albert Chan

What’s the Story?

Our The 12 Weeks of Holidays 2021 series counts down to this year’s holiday peak with new thematic research each week. In this report, we present five predictions for US retail this holiday season, covering supply chain, store closures, consumer sentiment and sustainability.

Why It Matters

The holiday season is a crucial time of the year for the retail industry: Retailers look to the fourth quarter to be bolstered by holiday sales. Coresight Research expects a strong, 9%–10% year-over-year increase in total US retail sales for holiday 2021 (October–December quarter).

We expect the 2021 holiday season to be shaped by consumer sentiment and supply chain issues amid the ongoing impacts of Covid-19. Our five predictions aim to help keep retailers informed of when and how consumers expect to shop for the holidays in order to capture a higher share of wallet this season.

- Read our separate report for Coresight Research’s expectations for online versus offline shopping in the US this holiday season.

Five US Retail Predictions for Holiday 2021: Coresight Research Analysis

1. Holiday Shopping Has Begun Early This YearThe Covid-19 pandemic continues to impact the retail supply chain, with port congestion and container shortages likely to see brands and retailers turn to air shipments to ensure the timely arrival of goods. Consumers are aware of these issues: Coresight Research’s recent 2021 holiday survey of US consumers found that 35.8% of US holiday shoppers are concerned about online orders not being delivered in time.

- Our full holiday survey data analysis will be published in a forthcoming report.

Furthermore, our US Consumer Tracker survey on October 11, 2021, found that concerns around product availability have continued to rise, with 37.3% of holiday shoppers reporting such concerns for holiday purchases—up from 32.3% the month before.

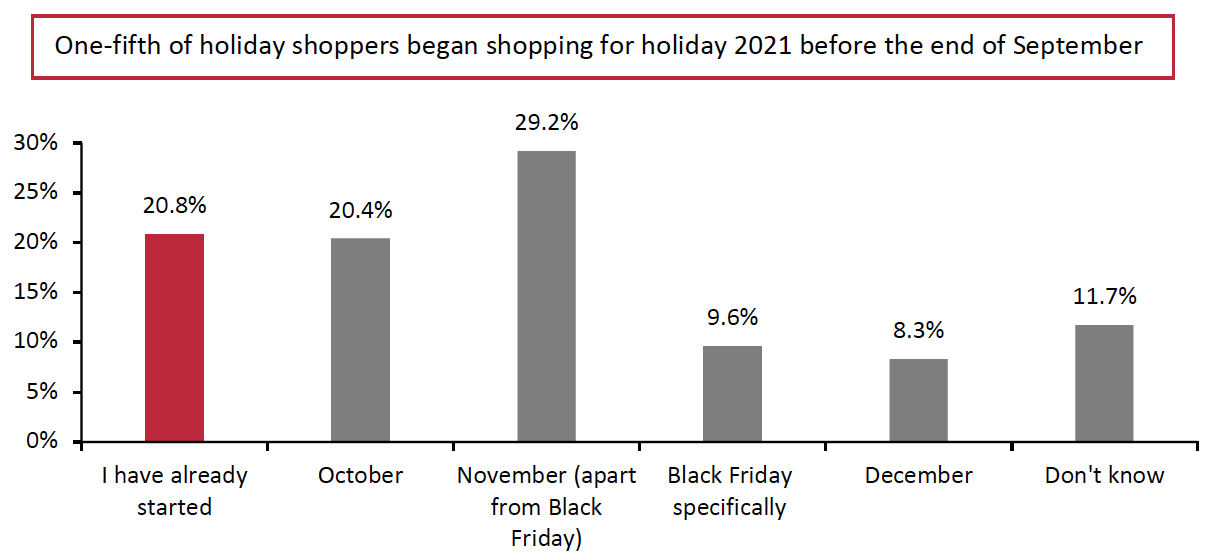

We are therefore seeing consumers start shopping for the holidays early this year—ahead of the typical November and Black Friday push. Our holiday survey found that around one-fifth of consumers had already begun their holiday shopping, as of September 28, 2021—and another one-fifth expected to begin in October (see Figure 1).

