DIpil Das

What’s the Story?

In US retail, shopper traffic, or footfall, to retail stores remains deeply negative when compared to the same period last year. We discuss the data and offer our analysis of the likely implications.Why It Matters

The shape and scale of consumer demand during the holiday peak is less certain than ever. Coresight Research’s coverage provides directional guidance to retailers, suppliers and vendors. According to our estimations, even this year, almost 78% of total retail sales and almost 72% of total nonfood retail sales will be in stores during the holiday quarter, underlining the significance of store visits to holiday retail sales.US Retail Traffic Remains Deeply Negative: In Detail

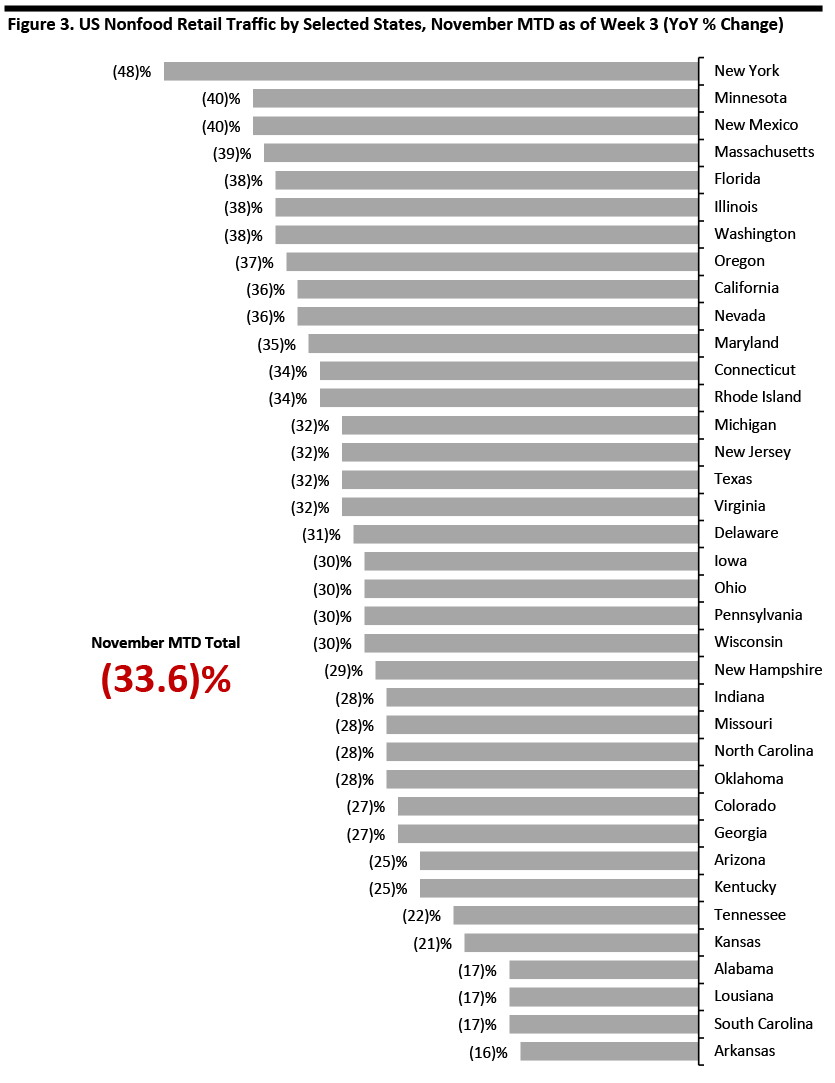

Traffic Trends Brick-and-mortar retail continues to see severely reduced shopper visits: Total November traffic in nonfood retail stores through the third week of the month was down 33.6% compared to the same period of 2019, according to RetailNext. As shown below, we saw an improving traffic trend over the first three weeks of November. However, in the context of sustained high levels of infection and hospitalizations and consequent further or potential restrictions in some states, we expect this trend to level off at best—but more probably to reverse and for declines to return to deeper levels. Earlier holiday shopping this year is likely to further lighten traffic numbers in late November and into December. Contributing to expected deepening declines in later November, we estimate that nonfood traffic on the busiest shopping days such as Black Friday will be (or have been, in the case of Black Friday) down by around 50% compared to 2019, given the demanding comparatives and as many consumers avoid the traditional crowds and retailers regulate shopper numbers. Black Friday, which is typically the busiest day for stores, has become a month-long event at many retailers this year, reducing pressure on the day itself. According to Sensormatic’s ShopperTrak, Black Friday is set to maintain the crown as the busiest day for stores in the 2020 holiday season, followed by “Super Saturday” on December 19 (versus December 23 in 2019), and December 26. By sector, traffic data shows the relative outperformance of home retailers—a theme that we have noted many times leading up to and during the holiday season. However, even in this sector, the decline in shopper visits remains steep, with the sector’s sales performance being buoyed by e-commerce. Figure 1 shows the year-over-year percentage change in US nonfood retail traffic, broken down by sector for the first three weeks of November.Figure 1. US Nonfood Retail Traffic by Sector, November 2020 (YoY % Change) [wpdatatable id=589 table_view=regular]

Source: RetailNext

- Separate data from Placer.ai, which uses a different methodology, shows November shopping-center visits down by 30% in week 1, and by 26% in each of weeks 2 and 3, on a year-over-year basis.

Figure 2. US Nonfood Retail Traffic, 2020 (YoY % Change) [wpdatatable id=590 table_view=regular]

