Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

1H19 Results

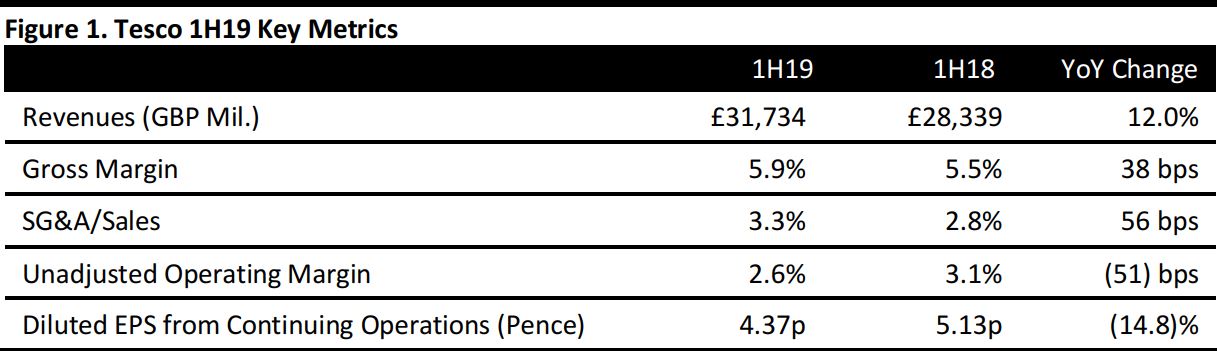

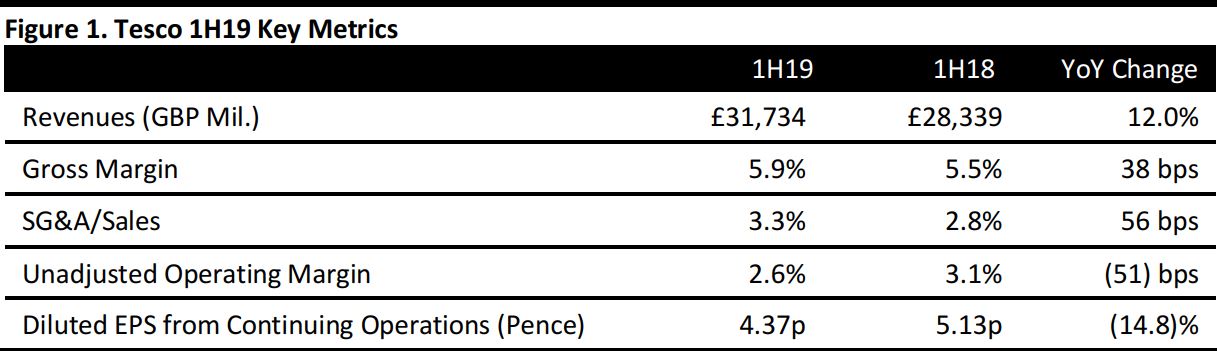

Tesco reported a 12.0% rise in revenues in 1H19, driven by the acquisition of wholesaler Booker, which was consolidated from March 5.

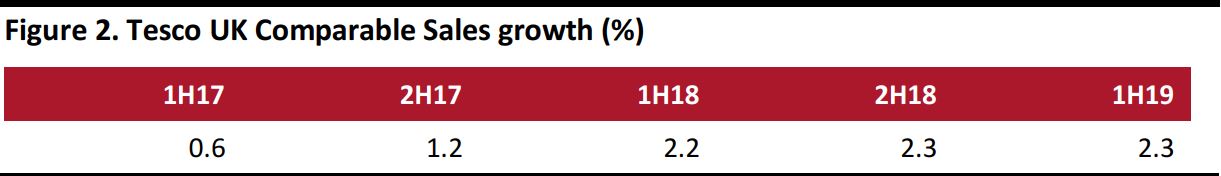

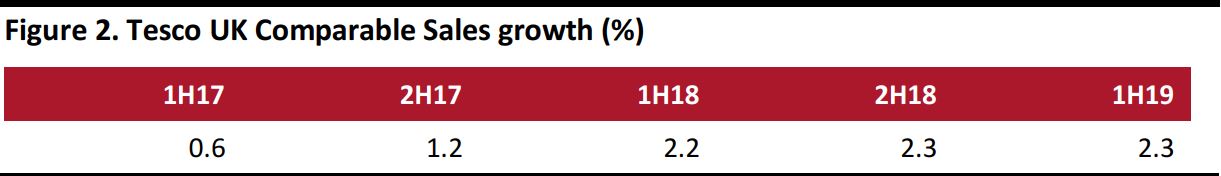

The keenly watched measure of UK comparable sales growth came in at 2.3%, level with the rate of growth seen in 2H18, and split 2.1% in 1Q19 and 2.5% in 2Q19. That 2Q19 figure was ahead of the consensus estimate of 2.1% recorded by StreetAccount.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

Total revenues of £31.73 billion came in ahead of the consensus estimate of £31.52 billion recorded by StreetAccount. Adjusted operating profit of £933 million was up 24.4% year over year but came in below the expectations of £962 million. This yielded an adjusted operating margin of 2.9% versus 2.6% for the year-ago period. Further adjusted to exclude the now-discontinued Tesco Direct general-merchandise operation, the company said its 1H19 operation margin came in at 3.0%.

Management stated that the company is on track to achieve its ambition of a 3.5%–4.0% operating margin by FY20.

Exceptional items excluded from the adjusted figures in 1H19 included Tesco Direct closure costs of £57 million, net restructuring and redundancy costs of £22 million, provision for customer redress of £7 million, a Tesco Bank provision for a cyber attack-related fine of £16 million and amortization of £40 million.

- In the UK, Tesco reported 2.4% comparable sales growth in clothing in 1H19. It said that all its UK store formats and channels achieved positive comp growth, with its large store formats, which had previously struggled to grow sales, turning in comp growth of 1.8%. Online grocery sales were up by a relatively modest 3.5%.

- In Central Europe, comp came in at (1.5)%, with changes to Sunday trading regulations impacting sales in Poland. In Asia, comp growth improved from (9.0)% in the first quarter to (4.8)% in the second quarter, yielding a 1H19 comp decline of 7.0%. Central Europe and Asia 2Q19 comps came in below expectations.

- 1H19 group comp growth was supported by a 14.7% comp at Booker and a 3.1% comp in Ireland, with both measures accelerating sequentially in 2Q19.

Outlook

Management restated the ambitions that it laid out in October 2016—namely, to reduce costs by £1.5 billion, to generate £9 billion of retail cash from operations and to improve group operating margins to between 3.5% and 4.0% by FY20.

Management anticipates that synergies associated with its merger with Booker will generate a benefit of at least £60 million in FY19, growing to a cumulative c.£140 million in FY20 and c.£200 million by FY21.

For FY19, analysts expect Tesco to report revenues of £64.15 billion, up 11.5% year over year, and pretax profit, excluding exceptional items, of £1.77 billion, up 55% year over year.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research Source: Company reports/Coresight Research

Source: Company reports/Coresight Research