Nitheesh NH

What’s the Story?

Our The 12 Weeks of Holidays 2021 series counts down to this year’s holiday peak with new thematic research each week. In this report, we discuss ongoing supply chain challenges and out-of-stocks, highlighting key commentary on these issues from major US retailers.Why It Matters

The holiday season is a crucial time of the year for the retail industry: Retailers look to the fourth quarter to be bolstered by holiday sales. Coresight Research expects a strong, 9%–10% year-over-year increase in total US retail sales for holiday 2021 (October–December quarter). Robust demand compounds already complex supply chain issues, with ongoing disruption from port congestion and product shortages. With the holiday season surge, we expect supply chain challenges to amplify and continue well into 2022, until consumers switch a significant portion of their spending away from goods and back to services, such as eating out and travel.Retailer Commentary on Out-of-Stocks and Supply Chain Risk Mitigation: Coresight Research Analysis

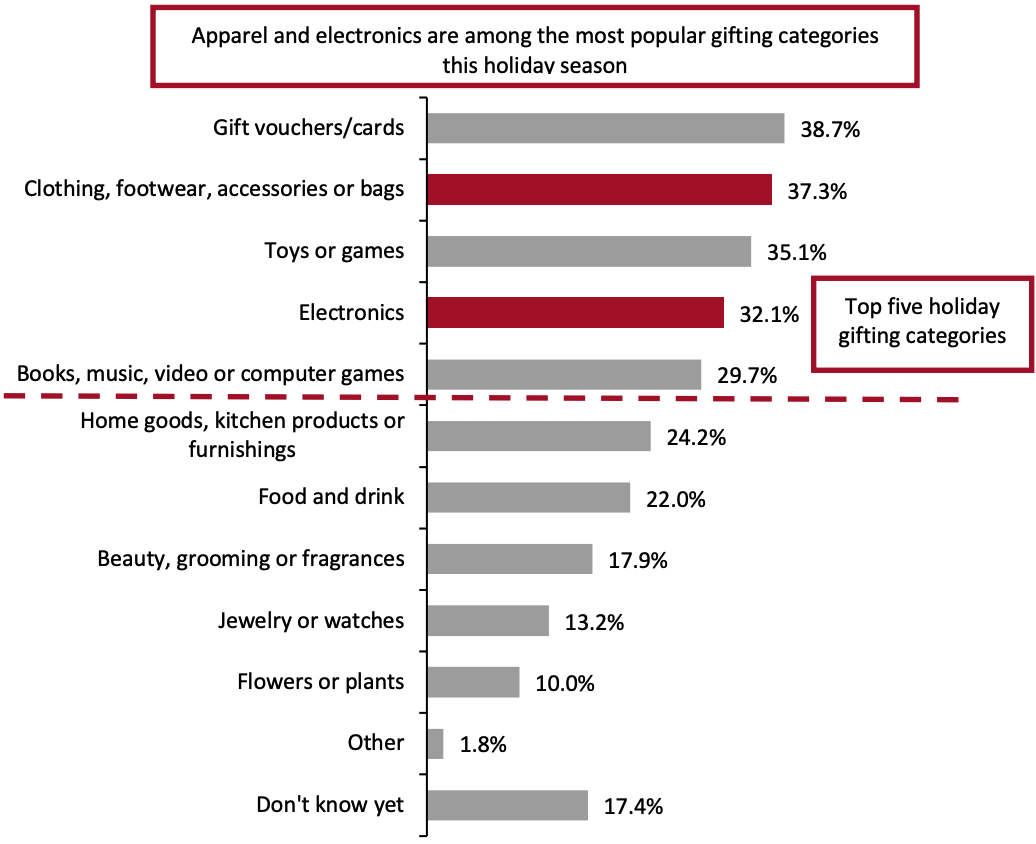

Out-of-Stocks in Apparel and Electronics Consumers are likely to face out-of-stocks in popular holiday categories, such as apparel and electronics, as retailers in these categories have significant exposure to imports and often source from markets that have been subjected to prolonged pandemic-led lockdowns and escalating port congestion (in Asia, for example).- Electronics retailer Best Buy remarked on its earnings call on November 23, 2021, that it is confident in its inventory planning to serve customers during the holiday but that some categories—such as appliances, gaming consoles and mobile phones—seem constrained.

- Apparel specialty retailer Gap was severely affected by product delays. During its earnings call on November 24, 2021, the company announced that it has slashed its full-year sales growth forecast from the previously announced 30% to 20%, as it estimates $550–$650 million of lost sales due to supply chain delays to available inventory and approximately $450 million in total air-freight expenses for the year.

- On its earnings call on November 10, 2021, sportswear company Adidas reported that it was experiencing delays of more than two weeks in about one-third of shipments leaving Asia and “significant delays” at several destinations in the US and Europe. The company expects supply shortages to impact its top line in the next two quarters. Adidas also reported that its supply shortages are more pronounced due to the extended lockdowns in Vietnam, where close to 40% of its goods are manufactured.

