DIpil Das

What’s the Story?

We are counting down to the holiday season with a 12-week series focused on the data, trends and observations surrounding the end-of-year peak. In the final report of the series, we discuss five trends that we have seen this holiday season.Why It Matters

The 2020 holiday shopping season is turning out to be unlike any other, characterized by an early shopping surge, increased e-commerce shopping and consumers seeking alternative delivery options. Coresight Research estimates that US online retail sales will climb by around one-third year over year in the holiday quarter, to represent around 21.5% of all US retail sales. Retailers have bolstered their digital offerings to capitalize on the e-commerce boom, which means retail hiring practices have shifted to serve more online customers, a change that is expected to stick post crisis. With restrictions on large gatherings and a continued move away from food service, restaurants and dining, at-home consumption will see higher demand in this holiday season, providing grocery brands and retailers with additional opportunities to drive sales. Brick-and-mortar retail continues to see severely reduced shopper visits. US nonfood retail is on course for an approximate 30–35% year-over-year fall in traffic in stores this holiday season (October to December). Against this backdrop, retailers have been leveraging digitally immersive experiences to inspire consumer spending in the absence of in-store seasonal atmosphere and mood. With the rise in online spending activity, BOPIS and curbside pickup have gone from added retail services to critical retail functions this holiday season. A combined 30.3% of US consumers used BOPIS or curbside pickup over the Thanksgiving-to-Cyber Monday weekend, according to a recent Coresight Research survey. Retailers are looking to progress on this front by simplifying these processes while reducing human-to-human contact.Five Things We Have Seen This Holiday Season: In Detail

1. Holiday Hiring Slides by 20% Against the backdrop of ongoing health risks, growing e-commerce trends and rampant retail bankruptcies, holiday hiring patterns this season underwent a radical transformation. On a comparable basis, Coresight Research had tracked a 19.8% year-over-year decline in total holiday hiring by retailers and allied sectors such as logistics companies that have announced hiring plans this year. Department stores drove the bulk of the decline, with Macy’s cutting seasonal hires to 25,000 this year from 80,000 in 2019. JCPenney, which was rescued from bankruptcy in early November, is hiring just 1,700 people in contrast to 37,000 last year. On a comparable basis, we have tracked a 32% year-over-year decline in total hiring by retailers that have announced such plans this year. This holiday season, retail hiring practices shifted to serve more online customers, benefitting the logistics and transportation sector, which saw increased hiring activities to handle the festive e-commerce rush. Courier companies announced hiring plans that matched or exceeded job openings from last year. In total, we have tracked a 13.9% uplift in hiring by selected logistics firms.Figure 1. Seasonal Hiring Announcements by Selected Retailers and Logistics Firms [wpdatatable id=639 table_view=regular]

