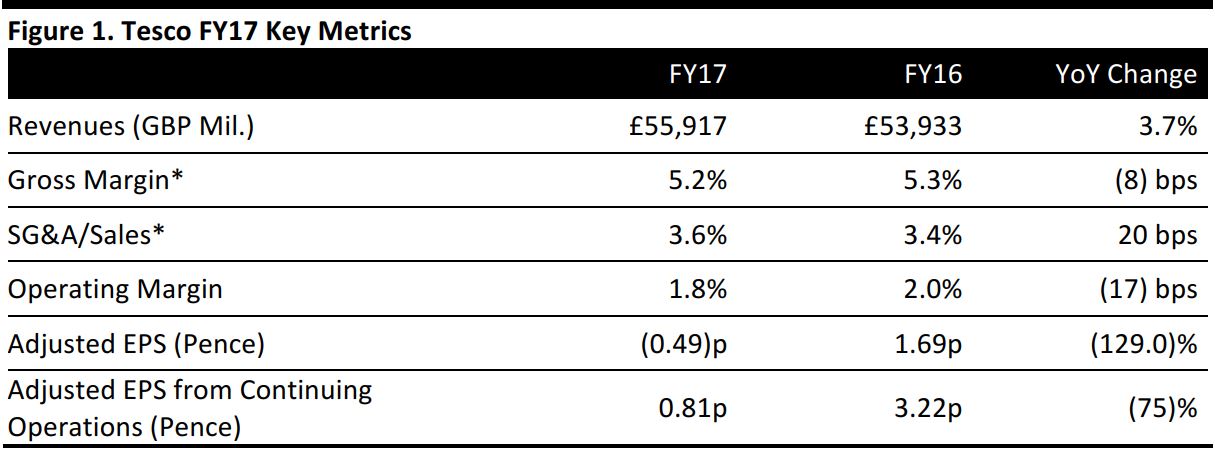

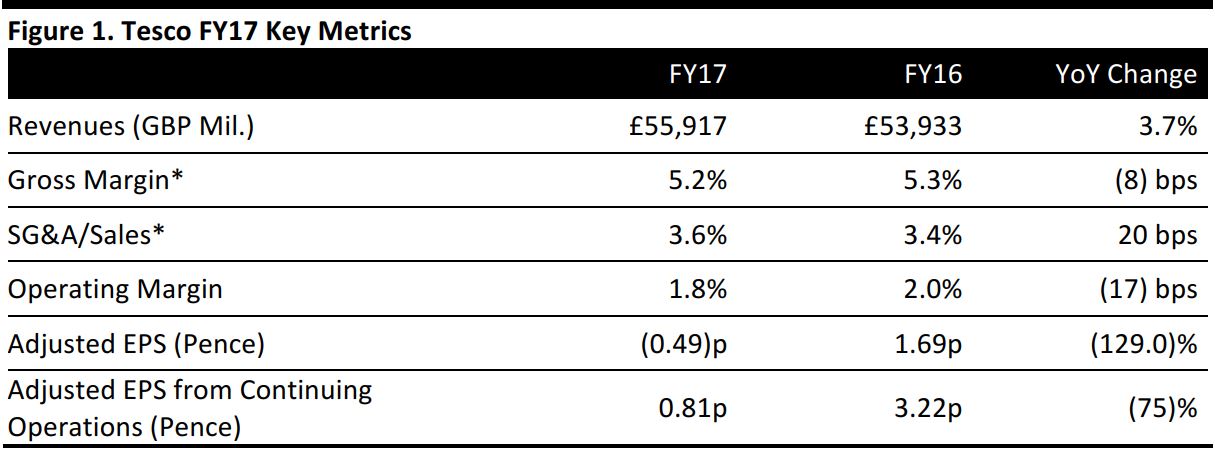

All profit figures are after exceptional items.

*Tesco includes some selling and general expenses within cost of sales rather than SG&A.

Source: Company reports/Fung Global Retail & Technology

FY17 Results

Impacted by exceptional costs, Tesco reported profit before tax of £145 million in the year ended February 25, down from £202 million in the prior year. The company reported a net loss of £54 million compared with a net profit of £129 million in the previous year. Tesco’s shareholders saw a diluted loss per share of 0.49 pence, compared with EPS of 1.69 pence in the prior year.

More positively, Tesco grew its top line by 3.7%, to £55.9 billion, which was ahead of the consensus estimate of £55.7 billion. Group sales excluding automotive fuel climbed 4.3%.

Excluding exceptional items, the company grew operating profit by 30%, to £1.28 billion, which was ahead of the £1.26 billion consensus. Also excluding exceptionals, Tesco expanded its operating margin from 1.8% in FY16 to 2.3% in FY17. The company has set a target of reaching a 3.5%–4.0% operating margin by fiscal 2020.

Excluding exceptional items, full-year net profit came in at £507 million, up from £353 million in the prior year. On a continuing-operations basis and excluding exceptionals, diluted EPS came in at 6.75 pence, up from 4.05 pence in the prior year.

Discontinued operations included Kipa, Tesco’s Turkish business, which was sold on March 1, 2017.

Exceptional items included £153 million of restructuring and redundancy costs, a £45 million provision for customer redress for historical misselling of payment protection insurance, and a £235 million charge in relation to its recently announced deferred prosecution agreement with the Financial Conduct Authority over historical profit misstatements. That charge was not factored into some analysts’ estimates recorded by S&P Capital IQ. However, even if we add the £235 million back into Tesco’s profit before tax, the company missed consensus on this measure.

Selected Metrics

Tesco reported the following metrics:

- UK comparable sales, which were closely watched, were up 0.9% in FY17, making it the first full year of UK comp growth since FY10.

- UK comps accelerated sequentially in the first three quarters of FY17, before slowing to 0.7% in the final quarter.

- FY17 comparable sales were down 0.1% in Ireland, up 0.9% in the rest of Europe and up 1.8% in Asia. In total, group comps were up 1.0%.

- Net debt of £3.7 billion was down 27% year over year.

- Tesco delivered cost savings of £226 million toward its medium-term target of £1.5 billion in cost savings.

Tesco continues to engage with the Competition and Markets Authority in relation to its proposed merger with Booker, a wholesale group.

Tesco CEO Dave Lewis said, “Today, our prices are lower, our range is simpler, and our service and availability have never been better. Our exclusive fresh food brands have strengthened our value proposition and our food quality perception is at its highest level for five years. At the same time, we have increased profits, generated more cash and significantly reduced debt.”

Outlook

Lewis commented, “We are ahead of where we expected to be at this stage…. We are confident that we can build on this strong performance in the year ahead, making further progress towards our medium-term ambitions. On top of this, our proposed merger with Booker will bring together two complementary businesses, driving additional value for shareholders by realizing substantial synergies and enabling us to access the faster-growing ‘out of home’ food market.”

For FY18, analysts expect Tesco to grow revenue by 2.7% and EBIT by 17.6%, and to report diluted EPS of 9 pence. These estimates were collated before the latest results were announced.