albert Chan

What’s the Story?

Our The 12 Weeks of Holidays 2021 series counts down to this year’s holiday peak with new thematic research each week. In this report, we discuss key trends that we think are going to influence online and offline shopping in the US this holiday season.

Why It Matters

The holiday season is a crucial time of the year for the retail industry: Retailers look to the fourth quarter to be bolstered by holiday sales. In 2020, US holiday-season retail sales (calendar fourth quarter) totaled $1.1 trillion, according to our analysis of US Census Bureau data, up 9.2% year over year—the highest annual growth since 2010 and comprising 28% of total US retail sales. The online channel accounted for 20% of holiday sales, with e-commerce sales having increased by 32.5% year over year, according to the US Census Bureau.

The 2021 holiday shopping season will likely see the continuation of heightened e-commerce driven by the pandemic, particularly with the ongoing threat of the Covid-19 Delta variant. Coresight Research expects a strong, 9%–10% year-over-year increase in total US retail sales for holiday 2021 (October–December quarter); retailers must be prepared across both the online and offline channels to capitalize on demand and realize growth potential.

Online vs. Offline Shopping for Holiday 2021: Coresight Research Analysis

E-Commerce

More Than Three-Quarters of Holiday Shoppers Expect To Buy Gifts Online

Online sales will continue to benefit from the long-term secular channel shift, as well as ongoing pandemic-related health concerns and worries about in-store stock availability: We are likely to be heading for an “IOS” holiday season, meaning one characterized by inflationary pressures, out-of-stock products and consumers spending more time at home (read our Holiday 2021: US Retail Outlook for more).

Our recent 2021 holiday survey of US consumers found that 19.5% of respondents who spend on the holidays plan to shift some or all of their holiday spending from stores to e-commerce this season—a higher proportion than the 11.6% who plan to shift some of all of their holiday spending from e-commerce to stores, suggesting continued momentum in the transition to online shopping.

