albert Chan

What’s the Story?

We offer further analysis on the trajectory and trends that we expect to see in US holiday retail this year. This report is a follow-up to our holiday outlook from September and is the first in our The 12 Weeks of Holidays 2021 series, which will count down to this year’s holiday peak with new thematic research each week. In this report, we consider the prospects of a services-versus-retail battle for discretionary dollars and our sector analysts offer their insights into apparel, department stores and grocery in the coming holiday season.

We have already outlined our projection for total holiday retail sales: Coresight Research expects a strong, 9–10% year-over-year increase in total retail sales for holiday 2021. On top of a 9.2% increase last year, the 9.5% midpoint of our estimate would take two-year growth to 19.6%.

Our definition of the holiday season is the October–December quarter and our core metric is the change in total retail sales excluding automobiles and gasoline (and retail inherently excludes restaurants/foodservice).

Why It Matters

After a year of strong growth and, for some sectors, recovery, understanding the shape and scale of demand during the holiday season is critical for retailers. In a fluctuating context, our regular holiday reports provide directional insights to help the sector, and those working with it, plan for the peak.

US Retail Outlook Update: Coresight Research Analysis

1. Services vs. Retail and Potential Consumer-Demand Shifts2021 has so far been a year of booming retail sales. Will that be sustained into the holiday peak? The signs look positive overall. Higher inflation and product availability may present challenges but rising prices will push up the total value of sales that go through retailers’ tills. Moreover, consumers are equipped to absorb some price rises—Coresight Research calculates that across 2020 and 2021, a total of $1.66 trillion will have been paid to consumers through stimulus measures.

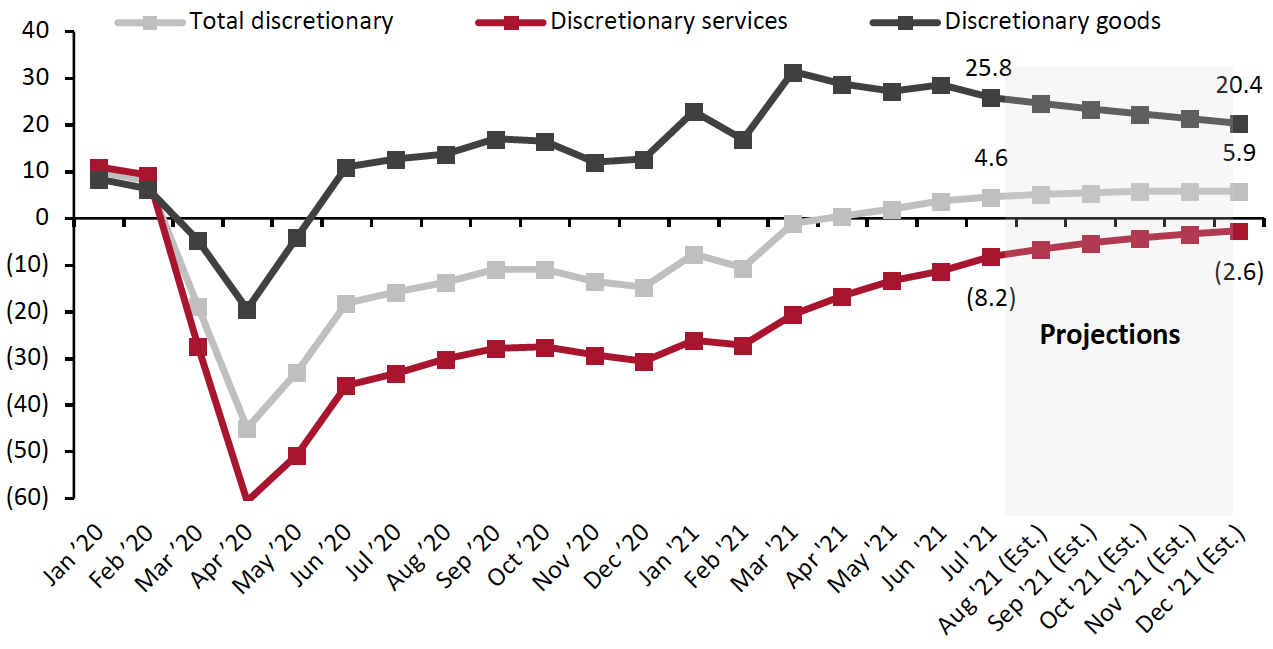

One possible challenge to retail remains the incremental return of discretionary spending to services. As charted below, consumer spending on discretionary services in aggregate remains below that seen in the comparable precrisis period: As of July 2021 (latest confirmed spending data), discretionary services spend remains 8.2% below that seen in July 2019, while discretionary goods are 25.8% above the precrisis comparative. The recent trend for services has been one of gradual recovery—but not enough, in aggregate, to threaten the expansion of retail spending. Discretionary goods, meanwhile, has tended to see a very slight softening of the rate of aggregate growth after peaking in March.

