Nitheesh NH

[caption id="attachment_83480" align="aligncenter" width="720"] All figures are statutory

All figures are statutory

*Ex VAT, incl. fuel

**From continuing operations.

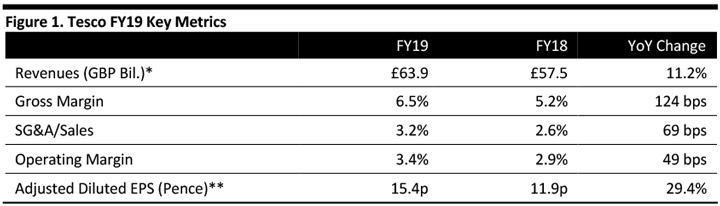

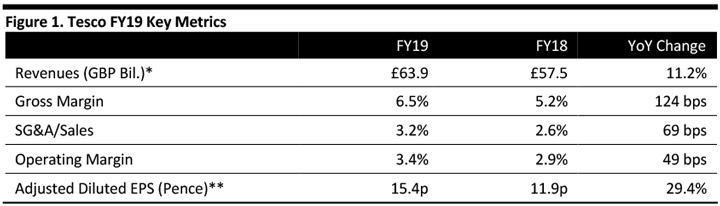

Source: Company reports/Coresight Research [/caption] FY19 Results Tesco reported FY19 results with the top line slightly missing the consensus estimate. Its FY19 adjusted operating margin came in at 3.45% versus the company’s long-term aim to hit a 3.5-4.0% margin by FY20. The company also noted that it had achieved £1.4 billion in savings compared to its target of £1.5 billion savings by FY20. The highlights are as follows:

All figures are statutory

All figures are statutory *Ex VAT, incl. fuel

**From continuing operations.

Source: Company reports/Coresight Research [/caption] FY19 Results Tesco reported FY19 results with the top line slightly missing the consensus estimate. Its FY19 adjusted operating margin came in at 3.45% versus the company’s long-term aim to hit a 3.5-4.0% margin by FY20. The company also noted that it had achieved £1.4 billion in savings compared to its target of £1.5 billion savings by FY20. The highlights are as follows:

- Tesco grew total sales 11.0% year over year on a constant-currency basis to £9 billion (up 11.2% as reported), missing the consensus of £64.5 billion recorded by StreetAccount.

- Booker contributed revenues of £5.83 billion from March 5, 2018 to February 23, 2019.

- Group same-store sales grew 1.4% year over year, excluding fuel and VAT.

- The gross margin expanded 124 basis points (bps) year over year to 6.5%.

- Tesco grew its operating profit by 16.7% year over year on a constant-currency basis to £15 billion (up 17.1% as reported). The company reported a group adjusted operating margin of 3.45%, up 49 bps year over year; in 2H19, the group operating margin reached 3.96% (3.79% ex Booker). These compare to Tesco’s long-term target of 3.5-4.0% operating margin by FY20.

- The company achieved total cost savings of £532 million in the fiscal year, bringing total savings to £1.4 billion to date — within reach of its £1.5 billion FY20 target.

- The company reported diluted EPS of 13.55 pence, up 11.9% year over year. After adjusting for exceptional items, amortisation of acquired intangibles, net pension finance costs and fair value remeasurements of financial instruments, diluted EPS was 15.4 pence, up 29.4% year over year and above the consensus of 14.12 pence recorded by StreetAccount.

- Profit margin from continuing operations expanded 34 bps to 2.1%.

- Booker contributed net profit after tax of £122 million to the group from March 5, 2018 to February 23, 2019.

- The company reported retail operating cash flow of £5 billion.

- UK & Republic of Ireland (ROI) comparable sales grew 1.9%, the same rate as 3Q19.

- Tesco UK comparable sales grew 1.7%, compared to 0.7% growth in the previous quarter and slightly below the 1.8% consensus growth recorded by StreetAccount.

- ROI comparable sales fell 0.4% compared to a 0.2% slide in the previous quarter.

- Booker comparable sales grew 4.3%, compared to 11.0% growth in the previous quarter and below the 5.9% consensus growth recorded by StreetAccount.

- UK & ROI total revenues grew 14.6% year over year, compared to 14.5% growth in the previous quarter.

- UK & ROI comparable sales grew 2.9% year over year, excluding fuel and VAT.

- UK & ROI sales grew 16.1% year over year to £44.8 billion. The company consolidated its Booker business with the UK & ROI segment.

- Tesco UK comps were 1.7%. The company completed rolling out its range of eight new “Exclusively at Tesco” brands, such as Ms Molly’s and Hearty Food Co., as part of its program to relaunch 10,000 own-branded products.

- In general merchandise, Fox & Ivy and Go Cook ranges contributed to same store sales growth of 4.2% in its home category. Clothing comparable sales grew 3.0%.

- Booker’s comparable sales grew by 11.1% (10.8% excluding tobacco), while ROI comps were 1.3%.

- Central Europe comparable sales fell 3.0%, the same rate as in the previous quarter and versus the consensus estimate of a 3.1% decline recorded by StreetAccount.

- On a constant-currency basis, total revenues declined 5.7% year over year, compared to a 5.2% decline in the previous quarter.

- The segment’s comparable sales declined 2.3%, excluding fuel and VAT.

- Central Europe sales fell 4.5% year over year on a constant-currency basis to £6.0 billion (down 4.9% as reported).

- The company noted its planned reduction of unprofitable general merchandise sales, including a decision not to participate in Black Friday promotions, impacted comps performance by (1.2)% for the full year. Also, changes to Sunday trading regulations in Poland resulted in 25 fewer trading days in the year, which impacted comps in the region by (1.3)%. (The new Sunday trading regulations came into effect in January, and say stores in Poland can open on the last Sunday of each month only, compared with two Sundays per month previously).

- Asia comparable sales fell 3.0%, compared to an 8.0% slump in the previous quarter and versus the consensus estimate of a 2.6% decline recorded by StreetAccount.

- On a constant-currency basis, total revenues declined 0.7% year over year, compared to a 6.0% decline in the previous quarter.

- Asia comparable sales fell 6.2%, excluding fuel and VAT. Performance was negatively impacted by significant changes to the sales mix and promotional strategy, particularly in the first half.

- Asia revenues fell 4.1% year over year on a constant-currency basis to £4.87 billion (down 1.6% as reported).

- Tesco Bank grew its revenues 4.7% year over year to £1.1 billion.

After four years we have met or are about to meet the vast majority of our turnaround goals. I’m very confident that we will complete the journey in 2019/20. I’m delighted with the broad-based improvement across the business. The full year margin of 3.45% represents clear progress and the second half level of 3.79%, even before the benefit of Booker, puts us comfortably in the aspirational range we set four years ago. I’m pleased that we are able to accelerate the recovery in the dividend as a result of our continued capital discipline and strong improvement in cash profitability.

Outlook For FY20:- Tesco is “comfortable” with consensus profit expectations.

- The company will focus on strengthening its balance sheet and delivering free cash flow.

- It expects to reach a dividend cover level of about two times earnings and has a target of a leverage range of 3 times to 2.5 times total debt to EBITDAR.