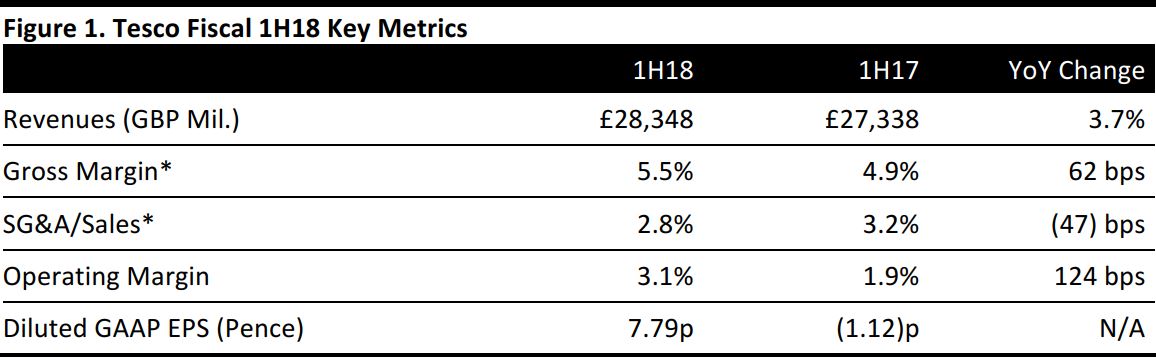

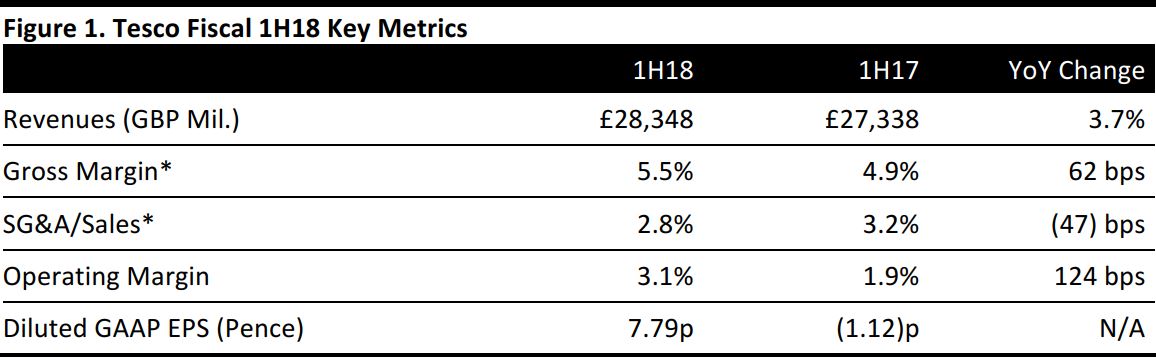

All profit figures are after exceptional items.

*Like a number of other UK grocery retailers, Tesco allocates some operating costs to cost of sales, so these expenses impact gross margin rather than SG&A/sales.

Source: Company reports/FGRT

Fiscal 1H18 Results

For fiscal 1H18, Tesco reported group revenues of £28.35 billion, up 3.7% year over year. The figure was ahead of consensus of £28.17 billion and represented a continuation of the rate of growth reported in FY17.

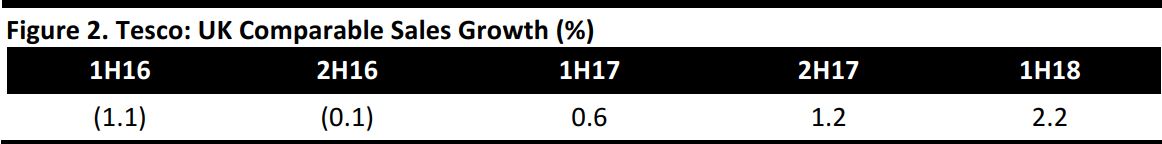

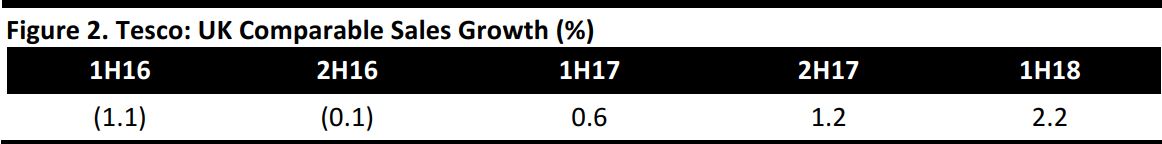

The closely watched measure of UK comparable sales growth was 2.2% for the first half, which included a slight ease back in 2Q18 from 1Q18 but was up sequentially from previous half years. The trend signals a sustained improvement in Tesco’s core business, as we tabulate below.

Source: Company reports

Outside the UK, year-over-year comparable sales at constant exchange rates came in at 1.1% in Ireland, 0.1% in Central Europe and (8.3)% in Asia. Group comps were 0.8% in 1H18, slowing sequentially from 1.0% for FY17.

Group operating profit jumped by 27% year over year before exceptional items and by 72% after exceptionals. Such items included gains from property transactions and the sale of a minority share in Asian Internet retailer Lazada, negative impacts from restructuring and redundancies and, in the comparable period of the prior year, customer redress costs at Tesco Bank. Exceptional items represented a net contribution of £126 million to operating profit in 1H18 versus a net drag of £81 million on operating profit in the same period last year.

On a statutory basis, Tesco generated an operating margin of 3.1% in the first half. Excluding exceptionals, the margin was 2.7%. Both measures were up from the same period a year earlier. Tesco is targeting an operating margin of 3.5%–4.0% by fiscal 2020.

Nonfinancial Metrics in the UK

Tesco UK noted that customer transactions grew by 0.4% and that volume sales grew by 0.3% year over year. Fresh food categories saw volume growth of 1.5%. Management noted the challenge of inflationary pressures and said that the company had worked hard to limit price increases. Tesco’s clothing sales were up by 3.5% year over year on a comparable basis, with back-to-school ranges up 13%.

The company saw comparable growth across all its UK store formats, with large-store sales growing by 1.6%. Online grocery sales were up 4.6% year over year.

Outlook

Management provided the following guidance:

- The company remains on track to reduce costs by £1.5 billion, generate £9 billion of retail cash from operations and improve its operating margin to 3.5%–4.0% by fiscal 2020.

- Capital expenditure in the current fiscal year is expected to be £1.1 billion. The company expects it to be £1.1–£1.4 billion in future years.

For the current fiscal year, analysts expect Tesco to grow revenues by 3.2% and EBIT by 17.6%, yielding an EBIT margin of 2.9%.