DIpil Das

What’s the Story?

Our The 12 Weeks of Holidays 2021 series counts down to this year’s holiday peak with new thematic research each week. In this 12th and final report, we discuss season-to-date (October and November) retail sales in the US and the key trends that are impacting holiday shopping this year.Why It Matters

The holiday season is a crucial time of the year for the retail industry: Retailers look to the fourth quarter to be bolstered by holiday sales. In 2020, US holiday-season retail sales (calendar fourth quarter) totaled $1.1 trillion, according to our analysis of US Census Bureau data, up 9.2% year over year—the highest annual growth since 2010 and comprising 28% of total US retail sales. The online channel accounted for 20% of holiday sales, with e-commerce sales having increased by 32.5% year over year, according to the US Census Bureau. Coresight Research continues to expect a strong, 9%–10% year-over-year increase in total US retail sales for holiday 2021 (October–December quarter).US Holiday 2021 Homestretch: Coresight Research Analysis

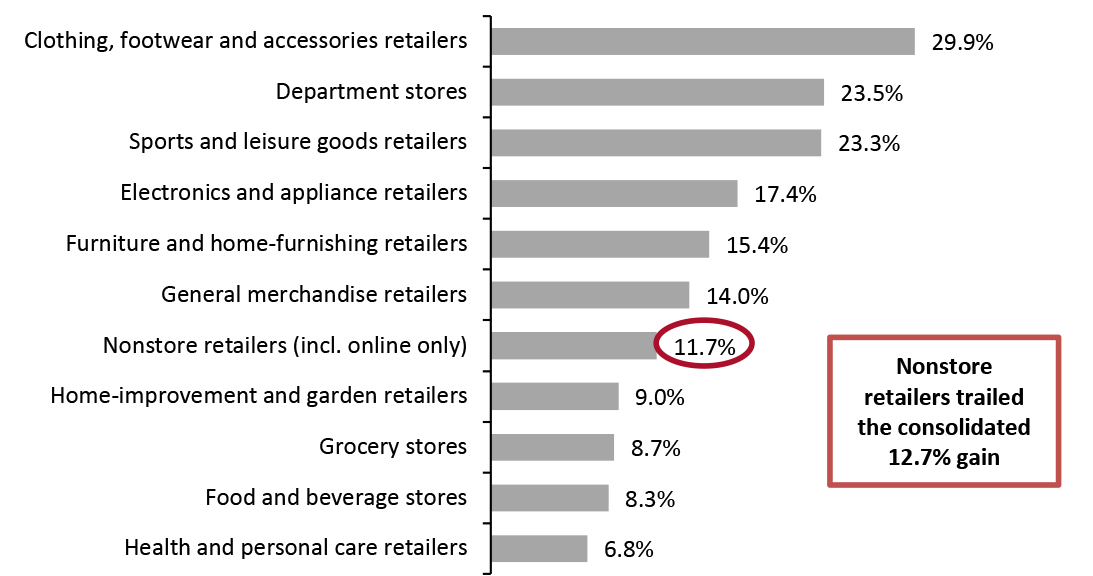

Season-to-Date Retail Sales Following October’s double-digit retail sales gain of 10.5% year over year (revised from 10.9%), November saw an acceleration to 14.8% growth. (Coresight Research’s measure of core retail sales is the unadjusted year-over-year change, excluding gasoline and automobiles.) This represents a season-to-date (October and November combined) year-over-year sales increase of 12.7%—putting the season on track to meet our projection of a 9%–10% overall holiday sales increase. Clothing, footwear and accessories retailers saw the highest year-over-year sales increase among all retail channels, of 35.3%. Department stores also recorded a strong performance, of 24.8%. Even on a two-year basis (versus pre-pandemic November 2019), these retailers both exhibited solid growth, of 14.4% and 4.9%, respectively.- Read our November 2021: US Retail Sales report, which presents US Census Bureau data in more detail.