Source: RetailNext Trends Reinforce Tailwinds for Online Expansion at Multichannel Retailers This stalling of the recovery for stores—and the prospect of trends becoming more negative as US case numbers remain high—reinforce our expectations for very strong online retail sales growth over the holiday season. For the holiday season overall, we expect total online retail sales to rise by one-third (33.5%) year over year, taking e-commerce sales to around $234 billion. This is equivalent to 21.7% of all retail sales in the holiday quarter (versus 17.1% for holiday 2019). Across nonfood categories in total, we estimate that e-commerce’s share of sales will higher, at 27.6%. Across nonfood retail, we expect a low-30s-percent rise to take total online nonfood sales to $220 billion in the holiday quarter. However, this growth will not inherently favor online-only retailers such as the major e-commerce platforms. So far this year, multichannel retailers (i.e., those with stores) have tended to outperform online-only rivals in terms of online sales growth:

- In total, online-only retailers lost six percentage points of online channel share between the first and second quarters of 2020, according to our calculations from Census Bureau data.

- The gains made by retailers with stores are reflected in second- and third-quarter updates. For example, Best Buy reported US online comp growth of 242.2% in the second quarter, followed by 173.7% in the third quarter. Target reported US online comp growth of 195% in the second quarter, followed by 155% in the third quarter. By contrast, Amazon reported net sales growth in North America (ex. Amazon Web Services) of 43% in the second quarter and 39% in the third quarter.

Source: RetailNext[/caption]

What We Think

Source: RetailNext[/caption]

What We Think

- Recent trends and our expectations for the coming weeks suggest that the year-over-year decline in total shopper visits to nonfood stores is likely to settle at around 30–35% for the holiday season.

- A stalling of the recovery in shopper traffic—or a deepening of the decline—will be a blow to brick-and-mortar retailers, who would have hoped for an incremental improvement in traffic trends.

- The data further supports our expectations for very strong online retail sales growth: We expect total sales to climb by around 33.5% year over year.

- For brick-and-mortar retailers (or, at least those that also have sophisticated e-commerce operations), the good news is that they look set to outperform their online-only rivals in terms of e-commerce sales growth. Sector-wide and company-specific data points so far this year point to solid gains in online channel share by multichannel retailers at the expense of digital-only rivals.

- Strong growth in online sales will help those multichannel companies to offset some of the sales hit from lower shopper traffic—but online sales tend to come with higher costs, and, in the new year, retailers are likely to report negative margin impacts from strong online sales during the holiday peak.