DIpil Das

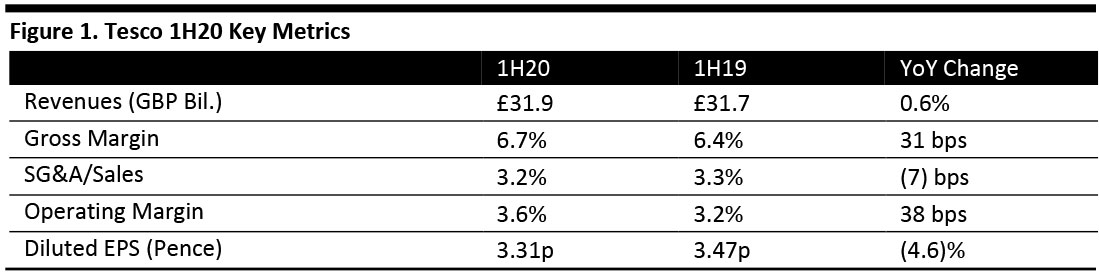

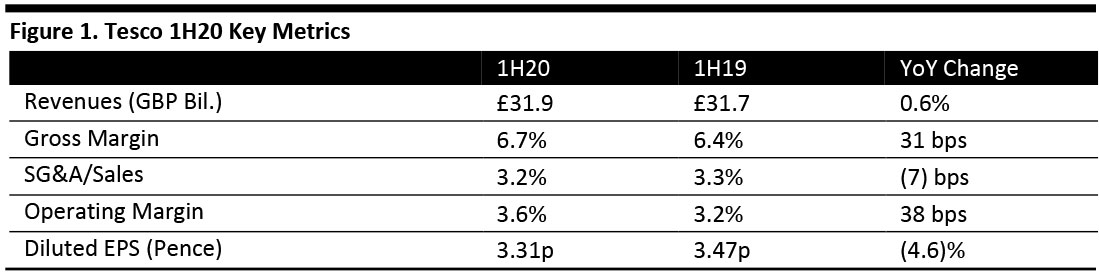

[caption id="attachment_97454" align="aligncenter" width="700"] All figures are statutory