Figure 1. US Retail Sales: November 2021 (YoY % Change) [caption id="attachment_138362" align="aligncenter" width="700"]

Source: US Census Bureau/Coresight Research [/caption]

Apparel and department stores are traditionally popular channels for gift shopping. Analyzing combined October and November sales growth, we can see that traditional popular gifting channels have recorded the strongest performance in the holiday shopping season so far: apparel retailers, department stores and electronics/appliance retailers have seen growth of high teens or better in percentage terms (see Figure 2). Interestingly, nonstore retailers have underperformed the overall 12.7% year-over-year gain in season-to-date holiday sales.

Source: US Census Bureau/Coresight Research [/caption]

Apparel and department stores are traditionally popular channels for gift shopping. Analyzing combined October and November sales growth, we can see that traditional popular gifting channels have recorded the strongest performance in the holiday shopping season so far: apparel retailers, department stores and electronics/appliance retailers have seen growth of high teens or better in percentage terms (see Figure 2). Interestingly, nonstore retailers have underperformed the overall 12.7% year-over-year gain in season-to-date holiday sales.

Figure 2. US Retail Sales: Season to Date* (YoY % Change) [caption id="attachment_138363" align="aligncenter" width="700"]

*October and November 2021 combined

*October and November 2021 combined Source: US Census Bureau/Coresight Research [/caption] On a two-year basis, department stores have seen an 8.8% sales gain in the holiday season so far (October and November). The pandemic has provided the department-store channel the opportunity to test and trial new strategies, including in the digital channel. New fashion trends, pent-up demand and vaccination rollouts among Covid-fatigued consumers have also prompted store visits, benefitting both department stores and clothing stores, which recorded two-year growth of 15.4% (see Figure 3). 2022 will be pivotal to see if department stores can continue their turnaround and recreate relevancy beyond profit-eroding promotions. However, there will be numerous challenges, including the end of government stimulus, inflationary pressures across multiple discretionary and nondiscretionary categories and the gradual shift to more experiential/service-related purchases such as travel, sporting and cultural events, as well as dining out as pandemic-related health concerns (hopefully) diminish.

Figure 3. US Retail Sales: Season to Date* (Yo2Y % Change) [caption id="attachment_138364" align="aligncenter" width="699"]

