DIpil Das

What’s the Story?

Our The 12 Weeks of Holidays 2021 series counts down to this year’s holiday peak with new thematic research each week. In this report, we consider developments so far in UK holiday retail, discuss what we expect to see in the remainder of the peak season, and consider what that means as we head into 2022.Why It Matters

The shape and scale of consumer demand during the final-quarter peak is crucial for retailers. Coresight Research’s global coverage provides directional guidance to retailers, suppliers and vendors.UK Retail Update: Coresight Research Analysis

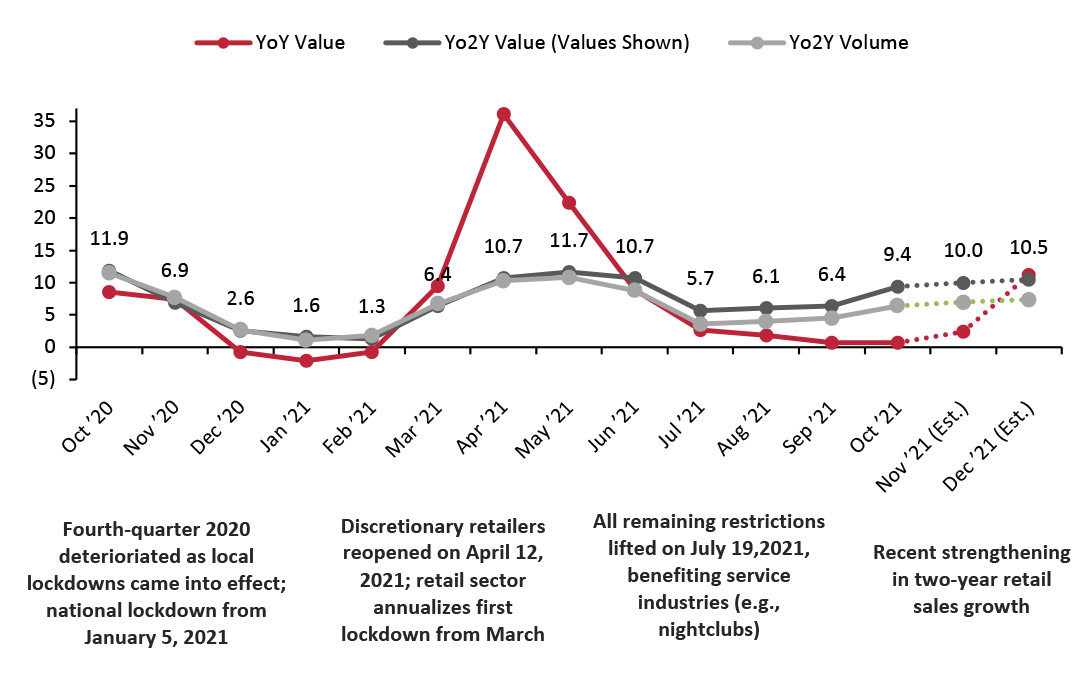

Retail Growth Has Strengthened Heading Toward Christmas Rising inflation has supported total UK retail sales expansion, yet even on a volume basis (i.e., in real terms), two-year retail growth has been respectably positive recently, at 6.4% in October 2021. The underlying trend is for retail demand to be solid, although unexceptional, when not impacted by external forces such as lockdowns or the easing of major Covid-19 restrictions. This underlying pattern is reflected in the two-year growth seen in the April–June and August–October 2021 periods, when regulations were stable (see Figure 1). We do not yet have confirmed November retail sales from the Office for National Statistics (ONS). However, Barclaycard tracked a 16% jump in consumer spending (including on services) via its cards versus two years earlier, the strongest pace of growth recorded by the card company so far in 2021. Barclaycard pointed to strong growth in purchases of clothing. The British Retail Consortium (BRC) also reported an acceleration in its retail sales metric, to 5% year over year, in November. Given recent trends, we expect the last two months of 2021 to prove solid on a two-year basis; we expect reported December year-over-year growth to jump versus weak comparatives from December 2020. Final-quarter retail growth will be driven by nonfood retail. The ONS and third-party data firms such as Kantar have been tracking negative year-over-year growth in grocery sector sales in recent months as the sector annualizes a strong 2020.Figure 1. UK Retail Sales: % Change [caption id="attachment_137761" align="aligncenter" width="699"]