Figure 1 shows how we would end the year should those two recent trends continue. On that projection, discretionary goods would still be very strongly ahead while services would be still below precrisis levels.

Figure 1. Two-Year % Change in US Consumer Spending on Major Discretionary Categories

[caption id="attachment_133844" align="aligncenter" width="700"] Discretionary goods includes beauty products, clothing and footwear, jewelry, luggage, recreational items, sporting goods, watches and other categories. Discretionary services includes accommodation, food services, foreign travel, personal care services, recreational services and other categories. Projections assume consistent sequential change using the average from the most recent four months.

Discretionary goods includes beauty products, clothing and footwear, jewelry, luggage, recreational items, sporting goods, watches and other categories. Discretionary services includes accommodation, food services, foreign travel, personal care services, recreational services and other categories. Projections assume consistent sequential change using the average from the most recent four months.Source: BEA/Coresight Research[/caption]

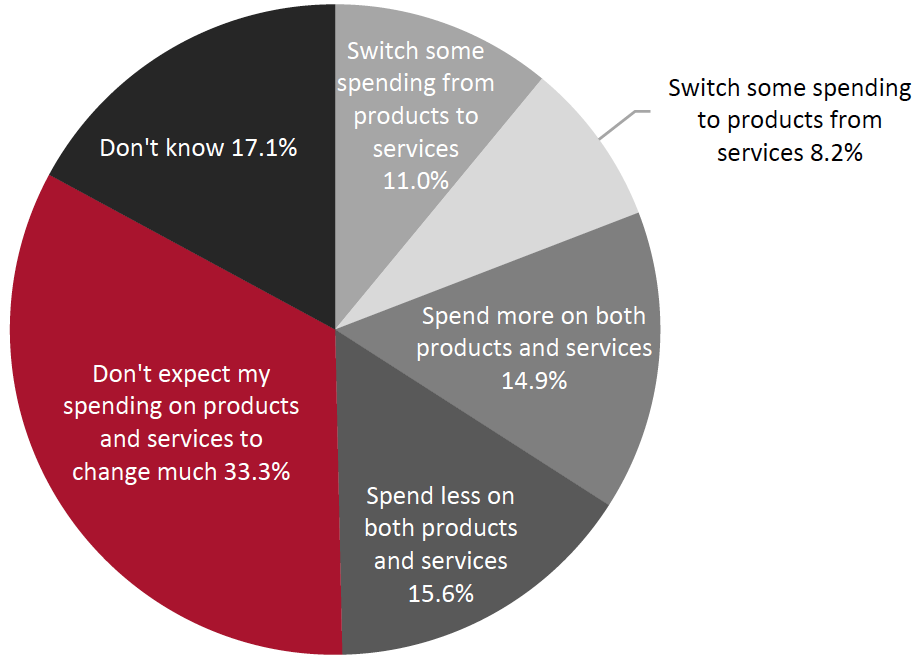

Our new holiday consumer survey asked respondents about their spending intentions for goods versus services and, as charted in Figure 2, found a relatively even balance. Consumers expecting to switch some spend from products to services came in slightly ahead of those expecting to switch spend in the other direction—but the 2.8-percentage-point difference is just within the 3-percentage-point margin of error. Likewise, the options of spending more on both products and services and spending less on both products and services were evenly balanced. Although the overall picture perhaps looks more negative than actual recent spending data show (for example, we know that consumers are, in total, spending more on services year over year), it also implies a degree of stability—that no major switching trend lies ahead.

- Our full holiday survey data analysis will be published in a forthcoming report.