*October and November 2021 combined

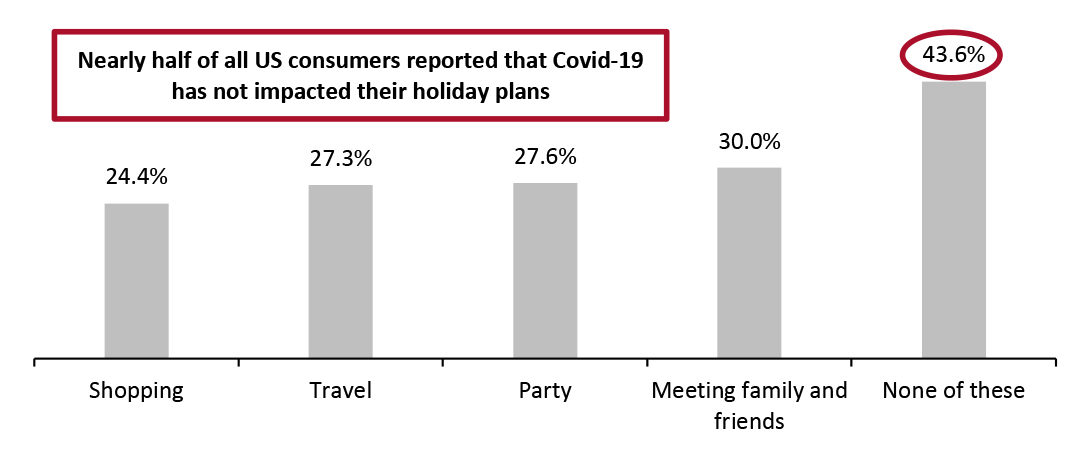

*October and November 2021 combined Source: US Census Bureau/Coresight Research [/caption] We are in the final stretch of holiday shopping as we write this report, and the short window for online deliveries makes a trip to stores for discovering, buying or picking up online purchases likely in the week running up to Christmas. Moreover, Coresight Research’s survey of US consumers on December 6, 2021, found that 38.5% of respondents had completed less than 50% of their holiday shopping and 14.9% had not yet begun holiday shopping—providing fuel to further retail sales growth in the final month of December. However, the daily barrage of warnings regarding Omicron has slowed traffic, according to our conversations with retailers and our channel checks. On “Super Saturday” (December 18, 2021), which is traditionally one of the busiest shopping days of the holiday season and the year overall, traffic was muted in the New York metro area. We expect consumers to continue to shop right up until (and after) Christmas, across both online and brick-and-mortar channels, to buy gifts and explore post-Christmas bargains. The season’s results could surpass our projection of a 9%–10% year-over-year sales increase, barring further alarming developments regarding Covid-19 and its variants, Delta and Omicron. We discuss the impacts of Covid-19 on US consumer behavior further in the next section. The Impacts of Covid-19 A daily deluge of government and health officials proclaiming the dangers of social interactions is increasing anxiety among businesses, employees, educators, students, employees and consumers. Announcements of canceled theatrical and concert events, schools rethinking 2022 in-person classes and businesses postponing a return to the office have seen many consumers cancel reservations and travel plans. Our December 6, 2021, survey reflects this, with consumers reporting that Covid-19 and the threat of the Omicron variant has impacted plans for the holidays, whether they be shopping, travel, party or social plans (each cited by around one-quarter of respondents). However, many consumers have Covid-19 fatigue. They are vaccinated, have had their booster shot and want to celebrate the holidays with family and friends. Nearly half of our survey respondents reported that Covid-19 has not impacted their holiday plans (see Figure 4).

Figure 4. Holiday Plans That Have Been Impacted by Covid-19 (% of Respondents) [caption id="attachment_138365" align="aligncenter" width="701"]

*Including the threat of the Omicron variant

*Including the threat of the Omicron variant Consumers could select more than one option

Base: US respondents aged 18+

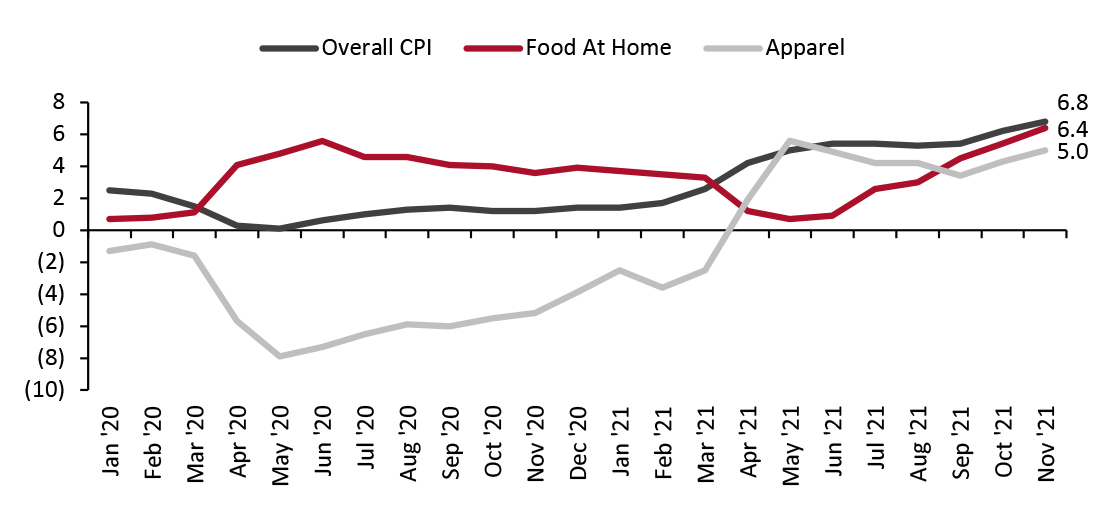

Source: Coresight Research [/caption] Inflationary Pressures Build 2021 is seeing an “IOS” holiday season, meaning one characterized by inflationary pressures, out-of-stock products and consumers spending more time at home. Consumer price inflation has been trending high in the final months of 2021, propelled largely by higher food and gas prices. In November, consumer prices increased by 6.8% year over year, representing a 39-year high in inflation, according to the US Consumer Price Index (CPI) as reported by the Bureau of Labor Statistics. Since retail sales are not adjusted for inflation, higher inflation contributes to higher overall sales numbers—but November retail sales numbers nonetheless demonstrate that consumer demand for goods remains strong despite high inflation. The low unemployment rate, increasing average hourly wages, and savings built up during the pandemic may be contributing to consumers’ ability to spend despite the increase in prices.

