What’s the Story?

The 2020 holiday retail shopping season is not going to be business as usual. The year started off with trade tensions, followed by Covid-19 lockdowns and gradual store reopenings. Consumers became cautious, plowing income into savings and increasingly turning to shop via e-commerce. In this report—the second of our four-part series—we look at shoppers’ propensity to spend on retail purchases.

Why It Matters

The holiday retail season is the most important selling season of the year, typically signified by the turning point of “Black Friday,” when retailers become profitable for the year. In 2020, with many retailers losing several months’ revenue due to forced store closures, in addition to the current challenging retail environment—with sales down significantly year over year—the holiday retail season is likely to be even more essential for many retailers’ survival. There remain a large number of variables—encompassing both supply and demand—that will be key for retailers this holiday season.

Our Questions for the Holidays: In Detail

1. How will the employment situation affect the consumer balance sheet and holiday spending?

The unemployment rate is 2.5 times as high as it was last year. The employment situation continues to deteriorate—though at a slowing rate—and the second round of future supplemental unemployment payments will be smaller than the first, with limited funding.

Although the number of US weekly unemployment claims continues to decline from nearly 7 million at the end of March, the level has remained at more than 1 million per week since then, amounting to 1.1 million in the week ended August 15, 2020. This puts the unemployment rate at 10.2% in July, compared to 3.7% the year prior.

At the same time, the $600 weekly additional unemployment benefits provided by the CARES (Coronavirus Aid, Relief, and Economic Security) Act expired at the end of July. Although President Trump signed an executive order providing an extra $300 in weekly unemployment benefits, US states are required to cover 25% of these payments from the Coronavirus Relief Fund, which must be spent by the end of the year. The federal government is funding its share of the payments from Homeland Security’s Disaster Relief Fund, which has about $70 billion available and would fund the payments for an estimated four of five weeks. As of the time of this report’s writing, 30 state governments have approved the $300 supplemental unemployment benefits from the White House’s executive order.

