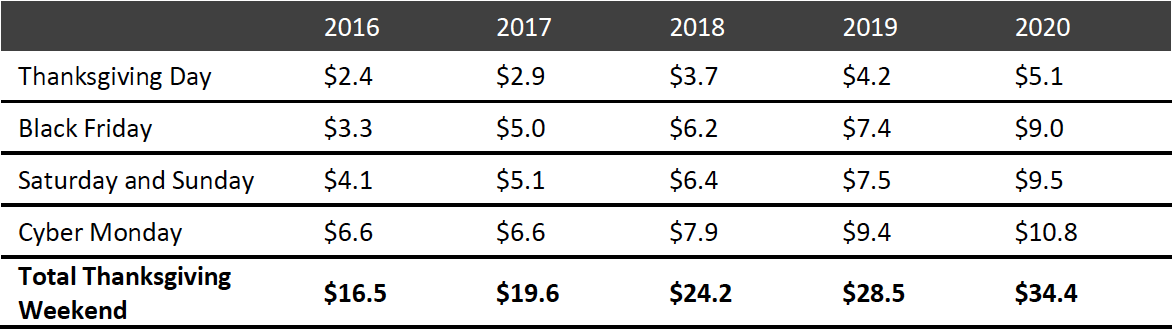

Thanksgiving Weekend

Although e-commerce is set to see strong shopping trends during the Thanksgiving weekend this year, total online sales growth will likely slow compared to the e-commerce boom during the same period last year. According to Adobe, which analyzed 1 trillion visits and 100 million SKUs (stock-keeping units) from 80 of the 100 largest US retailers during the Thanksgiving weekend last year, online sales totaled $34.4 billion between Thanksgiving Day and Cyber Monday. Year-over-year growth exceeded the CAGR for the 2016–2020 period for all days except Black Friday, where the 2020 year-over-year growth was 21.6%, versus a 28.1% CAGR.

Figure 3. Thanksgiving Weekend: Total Online Sales (USD Bil.)

[caption id="attachment_135719" align="aligncenter" width="700"] Source: Adobe[/caption]

Source: Adobe[/caption]

What We Think

We expect the long weekend—Thanksgiving Day through Cyber Monday—to jumpstart significant spending momentum for holiday shopping, despite early Black Friday promotions and the blurring of the traditional holiday season. This is because many US consumers take a few days off to celebrate the holiday and see family and friends and shop. Despite consumer concerns around Covid-19, the Thanksgiving weekend remains part of the fabric of the US culture, during which time consumers eat, visit friends and family, watch football and shop.

This year, amid supply chain concerns and expectations of late product deliveries, we expect shoppers to shop early and shop for product, not for price. As such, we do not expect door busters that attract throngs of shoppers waiting in line for stores to open on Black Friday—particularly with retailers starting Black Friday sales early to entice shoppers.

We think that for the Thanksgiving weekend this year, retailers will need to be focused on consumer concerns, demands, expectations and needs across multiple points of sales—both online and offline. Increasingly omnichannel shoppers present opportunities for brands and retailers to boost sales by providing seamless, integrated shopping experiences.

Implications for Brands/Retailers

Brands and retailers should accelerate omnichannel strategies that track shopper behavior and analyze consumer data across multiple retail channels. With in-store traffic likely to be up versus 2020, retailers need to be prepared with greater numbers of sales associates, and in-store technology that allows consumers to complete searches and purchases online will be a plus.

Brands and retailers should look to create an emotional connection with shoppers to boost sales as well as customer lifetime value; providing an exciting (but safe) festive shopping experience will be key.

Implications for Real Estate Firms

Real estate companies should create festive events this holiday that capture and spark consumers’ desire for festivities, while still addressing the health concerns of many shoppers. Staggering events during early hours and across multiple days/weekends will drive traffic.

In addition to setting the backdrop, shopping centers can make life easy for shoppers with local mall apps that alert shoppers to parking spots and allow shoppers to make reservations at food venues in the mall, for example. Making malls a top destination for holiday shoppers will be important to compete against the continued dominance of e-commerce.