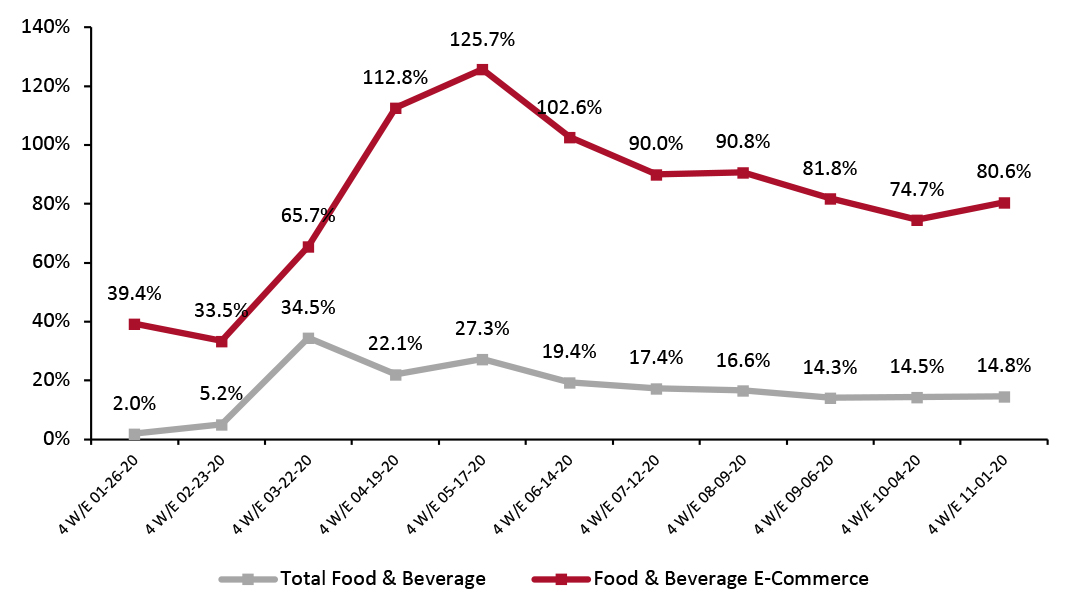

*USPS numbers for 2018 and 2020 are only for a specific region and is not a nationwide hiring number **Year-over-year percentage change is on a comparable basis Source: Company press releases 2. Online Grocery Reaccelerates Grocery e-commerce growth stayed widely above pre-pandemic growth figures and reaccelerated in the fourth quarter of the year. Online food and beverage sales climbed 80.6% for the four weeks ended November 1, after growth softened for two consecutive periods. Albertsons said that it is holding more inventory than normal this holiday season to counter any potential hoarding, while Walmart said that it has turned on almost 2,500 stores to fulfill online orders and can quickly flex this number to help relieve pressure on its e-commerce fulfillment centers during the holiday season. Against the backdrop of the resurgence of coronavirus cases and varying regional lockdowns imposed by local governments, we believe that online grocery sales will continue to post high growth during the holiday season. Typical celebratory on-premise consumption, which tends to spike in the last quarter of every year, will suffer from continued consumer avoidance and socializing restrictions. According to Coresight Research survey undertaken on December 8, almost half of the respondents who expect to spend less this holiday season said that they plan to spend less, or have spent less, on dining out or going to a bar/nightclub, up from nine percentage points from 39.8% a month ago. As more people organize small get-togethers at home rather than dining out or attending social events this holiday season, grocery brands and retailers will be the major beneficiaries of holiday spending.

Figure 2. US Food & Beverage Total and E-Commerce Sales Growth (YoY % Change) [caption id="attachment_120915" align="aligncenter" width="700"]

