Nitheesh NH

What’s the Story?

With a resurgence of Covid-19 cases, US consumers are visiting physical retail stores less and are buying more online in the peak holiday season, the most critical time in retail. We analyze the likely implications of a digital December for US retailers.Why It Matters

The holiday season is a crucial time of the year for the retail industry: Retailers look to the fourth quarter to be bolstered by holiday sales. However, due to the Covid-19 pandemic, consumer behavior is shifting rapidly, causing many shoppers to turn to e-commerce rather than brick-and-mortar stores for buying gifts. Retailers must be prepared for online demand this December, including by enhancing their digital operations and fulfillment capabilities.Our Predictions for a Digital December in US Retail: In Detail

Physical Retail Traffic Drops, While Online Sales Surge This holiday season is seeing deep declines in physical store traffic mirrored by a major acceleration in e-commerce traffic and sales. We expect this to culminate in a digital December.- According to the latest Coresight Research survey findings, 65% of consumers reported that they shopped online over the extended Black Friday weekend (November 26–30, 2020), while only 25% shopped in store.

- We expect digital sales across nonfood retail to rise in the low-30s-percent range, totaling $220 billion, or 27.6% of all nonfood retail sales, in the holiday quarter. We continue to expect an approximate one-third (33.5%) rise in total holiday-quarter online retail sales.

- Total traffic in nonfood retail stores during the last week of November was down 41.3% year over year, and down 42.3% on Black Friday weekend, according to RetailNext—representing a significant drop from the third week, which saw a traffic decline of 31.3% (read further discussion of traffic trends in the previous The 12 Weeks of Holidays report).

- According to Adobe Analytics, e-commerce sales were up 18.2% year over year for Thanksgiving Day, Black Friday and Cyber Monday combined—from $21 billion in 2019 to $24.9 billion in 2020. This was lower than our estimate for total holiday-season growth in e-commerce as early Black Friday deals spread demand through November and softened the traditional e-commerce peaks.

- Estée Lauder Companies’ Clinique brand launched on-demand livestreaming that features consultants and social media influencers promoting holiday gift sets, and its Bobby Brown brand is offering virtual services including video consultations, master classes, livestreaming and live chat through social platforms such as Instagram, WeChat and WhatsApp. Estée Lauder reported that these virtual services have a higher conversion rate of up to 10 times the average and a higher average order value: Sales on Estee Lauder’s brand.com websites (Bobby Brown and Clinique included) grew 60% over the company’s first fiscal quarter of 2021, ended September 30, 2020.

- Nordstrom saw digital sales account for 54% of total sales in its third fiscal quarter of 2020, ended October 31, 2020. The company highlighted its virtual styling appointments were a standout service, comprising one-third of all styling appointments, and sales tripled in volume from the previous quarter.