- Read our latest analysis of the leading indicators of US retail sales for more.

Figure 5. US Consumer Price Index: YoY % Change [caption id="attachment_138366" align="aligncenter" width="700"]

Source: Bureau of Labor Statistics/Coresight Research[/caption]

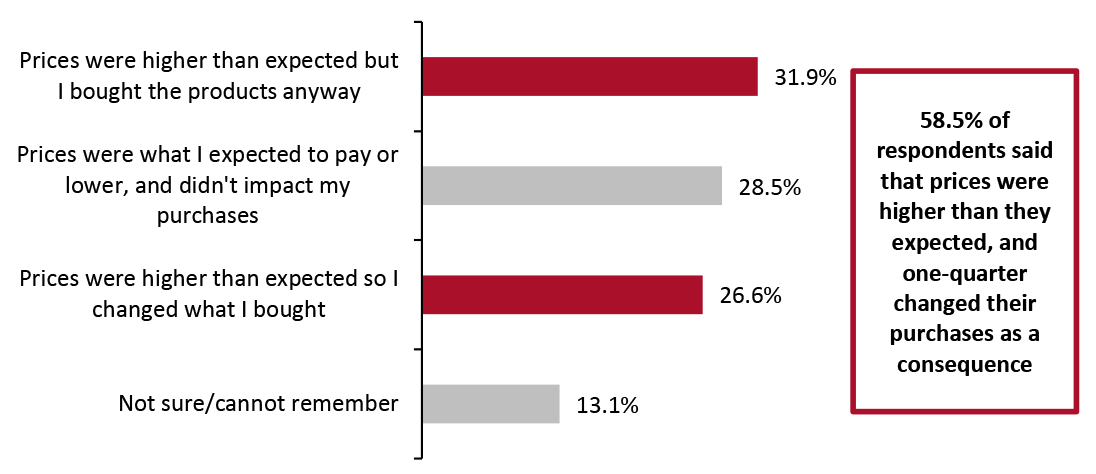

Consumers have encountered higher prices when shopping this holiday season, as retailers have entered the season with tight inventories, diminishing the need for promotional pricing to drive sales. In our December 6, 2021, survey, nearly six in 10 respondents said that prices were higher than they expected (see Figure 6).

Source: Bureau of Labor Statistics/Coresight Research[/caption]

Consumers have encountered higher prices when shopping this holiday season, as retailers have entered the season with tight inventories, diminishing the need for promotional pricing to drive sales. In our December 6, 2021, survey, nearly six in 10 respondents said that prices were higher than they expected (see Figure 6).

Figure 6. US Consumer Expectations Around Pricing and Impacts on Purchase Behaviors This Holiday Shopping Season (% of Respondents) [caption id="attachment_138368" align="aligncenter" width="701"]

Base: US respondents aged 18+

Base: US respondents aged 18+ Source: Coresight Research [/caption] While inflation is worrisome, for some discretionary goods such as apparel, the higher CPI partly reflects an annualizing of deflation amid depressed demand in 2020—and provides the prospect of some moderation in the year-over-year change once that annualization effect falls away and as the global supply chain gradually becomes ungnarled, not likely until mid-2022 at the earliest. Revitalization of Physical Retail The Covid-19 pandemic has prompted a reconsideration of the value of the physical store by consumers and retailers alike.

- For retailers, stores became important in the fulfillment of online orders as local distribution centers, including through BOPIS (buy online, pick up in store) and ship-from-store services.

- For brands, stores are the backdrop for the full expression of a brand, from scent to merchandising to services and products.

- With consumers gradually feeling more comfortable returning to stores through 2021, the brick-and-mortar channel has become a social destination, the place to discover, see and test products, as well as a means to makes purchase and returns.