Emphasizing the early start this year, our October 11, 2021, survey saw 27.9% of US holiday shoppers report plans to start holiday shopping earlier that in pre-pandemic years. We expect concern around the spread of the Covid-19 Delta variant to see holiday shoppers remain cautious of visiting brick-and-mortar stores during the peak holiday period in December—which will likely have a dual effect of boosting online shopping and pulling forward holiday shopping.

Figure 1. When US Holiday Shoppers Expect To Begin Holiday Shopping in 2021 (% of Respondents) [caption id="attachment_135212" align="aligncenter" width="700"]

Base: 1,567 US respondents aged 18+ who spend on the holidays, surveyed on September 28, 2021

Base: 1,567 US respondents aged 18+ who spend on the holidays, surveyed on September 28, 2021Source: Coresight Research[/caption]

The early start to the holiday season is being encouraged by major brands and retailers, which have been offering deals and promotions ahead of Black Friday this year. Sales events enable retailers to spread out the shopping season and so minimize supply chain impacts and ensure customer satisfaction with in-stock product availability and timely delivery—as well as maximizing sales through the holiday quarter, of course.

- Casual apparel and outerwear brand Lands’ End launched its Black Friday Preview sales at the end of October, offering discount codes to enable shoppers to access heavy discounts in advance of Black Friday.

Source: Company website[/caption]

Source: Company website[/caption]

- Target Deal Days ran for three days, from October 10 to 12, 2021. The company’s “Holiday Price Match Guarantee” encourages holiday shoppers not to hold out for better deals closer to Christmas: Target purchases made between October 10 and December 24, 2021, will qualify for a price adjustment if the Target price goes down at any point in that timeframe.

- Walmart’s Black Friday Deals for Days is a series of deal drops through November, with the first event on November 3, 2021. The event offers early online access for Walmart+ loyalty program members, who can shop all deals four hours earlier than the general public.

Source: Company website[/caption]

2. The Online Channel Will Dominate Through Thanksgiving

Source: Company website[/caption]

2. The Online Channel Will Dominate Through Thanksgiving

Macy’s, Walmart and Simon Property Group, the largest operator of shopping centers in the US, have all recently announced that they will close all store locations for Thanksgiving, joining the majority of US retailers. However, as we saw in 2020, we expect consumer spending to be redirected to e-commerce. Last year, Adobe tracked a record-high $5.1 billion in online sales on Thanksgiving Day, a 21.5% increase over 2019.

In addition to shopping through companies’ e-commerce sites, we expect consumers to engage in social shopping through apps and social media platforms—particularly with livestreaming (shoppable videos) continuing to gain traction in the US. According to our 2021 holiday survey, 7% of holiday shoppers expect to use livestreaming to make some holiday purchases this year.

3. Consumers Remain Reluctant To Visit Shopping CentersIn our latest weekly consumer survey, conducted on October 25, 2021, nearly two-thirds (61.8%) of survey respondents reported that they are avoiding public places. The good news is that this is the lowest level since August 9, 2021, when the Covid-19 Delta variant began to impact consumers’ comfort in socializing, and compares quite favorably to a year ago (October 27, 2020) when 80.4% of survey respondents were avoiding public places.

However, the overall avoidance rate is still high, and retailers will be impacted by consumers’ reluctance to visit public places: According to the same survey, more than one-third (35.7%) of respondents stated that they are avoiding shopping malls, while nearly one-quarter (24.3%) are avoiding shops in general.

We do not expect consumer sentiment about the brick-and-mortar channel to change significantly during the holiday season. Our 2021 holiday survey found that 34.4% of holiday shoppers expect to avoid stores/limit their use of physical stores because of Covid-19. These shoppers are likely to turn to the online channel.

