albert Chan

Tesco

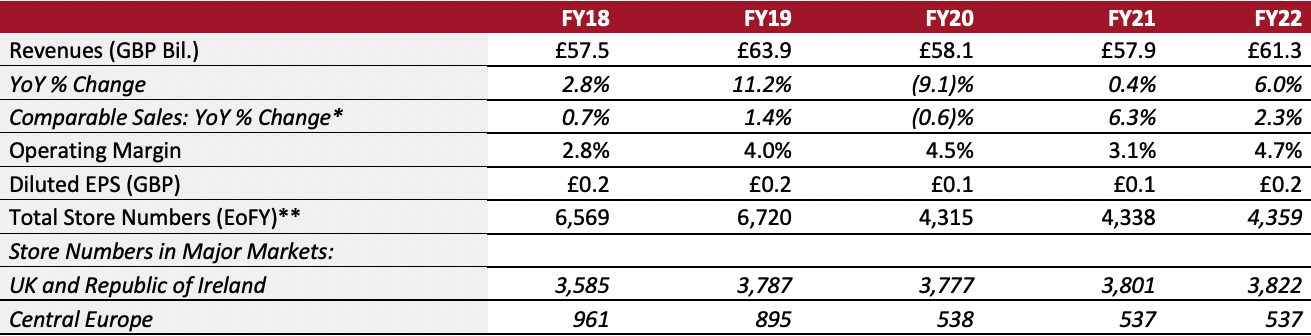

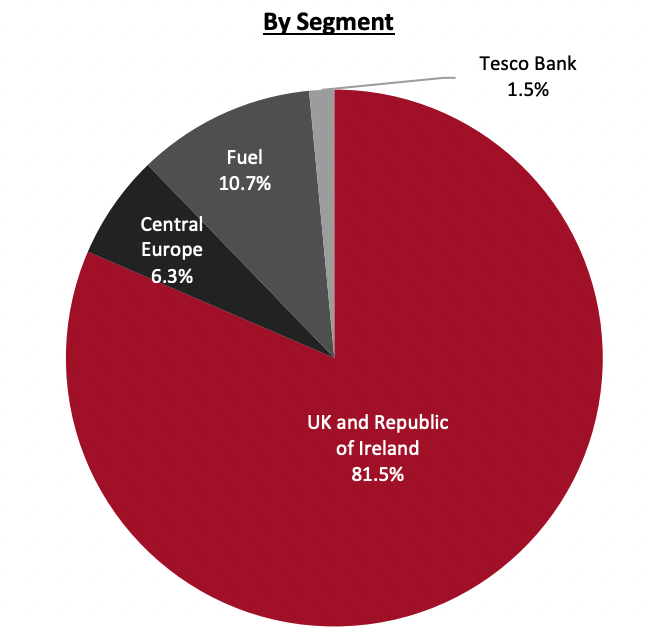

Sector: Food, drug and mass retailers Countries of operation: Czech Republic, Hungary, India, Republic of Ireland, Slovakia and the UK Key product categories: Apparel and footwear, food and beverage, fuel, general merchandise, and health and beauty Annual Metrics [caption id="attachment_151360" align="aligncenter" width="700"] Fiscal year ends February 28 of the same calendar year

Fiscal year ends February 28 of the same calendar year*Excluding VAT and fuel

**Excluding franchise stores[/caption] Summary Tesco was founded in 1919 and is headquartered in Welwyn Garden City in Hertfordshire, England. The retailer sells groceries and general merchandise including apparel, books, electronics, footwear, furniture and toys. It also offers fuel and services such as insurance and retail banking. In the UK, the company operates the store formats Tesco Extra (hypermarkets), Tesco Superstores (supermarkets), Tesco Metro (sized between supermarkets and convenience stores), Tesco Express (convenience stores), One Stop (small convenience stores) and an e-commerce site. The company also owns wholesale business Booker, which it acquired in 2018. As of February 26, 2022, the company operates 4,359 stores in the UK and Central Europe, excluding franchise stores. Company Analysis Coresight Research insight: Tesco is a heavyweight in the UK’s grocery retail space and is classed as one of the country’s “Big Four” supermarket chains. The company completed an ambitious turnaround between 2014 and 2020 under its CEO at the time, Dave Lewis. We believe that Tesco, as the largest grocer in the UK in both the online and offline channels, with a strong store network, should be able to use its scale advantage to drive results in ways its rivals cannot. Additionally, Tesco’s aggressive investments in its value proposition, including a higher number of Aldi price match products (650 lines as of February 26, 2022), everyday low prices and Clubcard loyalty prices, will result in competitive price perception. During 2020–2021, Tesco and other supermarket retailers were supported by the relatively weak performance of the discounters. However, the discounters have since gained momentum and have become even more relevant given the current rise in the cost of living. We believe the discounters will continue to put pressure on sector-wide pricing, limiting margin expansion opportunities for the Big Four.