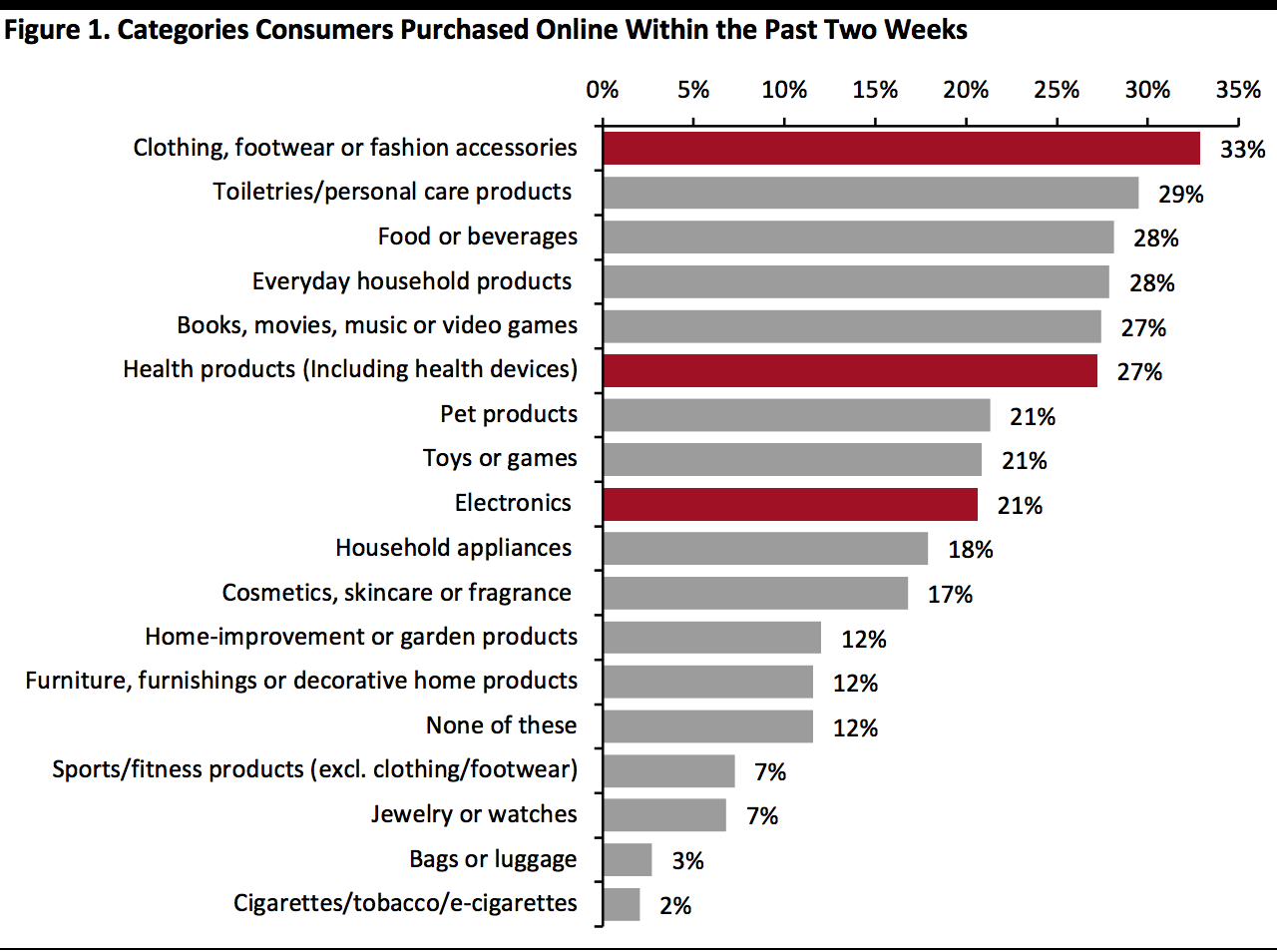

Respondents could select more than one option

Respondents could select more than one optionBase: US respondents aged 18+, surveyed on December 1

Source: Coresight Research[/caption] After the worst year in memory for the fashion industry, solid rates of gift purchasing of clothing and footwear will support improved trends in the final quarter. Those apparel purchases will be disproportionately online: Our survey found that only 22% of all respondents had bought clothing or footwear in a store in the past two weeks, compared to 33% online (shown above). Some 27% of consumers reported purchasing health products online (versus 31% in a store) and 17% of respondents purchased cosmetics, skincare and fragrance online (versus 16% in a store). We expect beauty to be strong this holiday, particularly in health, wellness and DIY beauty technology tools. Technology and electronics demand will be strengthened by consumers spending more time at home during the holidays and desiring entertainment. Our survey found that 11% of respondents had bought electronics in a store in the past two weeks versus 21% online (charted above). Adobe Analytics reported the bestselling products on Cyber Monday were rooted in technology, including Airpods, Chromecast, HP and Dell Computers, Super Mario 3D All-Stars and Vtech Toys. Target reported that during its third quarter of 2020, ended October 31, electronics was its strongest category, growing by more than 50%—with particular strength in computer software, video games, portable electronics and office equipment. This holiday, consumers that carry electronics and hot tech products should showcase their electronics as a selling point online to help drive traffic. Online-Order Fulfillment and Last-Mile Delivery: Opportunities for Competitive Advantage BOPIS and Curbside Pickup BOPIS and curbside pickup have gone from added retail services to critical retail functions this holiday season, with consumers increasingly shopping online. A combined 30.3% of consumers surveyed used BOPIS or curbside pickup over the Thanksgiving-to-Cyber Monday weekend, according to Coresight Research’s recent survey. These services put the consumer in control of the delivery process, offering assurance that they will receive the item without delivery delay by providing options to pick up items at the store. BOPIS and curbside-pickup solutions also benefit retailers, because these services help to defray costs associated with shipping. Black Friday weekend data suggests that consumers are choosing retailers that offer these services, and retailers are outperforming those that do not offer BOPIS and curbside pickup:

- On Black Friday, US retailers that offered BOPIS or curbside pickup saw 19% more online sales than those that did not, according to Salesforce.