Figure 2. US Consumer Survey: Agreement with Statements (% of Respondents) [caption id="attachment_133845" align="aligncenter" width="550"]

Base: 1,567 US respondents aged 18+ who spend on the holidays, surveyed on September 28, 2021

Base: 1,567 US respondents aged 18+ who spend on the holidays, surveyed on September 28, 2021Source: Coresight Research[/caption]

One support for retail in aggregate could be the apparent consumer retreat amid concern about Covid-19 Delta cases—should this be sustained, it could prompt a renewed redirection of spend from discretionary services into retail categories.

In recent months, US consumers have been spending around $150 billion each month on selected major discretionary services (from foreign travel to dining out to leisure services) and around $130 billion each month on selected major discretionary goods categories (such as beauty products, clothing and footwear, jewelry and watches, and recreational items), according to our analysis of BEA data. From these bases, each 1% dialing back on aggregate discretionary services spend by consumers during a quarter would free up $4.5 billion for competing categories. Each $4.5 billion, in turn, represents around 1.2% of quarterly discretionary goods spending or 0.37% of total projected holiday-quarter retail sales of $1.2 trillion.

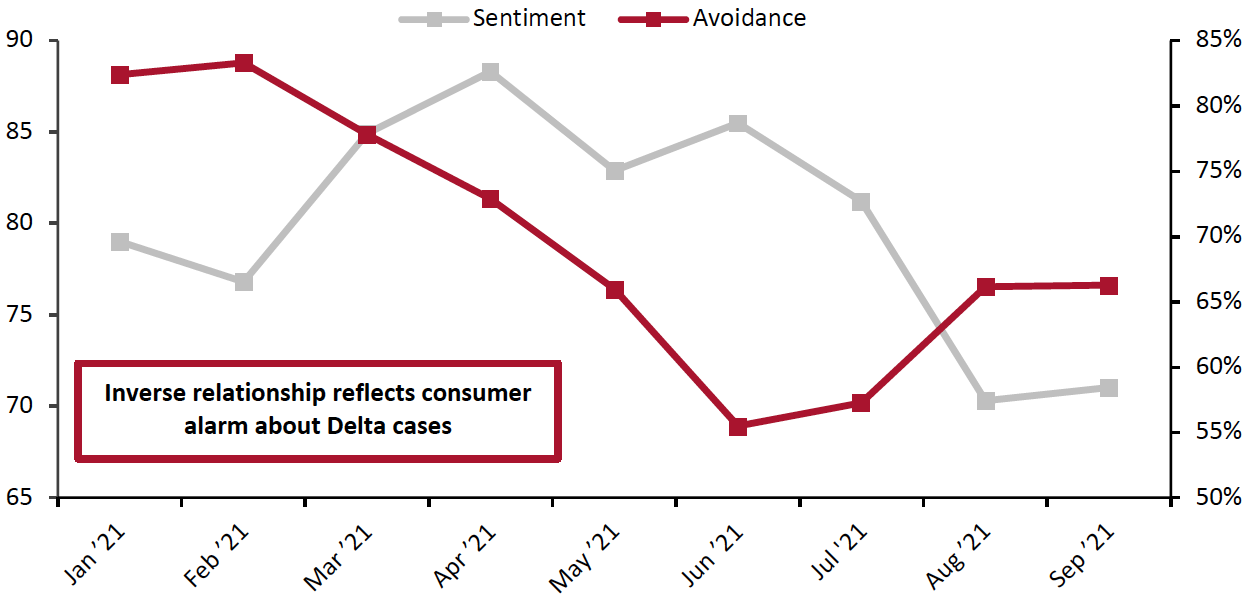

Reflecting concerns about the Delta variant, the University of Michigan’s consumer sentiment index has declined since June. This mirrors Coresight Research’s survey data, which shows that the same month was an inflection point in terms of consumers avoiding public places. Both metrics leveled off in September.

Figure 3. US Consumer Confidence (Left Axis; Index) vs. Proportion of Survey Respondents Avoiding Any Kind of Public Place (Right Axis; %)

[caption id="attachment_133846" align="aligncenter" width="700"] Base for avoidance: US respondents aged 18+ surveyed weekly

Base for avoidance: US respondents aged 18+ surveyed weeklySource: University of Michigan/Coresight Research[/caption] 2. Major Sectors Look On Track for Solid Holiday Demand

Coresight Research’s analysts outline their expectations for the holiday quarter for three major sectors—apparel, department stores and grocery. We will shortly publish standalone sector outlook reports, which expand on this commentary.