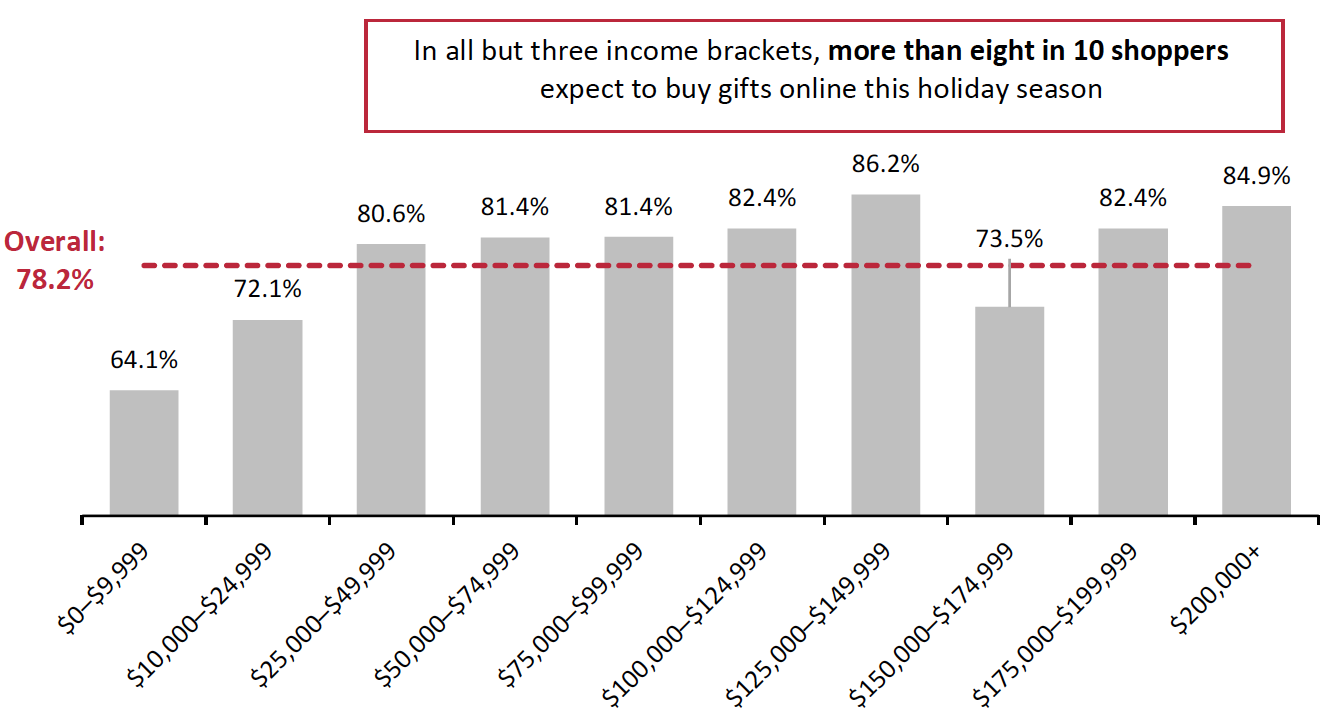

Furthermore, our survey found that 78.2% of respondents who spend on the holidays expect to shop online (not exclusively) for gifts this holiday season, with all but three income brackets seeing more than 80% of shoppers report expectations to buy gifts online (see Figure 1). The highest earners (respondents with an income level of $200,000 or above) have the greatest intent to shop online this holiday, with around 85% stating that they expect to buy gifts online. As such, online retailers, with their endless aisles and marketplaces, have a huge opportunity to capture increased share of wallet among US holiday shoppers and high earners in particular.

- Our full holiday survey data analysis will be published in a forthcoming report.

Coresight Research estimates that fourth-quarter 2021 e-commerce sales (excluding gasoline and automobiles) will see mid-teens year-over-year growth in percentage terms—outpacing total retail sales growth—and more than 50% growth compared to the holiday quarter in pre-pandemic 2019. In terms of e-commerce penetration, we expect online sales to comprise around 21.3% of total sales in the fourth quarter of 2021—up slightly from 20.1% in the year-ago period.

Figure 1. US Holiday Shoppers: Proportions That Expect To Buy Gifts Online for Holiday 2021, by Income Level (% of Respondents)

[caption id="attachment_134900" align="aligncenter" width="700"] Base: 1,567 US respondents aged 18+ who spend on the holidays

Base: 1,567 US respondents aged 18+ who spend on the holidaysSource: Coresight Research[/caption]

Brands and Retailers Offer Same-Day Delivery

Our survey found that 35.8% of US holiday shoppers are concerned about online orders not being delivered in time. In order to meet increased e-commerce demand and ensure timely delivery, many brands and retailers are offering same-day delivery services. We summarize such offerings from selected companies in Figure 2.

Figure 2. Online Order Fulfillment: Selected Brands’ and Retailers’ Same-Day Delivery Offerings

| Company | Same-Day Delivery Offering |

| Apparel Brands and Retailers | |

| American Eagle Outfitters, Inc. | Same-day delivery on orders placed before the local cutoff time is available to customers within a 10-mile (16.1-kilometer) radius of participating stores. Orders placed by customers within that radius after the cutoff time are delivered the next business day. |

| Dick’s Sporting Goods, Inc. | The company offers same-day delivery through its partnership with delivery service provider Instacart. |

| Foot Locker, Inc. | Rush orders placed on a business day (Monday–Friday) prior to 1.00 p.m. are shipped the same day. |

| Guess? Inc. | Guess? offers same-day delivery through Uber Delivery for $20. The US delivery radius is 15 miles (24 kilometers) with exceptions: New York City, the District of Columbia, Philadelphia, Boston and Chicago each have a 10-mile (16-kilometer) delivery radius. The delivery radius in Canada is 10 miles (16 kilometers). |