| Tailwinds | Headwinds |

|

|

- Remove price as a reason for shoppers to want or need to shop elsewhere.

- Improve quality perception of the offering, especially in fresh food.

- Innovate with supplier partners to make healthy food available and affordable for all.

- Work on sustainability initiatives to reduce environmental impact.

- Allow shoppers to choose when, how and where they earn and use the rewards.

- Increase the value of the Tesco Clubcard for frequent users.

- Create additional value from the Clubcard digital platform.

- Leverage data partnerships to generate additional income streams.

- Accelerate the core online business.

- Roll out urban fulfillment centers (UFCs) and further productivity improvements.

- Test and learn from new on-demand service pilot.

- Strengthen the online platform through capital-light opportunities.

- Identify £1 billion of cost savings over the next three years.

- Create headroom to fund investments.

- Aim to offset cost inflation.

Company Developments

Company Developments

| Date | Development |

| March 29, 2022 | Tesco expands its electric vehicle charging network to 500 Tesco stores across the UK. |

| February 18, 2022 | Tesco announces that it has eliminated one and a half billion pieces of plastic from its UK business since August 2019. |

| January 31, 2022 | Tesco announces that it will close down seven of its Jack discount stores while converting the remaining six to Tesco superstores. |

| November 30, 2021 | Tesco launches Tesco Media and Insight (powered by Dunnhumby), a closed loop platform to help suppliers engage more effectively with customers. |

| October 28, 2021 | Tesco launches a 10-minute grocery delivery service pilot in partnership with rapid-delivery company Gorillas. |

| October 19, 2021 | Tesco opens its first checkout-free store GetGo in London, in partnership with frictionless checkout solutions provider Trigo. |

| May 24, 2021 | Tesco announces a partnership with plant-based meat substitute producer Beyond Meat to launch a line of frozen ready meals under its Wicked Kitchen range. |

| March 10, 2021 | Tesco announces that it will roll out soft plastic collection points at 171 stores, with plans to expand the network to all large stores nationwide. Customers can return their used soft plastic at those points, which will be later recycled and turned into new packaging. |

| January 20, 2021 | Tesco launches a £634 million ($858 million) sustainability-linked bond that is aligned with the company’s commitment to reducing greenhouse gas emissions. |

| December 18, 2020 | Tesco announces that it has completed the sale of its Thailand and Malaysia businesses to Bangkok-based agribusiness conglomerate Charoen Pokphand Group. |

| November 25, 2020 | Tesco announces that it will stop using plastic trays to pack its fresh whole chickens from 2021. |

| October 9, 2020 | Tesco announces that it will recruit over 11,000 temporary associates in stores across the UK to help customers during the holiday season. |

| September 29, 2020 | Tesco CEO Dave Lewis steps down and is succeeded by former Walgreens Boots Alliance executive Ken Murphy. |

| August 24, 2020 | Tesco announces that it will create 16,000 new permanent roles to support its online business, including pickers and drivers and a variety of other positions in stores and distribution centers. |

| June 18, 2020 | Tesco announces plans to divest its Polish business, including 301 stores and associated distribution centers, to supermarket operator Salling Group A/S. |

| February 26, 2020 | Tesco launches its first cashless shop in Central London that offers a range of electronic payment methods and does not accept notes or coins. |

| February 25, 2020 | Tesco announces the sale of its 20% stake in Gain Land to its joint venture partner China Resource Holdings. Tesco had established the Gain Land venture with China Resource Holdings in 2014, combining the British retailer’s 131 stores in China with its partner’s almost 3,000. |

- John Allan—Non-Executive Chairman

- Ken Murphy—CEO

- Imran Nawaz—CFO

Source: Company reports