- Online furniture retailer Wayfair stated on its earnings call on November 4, 2021, that it has listed inventory that has not come onshore as “out of stock” on its e-commerce site, and that it is listing only items that are in-transit or onshore as “in stock.” The company said that its customers know to expect longer lead times on orders.

- In its October 28, 2021, earnings call, outerwear company Columbia Sportswear reported that the time taken for in-transit inventory to move through the supply chain had doubled due to port congestion and unavailability of trucks and drivers. Goods are now taking six weeks longer to be delivered, according to the company.

- Read our full survey findings and analysis of US holiday shoppers’ behaviors and expectations.

Figure 1. Product Categories That US Holiday Shoppers Expect To Buy as Gifts for Holiday 2021 (% of Respondents) [caption id="attachment_137308" align="aligncenter" width="700"]

Base: 1,567 US respondents aged 18+ who spend on the holidays, surveyed on September 28, 2021

Base: 1,567 US respondents aged 18+ who spend on the holidays, surveyed on September 28, 2021Source: Coresight Research[/caption] Off-Price Opportunities The ongoing delays in shipping and stock delivery are priming off-price retailers for a bumper buying season. Delayed inventory receipts by full-price retailers are proving to be a bright spot for off-price retailers, while robust consumer demand is reducing markdown activities at some retailers.

- Department store chain Burlington Stores stated on its earnings call on November 23, 2021, that holiday merchandise that does not make it to the shop floor due to shipping delays will find its way to the off-price channel. The company anticipates that “the next couple of months could be a very good buying opportunity for off-price.”

- Discount department store retailer Ross Stores reported during its earnings call on November 19, 2021, that the company would have “more closeout opportunities” in the future due to supply chain congestion. Company CEO Barbara Rentler clarified that Ross Stores expects to cancel orders of delayed goods because they cannot be sold, and pack away a substantial proportion for the third and fourth quarters of 2022, while some seasonless clothing would be part of first-quarter inventory in 2022.

- On The TJX Companies’ earnings call on November 17, 2021, CEO Ernie Herman said that the company “could see a tremendous amount of packaways based on the supply chain challenges” that the market will encounter as the holiday season ends. Herman added that the seasonal inventory that did not arrive promptly for the holidays “is going to spill off a great opportunity for [TJX] to have increased packaways for next fall.”

- Apparel brand Urban Outfitters reported during its earnings call on November 23, 2021, that “lighter apparel inventory and fewer promotions” led to strong sell-throughs and “a historically low markdown rate.”

- Department store retailer Macy’s observed on its earnings call on November 18, 2021, that lower inventory levels, as well as pricing and promotion activities, led to fewer markdowns in its most recent quarter.

- Mass merchandiser Walmart stated on its third-quarter earnings call on November 16, 2021, that it is seeing strong consumer demand, which has led to higher sell-through and thus lower markdowns coming into the holiday quarter.

- Walmart stated on its latest earnings call that it had pulled forward inventory, especially Halloween and Christmas merchandise, which puts it in “a good trading position.”

- During its first-quarter earnings call on November 11, 2021, luxury company Tapestry stated that it expects inventory to be up meaningfully for the rest of the fiscal year as it has pulled forward receipts to manage the long supply chain.

- Consumer products company Clorox has increased its share of contract manufacturers from 20% to 50% of its production to meet near-term high demand for its products. The company has reported plans to scale back on these additional suppliers once demand normalizes and identify more efficient sources.

- Toymaker Mattel has nearshored some manufacturing to make sure there are enough toys in supply for the holiday season, as reported by the company on its earnings call in October 2021.

- On its earnings call on November 9, 2021, luxury e-commerce company The RealReal stated that it is automating operations at its authentication centers.

- Acquiring companies that enable supply chain operations allows brands and retailers to quickly add capacity and gain greater control over the supply chain.

- American Eagle has acquired AirTerra, a parcel shipping firm, and Quiet Logistics, an order fulfillment and returns management company, to help it achieve greater control over the supply chain.

What We Think

The continuing supply chain crisis appears to be a double-edged sword—it is resulting in millions of dollars of lost sales for some companies while presenting new buying and strategic planning opportunities for others. Implications for Brands/Retailers- Retailers that have significant exposure to single-source suppliers must act quickly to reshuffle their sourcing mix for the longer term. Businesses across industries have been battered by the pandemic and suppliers will be looking to forge new, longer-term relationships. Retailers and brands in the apparel, home and mass merchandising sectors that have historically relied on low-cost, high-capacity manufacturing countries in the Far East must act fast to diversify their sources and insulate themselves from further risk.

- Off-price retailers can make the most of the upcoming buying season with unsold/undelivered stock up for grabs.

- As the crisis continues to highlight the importance of flexibility and speed, retailers across sectors must look to implement measures such as nearshoring and automation as part of their supply chain strategies.