Apparel and Footwear

We expect to see continued outperformance in apparel and footwear, driven by ongoing strong demand for athleisure, casualwear and intimates categories and a rebound in demand for dresswear, as consumers are increasingly returning to socializing.

So far in 2021, apparel spending has recovered substantially, exceeding pre-crisis levels from 2019 in every month in 2021. On a two-year basis, apparel spending growth averaged 15.4% between January and July 2021. We are seeing consumers increasingly renewing their wardrobes as restrictions ease and they resume social activities despite the spread of the Delta variant. In our holiday consumer survey, undertaken on September 28, clothing and footwear recorded the greatest proportion of consumers expecting to spend more versus 2020 out of the major holiday-related categories.

As the apparel specialty sector annualized the deep declines of 2020, the first eight months of 2021 saw specialty sector sales surge by around 70% year over year. We estimate that sector year-over-year sales growth will moderate to the high teens in percentage terms in the holiday quarter as the sector annualizes more demanding comparatives from holiday 2020. This equates to a high-single-digit percentage increase in sector sales versus pre-crisis 2019.

Major apparel specialists are planning to capitalize on scale advantages and bring inventory earlier than normal to protect holiday sales. A few major retailers intend to ensure holiday inventory by securing significantly expedited deliveries at an additional cost to hedge against the impact of supply chain disruptions.

Department Stores

After a strong first half of the year for department stores, we expect year-over-year growth among major department store retailers to be in the mid-teens during the holiday quarter, which equates to a decrease in the low single digits versus the precrisis 2019 holiday period.

The three major department stores, Kohl’s, Macy’s and Nordstrom, comprise 72% of the total department store sector and at the end of the second quarter of fiscal year 2021, their total revenues were up 55.2% year over year, or down 5.7% compared to 2019. Our growth expectation is supported by the strong outlook for apparel and footwear, as around 50% of department store revenues comprise apparel and footwear sales.

In the last half of the year, we expect to see outperformance in occasion wear, as more consumers will be attending holiday events and gatherings, visiting family, and attending events that were postponed in 2020. For the remainder of the year, we expect sector outperformance in two major categories—beauty and toys. The Kohl’s x Sephora shop-in-shop locations that launched in August should help to boost the department store’s beauty sales. Macy’s announced its collaboration with Toys“R”Us for 400 shop-in-shop locations in 2022; launching the brand on its website in mid-August 2021. The company reported at the Goldman Sachs 28th Annual Global Retailing Conference on September 9 that its toys business has doubled since the website launch.

Department stores are reporting that the categories most affected by supply chain disruptions are apparel and footwear. This is a potential headwind, as department stores are already running lean on inventory coming out of the second quarter.

Grocery

After a solid first half of 2021, which saw grocery surge by almost 6% year over year we estimate, Coresight Research expects total grocery growth to ease to approximately low single digits in the holiday quarter—but be up 10–15% versus pre-crisis 2019. We model slower year-over-year growth in grocery sales against demanding comparatives from holiday 2020 and a partial shift of spend to foodservice—as some consumers are likely to go back to typical, celebratory on-premise consumption having had low-key celebrations in holiday 2020. Others will continue to organize small get-togethers at home rather than dining out or attending social events as a cautionary measure, boosting sales of grocery retailers.

The grocery sector will benefit from the at-home consumption trend attributed to renewed consumer caution from current high coronavirus cases, a pattern that bears some similarity with last holiday season. Despite consumers’ return to in-store shopping, some are still choosing to fill their carts virtually. Even against tough comparatives, year-over-year growth of food and beverage e-commerce has not yet turned negative, reflecting retention of online shopping behaviors. According to IRI E-Market Insights, online food and beverage sales grew 7.2% year over year for the four weeks ended September 5, 2021, and 113.6% from 2019 levels.

What We Think

We reiterate our expectations for a strong, double-digit rise in total retail sales on a two-year basis. This strong demand should be broad-based: The previously challenged apparel specialty and department store sectors are seeing buoyant recoveries, and grocery retail has proved resilient this year despite some return to foodservice.

Services represent competition to retail for discretionary dollars but we point to the apparently gradual pace of service recovery, which would appear to still leave aggregate services spending down versus 2019 by the end of the year. In addition, we note the potential for some switching back from some services to retail amid a consumer retreat in the face of Covid-19.

The headwinds this year will not be demand but supply, as creaking global supply chains and domestic labor shortages impact product availability, replenishment and fulfillment.