| Industria de Diseño Textil, S.A. | Same-day delivery is available in major global metropolitan cities including New York. |

| Levi Strauss & Co. | The company offers same-day delivery on online orders for a $20 flat fee. |

| Lululemon Athletica Inc. | The company continues to strengthen its omnichannel capabilities, such as curbside pickup, same-day delivery and BOPIS (buy online, pick up in store) services. |

| Beauty Retailers | |

| Sephora | Sephora (a beauty retailer under French multinational parent company LVMH) has launched a same-day delivery service just ahead of the holiday shopping season. Available seven days a week in most major cities and suburbs for orders placed before 4.00 p.m., same-day orders will be retrieved from a nearby store and delivered by courier for a $6.95 fee, according to the company. |

| Ulta Beauty, Inc. | Ulta Beauty at Target on Target.com and via the Target app offers free shipping for qualifying orders, as well as Target’s same-day fulfillment services. Customers benefit from rewards across both the Ultamate Rewards and Target Circle loyalty programs. |

| Department Stores | |

| Kohl’s Corporation | The company offers same-day delivery on online orders placed before 1.00 p.m. The fee for orders of up to $75 is $14.95, and the fee for higher-value orders is $9.95. |

| Macy’s, Inc. | For online orders of $25 or more, same-day delivery is available for a $15 fee when the order is placed before 12.00 p.m. The shipping fee increases to $29.95 for orders under $25. |

| E-Commerce Companies | |

| Instacart | Instacart same-day delivery starts at $3.99 for orders worth $35 or more. |

| Food, Drug and Mass Retailers | |

| Big Lots, Inc. | The company offers same-day delivery through its partnership with Instacart. |

| BJ’s Wholesale Club Holdings, Inc. | Members can use EBT (electronic benefits transfer) payments when shopping on bjs.com for ship-to-home, same-day delivery, in-club pickup and curbside-pickup services; this offering is currently live in nine states. Pending state approval, the company expects digital EBT payments to become available in additional eligible locations in the next few months. |

| Five Below, Inc. | The company offers same-day delivery through its partnership with Instacart. |

| The Kroger Co. | The company offers same-day delivery for a flat fee of $9.95. |

| Target Corporation | Target provides a same-day delivery service nationwide with Shipt, with delivery in as little as one hour. |

| Walgreens Boots Alliance, Inc. | In spring 2021, Walgreens launched nationwide same-day home delivery across multiple marketplace platforms. |

| Walmart Inc. | Walmart offers same-day delivery for free for Walmart+ loyalty members, or for a fee for non-members. |

| Home and Home-Improvement Retailers | |

| Tractor Supply Company | The company offers same-day delivery on orders placed before 2.00 p.m. within 25 miles (40 kilometers) of the local store. |

| Luxury Brands and Retailers | |

| Moncler S.p.A. | Moncler offers a same-day delivery service for customers in Manhattan. The service costs $40 and is only available for orders placed before 2.00 p.m. on working days. |

Source: Company reports

Brick-and-Mortar Retail

Nearly Two-Thirds of Holiday Shoppers Expect To Buy Gifts in Physical Stores

The physical store remains a key touchpoint between brands and shoppers, offering retailers the opportunity to build deeper levels of engagement, loyalty and customer lifetime value. Shelley Haus, Chief Marketing Officer at Ulta Beauty, emphasized this during the beauty retailer’s investor conference on October 19, 2021:

The store is still where it all comes together. As much as ease from home has become the norm, the store experience is key. In fact, 95% of our guests say they miss the store terribly… Consumers are looking for all of it: a seamless ecosystem of experiences for whatever they need, whatever time they need it. Adaptation has become expectation.

