DIpil Das

What’s the Story?

Why It Matters

The shape and scale of consumer demand during the holiday peak is less certain than ever. Our holiday coverage aims to offer directional guidance.Three Things Shoppers Will Do Differently: In Detail

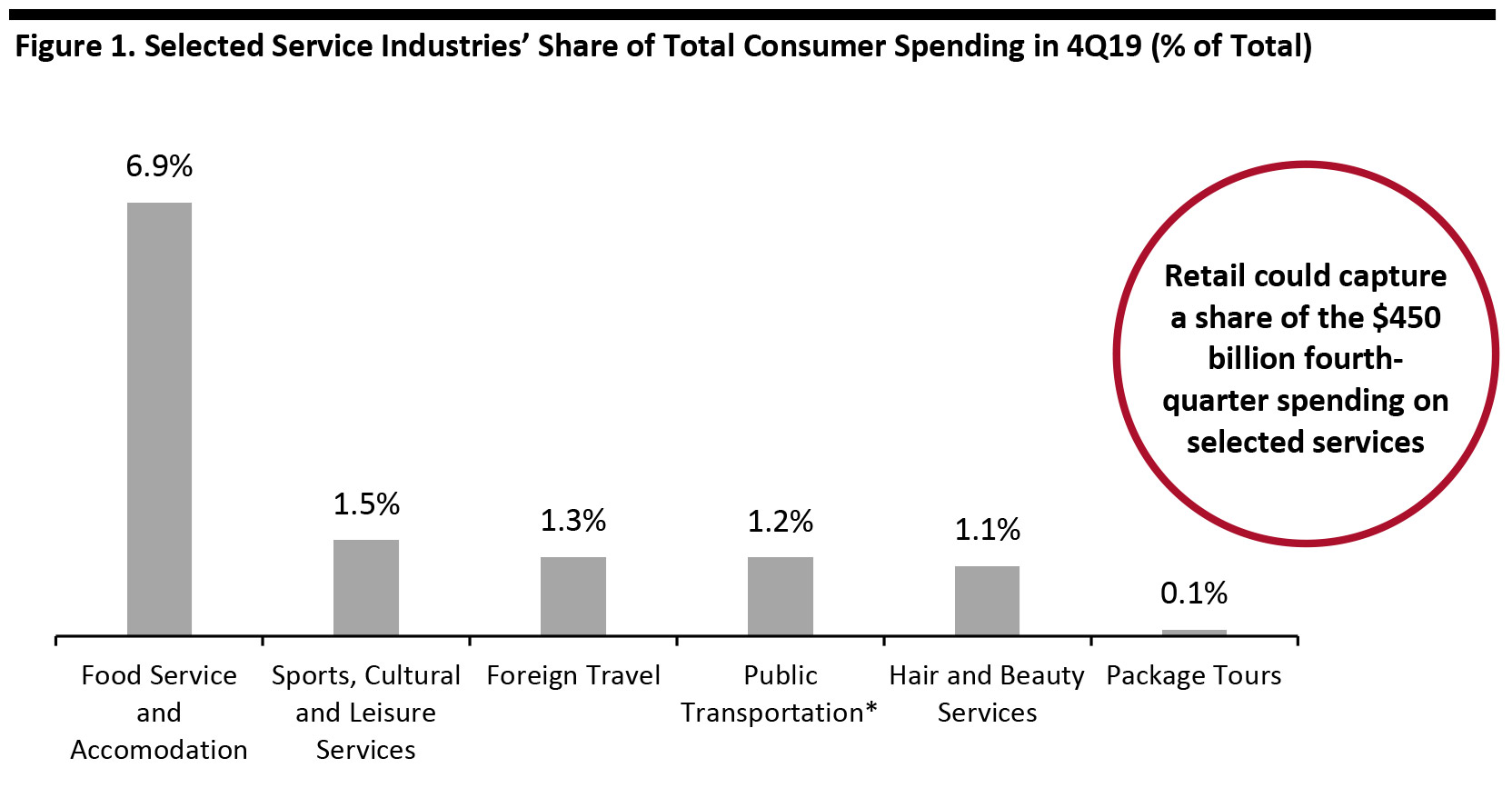

1. Switch Spending from Services to Retail Almost seven in 10 (68.9%) holiday shoppers told us that they would switch some spending from services to products as a result of Covid-19 restrictions. As consumers’ choices to spend on dining out, travel, nights out and other leisure activities are unusually limited, there is an opportunity for more discretionary dollars to flow to retail. Our survey found that expectations to switch spend from services to products (i.e., retail) peaked at 75% among the youngest adult age group, of 18–29, and declined by age thereafter, to a low of 60% among those aged over 60. The youngest shoppers tend to have less disposable income, but they are more likely to spend on services—so the high degree of expected switching bodes well for retail.- In the holiday quarter of 2019, the selected service categories charted below accounted for around 12% of all consumer spending.

- In dollar terms, that translated to around $450 billion of consumer spending on categories ranging from food service to foreign travel to package tours in the fourth quarter of 2019.

- For comparison, fourth-quarter 2019 retail sales totaled just over $1 trillion.