All figures are statutory

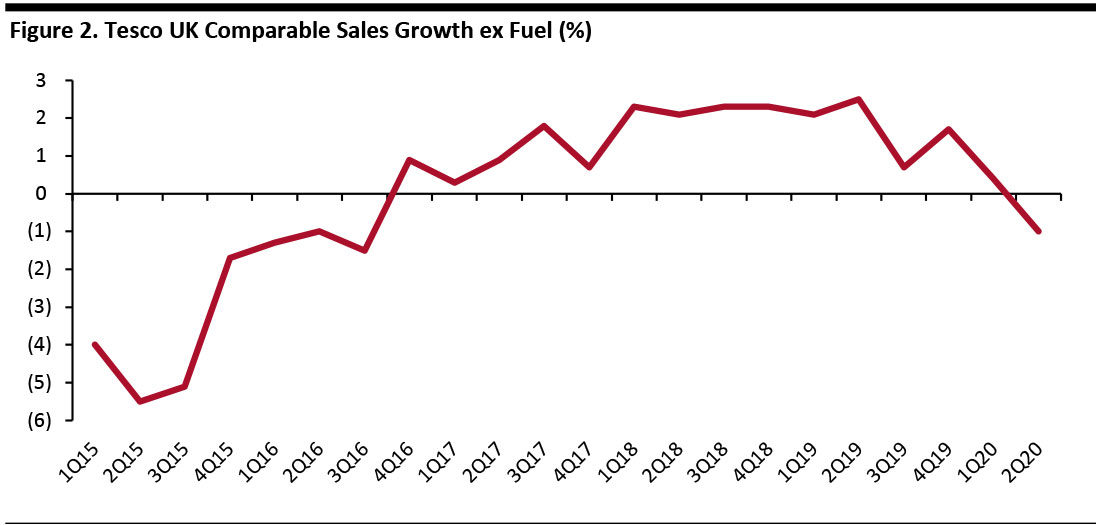

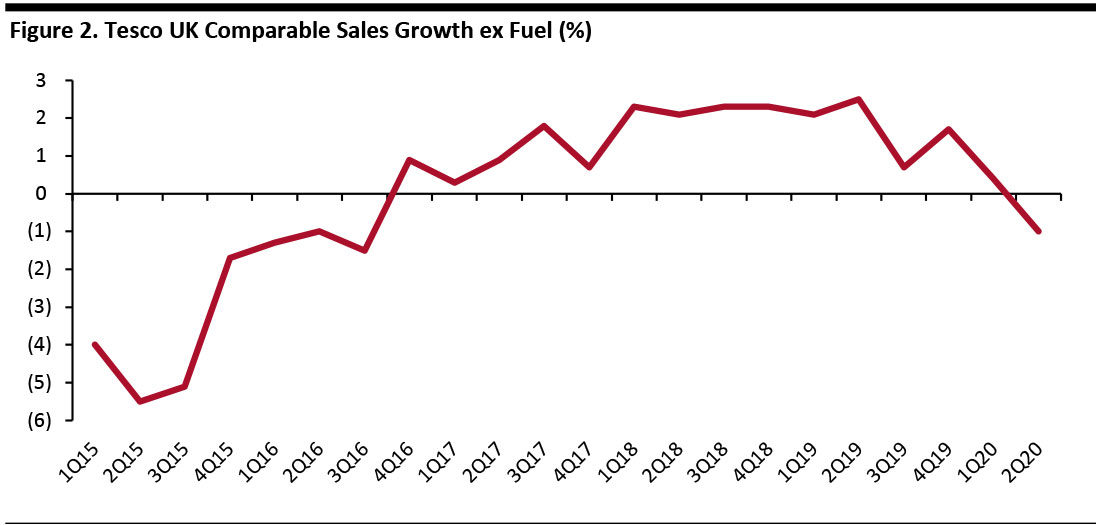

Source: Company reports/Coresight Research [/caption] 1H20 Results and CEO Succession Tesco announced that CEO Dave Lewis will step down in summer 2020. He will be succeeded by Ken Murphy, who until January was Chief Commercial Officer, President of Global Brands and EVP at Walgreens Boots Alliance. Lewis arrived in July 2014 and instigated a turnaround based on cutting costs, which included slashing jobs, divesting noncore assets and closing unprofitable stores; and growing volumes by relaunching Tesco private labels and slimming down overall ranges. Lewis’s turnaround has been highly successful. In October 2016, Lewis set out plans to reduce operating costs by £1.5 billion, generate £9 billion cash from operations, and achieve a 3.5–4.0% operating margin by the end of fiscal 2020 (the current year). The company has achieved cost savings of £1.6 billion to date and, as we note below, it has exceeded the target for operating margin expansion. As we show below, Lewis’s refocusing of UK operations on simplified ranges, lower prices and revamped private labels yielded an upturn in the core measure of UK comparable sales growth. [caption id="attachment_97455" align="aligncenter" width="700"] Source: Company reports[/caption]

For 1H20, the 26 weeks ended August 24, Tesco reported:

Source: Company reports[/caption]

For 1H20, the 26 weeks ended August 24, Tesco reported:

All figures are statutory

All figures are statutory Source: Company reports/Coresight Research [/caption] 1H20 Results and CEO Succession Tesco announced that CEO Dave Lewis will step down in summer 2020. He will be succeeded by Ken Murphy, who until January was Chief Commercial Officer, President of Global Brands and EVP at Walgreens Boots Alliance. Lewis arrived in July 2014 and instigated a turnaround based on cutting costs, which included slashing jobs, divesting noncore assets and closing unprofitable stores; and growing volumes by relaunching Tesco private labels and slimming down overall ranges. Lewis’s turnaround has been highly successful. In October 2016, Lewis set out plans to reduce operating costs by £1.5 billion, generate £9 billion cash from operations, and achieve a 3.5–4.0% operating margin by the end of fiscal 2020 (the current year). The company has achieved cost savings of £1.6 billion to date and, as we note below, it has exceeded the target for operating margin expansion. As we show below, Lewis’s refocusing of UK operations on simplified ranges, lower prices and revamped private labels yielded an upturn in the core measure of UK comparable sales growth. [caption id="attachment_97455" align="aligncenter" width="700"]

Source: Company reports[/caption]

For 1H20, the 26 weeks ended August 24, Tesco reported:

Source: Company reports[/caption]

For 1H20, the 26 weeks ended August 24, Tesco reported:

- Adjusted operating income of £1.4 billion, yielding an adjusted operating margin of 4.4%, versus the abovementioned target of 3.5–4.0% for the current fiscal year. Management noted that it had achieved its target six months ahead of plan.

- Adjusted operating profit was up 25.4% and ahead of the consensus estimate of £1.3 billion recorded by StreetAccount. Statutory operating profit was up 12.6% in 1H20.

- Total revenue of £31.8 billion was up 0.6% and in line with analyst expectations. Group comparable sales were down 0.4%.

- Pretax profit was up 6.7% to £494 million.

- Tesco reported UK comparable sales were down 1.0%, versus a 0.4% rise in 1Q20 and consensus of a 0.6% decline. Management said Tesco outperformed the UK market in volume terms in the first half overall.

- Ireland comps were also down 1.0%, versus a 1.3% rise in 1Q20. Management noted strong sales growth in fresh food in the first half of the fiscal year.

- Booker comps were up 1.9%, compared to 3.1% in 1Q20.

- Central Europe comps were down 1.4%, versus a 4.9% fall in 1Q20. The company is undertaking a transformation program in this region, which includes store closures. Management cited lower general-merchandise sales and disruption from refitting stores as factors in the sales decline.

- Asia comps were down 2.7% versus a 0.1% rise in the previous quarter. Management cited reduced general-merchandise sales in 1H20.