It is not all bad news for physical retailers, though. Local mom-and-pop stores, independent retailers and outdoor craft markets are deemed safer destinations than shopping malls (particularly enclosed centers) by many consumers. In our conversations with brands and retailers, we have found that main street locations have enjoyed greater store traffic and sales than urban and mall locations, which have felt the greatest impact of shoppers avoiding public places.

4. Consumers Will Continue To Be Eager To Celebrate the HolidaysOur recent US Consumer Tracker surveys (September 27–October 25, 2021), show that more than half of all respondents have been meeting friends and family and nearly half have been going to restaurants, demonstrating consumers’ interest in returning to social activities following Covid-19 lockdowns. Reiterating this, our holiday survey found that 27.1% of respondents expect to travel this holiday to visit family or friends.

According to a September 17, 2021, survey by data and tech firm Numerator, 72% of US consumers plan to spend the holiday with family and friends, versus 86% that would have done so in previous years. While the level is down from pre-pandemic levels, nearly three-quarters of consumers planning to celebrate Christmas with social gatherings is a huge population.

Anecdotally, on 57th Street in New York City on Friday, October 29, 2021, the Coresight Research team saw a line 200+ people deep at the local costume shop as consumers prepared for Halloween, reflecting New Yorkers’ eagerness to celebrate holidays and events this fall.

What will consumers wear for holiday 2021 festivities? While the return of catered office parties is unlikely, we are seeing an uptick in demand for occasion wear and high heels, based on recent conversations with retailers. Aligning with the trend of consumers being eager to socialize, we are likely to see a lift in sales of color cosmetics—particularly as mask mandates have been lifted. Beauty services are likely to enjoy growth as we lap year-ago muted demand.

5. Sustainability Will Be a Key Consideration Among Young Holiday ShoppersSustainability has become top of mind for multiple stakeholders—consumers, employees, investors, governments and NGOs (non-governmental organizations). It is important for brands and retailers to implement sustainable practices throughout their supply chain and communicate their efforts to customers.

In our report Where, What and How Will US Consumers Shop For Holiday 2021?, we present US consumer survey findings from August 2021 which show that sustainable products and purpose-driven brands resonate with millennials and Gen Z consumers: A huge 19% “net more” shoppers (the positive difference between the proportion of respondents that plan to buy more in the 2021 holiday season compared to 2020 and the proportion that plan to spend less) aged 30–44, and 12% net more shoppers aged 18–29, plan to buy more sustainable products for holiday 2021. For comparison, there was a “net less” result among the over-60 age group.

Aligning with these findings, holiday shoppers aged 30–44 are leading the drive toward sustainability in terms of choosing a brand/retailer to shop with this holiday season, with 17% of this age group considering product sustainability to be an important factor—followed by 11% in the 18–29 age group.

Our findings reveal that brands and retailers can attract holiday shoppers by communicating their efforts to make positive environmental impacts to millennials and Gen Zers.

What We Think

Supply chain issues will shape the holiday season this year, as product availability and delivery delays remain key concerns among consumers and retailers alike. As a result, we believe that shoppers will start holiday shopping earlier than in pre-pandemic years, encouraged by early Black Friday sales by brands and retailers.

In our many conversations with consumers and retailers, we found that consumers are eager, if cautious, to return to social activities—which bodes well for the apparel and beauty retail sectors.

Implications for Brands/Retailers

- Brands and retailers should maintain accurate inventory tracking and be transparent with consumers about product availability to avoid disappointing shoppers with out-of-stocks during the important holiday shopping season.

- A flexible and agile omnichannel fulfillment strategy will win this holiday amid concerns about shipping delays and product availability.

Implications for Real Estate Firms

- Real estate companies should create festive events that capture and spark consumers’ desire to shop this holiday, but addressing the health concerns of many shoppers will b be paramount. Staggering events during early hours and across multiple days/weekends will drive traffic.