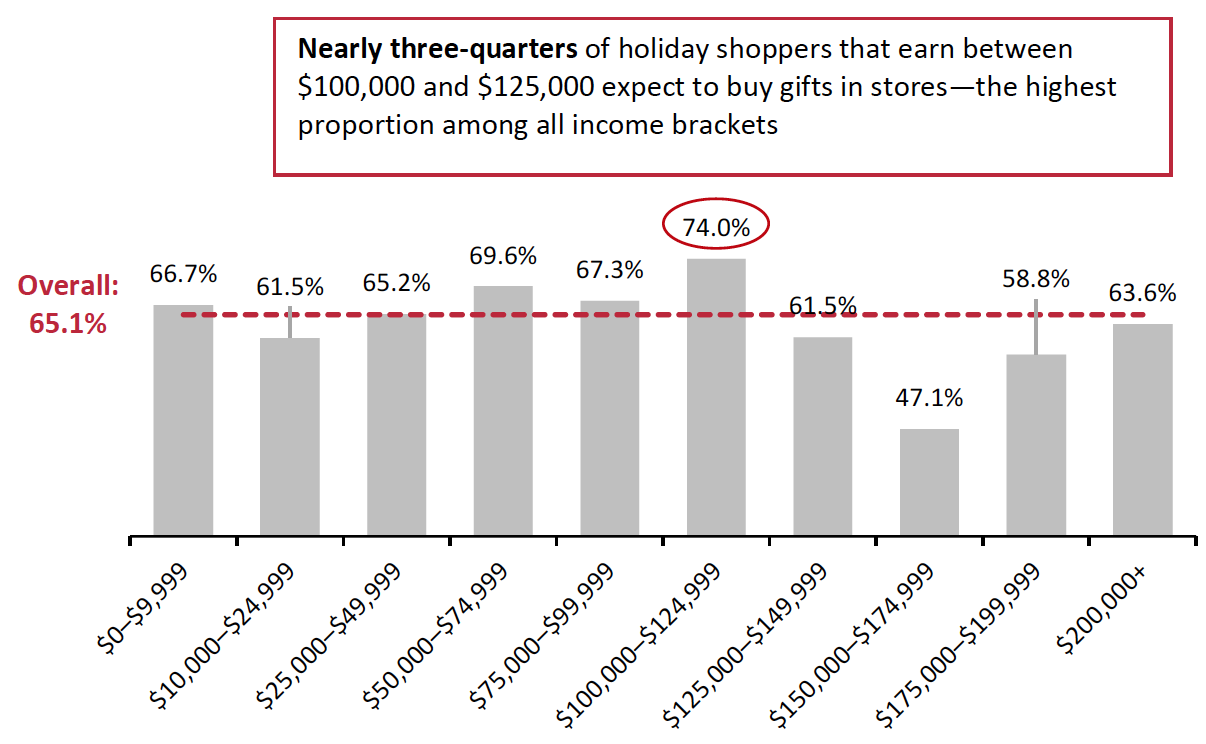

Nearly two-thirds (65.1%) of US holiday shoppers expect to buy gifts in physical stores this holiday shopping season, according to our survey. The $150,000–$200,000 income brackets fall significantly behind this total, while holiday shoppers earning $100,000–$125,000 are driving brick-and-mortar shopping expectations—with 74.0% of these respondents reporting that they expect to buy gifts in-store this holiday season.

Figure 3. US Holiday Shoppers: Proportions That Expect To Buy Gifts in Physical Stores for Holiday 2021 (% of Respondents) [caption id="attachment_134901" align="aligncenter" width="700"]

Base: 1,567 US respondents aged 18+ who spend on the holidays

Base: 1,567 US respondents aged 18+ who spend on the holidaysSource: Coresight Research[/caption]

Brands and Retailers Offer Store-Based Fulfillment Options for Online Orders

Although the brick-and-mortar channel will be key for brands and retailers to drive sales this holiday season, we also expect that store-based fulfillment for online orders—which has gained traction during the Covid-19 pandemic—will remain popular among holiday shoppers. This year, 21.1% of holiday shoppers expect to use curbside pickup, and 17.9% expect to use in-store pickup, for some online purchases, according to our survey.

