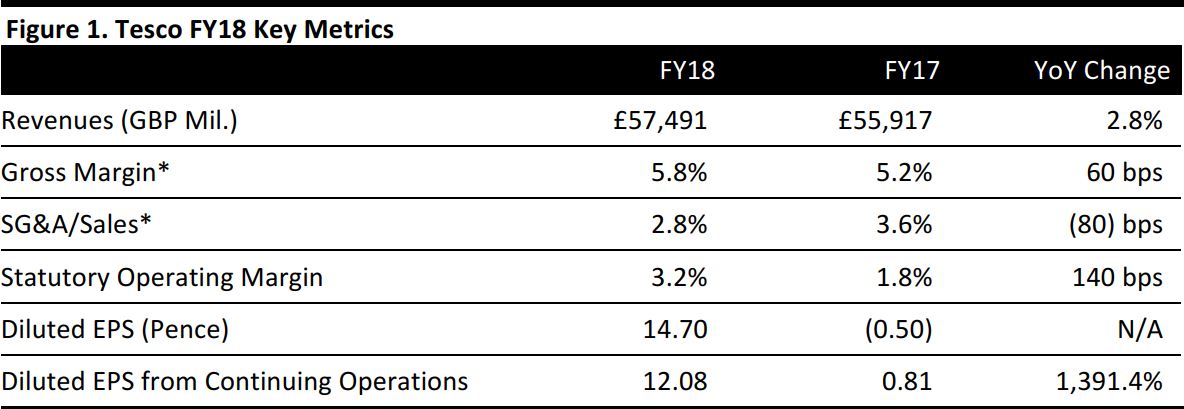

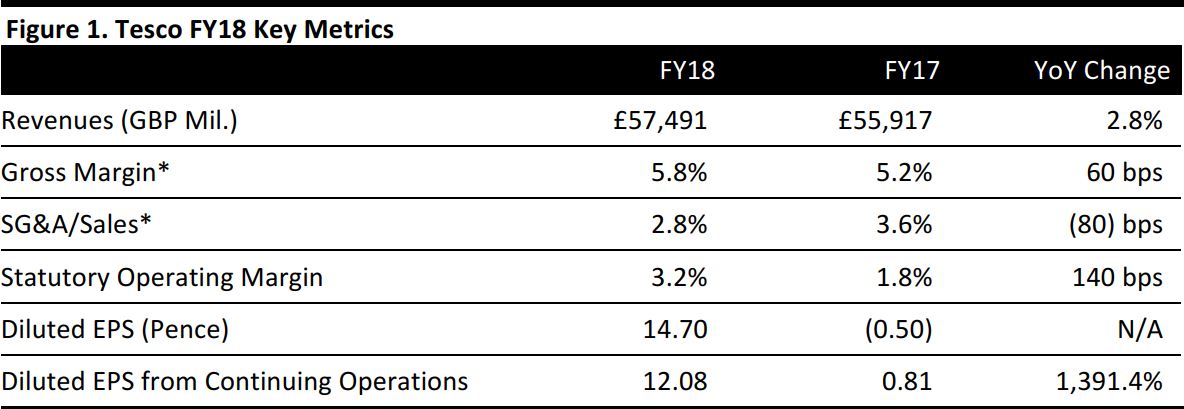

All profit figures are after exceptional items.

*Tesco includes some selling and general expenses within cost of sales rather than SG&A.

Source: Company reports/Coresight Research

FY18 Results

British retailer Tesco reported a significant turnaround in its business in the year ended February 24, 2018. Net profit for the year, after exceptional items, stood at £1,208 million compared to last year’s net loss of £54 million. Tesco grew group revenues by 2.8% at actual rates and by 1.3% at constant currency to £57,491 million, slightly above the consensus estimate of £57,340.7 million as recorded by S&P Capital IQ.

Tesco provided the following additional details:

- Operating income jumped 81% year over year to £1,837 million. The operating margin expanded by 140 basis points to 3.2%. Excluding exceptional items, operating income was £1,644 million, above the consensus estimate of £1,585 million and resulted in an adjusted operating margin of 2.9%, up by 57 basis points from FY17. Exceptional items amounted to £193 million and include profits arising from disposal of properties. Growth in operating profit was also against weak comparatives from last year when exceptional costs included a charge of £235 million over historical profit misstatements.

- UK comparable sales were up by 2.2% during the year. Tesco said that there was consistent strength in fresh food, while there was a 0.4% drag from general merchandise as it “de-emphasized” some categories. 4Q17 UK comps were up 2.3%, level with the prior quarter.

- Group comparable sales were up by 0.7% in FY18. In 4Q18, comps were up by 0.4%, denoting the ninth consecutive quarter of comps growth.

- FY18 comps were up by 2.7% in Ireland, up by 0.3% in the rest of Europe and down by 10.0% in Asia.

- Diluted EPS was 14.70 pence, compared to a loss per share of 0.50 pence in FY17. Consensus called for EPS of 11.00 pence.

- Net debt reduced by £1.1 billion to £2.6 billion, during the year.

Outlook

Tesco said that it remains on track to deliver the goals set out in October 2016: to reduce costs by £1.5 billion, to generate £9 billion of retail cash from operations and to improve operating margins to between 3.5% and 4.0% by FY20.

Tesco completed its merger with wholesale group Booker on March 5, 2018 and anticipates a synergy benefit of about £60 million in the first-year post completion of the merger.

For FY19, analysts expect Tesco’s revenues to grow by 10.0% to £63,264 million, on the back of the Booker acquisition. Consensus calls for operating profit, excluding exceptional items, to grow by 27.5% to £2,096 million and for diluted EPS to fall by 12.0% to 13 pence.