- On Cyber Monday, curbside pickup sales increased by 30% over 2019 levels, according to Adobe Analytics while e-commerce increased by 15.1% year over year. On Thanksgiving Day, retailers with curbside-pickup options had 31% better conversion rates than those that did not have this option.

- Dick’s Sporting Goods reported on its earnings call for the third quarter of 2020, ended October 31, that curbside and in-store pickup increased by over 300% year over year, as “curbside customers” shopped more frequently and transacted 20% more than non-curbside customers. The company has enhanced its curbside process, including the ability to do returns, and has dedicated parking spaces for this service at most of its stores.

- Target reported that during its third quarter of 2020, ended October 31, curbside pickup grew more than 500% and BOPIS increased by more than 50%.

- Due to Covid-19, there is more unpredictability around the traditional holiday shipping dates and deadlines. Although shipping deadlines were reported early in the season, the shipping industry is under pressure this year, and these deadlines may shift or carriers may report that they are unable to handle demand. Retailers may therefore need to introduce same-day delivery services and lean on an outside services to ensure delivery capabilities—for example, Urban Outfitters highlighted on its third-quarter 2021 earnings call on November 23 that it is working with other network providers to support delivery.

- Having same-day delivery capability will be essential during the frenetic last few days of holiday shopping in late December for retailers to maximize sales and take share from other players that offer traditional delivery windows of five to seven days. Offering same-day delivery can help a national retailer to generate millions of dollars: Target reported that its same-day delivery service via Shipt saw 280% growth during the third quarter of 2020, representing $200 million of incremental sales.

Source: Company reports

We expect that same-day delivery will be a key differentiator for retailers during December, benefiting big-box retailers in particular, which are skewed toward value, and multibrand retailers, such as department stores, because consumers can shop for the entire family, buying multiple gifts in one order. The most competitive retailers in the space may even reduce minimum thresholds for delivery or reduce fees for same-day delivery to match or beat competitors such as Amazon, Target and Walmart. Ship-from-Store and Increased Fulfillment Capacity The expected increase in digital orders this holiday season will create fulfillment capacity challenges at many distribution centers. Retailers have been making strategic investments in bolstering fulfillment capabilities and increasing capacity, which includes building new distribution centers or adding functionality to existing centers. Retailers are also using retail stores as fulfillment centers, leveraging the inventory in stores to ship to consumers. Both of these supply chain investments take months to execute across national retail chains, so the retailers that have already been strategically investing in these capabilities are best positioned in the near term. Target highlighted its “store as a hub” fulfillment model on its third-quarter 2020 earnings call, with management explaining that the model, which was launched in 2017, spans same-day services fulfilled by Shipt and packages shipped to consumers: Approximately 75% of digital sales in the quarter were fulfilled by Target stores. Figure 3 summarizes selected retailers within the Coresight 100—a focus list of 100 companies that Coresight Research covers closely—reported increased fulfillment capabilities or ship-from-store models in their most recent earnings calls. Figure 3. Selected Major US Retailers: Increased Fulfillment Capacity or Ship-from-Store Models [wpdatatable id=613]Source: Company reports

As digital growth is expected to continue beyond the holiday, we expect that retailers will expand their e-commerce and ship-from-store capabilities, which will become the new normal. A diversified fulfillment strategy is necessary this holiday in order to prevent bottlenecks. In the short term, the retailers that are poised to gain this holiday include those that have recently bolstered e-commerce fulfillment capacity, such as those listed in Figure 3.What We Think

- Recent trends suggest that physical retail will continue to be under pressure due to Covid-19, and we are expecting to see a year-over-year traffic decline in nonfood retail of 35–40% for December. We expect digital demand to remain elevated and estimate an estimated low-30s-percent rise in online nonfood retail sales, taking e-commerce to 27.6% of all nonfood retail sales.

- Despite the surge in digital demand, the role of the physical store cannot be understated this holiday, as consumers are looking to physical stores to pick up their items, particularly with curbside pickup. BOPIS and curbside pickup have become a consumer preference and a retailer necessity, and stores offering these services are outperforming those without. We expect this holiday will be especially beneficial for off-mall retailers and store anchors; going forward, if Covid-19 persists, we see contactless pickup as essential.

- Diversification will be key this holiday and beyond. We expect retailers will begin to work strategically on diversifying and unifying online and offline strategies. We expect retailers will work to integrate these functions, to maximize sales and minimize costs. We expect this will become a retail priority with more store fulfillment, expanded delivery networks and partnerships with delivery carriers beyond the holiday season.