Store-based pickup services such as curbside pickup and BOPIS (buy online, pick up in store) present brands and retailers the opportunity to increase the value of transactions with add-on purchases while reducing last-mile delivery expenses. The ship-from-store (SFS) fulfillment model is a store-based delivery option that enables retailers to meet consumer demand for fast delivery while reducing stockouts by leveraging local inventory.

We highlight examples of BOPIS and SFS offerings from selected companies in Figure 4.

Figure 4. Store-Based Online Order Fulfillment: Selected Brands’ and Retailers’ BOPIS and SFS Offerings

| Company | BOPIS/SFS Offering |

| Apparel Brands and Retailers | |

| Adidas AG | BOPIS: Shoppers can collect their order at a nearby store for free (minimum spend applicable). After online checkout, orders are reserved for seven days to collect from the designated store. |

| Dick’s Sporting Goods, Inc. | BOPIS/SFS: Stores fulfill more than 70% of online sales, according to the company—through SFS, BOPIS and curbside pickup. |

| Foot Locker, Inc. | BOPIS: Orders placed online or via Foot Locker’s mobile app can be picked up at a customer’s local store for free. |

| Gap Inc. | BOPIS: Customers receive a notification email when their order is ready to be picked up from the designated store. Most orders are ready for pickup within two hours, according to the company. In-store pickup is available during store hours for all Gap Inc. brands. |

| Guess?, Inc. | BOPIS: The retailer offers same-day pickup on orders placed by 2.00 p.m. Orders placed after that time are made available for next-day in-store pickup. |

| Industria de Diseño Textil, S.A. | BOPIS: Collection at US Zara stores is free; orders are typically available in three to five days. |

| Levi Strauss & Co. | BOPIS: The “Pickup In-Store” service allows shoppers to place an order and pick it up at a nearby Levi’s store—on the same day if the order is placed three hours before store-closing time; otherwise, on the next business day. In late 2020, Levi’s introduced a new experiential store in Palo Alto, California, as part of its push toward more direct-to-consumer sales and less wholesale. There are several digitally focused features of the “NextGen” store, including integration with the company’s app, curbside pickup and contactless returns, and an inventory assortment that is driven by local customer data. |

| Lululemon Athletica Inc. | BOPIS/SFS: The company is leveraging its stores to facilitate omnichannel capabilities, including BOPIS (with orders available locally within two hours) and SFS. |

| NIKE, Inc. | BOPIS: The sportswear brand offers BOPIS services, with order pickup available at a customer’s local store within two hours. SFS: NIKE is beginning to extend SFS fulfillment globally, according to the company. |

| Urban Outfitters, Inc. | BOPIS: Items that are in stock are made available for pickup within 24 hours. If an item needs to be shipped to a selected store, it is ready for pickup in four to six days. |

| Beauty Retailers | |

| Ulta Beauty, Inc. | BOPIS: According to the company, its BOPIS service comprised 20% of e-commerce sales in the July 2021 quarter, and 97% of orders were ready for pickup within two hours. Ulta Beauty has recently increased the number of stores with dedicated parking spaces and is looking for opportunities to make curbside pickup available at nontraditional Ulta Beauty locations, the company reported. |

| Department Stores | |

| Kohl’s Corporation | BOPIS/SFS: Kohl’s fulfilled over 40% of digital sales from stores in the July 2021 quarter, according to the company. |

| Macy’s, Inc. | BOPIS: Macy’s offers a BOPIS service with no shipping fee. SFS: The retailer is planning to roll out tests at a small number of its stores, looking at ways to improve the productivity and efficiency of all store fulfillment activities, including equipping stores with varying levels of automation to support pickup, speed, efficiency and SFS capabilities, according to Macy’s. |

| Nordstrom, Inc. | BOPIS: During its Anniversary Sale in early August 2021, nearly 40% of next-day online order pickups happened at Rack stores. |