Source: IRI E-Market Insights™/Coresight Research

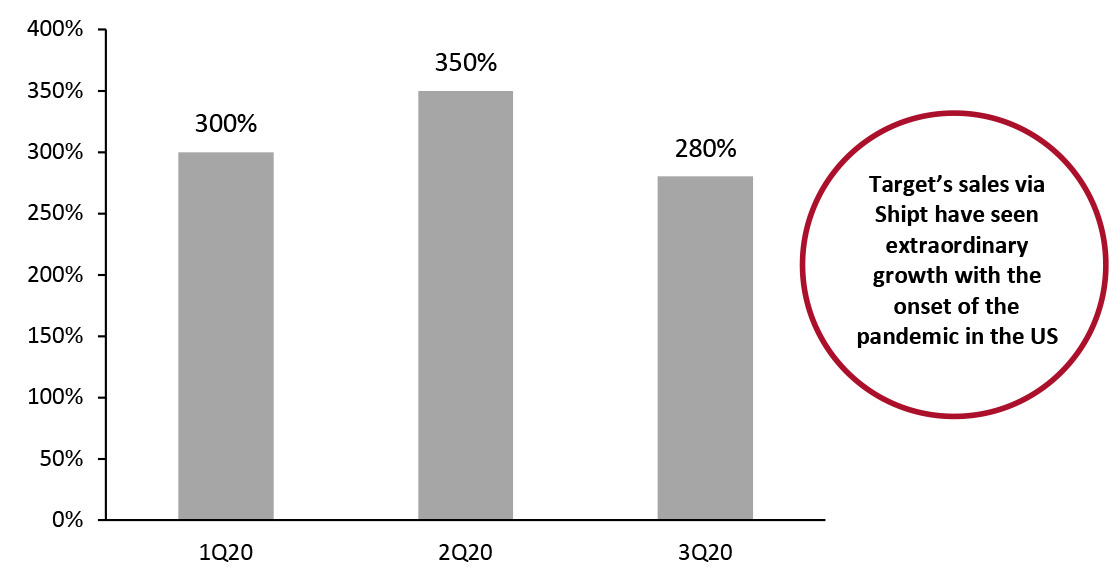

Source: IRI E-Market Insights™/Coresight ResearchIRI Disclaimer: The information contained herein is based in part on data reported by the IRI E-Market Insights™ solution and as interpreted solely by Coresight Research. The information is believed to be reliable at the time supplied by IRI but is neither all-inclusive nor guaranteed by IRI or Coresight Research, Inc. Without limiting the generality of the foregoing, specific data points may vary considerably from other information sources. Any opinion expressed herein reflect the judgement of Coresight Research, Inc. and are subject to change. IRI disclaims liability of any kind arising from the use of this information. [/caption] 3. Retailers Owning Last-Mile Delivery Have the Upper Hand Pandemic-induced online shopping has overwhelmed parcel delivery companies, stretching their capacity to the limit. On December 2, 2020, UPS placed shipping restrictions on six retailers due to space allocation, namely Gap Inc., Hot Topic, Inc., L.L.Bean, Macy’s, Newegg, Inc. and NIKE, according to The Wall Street Journal. Additionally, FedEx, UPS and USPS had levied holiday shipping surcharges, spanning the period from mid-October to mid-January. In this context, the capability of owning last-mile delivery cannot be underestimated as traditional carriers are already operating beyond capacity. Retailers that have strategically invested in bringing last-mile delivery in-house are poised to be winners in the holiday season. Amazon, which has been expanding its own shipping operations in recent years, has surged ahead without much shipping trouble, as it relies heavily on its own delivery service and drivers to accommodate its slew of shipments. According to the consulting firm MWPVL International, Amazon now delivers 67% of its own packages, up from 50% in 2019. Amazon has recently reported that 2020 has been the largest holiday shopping season so far in its history and highlighted that sales of small and medium-sized businesses selling on Amazon surpassed $4.8 billion in global sales from Black Friday through Cyber Monday, an increase of over 60% year over year. Target has invested heavily in developing its own last-mile logistics over the last few years, including its $550 million acquisition of Shipt in 2018 and its acquisition of transportation technology firm Grand Junction in the same year, as well as its acquisition of technology assets from last-mile technology company Deliv in May 2020. In its third quarter ended October 31, Target recently reported that its sales via Shipt increased by nearly 280%, accounting for more than $280 million of incremental sales, and added that it would play a key part in driving Target’s business in the fourth quarter.

Figure 3. Target’s Sales Fulfilled by Shipt, YoY% Change [caption id="attachment_120891" align="aligncenter" width="700"]

Source: Company reports[/caption]

4. Retailers Simulate Brick-and-Mortar Holiday Shopping Experiences with Virtual Stores

With consumers reluctant to visit brick-and-mortar locations, retailers are experimenting with virtual stores that replicate the live holiday shopping experience. These online stores allow shoppers to navigate through virtual versions of their digital locations and explore items while enjoying the holiday season’s colors, textures, décor and music. The virtual stores personalize the shopping experience for visitors, making it easier for consumers to discover products, get advice and make purchases—all of which drive e-commerce sales.

Ralph Lauren trialed its virtual shopping experience with the Beverly Hills store this fall and saw encouraging results with virtual foot traffic 10 times higher than the number of people who would have visited their storefront. In addition to the Beverly Hills store, shoppers can also visit virtual versions of Ralph Lauren stores in New York, Paris and Hong Kong.

At the Charlotte Tilbury virtual store, customers are accompanied around the store by an avatar of makeup artist and brand CEO and Founder Charlotte Tilbury. The store allows customers to virtually try on products with an AR (augmented reality) tool and watch tutorials to achieve the brand’s 10 signature makeup looks. Virtual shoppers can receive personalized product recommendations, watch live events and invite friends to join video calls to shop with them, recreating the excitement and social features of shopping in stores.