*Includes air transportation and water transportation as well as ground transportation

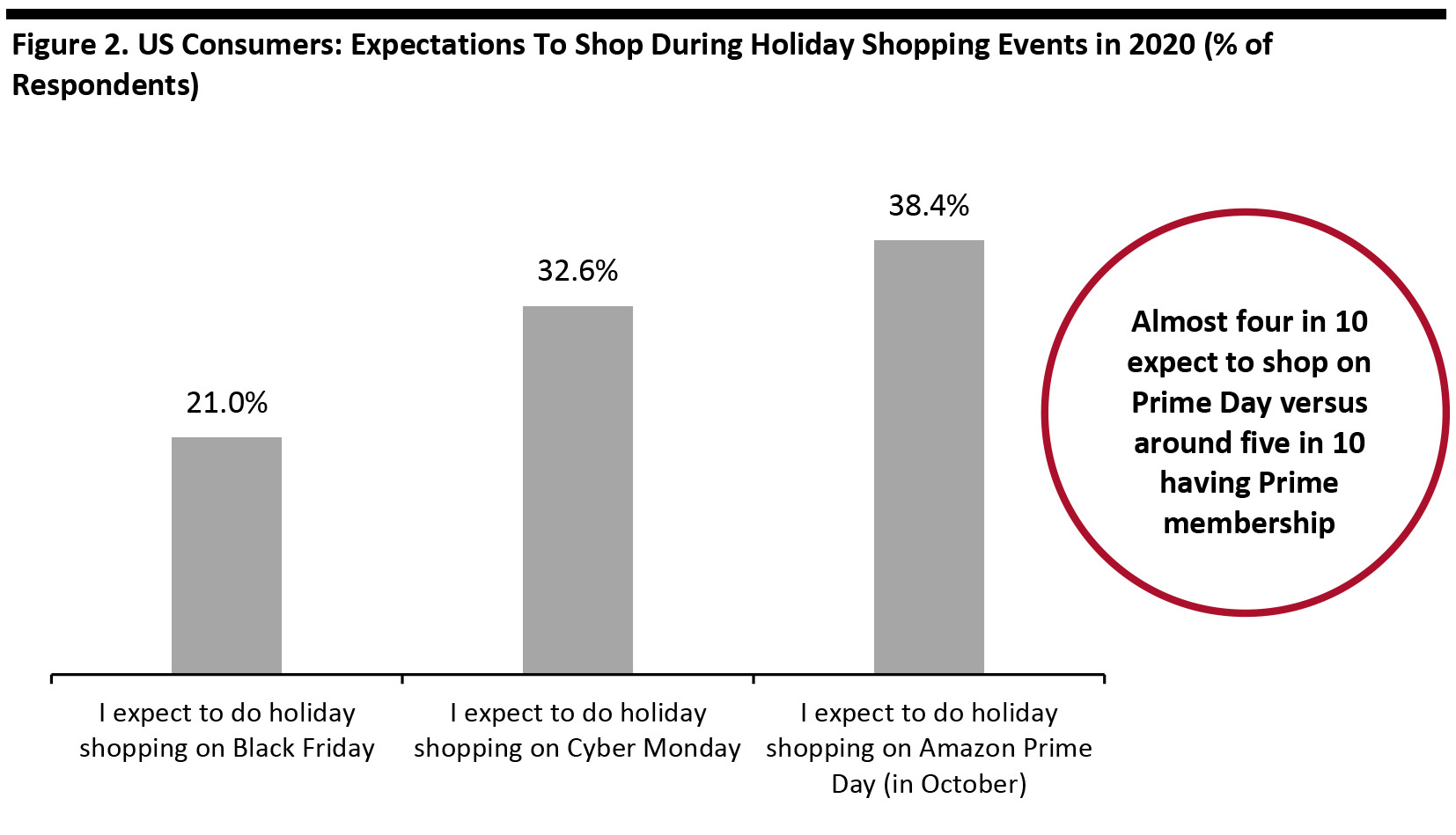

*Includes air transportation and water transportation as well as ground transportation Source: US Bureau of Economic Analysis/Coresight Research [/caption] 2. Shoppers Will Buy Early Three in 10 (30.4%) holiday shoppers told us that they expect to start holiday shopping earlier than usual this year, versus 10.5% expecting to start later. That 20-percentage-point difference is good news to retailers and fulfillment companies, which must square limited shipping capacity with surging demand for e-commerce. Pulling forward holiday shopping should help ease the pressures on the e-commerce supply chain. Consumers seem attuned to the potential logistical challenges. Among those expecting to start shopping earlier, almost half (47.8%) said it was because they were concerned about online orders not being delivered in time. 3. A Fall Prime Day Will See Strong Demand One challenge to logistics providers in the fourth quarter could be explosive demand around Amazon’s Prime Day. While the date for Prime Day 2020 is unconfirmed, it is widely expected to fall in October. Some 38.4% of holiday shoppers told us that they expect to shop on an October Amazon Prime Day—well ahead of the more traditional Black Friday and Cyber Monday, as we chart in Figure 2. We would not be surprised to see Amazon offer a highly extended Prime Day(s), or even week, to prevent condensed demand exacerbating the shipping challenges that we discussed above.

- In March, we recorded 54.3% of survey respondents personally having an Amazon Prime membership and a further 27.3% having access to Prime benefits through someone else in their household (while not having a Prime membership themselves).

- Based only on those who personally have a Prime membership, our latest survey data suggests that a large majority of around seven in 10 Prime members plan to shop on Prime Day.

Base: 1,116 US Internet users aged 18+ who expect to spend on the holiday season, surveyed in September 2020

Base: 1,116 US Internet users aged 18+ who expect to spend on the holiday season, surveyed in September 2020 Source: Coresight Research [/caption]

What We Think

Implications for Brands/Retailers- Retailers should take every opportunity to encourage consumers to shop early, and so ease pressures in e-commerce logistics.

- Retailers must make efforts to capture spending that would otherwise have flowed to services—including from younger shoppers.

- Retailers must prepare to compete with an October Prime Day—and Coresight Research’s 10.10 Shopping Festival provides such an opportunity.

- Shopper demand could prove resilient this holiday season. However, we expect to see constraints in supply, including in fulfillment bottlenecks, store-capacity limitations in in-store shopping and inventory availability due to cautious buying by retailers early in the year.