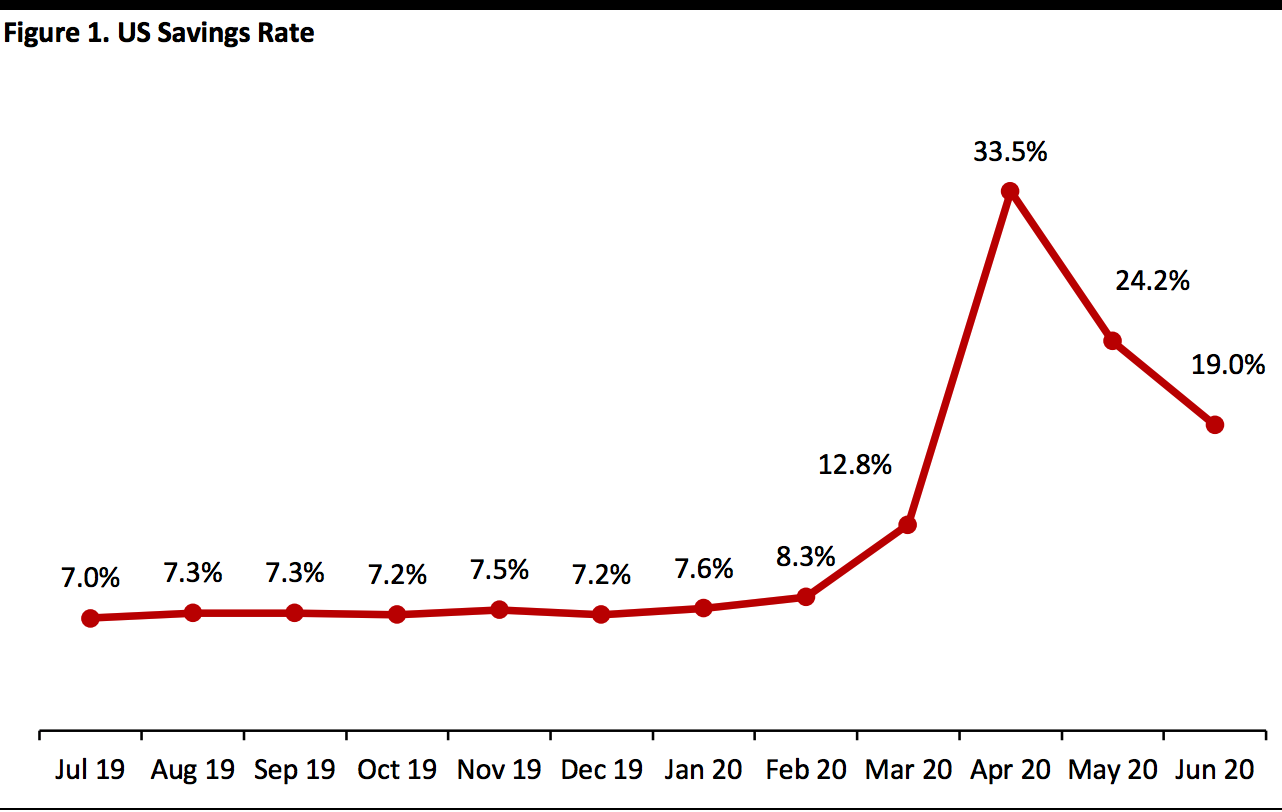

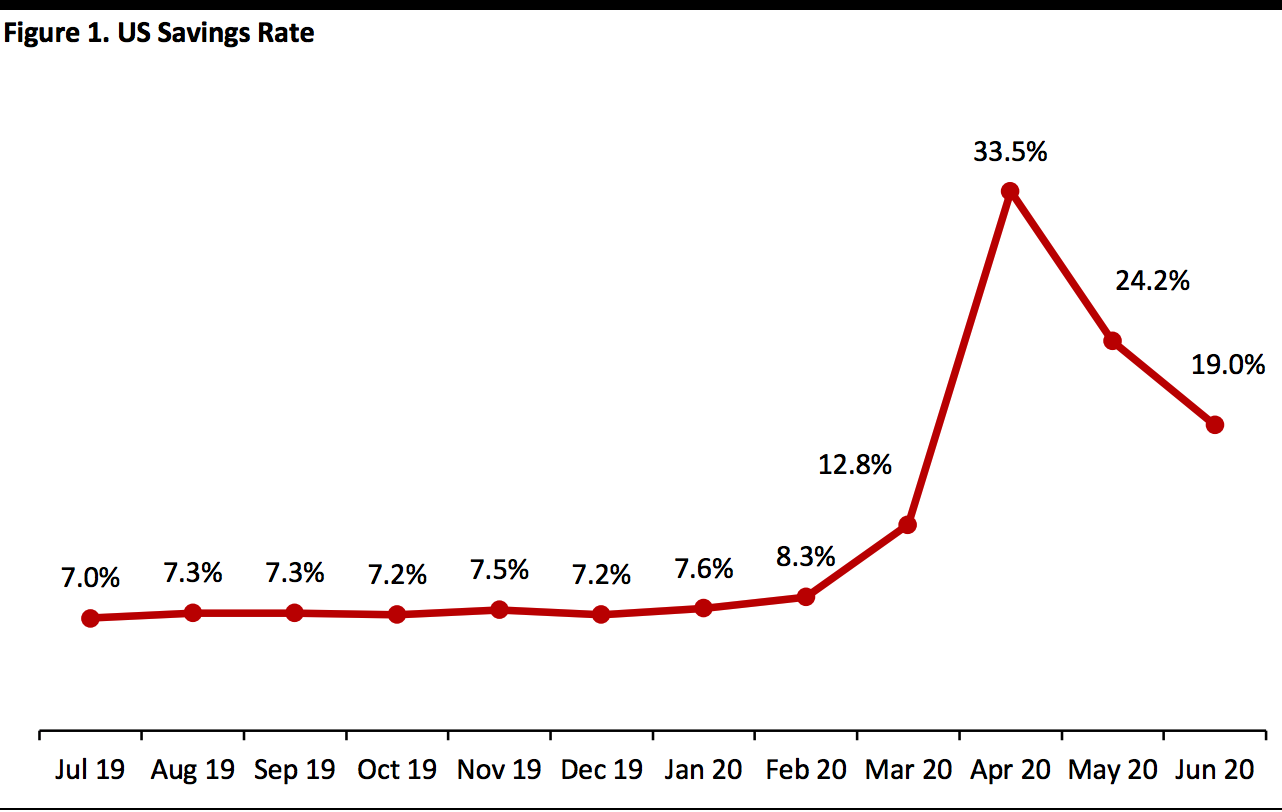

However, even with raised unemployment rates, the majority of Americans are in work. Perhaps more pertinent to holiday retail is the abnormally high personal savings rate, which had not approached the high-teens since the Bureau of Economic Analysis began tracking this metric in 1959 but stood at 19% in June. The average for the past 60 years is 8.9%.

Consumers continue to save, and by the time the holiday season starts, they will have substantial savings to deploy if they feel confident enough to spend.

[caption id="attachment_115645" align="aligncenter" width="700"]

Federal Reserve Bank of St. Louis

Federal Reserve Bank of St. Louis[/caption]

2. How will a “wealth effect” affect holiday spending?

The stock market, housing prices and savings rate all indicate the potential for surprisingly solid holiday spending.