| E-Commerce Companies | |

| Instacart | BOPIS: The Instacart platform offers a pickup option for website and app shoppers at select locations. |

| Electronics Retailers | |

| Best Buy Co., Inc. | BOPIS/SFS: Best Buy fulfills about 60% of online orders from its stores, including in-store and curbside pickup, and SFS. |

| Food, Drug and Mass Retailers | |

| BJ’s Wholesale Club Holdings, Inc. | BOPIS: 50% of BOPIC (buy online, pick up in club) orders were delivered curbside in its fourth quarter of fiscal 2020, according to the company. |

| Dollar Tree, Inc. | BOPIS: Orders are shipped to a store of the shopper’s choice, typically within four to six business days. |

| Target Corporation | BOPIS/SFS: Same-day services, in-store pickup, Drive Up and Shipt together grew by 55% in the July 2021 quarter, on top of more than 270% growth last year, according to the company. |

| Walgreens Boots Alliance, Inc. | BOPIS: In November 2020, the retailer launched curbside pickup nationwide, with pickup availability in as little as 30 minutes. |

| Home and Home-Improvement Retailers | |

| The Home Depot, Inc. | BOPIS: The retailer offers free in-store pickup for online orders, as well as SFS services. |

| Lowe’s Companies, Inc. | BOPIS: Lowe’s saw 9% e-commerce penetration in the July 2021 quarter, with approximately 60% of online orders picked up in-store. Dedicated in-store fulfillment teams are an integral part of the Lowe’s omnichannel customer experience, according to the company. SFS: In addition to BOPIS, Lowe’s offers SFS services and pickup at contactless lockers. |

| Tractor Supply Company | BOPIS: The company offer one-hour pickup availability for free. |

| Luxury Brands and Retailers | |

| Burberry Group plc | BOPIS: The retailer offers online shoppers, both on its website and via its app, in-store pickup at selected stores as soon as the following day. |

| LVMH Moët Hennessy Louis Vuitton S.E. | BOPIS: Orders placed by 3.00 p.m. on weekdays (Monday to Friday) are delivered to a customer’s choice of store within four business days. Orders placed on Saturday or Sunday are processed the following business day. |

| Prada S.p.A | BOPIS: Prada offers the option to place an order online to be picked up directly at one of its stores. |

What We Think

In our many conversations with consumers and retailers, we found that 2021 has been a year when consumers were eager, if cautious, to return to physical shopping—to touch and try on products and to discover new colors, fashions, products and services. However, shopper expectations are heightened, and so brick-and-mortar stores are evolving into distribution hubs to meet demand for fast and convenient delivery, as well as providing a physical touchpoint with brands and retailers.

Holiday is an important season for retail, and we expect both online and offline sales opportunities to drive growth in the 2021 holiday season.

To read more about Coresight Research’s expectations for the US holiday season by sector, see our separate reports:

- Holiday 2021: Outlook for the US Apparel Sector

- Holiday 2021: Outlook for US Grocery

- Holiday 2021: Outlook for the US Department Store Sector

- Holiday 2021: Outlook for the US Beauty Sector

Implications for Brands/Retailers

Brands and retailers need to be prepared to meet shoppers in stores, on e-commerce websites, on social media and via livestreaming with channel-appropriate product and service offerings. They should be looking to delight and surprise holiday shoppers to capture critical share of wallet during this critical sales season.

Implications for Real Estate Firms

Real estate companies should work with brands and retailers to meet consumer demand for convenience and make them feel safe in malls amid heightened pandemic-related health concerns. Curbside-pickup services and returns kiosks present opportunities for shopping centers to offer centralized fulfillment and returns across multiple tenant retail companies.

Implications for Technology Vendors

Technology providers can work with brands, retailers and retail real estate firms to provide in-store and in-app solutions that connect shoppers with products and services in real time and provide a seamless shopping experience from discovery and purchase to pickup and delivery this holiday season and beyond.