Sam’s Club partnered with Warner Bros. to create a virtual shopping experience based on National Lampoon’s holiday comedy film Christmas Vacation. The Sam’s Club virtual store is set in the Christmas Vacation home, the Griswold household in suburban Chicago, where customers can move through and purchase gifts. The company said that it would update the store experience through the season, connecting customers to sales and promotions.

The shift to virtual stores is likely going to stick beyond December shopping as retailers continue to offer access to their virtual stores but with different experience offerings. Through AR shopping experiences, retailers can reinvigorate physical foot traffic by stirring consumers’ curiosity and inspiring them to visit the brick-and-mortar stores in future.

5. Retailers Digitally Enhance In-Store and Curbside Pickup

Collection services have gained immense popularity amid the pandemic. Retailers of all types have ramped their BOPIS and curbside-pickup services as a safe and convenient alternative to in-store shopping in the age of social distancing. These services are less margin-erosive for retailers, and many price-conscious consumers also prefer collection to delivery, as assessed fees are typically lower than those on delivery orders.

Several retailers are now turning to technology to readjust and refine their approaches to increase operational efficiency, decrease wait times and further enhance the customer experience with collection services.

Source: Company reports[/caption]

4. Retailers Simulate Brick-and-Mortar Holiday Shopping Experiences with Virtual Stores

With consumers reluctant to visit brick-and-mortar locations, retailers are experimenting with virtual stores that replicate the live holiday shopping experience. These online stores allow shoppers to navigate through virtual versions of their digital locations and explore items while enjoying the holiday season’s colors, textures, décor and music. The virtual stores personalize the shopping experience for visitors, making it easier for consumers to discover products, get advice and make purchases—all of which drive e-commerce sales.

Ralph Lauren trialed its virtual shopping experience with the Beverly Hills store this fall and saw encouraging results with virtual foot traffic 10 times higher than the number of people who would have visited their storefront. In addition to the Beverly Hills store, shoppers can also visit virtual versions of Ralph Lauren stores in New York, Paris and Hong Kong.

At the Charlotte Tilbury virtual store, customers are accompanied around the store by an avatar of makeup artist and brand CEO and Founder Charlotte Tilbury. The store allows customers to virtually try on products with an AR (augmented reality) tool and watch tutorials to achieve the brand’s 10 signature makeup looks. Virtual shoppers can receive personalized product recommendations, watch live events and invite friends to join video calls to shop with them, recreating the excitement and social features of shopping in stores.

Sam’s Club partnered with Warner Bros. to create a virtual shopping experience based on National Lampoon’s holiday comedy film Christmas Vacation. The Sam’s Club virtual store is set in the Christmas Vacation home, the Griswold household in suburban Chicago, where customers can move through and purchase gifts. The company said that it would update the store experience through the season, connecting customers to sales and promotions.

The shift to virtual stores is likely going to stick beyond December shopping as retailers continue to offer access to their virtual stores but with different experience offerings. Through AR shopping experiences, retailers can reinvigorate physical foot traffic by stirring consumers’ curiosity and inspiring them to visit the brick-and-mortar stores in future.

5. Retailers Digitally Enhance In-Store and Curbside Pickup

Collection services have gained immense popularity amid the pandemic. Retailers of all types have ramped their BOPIS and curbside-pickup services as a safe and convenient alternative to in-store shopping in the age of social distancing. These services are less margin-erosive for retailers, and many price-conscious consumers also prefer collection to delivery, as assessed fees are typically lower than those on delivery orders.

Several retailers are now turning to technology to readjust and refine their approaches to increase operational efficiency, decrease wait times and further enhance the customer experience with collection services.

- Lululemon Athletica has launched a virtual waitlist technology that notifies consumers via text when it is their turn to enter the store or pick up, return and exchange orders. Customers can also use the waitlist service to schedule appointments for shopping even before or after the store’s normal operating hours.

- Ulta Beauty, which launched curbside pickup in April 2020, has implemented a curbside customer alert notification system integrated with GPS and geofencing technology. It automatically alerts the store associate when customers are on the way to stores, allowing them to deliver orders to customers as soon as they arrive at the pickup zones.

- Supermarkets such as Albertsons and Giant Eagle have implemented similar technology based on GPS and geofencing, eliminating customers’ need to call the store on arrival, thus making the curbside-pickup process easier.