The S&P 500 Index started off the year at around 3,245 and declined to a low of 2,237 on March 23, a decline of 31%. However, since then, the S&P 500 has rebounded to 3,500—i.e., up 7.8% for the year as of August 31. Stock-owning consumers who held tight in their portfolios are better off than at the beginning of the year and may therefore feel comfortable with holiday spending.

Housing prices, which have been on the rise throughout the year, increase the perception of wealth. The S&P/Case-Shiller U.S. National Home Price Index hit 223.5 in June, up from 212.5 in January—an increase of 5%. Higher home values create a wealth effect, boosting confidence to spend, and enable homeowners to borrow more against the equity of their homes.

3. How could the upcoming US presidential election affect holiday spending?

After the presidential election, the winners will celebrate and the losers will woefully lament. Shopping will likely go on as before, unless there is a prolonged questioning of the outcome creating more unease and a preoccupation with the news instead of gift giving. The completion of the election will also serve to clarify the US economic strategy over the next four years. If the incumbent party wins, then the country can expect an environment similar to that of the past three-plus years—and if the challenger wins, a new set of economic and social policies will be articulated. Political transitions can create a pause in business spending, especially capital spending on projects such as IT, as spending is often put on hold until the political outlook becomes clearer.

What We Think

Implications for Brands/Retailers

- Retail stands to gain from a months-long high savings rate and from the transfer of discretionary spending from services to products—but, with fewer everyday prompts for shoppers to buy gifts for colleagues, friends, event hosts and maybe even family members, retailers must work harder to capture that spending—and they may ultimately find those lost purchases simply offset the additional discretionary dollars available to some shoppers.

Implications for Technology Vendors

- Technology vendors can assist retailers to fine-tune their supply-chain management tools to adapt and handle unexpected changes in the pandemic outlook and different consumer demand patterns.

Federal Reserve Bank of St. Louis[/caption]

2. How will a “wealth effect” affect holiday spending?

The stock market, housing prices and savings rate all indicate the potential for surprisingly solid holiday spending.

The S&P 500 Index started off the year at around 3,245 and declined to a low of 2,237 on March 23, a decline of 31%. However, since then, the S&P 500 has rebounded to 3,500—i.e., up 7.8% for the year as of August 31. Stock-owning consumers who held tight in their portfolios are better off than at the beginning of the year and may therefore feel comfortable with holiday spending.

Housing prices, which have been on the rise throughout the year, increase the perception of wealth. The S&P/Case-Shiller U.S. National Home Price Index hit 223.5 in June, up from 212.5 in January—an increase of 5%. Higher home values create a wealth effect, boosting confidence to spend, and enable homeowners to borrow more against the equity of their homes.

3. How could the upcoming US presidential election affect holiday spending?

After the presidential election, the winners will celebrate and the losers will woefully lament. Shopping will likely go on as before, unless there is a prolonged questioning of the outcome creating more unease and a preoccupation with the news instead of gift giving. The completion of the election will also serve to clarify the US economic strategy over the next four years. If the incumbent party wins, then the country can expect an environment similar to that of the past three-plus years—and if the challenger wins, a new set of economic and social policies will be articulated. Political transitions can create a pause in business spending, especially capital spending on projects such as IT, as spending is often put on hold until the political outlook becomes clearer.

Federal Reserve Bank of St. Louis[/caption]

2. How will a “wealth effect” affect holiday spending?

The stock market, housing prices and savings rate all indicate the potential for surprisingly solid holiday spending.

The S&P 500 Index started off the year at around 3,245 and declined to a low of 2,237 on March 23, a decline of 31%. However, since then, the S&P 500 has rebounded to 3,500—i.e., up 7.8% for the year as of August 31. Stock-owning consumers who held tight in their portfolios are better off than at the beginning of the year and may therefore feel comfortable with holiday spending.

Housing prices, which have been on the rise throughout the year, increase the perception of wealth. The S&P/Case-Shiller U.S. National Home Price Index hit 223.5 in June, up from 212.5 in January—an increase of 5%. Higher home values create a wealth effect, boosting confidence to spend, and enable homeowners to borrow more against the equity of their homes.

3. How could the upcoming US presidential election affect holiday spending?

After the presidential election, the winners will celebrate and the losers will woefully lament. Shopping will likely go on as before, unless there is a prolonged questioning of the outcome creating more unease and a preoccupation with the news instead of gift giving. The completion of the election will also serve to clarify the US economic strategy over the next four years. If the incumbent party wins, then the country can expect an environment similar to that of the past three-plus years—and if the challenger wins, a new set of economic and social policies will be articulated. Political transitions can create a pause in business spending, especially capital spending on projects such as IT, as spending is often put on hold until the political outlook becomes clearer.