YoY=year over year; Yo2Y=on a two-year basis

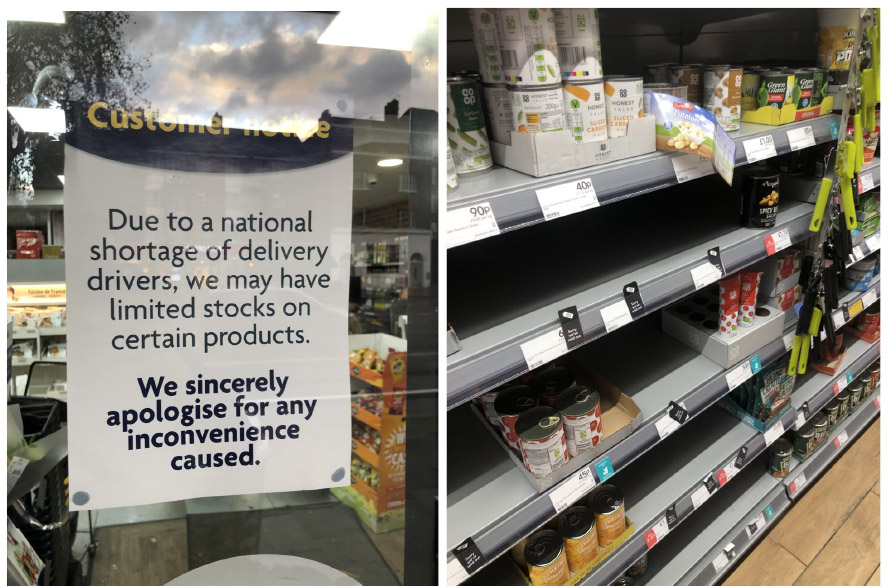

YoY=year over year; Yo2Y=on a two-year basis Source: ONS/Coresight Research [/caption] Supply Chain Struggles and Inflation As elsewhere in the world, supply chain difficulties have been driven by global shipping bottlenecks and a tight domestic labor market. The latter has been compounded in logistics by Covid-19 severely hindering the number of truck drivers tested and approved in 2020. The UK has an estimated 90,000–100,000 shortfall in truck drivers, and the government has upped capacity in driver testing to help meet the shortfall. Those local logistics issues in particular have led to limited availability of products on the shelf in some instances. [caption id="attachment_137762" align="aligncenter" width="700"]

Availability issues in London grocery stores

Availability issues in London grocery stores Source: Coresight Research [/caption] Management at major retailers have been somewhat confident of availability, however. In Tesco’s October 2021 earnings call, CFO Imran Nawaz stated:

We maintained very good levels of availability even as industry supply chains came under strong pressure… We work hard to mitigate the impact of significant supply chain challenges, including a high number of colleagues required to isolate due to Covid-19 as well as the shortage of HGV [heavy goods vehicle] drivers.

On the outlook, Tesco CEO Ken Murphy added:We see the majority of the supply chain issues as temporary. How long is temporary? That is something we don't know. I think what's really important, though, is that we are maintaining a fantastic level of availability despite all the challenges we've seen over the summer—and we have very strong plans in place to continue doing so right the way through Christmas and beyond.

On a November earnings call, Marks & Spencer CFO Eoin Tonge pointed to “labor challenges globally but probably slightly more acutely in the UK.” In M&S clothing, Tonge said he did not think that there would be “material availability issues” for M&S in the Christmas peak.On the Food side of things, I would say the supply chains are also creeping. The labor availability in the UK, in particular, is tough, as I said, and that is impacting our suppliers. To a certain extent, it's impacting our warehouses as well. And again, we're working through it… We wouldn't have been able to maintain the high level of sales that we have if we weren't, but it's tough going—and I don’t think it’s without risk going into the Christmas period.

At grocer Sainsbury’s, which also owns general-merchandise chain Argos, CEO Simon Roberts told analysts in November that consumer electronics would be a “good example” of where there are supply chain challenges, with a “global shortage of products,” and that Argos was taking a less promotional stance as a consequence. The company delayed a toy promotion because the available stock was delayed getting to the UK. On grocery, Roberts added:It's been tricky on a combination of supply, clearly labor, HGV drivers, the challenges upwards in the supply chain, too… It's tough at the end of the summer, particularly in areas like milk and bread some of the grocery lines, but we've seen that improve.

When we look over the second half of the year… we're doing a lot of work on recruitment to make sure we can move product through the supply chain. Interestingly, in the last few weeks, we've actually begun to pick up product from suppliers to make sure we can guarantee availability back in the business—and that's been one of the enabling factors to improve in the situation. So, it's clearly really challenging out there.

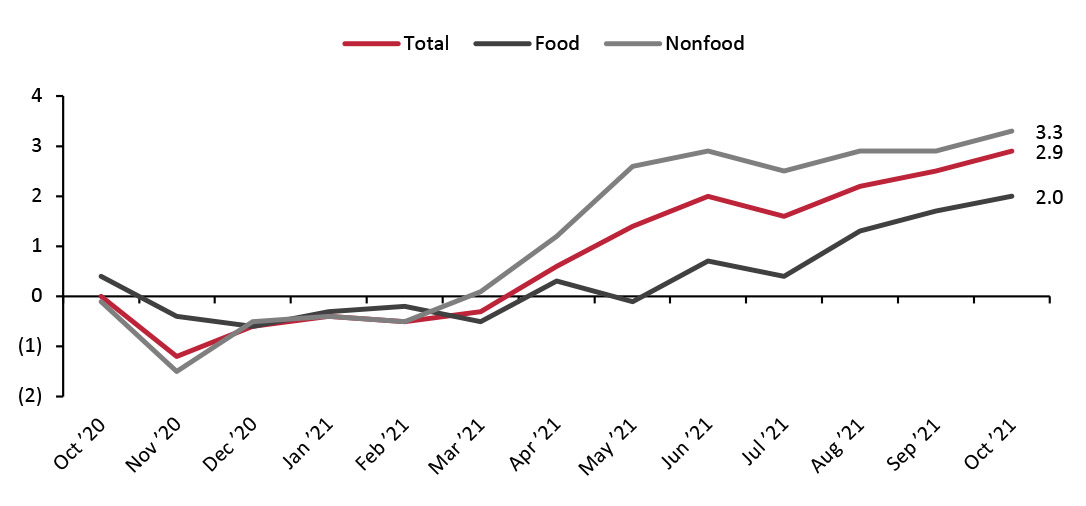

Roberts concluded that he expected it to be “a really big Christmas” and that consumers will “really want to celebrate this year given the events of last year.” Reflecting supply chain challenges and commodity price rises, shop-price inflation has been on a steady upward trend, reaching close to 3% at the start of the holiday quarter. Circa-3% retail inflation will support reported value growth for the sector this Christmas, yet retail volumes are rising, too (as discussed earlier).Figure 2. UK Retail Shop Prices, by Type of Retailer: YoY % Change [caption id="attachment_137763" align="aligncenter" width="700"]

Source: ONS/Coresight Research[/caption]

Online and the Omicron Risk

Shoppers have returned to stores with enthusiasm. As a result, versus a lockdown-heavy 2020, which stretched into the holiday season, UK online retail sales have gone into reverse—e-commerce sales have been down year over year in each month from June 2021 onward. In October (latest), online sales were down 8.4% versus 2020, led by an 11.1% fall in digital sales at nonstore retailers. This echoes the trend we have observed in the US, where online-only (or online-predominant) retailers have tended to underperform versus their multichannel rivals in e-commerce sales this year.

E-commerce’s share of total retail sales is set to fall meaningfully this holiday season. Last year, e-commerce accounted for 32.5% of all retail sales and 46.8% of all nonfood retail sales; that was up sharply from 20.8% of all retail and 30.9% of all nonfood in 2019. As of October 2021, the proportions stand at 26.3% of all retail and 37.3% of all nonfood sales—so very roughly halfway between precrisis levels and those of 2020.

One potential boost to e-commerce in the final lap of the Christmas shopping season is the emergence of the Omicron variant of Covid-19. There is little evidence yet of a marked change in shoppers’ habits. However, in spite of high vaccination rates and strong take-up in the UK’s booster vaccination effort, government caution has prompted regulations that may have a negative impact on in-store shopping in December:

Source: ONS/Coresight Research[/caption]

Online and the Omicron Risk

Shoppers have returned to stores with enthusiasm. As a result, versus a lockdown-heavy 2020, which stretched into the holiday season, UK online retail sales have gone into reverse—e-commerce sales have been down year over year in each month from June 2021 onward. In October (latest), online sales were down 8.4% versus 2020, led by an 11.1% fall in digital sales at nonstore retailers. This echoes the trend we have observed in the US, where online-only (or online-predominant) retailers have tended to underperform versus their multichannel rivals in e-commerce sales this year.

E-commerce’s share of total retail sales is set to fall meaningfully this holiday season. Last year, e-commerce accounted for 32.5% of all retail sales and 46.8% of all nonfood retail sales; that was up sharply from 20.8% of all retail and 30.9% of all nonfood in 2019. As of October 2021, the proportions stand at 26.3% of all retail and 37.3% of all nonfood sales—so very roughly halfway between precrisis levels and those of 2020.

One potential boost to e-commerce in the final lap of the Christmas shopping season is the emergence of the Omicron variant of Covid-19. There is little evidence yet of a marked change in shoppers’ habits. However, in spite of high vaccination rates and strong take-up in the UK’s booster vaccination effort, government caution has prompted regulations that may have a negative impact on in-store shopping in December:

- On November 30, 2021, the UK government made the wearing of masks mandatory in shops in England.

- On December 8, 2021, the government announced that people should work at home wherever possible, effective from the following week—this is likely to once again negatively impact city-center and town-center traffic and could drive some work-at-home shoppers to e-commerce.

- Traffic was down 16.8% in September.

- Traffic was down 13.7% in October.

- The decline deepened to 15.7% amid poor weather in November.